Deck 10: Understanding a Firms Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/78

العب

ملء الشاشة (f)

Deck 10: Understanding a Firms Financial Statements

1

Accounts payable consist of payments due from a firm's customers.

False

2

The income statement answers the question: "How profitable is the business?"

True

3

The income statement shows the profit or loss from a firm's operations over a given period of time.

True

4

A new business needs to manage cash flows carefully because if a firm runs out of cash, it is out of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

5

Depreciation is the cost of a firm's equipment and building allocated over their useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

6

The income statement shows a firm's financial position on a specific date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

7

The balance sheet shows a firm's assets, liabilities, and owners' equity at a specific point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

8

The money that owners invest in the business is called owners' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

9

Ownership equity represents the owner's investment in the company, which can be either his/her cash invested in the company or money borrowed from a bank to purchase fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

10

Total assets less outstanding debt must always equal ownership equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

11

Assets that can be converted to cash relatively quickly are said to be liquid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

12

In the text the authors state that the terms earnings and profits will be used interchangeably, but not income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

13

A profitable company does not necessarily have positive cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

14

Profits reward owners for investing in a company, but they do little to promote future growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

15

Jan Woodring is considering investing in a business. To see the firm's financial position over a period of time, she should look at its balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

16

The cash flow statement answers the questions "where did the cash come from?' and "where did it go?"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

17

The income statement reports a firm's results over a given period of time, but to determine a firm's complete financial position the cash flow statement is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

18

Cash flows that investors either provide to or receive from the business are called cash flows from owners' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

19

Accounts payable, accrued expenses, 5-year notes payable, and 90-day notes are short-term liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

20

The major difference between cash-basis accounting and accrual-basis accounting lies in when the firm recognizes revenue and profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

21

Other assets include

A) land.

B) machinery.

C) contingency funds.

D) goodwill.

A) land.

B) machinery.

C) contingency funds.

D) goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

22

The best financial ratio to determine a company's ability to pay debt as it comes due is the debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

23

As Krista explained to her daughters Ashley and Cameron, the report that provides a picture of the firm's assets and its sources of financing at a point in time is the

A) balance sheet.

B) income statement.

C) cash flow statement.

D) asset list.

A) balance sheet.

B) income statement.

C) cash flow statement.

D) asset list.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

24

A conventional measure of a firm's liquidity is a comparison of current assets to current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

25

Liquidity represents the degree to which a firm can meet maturing short-term debt obligations with available working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

26

Fixed assets include

A) land.

B) copyrights.

C) contingency funds.

D) goodwill.

A) land.

B) copyrights.

C) contingency funds.

D) goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

27

In order to determine the cash flows from day-to-day operations the firm must convert the company's income statement from an accrual basis to a cash basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

28

To determine the debt ratio, the total debt is divided by the total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

29

Assets that are relatively liquid are classified as

A) current assets.

B) fixed assets.

C) short-term assets.

D) other assets.

A) current assets.

B) fixed assets.

C) short-term assets.

D) other assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

30

Other assets would include all of the following except

A) startup costs.

B) patents.

C) copyrights.

D) inventories.

A) startup costs.

B) patents.

C) copyrights.

D) inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

31

The ____ shows the results of a firm's operations over a period of time, usually one year.

A) income statement

B) balance sheet

C) statement of cash flow

D) statement of financial position

A) income statement

B) balance sheet

C) statement of cash flow

D) statement of financial position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

32

The three activities that explain the cash inflows and outflows of a business are the selling, investment and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

33

An example of a fixed asset is

A) a delivery truck for sale by an automotive dealer.

B) inventory.

C) a delivery truck used by a grocer to deliver merchandise to customers.

D) short-term investments in stock.

A) a delivery truck for sale by an automotive dealer.

B) inventory.

C) a delivery truck used by a grocer to deliver merchandise to customers.

D) short-term investments in stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

34

Earnings before taxes are computed by deducting the firm's interest expense from its ____ income.

A) total

B) projected

C) net

D) operating

A) total

B) projected

C) net

D) operating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

35

An example of a current asset is

A) equipment.

B) land.

C) leased property.

D) accounts receivable.

A) equipment.

B) land.

C) leased property.

D) accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

36

Ownership equity is derived only from sources external to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

37

Dividends to a firm's owners are not considered an expense in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

38

An example of a current asset is

A) land.

B) inventories.

C) equipment.

D) buildings.

A) land.

B) inventories.

C) equipment.

D) buildings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

39

Using more debt can increase the owner's return on equity but it also increases risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

40

The net income does not measure the return on the firm's total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is not used in determining a company's profitability on assets?

A) return on assets

B) debt ratio

C) operating profit margin

D) total asset turnover

A) return on assets

B) debt ratio

C) operating profit margin

D) total asset turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

42

The amount of the business owners' initial investment, owners' later investment in the business, and retained earnings comprise

A) debt capital.

B) accrued expenses.

C) owners' long-term debt.

D) owners' equity capital.

A) debt capital.

B) accrued expenses.

C) owners' long-term debt.

D) owners' equity capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

43

Cumulative depreciation expense is shown on the

A) balance sheet.

B) cash-flow statement.

C) income statement.

D) all of these.

A) balance sheet.

B) cash-flow statement.

C) income statement.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

44

The income statement reports financial information related to the following broad areas of business except

A) sales

B) operating expenses

C) accumulated depreciation

D) interest expense

A) sales

B) operating expenses

C) accumulated depreciation

D) interest expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

45

Raw materials and products held by the firm for sale constitute _____.

A) accounts payable.

B) accounts receivable.

C) cost of goods.

D) inventories.

A) accounts payable.

B) accounts receivable.

C) cost of goods.

D) inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

46

The debt ratio is determined by dividing the firm's total debt by the total _____.

A) income

B) operating profits

C) assets

D) liabilities

A) income

B) operating profits

C) assets

D) liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

47

The cash flow statement reflects cash flows from

A) operating activities.

B) investment activities.

C) financing activities.

D) operating, investment, and financing activities.

A) operating activities.

B) investment activities.

C) financing activities.

D) operating, investment, and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

48

A two year-old asset has a depreciable life of 10 years. Its initial purchase cost was $450,000 and it is depreciated by 10 percent annually. What is the remaining depreciable value of the asset?

A) $ 0.00

B) $90,000

C) $200,000

D) $360,000

A) $ 0.00

B) $90,000

C) $200,000

D) $360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

49

Current debt represents amounts borrowed from banks or other lending sources for _____ or less.

A) 2 years

B) 6 months

C) 1 quarter

D) 12 months

A) 2 years

B) 6 months

C) 1 quarter

D) 12 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

50

For their opening day, Ashley and Cameron bought $40 of "premium pink lemonade mix" and paper cups, which constituted their

A) cash balance.

B) fixed assets.

C) inventories.

D) cost of goods sold.

A) cash balance.

B) fixed assets.

C) inventories.

D) cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

51

The cash flow statement measures cash flows on

A) an annual basis.

B) an accrual basis.

C) a cash-basis.

D) a normalized basis.

A) an annual basis.

B) an accrual basis.

C) a cash-basis.

D) a normalized basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

52

On the balance sheet, for every dollar of assets there must be a dollar of financing in the form of debt or _____.

A) owner's equity

B) accounts receivable

C) accumulated depreciation

D) net profit

A) owner's equity

B) accounts receivable

C) accumulated depreciation

D) net profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

53

The value of a depreciable asset

A) is constant over time.

B) increases with each use of the asset.

C) decreases over time.

D) increases over time.

A) is constant over time.

B) increases with each use of the asset.

C) decreases over time.

D) increases over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

54

The "bottom line" of the income statement is affected by all of the following EXCEPT:

A) cost of good sold

B) dividends paid to owners

C) general and administrative costs

D) marketing expenses

A) cost of good sold

B) dividends paid to owners

C) general and administrative costs

D) marketing expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

55

The _____ shows all cash receipts and payments involved in operating the business and managing its financial activities.

A) income statement

B) balance sheet

C) cash flow statement

D) statement of financial position

A) income statement

B) balance sheet

C) cash flow statement

D) statement of financial position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

56

After their first day Ashley and Cameron's profits were $45, but their cash increased by only $30 because their _____ also increased.

A) debt

B) inventory

C) accounts payable

D) accounts receivable.

A) debt

B) inventory

C) accounts payable

D) accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

57

In order to derive a cash flow statement, starting with the income statement the owner must add back in _____.

A) depreciation expense

B) increase in accounts receivable

C) increases in inventory

D) decrease in accounts payable

A) depreciation expense

B) increase in accounts receivable

C) increases in inventory

D) decrease in accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

58

The major distinction between cash-basis and accrual-basis accounting is that the

A) cash method is easier to use.

B) cash method matches revenue and expenses better.

C) point of recognition of revenue and expenses is different.

D) cash method involves less record keeping.

A) cash method is easier to use.

B) cash method matches revenue and expenses better.

C) point of recognition of revenue and expenses is different.

D) cash method involves less record keeping.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

59

Current assets include all of the following EXCEPT

A) accounts payable.

B) accounts receivable.

C) cash.

D) inventories.

A) accounts payable.

B) accounts receivable.

C) cash.

D) inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

60

Interest expense is deducted from the _____ to arrive at the company's profits before taxes.

A) operating profits

B) gross profits

C) net profits

D) cost of goods sold

A) operating profits

B) gross profits

C) net profits

D) cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

61

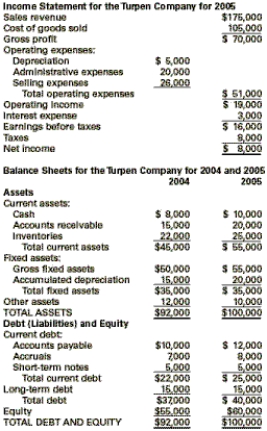

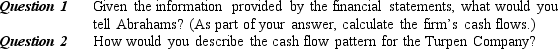

You Make the Call-Situation 2

At the beginning of 2005, Mary Abrahams purchased a small business, the Turpen Company, whose income statement and balance sheets are shown below.

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

At the beginning of 2005, Mary Abrahams purchased a small business, the Turpen Company, whose income statement and balance sheets are shown below.

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

62

Describe the main reasons why profits based on an accrual accounting system will differ from those based on a cash-based system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

63

The number resulting when taxes are subtracted from earnings is the _____ income

A) total

B) projected

C) net

D) operating

A) total

B) projected

C) net

D) operating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

64

A company's net income depends on all of the following except

A) amount of sales.

B) cost of goods sold.

C) interest expenses and taxes.

D) inventory estimates.

A) amount of sales.

B) cost of goods sold.

C) interest expenses and taxes.

D) inventory estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

65

List the four primary ways an entrepreneur's decisions play out when it comes to evaluating a firm's financial performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

66

Name and define three categories of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

67

The computation of cost of goods sold and operating expenses is based on all of the following except

A) the cost of goods sold.

B) general and administrative expenses.

C) the firm's interest expense.

D) depreciation expenses.

A) the cost of goods sold.

B) general and administrative expenses.

C) the firm's interest expense.

D) depreciation expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

68

You Make the Call-Situation 1

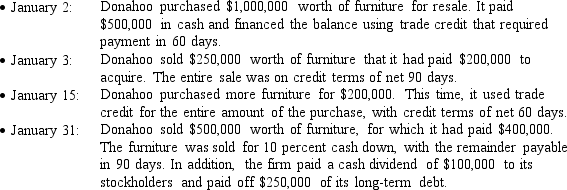

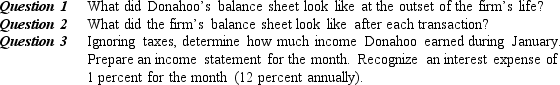

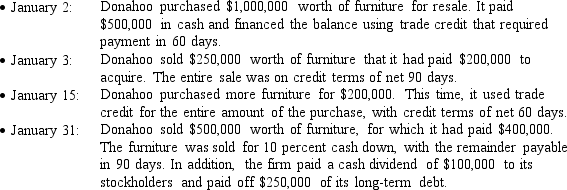

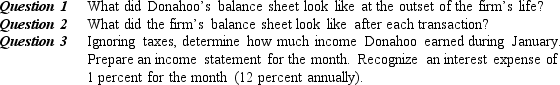

The Donahoo Furniture Sales Company was formed on December 31, 2004, with $1,000,000 in equity plus $500,000 in long-term debt. On January 1, 2005, all of the firm's capital was held in cash. The following transactions occurred during January 2005.

The Donahoo Furniture Sales Company was formed on December 31, 2004, with $1,000,000 in equity plus $500,000 in long-term debt. On January 1, 2005, all of the firm's capital was held in cash. The following transactions occurred during January 2005.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

69

Briefly explain the difference between accrual-basis accounting and cash-basis accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

70

The textbook identifies a number of sources of current debt. Name these sources and describe the nature of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a firm's current ratio improves from 1.5 to 2.0, what has likely happened?

A) Current liabilities have decreased

B) Fixed assets have increased

C) Ownership equity has increased

D) Long-term debt has decreased

A) Current liabilities have decreased

B) Fixed assets have increased

C) Ownership equity has increased

D) Long-term debt has decreased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

72

The liquidity of a firm is

A) often measured by a ratio of current assets to current liabilities.

B) not important to a company's financial health.

C) the ability of the firm to sell its products quickly.

D) a measurement of spontaneous financing.

A) often measured by a ratio of current assets to current liabilities.

B) not important to a company's financial health.

C) the ability of the firm to sell its products quickly.

D) a measurement of spontaneous financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

73

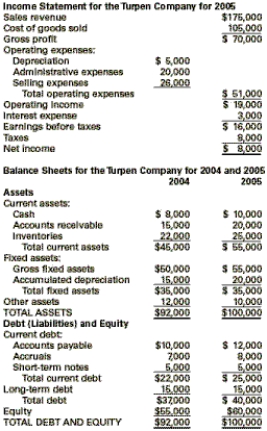

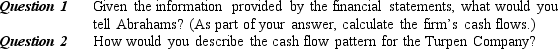

You Make the Call-Situation 3

Cameron Products, Inc., used as an example in chapter 10, is an actual firm (although some of the facts were changed to maintain confidentiality). Kate Lynn bought the firm from its founding owners and moved its operations to her hometown. Although she estimated the firm's asset needs and financing requirements, she cannot be certain that these projections will be realized. The figures merely represent the most likely case. Lynn also made some projections that she considers to be the worst-case and best-case sales and profit figures. If things do not go well, the firm might have sales of only $200,000 in its first year. However, if the potential of the business is realized, Lynn believes that sales could be as high as $325,000. If she needs any additional financing beyond the existing line of credit, she could conceivably borrow another $5,000 in short-term debt from the bank by pledging some personal investments. Any additional financing would need to come from Lynn herself, thereby increasing her equity stake in the business.

[Source: Personal conversation with Kate Lynn. (Numbers are hypothetical.)]

![You Make the Call-Situation 3 Cameron Products, Inc., used as an example in chapter 10, is an actual firm (although some of the facts were changed to maintain confidentiality). Kate Lynn bought the firm from its founding owners and moved its operations to her hometown. Although she estimated the firm's asset needs and financing requirements, she cannot be certain that these projections will be realized. The figures merely represent the most likely case. Lynn also made some projections that she considers to be the worst-case and best-case sales and profit figures. If things do not go well, the firm might have sales of only $200,000 in its first year. However, if the potential of the business is realized, Lynn believes that sales could be as high as $325,000. If she needs any additional financing beyond the existing line of credit, she could conceivably borrow another $5,000 in short-term debt from the bank by pledging some personal investments. Any additional financing would need to come from Lynn herself, thereby increasing her equity stake in the business. [Source: Personal conversation with Kate Lynn. (Numbers are hypothetical.)]](https://d2lvgg3v3hfg70.cloudfront.net/TB4697/11eaba9b_d07d_48bd_836c_59fc701b4e8b_TB4697_00.jpg)

Cameron Products, Inc., used as an example in chapter 10, is an actual firm (although some of the facts were changed to maintain confidentiality). Kate Lynn bought the firm from its founding owners and moved its operations to her hometown. Although she estimated the firm's asset needs and financing requirements, she cannot be certain that these projections will be realized. The figures merely represent the most likely case. Lynn also made some projections that she considers to be the worst-case and best-case sales and profit figures. If things do not go well, the firm might have sales of only $200,000 in its first year. However, if the potential of the business is realized, Lynn believes that sales could be as high as $325,000. If she needs any additional financing beyond the existing line of credit, she could conceivably borrow another $5,000 in short-term debt from the bank by pledging some personal investments. Any additional financing would need to come from Lynn herself, thereby increasing her equity stake in the business.

[Source: Personal conversation with Kate Lynn. (Numbers are hypothetical.)]

![You Make the Call-Situation 3 Cameron Products, Inc., used as an example in chapter 10, is an actual firm (although some of the facts were changed to maintain confidentiality). Kate Lynn bought the firm from its founding owners and moved its operations to her hometown. Although she estimated the firm's asset needs and financing requirements, she cannot be certain that these projections will be realized. The figures merely represent the most likely case. Lynn also made some projections that she considers to be the worst-case and best-case sales and profit figures. If things do not go well, the firm might have sales of only $200,000 in its first year. However, if the potential of the business is realized, Lynn believes that sales could be as high as $325,000. If she needs any additional financing beyond the existing line of credit, she could conceivably borrow another $5,000 in short-term debt from the bank by pledging some personal investments. Any additional financing would need to come from Lynn herself, thereby increasing her equity stake in the business. [Source: Personal conversation with Kate Lynn. (Numbers are hypothetical.)]](https://d2lvgg3v3hfg70.cloudfront.net/TB4697/11eaba9b_d07d_48bd_836c_59fc701b4e8b_TB4697_00.jpg)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

74

The equation "Sales-Expenses = Profits" would represent which financial statement?

A) Cash flow

B) Income

C) Retained earnings

D) Balance sheet

A) Cash flow

B) Income

C) Retained earnings

D) Balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a firm's current ratio _____, its liquidity _____.

A) increases. increases

B) increases, decreases

C) decreases, increases

D) increases, remains the same

A) increases. increases

B) increases, decreases

C) decreases, increases

D) increases, remains the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

76

Operating expenses include

A) marketing-related expenses.

B) the cost for independent dealers to prepare for the distribution of the product.

C) interest on all loans.

D) income taxes.

A) marketing-related expenses.

B) the cost for independent dealers to prepare for the distribution of the product.

C) interest on all loans.

D) income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

77

A business loan for 9 months would be best described as a(n)

A) account payable.

B) accrued expense.

C) short-term note.

D) long-tern debt.

A) account payable.

B) accrued expense.

C) short-term note.

D) long-tern debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck

78

What four variables drive the amount of profit a company earns?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 78 في هذه المجموعة.

فتح الحزمة

k this deck