Deck 7: Accounting Periods and Methods and Depreciation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/111

العب

ملء الشاشة (f)

Deck 7: Accounting Periods and Methods and Depreciation

1

The hybrid method of accounting involves the use of both the accrual and cash methods of accounting.

True

2

Amy is a calendar year taxpayer reporting on the cash basis. Indicate which of the following income or expense items should not be included in her 2015 tax return.

A)On April 15, 2016, she makes a deductible contribution to an IRA for 2015.

B)She prepays half a year of interest in advance on her mortgage on the last day of 2015.

C)She pays all her outstanding invoices for standard business expenses in the last week of December 2015.

D)She sends out a big bill to a customer on January 1, 2016, even though she did all of the work in December of 2015.

A)On April 15, 2016, she makes a deductible contribution to an IRA for 2015.

B)She prepays half a year of interest in advance on her mortgage on the last day of 2015.

C)She pays all her outstanding invoices for standard business expenses in the last week of December 2015.

D)She sends out a big bill to a customer on January 1, 2016, even though she did all of the work in December of 2015.

B

3

Quince Corporation changes its year-end from a fiscal year-end to a calendar year-end. The corporation has taxable income of $39,000 for its 3-month short period beginning October 1, 2015 and ending December 31, 2015. Calculate the corporation's tax for the short period.

$39,000 / 3 months × 12 months = $156,000

Tax on $156,000 = $44,090; $44,090 = [$22,250 + 39% × ($156,000 - $100,000)]

$11,023 = $44,090 / 12 × 3, short-period tax

Tax on $156,000 = $44,090; $44,090 = [$22,250 + 39% × ($156,000 - $100,000)]

$11,023 = $44,090 / 12 × 3, short-period tax

4

Mark the correct answer. In cash basis accounting, for tax purposes:

A)Income is recognized when it is actually or constructively received and expenses are recognized when they are actually or constructively incurred, regardless of when paid.

B)Income is recognized when it is earned regardless of when received and expenses are recognized when they are actually or constructively incurred.

C)Income is generally recognized when it is actually or constructively received and expenses are generally recognized when they are paid.

D)The cash basis is not allowed for businesses reported on Schedule C.

A)Income is recognized when it is actually or constructively received and expenses are recognized when they are actually or constructively incurred, regardless of when paid.

B)Income is recognized when it is earned regardless of when received and expenses are recognized when they are actually or constructively incurred.

C)Income is generally recognized when it is actually or constructively received and expenses are generally recognized when they are paid.

D)The cash basis is not allowed for businesses reported on Schedule C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

5

The Dot Corporation has changed its year-end from a calendar year-end to August 31. The income for its short period from January 1 to August 31 is $54,000. The tax for this short period is:

A)$2,040

B)$6,250

C)$8,667

D)$10,572

A)$2,040

B)$6,250

C)$8,667

D)$10,572

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

6

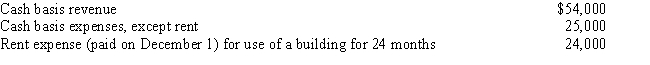

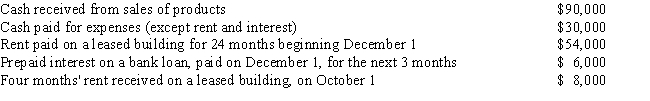

Becky is a cash basis taxpayer with the following transactions during her calendar tax year: What is the amount of Becky's taxable income from her business for this tax year?

A)$7,000 loss

B)$11,000

C)$27,500

D)$28,000

E)None of the above

A)$7,000 loss

B)$11,000

C)$27,500

D)$28,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following entities cannot use the cash method for tax purposes?

A)A large almond farm with $40 million in gross receipts.

B)A continuing education provider with $2 million in gross receipts and 20 employees.

C)A law firm operating as a personal service corporation with $5.4 million in gross receipts.

D)A small sole proprietorship with $150,000 in gross receipts.

E)All of the above may use the cash method.

A)A large almond farm with $40 million in gross receipts.

B)A continuing education provider with $2 million in gross receipts and 20 employees.

C)A law firm operating as a personal service corporation with $5.4 million in gross receipts.

D)A small sole proprietorship with $150,000 in gross receipts.

E)All of the above may use the cash method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

8

All S corporations must use the accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

9

Generally, cash basis taxpayers must account for payments of prepaid interest using the accrual method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

10

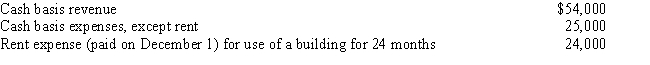

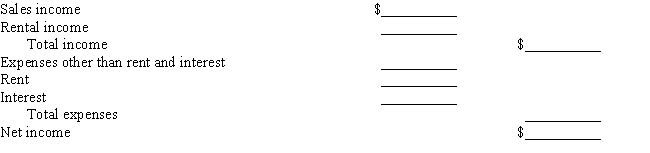

William, a cash-basis sole proprietor, had the following receipts and disbursements for 2015: For 2015, what amount should William report as net earnings from self-employment?

A)$13,400

B)$14,000

C)$15,000

D)$20,000

E)None of the above

A)$13,400

B)$14,000

C)$15,000

D)$20,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

11

In general, accrual basis taxpayers recognize income when it is earned, regardless of when it is received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

12

"Annualizing" is a method by which the taxpayer can usually decrease the amount of tax he or she pays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under the cash basis of accounting, expenses are generally deducted in the year they are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

14

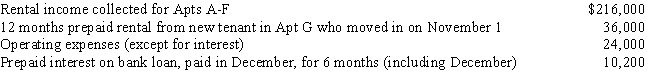

From the records of Tom, a cash basis sole proprietor, the following information was available: What amount should Tom report as net earnings from self-employment?

A)$10,900

B)$11,300

C)$11,400

D)$14,400

E)None of the above

A)$10,900

B)$11,300

C)$11,400

D)$14,400

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a corporation has a short tax year, other than their first or last year of operation, explain how the corporation calculates the tax for the short period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

16

Kate is an accrual basis, calendar-year taxpayer. On November 1, 2015, Kate leased out a building for $4,500 a month. On that day Kate received 7 months rental income on the building, a total of $31,500 ($4,500 × 7 months). How much income must Kate include on her 2015 tax return as a result of this transaction?

A)$4,500

B)$9,000

C)$31,500

D)$54,000

E)None of the above

A)$4,500

B)$9,000

C)$31,500

D)$54,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not an acceptable method of accounting under the tax law?

A)The accrual method

B)The cash method

C)The hybrid method

D)All of the above are acceptable

E)None of the above are acceptable

A)The accrual method

B)The cash method

C)The hybrid method

D)All of the above are acceptable

E)None of the above are acceptable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

18

Most partnerships, S corporations, and personal service corporations owned by individuals choose a September 30 year-end so that they may defer 3 months of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

19

Vernon is a cash basis taxpayer with a calendar tax year. On October 1, 2015, Vernon entered into a lease to rent a building for use in his business at $3,000 a month. On that day Vernon paid 18 months rent on the building, a total of $54,000 ($3,000 × 18 months). How much may Vernon deduct for rent expense on his 2015 tax return?

A)$0

B)$12,000

C)$36,000

D)$54,000

E)None of the above

A)$0

B)$12,000

C)$36,000

D)$54,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

20

Choose the incorrect statement.

A)Books and records may be kept on a different year-end basis than the year-end used for tax purposes.

B)The choice to file on a fiscal year-end basis must be made with an initial tax return.

C)Almost all individuals file tax returns using a calendar year accounting period.

D)An individual may request IRS approval to change to a fiscal year-end basis if certain conditions are met.

A)Books and records may be kept on a different year-end basis than the year-end used for tax purposes.

B)The choice to file on a fiscal year-end basis must be made with an initial tax return.

C)Almost all individuals file tax returns using a calendar year accounting period.

