Deck 12: Valuation: Cash-Flow-Based Approaches

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/64

العب

ملء الشاشة (f)

Deck 12: Valuation: Cash-Flow-Based Approaches

1

If an analyst wants to value a potential investment in the common stock equity in a firm,the relevant cash flows the analyst should use are:

A) free cash flow from operations.

B) free cash flows for all debt and equity capital stakeholders.

C) free cash flows to common equity shareholders.

D) cash flow from operations.

A) free cash flow from operations.

B) free cash flows for all debt and equity capital stakeholders.

C) free cash flows to common equity shareholders.

D) cash flow from operations.

C

2

Starting with net cash flow from operations and adjusting for capital expenditures and dividends equals:

A) free cash flows for all debt and equity capital stakeholders.

B) free cash flow.

C) free cash flows to common equity capital shareholders.

D) free cash flow from operations.

A) free cash flows for all debt and equity capital stakeholders.

B) free cash flow.

C) free cash flows to common equity capital shareholders.

D) free cash flow from operations.

B

3

Free cash flow is calculated as net cash provided by operating activities less:

A) dividends.

B) capital expenditures and depreciation.

C) capital expenditures.

D) capital expenditures and dividends.

A) dividends.

B) capital expenditures and depreciation.

C) capital expenditures.

D) capital expenditures and dividends.

D

4

If an analyst wants to value a potential investment in the common stock equity of a firm,the analyst should discount the projected free cash flows at the:

A) required return on equity capital.

B) weighted average cost of capital.

C) risk-free rate.

D) market risk premium.

A) required return on equity capital.

B) weighted average cost of capital.

C) risk-free rate.

D) market risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

5

If an analyst wants to value a potential investment in the net operating assets of a division of another firm,the analyst should discount the projected free cash flows at the:

A) cost of debt capital.

B) cost of equity capital.

C) weighted average cost of capital.

D) risk-free rate.

A) cost of debt capital.

B) cost of equity capital.

C) weighted average cost of capital.

D) risk-free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

6

Continuing free cash flows represent:

A) the cash flows remaining after deducting cash flows attributable to debt holders.

B) the free cash flows after the point at which the firm has settled into a long-run steady-state growth rate.

C) all sustainable free cash flows.

D) all after-tax free cash flows.

A) the cash flows remaining after deducting cash flows attributable to debt holders.

B) the free cash flows after the point at which the firm has settled into a long-run steady-state growth rate.

C) all sustainable free cash flows.

D) all after-tax free cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

7

Plough Corporation reports the following information:

Net cash provided by operating activities$300,000

Average current liabilities150,000

Average long-term liabilities100,000

Dividends paid80,000

Capital expenditures140,000

Payments of debt35,000

Plough's free cash flow is:

A) $80,000

B) $105,000

C) $45,000

D) $10,000

Net cash provided by operating activities$300,000

Average current liabilities150,000

Average long-term liabilities100,000

Dividends paid80,000

Capital expenditures140,000

Payments of debt35,000

Plough's free cash flow is:

A) $80,000

B) $105,000

C) $45,000

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

8

A disadvantage of the free cash flow valuation method is:

A) The terminal value tends to dominate the total value in many cases.

B) The projection of free cash flows depends on earnings estimates.

C) The free cash flow method is not rigorous.

D) The free cash flow method is not used widely in practice.

A) The terminal value tends to dominate the total value in many cases.

B) The projection of free cash flows depends on earnings estimates.

C) The free cash flow method is not rigorous.

D) The free cash flow method is not used widely in practice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

9

If an analyst wants to value a potential investment in the net operating assets of a division of another firm,the relevant cash flows the analyst should use are:

A) free cash flow from operations.

B) free cash flows for all debt and equity capital stakeholders.

C) free cash flows to common equity shareholders.

D) cash flow from operations.

A) free cash flow from operations.

B) free cash flows for all debt and equity capital stakeholders.

C) free cash flows to common equity shareholders.

D) cash flow from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

10

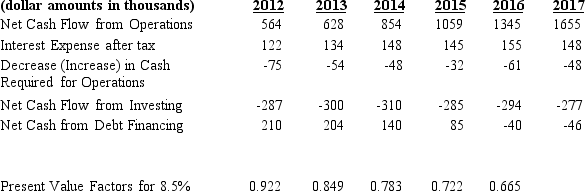

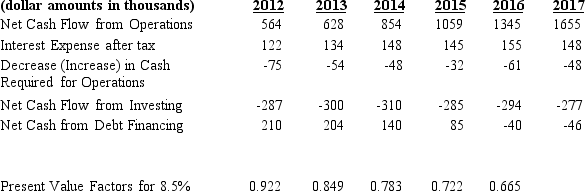

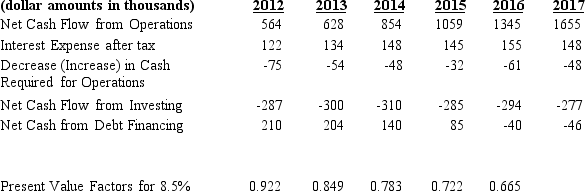

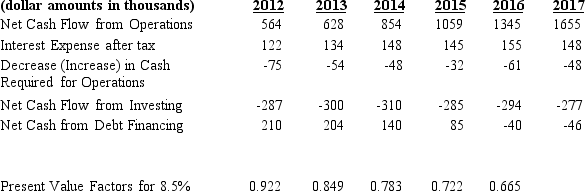

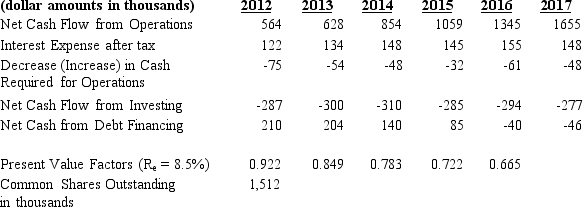

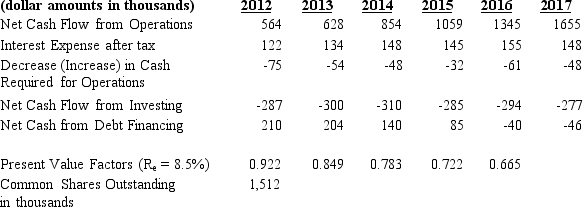

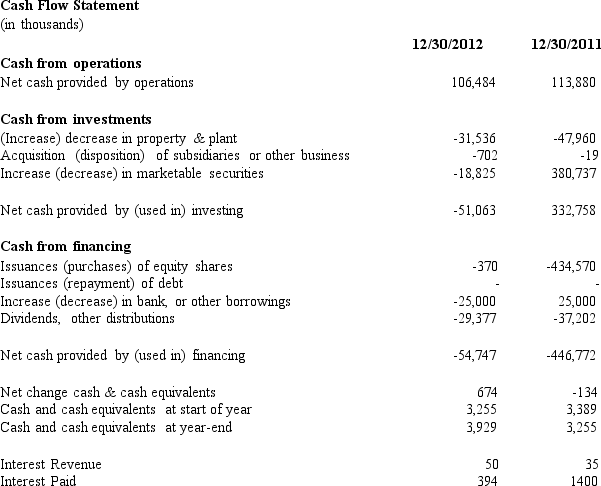

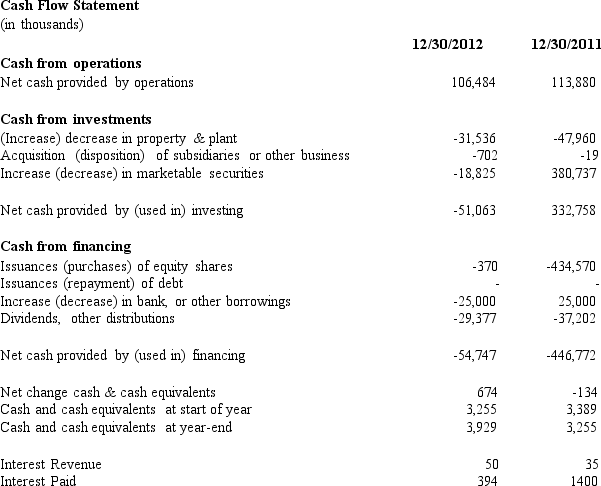

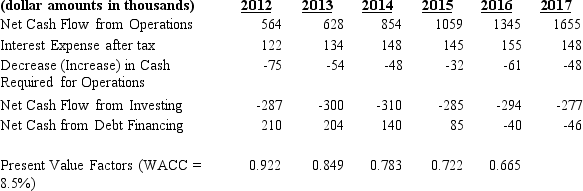

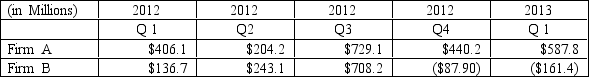

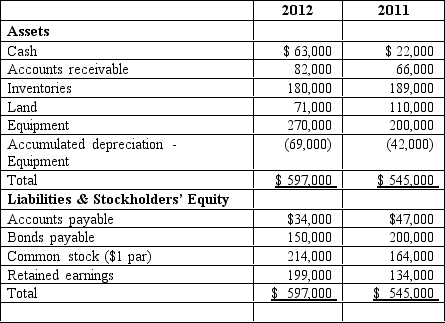

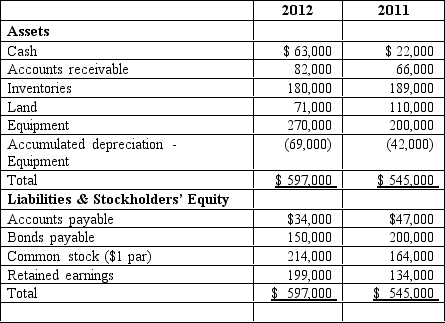

Houston, Inc.

The following information pertains to Houston, Inc.a manufacturer of belt buckles:

What is Houston's free cash flow for common equity holders for year 2012?

A) $564

B) $399

C) $324

D) $412

The following information pertains to Houston, Inc.a manufacturer of belt buckles:

What is Houston's free cash flow for common equity holders for year 2012?

A) $564

B) $399

C) $324

D) $412

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

11

Financial liabilities include all of the following except:

A) mortgages payable

B) current maturities of long-term debt

C) accrued taxes

D) bonds payable

A) mortgages payable

B) current maturities of long-term debt

C) accrued taxes

D) bonds payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

12

The conceptual framework for free cash flows separates all assets and liabilities into the following categories:

A) Current and non-current

B) Monetary and non-monetary

C) Operating and non-operating

D) Operating and financial

A) Current and non-current

B) Monetary and non-monetary

C) Operating and non-operating

D) Operating and financial

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

13

The conceptual framework for free cash flows separates the balance sheet equation into the following categories:

A) CA + LT A = CL + LT L + SE

B) OA + FA = OL + FL + SE

C) OA + FA = OL + FL + OSE + FSE

D) Non-FA + FA = Non-FL + FL + SE

A) CA + LT A = CL + LT L + SE

B) OA + FA = OL + FL + SE

C) OA + FA = OL + FL + OSE + FSE

D) Non-FA + FA = Non-FL + FL + SE

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

14

Steady-state growth in free cash flows could be driven by long-run expectations for growth attributable to:

A) interest rates

B) national exports

C) general economic productivity

D) balance of payments

A) interest rates

B) national exports

C) general economic productivity

D) balance of payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is not a problem with using a dividend-based valuation formula?

A) Dividends are arbitrarily established.

B) Dividends represent a transfer of wealth to shareholders.

C) Some firms do not pay a regular periodic dividend.

D) It is a challenge to forecast the final liquidating dividend.

A) Dividends are arbitrarily established.

B) Dividends represent a transfer of wealth to shareholders.

C) Some firms do not pay a regular periodic dividend.

D) It is a challenge to forecast the final liquidating dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

16

Sun Corporation reports the following information:

Net cash provided by operating activities$255,000

Average current liabilities150,000

Average long-term liabilities100,000

Dividends paid60,000

Capital expenditures110,000

Payments of debt35,000

Sun's free cash flow is:

A) $195,000

B) $145,000

C) $50,000

D) $85,000

Net cash provided by operating activities$255,000

Average current liabilities150,000

Average long-term liabilities100,000

Dividends paid60,000

Capital expenditures110,000

Payments of debt35,000

Sun's free cash flow is:

A) $195,000

B) $145,000

C) $50,000

D) $85,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

17

Houston, Inc.

The following information pertains to Houston, Inc.a manufacturer of belt buckles:

What is Houston's free cash flow for all debt and equity holders for year 2012?

A) $564

B) $399

C) $324

D) $202

The following information pertains to Houston, Inc.a manufacturer of belt buckles:

What is Houston's free cash flow for all debt and equity holders for year 2012?

A) $564

B) $399

C) $324

D) $202

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

18

When calculating free cash flows to common equity shareholders,financing activities do not include:

A) Debt cash flows

B) Adjustments for capital expenditures

C) Adjustments for Preferred stock cash flows

D) Financial asset cash flows

A) Debt cash flows

B) Adjustments for capital expenditures

C) Adjustments for Preferred stock cash flows

D) Financial asset cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

19

All of the following are logical steps that enable the analyst to determine reliable estimates of value except:

A) Understand the economics of the industry

B) Assess the particular firm's strategy

C) Evaluate the quality of the firm's accounting

D) Derive a single point estimate of value for a share's current price

A) Understand the economics of the industry

B) Assess the particular firm's strategy

C) Evaluate the quality of the firm's accounting

D) Derive a single point estimate of value for a share's current price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

20

Financial assets include all of the following except:

A) excess cash

B) short term investments

C) intangible assets

D) long-term investments

A) excess cash

B) short term investments

C) intangible assets

D) long-term investments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

21

The present value of future free cash flows valuation method focuses on free cash flows,a base that economists argue has more economic meaning than ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

22

An equity security with systematic risk equal to the average amount of systematic risk of all equity securities in the market:

A) has a market beta equal to one.

B) should expect to earn the same rate of return as the average stock in the market portfolio.

C) gives no insight into the risk premium of stock.

D) Both a and b are correct.

A) has a market beta equal to one.

B) should expect to earn the same rate of return as the average stock in the market portfolio.

C) gives no insight into the risk premium of stock.

D) Both a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a firm generates a rate of return on __________________________________________________ equal to the discount rate used by the investor then it does not matter if an analyst uses cash flows to the investor or cash flows to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

24

The risk-adjusted discount rate used to compute the present value of all the projected free cash flows for common equity shareholders equals the _______________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

25

Net cash flow from operations ________________ dividends equals_______________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

26

________________________________________ typically include accounts payable,accrued expenses,accrued taxes,deferred taxes,pension obligations and other retirement benefit obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

27

If cash flow projections include the effect of inflation then the discount rate used should be a(n)____________________ rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a firm's stock returns co-vary identically with returns to a market-wide portfolio,then its market beta from such a regression is:

A) equal to zero.

B) equal to one.

C) less than one.

D) greater than one.

A) equal to zero.

B) equal to one.

C) less than one.

D) greater than one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

29

Changes in general price levels due to inflation or deflation cause the ______________________________ of the monetary unit to increase or decrease ______________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the objective is to value operating assets net of operating liabilities of a firm then the appropriate free cash flow measure to be used is ______________________________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

31

________________ is an estimate of systematic risk based on the degree of covariation between a firm's stock returns and an index of stock returns for all firms in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

32

Nonsystematic risk factors would include all of the following except:

A) the sustainability of the firm's strategy

B) the firm's ability to generate revenue growth

C) the firm's ability to control expenses

D) unemployment levels

A) the sustainability of the firm's strategy

B) the firm's ability to generate revenue growth

C) the firm's ability to control expenses

D) unemployment levels

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

33

The forecasting and valuation process is particularly difficult for ______________________________ when the near term free cash flows tend to be negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

34

Free cash flows for common equity shareholders are the cash flows specifically available to the common shareholders after making all capital expenditures,_____________________________________________ and ____________________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

35

For most firms,______________________________ include cash and short-term investment securities,accounts receivable,inventory,property,plant and equipment,intangible assets and investments in affiliated companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

36

The analyst can use expectations of the dividends to be paid to the investor or the free cash

flows to be generated by the firm (that will ultimately be paid to the investor)as equivalent

approaches to measure the ____________ expected payoffs to shareholders.

flows to be generated by the firm (that will ultimately be paid to the investor)as equivalent

approaches to measure the ____________ expected payoffs to shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

37

Steady-state growth in ___________________________________ could be driven by long-run expectations for growth attributable to economy-wide inflation,general economic productivity,the population,or long-run growth in industry's sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

38

Even in relatively efficient securities markets,______ is observable but ______ is not; therefore,______ must be estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

39

The cash-flow-based valuation approach measures and values the cash flows that are "free" to be ________________________________________ unencumbered by necessary reinvestments in operating assets or required payments to debt holders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

40

One advantage of the free cash flow valuation method is cash is the medium of exchange and therefore is a fundamental source of ________________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

41

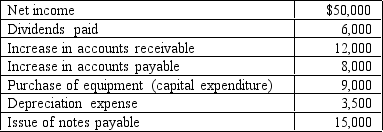

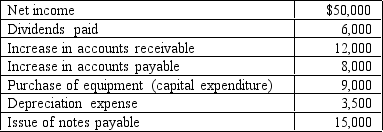

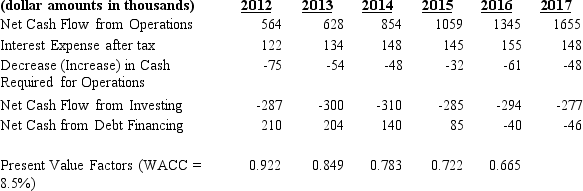

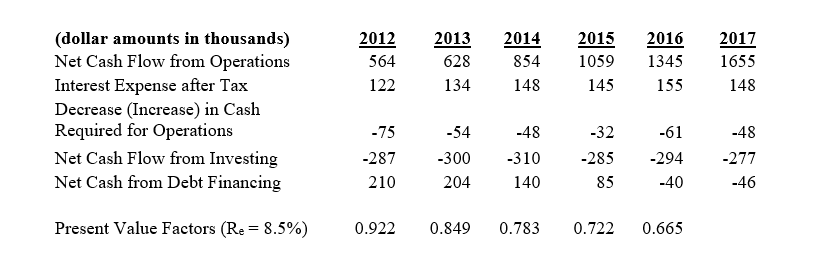

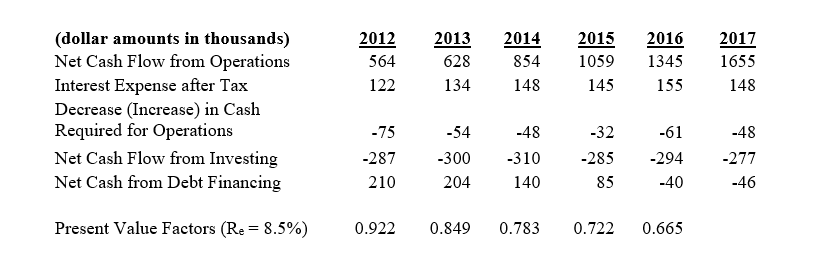

Shady Sunglasses operates retail sunglass kiosks in shopping malls.Below is information related to the company:

Using the above information and assuming that steady-state growth in year 2017 and beyond will be 4% calculate Shady Sunglasses' current value per share.

Using the above information and assuming that steady-state growth in year 2017 and beyond will be 4% calculate Shady Sunglasses' current value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

42

Simpson Department Store

Simpson Department Stores operates retail department store chains throughout the United States.At the end of Year 10, Simpson reports debt of $5,897 million and common shareholders' equity at book value of $4,400 million.The market value of its common stock is $6,895, and its market equity beta is 0.79.An equity buyout group is considering an LBO of Simpson as of the beginning of Year 11.The group intends to finance the buyout with 25 percent common equity and 75 percent debt carrying an interest rate of 10.65 percent.

Regarding the equity buyout,compute the cost of equity capital with the new capital structure that results from the LBO.Assume a risk-free rate of 3.75percent and a market risk premium of 5.0 percent.

Simpson Department Stores operates retail department store chains throughout the United States.At the end of Year 10, Simpson reports debt of $5,897 million and common shareholders' equity at book value of $4,400 million.The market value of its common stock is $6,895, and its market equity beta is 0.79.An equity buyout group is considering an LBO of Simpson as of the beginning of Year 11.The group intends to finance the buyout with 25 percent common equity and 75 percent debt carrying an interest rate of 10.65 percent.

Regarding the equity buyout,compute the cost of equity capital with the new capital structure that results from the LBO.Assume a risk-free rate of 3.75percent and a market risk premium of 5.0 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

43

Simpson Department Store

Simpson Department Stores operates retail department store chains throughout the United States.At the end of Year 10, Simpson reports debt of $5,897 million and common shareholders' equity at book value of $4,400 million.The market value of its common stock is $6,895, and its market equity beta is 0.79.An equity buyout group is considering an LBO of Simpson as of the beginning of Year 11.The group intends to finance the buyout with 25 percent common equity and 75 percent debt carrying an interest rate of 10.65 percent.

Regarding the equity buyout,compute the unlevered market equity (asset)beta of Simpson before consideration of the LBO.Assume that the book value of the debt equals its market value.The income

tax rate is 35 percent.

Simpson Department Stores operates retail department store chains throughout the United States.At the end of Year 10, Simpson reports debt of $5,897 million and common shareholders' equity at book value of $4,400 million.The market value of its common stock is $6,895, and its market equity beta is 0.79.An equity buyout group is considering an LBO of Simpson as of the beginning of Year 11.The group intends to finance the buyout with 25 percent common equity and 75 percent debt carrying an interest rate of 10.65 percent.

Regarding the equity buyout,compute the unlevered market equity (asset)beta of Simpson before consideration of the LBO.Assume that the book value of the debt equals its market value.The income

tax rate is 35 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

44

Simpson Department Store

Simpson Department Stores operates retail department store chains throughout the United States.At the end of Year 10, Simpson reports debt of $5,897 million and common shareholders' equity at book value of $4,400 million.The market value of its common stock is $6,895, and its market equity beta is 0.79.An equity buyout group is considering an LBO of Simpson as of the beginning of Year 11.The group intends to finance the buyout with 25 percent common equity and 75 percent debt carrying an interest rate of 10.65 percent.

Regarding the equity buyout,compute the weighted average cost of capital of the new capital structure.

Simpson Department Stores operates retail department store chains throughout the United States.At the end of Year 10, Simpson reports debt of $5,897 million and common shareholders' equity at book value of $4,400 million.The market value of its common stock is $6,895, and its market equity beta is 0.79.An equity buyout group is considering an LBO of Simpson as of the beginning of Year 11.The group intends to finance the buyout with 25 percent common equity and 75 percent debt carrying an interest rate of 10.65 percent.

Regarding the equity buyout,compute the weighted average cost of capital of the new capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is the purpose of a free cash flow analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

46

When should an analyst use nominal cash flows and when should an analyst use real cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

47

Starting with free cash flows from operations,discuss how an analyst would measure free cash flows to common equity shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

48

What three elements are needed to value a resource when using cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

49

Currently,financial reporting does not take into account changes in prices,either at the general level or at the specific level.Many analysts believe that not taking price changes into account distorts the meaningfulness of financial reports.How do changing prices affect financial reports?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

50

Explain "free" cash flows.Describe which types of cash flows are free and which are not.How do free cash flows available for debt and equity stakeholders differ from free cash flows available for common equity shareholders?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

51

Discuss under which scenario it is appropriate to use free cash flows for all debt and equity capital stakeholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

52

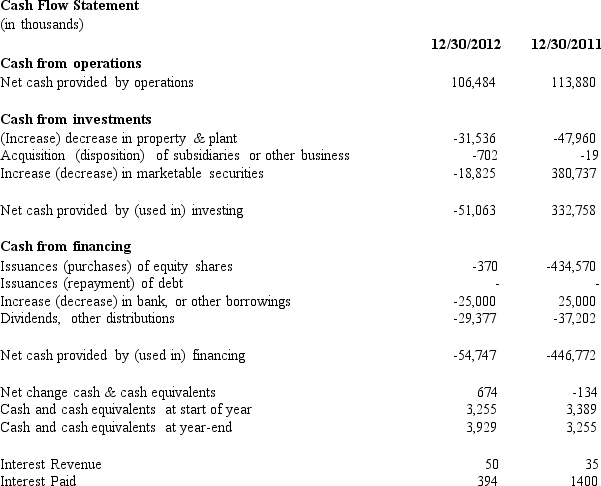

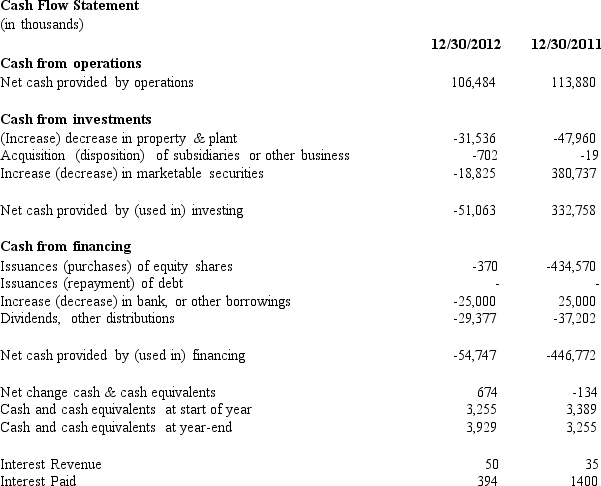

Below is information from the statement of cash flow and income statement for Garland Products,Inc.for 2012 and 2011.Marketable securities represent investments of excess cash that Garland Products does not need for operations.Garland Products' tax rate is 35%.

Using the above information calculate the amount of free cash flows for common equity shareholders for Garland Products for year 2012 and 2011.

Using the above information calculate the amount of free cash flows for common equity shareholders for Garland Products for year 2012 and 2011.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

53

Below is information from the statement of cash flow and income statement for Garland Products,Inc.for 2012 and 2011.Marketable securities represent investments of excess cash that Garland Products does not need for operations.Garland Products' tax rate is 35%.

Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Garland Products for year 2012 and 2011.

Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Garland Products for year 2012 and 2011.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

54

Net income for the year for Tanglewood Inc.was $750,000,but the statement of cash flows reports that cash provided by operating activities was $860,000.Tanglewood also reported capital expenditures of $75,000 and paid dividends in the amount of $30,000.Compute Tanglewood's free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

55

Morgan Company reported the following items in 2013:

Required:

Calculate the following:

(1)net cash provided by operating activities,

(2)the net change in cash during 2013,and

(3)free cash flow.

Required:

Calculate the following:

(1)net cash provided by operating activities,

(2)the net change in cash during 2013,and

(3)free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

56

Provide the rationale for using expected free cash flow in valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

57

Shady Sunglasses operates retail sunglass kiosks in shopping malls.Below is information related to the company:

Using a five-year forecast horizon compute the sum of the present value of free cash flows accruing to all debt and common equity holders for years 2012 to 2016.

Using a five-year forecast horizon compute the sum of the present value of free cash flows accruing to all debt and common equity holders for years 2012 to 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

58

Shady Sunglasses operates retail sunglass kiosks in shopping malls.Below is information related to the company:

Using a five-year forecast horizon,compute the sum of the present value of free cash flows accruing to common equity holders for years 2012 to 2016.

Using a five-year forecast horizon,compute the sum of the present value of free cash flows accruing to common equity holders for years 2012 to 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

59

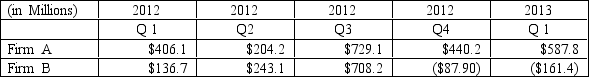

The quarterly cash flows from operations for two computer companies are as follows:

Required:

1)Explain why Firm B has more credit risk than Firm A.

2)Suppose that Firm B's cash flow was $200 million higher each quarter.Explain why Firm B might still be viewed as having higher credit risk than Firm A.

Required:

1)Explain why Firm B has more credit risk than Firm A.

2)Suppose that Firm B's cash flow was $200 million higher each quarter.Explain why Firm B might still be viewed as having higher credit risk than Firm A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

60

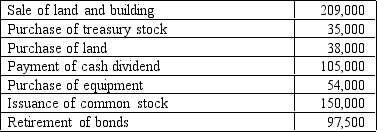

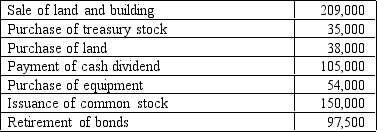

Clarmont Corporation engaged in the following cash transactions during 2012:

Required:

What is Clarmont's free cash flow,assuming that it reported net cash provided by operating activities of $650,000?

Required:

What is Clarmont's free cash flow,assuming that it reported net cash provided by operating activities of $650,000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

61

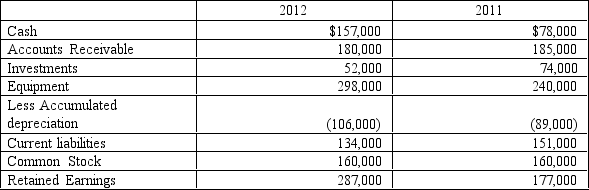

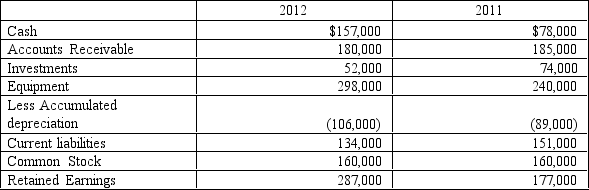

Below is a condensed version of the comparative balance sheets for Stiller Corporation for 2011 and 2012:

Additional information:

Investments were sold at a loss (not extraordinary)of $7,000; no equipment was sold; cash dividends paid were $50,000; and net income was $160,000.

Required:

(a)Prepare a statement of cash flows for 2012 for Stiller Corporation.

(b)Calculate the company's free cash flow.

Additional information:

Investments were sold at a loss (not extraordinary)of $7,000; no equipment was sold; cash dividends paid were $50,000; and net income was $160,000.

Required:

(a)Prepare a statement of cash flows for 2012 for Stiller Corporation.

(b)Calculate the company's free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

62

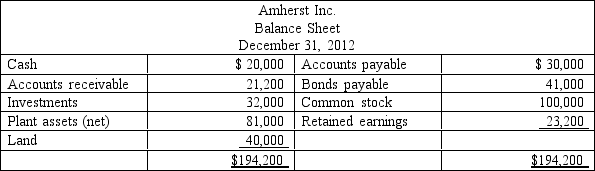

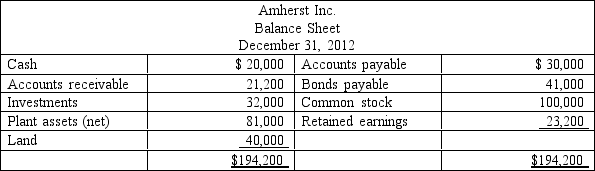

Amherst,Inc.had the following balance sheet at December 31,2012:

During 2013 the following occurred.

1.Amherst liquidated its available for sale investment portfolio at a loss of $5,000.

2.A tract of land was purchased for $38,000.

3.An additional $30,000 in common stock was issued at par.

4.Dividends totaling $10,000 were declared and paid to stockholders.

5.Net income for 2013 was $35,000,including $12,000 in depreciation expense.

6.Land was purchased through the issuance of $30,000 of additional bonds.

7.At December 31,2013,Cash was $70,200,Accounts Receivable was $42,000 and Accounts Payable was $40,000.

During 2013 the following occurred.

1.Amherst liquidated its available for sale investment portfolio at a loss of $5,000.

2.A tract of land was purchased for $38,000.

3.An additional $30,000 in common stock was issued at par.

4.Dividends totaling $10,000 were declared and paid to stockholders.

5.Net income for 2013 was $35,000,including $12,000 in depreciation expense.

6.Land was purchased through the issuance of $30,000 of additional bonds.

7.At December 31,2013,Cash was $70,200,Accounts Receivable was $42,000 and Accounts Payable was $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

63

A comparative balance sheet for Otto Inc.is presented below:

Additional information:

1.Net income for 2012 was $105,000.

2.Cash dividends of $40,000 were declared and paid.

3.Bonds payable amounting to $50,000 were retired through issuance of common stock.

Required:

(a)Prepare a statement of cash flows for 2012 for Otto,Inc.

(b)Compute Otto's current cash debt coverage ratio and cash debt coverage ratio.

(c)Determine Otto Inc.'s free cash flow and comment on its liquidity and financial flexibility.

Additional information:

1.Net income for 2012 was $105,000.

2.Cash dividends of $40,000 were declared and paid.

3.Bonds payable amounting to $50,000 were retired through issuance of common stock.

Required:

(a)Prepare a statement of cash flows for 2012 for Otto,Inc.

(b)Compute Otto's current cash debt coverage ratio and cash debt coverage ratio.

(c)Determine Otto Inc.'s free cash flow and comment on its liquidity and financial flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

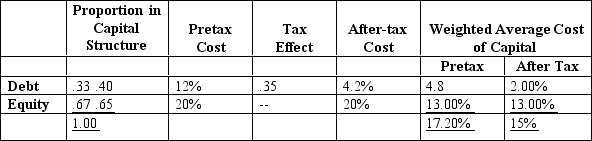

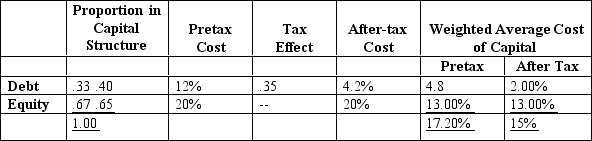

64

Suppose a firm faces the following costs of capital:

Assume that this firm expects to generate $95 million of pretax-free cash flows.

Required:

(1)What would be the after-tax free cash flows one year from today?

(2)Assuming a one-year horizon,what is the appropriate valuation to be used by the analyst?

Assume that this firm expects to generate $95 million of pretax-free cash flows.

Required:

(1)What would be the after-tax free cash flows one year from today?

(2)Assuming a one-year horizon,what is the appropriate valuation to be used by the analyst?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck