Deck 11: Income Taxation of Individuals

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 11: Income Taxation of Individuals

1

A taxpayer's exemptions and standard deduction are limited by the taxpayer's AGI if AGIexceeds a certain threshold.

False

2

A parent cannot be claimed as a dependent if his or her gross income equals or exceeds the amount of the dependency exemption.

True

3

To file as a surviving spouse,a taxpayer must maintain a home for a dependent child for the entire year.

True

4

_____16.Sales taxes levied on the purchase of depreciable business property are deductible as part of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

The itemized deduction for medical expenses is subject to the phase-out applicable to total itemized deductions based on the taxpayer's AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

A legally married couple can elect to file as married filing jointly or single individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

Surviving spouse status may be claimed for three years after the year of the spouse's death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

Beginning in 2017,qualified medical expenses for a 66-year-old single individual must exceed 10 percent of AGI to be deductible for regular income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

An abandoned spouse must only live apart from his or her spouse during the last six months of the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

Contributions to health savings accounts are made with before-tax dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

A personal theft loss can be deducted if it exceeds $100 plus 10 percent of AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

Real property taxes are deductible for state,local,and foreign real property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under a multiple support agreement,Jim may claim an exemption for his mother if he supplies 25 percent,his brother supplies 40 percent,and his sister supplies 8 percent of the support for their mother.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

Each separate item of miscellaneous itemized deductions must exceed two percent of AGIto be deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

The deduction for student loan interest has limits placed on it based on the taxpayer's AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

Single individuals must reduce their personal exemption if their AGI exceeds $258,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

A homeowner who itemizes his or her deductionscan only deduct the property taxes on his or her primary residence and one other residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

To qualify as head of household,the taxpayer must pay more than half of the costs of a home in which a qualifying person lives for the entire year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

The basic and additional standard deductions are both indexed for inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

Jan and James's divorce is final on December 31 of the current year.They must file married filing separately for the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the retirement savings contribution credit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the minimum support required to be allowed the dependency exemption as part of a multiple support agreement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

How is the deductibility of itemized deductions limited in determining taxable income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

Torri is a sixth grade teacher.In 2015,she earned a salary of $33,400.She contributed $675 to her Roth IRA and paid $800 in student loan interest.What is Torri's taxable income and income tax if she is single and does not itemize deductions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is included in investment income? What is the limit on the deduction for investment interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

What is required for a taxpayer to qualify to file as a surviving spouse?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

25 The tax rate applied to the AMTI for individuals is the same as the tax rate applied to the AMTI for corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

Who are qualifying relatives for a dependency exemption?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

What limits are placed on the deduction for interest on debt that is secured by a person's personal residence?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

Taxpayers can apply any excess FICA tax paid to their income tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

Briefly describe the residential credits available for improvements to the energy efficiency of a taxpayer's principal residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

The maximum annual lifetime learning credit is $2,000 per taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

When should a taxpayer itemize deductions rather than taking the standard deduction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

What is the purpose of the Health Savings Account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

What limits are placed on an individual's charitable contribution deduction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

Explain the difference in benefits between a tax deduction and a tax credit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

Qualifying low-income wage earners may not only deduct their IRA contributions but they may take a credit for their contribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is the standard deduction for a person claimed as a dependent on another person's return in 2015?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

What types of insurance premiums are deductible as an itemized deduction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

Sonja is a talented 18 year-old dancer and has earned quite a bit of money over the last six years that her parents invested for her.During 2015,however,she earned only $5,500 from dancing but $1,900 in interest.If her parents claim her as a dependent,what is her income tax liability in the current year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

Sebastian(age 46)and Kaitlin(age 45)are married and file a joint tax return.Their 2015 adjusted gross income is $390,000 and includes $2,600 in investment income ($2,000 in short-term capital gains and $600 of interest income).They provided 100% of the support for their daughter,Olivia,age 26,who lives with them,and earned $4,700 from her part-time job.They also provided 100 percent of the support for Sebastian's mother,Emily,who is 67,blind,and lives in a nursing home.Emily received $4,000 in Social Security benefits and $450 of interest income.What is Sebastian and Kaitlin's deduction for personal and dependency exemptions for 2015?

A)$16,000

B)$12,000

C)$7,920

D)$4,080

A)$16,000

B)$12,000

C)$7,920

D)$4,080

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is a requirement to file for head of household?

A)A single individual (except abandoned spouse)

B)Provides over one-half the cost of maintaining a household for a dependent or a child

C)Qualifying dependent (except a parent)or child must live in the taxpayer's household

D)All of the above are requirements

A)A single individual (except abandoned spouse)

B)Provides over one-half the cost of maintaining a household for a dependent or a child

C)Qualifying dependent (except a parent)or child must live in the taxpayer's household

D)All of the above are requirements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

Ethan,age 67,and Abigail,age 64,with good eyesight,are marriedand file a joint tax return.They have adjusted gross income of $1,200,000 for2015.They have only $5,000 of itemized deduction,so they claim their standard deduction.How much of their standard deduction is phased out in 2015?

A)$13,850

B)$12,600

C)$10,682

D)0

A)$13,850

B)$12,600

C)$10,682

D)0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following filing statuses can never be used by a single individual?

A)Surviving spouse

B)Head of household

C)Married filing separately

D)Single

A)Surviving spouse

B)Head of household

C)Married filing separately

D)Single

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

Lisa's husband died in 2012.Lisa did not remarry,and continued to maintain a home for herself and her dependent daughter during 2013,2014,and 2015 providing full support for herself and her daughter during these years.For 2015,Lisa's filing status is:

A).Single

B)Married filing separately

C)Head of household

D)Surviving Spouse,using married filing jointly rate

A).Single

B)Married filing separately

C)Head of household

D)Surviving Spouse,using married filing jointly rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

All of the following are a common filing status for a married person except:

A)Married filing jointly

B)Head of household

C)Married filing separately

D)Surviving spouse

A)Married filing jointly

B)Head of household

C)Married filing separately

D)Surviving spouse

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

Margo is single and has twin sons who are freshmen in college and a daughter who is a junior during 2015.Margo also attends the local college and took one graduate course each semester.She pays $4,000 tuition and fees for each of the three children and $1,900 in tuition and fees for her courses.What are her allowable education credits if her AGI is $59,000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

John is a 36-year-old calendar-year taxpayer whose wife died in August of 2015.His eight year-old son lives with him.During 2015,he had salary income of $52,000,$600 of dividend income,and received $50,000 from the life insurance policy on his wife.He made a $2,000 contribution to his regular IRA and paid $9,800 for a hospital bill and $3,000 for a doctor bill for his deceased wife.He also paid $4,000 in mortgage interest,$800 in property taxes,$300 of credit card interest and $400 in job hunting expenses when he tried to find a better paying job in the same line of work in March.Determine John's income tax liability for 2015 before any allowable credits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

Cora,who is single,has $58,000 of salary income,$2,300 in dividends,and $3,800 in interest income.She has $13,200 of itemized deductions.Determine her tax liability for 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

Cleo's husband died in January of 2014.She has a 20 year-old son and a sister who live with her.Her son attends a trade school part-time and earned $11,000 from his part-time job.Cleo's sister is a full-time student and only earned $2,800 from her part-time job.How many personal and dependency exemptions can Cleo claim in 2015 and what is her filing status?

A)3; surviving spouse

B)2; surviving spouse

C)2; head of household

D)3; head of household

E)1; single

A)3; surviving spouse

B)2; surviving spouse

C)2; head of household

D)3; head of household

E)1; single

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

In 2015,which of the following is allowed as an addition to a nonitemizer's standard deduction?

A)Sales tax on new automobile purchases

B)$500 for real property taxes

C)The allowable casualty deduction for disaster areas

D)None of the above

A)Sales tax on new automobile purchases

B)$500 for real property taxes

C)The allowable casualty deduction for disaster areas

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

Justin,age 42 and divorced,is the sole support of his mother,age 69,who resided in a local nursing home for the entire year.Justin's mother had no income for the year.Justin's filing status and the number of exemptions he can claim are:

A)Single and 1 exemption

B)Single and 2 exemptions

C)Head of household and 1 exemption

D)Head of household and 2 exemptions

A)Single and 1 exemption

B)Single and 2 exemptions

C)Head of household and 1 exemption

D)Head of household and 2 exemptions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

Buffy and Biff are veterinarians.They have two dependent children ages 9 and 10 and they pay $7,200 for child care while they work.In 2015,they have net income from their practice of $170,000.They each put $4,000 into their traditional IRAs (these IRAs are their only retirement plans).Their itemized deductions are $28,000.What is their net tax liabilityafter all allowable credits if they file jointly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

Seth and Clara have three dependent children ages 2,6,and 10.They have AGI of $119,250 in 2015.What is their allowable child tax credit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

Colin (single and age 40)has AGI of $100,000.Colin provided the following information about his cash expenditures for 2015: Interest on loan to purchase corporate securities $ 900

Interest on American Express card 1,200

Points to refinance his home for 10 years at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

If Colin does not itemize,what is his total deduction from AGI in 2015:

A)$4,000

B)$6,300

C)$10,000

D)$10,300

Interest on American Express card 1,200

Points to refinance his home for 10 years at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

If Colin does not itemize,what is his total deduction from AGI in 2015:

A)$4,000

B)$6,300

C)$10,000

D)$10,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

Wallace and Clarice (both age 45)have combined salary and wages of $90,000.They each contribute $3,000 to a Roth IRA and take the standard deduction when they file jointly in 2015.If they have a $60,000 preference item,what is their alternative minimum tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

George (49)and Jean (36),a married couple with no dependents,have AGI of $2,400,000.They have $220,000 of medical expenses related to a kidney transplant,$80,000 of property taxes on their principal residence,$65,000 of interest expense on the $980,000 acquisition mortgage,$25,000 in charitable contributions,and $20,000 of miscellaneous itemized deductions before applying any limitations.If they have a $400,000 preference item,what are their regular taxable income,their alternative minimum taxable income,and their alternative minimum tax in 2015? (Exclude any Medicare surtaxes on regular taxable income in your solution.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

Sherry works as a waitress.During the year she earned $26,500 in wages and tips.She paid $3,200 for childcare for her dependent son.What is her credit for childcare?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

Colin (age 40)is single,itemizes his deductions,and has AGI of $100,000.Colin provided the following information about his cash expenditures for 2015: Interest on American Express card 1,200

Points to refinance his home for 10 years at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

If Colin itemizes,what are his total itemized deductions in 2015:

A)$18,100

B)$21,000

C)$24,200

D)$27,000

Points to refinance his home for 10 years at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

If Colin itemizes,what are his total itemized deductions in 2015:

A)$18,100

B)$21,000

C)$24,200

D)$27,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

Sophie,age 68,has AGI of $47,000.Her itemized deductions after limitations are $1,400 for medical expenses,$700 in property taxes,$4,500 of mortgage interest and $800 for charitable contributions.What are her AMTI itemized deductions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

Sebastian(age 46)and Kaitlin(age 45)are married and file a joint tax return.Their 2015 adjusted gross income is $390,000 and includes $2,600 in investment income ($2,000 in short-term capital gains and $600 of interest income).They provided 100% of the support for their daughter,Olivia,age 26,who lives with them,and earned $4,700 from her part-time job.They also provided 100 percent of the support for Sebastian's mother,Emily,who is 67,blind,and lives in a nursing home.Emily received $4,000 in Social Security benefits and $450 of interest income.Sebastian and Kaitlinalso paid the following amounts in 2015: -$38,500 interest on their home mortgage (acquisition debt)on their principal residence purchased in 1995.The principal amount of the mortgage is $1,250,000.They also paid $11,000 in real estate taxes on the home.

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for taxes for 2015?

A)$11,000

B)$12,800

C)$15,700

D)$17,500

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for taxes for 2015?

A)$11,000

B)$12,800

C)$15,700

D)$17,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

Colin (age 40)is single and itemizes his deductions.His AGI is $100,000.Colin provided the following information about his cash expenditures for 2015: Interest on loan to purchase corporate securities $ 900

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

What is the amount of Colin's deductible interest expense if he received $600 in corporate dividends that are taxed at the 15% tax rate?

A)$11,800

B)$12,400

C)$12,700

D)$14,400

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

What is the amount of Colin's deductible interest expense if he received $600 in corporate dividends that are taxed at the 15% tax rate?

A)$11,800

B)$12,400

C)$12,700

D)$14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

Sebastian(age 46)and Kaitlin(age 45)are married and file a joint tax return.Their 2015 adjusted gross income is $390,000 and includes $2,600 in investment income ($2,000 in short-term capital gains and $600 of interest income).They provided 100% of the support for their daughter,Olivia,age 26,who lives with them,and earned $4,700 from her part-time job.They also provided 100 percent of the support for Sebastian's mother,Emily,who is 67,blind,and lives in a nursing home.Emily received $4,000 in Social Security benefits and $450 of interest income.What is Sebastian and Kaitlin standard deduction on their 2015 tax return if they do not itemize?

A)$13,850

B)$12,600

C)$10,197

D)$1,329

A)$13,850

B)$12,600

C)$10,197

D)$1,329

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

Sebastian(age 46)and Kaitlin(age 45)are married and file a joint tax return.Their 2015 adjusted gross income is $390,000 and includes $2,600 in investment income ($2,000 in short-term capital gains and $600 of interest income).They provided 100% of the support for their daughter,Olivia,age 26,who lives with them,and earned $4,700 from her part-time job.They also provided 100 percent of the support for Sebastian's mother,Emily,who is 67,blind,and lives in a nursing home.Emily received $4,000 in Social Security benefits and $450 of interest income.Sebastian and Kaitlinalso paid the following amounts in 2015: -$38,500 interest on their home mortgage (acquisition debt)on their principal residence purchased in 1995.The principal amount of the mortgage is $1,250,000.They also paid $11,000 in real estate taxes on the home.

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for charitable contributions for 2015?

A)$5,200

B)$7,200

C)$7,700

D)$20,500

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for charitable contributions for 2015?

A)$5,200

B)$7,200

C)$7,700

D)$20,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

Sonjay had AGI of $60,000 in 2015 and made several charitable contributions as follows: Land donated to county for new school: FMV = $30,000; basis = $20,000

Appraisal fee for the land: $2,500

Contributions to his church: $4,000

Contributions to the Red Cross: $1,000

What is the maximum charitable contribution deduction that Sonjay could claim in 2015?

A)$30,000

B)$27,500

C)$25,000

D)$24,000

Appraisal fee for the land: $2,500

Contributions to his church: $4,000

Contributions to the Red Cross: $1,000

What is the maximum charitable contribution deduction that Sonjay could claim in 2015?

A)$30,000

B)$27,500

C)$25,000

D)$24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

Amelia,an accountant,normally bills her clients $125 per hour for her time and her adjusted gross income for 2015 was $100,000.In January and February 2015,however,Amelia spent 80 hours of her time volunteering for the Salvation Army doing accounting work.She paid $100 out of her own pocket for supplies and made an additional cash contribution of $1,000 to the Salvation Army in 2015.What is Amelia's charitable contribution deduction for 2015?

A)$11,100

B)$11,000

C)$1,100

D)$1,000

A)$11,100

B)$11,000

C)$1,100

D)$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

Sean bought a home in 2010 for $625,000 financing $550,000 of the purchase price with a 30 year mortgage.In 2015 when his existing mortgage balance was $520,000,he took out a home equity loan for $150,000.He used the proceeds to pay off credit card debt of $40,000 and purchase a car for $85,000; the balance he used to buy an engagement ring for his girlfriend.In 2015 he paid $30,000 interest on the mortgage and paid interest only of $6,600 on the home equity loan.What is his deduction for qualified residential interest for 2015?

A)$36,600

B)$34,400

C)$30,000

D)$6,600

A)$36,600

B)$34,400

C)$30,000

D)$6,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

Sebastian(age 46)and Kaitlin(age 45)are married and file a joint tax return.Their 2015 adjusted gross income is $390,000 and includes $2,600 in investment income ($2,000 in short-term capital gains and $600 of interest income).They provided 100% of the support for their daughter,Olivia,age 26,who lives with them,and earned $4,700 from her part-time job.They also provided 100 percent of the support for Sebastian's mother,Emily,who is 67,blind,and lives in a nursing home.Emily received $4,000 in Social Security benefits and $450 of interest income.Sebastian and Kaitlinalso paid the following amounts in 2015: -$38,500 interest on their home mortgage (acquisition debt)on their principal residence purchased in 1995.The principal amount of the mortgage is $1,250,000.They also paid $11,000 in real estate taxes on the home.

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much of Sebastian and Kaitlin's total itemized deductions will be disallowed due to the phaseout rules for 2015?

A)$290

B)$1,848

C)$2,403

D)$9,271

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much of Sebastian and Kaitlin's total itemized deductions will be disallowed due to the phaseout rules for 2015?

A)$290

B)$1,848

C)$2,403

D)$9,271

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

Vera and Jake (both age 45)are a married couple with AGI of $325,900 for 2015.Theypaid $20,000 of mortgage interest,$8,000 of unreimbursed medical expenses,$4,000 of property taxes,and $9,000 of charitable contributions for the year.How much may they claim for itemized deductions in 2015?

A)$40,220

B)$33,020

C)$32,520

D)$25,000

A)$40,220

B)$33,020

C)$32,520

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

Carl,age 42,is married and has three children.In preparing to go to his accountant,he determines that he has $63,100 of salary income and $250 in dividends.He contributes $4,000 to a Roth IRA and has $6,800 of itemized deductions.His wife has no income.What is the taxable income on their 2015 joint return?

A)$42,350

B)$34,800

C)$30,750

D)$30,500

A)$42,350

B)$34,800

C)$30,750

D)$30,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

Ikito had a bad year.In 2015,his home was broken into and his TV,DVD,VCR and computer were all stolen.The properties had a basis of $15,000 and a current fair market value of $9,000.Later that year,his car was hit by a garbage truck.It cost Ikito $9,000 to have the car repaired.Ikito didn't believe in insurance,so he received no reimbursements.In addition,the garbage company filed for bankruptcy after the accident.How much may Ikito deduct as an itemized deduction in 2015if his AGI is $68,000?

A)$18,000

B)$17,800

C)$11,000

D)$10,200

A)$18,000

B)$17,800

C)$11,000

D)$10,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Emma purchased investment land in 2012 for $46,000.At the end of 2014,she was approached by the local Girl Scout organization in which she had been an active troop leader,about donating the land for a summer camp site.Emma agreed and deeded the land to the Girl Scouts for their camp in February 2015.The fair market value of the land at the end of 2014 was $55,000 and in February 2015 was $56,000.Emma's adjusted gross income was $100,000 for 2014 and $110,000 for 2015.Emma expects her AGI to decrease to $10,000 in 2016 because most of her future retirement income will be from tax-exempt sources.What is the maximum amount Emma can deduct for 2015 if this is her only itemized deduction?

A)$46,000

B)$50,000

C)$55,000

D)$56,000

A)$46,000

B)$50,000

C)$55,000

D)$56,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following expenditures is not subject to some form of limitation on its deductibility based on AGI?

A)Interest on a home equity loan

B)Surgery to replace a hip joint

C)Contribution to a university endowment fund

D)Job-hunting expenses

A)Interest on a home equity loan

B)Surgery to replace a hip joint

C)Contribution to a university endowment fund

D)Job-hunting expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

Colin (age 40)is single and itemizes his deductions.His AGI is $100,000.Colin provided the following information about his cash expenditures for 2015: Interest on loan to purchase corporate securities $ 900

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

What is Colin's deduction for taxes?

A)$8,700

B)$7,500

C)$5,400

D)$2,100

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

What is Colin's deduction for taxes?

A)$8,700

B)$7,500

C)$5,400

D)$2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

Sebastian(age 46)and Kaitlin(age 45)are married and file a joint tax return.Their 2015 adjusted gross income is $390,000 and includes $2,600 in investment income ($2,000 in short-term capital gains and $600 of interest income).They provided 100% of the support for their daughter,Olivia,age 26,who lives with them,and earned $4,700 from her part-time job.They also provided 100 percent of the support for Sebastian's mother,Emily,who is 67,blind,and lives in a nursing home.Emily received $4,000 in Social Security benefits and $450 of interest income.Sebastian and Kaitlinalso paid the following amounts in 2015: -$38,500 interest on their home mortgage (acquisition debt)on their principal residence purchased in 1995.The principal amount of the mortgage is $1,250,000.They also paid $11,000 in real estate taxes on the home.

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for miscellaneous itemized expenses for 2015?

A)0

B)$290

C)$7,800

D)$8,090

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for miscellaneous itemized expenses for 2015?

A)0

B)$290

C)$7,800

D)$8,090

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

In 2015,Carol,who is 54 and single,earned a salary of $54,000 and $6,000 of interest on State of Nevada bonds.She contributed $2,000 to her Roth IRA,paid a $4,000 hospital bill,state income taxes of $1,500,real estate taxes of $900,mortgage interest of $4,500,and $2,000 interest on her margin account under which she purchased the bonds.What is Carol's taxable income?

A)$41,100

B)$43,100

C)$44,700

D)$47,400

A)$41,100

B)$43,100

C)$44,700

D)$47,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

The 2015 standard deduction for a married taxpayer,age 68,who files a separate return is:

A)$6,300

B)$7,550

C)$7,850

D)$10,800

A)$6,300

B)$7,550

C)$7,850

D)$10,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

Colin (age 40)is single and itemizes his deductions.His AGI is $100,000.Colin provided the following information about his cash expenditures for 2015: Interest on loan to purchase corporate securities $ 900

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

How much are Colin's deductible contributions?

A)$500

B)$1,000

C)$1,500

D)$2,500

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

How much are Colin's deductible contributions?

A)$500

B)$1,000

C)$1,500

D)$2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

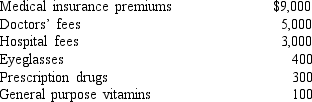

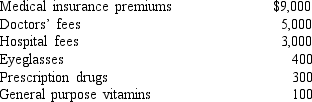

Camila,age 60,is single and has adjusted gross income of $100,000.She paid (with after-tax dollars)the following medical expenses in 2015:  She received only $2,000 in reimbursements from her insurance company for hermedical expenses.How much can Camila deduct for medical expenses in 2015 if she has $30,000 of other itemized deductions?

She received only $2,000 in reimbursements from her insurance company for hermedical expenses.How much can Camila deduct for medical expenses in 2015 if she has $30,000 of other itemized deductions?

A)$15,800

B)$8,300

C)$5,800

D)$5,700

She received only $2,000 in reimbursements from her insurance company for hermedical expenses.How much can Camila deduct for medical expenses in 2015 if she has $30,000 of other itemized deductions?

She received only $2,000 in reimbursements from her insurance company for hermedical expenses.How much can Camila deduct for medical expenses in 2015 if she has $30,000 of other itemized deductions?A)$15,800

B)$8,300

C)$5,800

D)$5,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

Sebastian(age 46)and Kaitlin(age 45)are married and file a joint tax return.Their 2015 adjusted gross income is $390,000 and includes $2,600 in investment income ($2,000 in short-term capital gains and $600 of interest income).They provided 100% of the support for their daughter,Olivia,age 26,who lives with them,and earned $4,700 from her part-time job.They also provided 100 percent of the support for Sebastian's mother,Emily,who is 67,blind,and lives in a nursing home.Emily received $4,000 in Social Security benefits and $450 of interest income.Sebastian and Kaitlinalso paid the following amounts in 2015: -$38,500 interest on their home mortgage (acquisition debt)on their principal residence purchased in 1995.The principal amount of the mortgage is $1,250,000.They also paid $11,000 in real estate taxes on the home.

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for interest expense for 2015?

A)$38,500

B)$38,400

C)$41,800

D)$49,500

-$6,250 interest on a home equity loan (principal amount of $125,000)on their home.They spent $50,000 of the loan proceeds for remodeling their kitchen,$30,000 on a European vacation,and $45,000 for a new car.

-$6,000 investment interest expense

-$7,600 unreimbursed employee business expenses (none for meal or entertainment expenses)

-$4,700 in state income taxes to the state of California where Sebastian worked for part of the year

-$1,800 in state and local general sales taxes

-$490 fee for preparation of their 2014 tax return,paid to their CPA in 2015

-$2,500 contributed to the State University Athletic Booster Club (to allow them to purchase tickets in good seat locations for football games)and $1,000 contributed to the State University Business School Alumni Association for academic scholarships.They also donated a painting (purchased 11 years ago for $4,200)to the Salvation Army,which was then sold for it fair market value of $17,000 at its fundraising auction.

How much can Sebastian and Kaitlin deduct for interest expense for 2015?

A)$38,500

B)$38,400

C)$41,800

D)$49,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck