Deck 13: Planning for the Harvest

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/82

العب

ملء الشاشة (f)

Deck 13: Planning for the Harvest

1

In earlier years, the leveraged buyout became synonymous with the bust-up leveraged buyout.

True

2

With an initial public offering, the entrepreneur's goals and motivations are likely to be very different from those of the investment banker.

True

3

A strategic buyer is most interested in the stand-alone, cash-generating potential of a business.

False

4

Investors in a startup company are mainly interested in the new firm's growth; thereby increasing their value. Consequently, they are not particularly interested in an exit plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

5

Many entrepreneurs consider an initial public offering to be the "holy grail" of their career, even though most do not really understand the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

6

Many entrepreneurs successfully grow their firms, but fail to develop an effective exit plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

7

With a private equity placement, the firm's equity is sold in public equity markets, but the transaction is handled by a private investment banker.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

8

Employee stock ownership plans provide a way for employees with stock in a firm to cash out their ownership position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

9

Harvesting is the method entrepreneurs and investors use to grow their firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

10

As in any exit strategy, the sale of a firm is solely about determining the value of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

11

Harvesting encompasses more than just selling and leaving a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

12

One of the reasons for going public to raise equity capital is to create a liquid market for the company's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

13

The build-up leveraged buyout is typically used in industries that are dominated by large firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

14

Since future growth usually requires great cash inflows, owners who decide to harvest a value-creating firm by withdrawing cash flows should accelerate the process as much as possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

15

More recently, the bust-up leveraged buyout was replaced with the build-up leveraged buyout.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

16

The boost to employee motivation and effort that results from ownership will vary significantly from firm to firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

17

One of the drawbacks of harvesting by withdrawing cash flows is that the owner must seek out a buyer for the eventual sale of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

18

For the entrepreneur who is simply tired of the day-to-day operations of the business, siphoning off cash flows over time may require too much patience.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

19

Most small business owners prefer selling their firm to a financial buyer rather than a strategic buyer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

20

An employee buyer is most interested in the firm as a stand-alone, cash-generating business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

21

The different types of transactions involving small businesses are

A) strategic, financial, and employee acquisitions.

B) financial, employee, and internal acquisitions.

C) strategic, internal, and financial acquisitions.

D) internal, external, and complex acquisitions.

A) strategic, financial, and employee acquisitions.

B) financial, employee, and internal acquisitions.

C) strategic, internal, and financial acquisitions.

D) internal, external, and complex acquisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

22

Harvesting owners can be paid in cash or in stock of the acquiring firm, with stock generally being preferred over cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

23

Entrepreneurs often do not make good employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

24

Owing to the precision of the formulas that guide practice, many think of business valuation as an exact science.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

25

Entrepreneurs who accept stock in payment for the sale of their businesses are usually pleased with the results because they escape a significant tax burden.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

26

Entrepreneurs should think very carefully about their motives for exiting a business and what they plan to do after the harvest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

27

Investors always think ahead about how to exit an enterprise, but the entrepreneur should not have this focus since the business will perform better if it is managed with day-to-day operations in mind.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

28

Many entrepreneurs have a sense of gratitude for the benefits they have received from living in a capitalist system, so they feel the need to give something back to society, both with their time and with their money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

29

Harvesting refers to

A) starting a business.

B) managing the growth of a business.

C) exiting a business.

D) diversifying a business.

A) starting a business.

B) managing the growth of a business.

C) exiting a business.

D) diversifying a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is not one of the common harvest strategies used by small businesses?

A) Releasing the firm's cash flows to its owners

B) Offering stock to the public in an IPO

C) Completing a private placement of a stock

D) Inviting a friendly takeover

A) Releasing the firm's cash flows to its owners

B) Offering stock to the public in an IPO

C) Completing a private placement of a stock

D) Inviting a friendly takeover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

31

Exiting or harvesting encompasses

A) merely selling and leaving a business.

B) the creation of future options.

C) the establishment of a benchmark for firm risk.

D) capturing future profitability.

A) merely selling and leaving a business.

B) the creation of future options.

C) the establishment of a benchmark for firm risk.

D) capturing future profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

32

The recession of 2009 affected the availability of financing to buy companies, resulting in an increase of seller financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

33

Strategic buyers evaluate acquisition candidates according to the

A) stand-along, cash-generating potential of a target business.

B) synergies they think the target business will create.

C) potential of the target business to preserve employment.

D) quality of the business strategy of the target firm.

A) stand-along, cash-generating potential of a target business.

B) synergies they think the target business will create.

C) potential of the target business to preserve employment.

D) quality of the business strategy of the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

34

The availability of exit options is an important determinant of the appeal of the firm to

A) suppliers.

B) investors.

C) the employees of the company.

D) the management of the company.

A) suppliers.

B) investors.

C) the employees of the company.

D) the management of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

35

Martin Lightsey, in selling shares in Specialty Blades, Inc., took advantage of an SEC exemption called an intrastate offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

36

Entrepreneurs frequently do not appreciate the difficulty of selling or exiting a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

37

A management buyout can contribute significantly to a firm's operating performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

38

In earlier years, leveraged buyouts became synonymous with the ____ LBO.

A) bust-up

B) build-up

C) owner-financed

D) publicly-funded

A) bust-up

B) build-up

C) owner-financed

D) publicly-funded

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

39

The harvesting of a business is exclusively the selling and exiting of a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

40

The opportunity to exit a business is triggered by an interested seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

41

A leveraged buyout involves a high level of _____ financing.

A) debt

B) equity

C) strategic

D) unsecured

A) debt

B) equity

C) strategic

D) unsecured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

42

Having publicly traded stock can be beneficial to owners in that a public market offers

A) greater liquidity.

B) protection against an unwanted harvest.

C) insight into how to improve the performance of the firm.

D) a justification for refusing requests for ESOP options.

A) greater liquidity.

B) protection against an unwanted harvest.

C) insight into how to improve the performance of the firm.

D) a justification for refusing requests for ESOP options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is a very important question to ask as a firm moves toward a harvest?

A) Why do the owners want to harvest?

B) What is the value of the firm?

C) Does the firm have a leadership succession plan in the event that the firm sells?

D) Will the owners change their minds?

A) Why do the owners want to harvest?

B) What is the value of the firm?

C) Does the firm have a leadership succession plan in the event that the firm sells?

D) Will the owners change their minds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

44

The owner of a hardware store has agreed to sell his business to another local hardware store owner. The purchaser would likely be described as a sale to a _____ buyer.

A) competing

B) employee

C) financial

D) strategic

A) competing

B) employee

C) financial

D) strategic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

45

Michael Handelsman's tips for selling a business in a difficult economy include the following except

A) clean up the books

B) seek cash buyers only

C) keep revenue strong

D) consider your sector and market

A) clean up the books

B) seek cash buyers only

C) keep revenue strong

D) consider your sector and market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

46

The mere fact that a firm is earning high rates of return on the firm's asset indicates that

A) the firm is worth more as a going concern than as a dead one.

B) downsizing is likely to be an economically sound option for the business.

C) it is time to start growing the business again.

D) it might be wise to further limit the cash flows returned to investors.

A) the firm is worth more as a going concern than as a dead one.

B) downsizing is likely to be an economically sound option for the business.

C) it is time to start growing the business again.

D) it might be wise to further limit the cash flows returned to investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

47

From the owner's perspective, which of the following would be considered an advantage of harvesting via withdrawal of cash flows from the firm?

A) Retaining control

B) Preserving cash for later reinvestment

C) Greater latitude in seeking out a buyer for the firm

D) Increasing long-term returns from the business

A) Retaining control

B) Preserving cash for later reinvestment

C) Greater latitude in seeking out a buyer for the firm

D) Increasing long-term returns from the business

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

48

An MBO is a(n) _____ in which management is part of the group buying the company.

A) ESOP

B) IPO

C) PPO

D) LBO

A) ESOP

B) IPO

C) PPO

D) LBO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following steps in the IPO process precedes the others?

A) Audit the last three years of financial statements

B) Draft a registration statement

C) Explain IPO attributes to potential investors

D) Decide upon a price for the business

A) Audit the last three years of financial statements

B) Draft a registration statement

C) Explain IPO attributes to potential investors

D) Decide upon a price for the business

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

50

Going public can be beneficial to a firm by helping it

A) create a liquid currency to fund future acquisitions.

B) avoid becoming a takeover target in the future.

C) erect a shield against the fluctuations of the stock market.

D) offer better compensation packages to attract superior management talent.

A) create a liquid currency to fund future acquisitions.

B) avoid becoming a takeover target in the future.

C) erect a shield against the fluctuations of the stock market.

D) offer better compensation packages to attract superior management talent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

51

An IPO occurs when a company offers its stock to

A) investment practitioner organizations

B) family

C) intrastate private investors

D) the general public

A) investment practitioner organizations

B) family

C) intrastate private investors

D) the general public

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

52

The most immediate goal of a company once it becomes highly leveraged is to

A) make an operating profit.

B) purchase additional assets.

C) restructure its logistics systems.

D) service the debt.

A) make an operating profit.

B) purchase additional assets.

C) restructure its logistics systems.

D) service the debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

53

Harvesting a business by releasing the cash flows as dividends creates the worst tax disadvantage for _____.

A) C-corporation shareholders

B) partnerships

C) S-corporation shareholders

D) sole proprietors

A) C-corporation shareholders

B) partnerships

C) S-corporation shareholders

D) sole proprietors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

54

The IPO process may be one of the most _____ experiences of an entrepreneur's life.

A) exhilarating, frustrating, and exhausting

B) frustrating, tempting, and exhausting

C) tempting, exhausting, and exhilarating

D) encouraging and nerve-wrecking

A) exhilarating, frustrating, and exhausting

B) frustrating, tempting, and exhausting

C) tempting, exhausting, and exhilarating

D) encouraging and nerve-wrecking

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

55

Matt Townsend owns a car dealership that is very profitable. Since he plans to retire in 5-10 years, Townsend has decided to retain ownership for now, but without continuing to grow the business. This change would also allow him to invest for retirement some of the cash that the business is now generating. Which of the following harvesting methods does this illustrate?

A) A delayed sellout

B) A strategy to release the firm's free cash flows to the owners

C) Offering stock to the public through an IPO

D) Issuing a private placement of stock

A) A delayed sellout

B) A strategy to release the firm's free cash flows to the owners

C) Offering stock to the public through an IPO

D) Issuing a private placement of stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

56

A build-up leveraged buyout involves

A) developing the business to make it an attractive takeover target.

B) acquiring businesses that occupy a higher level in the market channel.

C) a longer time horizon than a bust-up leveraged buyout.

D) constructing a larger enterprise to be taken public via an IPO.

A) developing the business to make it an attractive takeover target.

B) acquiring businesses that occupy a higher level in the market channel.

C) a longer time horizon than a bust-up leveraged buyout.

D) constructing a larger enterprise to be taken public via an IPO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

57

An MBO is a potentially viable means of transferring ownership from the founder to the

A) marketing team.

B) market build-up team.

C) management team.

D) market bust-up team.

A) marketing team.

B) market build-up team.

C) management team.

D) market bust-up team.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

58

_____ acquisitions are not popular among many small business owners.

A) Competing

B) Employee

C) Financial

D) Strategic

A) Competing

B) Employee

C) Financial

D) Strategic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

59

An employee stock ownership plan represents

A) a good way for a business founder to build his/her position in the company.

B) an opportunity for employees to acquire an ownership interest in their company.

C) a harvest method of choice.

D) an effort to ease investor concerns.

A) a good way for a business founder to build his/her position in the company.

B) an opportunity for employees to acquire an ownership interest in their company.

C) a harvest method of choice.

D) an effort to ease investor concerns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

60

Regarding IPOs, the primary motivation of the issuing firm and that of the investment banker are

A) the same-maximizing the price of the firm.

B) similar-completing the sale.

C) very different because they are compensated for different outcomes.

D) impossible to know since every deal is structured differently.

A) the same-maximizing the price of the firm.

B) similar-completing the sale.

C) very different because they are compensated for different outcomes.

D) impossible to know since every deal is structured differently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

61

Financial Buyers evaluate acquisition candidates according to

A) stand-alone, cash generating potential of a target business.

B) synergies they think the target business will create.

C) potential of the target business to preserve employment.

D) the level of debt the target business has accumulated.

A) stand-alone, cash generating potential of a target business.

B) synergies they think the target business will create.

C) potential of the target business to preserve employment.

D) the level of debt the target business has accumulated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

62

A private IPO provides _____ cash than a LBO, but allows the entrepreneur to _____ control of the firm

A) less; release

B) more; release

C) less; retain

D) more; retain

A) less; release

B) more; release

C) less; retain

D) more; retain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

63

After harvesting, many entrepreneurs experience conflicts that are _____ in nature.

A) financial

B) practical

C) emotional

D) tactical

A) financial

B) practical

C) emotional

D) tactical

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

64

You Make the Call-Situation 3

At age 63, Michael Lipper sold his firm to Reuters. His assessment of the sale follows:

One of the reasons we sold our business to Reuters was because we knew we probably couldn't manage the technology of the future by ourselves. Any entrepreneur who builds a business for as long as I have would be dishonest if he did not suffer a certain sadness [from selling]. If [Reuters] make a wonderful success out of this, there may be some ego pain. If they muck it up, they've damaged our name and hurt our people.

Lois Silverman co-founded CRA Managed Care (now known as Concentra Managed Care). When the firm went public in 1995, Silverman's stake was over $10 million. After taking Concentra public, Silverman gave up all involvement in day-to-day operations. Along with 12 other successful businesswomen, she formed the not-for-profit Commonwealth Institute, to help women entrepreneurs set up boards and secure capital. She also became involved with a newspaper called Women's Business. She later told this story:

The other day a man said to me on a golf course, "I hope I hit this ball, because since I've left my business, I don't know what to do with myself." And I said to myself, "I'm so lucky."

![You Make the Call-Situation 3 At age 63, Michael Lipper sold his firm to Reuters. His assessment of the sale follows: One of the reasons we sold our business to Reuters was because we knew we probably couldn't manage the technology of the future by ourselves. Any entrepreneur who builds a business for as long as I have would be dishonest if he did not suffer a certain sadness [from selling]. If [Reuters] make a wonderful success out of this, there may be some ego pain. If they muck it up, they've damaged our name and hurt our people. Lois Silverman co-founded CRA Managed Care (now known as Concentra Managed Care). When the firm went public in 1995, Silverman's stake was over $10 million. After taking Concentra public, Silverman gave up all involvement in day-to-day operations. Along with 12 other successful businesswomen, she formed the not-for-profit Commonwealth Institute, to help women entrepreneurs set up boards and secure capital. She also became involved with a newspaper called Women's Business. She later told this story: The other day a man said to me on a golf course, I hope I hit this ball, because since I've left my business, I don't know what to do with myself. And I said to myself, I'm so lucky.](https://d2lvgg3v3hfg70.cloudfront.net/TB4697/11eaba9b_d078_b4c1_836c_ef97a836f77b_TB4697_00.jpg)

At age 63, Michael Lipper sold his firm to Reuters. His assessment of the sale follows:

One of the reasons we sold our business to Reuters was because we knew we probably couldn't manage the technology of the future by ourselves. Any entrepreneur who builds a business for as long as I have would be dishonest if he did not suffer a certain sadness [from selling]. If [Reuters] make a wonderful success out of this, there may be some ego pain. If they muck it up, they've damaged our name and hurt our people.

Lois Silverman co-founded CRA Managed Care (now known as Concentra Managed Care). When the firm went public in 1995, Silverman's stake was over $10 million. After taking Concentra public, Silverman gave up all involvement in day-to-day operations. Along with 12 other successful businesswomen, she formed the not-for-profit Commonwealth Institute, to help women entrepreneurs set up boards and secure capital. She also became involved with a newspaper called Women's Business. She later told this story:

The other day a man said to me on a golf course, "I hope I hit this ball, because since I've left my business, I don't know what to do with myself." And I said to myself, "I'm so lucky."

![You Make the Call-Situation 3 At age 63, Michael Lipper sold his firm to Reuters. His assessment of the sale follows: One of the reasons we sold our business to Reuters was because we knew we probably couldn't manage the technology of the future by ourselves. Any entrepreneur who builds a business for as long as I have would be dishonest if he did not suffer a certain sadness [from selling]. If [Reuters] make a wonderful success out of this, there may be some ego pain. If they muck it up, they've damaged our name and hurt our people. Lois Silverman co-founded CRA Managed Care (now known as Concentra Managed Care). When the firm went public in 1995, Silverman's stake was over $10 million. After taking Concentra public, Silverman gave up all involvement in day-to-day operations. Along with 12 other successful businesswomen, she formed the not-for-profit Commonwealth Institute, to help women entrepreneurs set up boards and secure capital. She also became involved with a newspaper called Women's Business. She later told this story: The other day a man said to me on a golf course, I hope I hit this ball, because since I've left my business, I don't know what to do with myself. And I said to myself, I'm so lucky.](https://d2lvgg3v3hfg70.cloudfront.net/TB4697/11eaba9b_d078_b4c1_836c_ef97a836f77b_TB4697_00.jpg)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a harvest situation, the exiting owners are usually paid in cash or

A) tangible assets.

B) imputed goodwill.

C) favorable publicity.

D) stock.

A) tangible assets.

B) imputed goodwill.

C) favorable publicity.

D) stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following are always concerned about how to exit a business?

A) Investors

B) Entrepreneurs

C) Employees of the firm

D) Investment bankers

A) Investors

B) Entrepreneurs

C) Employees of the firm

D) Investment bankers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

67

Harvesting owners generally prefer _____ over _____.

A) cash, stock

B) debt, equity

C) equity, debt

D) stock, cash

A) cash, stock

B) debt, equity

C) equity, debt

D) stock, cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

68

The opportunity cost on a specific investment is the

A) projected future value of the investment.

B) present value of that investment.

C) value of the assets used for capital for that investment.

D) rate of return that could be earned on a similar investment.

A) projected future value of the investment.

B) present value of that investment.

C) value of the assets used for capital for that investment.

D) rate of return that could be earned on a similar investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

69

A(n) _____ exists when a company offers its stock to the general public

A) ESOP

B) IPO

C) MBO

D) LBO

A) ESOP

B) IPO

C) MBO

D) LBO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

70

What are the personal issues an entrepreneur will face in post-harvest life?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

71

The value of a business is determined by

A) what the owner believes the business is worth.

B) what a valuation formula determines its worth is to the owner.

C) what a valuation formula determines its worth is to the buyer.

D) what a buyer with the cash is prepared to pay.

A) what the owner believes the business is worth.

B) what a valuation formula determines its worth is to the owner.

C) what a valuation formula determines its worth is to the buyer.

D) what a buyer with the cash is prepared to pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

72

List the three basic types of acquisitions and identify the purpose of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

73

The effects of the harvesting process include

A) a reduction in time and energy.

B) an increased managerial focus.

C) an increase in momentum.

D) poor performance.

A) a reduction in time and energy.

B) an increased managerial focus.

C) an increase in momentum.

D) poor performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

74

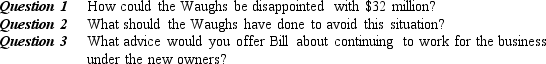

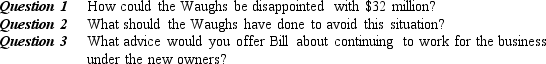

You Make the Call-Situation 1

Bill and Francis Waugh founded Casa Bonita. They started with a single fast-food Mexican restaurant in Abilene, Texas. At the time, they both worked seven days a week. From that small beginning, they expanded to 84 profitable restaurants located in Texas, Oklahoma, Arkansas, and Colorado. Over the years, other restaurant owners expressed an interest in buying the firm; however, the Waughs were not interested in selling. Then an English firm, Unigate Limited, offered them $32 million for the business and said Bill could remain the firm's CEO. The Waughs were attracted by the idea of having $32 million in liquid assets. They flew to London to close the deal. On the flight home, however, Bill began having doubts about their decision to sell the business. He thought, "We spent 15 years of our lives getting the business where we wanted it, and we've lost it." After their plane landed in New York, they spent the night and then flew back to London the next day. They offered the buyers $1 million to cancel the contract, but Unigate's management declined the offer. The Waughs flew home disappointed.

Bill and Francis Waugh founded Casa Bonita. They started with a single fast-food Mexican restaurant in Abilene, Texas. At the time, they both worked seven days a week. From that small beginning, they expanded to 84 profitable restaurants located in Texas, Oklahoma, Arkansas, and Colorado. Over the years, other restaurant owners expressed an interest in buying the firm; however, the Waughs were not interested in selling. Then an English firm, Unigate Limited, offered them $32 million for the business and said Bill could remain the firm's CEO. The Waughs were attracted by the idea of having $32 million in liquid assets. They flew to London to close the deal. On the flight home, however, Bill began having doubts about their decision to sell the business. He thought, "We spent 15 years of our lives getting the business where we wanted it, and we've lost it." After their plane landed in New York, they spent the night and then flew back to London the next day. They offered the buyers $1 million to cancel the contract, but Unigate's management declined the offer. The Waughs flew home disappointed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

75

Outline the steps in the IPO process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

76

Post-harvest entrepreneurs may become disillusioned when they realize their sense of identity

A) was associated with the quest for wealth.

B) derived from interactions with employees.

C) was intertwined with their business.

D) does not return after joining in social or charitable work.

A) was associated with the quest for wealth.

B) derived from interactions with employees.

C) was intertwined with their business.

D) does not return after joining in social or charitable work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

77

List and briefly explain the four basic harvest strategies for the small business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

78

Uncertainties accompanying an impending sale of a business often

A) lead to lower employee morale.

B) attract the attention of the Securities and Exchange Commission.

C) cause the deal to fall through.

D) increase costs from added legal services.

A) lead to lower employee morale.

B) attract the attention of the Securities and Exchange Commission.

C) cause the deal to fall through.

D) increase costs from added legal services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following best characterizes business valuation?

A) Valuation is almost a perfect science.

B) Since there are so many intangibles, valuation is mostly an art.

C) The buyer determines the value of a business.

D) Negotiation skills play an important part in valuation.

A) Valuation is almost a perfect science.

B) Since there are so many intangibles, valuation is mostly an art.

C) The buyer determines the value of a business.

D) Negotiation skills play an important part in valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

80

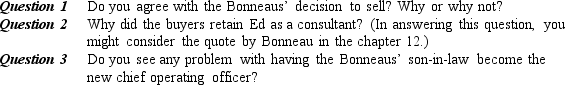

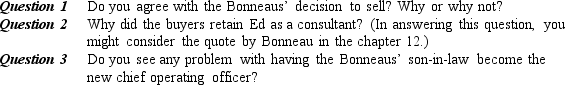

You Make the Call-Situation 2

Ed and Barbara Bonneau started their wholesale sunglass distribution firm 30 years ago with $1,000 of their own money and $5,000 borrowed from a country banker in Ed's hometown. The firm grew quickly, selling sunglasses and reading glasses to such companies as Wal-Mart, Eckerd Drugs, and Phar-Mor. In addition, the Bonneaus enjoyed using the company to do good things. For example, they had a company chaplain, who was available when employees were having family problems, such as a death in the family. Although the company had done well, the market had matured recently and profit margins narrowed significantly. Wal-Mart, for example, was insisting on better terms, which meant significantly lower profits for the Bonneaus. Previously, Ed had set the prices that he needed to make a good return on his investment. Now, the buyers had consolidated, and they had the power. Ed didn't enjoy running the company as much as he had in the past, and he was finding greater pleasure in other activities; for instance, he served on a local hospital board and was actively involved in church activities.

Just as Ed and Barbara began to think about selling the company, they were contacted by a financial buyer, who wanted to use their firm as a platform and then buy up several sunglass companies. After negotiations, the Bonneaus sold their firm for about $20 million. In addition, Ed received a retainer fee for serving as a consultant to the buyer. Also, the Bonneaus' son-in-law, who was part of the company's management team, was named the new chief operating officer.

Ed and Barbara Bonneau started their wholesale sunglass distribution firm 30 years ago with $1,000 of their own money and $5,000 borrowed from a country banker in Ed's hometown. The firm grew quickly, selling sunglasses and reading glasses to such companies as Wal-Mart, Eckerd Drugs, and Phar-Mor. In addition, the Bonneaus enjoyed using the company to do good things. For example, they had a company chaplain, who was available when employees were having family problems, such as a death in the family. Although the company had done well, the market had matured recently and profit margins narrowed significantly. Wal-Mart, for example, was insisting on better terms, which meant significantly lower profits for the Bonneaus. Previously, Ed had set the prices that he needed to make a good return on his investment. Now, the buyers had consolidated, and they had the power. Ed didn't enjoy running the company as much as he had in the past, and he was finding greater pleasure in other activities; for instance, he served on a local hospital board and was actively involved in church activities.

Just as Ed and Barbara began to think about selling the company, they were contacted by a financial buyer, who wanted to use their firm as a platform and then buy up several sunglass companies. After negotiations, the Bonneaus sold their firm for about $20 million. In addition, Ed received a retainer fee for serving as a consultant to the buyer. Also, the Bonneaus' son-in-law, who was part of the company's management team, was named the new chief operating officer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck