Deck 6: Credits and Special Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/109

العب

ملء الشاشة (f)

Deck 6: Credits and Special Taxes

1

To be eligible for the earned income credit for 2015, a taxpayer must have a "qualifying child."

False

2

In 2015, the child tax credit available to married taxpayers filing jointly is phased out, beginning at:

A)$55,000

B)$75,000

C)$95,000

D)$110,000

A)$55,000

B)$75,000

C)$95,000

D)$110,000

D

3

To qualify for the additional child tax credit

A)the typical child yax credit must be limited by tax liability

B)the taxpayer must have earned income of over $3,000

C)the taxpayer must have at least one qualifying child

D)all of the above are required to qualify for the additional child tax credit

A)the typical child yax credit must be limited by tax liability

B)the taxpayer must have earned income of over $3,000

C)the taxpayer must have at least one qualifying child

D)all of the above are required to qualify for the additional child tax credit

D

4

In 2015, Alex has income from wages of $16,000, adjusted gross income of $18,000, and tax liability of $300 before the earned income credit. What is the amount of Alex's earned income credit for 2015, assuming he is single and his 5-year-old dependent son lives with him for the full year?

A)$0

B)$1,000

C)$3,274

D)$3,359

E)None of the above

A)$0

B)$1,000

C)$3,274

D)$3,359

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

5

What would reduce income taxes more: a $100 tax credit or a $100 tax deduction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

6

Denice is divorced and files a single tax return claiming her two children, ages 7 and 9, as dependents. Her AGI for 2015 is $81,500. Denice's child tax credit for 2015 is:

A)$0

B)$350

C)$1,000

D)$1,650

E)$2,000

A)$0

B)$350

C)$1,000

D)$1,650

E)$2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

7

The earned income credit:

A)Must be calculated on earned income as well as adjusted gross income in some cases.

B)Can not exceed the amount of the tax liability.

C)Is available only if the taxpayer has qualifying children.

D)Is available to married taxpayers who file separate returns.

A)Must be calculated on earned income as well as adjusted gross income in some cases.

B)Can not exceed the amount of the tax liability.

C)Is available only if the taxpayer has qualifying children.

D)Is available to married taxpayers who file separate returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

8

Maxine is a 29-year-old single mother. Her tax liability before credits is $1,000 and her earned income credit is $2,500. How much earned income credit will be refunded to Maxine? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

9

The child tax credit is not available for children ages 17 and older.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

10

Calculate the child tax credits for the following taxpayers. Please show your work.

a.Ninfa is a single mother with 8-year-old and 9-year-old dependent sons and has $50,000 of AGI.

b.Sharon and Mark have one dependent 2-year-old child and $126,300 of AGI.

c.Carol is single and has one dependent 18-year-old son and $21,000 of AGI.

a.Ninfa is a single mother with 8-year-old and 9-year-old dependent sons and has $50,000 of AGI.

b.Sharon and Mark have one dependent 2-year-old child and $126,300 of AGI.

c.Carol is single and has one dependent 18-year-old son and $21,000 of AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

11

Bob and Carol file their tax returns using the married filing jointly status. Their AGI is $132,500. They have two children, ages 11 and 7. How much child tax credit can Bob and Carol claim for their two children?

A)$0

B)$850

C)$875

D)$1,150

E)None of the above is correct.

A)$0

B)$850

C)$875

D)$1,150

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

12

The use of the earned income credit could result in a taxpayer receiving a refund even though he or she has not paid any income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which one of the following taxpayers qualify for the earned income credit?

A)A 70-year-old doctor whose practice had a net loss and who has an AGI of $5,000 in 2015.

B)An 18-year-old college student who earns $8,000 at a part-time job.

C)A couple who have a combined AGI of $17,000 and three children but file separately.

D)A 31-year-old construction worker with $22,000 of AGI and two children.

E)None of the above qualifies for the earned income credit.

A)A 70-year-old doctor whose practice had a net loss and who has an AGI of $5,000 in 2015.

B)An 18-year-old college student who earns $8,000 at a part-time job.

C)A couple who have a combined AGI of $17,000 and three children but file separately.

D)A 31-year-old construction worker with $22,000 of AGI and two children.

E)None of the above qualifies for the earned income credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

14

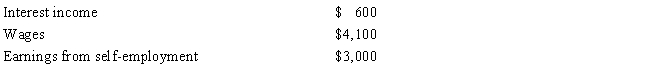

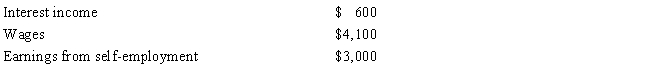

For the 2015 tax year, Sally, who is single, reported the following items of income: She maintains a household for herself and her 1-year-old son who qualifies as her dependent. What is the earned income credit available to her for 2015, using the tables?

A)$503

B)$1,369

C)$2,423

D)$2,627

E)None of the above

A)$503

B)$1,369

C)$2,423

D)$2,627

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

15

For 2015, Beatrice qualifies for the earned income credit. She has one daughter who is 7 years old. Her earned income and adjusted gross income for 2015 are $6,200.

a.Using the EIC tables, calculate the amount of her 2015 earned income credit.

b.

Calculate the amount of Beatrice's 2015 earned income credit assuming her earned income for 2015 is $8,500 and her adjusted gross income is $10,000.

a.Using the EIC tables, calculate the amount of her 2015 earned income credit.

b.

Calculate the amount of Beatrice's 2015 earned income credit assuming her earned income for 2015 is $8,500 and her adjusted gross income is $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

16

Curly and Rita are married, file a joint return, and have two dependent children, ages 11 and 13. Their AGI is $117,000. By how much is their child credit reduced in 2015?

A)$0

B)$300

C)$350

D)$700

E)$7,000

A)$0

B)$300

C)$350

D)$700

E)$7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

17

The child tax credit is $1,000 per qualifying child unless it is phased out due to higher levels of parental income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following tax credits is not available for the 2015 tax year?

A)Foreign tax credit

B)Earned income credit

C)Adoption credit

D)Child and dependent care credit

E)All of the above are available credits

A)Foreign tax credit

B)Earned income credit

C)Adoption credit

D)Child and dependent care credit

E)All of the above are available credits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

19

For 2015, Wilson and Virginia Todd qualify for the earned income credit. They have two dependent children, ages 6 months and 4 years at the end of the year.

a.

Using the EIC tables, calculate the amount of Wilson and Virginia Todd's earned income credit assuming Wilson has earned income of $7,300 and Virginia has no earned income.Their adjusted gross income for 2015 is $9,000.

b.

Calculate the amount of Wilson and Virginia Todd's earned income credit assuming Wilson has earned income of $14,300 and Virginia has earned income of $2,000.Their adjusted gross income for 2015 is $16,500.

a.

Using the EIC tables, calculate the amount of Wilson and Virginia Todd's earned income credit assuming Wilson has earned income of $7,300 and Virginia has no earned income.Their adjusted gross income for 2015 is $9,000.

b.

Calculate the amount of Wilson and Virginia Todd's earned income credit assuming Wilson has earned income of $14,300 and Virginia has earned income of $2,000.Their adjusted gross income for 2015 is $16,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

20

a. Norm and Linda are married, file a joint return, and have one 5-year-old child. Their adjusted gross income is $136,000. What is their child credit for the current year?

b. If Norm and Linda had a 3-year-old as well as the 5-year-old and an 18-year-old from Linda's first marriage, what would their child tax credit be for the current year?

C. above, how many qualifying children do Norm and Linda have? Explain.

b. If Norm and Linda had a 3-year-old as well as the 5-year-old and an 18-year-old from Linda's first marriage, what would their child tax credit be for the current year?

C. above, how many qualifying children do Norm and Linda have? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

21

The child and dependent care provisions:

A)Apply only to children under age 15.

B)Are available only to single parents.

C)Are available for spouses incapable of self-care.

D)Are allowed only for taxpayers earning less than $43,000.

A)Apply only to children under age 15.

B)Are available only to single parents.

C)Are available for spouses incapable of self-care.

D)Are allowed only for taxpayers earning less than $43,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

22

A taxpayer with earned income of $50,000 is not eligible to claim the credit for child and dependent care expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

23

Married taxpayers must file a joint tax return to claim the child and dependent care credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is the maximum investment income a taxpayer is allowed to have and still be allowed to claim the earned income credit? Why is there an earned income credit in the law?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

25

Jeff is a stay-at-home father who earns $600 from odd jobs and takes care of his daughter. His wife, Michelle, is the bread-winner and brings in $60,000 of income a year. In addition to the care provided by Jeff, Michelle pays $4,500 in child care.

In the current year, how much are Jeff and Michelle's qualifying expenses for the child and dependent care credit?

In the current year, how much are Jeff and Michelle's qualifying expenses for the child and dependent care credit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

26

Robert and Mary file a joint tax return for 2015 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000, respectively, during 2015. In order for Mary to be gainfully employed, they pay the following child care expenses for their 4-year-old son, John: What is the amount of the child and dependent care credit they should report on their tax return for 2015?

A)$270

B)$459

C)$675

D)$729

E)None of the above

A)$270

B)$459

C)$675

D)$729

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

27

Martin and Rachel are married and have a 3-year-old child. Martin is going to medical school full-time for 12 months of the year and Rachel earns $45,000. Their child is in day care so Martin can go to school while Rachel is at work. The cost of their day care is $10,000. What is their child and dependent care credit? Please show your calculations and explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

28

Amounts paid to a relative generally do not qualify as child care expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

29

Avery is a singe 26 year old graduate student at State University with no children. She is a US citizen with a valid Social Security number. Her only income is from a part-time job on campus from which she earned wages of $6,000. Avery qualifies for the earned income credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

30

Caprice is a single 42-year-old with income of $12,000 in 2015. She lacked minimum essential coverage for 7 months in 2015. What is her individual shared responsibility payment amount?

A)$0

B)$27.08

C)$325.00

D)$190.00

E)None of the above

A)$0

B)$27.08

C)$325.00

D)$190.00

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

31

Jeff and Geri are married and have AGI of $95,000 and three young children. Geri pays $6,000 a year to day care providers so she can teach a yoga class and do household errands. Geri earns $5,000 teaching the yoga class. How much child and dependent care credit can Jeff and Geri claim? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

32

Clark, a widower, maintains a household for himself and his two dependent preschool children. For the year ended December 31, 2015, Clark earned a salary of $32,000. He paid $3,600 to a housekeeper to care for his children in his home, and also paid $1,500 to a kiddie play camp for child care. He had no other income or expenses during 2015. How much can Clark claim as a child and dependent care credit in 2015?

A)$910

B)$1,300

C)$1,326

D)$5,100

E)None of the above

A)$910

B)$1,300

C)$1,326

D)$5,100

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

33

All taxpayers are required to have minimum essential health coverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

34

Phillip and Naydeen Rivers are married with two dependent children. The family has household income of $38,160 in 2015. They paid $11,000 for health care for the year. A designated silver plan would have cost $9,800. What is the Rivers' premium tax credit?

A)$0

B)$1,413

C)$8,387

D)$8,098

E)$9,800

A)$0

B)$1,413

C)$8,387

D)$8,098

E)$9,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

35

In determining the amount of the child and dependent care credit, there is a limit of $2,000 on the amount of qualified expenses for one dependent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is not a requirement to claim an earned income credit?

A)Social Security number

B)At least one child claimed as a dependent

C)At least $1 of earned income

D)US citizenship or resident alien status

A)Social Security number

B)At least one child claimed as a dependent

C)At least $1 of earned income

D)US citizenship or resident alien status

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

37

Jessica and Robert have two young children. They have $7,000 of qualified child care expenses and an AGI of $22,000 in 2015. What is their allowable child and dependent care credit?

A)$1,860

B)$1,920

C)$2,000

D)$6,000

E)$7,000

A)$1,860

B)$1,920

C)$2,000

D)$6,000

E)$7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

38

For 2015, the maximum amount of expenses that qualify for the child and dependent care credit is the same for three dependents as it is for two dependents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

39

Marion has an 11-year-old daughter. Please calculate her child and dependent care credit under these two alternatives:

a.Marion pays $4,000 a year in day care costs.Her salary is $32,000.

b.Marion pays $8,000 a year in day care costs.Her salary is $80,000.

a.Marion pays $4,000 a year in day care costs.Her salary is $32,000.

b.Marion pays $8,000 a year in day care costs.Her salary is $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

40

Arthur is divorced with two dependent children, ages 8 and 13. His adjusted gross income is $28,000, and he incurs qualified child care expenses of $6,000, $3,000 for each child.

a.What is the amount of Arthur's qualified child care expenses after any limitation?

b.Calculate the amount of Arthur's child and dependent care credit.

a.What is the amount of Arthur's qualified child care expenses after any limitation?

b.Calculate the amount of Arthur's child and dependent care credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

41

Taxpayer Q has net taxable income of $30,000 from Country Y which imposes a 40 percent income tax. In addition to the income from Country Y, taxpayer Q has net taxable income from U.S. sources of $120,000, and U.S. tax liability, before the foreign tax credit, of $41,750. What is the amount of Q's foreign tax credit?

A)$2,400

B)$8,350

C)$12,000

D)$30,000

E)None of the above

A)$2,400

B)$8,350

C)$12,000

D)$30,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

42

Jim has foreign income. He earns $26,000 from Country A which taxes the income at a 20 percent rate. He also has income from Country B of $18,000. Country B taxes the $18,000 at a 10 percent rate. His U.S. taxable income is $90,000, which includes the foreign income. His U.S. income tax on all sources of income before credits is $19,000. What is his foreign tax credit?

A)$6,500

B)$7,000

C)$9,289

D)$19,000

E)Jim does not qualify for a foreign tax credit.

A)$6,500

B)$7,000

C)$9,289

D)$19,000

E)Jim does not qualify for a foreign tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

43

Jasmine is a single marketing manager with a college degree. She continually updates her marketing knowledge and gets fresh ideas by taking classes at the local community college. This year she spent $1,500 on course tuition and fees. If Jasmine has AGI of $57,000, how much lifetime learning credit can she claim on her tax return? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

44

Steve goes to Tri-State University and pays $40,000 in tuition. Steve works a part-time job to pay for his schooling and has an AGI of $17,000. How much is his American Opportunity tax credit?

A)$2,000

B)$2,500

C)$4,000

D)$1,000

E)He does not qualify for the American Opportunity tax credit.

A)$2,000

B)$2,500

C)$4,000

D)$1,000

E)He does not qualify for the American Opportunity tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

45

Hal is enrolled for one class at a local community college; tuition cost him $190. Hal's AGI is $20,000. Hal can take a lifetime learning credit of:

A)$0

B)$38

C)$100

D)$190

E)$250

A)$0

B)$38

C)$100

D)$190

E)$250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

46

The American Opportunity tax credit

A)Is 50 percent of the first $1,200 of tuition and fees paid and 100 percent of the next $1,200.

B)Is available for 2 years of post-secondary education.

C)Is fully refundable even if the credit exceeds the tax liability.

D)Is available for qualifying expenses paid on behalf of the taxpayer and his or her spouse, in addition to those paid for dependents.

A)Is 50 percent of the first $1,200 of tuition and fees paid and 100 percent of the next $1,200.

B)Is available for 2 years of post-secondary education.

C)Is fully refundable even if the credit exceeds the tax liability.

D)Is available for qualifying expenses paid on behalf of the taxpayer and his or her spouse, in addition to those paid for dependents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

47

John graduates from high school in 2015 and enrolls in a private college in the fall. His parents pay $10,000 for his tuition and fees.

a.Assuming John's parents have AGI of $46,000, what is the American Opportunity credit they can claim for John? Explain.

b.Assuming John's parents have AGI of $175,000, what is the American Opportunity credit they can claim for John? Explain.

a.Assuming John's parents have AGI of $46,000, what is the American Opportunity credit they can claim for John? Explain.

b.Assuming John's parents have AGI of $175,000, what is the American Opportunity credit they can claim for John? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

48

Household income for purpose of the individual shared responsibility payment includes all of the following except:

A)AGI of the taxpayer

B)AGI of the taxpayer's dependents

C)Any tax-exempt income

D)Untaxed Social Security benefits

E)All of the above are included in household income

A)AGI of the taxpayer

B)AGI of the taxpayer's dependents

C)Any tax-exempt income

D)Untaxed Social Security benefits

E)All of the above are included in household income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

49

Fletch and Cammie Gates are married with three dependent children and household income of $50,238 in 2015. The Gates purchased health care insurance on their state's exchange for total premiums of $6,000. A designated silver plan for their family in their state costs $9,700. Calculate the Gates' premium tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

50

Household income for purpose of the premium tax credit includes all of the following except:

A)AGI of the taxpayer

B)AGI of the taxpayer's dependents

C)Any tax-exempt income

D)Untaxed Social Security benefits

E)All of the above are included in household income

A)AGI of the taxpayer

B)AGI of the taxpayer's dependents

C)Any tax-exempt income

D)Untaxed Social Security benefits

E)All of the above are included in household income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

51

Keith has a 2015 tax liability of $2,250 before taking into account his American Opportunity tax credit. He paid $2,600 in qualifying expenses, was a full-time student, was not claimed as a dependent on his parents' return, and his American Opportunity tax credit was not subject to phase-out. What is the amount of his American Opportunity tax credit allowed?

A)$0

B)$2,150

C)$2,250

D)$2,600

E)$4,000

A)$0

B)$2,150

C)$2,250

D)$2,600

E)$4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

52

Explain what type of educational expenses qualify for the American Opportunity tax credit and what type of educational expenses qualify for the lifetime learning credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

53

Taxpayers are required to wait until they file their tax return to receive the premium tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is not an exemption from minimum essential coverage for health insurance:

A)the taxpayer had coverage for all but 1 month during the year

B)the taxpayer's income of less than 200% of the federal poverty level

C)the taxpayer was in jail

D)the taxpayer spent 350 days out of the US during the year

A)the taxpayer had coverage for all but 1 month during the year

B)the taxpayer's income of less than 200% of the federal poverty level

C)the taxpayer was in jail

D)the taxpayer spent 350 days out of the US during the year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

55

The foreign tax credit applies only to foreign corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

56

After raising two children, Anh, a single 48 year old, decided to go to college to get a degree. She spent two years in community college and earned an Associates degree. In 2015, she is enrolled half-time at State University to earn a Bachelor's degree in Accounting and also works part-time. Anh is eligible for the American Opportunities tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

57

Brad works at the local pizza shop as a delivery person. He is hoping to change to a position in the kitchen and takes a culinary course at the local community college for $1,400. Assuming he is eligible, Brad's lifetime learning credit is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

58

Margo and her spouse have health insurance for the entire year through the state health care exchange. Margo will need to pay her spouse's individual shared responsibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

59

Alice is a single taxpayer with no dependents that has AGI of $9,000 in 2015. Alice is required to carry minimum essential coverage in 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

60

Vicky is a single, 21 year-old, full-time student who purchased health care through the state health care exchange for the full year. Her part-time job pays her $12,000 in 2015. She files her own tax return but is claimed as a dependent by her parents. Vicky is eligible for the premium tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

61

The alternative minimum tax must be paid only if the tentative minimum tax exceeds a taxpayer's regular tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is the purpose of the alternative minimum tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

63

For all taxpayers, except those married filing separately, the individual alternative minimum tax rate for 2015 is 26 percent on the first $185,400 of income and 28 percent on income above $185,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

64

Edward has business operations in Country F and Country G. He pays tax to Country F of $12,000 on $30,000 of income and pays tax to Country G of $4,000 on $10,000 of income. In addition to the income from Country F and Country G, Edward has $100,000 of income from U.S. sources and a total U.S. tax liability, before the foreign tax credit, of $42,000.

What amount of foreign tax credit may Edward claim on his U.S. tax return?

What amount of foreign tax credit may Edward claim on his U.S. tax return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

65

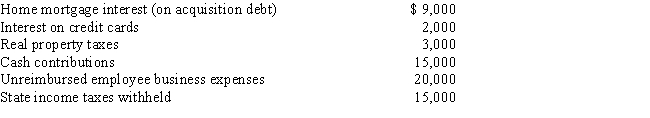

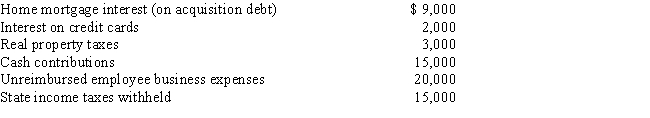

Dan and Maureen file a joint income tax return for 2015. They have two dependent children, ages 7 and 9. Together they earn wages of $152,000. They also receive taxable interest income of $8,000 and interest on City of Los Angeles bonds of $12,000. During 2015, they received a state income tax refund of $3,000 relating to their 2014 state income tax return on which they itemized deductions. Their expenses for the year consist of the following:

Calculate Dan and Maureen's tentative minimum tax liability assuming an exemption amount of $83,400, before any phase-outs. Show your calculations.

Calculate Dan and Maureen's tentative minimum tax liability assuming an exemption amount of $83,400, before any phase-outs. Show your calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

66

In 2015, Erin purchased a solar system to generate electricity for her home, at a cost of $5,000.

a.How much is her tax credit in 2015?

b.If she had purchased a solar heating system for her swimming pool at a cost of $3,500, how much could she claim as a tax credit?

c.If she had purchased a $5,000 solar electric system and a $4,500 solar heating system for her principal home (not for the swimming pool), how much could she claim as a tax credit?

d.If she had purchased the electric system for her principal residence and the solar heating system for a second residence, how much could she claim as a tax credit?

a.How much is her tax credit in 2015?

b.If she had purchased a solar heating system for her swimming pool at a cost of $3,500, how much could she claim as a tax credit?

c.If she had purchased a $5,000 solar electric system and a $4,500 solar heating system for her principal home (not for the swimming pool), how much could she claim as a tax credit?

d.If she had purchased the electric system for her principal residence and the solar heating system for a second residence, how much could she claim as a tax credit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

67

Taxpayers are allowed two tax breaks for adoption expenses. They are allowed:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

68

Sheila and Jerry are married taxpayers with $600 of foreign tax withholding from the dividends in a mutual fund. They have enough foreign income from the mutual fund to claim the full $600 as a foreign tax credit. They are in the 35% tax bracket and they itemize deductions. Should they claim the foreign tax credit on the Form 1040 or a deduction for foreign taxes on their Schedule A? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

69

Choose the correct statement:

A)A taxayer may receive a 30-percent credit for installing energy-efficient window shades.

B)A taxpayer may receive a 30-percent credit for installing a windmill, which generates electricity, at his vacation home.

C)A taxpayer may receive a 30-percent credit for installing a solar water-heating panel for his swimming pool.

D)A taxpayer may receive a 30-percent credit for the purchase of a plug-in electric vehicle.

A)A taxayer may receive a 30-percent credit for installing energy-efficient window shades.

B)A taxpayer may receive a 30-percent credit for installing a windmill, which generates electricity, at his vacation home.

C)A taxpayer may receive a 30-percent credit for installing a solar water-heating panel for his swimming pool.

D)A taxpayer may receive a 30-percent credit for the purchase of a plug-in electric vehicle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

70

List at least two AMT preferences and/or adjustments and show the simplified formula for calculating AMT. Do not include dollar exemption amounts or the tax rate schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

71

A tax credit is allowed for qualified adoption expenses paid by taxpayers:

A)And an additional credit is allowed for qualified adoption expenses paid for by taxpayers' employers.

B)And an income exclusion is allowed for qualified adoption expenses paid for by taxpayers' employers.

C)And is available each year qualifying expenses are incurred.

D)And is not subject to a phase-out based on adjusted gross income.

A)And an additional credit is allowed for qualified adoption expenses paid for by taxpayers' employers.

B)And an income exclusion is allowed for qualified adoption expenses paid for by taxpayers' employers.

C)And is available each year qualifying expenses are incurred.

D)And is not subject to a phase-out based on adjusted gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

72

Richard has $30,000 of income from a country that imposes a 40-percent income tax and $30,000 of income from a country that imposes a 34- percent income tax. In addition to the foreign income, he has taxable income from U.S. sources of $120,000 and a U.S. tax liability, before credits, of $45,575. The amount of Richard's foreign tax credit is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

73

Jenny adopts a Vietnamese orphan. The adoption takes three years, two trips to Vietnam, and becomes final in 2015. She pays $10,000 in 2013, $5,000 in 2014, and $5,000 in 2015 of qualified adoption expenses. She has AGI of $150,000.

a.What is the adoption credit Jenny can claim in 2015?

b.How much credit could she claim if the adoption falls through and is never finalized?

a.What is the adoption credit Jenny can claim in 2015?

b.How much credit could she claim if the adoption falls through and is never finalized?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

74

In the case of the adoption of a child who is not a U.S. citizen or resident of the U.S., the credit for qualified adoption expenses is available:

A)In the first year the expenses are paid.

B)Each year expenses are paid.

C)In the last year expenses are paid.

D)In the year the adoption becomes final.

A)In the first year the expenses are paid.

B)Each year expenses are paid.

C)In the last year expenses are paid.

D)In the year the adoption becomes final.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

75

In calculating the individual AMT, the tentative minimum tax liability may not exceed the regular tax liability of the taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

76

Daddy Warbucks is in the process of adopting Annie from a New York orphanage. He pays $5,000 in 2013, $7,000 in 2014, and $4,500 in 2015. Daddy Warbucks' AGI for 2015 is $165,000.

a.How much is the adoption credit that Daddy Warbucks may claim for 2015 if the adoption becomes final in 2015?

b.How much is the adoption credit that Daddy Warbucks may claim for 2015 if the adoption becomes final in 2016?

c.How much is the adoption credit that Daddy Warbucks may claim for 2015 if the adoption falls through and is never finalized?

a.How much is the adoption credit that Daddy Warbucks may claim for 2015 if the adoption becomes final in 2015?

b.How much is the adoption credit that Daddy Warbucks may claim for 2015 if the adoption becomes final in 2016?

c.How much is the adoption credit that Daddy Warbucks may claim for 2015 if the adoption falls through and is never finalized?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

77

The total expenses that can be taken as a credit for all tax years for adoption of a child without "special needs" is $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

78

In 2015, Brady purchases a 2015 Nissan Leaf electric vehicle for his personal use. He is eligible to claim a credit of $7,500. He is in the 35 percent marginal tax bracket and his regular

tax liability before credits is $14,800. What is the tax benefit Brady realizes from this purchase?

tax liability before credits is $14,800. What is the tax benefit Brady realizes from this purchase?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

79

Carla and Bob finalized an adoption in 2015. Their adoption fees totaled $9,500. They have AGI of $207,000 for 2015. What is their adoption credit?

A)$7,334

B)$8,077

C)$9,500

D)$13,400

A)$7,334

B)$8,077

C)$9,500

D)$13,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

80

An individual may claim both a credit and an exclusion from income in connection with the adoption of an eligible child, but may not claim both a credit and an exclusion for the same expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck