Deck 27: Money and Banking

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/181

العب

ملء الشاشة (f)

Deck 27: Money and Banking

1

The government has a balanced budget if

A) its total revenues are equal to its total expenditures.

B) its total revenues are less than its total expenditures.

C) its total revenues are greater than its total expenditures.

D) the money supply is less than total expenditures.

A) its total revenues are equal to its total expenditures.

B) its total revenues are less than its total expenditures.

C) its total revenues are greater than its total expenditures.

D) the money supply is less than total expenditures.

its total revenues are equal to its total expenditures.

2

Public investment expenditure for highways, schools, and national defense is included in which component of GDP?

A) consumption

B) gross private investment

C) government purchases

D) public investment

A) consumption

B) gross private investment

C) government purchases

D) public investment

government purchases

3

Which of the following statements is true regarding the government budget?

A) The government's budget has been in deficit since the 1960s.

B) The government's budget has been in deficit since World War II except for a brief period between 1998 and 2001.

C) The government's budget was generally in surplus until the 1980s, then mostly in deficit since except for a brief period between 1998 and 2001.

D) The government's budget was generally in surplus in the 1960s, then mostly in deficit since except for a brief period between 1998 and 2001.

A) The government's budget has been in deficit since the 1960s.

B) The government's budget has been in deficit since World War II except for a brief period between 1998 and 2001.

C) The government's budget was generally in surplus until the 1980s, then mostly in deficit since except for a brief period between 1998 and 2001.

D) The government's budget was generally in surplus in the 1960s, then mostly in deficit since except for a brief period between 1998 and 2001.

The government's budget was generally in surplus in the 1960s, then mostly in deficit since except for a brief period between 1998 and 2001.

4

The government has a budget surplus if

A) its total revenues are equal to its total expenditures.

B) its total revenues are less than its total expenditures.

C) its total revenues are greater than its total expenditures.

D) the money supply is less than total expenditures.

A) its total revenues are equal to its total expenditures.

B) its total revenues are less than its total expenditures.

C) its total revenues are greater than its total expenditures.

D) the money supply is less than total expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

5

Payments to households that do not require anything in exchange are called

A) transfer payments.

B) government purchases.

C) consumption expenditures.

D) investment expenditures.

A) transfer payments.

B) government purchases.

C) consumption expenditures.

D) investment expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

6

All of the following are instruments of fiscal policy except

A) rebate on payroll taxes.

B) education tax credits.

C) unemployment insurance benefits.

D) an interest rate cut.

A) rebate on payroll taxes.

B) education tax credits.

C) unemployment insurance benefits.

D) an interest rate cut.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

7

Medicaid, welfare payments, and Temporary Assistance to Needy Families are classified as

A) unilateral payments.

B) transfer payments.

C) gifts.

D) income redistribution payments.

A) unilateral payments.

B) transfer payments.

C) gifts.

D) income redistribution payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

8

The government purchases component of aggregate demand includes

I. all purchases by government agencies of goods and services produced by firms.

II. direct production by government agencies themselves.

III. government expenditures on transfer payments.

A) I only

B) I and II only

C) I and III only

D) I, II, and III

I. all purchases by government agencies of goods and services produced by firms.

II. direct production by government agencies themselves.

III. government expenditures on transfer payments.

A) I only

B) I and II only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

9

The bulk of transfer payment spending in the United States is undertaken by

A) non-profit organizations in the private sector.

B) state governments.

C) local governments.

D) the federal government.

A) non-profit organizations in the private sector.

B) state governments.

C) local governments.

D) the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

10

Government tax and expenditure policies that affect real GDP are called

A) automatic fiscal policy.

B) discretionary fiscal policy.

C) fiscal policy.

D) supply-side policy.

A) automatic fiscal policy.

B) discretionary fiscal policy.

C) fiscal policy.

D) supply-side policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

11

Transfer payments typically

A) rise during expansionary periods.

B) fall during recessions.

C) do not change as the economy expands and contracts during the business cycle.

D) fall during expansionary periods and rise during recessionary periods.

A) rise during expansionary periods.

B) fall during recessions.

C) do not change as the economy expands and contracts during the business cycle.

D) fall during expansionary periods and rise during recessionary periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

12

State and local tax receipts are dominated by

A) property taxes and state income taxes.

B) state income taxes and sales taxes.

C) property taxes and sales taxes.

D) sales taxes and business taxes.

A) property taxes and state income taxes.

B) state income taxes and sales taxes.

C) property taxes and sales taxes.

D) sales taxes and business taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements characterizes government transfer payment spending in the United States between 1960 and 2011?

A) Transfer payment spending by the federal government and by state and local governments has decreased as a percentage of GDP.

B) Transfer payment spending by the federal government and by state and local governments has about tripled as a percentage of GDP.

C) Transfer payment spending by the federal government and by state and local governments has remained constant as a percentage of GDP.

D) Transfer payment spending by the federal government and by state and local governments has fluctuated widely over this period.

A) Transfer payment spending by the federal government and by state and local governments has decreased as a percentage of GDP.

B) Transfer payment spending by the federal government and by state and local governments has about tripled as a percentage of GDP.

C) Transfer payment spending by the federal government and by state and local governments has remained constant as a percentage of GDP.

D) Transfer payment spending by the federal government and by state and local governments has fluctuated widely over this period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

14

The bulk of federal receipts come from

A) property taxes and personal income tax.

B) personal income tax and from payroll taxes.

C) corporate income taxes and personal income tax.

D) personal income tax and property taxes.

A) property taxes and personal income tax.

B) personal income tax and from payroll taxes.

C) corporate income taxes and personal income tax.

D) personal income tax and property taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

15

The government has a budget deficit if

A) its total revenues are equal to its total expenditures.

B) its total revenues are less than its total expenditures.

C) its total revenues are greater than its total expenditures.

D) the money supply is less than total expenditures.

A) its total revenues are equal to its total expenditures.

B) its total revenues are less than its total expenditures.

C) its total revenues are greater than its total expenditures.

D) the money supply is less than total expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

16

In late 2008, the U.S. government extended unemployment insurance benefits for seven additional weeks, in recognition of the growing unemployment problem. This extension is an example of

A) automatic fiscal policy.

B) discretionary fiscal policy.

C) expansionary monetary policy.

D) supply-side fiscal policy.

A) automatic fiscal policy.

B) discretionary fiscal policy.

C) expansionary monetary policy.

D) supply-side fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

17

The three major categories of government spending are

A) government purchases, defense spending, and interest payments.

B) defense spending, Medicare and Medicaid, and net interest.

C) government purchases, transfer payments, and net interest.

D) government purchases, defense spending, and transfer payments.

A) government purchases, defense spending, and interest payments.

B) defense spending, Medicare and Medicaid, and net interest.

C) government purchases, transfer payments, and net interest.

D) government purchases, defense spending, and transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements characterizes government purchases in the United States between 2001 and 2011?

A) Government purchases as a share of GDP have declined.

B) Government purchases as a share of GDP have increased.

C) Government purchases as a share of GDP have remained constant.

D) Government purchases have fluctuated widely over this period.

A) Government purchases as a share of GDP have declined.

B) Government purchases as a share of GDP have increased.

C) Government purchases as a share of GDP have remained constant.

D) Government purchases have fluctuated widely over this period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

19

All of the following are examples of transfer payments except

A) welfare benefits to the poor.

B) dividend payments to the wealthy.

C) Social Security payments to the elderly.

D) unemployment compensation to the unemployed.

A) welfare benefits to the poor.

B) dividend payments to the wealthy.

C) Social Security payments to the elderly.

D) unemployment compensation to the unemployed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

20

Taxes assessed on firms and employees on wages and salaries earned are called

A) dividend taxes.

B) payroll taxes.

C) corporate profits taxes.

D) earned income taxes.

A) dividend taxes.

B) payroll taxes.

C) corporate profits taxes.

D) earned income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

21

Generational accounting estimates for the United States for the year 2004 show that

A) the net burden on males is much lower than for females.

B) the net burden on females is much lower than for males.

C) the net burden on minorities is much greater than for Caucasians.

D) the net burden on college-educated Americans is lower than for those without a college education.

A) the net burden on males is much lower than for females.

B) the net burden on females is much lower than for males.

C) the net burden on minorities is much greater than for Caucasians.

D) the net burden on college-educated Americans is lower than for those without a college education.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

22

If the federal budget is initially balanced and government expenditures remain constant, then a

Decrease in GDP will

A) decrease tax revenues and create a budget surplus.

B) increase tax revenues and create a budget surplus.

C) decrease tax revenues and create a budget deficit.

D) increase tax revenues and create a budget deficit.

Decrease in GDP will

A) decrease tax revenues and create a budget surplus.

B) increase tax revenues and create a budget surplus.

C) decrease tax revenues and create a budget deficit.

D) increase tax revenues and create a budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

23

Judged by international standards, the national debt of the United States, in terms of its national

Debt as a percentage of GDP is

A) the highest among the developed nations.

B) the lowest among the developed nations.

C) above average among the developed nations.

D) below average among the developed nations.

Debt as a percentage of GDP is

A) the highest among the developed nations.

B) the lowest among the developed nations.

C) above average among the developed nations.

D) below average among the developed nations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is an automatic stabilizer?

A) It refers to a discretionary policy that is triggered when actual output is not equal to potential output to improve the economy's performance.

B) It refers to a stabilization program that keeps inflation in check automatically.

C) It refers to any government program that tends to reduce fluctuations in GDP automatically.

D) It refers to a government program that is automatically triggered when the economy enters a recession.

A) It refers to a discretionary policy that is triggered when actual output is not equal to potential output to improve the economy's performance.

B) It refers to a stabilization program that keeps inflation in check automatically.

C) It refers to any government program that tends to reduce fluctuations in GDP automatically.

D) It refers to a government program that is automatically triggered when the economy enters a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

25

The sum of all past federal deficits minus any surpluses is called the

A) transfer balance.

B) national deficit.

C) national debt.

D) national budget.

A) transfer balance.

B) national deficit.

C) national debt.

D) national budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is true about the U.S. national debt?

I. Relative to the level of economic activity, the debt is well below the levels reached during

World War II.

II. The ratio of debt to GDP rose from 1981 to 1996 and fell in the last years of the twentieth

Century; it began rising again in 2002.

III. Judged by international standards, the U.S. national debt relative to its GDP is above average among developed nations.

A) I only

B) II only

C) III only

D) I, II, and III

I. Relative to the level of economic activity, the debt is well below the levels reached during

World War II.

II. The ratio of debt to GDP rose from 1981 to 1996 and fell in the last years of the twentieth

Century; it began rising again in 2002.

III. Judged by international standards, the U.S. national debt relative to its GDP is above average among developed nations.

A) I only

B) II only

C) III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose in the beginning of 2013, a country has a national debt of $8,000 billion. Its GDP in

2013 is $32,000 billion and its budget deficit of $1,600 billion. Compute its debt-GDP ratio at the end of the year.

A) about 5. 0%

B) about 20,0%

C) about 25.0%

D) about 30%

2013 is $32,000 billion and its budget deficit of $1,600 billion. Compute its debt-GDP ratio at the end of the year.

A) about 5. 0%

B) about 20,0%

C) about 25.0%

D) about 30%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose a country's debt rises by 6% and its GDP rises by 5%. What happens to the debt-GDP ratio?

A) It rises if there is a budget deficit that period.

B) It falls.

C) It rises.

D) There is insufficient information to answer the question.

A) It rises if there is a budget deficit that period.

B) It falls.

C) It rises.

D) There is insufficient information to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

29

Suppose a country's debt rises by 6% and its GDP rises by 8%. What happens to the debt-GDP ratio?

A) It rises if there is a budget deficit that period.

B) It falls.

C) It rises.

D) There is insufficient information to answer the question.

A) It rises if there is a budget deficit that period.

B) It falls.

C) It rises.

D) There is insufficient information to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

30

The national debt

A) is the sum of all past federal deficits plus any surpluses.

B) grows when the government runs a deficit.

C) grows when government spending increases.

D) is a major problem facing the U.S. government.

A) is the sum of all past federal deficits plus any surpluses.

B) grows when the government runs a deficit.

C) grows when government spending increases.

D) is a major problem facing the U.S. government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

31

As populations age, the burden of current fiscal policy in many countries is increasingly borne by

A) younger people in the population.

B) older people in the population.

C) the government.

D) new immigrants into a country.

A) younger people in the population.

B) older people in the population.

C) the government.

D) new immigrants into a country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

32

Generational accounting

A) is a method of assessing the impact of fiscal policy lags from one generation to another.

B) measures the number of generations it takes to pay off the national debt at a given point in time.

C) evaluates the impact of current fiscal policies on different generations in the economy, including future generations.

D) is an accounting method that defers to the future, the cost of any government policy the rewards of which will be reaped in the future.

A) is a method of assessing the impact of fiscal policy lags from one generation to another.

B) measures the number of generations it takes to pay off the national debt at a given point in time.

C) evaluates the impact of current fiscal policies on different generations in the economy, including future generations.

D) is an accounting method that defers to the future, the cost of any government policy the rewards of which will be reaped in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose in the beginning of 2013, a country has a national debt of $5,000 billion. Its GDP in

2013 is $20,000 billion and its budget surplus of $130 billion. Compute its debt-GDP ratio at the end of the year.

A) 2.6%

B) 25.0%

C) 24.4%

D) 6.5%

2013 is $20,000 billion and its budget surplus of $130 billion. Compute its debt-GDP ratio at the end of the year.

A) 2.6%

B) 25.0%

C) 24.4%

D) 6.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

34

The use of government expenditures and taxes to influence the level of economic activity is

Called

A) deficit management policy.

B) debt management policy.

C) financial policy.

D) fiscal policy.

Called

A) deficit management policy.

B) debt management policy.

C) financial policy.

D) fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

35

If the federal budget is initially balanced and government expenditures remain constant, then an

Increase in GDP will _________ tax revenues and create a budget _________.

A) increase tax revenues and create a budget surplus.

B) increase tax revenues and create a budget deficit.

C) decrease tax revenues and create a budget surplus.

D) decrease tax revenues and create a budget deficit.

Increase in GDP will _________ tax revenues and create a budget _________.

A) increase tax revenues and create a budget surplus.

B) increase tax revenues and create a budget deficit.

C) decrease tax revenues and create a budget surplus.

D) decrease tax revenues and create a budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

36

One method of assessing the degree to which current fiscal policies affect future generations is through a device called

A) inter-temporal fiscal accounting.

B) generational accounting.

C) long-term debt assessment technique.

D) fiscal stabilization tool.

A) inter-temporal fiscal accounting.

B) generational accounting.

C) long-term debt assessment technique.

D) fiscal stabilization tool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

37

Generational accounting is useful for

A) assessing the effect of current monetary policy decisions on generations yet unborn.

B) assessing the effect of current fiscal policy decisions on generations yet unborn.

C) comparing local, state, and federal fiscal policies.

D) assessing the effect of government budget deficits on generations yet unborn.

A) assessing the effect of current monetary policy decisions on generations yet unborn.

B) assessing the effect of current fiscal policy decisions on generations yet unborn.

C) comparing local, state, and federal fiscal policies.

D) assessing the effect of government budget deficits on generations yet unborn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

38

Suppose a country has a national debt of $5,000 billion, a GDP of $20,000 billion, and a

Budget surplus of $130 billion. How much will its new national debt be?

A) $5,130 billion

B) $4, 870 billion

C) $15,130 billion

D) $19, 870 billion

Budget surplus of $130 billion. How much will its new national debt be?

A) $5,130 billion

B) $4, 870 billion

C) $15,130 billion

D) $19, 870 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose a country has a national debt of $2,000 billion, a GDP of $28,000 billion, and a

Budget deficit of $115 billion. How much will its new national debt be?

A) $2,115 billion

B) $1,885 billion

C) $28,115 billion

D) $25,885 billion

Budget deficit of $115 billion. How much will its new national debt be?

A) $2,115 billion

B) $1,885 billion

C) $28,115 billion

D) $25,885 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

40

The national debt

A) is the difference between total government revenues and government expenditures.

B) is the sum of all past federal deficits plus any surpluses.

C) is the sum of all past federal deficits less any surpluses.

D) grows when government spending increases.

A) is the difference between total government revenues and government expenditures.

B) is the sum of all past federal deficits plus any surpluses.

C) is the sum of all past federal deficits less any surpluses.

D) grows when government spending increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

41

During a recession, unemployment insurance ensures that

A) firms layoff fewer of its employees than it would if there is no unemployment insurance.

B) disposable income increases as GDP falls.

C) disposable income does not fall by as much as GDP decreases.

D) the marginal propensity to consume increases.

A) firms layoff fewer of its employees than it would if there is no unemployment insurance.

B) disposable income increases as GDP falls.

C) disposable income does not fall by as much as GDP decreases.

D) the marginal propensity to consume increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

42

During a recession, rising transfer payments and falling tax collections

I. help cushion households from the impact of the recession.

II. buffers the fall in real GDP (relative to a situation where transfer payments do not rise and

Tax revenues do not fall).

III. tend to increase a budget deficit or reduce a budget surplus.

A) I only

B) I and II only

C) II and III only

D) I, II, and III

I. help cushion households from the impact of the recession.

II. buffers the fall in real GDP (relative to a situation where transfer payments do not rise and

Tax revenues do not fall).

III. tend to increase a budget deficit or reduce a budget surplus.

A) I only

B) I and II only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

43

An example of an automatic stabilizer is

A) personal income taxes.

B) inheritance taxes.

C) veterans' benefits.

D) corporate dividends.

A) personal income taxes.

B) inheritance taxes.

C) veterans' benefits.

D) corporate dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

44

Discretionary fiscal policy refers to

A) deliberate government efforts to stabilize the economy through government spending and taxes.

B) the use of automatic stabilizers and intervention policies to stabilize the economy.

C) any government policy that requires a lag period of at least three months.

D) the deliberate use of government spending and taxes to complement the effects of monetary policy in an effort to stabilize the economy.

A) deliberate government efforts to stabilize the economy through government spending and taxes.

B) the use of automatic stabilizers and intervention policies to stabilize the economy.

C) any government policy that requires a lag period of at least three months.

D) the deliberate use of government spending and taxes to complement the effects of monetary policy in an effort to stabilize the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

45

Automatic stabilizers are considered

A) discretionary fiscal policies.

B) discretionary monetary policies.

C) non-discretionary fiscalpolicies.

D) non-discretionary monetarypolicies.

A) discretionary fiscal policies.

B) discretionary monetary policies.

C) non-discretionary fiscalpolicies.

D) non-discretionary monetarypolicies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

46

Changes in expenditures and taxes that occur through automatic stabilizers

A) shift the aggregate demand curve to the right in the event of an economic expansion.

B) shift the aggregate demand curve to the left in the event of an economic contraction.

C) do not shift the aggregate demand curve.

D) cause a movement up along the aggregate demand curve the event of an economic expansion and a movement down along the aggregate demand curve the event of an economic contraction.

A) shift the aggregate demand curve to the right in the event of an economic expansion.

B) shift the aggregate demand curve to the left in the event of an economic contraction.

C) do not shift the aggregate demand curve.

D) cause a movement up along the aggregate demand curve the event of an economic expansion and a movement down along the aggregate demand curve the event of an economic contraction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

47

A transfer payment that rises automatically during a recession is

A) interest payments on the national debt.

B) unemployment compensation.

C) Social Security payments to retired persons.

D) government payments to war veterans.

A) interest payments on the national debt.

B) unemployment compensation.

C) Social Security payments to retired persons.

D) government payments to war veterans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

48

During an economic expansion,

A) higher income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

B) higher income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

C) lower income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

D) lower income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

A) higher income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

B) higher income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

C) lower income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

D) lower income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following describes a discretionary fiscal policy action/program?

A) the progressive income tax system

B) the unemployment compensation program

C) Congress authorizes a temporary increase in unemployment insurance benefits for an additional seven weeks.

D) the system of welfare programs

A) the progressive income tax system

B) the unemployment compensation program

C) Congress authorizes a temporary increase in unemployment insurance benefits for an additional seven weeks.

D) the system of welfare programs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following describes a discretionary fiscal policy action/program?

A) the progressive income tax system

B) The government increases funding for the Dislocated Worker Program, a federal initiative that provides retraining and career counseling.

C) the unemployment compensation program

D) the system of welfare programs

A) the progressive income tax system

B) The government increases funding for the Dislocated Worker Program, a federal initiative that provides retraining and career counseling.

C) the unemployment compensation program

D) the system of welfare programs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

51

All of the following are examples of automatic stabilizers except

A) personal income taxes.

B) means-tested federal transfer payments.

C) welfare benefits.

D) government emergency spending.

A) personal income taxes.

B) means-tested federal transfer payments.

C) welfare benefits.

D) government emergency spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

52

Personal income taxes and transfer payments

A) acts as automatic stabilizers.

B) magnify fluctuations in GDP.

C) are discretionary fiscal policy tools only.

D) are influenced by monetary policy.

A) acts as automatic stabilizers.

B) magnify fluctuations in GDP.

C) are discretionary fiscal policy tools only.

D) are influenced by monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

53

During a contraction,

A) higher income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

B) higher income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

C) lower income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

D) lower income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

A) higher income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

B) higher income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

C) lower income tax revenues tend to automatically increase a budget deficit or reduce a budget surplus.

D) lower income tax revenues tend to automatically increase a budget surplus or reduce a budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is an automatic stabilizer?

I. inheritance taxes

II. government payments to war veterans

III. aid to families with dependent children

IV. sales taxes

A) I, II, III, and IV

B) I, II, and III only

C) II and III only

D) III only

I. inheritance taxes

II. government payments to war veterans

III. aid to families with dependent children

IV. sales taxes

A) I, II, III, and IV

B) I, II, and III only

C) II and III only

D) III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

55

In general, personal income taxes

A) rise automatically during a recession.

B) rise automatically during an expansion.

C) rise automatically during a contraction.

D) are decreased during a recession through legislative actions of Congress.

A) rise automatically during a recession.

B) rise automatically during an expansion.

C) rise automatically during a contraction.

D) are decreased during a recession through legislative actions of Congress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is an advantage of automatic stabilizers?

A) The lag for automatic stabilizers is relatively long.

B) It is much easier to measure the impact of automatic stabilizers compared to the impact of discretionary fiscal policy.

C) There is no administrative cost to implementing automatic stabilizers.

D) Because they affect disposable personal income directly, automatic stabilizers act swiftly to reduce the degree of changes in real GDP.

A) The lag for automatic stabilizers is relatively long.

B) It is much easier to measure the impact of automatic stabilizers compared to the impact of discretionary fiscal policy.

C) There is no administrative cost to implementing automatic stabilizers.

D) Because they affect disposable personal income directly, automatic stabilizers act swiftly to reduce the degree of changes in real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

57

In 2003, Congress passed a substantial cut in income taxes. The Federal Reserve also lowered interest rates. How can these two actions be categorized?

A) Both actions can be categorized as fiscal policy.

B) Both actions can be categorized as monetary policy.

C) The tax cut can be categorized as monetary policy and the lowering of interest rates can be categorized as fiscal policy.

D) The tax cut can be categorized as fiscal policy and the lowering of interest rates can be categorized as monetary policy.

A) Both actions can be categorized as fiscal policy.

B) Both actions can be categorized as monetary policy.

C) The tax cut can be categorized as monetary policy and the lowering of interest rates can be categorized as fiscal policy.

D) The tax cut can be categorized as fiscal policy and the lowering of interest rates can be categorized as monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

58

Suppose Congress increases the corporate profit tax rates. This is an example of

A) discretionary fiscal policy of the expansionary variety.

B) automatic fiscal policy of the expansionary variety.

C) discretionary fiscal policy of the contractionary variety.

D) automatic fiscal policy of the contractionary variety.

A) discretionary fiscal policy of the expansionary variety.

B) automatic fiscal policy of the expansionary variety.

C) discretionary fiscal policy of the contractionary variety.

D) automatic fiscal policy of the contractionary variety.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

59

Automatic stabilizers

A) increase the problems that lags cause in using fiscal policy as a stabilization tool.

B) are changes in taxes or government spending that increase aggregate demand without requiring policymakers to act when the economy goes into recession.

C) are changes in taxes or government spending that policymakers agree to when the economy goes into recession.

D) are part of discretionary fiscal policy.

A) increase the problems that lags cause in using fiscal policy as a stabilization tool.

B) are changes in taxes or government spending that increase aggregate demand without requiring policymakers to act when the economy goes into recession.

C) are changes in taxes or government spending that policymakers agree to when the economy goes into recession.

D) are part of discretionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

60

During an expansion, which of the following occur because of automatic stabilizers?

I. Income tax revenues tend to rise.

II. Government transfer payments tend to rise.

III. The government's budget deficit tends to fall or its budget surplus tends to rise.

IV. They tend to amplify the rise in real GDP.

A) I and III only

B) I, II, and III only

C) I, III, and IV only

D) I, II, III, and IV

I. Income tax revenues tend to rise.

II. Government transfer payments tend to rise.

III. The government's budget deficit tends to fall or its budget surplus tends to rise.

IV. They tend to amplify the rise in real GDP.

A) I and III only

B) I, II, and III only

C) I, III, and IV only

D) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

61

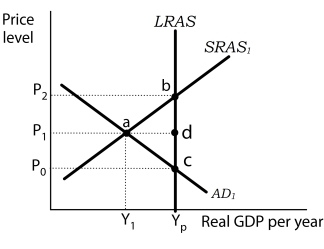

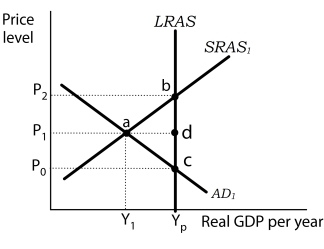

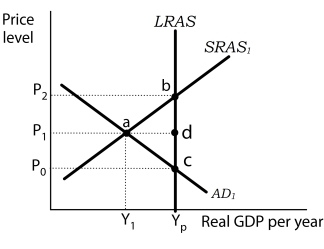

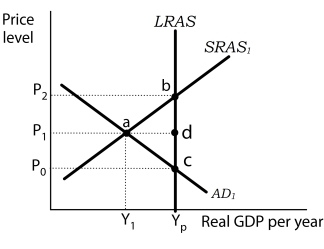

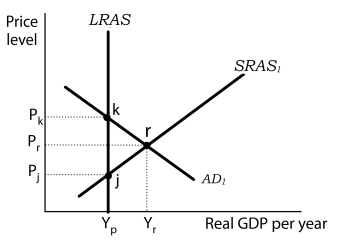

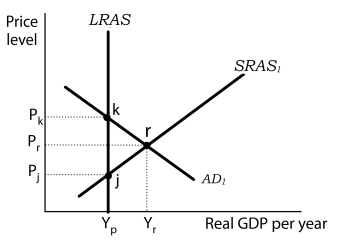

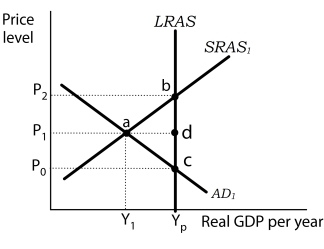

Figure 12-1

Refer to Figure 12-1. At output level Y1,

A) potential output is greater than actual output.

B) the economy is operating at a point outside its production possibilities curve.

C) the actual unemployment rate is less than the natural rate of unemployment.

D) aggregate demand will fall to restore equilibrium.

Refer to Figure 12-1. At output level Y1,

A) potential output is greater than actual output.

B) the economy is operating at a point outside its production possibilities curve.

C) the actual unemployment rate is less than the natural rate of unemployment.

D) aggregate demand will fall to restore equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

62

An inflationary gap can be closed with

A) using an expansionary monetary policy.

B) using a policy action such as a reduction in taxes.

C) using a policy action such as a reduction in government purchases.

D) imposing price controls to prevent prices from rising.

A) using an expansionary monetary policy.

B) using a policy action such as a reduction in taxes.

C) using a policy action such as a reduction in government purchases.

D) imposing price controls to prevent prices from rising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

63

An expansionary fiscal policy

I. includes an increase in government spending.

II. includes tax cuts.

III. increases a government budget deficit or reduces a government budget surplus.

A) I, II, and III

B) I and II only

C) I and III only

D) II and III only

I. includes an increase in government spending.

II. includes tax cuts.

III. increases a government budget deficit or reduces a government budget surplus.

A) I, II, and III

B) I and II only

C) I and III only

D) II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

64

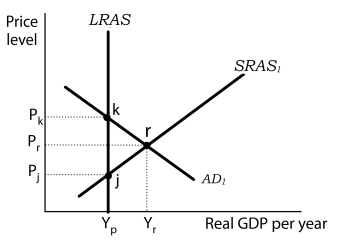

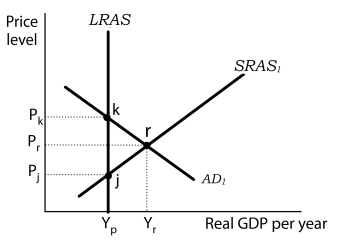

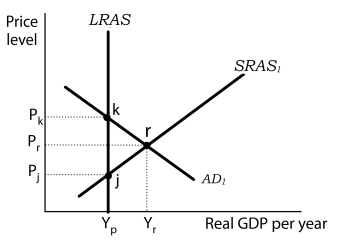

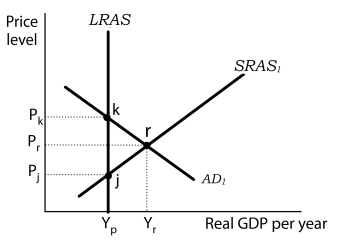

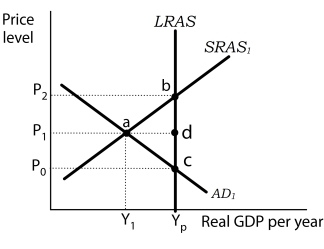

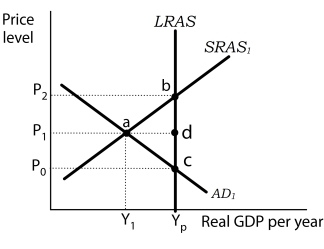

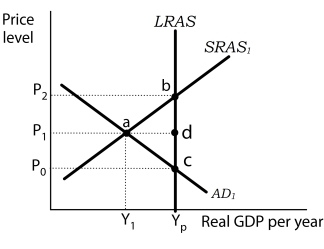

Figure 12-2

Refer to Figure 12-2. If real GDP is equal to Yr, there is

A) an inflationary gap.

B) a recessionary gap.

C) equilibrium at full employment.

D) a short-run and a long-run equilibrium.

Refer to Figure 12-2. If real GDP is equal to Yr, there is

A) an inflationary gap.

B) a recessionary gap.

C) equilibrium at full employment.

D) a short-run and a long-run equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

65

Expansionary fiscal policy includes

A) increasing taxes and increasing government purchases.

B) lowering interest rates, decreasing taxes and increasing transfer payments.

C) decreasing taxes and increasing government expenditures.

D) lowering the interest rates, decreasing taxes and decreasing government spending.

A) increasing taxes and increasing government purchases.

B) lowering interest rates, decreasing taxes and increasing transfer payments.

C) decreasing taxes and increasing government expenditures.

D) lowering the interest rates, decreasing taxes and decreasing government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

66

An expansionary fiscal policy shifts the aggregate demand curve

A) to the right and is used to close an inflationary gap.

B) to the right and is used to close a recessionary gap.

C) to the left and is used to close an inflationary gap.

D) to the left and is used to close a recessionary gap.

A) to the right and is used to close an inflationary gap.

B) to the right and is used to close a recessionary gap.

C) to the left and is used to close an inflationary gap.

D) to the left and is used to close a recessionary gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

67

Figure 12-1

Refer to Figure 12-1. In this situation, if policymakers want to close the output gap with fiscal policies that will stimulate aggregate demand, what should they do?

A) establish a consumption tax to encourage savings

B) increase government spending

C) loosen environmental regulations to lower businesses cost of production

D) raise interest rates

Refer to Figure 12-1. In this situation, if policymakers want to close the output gap with fiscal policies that will stimulate aggregate demand, what should they do?

A) establish a consumption tax to encourage savings

B) increase government spending

C) loosen environmental regulations to lower businesses cost of production

D) raise interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

68

Figure 12-2

Refer to Figure 12-2. At output level Yr,

A) potential output is greater than actual output.

B) the expected price level equals actual price level.

C) the actual unemployment rate is less than the natural rate of unemployment.

D) aggregate demand will fall over time to restore equilibrium.

Refer to Figure 12-2. At output level Yr,

A) potential output is greater than actual output.

B) the expected price level equals actual price level.

C) the actual unemployment rate is less than the natural rate of unemployment.

D) aggregate demand will fall over time to restore equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

69

If there is a recessionary gap in the economy, discretionary fiscal policy would likely involve

An action to

A) shift the aggregate demand curve to the right.

B) shift the aggregate demand curve to the left.

C) shift both the aggregate demand curve and aggregate supply curve to the right.

D) shift both the aggregate demand curve and aggregate supply curve to the left.

An action to

A) shift the aggregate demand curve to the right.

B) shift the aggregate demand curve to the left.

C) shift both the aggregate demand curve and aggregate supply curve to the right.

D) shift both the aggregate demand curve and aggregate supply curve to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

70

A contractionary fiscal policy shifts the aggregate demand curve

A) to the right and is used to close an inflationary gap.

B) to the right and is used to close a recessionary gap.

C) to the left and is used to close an inflationary gap.

D) to the left and is used to close a recessionary gap.

A) to the right and is used to close an inflationary gap.

B) to the right and is used to close a recessionary gap.

C) to the left and is used to close an inflationary gap.

D) to the left and is used to close a recessionary gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

71

If there is an inflationary gap in the economy, discretionary fiscal policy would likely involve

An action to

A) shift the aggregate demand curve to the right.

B) shift the aggregate demand curve to the left.

C) shift both the aggregate demand curve and aggregate supply curve to the right.

D) shift both the aggregate demand curve and aggregate supply curve to the left.

An action to

A) shift the aggregate demand curve to the right.

B) shift the aggregate demand curve to the left.

C) shift both the aggregate demand curve and aggregate supply curve to the right.

D) shift both the aggregate demand curve and aggregate supply curve to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

72

Figure 12-2

Refer to Figure 12-2. Suppose real GDP is equal to Yr. If policymakers want to close the output gap with demand management policies, what should they do?

A) lower corporate profit tax rates to encourage investments

B) increase investment tax credits to businesses

C) decrease government spending on transfer payments and on final goods and services

D) lower interest rates

Refer to Figure 12-2. Suppose real GDP is equal to Yr. If policymakers want to close the output gap with demand management policies, what should they do?

A) lower corporate profit tax rates to encourage investments

B) increase investment tax credits to businesses

C) decrease government spending on transfer payments and on final goods and services

D) lower interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

73

A recessionary gap can be closed with

A) using a contractionary monetary policy.

B) an increase in taxes.

C) a decrease in government purchases.

D) using an expansionary fiscal policy.

A) using a contractionary monetary policy.

B) an increase in taxes.

C) a decrease in government purchases.

D) using an expansionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

74

In the United States, most of the government's taxing and spending is

A) to stabilize the economy and move it to its potential output.

B) to bring about greater income equality.

C) to keep inflation at a moderate level.

D) for purposes other than economic stabilization.

A) to stabilize the economy and move it to its potential output.

B) to bring about greater income equality.

C) to keep inflation at a moderate level.

D) for purposes other than economic stabilization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

75

A contractionary fiscal policy

I. decreases a government budget deficit or increases a government budget surplus.

II. includes tax cuts.

III. may include discretionary cuts in transfer payments.

A) I, II, and III

B) I and II only

C) I and III only

D) II and III only

I. decreases a government budget deficit or increases a government budget surplus.

II. includes tax cuts.

III. may include discretionary cuts in transfer payments.

A) I, II, and III

B) I and II only

C) I and III only

D) II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

76

Figure 12-1

Refer to Figure 12-1. If discretionary fiscal policy is used to eliminate the gap, policy actions

Will

A) shift the aggregate demand curve to the right until long-run equilibrium is restored at a price level, P1 and output level, Yp.

B) shift the short-run aggregate supply curve to the right until long-run equilibrium is restored at a price level, P1 and output level, Yp.

C) shift the aggregate demand curve to the right until long-run equilibrium is restored at a price level, P2 and output level, Yp.

D) shift the aggregate demand curve and the short-run aggregate supply curve to the right until long-run equilibrium is restored at a price level corresponding to point d and output level, Yp.

Refer to Figure 12-1. If discretionary fiscal policy is used to eliminate the gap, policy actions

Will

A) shift the aggregate demand curve to the right until long-run equilibrium is restored at a price level, P1 and output level, Yp.

B) shift the short-run aggregate supply curve to the right until long-run equilibrium is restored at a price level, P1 and output level, Yp.

C) shift the aggregate demand curve to the right until long-run equilibrium is restored at a price level, P2 and output level, Yp.

D) shift the aggregate demand curve and the short-run aggregate supply curve to the right until long-run equilibrium is restored at a price level corresponding to point d and output level, Yp.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

77

Figure 12-1

Refer to Figure 12-1. Assume that the economy is initially at Y1. A nonintervention policy

Would result in the restoration of potential output by allowing the

A) the aggregate demand curve to shift to the right.

B) the short-run aggregate supply curve to shift to the right.

C) the aggregate demand curve to shift to the left.

D) the short-run aggregate supply curve to shift to the left.

Refer to Figure 12-1. Assume that the economy is initially at Y1. A nonintervention policy

Would result in the restoration of potential output by allowing the

A) the aggregate demand curve to shift to the right.

B) the short-run aggregate supply curve to shift to the right.

C) the aggregate demand curve to shift to the left.

D) the short-run aggregate supply curve to shift to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

78

Contractionary fiscal policy includes

A) increasing taxes and increasing government purchases.

B) raising interest rates, increasing taxes, and decreasing transfer payments.

C) increasing taxes and decreasing government expenditures.

D) raising interest rates, decreasing taxes, and decreasing government spending.

A) increasing taxes and increasing government purchases.

B) raising interest rates, increasing taxes, and decreasing transfer payments.

C) increasing taxes and decreasing government expenditures.

D) raising interest rates, decreasing taxes, and decreasing government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

79

Figure 12-1

Refer to Figure 12-1. The economy is initially at output level Y1 and there is

A) an inflationary gap.

B) a recessionary gap.

C) equilibrium at full employment.

D) a short-run and a long-run equilibrium.

Refer to Figure 12-1. The economy is initially at output level Y1 and there is

A) an inflationary gap.

B) a recessionary gap.

C) equilibrium at full employment.

D) a short-run and a long-run equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck

80

Suppose fiscal authorities raise state income tax rates. As a result, disposable income falls, thereby

A) decreasing consumption spending, and causing the aggregate demand curve to shift to the left.

B) decreasing consumption spending, and causing a movement along a given aggregate demand curve.

C) increasing saving, and causing the aggregate demand curve to shift to the left.

D) increasing saving, and causing a movement along a given aggregate demand curve.

A) decreasing consumption spending, and causing the aggregate demand curve to shift to the left.

B) decreasing consumption spending, and causing a movement along a given aggregate demand curve.

C) increasing saving, and causing the aggregate demand curve to shift to the left.

D) increasing saving, and causing a movement along a given aggregate demand curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 181 في هذه المجموعة.

فتح الحزمة

k this deck