D)An individual may request IRS approval to change to a fiscal year-end basis if certain conditions are met.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under MACRS, the same method of depreciation (accelerated or straight-line) must be used for all property in a given class placed in service during that year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a cash basis business owner pays 18 months of rent expense in advance during the last month of the tax year, how is this treated on the tax return? What is the reason tax law requires this treatment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

23

Taxpayers must use the straight-line method of depreciation for all productive assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

24

Cork Oak Corporation purchased a heavy-duty truck (not considered a passenger automobile for purposes of the listed property and luxury automobile limitations) on May 1, 2015 for use in its business. The truck, with a cost basis of $24,000, has a 5-year estimated life. It also is 5-year recovery property. How much depreciation should be taken on the truck for the 2015 calendar tax year using the conventional (for financial accounting purposes) straight-line depreciation method?

A)$400

B)$2,400

C)$3,200

D)$4,800

E)None of the above

A)$400

B)$2,400

C)$3,200

D)$4,800

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

25

Depreciation on property in the five-year MACRS class is claimed over a period of six tax years due to the half-year convention.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

26

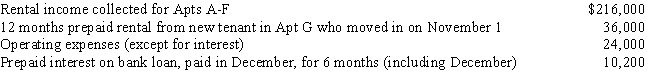

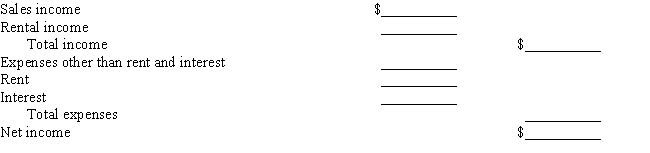

Countryside Acres Apartment Complex had the following transactions during the year:

Using the accrual method, calculate the net income:

Using the accrual method, calculate the net income:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

27

Routine maintenance costs for capital assets are deducted in the year the amount is paid or incurred, not capitalized as an improvement to the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a taxpayer purchases land worth $200,000 with an office building valued at $100,000 on it, how are the two depreciated for tax purposes?

Land:

Office building:

Land:

Office building:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

29

Depreciation refers to the physical deterioration or loss of value of an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

30

Automobiles generally have a 3-year cost recovery period under the Modified Accelerated Cost Recovery System (MACRS).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

31

Expenditures incurred to maintain an asset in good operating condition must be depreciated over the remaining useful life of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

32

If an asset's actual useful life is longer than the assigned recovery period, the MACRS tables cannot be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

33

Depreciation is the process of allocating the cost of assets to expense over a period of years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

34

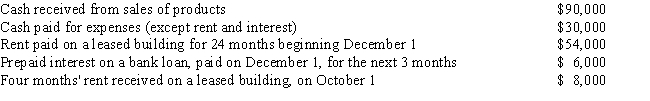

Polly is a cash basis taxpayer with the following transactions during the year:

Calculate Polly's income from her business for this calendar year.

Calculate Polly's income from her business for this calendar year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

35

In applying the statutory rates from the MACRS tables, the cost of the asset must first be reduced by the prior year's depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

36

Residential real estate is currently assigned a 27.5-year cost recovery period under the Modified Accelerated Cost Recovery System.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

37

To be depreciated, must an asset actually lose value each year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

38

ABC Corp bought a production machine on January 1, 2013 for $31,250. The company elected out of Section 179 expensing and elected out of claiming bonus depreciation in 2013, and is depreciating the machine using the MACRS accelerated depreciation tables for 5-year property. What is the 2015 depreciation (year 3) deduction for the machine?

A)$6,000

B)$6,250

C)$10,000

D)$12,500

E)None of the above is correct

A)$6,000

B)$6,250

C)$10,000

D)$12,500

E)None of the above is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

39

Jenny constructed a building for use as a residential rental property. The cost of the building was $82,488, and it was placed in service on August 1, 1991. The building has a 27.5-year MACRS life. What is the amount of depreciation on the building for 2015 for tax purposes?

A)$2,250

B)$3,000

C)$6,000

D)$6,547

E)None of the above

A)$2,250

B)$3,000

C)$6,000

D)$6,547

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

40

If land declines in value, it may be depreciated for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

41

On August 1, 2015, David purchased manufacturing equipment for use in his business. The equipment cost $14,000 and has an estimated useful life and MACRS class life of 7 years. No election to expense or use bonus depreciation is made.

a.

Calculate the amount of depreciation on the manufacturing equipment for 2015 using conventional (financial accounting, not MACRS) straight-line depreciation.

b.

Calculate the amount of depreciation on the manufacturing equipment for 2015 using the straight-line MACRS optional method.

c.

Calculate the amount of depreciation on the manufacturing equipment for 2015 using the accelerated MACRS method.

a.

Calculate the amount of depreciation on the manufacturing equipment for 2015 using conventional (financial accounting, not MACRS) straight-line depreciation.

b.

Calculate the amount of depreciation on the manufacturing equipment for 2015 using the straight-line MACRS optional method.

c.

Calculate the amount of depreciation on the manufacturing equipment for 2015 using the accelerated MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements with respect to the depreciation of real property under MACRS is correct?

A)Real property is depreciated using a mid-quarter convention.

B)Only one-half year of depreciation is allowed in the year of acquisition of real property, regardless of the actual date the property is placed in service.

C)Assuming the property is not disposed of during the year, the depreciation deduction for the second year of use of the real property will be greater than the depreciation deduction in the first year.

D)In some cases, where a significant amount of property is acquired during the last quarter of the taxpayer's tax year, the taxpayer may be required to use a mid-quarter convention in calculating depreciation on real property.

E)None of the above.

A)Real property is depreciated using a mid-quarter convention.

B)Only one-half year of depreciation is allowed in the year of acquisition of real property, regardless of the actual date the property is placed in service.

C)Assuming the property is not disposed of during the year, the depreciation deduction for the second year of use of the real property will be greater than the depreciation deduction in the first year.

D)In some cases, where a significant amount of property is acquired during the last quarter of the taxpayer's tax year, the taxpayer may be required to use a mid-quarter convention in calculating depreciation on real property.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

43

Calculate the following amounts:

a.The first year of depreciation on a residential rental building costing $100,000, purchased on November 30.

b.The first year of depreciation on an auto used 100 percent in business, costing $30,000, purchased in May 2015.(No bonus depreciation deducted).

c.The second year of depreciation on a computer used exclusively for business, costing $7,000, purchased May 2014.

d.The third year of depreciation on business furniture costing $1,000, purchased in July 2013, using the half-year convention and accelerated depreciation.

a.The first year of depreciation on a residential rental building costing $100,000, purchased on November 30.

b.The first year of depreciation on an auto used 100 percent in business, costing $30,000, purchased in May 2015.(No bonus depreciation deducted).

c.The second year of depreciation on a computer used exclusively for business, costing $7,000, purchased May 2014.

d.The third year of depreciation on business furniture costing $1,000, purchased in July 2013, using the half-year convention and accelerated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which one of the following is true about Modified Accelerated Cost Recovery System (MACRS)?

A)A building is depreciated using 200 percent declining balance depreciation.

B)Buildings and autos both have the same depreciation life.

C)A light duty business truck is depreciated using accelerated depreciation.

D)All of the above are false.

A)A building is depreciated using 200 percent declining balance depreciation.

B)Buildings and autos both have the same depreciation life.

C)A light duty business truck is depreciated using accelerated depreciation.

D)All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is the minimum number of years over which computers may be depreciated under MACRS?

A)3 years

B)5 years

C)7 years

D)10 years

E)15 years

A)3 years

B)5 years

C)7 years

D)10 years

E)15 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

46

On October 21, 2015, Jay purchased a commercial building. The cost basis assigned to the building is $700,000. Jay also owns a residential apartment building he purchased on June 15, 2014 with a cost basis of $500,000.

a.Calculate Jay's total depreciation deduction for the buildings for 2015, using MACRS.

b.Calculate Jay's total depreciation deduction for the commercial building for 2016, using MACRS.

a.Calculate Jay's total depreciation deduction for the buildings for 2015, using MACRS.

b.Calculate Jay's total depreciation deduction for the commercial building for 2016, using MACRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

47

Explain the use of the half-year convention for MACRS depreciation for assets other than real estate and the exception to the half-year convention rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

48

Steve Corp bought a $600,000 apartment building in June of 2014. Of the purchase price, $104,950 is allocated to the value of the land. What is the maximum amount of depreciation that the company can claim in 2015 (year 2) for the building?

A)$9,752

B)$18,000

C)$25,000 under the election to expense business property

D)$21,816

E)You cannot depreciate property costing over $500,000

A)$9,752

B)$18,000

C)$25,000 under the election to expense business property

D)$21,816

E)You cannot depreciate property costing over $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

49

Give the depreciable or amortizable lives for 2015 tax purposes for these assets:

Automobiles

Business furniture

Computers

Residential real estate

Commercial real estate

Land

Purchased goodwill

Automobiles

Business furniture

Computers

Residential real estate

Commercial real estate

Land

Purchased goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

50

An asset is placed in service on May 15, 2015 and has a depreciable basis of $40,000. The asset is in the 7-year recovery class. What is the maximum depreciation deduction that may be claimed for 2015, excluding the election to expense and bonus depreciation?

A)$2,572

B)$5,144

C)$5,716

D)$25,000

E)None of the above

A)$2,572

B)$5,144

C)$5,716

D)$25,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

51

A taxpayer places a $50,000 5-year recovery period asset in service in 2015. This is the only asset placed in service in 2015. Assuming half-year convention, no immediate expensing, and no income limitation, what is the amount of bonus depreciation (assuming extended into 2015)?

A)$0

B)$15,000

C)$25,000

D)$50,000

E)None of the above

A)$0

B)$15,000

C)$25,000

D)$50,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

52

John purchases residential rental property on June 30, 2015 for a cost of $290,000. Of this amount, $140,000 is allocable to the cost of the home and the remaining $150,000 is allocable to the cost of the land. What is John's maximum depreciation deduction for 2015?

A)$2,758

B)$1,485

C)$1,061

D)$370

E)None of the above

A)$2,758

B)$1,485

C)$1,061

D)$370

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

53

A taxpayer places a $50,000 5-year recovery period asset in service in 2015. This is the only asset placed in service in 2015. Assuming half-year convention, no immediate expensing and no income limitation, what is the amount of total cost recovery deduction if bonus depreciation is extended into 2015?

A)$0

B)$5,000

C)$25,000

D)$30,000

E)$50,000

A)$0

B)$5,000

C)$25,000

D)$30,000

E)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

54

If extended by Congress, bonus depreciation in 2015 permits taxpayers to deduct 100% of the cost of the asset in the year placed in service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

55

Mark the correct answer. In calculating depreciation:

A)Straight-line depreciation is higher than double declining balance depreciation in the early years.

B)Straight-line depreciation is higher than double declining balance depreciation in the later years.

C)Double declining balance is a method of straight-line depreciation.

D)MACRS depreciation requires that salvage value be taken into account.

A)Straight-line depreciation is higher than double declining balance depreciation in the early years.

B)Straight-line depreciation is higher than double declining balance depreciation in the later years.

C)Double declining balance is a method of straight-line depreciation.

D)MACRS depreciation requires that salvage value be taken into account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

56

Mark the correct statement.

A)Residential real property is depreciated over 39 years.

B)Nonresidential real property is depreciated over 27.5 years.

C)Nonresidential real property is depreciated over 39 years.

D)Depreciation on real property starts at the beginning of the year in which the property is placed in service.

A)Residential real property is depreciated over 39 years.

B)Nonresidential real property is depreciated over 27.5 years.

C)Nonresidential real property is depreciated over 39 years.

D)Depreciation on real property starts at the beginning of the year in which the property is placed in service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

57

On May 2, 2015, Scott purchased a commercial building. The cost basis assigned to the building is $600,000. Scott also owns a residential apartment building he purchased on June 15, 2014 with a cost basis of $400,000.

a.

Calculate Scott's total depreciation deduction for the buildings for 2015, using the Modified Accelerated Cost Recovery System.

b.

Calculate Scott's total depreciation deduction for the buildings for 2016, using the Modified Accelerated Cost Recovery System.

a.

Calculate Scott's total depreciation deduction for the buildings for 2015, using the Modified Accelerated Cost Recovery System.

b.

Calculate Scott's total depreciation deduction for the buildings for 2016, using the Modified Accelerated Cost Recovery System.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is true about the MACRS depreciation system?

A)No salvage value is used before depreciation percentages are applied to depreciable real estate.

B)Residential rental buildings are depreciated straight-line over 20 years .

C)Commercial real estate buildings are depreciated over 39 years using accelerated depreciation.

D)No matter when equipment is purchased during the month, it is considered to have been purchased mid-month for MACRS depreciation purposes.

A)No salvage value is used before depreciation percentages are applied to depreciable real estate.

B)Residential rental buildings are depreciated straight-line over 20 years .

C)Commercial real estate buildings are depreciated over 39 years using accelerated depreciation.

D)No matter when equipment is purchased during the month, it is considered to have been purchased mid-month for MACRS depreciation purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1, 2015, Roxburgia Company places a commercial storage building in service. The costs allocated to construction of the building total $300,000 and land is accounted for separately. Which of the following is a true statement with respect to the depreciation of the building?

A)The period over which the building must be depreciated is shorter than the period over which a residential building must be depreciated.

B)Since the building was placed in service on the first day of the year, the depreciation expense for each year the building is used, except for the year of disposition, will be the same amount.

C)Since the land is accounted for separately, the amount of depreciation expense for the building cannot be determined from the information given.

D)The depreciation expense for Year 2 would be the same regardless of whether the building is placed in service on January 1, 2015 or February 1, 2015.

E)All of the above.

A)The period over which the building must be depreciated is shorter than the period over which a residential building must be depreciated.

B)Since the building was placed in service on the first day of the year, the depreciation expense for each year the building is used, except for the year of disposition, will be the same amount.

C)Since the land is accounted for separately, the amount of depreciation expense for the building cannot be determined from the information given.

D)The depreciation expense for Year 2 would be the same regardless of whether the building is placed in service on January 1, 2015 or February 1, 2015.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

60

Betty purchases a used $12,000 car in 2015, to use exclusively in her business.

a.What will the standard MACRS depreciation schedule be for the 6 years the auto is depreciated?

Year 1:

Year 2:

Year 3:

Year 4:

Year 5:

Year 6:

b.If Betty holds the car until it is fully depreciated, and uses straight-line depreciation, how many years will this take?

a.What will the standard MACRS depreciation schedule be for the 6 years the auto is depreciated?

Year 1:

Year 2:

Year 3:

Year 4:

Year 5:

Year 6:

b.If Betty holds the car until it is fully depreciated, and uses straight-line depreciation, how many years will this take?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

61

Lanyard purchased office equipment (7-year property) for use in his business. He paid $10,000 for the equipment on July 1, 2015. Lanyard did not purchase any other property during the year. For 2015, his business had net income of $350,000, before depreciation and before considering the election to expense.

a.What is the maximum amount that Lanyard can deduct in 2015 under the election to expense?

b.

What is the total depreciation (regular depreciation and the amount allowed under the election to expense) on the office equipment for 2015, assuming Lanyard uses the accelerated method under MACRS and claims the maximum amount allowable under the election to expense?

c.What is Lanyard's total depreciation deduction for 2016 on the 2015 purchase of equipment?

a.What is the maximum amount that Lanyard can deduct in 2015 under the election to expense?

b.

What is the total depreciation (regular depreciation and the amount allowed under the election to expense) on the office equipment for 2015, assuming Lanyard uses the accelerated method under MACRS and claims the maximum amount allowable under the election to expense?

c.What is Lanyard's total depreciation deduction for 2016 on the 2015 purchase of equipment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

62

An asset (not an automobile) put in service in June 2015 has a depreciable basis of $535,000 and a recovery period of 5 years. Assuming bonus depreciation is extended into 2015, a half-year convention, and no expensing election, what is the maximum amount of cost that can be deducted in 2015?

A)$107,000

B)$267,500

C)$321,000

D)$374,500

E)$535,000

A)$107,000

B)$267,500

C)$321,000

D)$374,500

E)$535,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

63

Eva purchased office equipment (7-year property) for use in her business. She paid $12,600 for the equipment on July 1, 2015. Eva did not purchase any other property during the year. For 2015, her business had net income of $6,000, before depreciation and before considering the election to expense.

a.What is the maximum amount that Eva can elect to expense in 2015 under Section 179?

b.

What is the total depreciation (regular depreciation and the amount allowed as a 2015 deduction under the election to expense) on the office equipment for 2015, assuming Eva uses the accelerated method under MACRS and claims the maximum amount allowable under the election to expense?

c.

Assuming that Eva elected to expense the equipment in 2015 and that her business has net income in 2016 of $200,000, before depreciation and before considering the election to expense, what is Eva's total depreciation deduction (regular depreciation and the amount allowed under the election to expense) for the equipment for 2016?

a.What is the maximum amount that Eva can elect to expense in 2015 under Section 179?

b.

What is the total depreciation (regular depreciation and the amount allowed as a 2015 deduction under the election to expense) on the office equipment for 2015, assuming Eva uses the accelerated method under MACRS and claims the maximum amount allowable under the election to expense?

c.

Assuming that Eva elected to expense the equipment in 2015 and that her business has net income in 2016 of $200,000, before depreciation and before considering the election to expense, what is Eva's total depreciation deduction (regular depreciation and the amount allowed under the election to expense) for the equipment for 2016?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

64

An asset (not an automobile) put in service in June 2015 has a depreciable basis of $35,000 and a recovery period of 5 years. Assuming bonus depreciation is extended into 2015, a half-year convention, and the expensing election is made, what is the maximum amount of cost that can be deducted in 2015 (assume no income limitation)?

A)$7,000

B)$17,500

C)$21,000

D)$24,400

E)$35,000

A)$7,000

B)$17,500

C)$21,000

D)$24,400

E)$35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

65

Taxpayers choosing the election to expense:

A)May depreciate the amount of the asset cost that exceeds the amount allowed under the election to expense.

B)Will have the maximum that can be expensed under the election reduced by $0.50 for each dollar by which the cost of the asset acquired exceeds a specified limit.

C)May not carry over any amounts elected which are not allowed because of taxable income limitations.

D)May expense a $125,000 automobile so long as it is used 100 percent for business.

A)May depreciate the amount of the asset cost that exceeds the amount allowed under the election to expense.

B)Will have the maximum that can be expensed under the election reduced by $0.50 for each dollar by which the cost of the asset acquired exceeds a specified limit.

C)May not carry over any amounts elected which are not allowed because of taxable income limitations.

D)May expense a $125,000 automobile so long as it is used 100 percent for business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

66

On January 1, 2015, Sandy, a sole proprietor, purchased for use in her business a used production machine (7-year property) at a cost of $4,000. Sandy does not purchase any other property during 2015 and has net income from her business of $80,000. If the standard recovery period table would allow $572 of depreciation expense on the $4,000 of equipment purchased in 2015, what is Sandy's maximum depreciation deduction including the Section 179 election to expense (but not bonus depreciation) for 2015?

A)$572

B)$4,000

C)$4,572

D)$25,000

E)None of the above

A)$572

B)$4,000

C)$4,572

D)$25,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

67

A taxpayer places a $50,000 5-year recovery period asset in service in 2015. This is the only asset placed in service in 2015. Assuming half-year convention, immediate expensing (with 2014 amounts extended into 2015), and no income limitation, what is the amount of total cost recovery deduction (no bonus depreciation)?

A)$0

B)$5,000

C)$25,000

D)$30,000

E)$50,000

A)$0

B)$5,000

C)$25,000

D)$30,000

E)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

68

If listed property is used more than 50 percent in a qualified business use, depreciation must be calculated using the straight-line method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

69

The tax law imposes restrictions on the depreciation of "listed" property such as automobiles and computers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

70

An asset (not an automobile) put in service in June 2015 has a depreciable basis of $2,035,000 and a recovery period of 5 years. Assuming bonus depreciation is extended into 2015, a half-year convention, and the expensing election is made for the maximum eligible amount, what is the maximum amount of cost that can be deducted in 2015 assuming the business earned taxable income of $1,000,000 before deducting any cost recovery?

A)$407,000

B)$500,000

C)$1,000,000

D)$1,407,000

E)$2,000,000

A)$407,000

B)$500,000

C)$1,000,000

D)$1,407,000

E)$2,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

71

An asset (not an automobile) put in service in June 2015 has a depreciable basis of $535,000 and a recovery period of 5 years. Assuming bonus depreciation is extended into 2015, a half-year convention, and the expensing election is made, what is the maximum amount of cost that can be deducted in 2015 (assume no income limitation)?

A)$267,500

B)$321,000

C)$500,000

D)$521,000

E)$535,000

A)$267,500

B)$321,000

C)$500,000

D)$521,000

E)$535,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

72

The maximum annual Section 179 immediate expensing deduction in 2015 is $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

73

Taxpayers may expense the cost of depreciable personal property placed in service during the year and used in a trade or business in an amount up to a maximum of $20,000 annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

74

A taxpayer places a $50,000 5-year recovery period asset in service in 2015. This is the only asset placed in service in 2015. Assuming half-year convention, immediate expensing, and taxable income after all deductions except Section 179 of $5,000, what is the amount of Section 179 immediate expensing?

A)$0

B)$5,000

C)$25,000

D)$30,000

E)$50,000

A)$0

B)$5,000

C)$25,000

D)$30,000

E)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

75

Aaron has a successful business with $50,000 of income in 2015. He purchased a new 7-year MACRS property with a cost of $7,000. For tax purposes, what is the largest write-off Aaron can obtain in 2015 for the new asset?

A)$500

B)$1,000

C)$3,500

D)$7,000

A)$500

B)$1,000

C)$3,500

D)$7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

76

The election to expense is not permitted where listed property does not meet the qualified business use test.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

77

Section 179 immediate expensing can be taken on used property

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

78

During 2015, Travis purchases $13,000 of used manufacturing equipment (7-year property) for use in his business, his only asset purchase that year. Travis has taxable income from his business of $500,000. What is the maximum amount that Travis may deduct under the election to expense?

A)$0

B)$13,000

C)$25,000

D)$500,000

E)None of the above

A)$0

B)$13,000

C)$25,000

D)$500,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

79

An asset (not an automobile) put in service in June 2015 has a depreciable basis of $2,035,000 and a recovery period of 5 years. Assuming bonus depreciation is extended into 2015, a half-year convention, and the expensing election is made, what is the maximum amount of cost that can be deducted in 2015 (assume no income limitation)?

A)$407,000

B)$1,407,000

C)$2,000,000

D)$2,035,000

E)None of the above

A)$407,000

B)$1,407,000

C)$2,000,000

D)$2,035,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

80

An asset (not an automobile) placed in service in June 2015 has a depreciable basis of $35,000 and a recovery period of 5 years. Assuming bonus depreciation is extended into 2015, a half-year convention, and no expensing election, what is the maximum amount of cost that can be deducted in 2015?

A)$7,000

B)$17,500

C)$21,000

D)$24,500

E)$35,000

A)$7,000

B)$17,500

C)$21,000

D)$24,500

E)$35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck