Deck 6: Property Acquisitions and Cost Recovery Deductions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/84

العب

ملء الشاشة (f)

Deck 6: Property Acquisitions and Cost Recovery Deductions

1

A donee's basis in a gift is always equal to the donor's basis.

False

2

What is the difference in the basis of an asset acquired by gift and one acquired by inheritance?

The basis of an asset acquired by gift is normally the donor's basis increased by any gift tax paid on the asset's appreciation (fair market value - basis).If the fair market value of the gift is below the donor's cost basis at the date of the gift,however,the donee's basis for a loss on a subsequent sale by is this lower fair market value.The basis for inherited property is normally the fair market value of the property as of the date of the decedent's death.If,however,the administrator elects the alternate valuation date,the basis is the fair market value as of this date (or the date of disposition if disposed of before this date).

3

The basis in property acquired by inheritance is normally its fair market value at the date of the

decedent's death.

decedent's death.

True

4

The first year's depreciation for equipment acquired in October by a calendar-year business would be based on 1½ months if it was the only asset acquired that year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

5

The after-tax cost of a depreciable asset is dependent on the purchaser's marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

6

13 Bonus depreciation and Section 179 expensing are never taken on the same asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

7

The MACRS life for all realty is 27½ years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

8

Research expenditures must be capitalized and amortized over the period the research is expected to benefit the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

9

The cost of assets with useful lives expected to extend for 2 or more years are capitalized with costs allocated over their useful lives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

10

If more than 40 percent of all personalty purchased during the year is placed in service during the last quarter of the year,the mid-quarter convention must be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

11

The alternative depreciation system uses a straight-line allocation of an asset's cost to determine depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

12

The lease inclusion amount increases the deduction a person may take for business use of a leased automobile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

13

Explain how the basis of an asset is determined on acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a basket purchase of a group of assets,the purchaser and the seller can agree to the value of the separate assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

15

Section 179 expensing does not apply to realty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

16

Automobiles are subject to specific limitations on the amount of annual depreciation deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is the adjusted basis of an asset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

18

Depletion is the term used for the cost allocation of wasting assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

19

The mid-year and mid-month are acceptable conventions for depreciating personalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

20

Section 179 expenses exceeding the annual cost limitation may be carried forward for five years only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which averaging conventions are used for MACRS depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

22

When would it be advisable to use the alternative depreciation system? Which properties must be depreciated by the alternative depreciation system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

23

Explain the basic procedure for determining the net cost of a depreciable asset using net cash flow with a five-year MACRS life and no salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

24

Soledad left her son Juan property valued at $700,000 when she died.Soledad paid $825,000 for the property but its adjusted basis when she died was $450,000.Juan did not want the building so he authorized the administrator to sell the building 6 months after Soledad's death for $650,000.Due to the decline in value of a number of Soledad's other assets after her death,the administrator elected the alternate valuation date for the assets.What is the realized and recognized gain or loss on the sale of the asset? Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

25

The cost of an asset with a useful life exceeding one year can be

A)Expensed immediately

B)Capitalized until disposal

C)Capitalized with part of the costs deducted annually

D)All of the above are possible depending on the asset

A)Expensed immediately

B)Capitalized until disposal

C)Capitalized with part of the costs deducted annually

D)All of the above are possible depending on the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

26

Calvin gave his son ABC stock valued at $100,000 that he purchased for $50,000; he gave his daughter EFG stock valued at $100,000 that he purchased for $150,000.Calvin paid $30,000 in gift taxes on each of these gifts.What are the son's and daughter's bases in the stock received?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

27

Josephine Company purchases five-year MACRS property in mid-year for $12,000.What is its after-tax cost of this asset if it has a 35 percent tax rate and uses a 6 percent discount rate for project evaluation? No Section 179 expensing or bonus depreciation is claimed for this property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

28

What are listed properties?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is the purpose of the lease inclusion amount for automobiles?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the difference in after-tax cost of a five-year machine costing $10,000 that is depreciated using MACRS depreciation versus the alternative depreciation system? The taxpayer is in the 35 percent tax bracket and uses a 6 percent discount rate for evaluation.No Section 179 expensing or bonus depreciation is claimed for this property

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

31

The after-tax cost of an asset

A)Is higher for taxpayers with higher tax rates

B)Is lower for taxpayers with lower discount rates

C)Is higher for taxpayers with lower discount rates

D)Is not affected by the taxpayer's tax rate

A)Is higher for taxpayers with higher tax rates

B)Is lower for taxpayers with lower discount rates

C)Is higher for taxpayers with lower discount rates

D)Is not affected by the taxpayer's tax rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

32

What are the permissible tax treatments for research and experimentation expenditures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a business acquired a new machine in 2014,explain how it could have recovered its cost most efficiently.How does this differ from the maximum cost recovery deduction if the new machine is instead acquired in 2015?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

34

What limitations applied to the use of Section 179 expensing in 2014? What changes took effect on January 1,2015?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

35

Jeremy purchased an asset for $12,000 at the beginning of the year.Assuming the asset is depreciated over three years on a straight-line basis,no averaging conventions apply,Jeremy's tax rate is 35 percent,and he uses a 6 percent discount rate,what is the after-tax cost of the asset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the difference between cost and percentage depletion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

37

Joan gives an asset valued at $12,000 with a basis of $10,000 to Mary; Joan dies six-months later leaving an asset valued at $10,000 with a basis of $12,000 to Larry.What are Mary's and Larry's bases in these assets?

A)Mary = $12,000; Larry = $12,000

B)Mary = $12,000; Larry = $10,000

C)Mary = $10,000; Larry = $12,000

D)Mary = $10,000; Larry = $10,000

A)Mary = $12,000; Larry = $12,000

B)Mary = $12,000; Larry = $10,000

C)Mary = $10,000; Larry = $12,000

D)Mary = $10,000; Larry = $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is a mixed-use asset? What adjustment must be made for depreciating a mixed-use asset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

39

William has decided to purchase a large apartment complex.He pays $100,000 cash,obtains a loan on the property for $500,000,and assumes the first mortgage balance of $250,000.He also gives the sellers $100,000 of marketable securities that he purchased three years ago for $125,000.He paid a finder's fee of $5,000,legal fees of $6,000,and transfer taxes of $12,000.What is William's acquisition basis for the building? Does he have any other tax consequences as a result of this purchase?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

40

What is the difference between depreciation,depletion,and amortization?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

41

Gribble Corporation acquires the Dibble Corporation for $7,200,000.On appraisal,the assets of Dibble Corporation have a fair market value of $6,800,000.The excess of the purchase price over the fair market value of the assets:

A)Can be apportioned to the assets based on their relative fair market value.

B)Is goodwill that is amortized over 15 years.

C)Is goodwill that is amortized over 40 years.

D)Must be capitalized until Dibble is sold.

A)Can be apportioned to the assets based on their relative fair market value.

B)Is goodwill that is amortized over 15 years.

C)Is goodwill that is amortized over 40 years.

D)Must be capitalized until Dibble is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

42

Jack did not depreciate one of his machines that cost $40,000 because he had net operating losses for the last two years.Which of the following statements is true?

A)Jack's basis in the asset is $40,000 this year.

B)Jack can deduct three year's depreciation in the current year.

C)Jack must file amended returns to claim the depreciation for prior years.

D)If Jack sells the machine for $20,000 this year,he has a $20,000 loss.

A)Jack's basis in the asset is $40,000 this year.

B)Jack can deduct three year's depreciation in the current year.

C)Jack must file amended returns to claim the depreciation for prior years.

D)If Jack sells the machine for $20,000 this year,he has a $20,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

43

Momee Corporation,a calendar-year corporation,bought only one asset in 2010,a crane it purchased for $700,000 on November 24.It disposed of the asset in April,2015.What is its depreciation deduction for this asset in 2015 if cost recovery was determined using only regular MACRS?

A)$62,510

B)$61,110

C)$31,255

D)$22,916

A)$62,510

B)$61,110

C)$31,255

D)$22,916

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

44

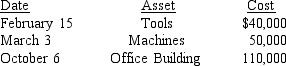

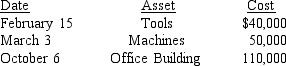

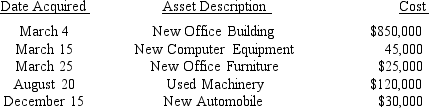

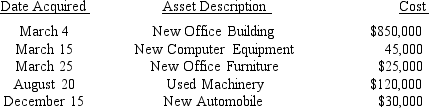

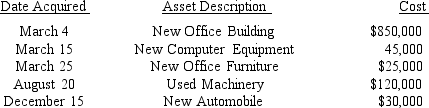

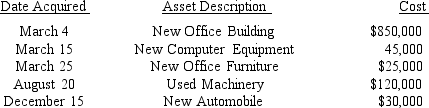

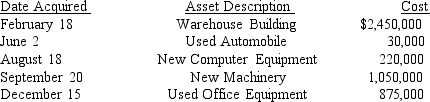

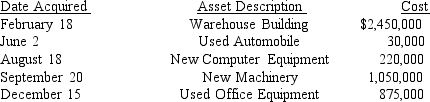

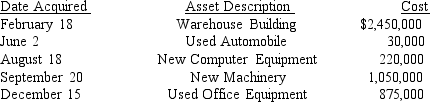

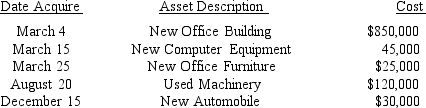

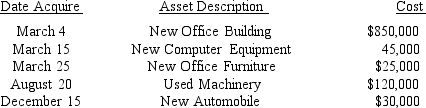

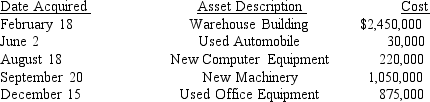

During the year,Garbin Corporation (a calendar-year corporation that manufactures furniture)purchased the following assets:  In computing depreciation of these assets,which of the following averaging conventions will be used?

In computing depreciation of these assets,which of the following averaging conventions will be used?

A)Half-year and mid-month

B)Mid-quarter and mid-month

C)Half-year,mid-quarter,and mid-month

D)Mid-quarter only

In computing depreciation of these assets,which of the following averaging conventions will be used?

In computing depreciation of these assets,which of the following averaging conventions will be used?A)Half-year and mid-month

B)Mid-quarter and mid-month

C)Half-year,mid-quarter,and mid-month

D)Mid-quarter only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

45

Joe started a new business this year.He had purchased a computer two years ago for $4,000 and decided to use it in his business until he could afford a new system.He could purchase a new computer with the same specifications for $1,800,but his used computer is worth only $1,100.What is his computer's basis for depreciation?

A)$1,100

B)$1,800

C)$4,000

D)The computer cannot be depreciated because it was a personal asset.

A)$1,100

B)$1,800

C)$4,000

D)The computer cannot be depreciated because it was a personal asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

46

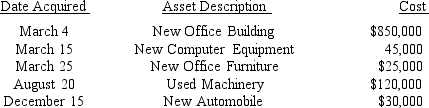

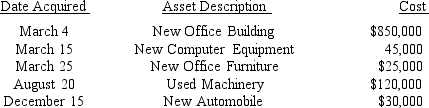

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?

A)$17,281

B)$28,972

C)$35,134

D)$35,394

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?A)$17,281

B)$28,972

C)$35,134

D)$35,394

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

47

The adjusted basis of an asset is:

A)Its acquisition price only

B)Acquisition cost less cost recovery

C)Acquisition cost less selling price

D)Only the cash used to purchase the asset

A)Its acquisition price only

B)Acquisition cost less cost recovery

C)Acquisition cost less selling price

D)Only the cash used to purchase the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

48

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.What is YumYum's Section 179 deduction for 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.What is YumYum's Section 179 deduction for 2015?

A)$500,000

B)$253,160

C)$25,000

D)$5,000

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.What is YumYum's Section 179 deduction for 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.What is YumYum's Section 179 deduction for 2015?A)$500,000

B)$253,160

C)$25,000

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

49

The after-tax cost of an asset increases if

A)The cost recovery period is increased

B)The marginal tax rate increases

C)The discount percentage decreases

D)The asset's salvage value increases

A)The cost recovery period is increased

B)The marginal tax rate increases

C)The discount percentage decreases

D)The asset's salvage value increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

50

Peter received his uncle's coin collection as a gift when it was valued at $150,000.Over the years,the uncle had purchased the coins for a total of $75,000.The uncle paid a $15,000 gift tax on the gift.What is Peter's basis in the coin collection?

A)$75,000

B)$82,500

C)$90,000

D)$150,000

A)$75,000

B)$82,500

C)$90,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

51

Useful lives for realty include all of the following except:

A)25 years

B)27.5 years

C)39 years

D)40 years

A)25 years

B)27.5 years

C)39 years

D)40 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

52

Conrad Corporation has a June 30 year end.What is the MACRS depreciation percentage deduction for the first year for a 5-year asset acquired October 15 under the mid-quarter convention.

A)35%

B)25%

C)15%

D)5%

A)35%

B)25%

C)15%

D)5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

53

What is the maximum amount that can be spent on depreciable personalty in the last quarter of 2015 to avoid the mid-quarter convention if $240,000 of equipment was purchased in the first three quarters ?

A)$80,000

B)$968,000

C)$160,000

D)$240,000

A)$80,000

B)$968,000

C)$160,000

D)$240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

54

MACRS means

A)Modified asset cost recovery system

B)Mid-year accelerated cost recovery system

C)Modified accelerated cost recovery system

D)Modified accelerated conventional recovery system

A)Modified asset cost recovery system

B)Mid-year accelerated cost recovery system

C)Modified accelerated cost recovery system

D)Modified accelerated conventional recovery system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

55

The only acceptable convention for MACRS realty is

A)Mid-week

B)Mid-month

C)Mid-quarter

D)Half-year

A)Mid-week

B)Mid-month

C)Mid-quarter

D)Half-year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

56

On June 20,2015 Baker Corporation (a calendar-year taxpayer)acquired 5-year equipment cost $30,000 and on October 28,2015,it acquired 7-year equipment cost $160,000.Baker did not elect Section 179 expensing and no other assets were acquired during the year.Baker's depreciation for 2015 is:

a.$28,864

b.$27,152

c.$13,212

d.$7,212

a.$28,864

b.$27,152

c.$13,212

d.$7,212

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

57

Barber Corporation purchased all the assets of TECO Corporation for $1,820,000.An appraisal yielded the following: the building had a fair market value of $1,200,000; equipment a value of $1,000,000; and office equipment a value of $400,000.What is the depreciable basis for the office equipment?

A)$400,000

B)$300,000

C)$280,000

D)$250,000

A)$400,000

B)$300,000

C)$280,000

D)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

58

All of the following are acceptable conventions for MACRS property except:

A)Mid-week

B)Mid-month

C)Mid-quarter

D)Half-year

A)Mid-week

B)Mid-month

C)Mid-quarter

D)Half-year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

59

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015.What is YumYum's maximum depreciation deduction for the office building in 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015.What is YumYum's maximum depreciation deduction for the office building in 2015?

A)$17,281

B)$24,472

C)$28.302

D)$29,622

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015.What is YumYum's maximum depreciation deduction for the office building in 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015.What is YumYum's maximum depreciation deduction for the office building in 2015?A)$17,281

B)$24,472

C)$28.302

D)$29,622

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

60

Gregory Corporation,a calendar-year corporation,purchased an office building in March of year 1.In September of year 17,it sold the building.What fraction must be applied to the MACRS percentage to determine the year 17 depreciation?

A)3/12

B)7.5/12

C)8.5/12

D)9/12

A)3/12

B)7.5/12

C)8.5/12

D)9/12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

61

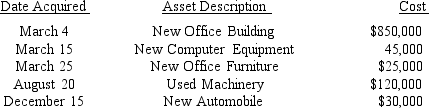

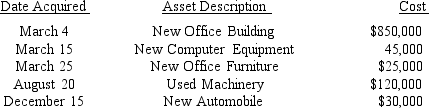

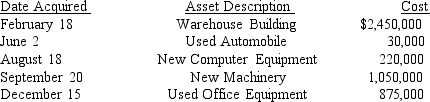

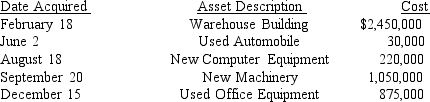

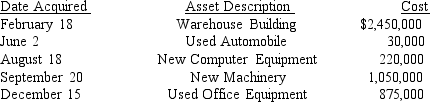

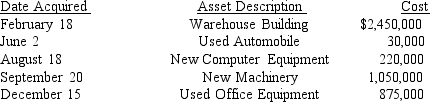

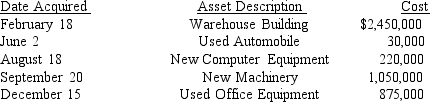

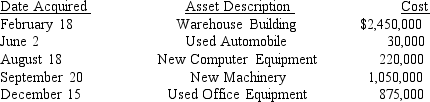

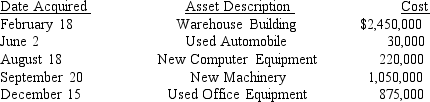

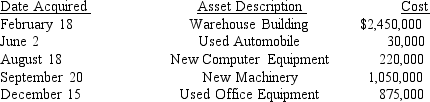

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the used office equipment for 2014?

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the used office equipment for 2014?

A)$28,7500

B)$43,750

C)$403,595

D)$450,038

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the used office equipment for 2014?

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the used office equipment for 2014?A)$28,7500

B)$43,750

C)$403,595

D)$450,038

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

62

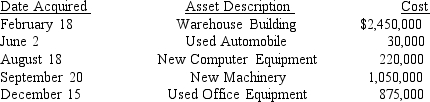

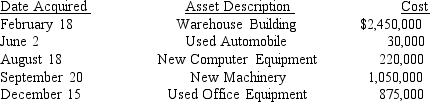

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the office equipment for 2015?

A)$134,695

B)$78,595

C)$31,680

D)0

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.What is Sanjuro Corporation's cost recovery deduction for the office equipment for 2015?

A)$134,695

B)$78,595

C)$31,680

D)0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

63

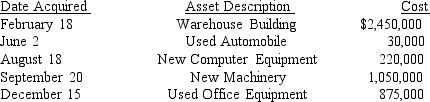

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the computer equipment for 2014?

A)$44,000

B)$110,000

C)$132,000

D)$220,000

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the computer equipment for 2014?

A)$44,000

B)$110,000

C)$132,000

D)$220,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

64

The lease inclusion amount:

A)Increases the annual lease payments.

B)Applies to all leased autos regardless of value.

C)Is larger in the earlier years of the lease.

D)Is a substitute for the depreciation limits applicable to purchased autos.

A)Increases the annual lease payments.

B)Applies to all leased autos regardless of value.

C)Is larger in the earlier years of the lease.

D)Is a substitute for the depreciation limits applicable to purchased autos.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

65

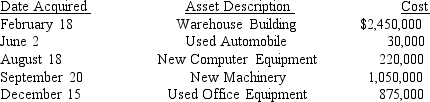

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the automobile for 2014?

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the automobile for 2014?

A)$3,160

B)$3,360

C)$11,160

D)$11,360

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the automobile for 2014?

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the automobile for 2014?A)$3,160

B)$3,360

C)$11,160

D)$11,360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

66

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's maximum deduction for cost recovery for the warehouse for 2015?

A)$62,818

B)$55,052

C)$49,809

D)$44,566

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.What is Sanjuro Corporation's maximum deduction for cost recovery for the warehouse for 2015?

A)$62,818

B)$55,052

C)$49,809

D)$44,566

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

67

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the warehouse for 2016 if it is sold in November of 2016?

A)$62,818

B)$54,966

C)$48,170

D)$3,724

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.What is Sanjuro Corporation's cost recovery deduction for the warehouse for 2016 if it is sold in November of 2016?

A)$62,818

B)$54,966

C)$48,170

D)$3,724

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

68

In May 2014,Stephen acquired a used automobile for $12,000 and used the automobile 75% for business.No Sec.179 election was made.In 2015,Stephen's business use of the automobile decreases to 45%.As a result of this change in business use:

A)The change does not affect the way Stephen computes his 2015 depreciation

B)Stephen's depreciation in 2015 is $2,250.

C)Stephen must recapture $900 as ordinary income in 2015

D)Stephen must amend the 2015 tax return and recompute depreciation.

A)The change does not affect the way Stephen computes his 2015 depreciation

B)Stephen's depreciation in 2015 is $2,250.

C)Stephen must recapture $900 as ordinary income in 2015

D)Stephen must amend the 2015 tax return and recompute depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

69

Cora,a calendar-year corporation,purchased a new machine for $35,000 and some used office furniture for $180,000 in July 2015.What is Cora's maximum cost recovery deduction for 2015?

A)$52,151

B)$39,295

C)$30,724

D)$29,295

A)$52,151

B)$39,295

C)$30,724

D)$29,295

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

70

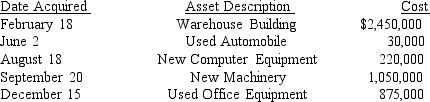

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.YumYum Corporation made any elections available to maximize its overall depreciation deduction for 2015.What is its maximum depreciation deduction on the new automobile in 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.YumYum Corporation made any elections available to maximize its overall depreciation deduction for 2015.What is its maximum depreciation deduction on the new automobile in 2015?

A)$3,160

B)$3,460

C)$6,000

D)$11,600

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.YumYum Corporation made any elections available to maximize its overall depreciation deduction for 2015.What is its maximum depreciation deduction on the new automobile in 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.YumYum Corporation made any elections available to maximize its overall depreciation deduction for 2015.What is its maximum depreciation deduction on the new automobile in 2015?A)$3,160

B)$3,460

C)$6,000

D)$11,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

71

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the automobile for 2017?

A)$0

B)$1,775

C)$1,875

D)$1,975

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.What is Sanjuro Corporation's cost recovery deduction for the automobile for 2017?

A)$0

B)$1,775

C)$1,875

D)$1,975

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

72

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's maximum deduction for cost recovery for the automobile for 2016?

A)$1,875

B)$2,950

C)$3,050

D)$5,100

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.What is Sanjuro Corporation's maximum deduction for cost recovery for the automobile for 2016?

A)$1,875

B)$2,950

C)$3,050

D)$5,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

73

On November 7,2015,Wilson Corporation acquires 7-year property for $35,000.This is the only property acquired this year and Section 179 expensing is elected.What is Wilson's total depreciation deduction for 2015?

A)$27,000

B)$26,000

C)$25,357

D)$25,037

A)$27,000

B)$26,000

C)$25,357

D)$25,037

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

74

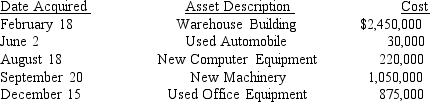

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015,what would its maximum cost recovery deduction be for 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015,what would its maximum cost recovery deduction be for 2015?

A)$17,281

B)$35,134

C)$54,447

D)$57,287

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015,what would its maximum cost recovery deduction be for 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015,what would its maximum cost recovery deduction be for 2015?A)$17,281

B)$35,134

C)$54,447

D)$57,287

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

75

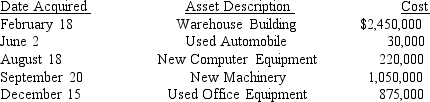

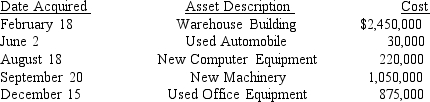

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What was Sanjuro Corporation's maximum total cost recovery deduction for 2014?

A)$512,550

B)$1,193,830

C)$1,731,707

D)$2,175,000

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.What was Sanjuro Corporation's maximum total cost recovery deduction for 2014?

A)$512,550

B)$1,193,830

C)$1,731,707

D)$2,175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

76

Rodriguez Corporation acquired 7-year property costing $50,000 on October 1,2015.This is the only property acquired this year and Rodriguez elects to expense the maximum amount under Section 179.Rodriguez's income before deducting depreciation is $20,000.What is the maximum amount that Rodriguez can deduction in 2015 for Section 179 expensing?

A)$10,000

B)$15,000

C)$20,000

D)$25,000

A)$10,000

B)$15,000

C)$20,000

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

77

Chipper,a calendar-year corporation,purchased new machinery for $1,125,000 in February,2014.In October,it purchased $1,075,000 of used machinery.What was Chipper's maximum cost recovery deduction for 2014?

A)$2,200,000

B)$1,257,190

C)$1,030,793

D)$712,333

A)$2,200,000

B)$1,257,190

C)$1,030,793

D)$712,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

78

Allen Corporation acquired 5-year property costing $150,000 on September 10,2015.This is the only property acquired this year and Allen elects to expense the maximum amount under Section 179.Allen's income before deducting depreciation is $15,000.What is the maximum amount that Allen can deduct in 2015 for Section 179 expensing?

A)$10,000

B)$15,000

C)$20,000

D)$25,000

A)$10,000

B)$15,000

C)$20,000

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

79

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the computer equipment for 2015?

A)$11,000

B)$22,200

C)$35,200

D)$44,000

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.What is Sanjuro Corporation's cost recovery deduction for the computer equipment for 2015?

A)$11,000

B)$22,200

C)$35,200

D)$44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

80

Zachary purchased a new car on August 1,2014 for $14,500.His records indicate that he uses the car 45 percent for business and 55 percent for personal use.What are his cost recovery deductions for 2014 and 2015?

A)$653; $1,305

B)$1,377; $2,205

C)$1,305; $2,088

D)$798; $1,595

A)$653; $1,305

B)$1,377; $2,205

C)$1,305; $2,088

D)$798; $1,595

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck