Deck 13: Valuation: Earnings-Based Approaches

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/67

العب

ملء الشاشة (f)

Deck 13: Valuation: Earnings-Based Approaches

1

Residual income in a long-run steady-state growth period is referred to as:

A) dynamic residual income

B) realistic residual income

C) continuing residual income

D) equilibrium residual income

A) dynamic residual income

B) realistic residual income

C) continuing residual income

D) equilibrium residual income

C

2

Assume that a firm had shareholders' equity on the balance sheet at a book value of $1,600 at the end of 2010.During 2011 the firm earns net income of $1,300,pays dividends to shareholders of $600,and uses $300 to repurchase common shares.The book value of shareholders' equity at the end of 2011 is:

A) $2,000

B) $400

C) $3,800

D) $2,600

A) $2,000

B) $400

C) $3,800

D) $2,600

A

3

Assume that a firm had shareholders' equity on the balance sheet at a book value of $1,500 at the end of 2010.During 2011 the firm earns net income of $1,900,pays dividends to shareholders of $200,and issues new stock to raise $500 of capital.The book value of shareholders' equity at the end of 2011 is:

A) $2,750

B) $250

C) $1,450

D) $3,700

A) $2,750

B) $250

C) $1,450

D) $3,700

D

$1,500+1,900-200+500=$3,700

$1,500+1,900-200+500=$3,700

4

To measure a firm's economic performance and position in a given period,it makes sense to

Measure all of the following except:

A) The daily free cash flow published by the Wall Street Journal

B) Expenses incurred for resources consumed in that period

C) A portion of the long-lived resources consumed during that period

D) The cost of commitments made during that period to pay retirement benefits to employees in future periods

Measure all of the following except:

A) The daily free cash flow published by the Wall Street Journal

B) Expenses incurred for resources consumed in that period

C) A portion of the long-lived resources consumed during that period

D) The cost of commitments made during that period to pay retirement benefits to employees in future periods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

5

Jarrett Corp.

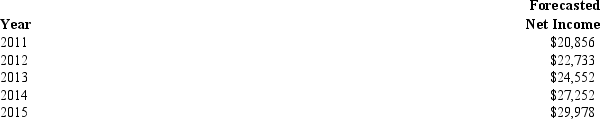

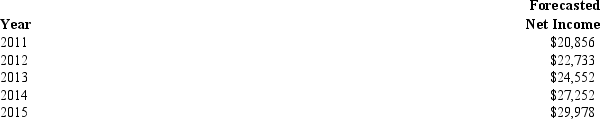

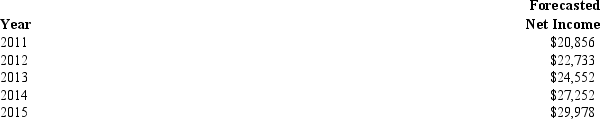

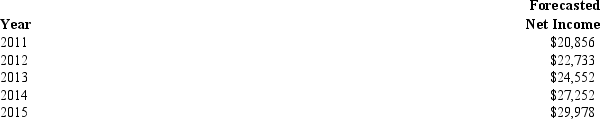

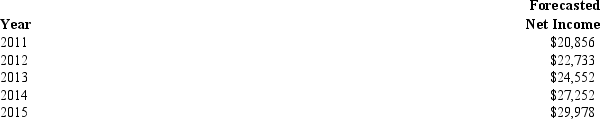

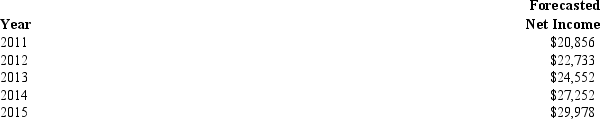

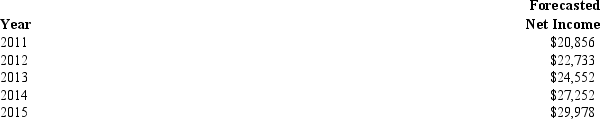

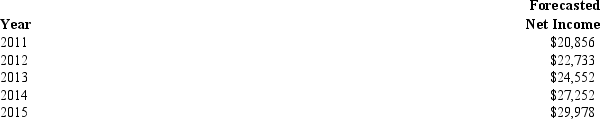

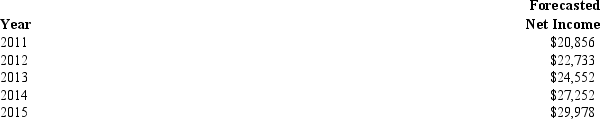

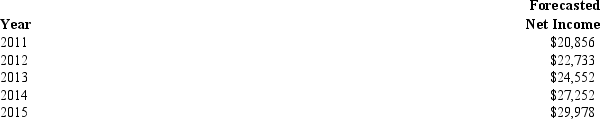

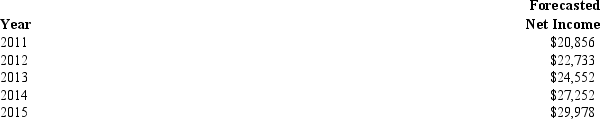

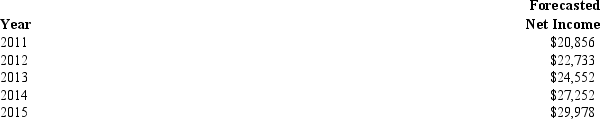

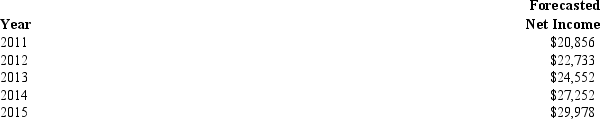

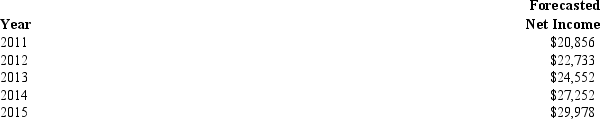

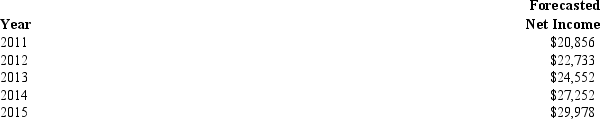

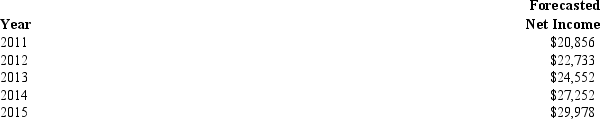

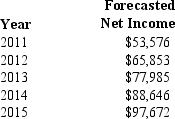

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

At the beginning of 2012 investors had invested $25,000 of common equity in Grant Corp.and expect to earn a return of 11% per year.In addition,investors expect Grant Corp.to pay out 100% of income in dividends each year.Forecasts of Grant's net income are as follows:

2012 - $3,500

2013 - $3,200

2014 - $2,900

2015 and beyond - $2,750

Using this information,what is Grant's residual income valuation at the beginning of 2012?

A) $25,000

B) $26,350

C) $26,151

D) $26,041

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

At the beginning of 2012 investors had invested $25,000 of common equity in Grant Corp.and expect to earn a return of 11% per year.In addition,investors expect Grant Corp.to pay out 100% of income in dividends each year.Forecasts of Grant's net income are as follows:

2012 - $3,500

2013 - $3,200

2014 - $2,900

2015 and beyond - $2,750

Using this information,what is Grant's residual income valuation at the beginning of 2012?

A) $25,000

B) $26,350

C) $26,151

D) $26,041

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

6

Jarrett Corp.

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Compute the value of Jarrett Corp.on January 1,2011,using the residual income valuation model.Use the half-year adjustment.

A) $112,768

B) $185,329

C) $195,540

D) $133,624

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Compute the value of Jarrett Corp.on January 1,2011,using the residual income valuation model.Use the half-year adjustment.

A) $112,768

B) $185,329

C) $195,540

D) $133,624

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

7

Jarrett Corp.

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

What would be Jarrett's common shareholders' equity at the end of 2014?

A) $180,909

B) $208,161

C) $95,540

D) $112,768

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

What would be Jarrett's common shareholders' equity at the end of 2014?

A) $180,909

B) $208,161

C) $95,540

D) $112,768

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

8

Jarrett Corp.

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Assume that a firm's book value at the beginning of the year is $17,800 and that the firm reports net income of $6,200.If the firm's book value at the end of the year is $20,000 what was the amount of dividends paid during the year?

A) $4,000

B) $8,800

C) $2,200

D) Insufficient information to determine

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Assume that a firm's book value at the beginning of the year is $17,800 and that the firm reports net income of $6,200.If the firm's book value at the end of the year is $20,000 what was the amount of dividends paid during the year?

A) $4,000

B) $8,800

C) $2,200

D) Insufficient information to determine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

9

Residual income will be greater than zero when:

A) the firm's reported net income exactly equals the required level of earnings necessary to cover the cost of equity capital.

B) the firm's expected future income is greater than the required level of earnings necessary to cover the cost of equity capital.

C) the firm's expected future income exactly equals the required level of earnings necessary to cover the cost of equity capital.

D) the firm's expected future income is less than the required level of earnings necessary to cover the cost of equity capital.

A) the firm's reported net income exactly equals the required level of earnings necessary to cover the cost of equity capital.

B) the firm's expected future income is greater than the required level of earnings necessary to cover the cost of equity capital.

C) the firm's expected future income exactly equals the required level of earnings necessary to cover the cost of equity capital.

D) the firm's expected future income is less than the required level of earnings necessary to cover the cost of equity capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

10

Jarrett Corp.

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

If investors have invested $20,000 of common equity in a company and it is determined that the required earnings of the company are $$1,250 each period,then investors must expect to earn what return?

A) the risk free rate

B) 9%

C) 6.25%

D) the market premium

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

If investors have invested $20,000 of common equity in a company and it is determined that the required earnings of the company are $$1,250 each period,then investors must expect to earn what return?

A) the risk free rate

B) 9%

C) 6.25%

D) the market premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

11

If an analyst expects a firm to generate net income each period exactly equal to required earnings,then the value of the firm will be:

A) exactly equal to the book value of common shareholders' equity.

B) greater than the book value of common shareholders' equity.

C) less than the book value of common shareholders' equity.

D) exactly equal to working capital.

A) exactly equal to the book value of common shareholders' equity.

B) greater than the book value of common shareholders' equity.

C) less than the book value of common shareholders' equity.

D) exactly equal to working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

12

Jarrett Corp.

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

What would be Jarrett's residual income in 2013?

A) $24,552

B) $18,763

C) $5,789

D) $5,200

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

What would be Jarrett's residual income in 2013?

A) $24,552

B) $18,763

C) $5,789

D) $5,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

13

Residual income valuation focuses on:

A) dividend-paying capacity in free-cash flows.

B) earnings as a periodic measure of shareholder wealth creation.

C) free cash flows as a periodic measure of shareholder wealth creation.

D) dividends as a periodic measure of shareholder wealth creation.

A) dividend-paying capacity in free-cash flows.

B) earnings as a periodic measure of shareholder wealth creation.

C) free cash flows as a periodic measure of shareholder wealth creation.

D) dividends as a periodic measure of shareholder wealth creation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

14

Residual income is:

A) adjusted net income the firm reports.

B) the difference between the net income the analyst expects the firm to generate and the required earnings of the firm.

C) the difference between the net income the analyst expects the firm to generate and the reported earnings of the firm.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

A) adjusted net income the firm reports.

B) the difference between the net income the analyst expects the firm to generate and the required earnings of the firm.

C) the difference between the net income the analyst expects the firm to generate and the reported earnings of the firm.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

15

Jarrett Corp.

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Assume that a firm's book value at the beginning of the year is $12,500 and that the firm reports net income of $3,200 and pays dividends of $1,100.What will the firm's book value at the end of the year?

A) $2,100

B) $15,700

C) $14,600

D) $16,800

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Assume that a firm's book value at the beginning of the year is $12,500 and that the firm reports net income of $3,200 and pays dividends of $1,100.What will the firm's book value at the end of the year?

A) $2,100

B) $15,700

C) $14,600

D) $16,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

16

The appropriate discount rate for the residual income model is:

A) weighted average cost of capital.

B) the risk-free interest rate.

C) the risk-free interest rate plus the market premium.

D) cost of common equity capital.

A) weighted average cost of capital.

B) the risk-free interest rate.

C) the risk-free interest rate plus the market premium.

D) cost of common equity capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

17

Jarrett Corp.

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

At the beginning of 2012 investors had invested $125,000 of common equity in Jan Corp.and expect to earn a return of 15% per year.In addition,investors expect Jan Corp.to pay out 100% of income in dividends each year.Forecasts of Jan's net income are as follows:

2012 - $41,000

2013 - $35,400

2014 - $33,200

2015 and beyond - $25,000

Using this information,what is Jan's residual income valuation at the beginning of 2012?

A) $125,000

B) $184,600

C) $190,262

D) $260,415

At the end of 2010 Jarrett Corp.developed the following forecasts of net income:

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' equity was $112,768 on December 31, 2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

At the beginning of 2012 investors had invested $125,000 of common equity in Jan Corp.and expect to earn a return of 15% per year.In addition,investors expect Jan Corp.to pay out 100% of income in dividends each year.Forecasts of Jan's net income are as follows:

2012 - $41,000

2013 - $35,400

2014 - $33,200

2015 and beyond - $25,000

Using this information,what is Jan's residual income valuation at the beginning of 2012?

A) $125,000

B) $184,600

C) $190,262

D) $260,415

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

18

Over the life of a firm,the capital invested in the firm by the shareholders plus the income of the firm will reflect:

A) the dividend paying ability of the firm.

B) the free cash flows available to shareholders.

C) the value of the firm to shareholders.

D) the value of the firm for debtholders and shareholders.

A) the dividend paying ability of the firm.

B) the free cash flows available to shareholders.

C) the value of the firm to shareholders.

D) the value of the firm for debtholders and shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

19

Residual income is the:

A) difference between the net sales that the analyst expects the firm to generate and the required earnings of the firm.

B) difference between the net income that the analyst expects the firm to generate and the required earnings of the firm.

C) difference between the common stock that the analyst expects the firm to issue and the required earnings of the firm.

D) difference between the expenses that the analyst expects the firm to generate and the required earnings of the firm.

A) difference between the net sales that the analyst expects the firm to generate and the required earnings of the firm.

B) difference between the net income that the analyst expects the firm to generate and the required earnings of the firm.

C) difference between the common stock that the analyst expects the firm to issue and the required earnings of the firm.

D) difference between the expenses that the analyst expects the firm to generate and the required earnings of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

20

Required earnings are the:

A) adjusted net income multiplied by the required rate of return on common equity capital.

B) net income the analyst expects the firm to generate multiplied by the required rate of return on common equity capital.

C) the market value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

A) adjusted net income multiplied by the required rate of return on common equity capital.

B) net income the analyst expects the firm to generate multiplied by the required rate of return on common equity capital.

C) the market value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is probably the least likely reason for acquirers to pay too much in an acquisition?

A) Overbidding

B) Over optimistic appraisal of market potential

C) Over estimation of synergies

D) Overuse of conventional financial statements

A) Overbidding

B) Over optimistic appraisal of market potential

C) Over estimation of synergies

D) Overuse of conventional financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

22

The residual income _____________________________ valuation model uses __________________ and the book value of common shareholders' equity as the basis for valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

23

Dirty surplus items in U.S.GAAP typically arise from all of the following except:

A) changes in investment security fair values

B) foreign currency exchange rates

C) interest rates

D) realized gains

A) changes in investment security fair values

B) foreign currency exchange rates

C) interest rates

D) realized gains

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

24

Early in a period in which sales were increasing at a modest rate and plan expansion and start-up costs were occurring at a rapid rate,a successful business would likely experience:

A) increased profits and no change in financing requirements.

B) decreased profits and increased financing requirements because of an increasing cash shortage.

C) decreased profits and decreased financing requirements because of an increasing cash surplus.

D) increased profits and increased financing requirements because of an increasing cash shortage.

A) increased profits and no change in financing requirements.

B) decreased profits and increased financing requirements because of an increasing cash shortage.

C) decreased profits and decreased financing requirements because of an increasing cash surplus.

D) increased profits and increased financing requirements because of an increasing cash shortage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

25

In theory,all three valuation models,when correctly implemented with internally consistent assumptions,will produce the same estimates of value.However,in practice,which of the following errors can result in different value estimates?

A) Incomplete or inconsistent earnings and cash flow forecasts

B) Inconsistent estimates of weighted average costs of capital

C) Incorrect continuing value computations

D) All of these errors result in different value estimates.

A) Incomplete or inconsistent earnings and cash flow forecasts

B) Inconsistent estimates of weighted average costs of capital

C) Incorrect continuing value computations

D) All of these errors result in different value estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

26

The residual income valuation model is a rigorous and straightforward valuation approach,

But the analyst should be aware of all of the following implementation issues that will hinder its ability to measure firm value correctly except:

A) common stock transactions

B) portions of net income attributable to equity claimants other than common shareholders

C) dirty surplus accounting items

D) positive book value of equity

But the analyst should be aware of all of the following implementation issues that will hinder its ability to measure firm value correctly except:

A) common stock transactions

B) portions of net income attributable to equity claimants other than common shareholders

C) dirty surplus accounting items

D) positive book value of equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

27

Accounting principles make accrual accounting earnings closer to the firm's underlying economic performance in a given period than are _________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

28

Economists sometimes argue that earnings are not a(n)_________________________ attribute on which to base valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would likely be the most useful when valuing a dot.com company?

A) Net asset value

B) Dividend yield

C) Discounted cash flow

D) Price-earnings

A) Net asset value

B) Dividend yield

C) Discounted cash flow

D) Price-earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

30

The foundation for residual income valuation is the classical _____________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

31

______________________________ is the amount by which expected future earnings exceed the required earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

32

Over the life of the firm,the present value of ______________________________,______________________________,and ____________________ will be the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

33

If an analyst expects a firm to generate net income each period exactly equal to required earnings,then the value of the firm will be equal to the ______________________________ of common shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

34

The two most popular discounted earnings models appear to be:

A) free cash flow and dividend discount model.

B) sales/market capitalization and price-earnings.

C) discounted abnormal earnings and residual income.

D) price-cash flow and dividend discount.

A) free cash flow and dividend discount model.

B) sales/market capitalization and price-earnings.

C) discounted abnormal earnings and residual income.

D) price-cash flow and dividend discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

35

In some industries,competitive dynamics eventually drive long-run projections of the future returns earned by the firm to an equilibrium level equal to the long-run expected cost of equity capital in the firm.At that point,a firm can be expected to earn ____________ residual income in the future.

A) increasing

B) zero

C) decreasing

D) There is not enough information to answer this question

A) increasing

B) zero

C) decreasing

D) There is not enough information to answer this question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

36

The required earnings of the firm equals the product of the required rate of return on common equity capital times the __________________________________________________ at the beginning of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

37

Clean surplus accounting for most common stock transactions holds for shares accounted for at market value.An exception to this is:

A) issuance of common equity shares for employee stock options exercises.

B) repurchase of common shares.

C) issuance of common shares to new shareholders in public exchanges.

D) None of these.

A) issuance of common equity shares for employee stock options exercises.

B) repurchase of common shares.

C) issuance of common shares to new shareholders in public exchanges.

D) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

38

The residual income valuation approach assumes that accounting for net income and book value of shareholders' equity follows ________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

39

The value of a share of common equity should equal the present value of the _____________________________________________ that the shareholders will receive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

40

Residual income valuation focuses on ____________________ as a periodic measure of shareholder wealth creation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the rationale for using expected earnings as a basis for valuations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

42

Over the life of a firm,the capital invested in the firm by the shareholders plus the income of the firm will reflect the ______________________________ to the shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

43

Accounting earnings numbers provide a basis for valuation because earnings are the primary measure of ______________________________ produced by the accrual accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

44

When debating the issue of whether to use free cash flows or earnings in a valuation model,economists sometimes argue that ____________________ can be subject to purposeful management by a firm and thus make them less useful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

45

Investors have invested $25,000 in common equity in a company.Given the risk inherent in the company the investors expect to earn a 15 percent return.In addition,the investors expect that the company will reinvest all income in projects that will earn 16%.The company is forecasted to earn $6,000 the first year,$5,000 the second year,$5,500 the third year and $6,244 each year after the third year.For this company determine the company's residual income valuation (round all numbers to the nearest dollar).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

46

What are the four components that make up dirty surplus accounting according to the FASB?

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

47

In many cases,using the residual income valuation model will result in a different value than either the dividend discount model or the free cash flow valuation methods.What are some reasons that the three valuation models would result in inconsistent valuations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

48

Clean surplus accounting means that net income includes all of the recognized elements of income for the firm for _____________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

49

Investors have invested $30,000in common equity in a company.Given the risk inherent in the company,the investors expect to earn a 13percent return.In addition,the investors expect the company to return all income to investors in the form of dividends.The company earns $4,500 the first year.For this company determine the following:

a.The company's required earnings

b.The company's residual earnings

a.The company's required earnings

b.The company's residual earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

50

Investors have invested $25,000 in common equity in a company.Given the risk inherent in the company the investors expect to earn a 15 percent return.In addition,the investors expect the company to return all income to investors in the form of dividends.The company is forecasted to earn $4,000 the first year,$5,000 the second year,$4,500 the third year and $3,750 each year after the third year.For this company determine the company's residual income valuation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

51

Clean surplus accounting means that ____________________ include all direct capital transactions between the firm and the common equity shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

52

Accounting for the residual income in a firm with 100% dividend payout can be expressed as follows:

RIt = CIt- ____________________ X BVt??

RIt = CIt- ____________________ X BVt??

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

53

Where is comprehensive income reported and what is its relevancy to the computation of residual income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

54

Explain required income.What does required income represent? How is required income conceptually analogous to interest expense?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

55

Over sufficiently long periods,_________________________ equals free cash flows to common equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is meant by the term clean surplus accounting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

57

What are the three arguments economists provide against using earnings as a value-relevant attribute in valuation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

58

__________________ means that net income includes all of the recognized elements of income of the firm for common equity shareholders and dividends include all direct capital transactions between the firm and the common equity shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

59

____________________ are the fundamental,value-relevant attribute of expected future returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

60

Why is the weighted average cost of capital not used as the discount rate when computing residual income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

61

Why is it appropriate to use the required rate of return on equity capital (rather than the weighted average cost of capital)as the discount rate in the residual income valuation approach?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

62

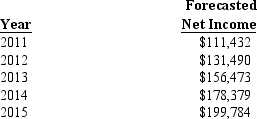

Todd Corp.manufactures train components.On January 1,2011,management provided the following forecast of income for the next five years:

Thomas' common shareholders' equity was $422,174 on January 1,2011.The firm does not expect to pay a dividend during the 2011-2015 period.Thomas' cost of equity capital is 11 percent.

Required:

Compute the value of Todd Company on January 1,2011,using the residual income valuation model and the half year convention.T.Harp,the CEO of Todd,expects net income to grow at a rate of 6 percent annually after 2015.

Thomas' common shareholders' equity was $422,174 on January 1,2011.The firm does not expect to pay a dividend during the 2011-2015 period.Thomas' cost of equity capital is 11 percent.

Required:

Compute the value of Todd Company on January 1,2011,using the residual income valuation model and the half year convention.T.Harp,the CEO of Todd,expects net income to grow at a rate of 6 percent annually after 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

63

Booker,Inc.is a distributor of building supplies.Management for the company has developed the following forecasts of net income:

Management expects net income to grow at a rate of 7 percent per year after 2015 and the company's cost of equity capital is 14%.Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy.Booker's common shareholders' equity at January 1,2011 is $544,902.

Required:

a.Using the residual income model,compute the value of Booker as of January 1,2011.

b.Using the dividend discount model,compute the value of Booker as of January 1,2011.

Management expects net income to grow at a rate of 7 percent per year after 2015 and the company's cost of equity capital is 14%.Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy.Booker's common shareholders' equity at January 1,2011 is $544,902.

Required:

a.Using the residual income model,compute the value of Booker as of January 1,2011.

b.Using the dividend discount model,compute the value of Booker as of January 1,2011.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

64

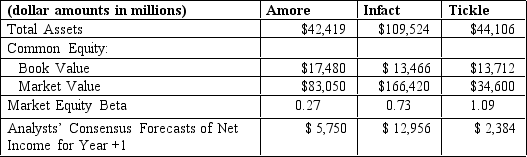

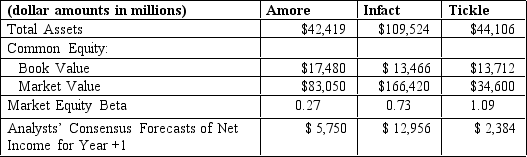

The following data represent total assets,book value,and market value of common shareholders' equity for Amore,Infact,and Tickle.Amore manufactures and sells cosmetics.Infact develops and manufactures computer chips.Tickle operates a chain of general merchandise stores.In addition,these data include existing market betas for the three firms and analysts' consensus forecasts of net income for Year +1

Assume that for each firm,analysts expect other comprehensive income items for

Year +1 to be zero; so Year +1 net income and comprehensive income will be identical.

Assume that the risk-free rate of return in the economy is 4.5 percent and the market risk

premium is 5.5 percent.

Required

a.Using the CAPM,compute the required rate of return on equity capital for each

firm.

b.Project required income for Year +1 for each firm.

c.Project residual income for Year +1 for each firm.

d.What do the different amounts of residual income imply about each firm? Do the

projected residual income amounts help explain the differences in market value of

equity across these three firms? Explain.

Assume that for each firm,analysts expect other comprehensive income items for

Year +1 to be zero; so Year +1 net income and comprehensive income will be identical.

Assume that the risk-free rate of return in the economy is 4.5 percent and the market risk

premium is 5.5 percent.

Required

a.Using the CAPM,compute the required rate of return on equity capital for each

firm.

b.Project required income for Year +1 for each firm.

c.Project residual income for Year +1 for each firm.

d.What do the different amounts of residual income imply about each firm? Do the

projected residual income amounts help explain the differences in market value of

equity across these three firms? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

65

If the firm competes in a very competitive,mature industry,what effect will competitive conditions have on residual income for the firm and others in the industry? Now suppose the firm holds a competitive advantage in an industry,but the advantage is not likely to be sustainable for more than a few years because of the potential for entry in the industry.As the firm's competitive advantage diminishes,what effect will that have on that firm's residual income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

66

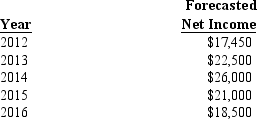

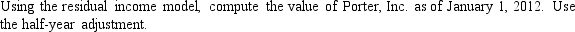

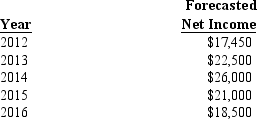

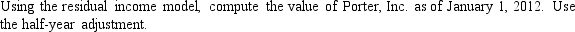

Porter,Inc.is a distributor of electrical supplies.Management for the company has developed the following forecasts of net income:

Fred King,CFO of Porter,Inc.,expects net income to grow at a rate of 9 percent per year after 2016 and the company's cost of equity capital is 15%.Management plans to pay out all income in dividends and plans to continue this policy into the future.Porter's common shareholders' equity at January 1,2011 is $100,000.

Required:

Fred King,CFO of Porter,Inc.,expects net income to grow at a rate of 9 percent per year after 2016 and the company's cost of equity capital is 15%.Management plans to pay out all income in dividends and plans to continue this policy into the future.Porter's common shareholders' equity at January 1,2011 is $100,000.

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

67

Explain residual income.What does residual income represent? What does residual income measure?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck