Deck 6: Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

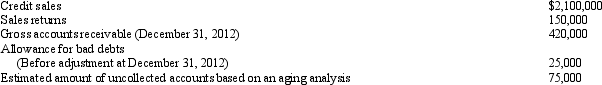

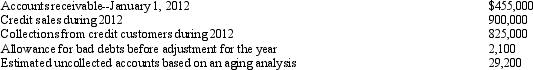

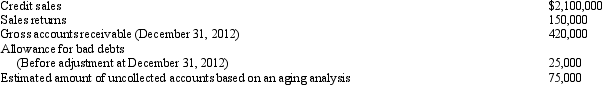

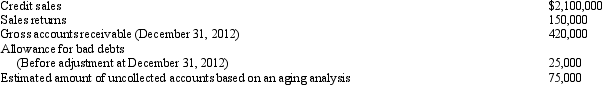

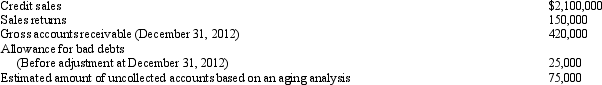

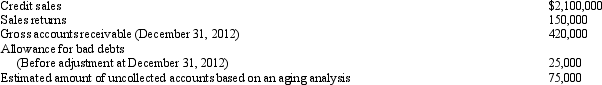

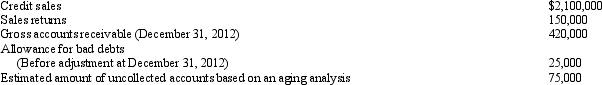

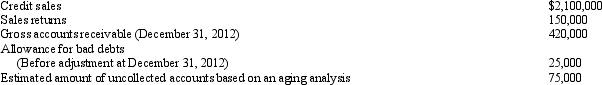

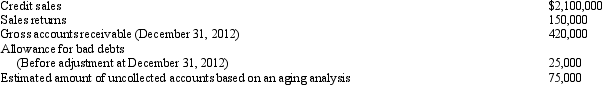

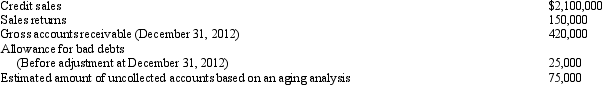

سؤال

سؤال

سؤال

سؤال

سؤال

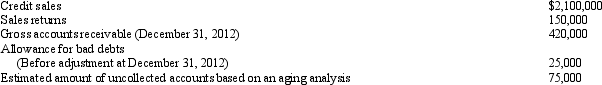

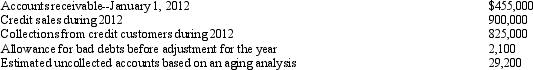

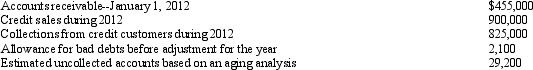

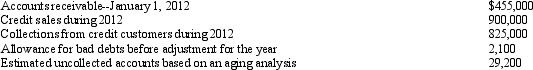

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

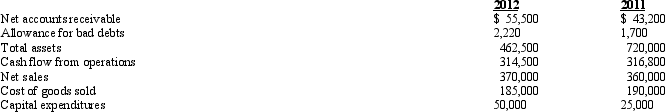

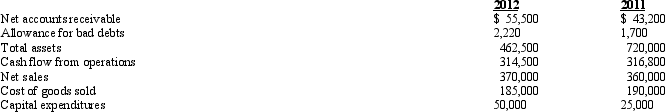

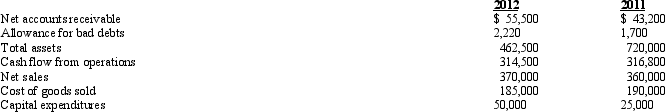

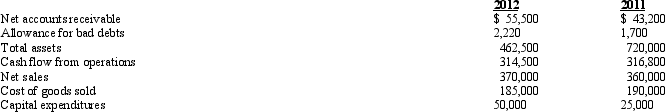

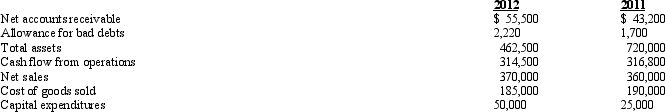

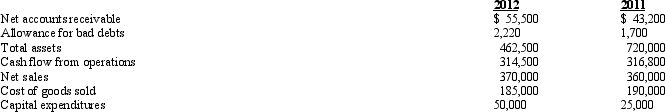

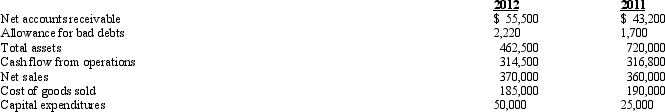

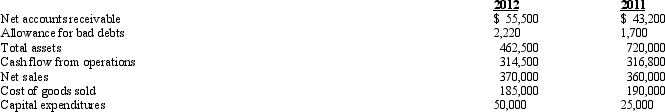

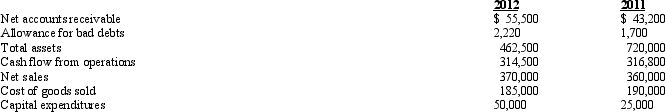

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

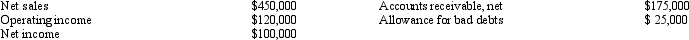

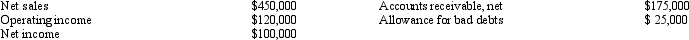

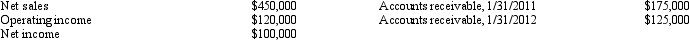

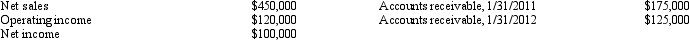

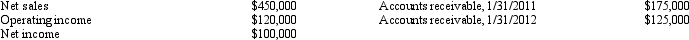

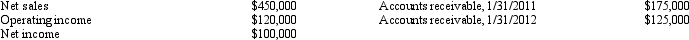

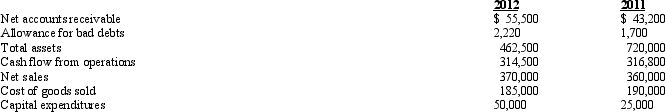

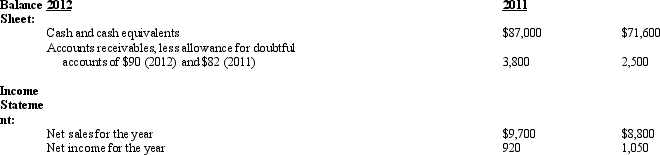

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

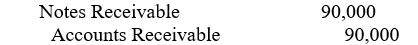

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/96

العب

ملء الشاشة (f)

Deck 6: Receivables

1

If a company uses the allowance method to account for doubtful accounts, when will the company's equity decrease?

A) At the date a customer's account is written off

B) At the end of the accounting period when an adjusting entry for bad debts is recorded

C) At the date a customer's account is determined to be uncollected

D) When the accounts receivable amount becomes past due

A) At the date a customer's account is written off

B) At the end of the accounting period when an adjusting entry for bad debts is recorded

C) At the date a customer's account is determined to be uncollected

D) When the accounts receivable amount becomes past due

B

2

Forrest Corporation uses the direct write-off method to account for bad debts. What are the effects on the accounting equation of the entry to record the write-off of a customer's account balance?

A) Assets and liabilities decrease

B) Assets and equity decrease

C) Equity and liabilities decrease

D) Assets increase and equity decrease

A) Assets and liabilities decrease

B) Assets and equity decrease

C) Equity and liabilities decrease

D) Assets increase and equity decrease

B

3

If a company uses the direct write-off method of accounting for bad debts:

A) it establishes an estimate for the allowance for doubtful accounts.

B) it will record bad debt expense only when an account is determined to be uncollected.

C) it will reduce the accounts receivable account at the end of the accounting period for estimated uncollected accounts.

D) total assets will stay the same, when an account is written off.

A) it establishes an estimate for the allowance for doubtful accounts.

B) it will record bad debt expense only when an account is determined to be uncollected.

C) it will reduce the accounts receivable account at the end of the accounting period for estimated uncollected accounts.

D) total assets will stay the same, when an account is written off.

B

4

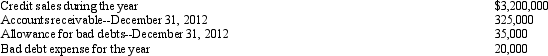

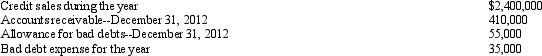

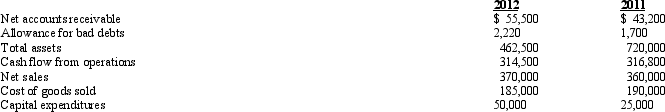

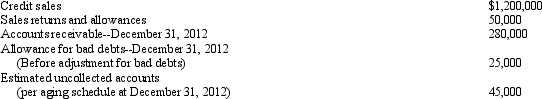

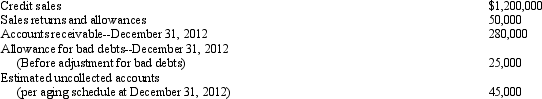

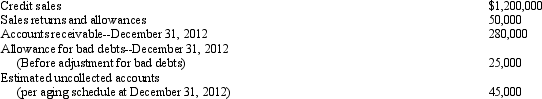

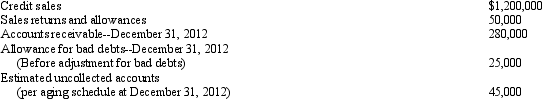

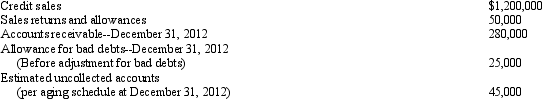

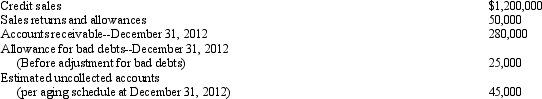

Digital Corporation

The following data concern Digital Corporation for 2012.

-Refer to the information provided for Digital Corporation. What are the effects on the accounting equation when Digital writes off a bad debt under the allowance method?

A) Assets decrease and equity increase

B) Assets and equity decrease

C) Assets increase and equity decreases

D) No effect on overall assets or equity

The following data concern Digital Corporation for 2012.

-Refer to the information provided for Digital Corporation. What are the effects on the accounting equation when Digital writes off a bad debt under the allowance method?

A) Assets decrease and equity increase

B) Assets and equity decrease

C) Assets increase and equity decreases

D) No effect on overall assets or equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

5

Two methods of accounting for uncollectible accounts are the:

A) direct write-off method and the allowance method.

B) allowance method and the accrual method.

C) allowance method and the net realizable method.

D) direct write-off method and the accrual method.

A) direct write-off method and the allowance method.

B) allowance method and the accrual method.

C) allowance method and the net realizable method.

D) direct write-off method and the accrual method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

6

On December 1, 2012, Alex's Drug Store concluded that a customer's $325 account receivable was uncollectible and that the account should be written off. What effect will this write-off have on Alex's 2012 net income and balance sheet totals assuming the allowance method is used to account for bad debts?

A) Decrease in net income; decrease in total assets

B) Increase in net income; no effect on total assets

C) No effect on net income; decrease in total assets

D) No effect on net income; no effect on total assets

A) Decrease in net income; decrease in total assets

B) Increase in net income; no effect on total assets

C) No effect on net income; decrease in total assets

D) No effect on net income; no effect on total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

7

One of the weaknesses of the direct write-off method is that it:

A) understates accounts receivable on the balance sheet.

B) violates the matching principle.

C) is too difficult to use for many companies.

D) is based on estimates.

A) understates accounts receivable on the balance sheet.

B) violates the matching principle.

C) is too difficult to use for many companies.

D) is based on estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

8

Leno, Inc. Data for Leno, Inc. for 2012 are presented below.

Refer to the information given above for Leno, Inc. What amount will Leno show on its year-end balance sheet for the net realizable value of its accounts receivable?

Refer to the information given above for Leno, Inc. What amount will Leno show on its year-end balance sheet for the net realizable value of its accounts receivable?

A) $305,000

B) $290,000

C) $280,000

D) $325,000

Refer to the information given above for Leno, Inc. What amount will Leno show on its year-end balance sheet for the net realizable value of its accounts receivable?

Refer to the information given above for Leno, Inc. What amount will Leno show on its year-end balance sheet for the net realizable value of its accounts receivable?A) $305,000

B) $290,000

C) $280,000

D) $325,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which one of the following is an accurate description of the allowance for bad debts?

A) Contra account

B) Liability account

C) Revenue account

D) Expense account

A) Contra account

B) Liability account

C) Revenue account

D) Expense account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

10

Digital Corporation

The following data concern Digital Corporation for 2012.

- Refer to the information provided for Digital Corporation. What amount will Digital show on its year-end balance sheet for the net realizable value of its accounts receivable?

A) $410,000

B) $295,000

C) $340,000

D) $355,000

The following data concern Digital Corporation for 2012.

- Refer to the information provided for Digital Corporation. What amount will Digital show on its year-end balance sheet for the net realizable value of its accounts receivable?

A) $410,000

B) $295,000

C) $340,000

D) $355,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

11

On January 2, Well Corporation sold merchandise with a gross price of $140,000 to Priority Corporation with terms of 2/10, n/30. How much sales discounts would be recorded if payment was received on January 8?

A) $ 2,800

B) $ 0

C) $ 137,200

D) $ 140.000

A) $ 2,800

B) $ 0

C) $ 137,200

D) $ 140.000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the allowance method of accounting for uncollectible receivables is used, which ledger account is credited to write off a customer's account as uncollectible?

A) Uncollectible accounts expense

B) Accounts receivable

C) Allowance for bad debts

D) Interest expense

A) Uncollectible accounts expense

B) Accounts receivable

C) Allowance for bad debts

D) Interest expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

13

Digital Corporation

The following data concern Digital Corporation for 2012.

-Refer to the information provided for Digital Corporation. What are the effects on the accounting equation when Digital makes the adjustment to record bad debt expense using the allowance method?

A) Assets increase and liabilities decrease

B) Assets and equity decrease

C) Assets increase and equity decreases

D) Assets decrease and equity increases

The following data concern Digital Corporation for 2012.

-Refer to the information provided for Digital Corporation. What are the effects on the accounting equation when Digital makes the adjustment to record bad debt expense using the allowance method?

A) Assets increase and liabilities decrease

B) Assets and equity decrease

C) Assets increase and equity decreases

D) Assets decrease and equity increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which one of the approaches for the allowance procedure emphasizes matching bad debts expense with revenue on the income statement?

A) The percentage-of-receivables approach

B) The percentage-of-sales approach

C) The percentage of accounts written off approach

D) The direct write off method

A) The percentage-of-receivables approach

B) The percentage-of-sales approach

C) The percentage of accounts written off approach

D) The direct write off method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

15

When the allowance method is used to account for uncollectible accounts, Bad Debt Expense is debited when:

A) a customer's account becomes past due.

B) an account becomes bad and is written off.

C) a sale is made.

D) the management estimates the amount of uncollectibles.

A) a customer's account becomes past due.

B) an account becomes bad and is written off.

C) a sale is made.

D) the management estimates the amount of uncollectibles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

16

Records Inc. received payment of a $20,000 accounts receivable within 10 days. The terms were 2/10, n/30. Records would show a:

A) trade discount of $400.

B) trade allowance of $400.

C) sales discount of $400.

D) sales allowance of $400.

A) trade discount of $400.

B) trade allowance of $400.

C) sales discount of $400.

D) sales allowance of $400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements is true regarding the two allowance approaches used to estimate bad debts?

A) The percentage-of-sales approach takes into account the existing balance in the Accounts Receivable account.

B) The direct write-off method takes into account the existing balance in the Allowance for Bad Debts account.

C) The percentage-of-receivables approach takes into account the existing balance in the Allowance for Bad Debts account.

D) The direct write-off method does a better job of matching revenues and expenses than allowance method.

A) The percentage-of-sales approach takes into account the existing balance in the Accounts Receivable account.

B) The direct write-off method takes into account the existing balance in the Allowance for Bad Debts account.

C) The percentage-of-receivables approach takes into account the existing balance in the Allowance for Bad Debts account.

D) The direct write-off method does a better job of matching revenues and expenses than allowance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

18

The allowance for bad debts represents:

A) bad debt losses incurred in the current period.

B) the amount of uncollected accounts written off to date.

C) the difference between total sales made on credit and the amount collected from those credit sales.

D) the difference between the recorded value of accounts receivable and the net realizable value of accounts receivable.

A) bad debt losses incurred in the current period.

B) the amount of uncollected accounts written off to date.

C) the difference between total sales made on credit and the amount collected from those credit sales.

D) the difference between the recorded value of accounts receivable and the net realizable value of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a company uses the allowance method of accounting for bad debts:

A) it uses a liability account called the Allowance for Bad Debts account.

B) it will record bad debts only when an account is determined to be uncollected.

C) it does not have to reduce accounts receivable when the account is written off.

D) it will report accounts receivable in the balance sheet at their net realizable value.

A) it uses a liability account called the Allowance for Bad Debts account.

B) it will record bad debts only when an account is determined to be uncollected.

C) it does not have to reduce accounts receivable when the account is written off.

D) it will report accounts receivable in the balance sheet at their net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

20

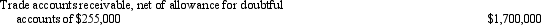

The following information was presented in the balance sheet of Diablo Company as of December 31, 2012:  Which one of the following statements is true?

Which one of the following statements is true?

A) Diablo expects that $1,955,000 of accounts receivable will be collected after year end.

B) The balance in the Accounts Receivable account in Diablo's general ledger is $1,700,000.

C) The net realizable value Diablo's accounts receivable is $1,700,000.

D) Diablo expects to collect only $1,445,000 from its customers.

Which one of the following statements is true?

Which one of the following statements is true?A) Diablo expects that $1,955,000 of accounts receivable will be collected after year end.

B) The balance in the Accounts Receivable account in Diablo's general ledger is $1,700,000.

C) The net realizable value Diablo's accounts receivable is $1,700,000.

D) Diablo expects to collect only $1,445,000 from its customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

21

Collision Corporation

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

-Refer to the information presented for Collision Corporation. If Collision estimates its bad debt to be 2% of net credit sales, what will be the balance in the Allowance for Bad Debts account after the adjustment for bad debts?

A) $15,000

B) $40,000

C) $39,200

D) $54,200

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

-Refer to the information presented for Collision Corporation. If Collision estimates its bad debt to be 2% of net credit sales, what will be the balance in the Allowance for Bad Debts account after the adjustment for bad debts?

A) $15,000

B) $40,000

C) $39,200

D) $54,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

22

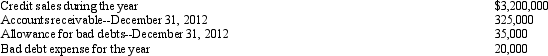

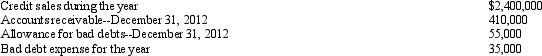

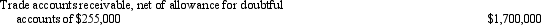

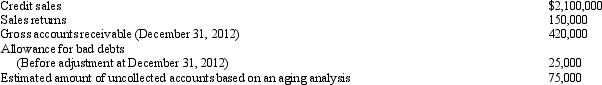

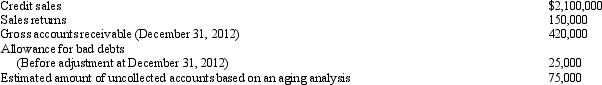

Aspen Corporation

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

-Refer to data provided for Aspen Corporation. If Aspen estimates its bad debts at 8% of accounts receivable, what amount will be reported as bad debt expense for 2012?

A) $75,000

B) $25,000

C) $ 8,600

D) $33,600

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

-Refer to data provided for Aspen Corporation. If Aspen estimates its bad debts at 8% of accounts receivable, what amount will be reported as bad debt expense for 2012?

A) $75,000

B) $25,000

C) $ 8,600

D) $33,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

23

Collision Corporation

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

- Refer to the information provided for Collision Corporation. If Collision uses the aging of accounts receivable approach to estimate its bad debts, what amount will be reported as bad debt expense for 2012?

A) $40,000

B) $55,000

C) $15,000

D) $39,200

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

- Refer to the information provided for Collision Corporation. If Collision uses the aging of accounts receivable approach to estimate its bad debts, what amount will be reported as bad debt expense for 2012?

A) $40,000

B) $55,000

C) $15,000

D) $39,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

24

Profile Corporation

The following data concern Profile Corporation for 2012.

Accounts receivable --january 1, 2012

Credit sales during 2012

Collections from credit customers during 2012 750,000

Allowance far bad debts-jaruary 1,2012 20,000

Eitimated uncollected accounts based on an aging aralysis 45,000

-Refer to the data provided for Profile Corporation. If the aging approach is used to estimate bad debts, find the balance in the Allowance for Bad Debts after the bad debt expense adjustment for 2012.

A) $20,000

B) $15,000

C) $25,000

D) $45,000

The following data concern Profile Corporation for 2012.

Accounts receivable --january 1, 2012

Credit sales during 2012

Collections from credit customers during 2012 750,000

Allowance far bad debts-jaruary 1,2012 20,000

Eitimated uncollected accounts based on an aging aralysis 45,000

-Refer to the data provided for Profile Corporation. If the aging approach is used to estimate bad debts, find the balance in the Allowance for Bad Debts after the bad debt expense adjustment for 2012.

A) $20,000

B) $15,000

C) $25,000

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

25

Ready Corporation's accounts receivable balance after posting net collections from customers for 2012 is $190,000. Management feels that uncollected accounts should be based on the following aging of accounts receivable and uncollected percentages. There are $120,000 that are 1 to 30 days past due at 3% and $70,000 that are 31 to 60 days past due at 8%. The net realizable value of the accounts receivable is:

A) $184,400

B) $186,400

C) $190,000

D) $180,800

A) $184,400

B) $186,400

C) $190,000

D) $180,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

26

Aspen Corporation

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

- Refer to the information provided for Aspen Corporation. If Aspen uses the aging of accounts receivable method to estimate its bad debts, what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A) $343,000

B) $345,000

C) $420,000

D) $395,000

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

- Refer to the information provided for Aspen Corporation. If Aspen uses the aging of accounts receivable method to estimate its bad debts, what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A) $343,000

B) $345,000

C) $420,000

D) $395,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

27

Bolt Corporation

The following data concern Bolt Corporation for 2012.

- Refer to the information provided for Bolt Corporation. If the aging approach is used to estimate bad debts, what amount should be recorded as bad debt expense for 2012?

A) $ 2,100

B) $27,100

C) $29,200

D) $31,300

The following data concern Bolt Corporation for 2012.

- Refer to the information provided for Bolt Corporation. If the aging approach is used to estimate bad debts, what amount should be recorded as bad debt expense for 2012?

A) $ 2,100

B) $27,100

C) $29,200

D) $31,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

28

Outlook Department Store's accounts receivable balance after posting net collections from customers for 2012 is $180,000. The customers took advantage of sales discounts of $15,000. Management aged the accounts receivable and estimate for uncollected account percentages as follows: The net realizable value of the accounts receivable is:

A) $173,200.

B) $170,200.

C) $172,700.

D) $180,000.

A) $173,200.

B) $170,200.

C) $172,700.

D) $180,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which one of the approaches for the allowance procedure emphasizes the net realizable value of accounts receivable on the balance sheet?

A) The percentage-of-receivables approach

B) The percentage-of-sales approach

C) The percentage-of-accounts written off method

D) The direct write-off method

A) The percentage-of-receivables approach

B) The percentage-of-sales approach

C) The percentage-of-accounts written off method

D) The direct write-off method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

30

Collision Corporation

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

-Refer to the information provided for Collision Corporation. If Collision estimates its bad debts at 2% of net credit sales, what amount will be reported as bad debt expense for 2012?

A) $40,000

B) $39,200

C) $24,200

D) $25,000

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

-Refer to the information provided for Collision Corporation. If Collision estimates its bad debts at 2% of net credit sales, what amount will be reported as bad debt expense for 2012?

A) $40,000

B) $39,200

C) $24,200

D) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

31

Aspen Corporation

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

- Refer to the information provided for Aspen Corporation. If Aspen estimates its bad debts at 4% of net credit sales, what amount will be reported as bad debt expense for 2012?

A) $50,000

B) $75,000

C) $78,000

D) $84,000

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

- Refer to the information provided for Aspen Corporation. If Aspen estimates its bad debts at 4% of net credit sales, what amount will be reported as bad debt expense for 2012?

A) $50,000

B) $75,000

C) $78,000

D) $84,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

32

Aspen Corporation

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

-Refer to information provided for Aspen Corporation. If Aspen uses the aging of accounts receivable method to estimate its bad debts, what amount will be reported as bad debt expense for 2012?

A) $50,000

B) $75,000

C) $78,000

D) $53,000

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

-Refer to information provided for Aspen Corporation. If Aspen uses the aging of accounts receivable method to estimate its bad debts, what amount will be reported as bad debt expense for 2012?

A) $50,000

B) $75,000

C) $78,000

D) $53,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

33

Aspen Corporation

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

- Refer to the information provided for Aspen Corporation. If Aspen uses 4% of net credit sales to estimate its bad debts, what will be the balance in the Allowance for Bad Debts account after the adjustment for bad debts?

A) $ 50,000

B) $103,000

C) $ 78,000

D) $ 75,000

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

- Refer to the information provided for Aspen Corporation. If Aspen uses 4% of net credit sales to estimate its bad debts, what will be the balance in the Allowance for Bad Debts account after the adjustment for bad debts?

A) $ 50,000

B) $103,000

C) $ 78,000

D) $ 75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

34

Collision Corporation

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

-Refer to the information provided for Collision Corporation. If Collision uses the aging of accounts receivable approach to estimate its bad debts, what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A) $610,000

B) $555,000

C) $595,000

D) $570,000

Data for Collision Corporation for the year ended December 31, 2012, are presented below.

Credit Sales

Sales retuns and allowances 40,000

Accounts receivable (December 31, 2012) 610,000

Allowance for bad debts

(Before adjustment at December 31, 2012) 15,000

Estimated amount of uncollected accounts based on aging analysis 55,000

-Refer to the information provided for Collision Corporation. If Collision uses the aging of accounts receivable approach to estimate its bad debts, what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

A) $610,000

B) $555,000

C) $595,000

D) $570,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

35

During 2012, the accounts receivable turnover ratio for Upward Company increased from 10 to 15 times per year. Which one of the following statements is the most likely explanation for the change?

A) The company's credit department has followed up with customers whose account balances are past due in order to generate quicker collections.

B) The company has decreased sales to its most credit worthy customers.

C) The company has increased the amount of time customers have to pay their accounts before they are past due.

D) The company has extended credit to more risky customers in order to increase the accounts receivable turnover ratio.

A) The company's credit department has followed up with customers whose account balances are past due in order to generate quicker collections.

B) The company has decreased sales to its most credit worthy customers.

C) The company has increased the amount of time customers have to pay their accounts before they are past due.

D) The company has extended credit to more risky customers in order to increase the accounts receivable turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

36

Aspen Corporation

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

-Refer to the data provided for Aspen Corporation. If Aspen uses 8% of accounts receivables to estimate its bad debts, what will be the balance in the Allowance for Bad Debts account after the adjustment for bad debts?

A) $ 33,600

B) $ 25,000

C) $ 8,600

D) $ 50,000

Data for Aspen Corporation for the year ended December 31, 2012, are presented below.

-Refer to the data provided for Aspen Corporation. If Aspen uses 8% of accounts receivables to estimate its bad debts, what will be the balance in the Allowance for Bad Debts account after the adjustment for bad debts?

A) $ 33,600

B) $ 25,000

C) $ 8,600

D) $ 50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

37

Union Corporation reported net credit sales of $2,500,000 and cost of goods sold of $1,800,000 for 2012. Its beginning balance of accounts receivable was $350,000. The accounts receivable balance decreased by $50,000 during 2012. Rounded to two decimal places, what is Union's accounts receivable turnover ratio for 2012?

A) 7.69

B) 7.14

C) 8.33

D) 11.03

A) 7.69

B) 7.14

C) 8.33

D) 11.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

38

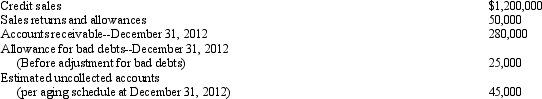

Tanning Company uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $300,000 and credit sales are $1,000,000. An aging of accounts receivable shows that 5% will be uncollectible. What adjusting entry will Tanning Company make if the Allowance for Bad Debts account has a credit balance of $2,000 before the adjustment?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

39

Bolt Corporation

The following data concern Bolt Corporation for 2012.

- Refer to information provided for Bolt Corporation. If the aging approach is used to estimate bad debts, what should the balance in the Allowance for Bad Debts account be after the bad debts adjustment?

A) $ 2,100

B) $31,100

C) $29,200

D) $27,100

The following data concern Bolt Corporation for 2012.

- Refer to information provided for Bolt Corporation. If the aging approach is used to estimate bad debts, what should the balance in the Allowance for Bad Debts account be after the bad debts adjustment?

A) $ 2,100

B) $31,100

C) $29,200

D) $27,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

40

Profile Corporation

The following data concern Profile Corporation for 2012.

Accounts receivable --january 1, 2012

Credit sales during 2012

Collections from credit customers during 2012 750,000

Allowance far bad debts-jaruary 1,2012 20,000

Eitimated uncollected accounts based on an aging aralysis 45,000

- Refer to the information provided for Profile Corporation. If the aging method is used to estimate bad debts, what amount should be recorded as bad debt expense for 2012?

A) $45,000

B) $20,000

C) $25,000

D) $15,000

The following data concern Profile Corporation for 2012.

Accounts receivable --january 1, 2012

Credit sales during 2012

Collections from credit customers during 2012 750,000

Allowance far bad debts-jaruary 1,2012 20,000

Eitimated uncollected accounts based on an aging aralysis 45,000

- Refer to the information provided for Profile Corporation. If the aging method is used to estimate bad debts, what amount should be recorded as bad debt expense for 2012?

A) $45,000

B) $20,000

C) $25,000

D) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

41

The following information is available for Elson Corporation for fiscal year ending January 31, 2012. Calculate the allowance ratio:

A) 14.28%

B) 12.3%

C) 12.5%

D) 36.36%

A) 14.28%

B) 12.3%

C) 12.5%

D) 36.36%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

42

Max's Tire Center Company

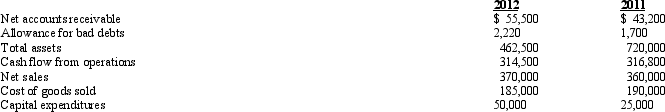

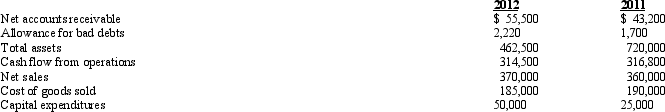

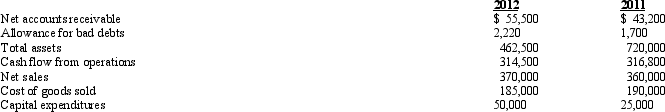

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. Which of the following would result from a vertical analysis of Max's balance sheet in 2012?

A) Net accounts receivable increased by $12,300 or 28.47% during 2012.

B) Net accounts receivable decreased by $12,300 or 28.47% during 2012.

C) Net accounts receivable is 6% of total assets in 2012.

D) Net accounts receivable is 12% of total assets in 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. Which of the following would result from a vertical analysis of Max's balance sheet in 2012?

A) Net accounts receivable increased by $12,300 or 28.47% during 2012.

B) Net accounts receivable decreased by $12,300 or 28.47% during 2012.

C) Net accounts receivable is 6% of total assets in 2012.

D) Net accounts receivable is 12% of total assets in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

43

The following information is available for Elson Corporation for fiscal year ending January 31, 2012. Calculate the receivable turnover ratio:

A) 3

B) 0.8

C) 3.6

D) 2.57

A) 3

B) 0.8

C) 3.6

D) 2.57

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

44

The party to a promissory note who will pay the interest and principal is called the:

A) lender.

B) maker of the note.

C) payee of the note.

D) recipient of the note.

A) lender.

B) maker of the note.

C) payee of the note.

D) recipient of the note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

45

Nadal Company

On October 1, 2012, Nadal Company received a $50,000 promissory note from Borg Company. The annual interest rate is 6%. Principal and interest will be collected in cash at the maturity date of September 30, 2013.

-

Refer to the information provided for Nadal Company. An adjusting entry for Nadal's year end, December 31, 2012 needed to:

A) increase interest revenue by $2,250

B) increase notes receivable by $750

C) increase interest receivable by $750

D) increase notes receivable by $2,250

On October 1, 2012, Nadal Company received a $50,000 promissory note from Borg Company. The annual interest rate is 6%. Principal and interest will be collected in cash at the maturity date of September 30, 2013.

-

Refer to the information provided for Nadal Company. An adjusting entry for Nadal's year end, December 31, 2012 needed to:

A) increase interest revenue by $2,250

B) increase notes receivable by $750

C) increase interest receivable by $750

D) increase notes receivable by $2,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

46

Bradford Corporation reported net credit sales of $3,200,000 and cost of goods sold of $2,600,000 for 2012. On January 1, 2012, accounts receivable was $450,000. Amounts owed by customers increased by $50,000 during 2012. Rounding to two decimal places, what is Bradford's receivable turnover ratio for 2012?

A) 5.47

B) 6.40

C) 6.74

D) 7.11

A) 5.47

B) 6.40

C) 6.74

D) 7.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

47

Max's Tire Center Company

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. What is Max's receivables turnover ratio in 2012?

A) The receivables turnover is 7.79 in 2012.

B) The receivables turnover is 6.67 in 2012.

C) The receivables turnover is 8.56 in 2012.

D) The receivables turnover is 7.21 in 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. What is Max's receivables turnover ratio in 2012?

A) The receivables turnover is 7.79 in 2012.

B) The receivables turnover is 6.67 in 2012.

C) The receivables turnover is 8.56 in 2012.

D) The receivables turnover is 7.21 in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

48

Bradford Corporation reported net accounts receivable of $380,000 and net sales of $2,600,000 for 2012. Allowance for bad debts was $40,000, ending 2012. Rounding to two decimal places, what is Bradford's allowance ratio for 2012?

A) 10.53%

B) 9.52%

C) 1.54%

D) 1.50%

A) 10.53%

B) 9.52%

C) 1.54%

D) 1.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

49

Nadal Company

On October 1, 2012, Nadal Company received a $50,000 promissory note from Borg Company. The annual interest rate is 6%. Principal and interest will be collected in cash at the maturity date of September 30, 2013.

-

Refer to the information provided for Nadal Company. The effect on Nadal's financial statements on September 30, 2013, is as follows:

A) Assets and equity increase

B) No net change in equity

C) Assets and liabilities increase

D) No net change in assets

On October 1, 2012, Nadal Company received a $50,000 promissory note from Borg Company. The annual interest rate is 6%. Principal and interest will be collected in cash at the maturity date of September 30, 2013.

-

Refer to the information provided for Nadal Company. The effect on Nadal's financial statements on September 30, 2013, is as follows:

A) Assets and equity increase

B) No net change in equity

C) Assets and liabilities increase

D) No net change in assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following information is available for Elson Corporation for fiscal year ending January 31, 2012. Calculate the days-in-receivables ratio:

A) 120.00

B) 121.66

C) 112.66

D) 188.33

A) 120.00

B) 121.66

C) 112.66

D) 188.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

51

How will the payee of the promissory note record the note on its books?

A) The promissory note will be recorded as an asset

B) The promissory note will be recorded as a liability

C) The promissory note will be recorded as an equity

D) The promissory note will be recorded as an expense

A) The promissory note will be recorded as an asset

B) The promissory note will be recorded as a liability

C) The promissory note will be recorded as an equity

D) The promissory note will be recorded as an expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

52

Bradford Corporation reported net credit sales of $3,200,000 and cost of goods sold of $2,600,000 for 2012. On January 1, 2012, accounts receivable was $450,000. Amounts owed by customers increased by $50,000 during 2012. Rounding the intermediate calculation to two decimal places, what is Bradford's days-in-receivables ratio for 2012?

A) 52.94

B) 53.67

C) 53.41

D) 54.15

A) 52.94

B) 53.67

C) 53.41

D) 54.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

53

Receivables turnover ratio measures:

A) a company's ability to collect its accounts receivables.

B) a comparison of allowance account to receivables.

C) the fair market value of accounts receivable.

D) the efficiency of the accounts payable function.

A) a company's ability to collect its accounts receivables.

B) a comparison of allowance account to receivables.

C) the fair market value of accounts receivable.

D) the efficiency of the accounts payable function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

54

Max's Tire Center Company

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. Which of the following would result from a horizontal analysis of Max's income statement?

A) Net sales increased by $10,000 or 2.78% during 2012.

B) Net sales increased by $2,300 or 10.0% during 2012.

C) Net sales is $360,000 in 2012.

D) Net sales decreased by $2,300 or 10.0% during 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. Which of the following would result from a horizontal analysis of Max's income statement?

A) Net sales increased by $10,000 or 2.78% during 2012.

B) Net sales increased by $2,300 or 10.0% during 2012.

C) Net sales is $360,000 in 2012.

D) Net sales decreased by $2,300 or 10.0% during 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

55

Max's Tire Center Company

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. Which of the following would result from a horizontal analysis of Max's balance sheet?

A) Net sales increased by $2,300 or 10.0% during 2012.

B) Net accounts receivable increased $12,300 or 28.47% during 2012.

C) Net accounts receivable is 12.0% of total assets in 2012.

D) The total assets is $462,500 in 2011.

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. Which of the following would result from a horizontal analysis of Max's balance sheet?

A) Net sales increased by $2,300 or 10.0% during 2012.

B) Net accounts receivable increased $12,300 or 28.47% during 2012.

C) Net accounts receivable is 12.0% of total assets in 2012.

D) The total assets is $462,500 in 2011.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

56

Max's Tire Center Company

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. Which of the following would result from a vertical analysis of Max's income statement in 2012?

A) Net sales increased by $10,000 or 2.78% during 2012.

B) Net sales is $360,000 in 2012.

C) Capital expenditures is 100% of total assets in 2012.

D) Cost of goods sold is 50% of net sales in 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

-Refer to the selected data provided for Max's Tire Center. Which of the following would result from a vertical analysis of Max's income statement in 2012?

A) Net sales increased by $10,000 or 2.78% during 2012.

B) Net sales is $360,000 in 2012.

C) Capital expenditures is 100% of total assets in 2012.

D) Cost of goods sold is 50% of net sales in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

57

Max's Tire Center Company

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. What is Max's allowance ratio in 2012?

A) The allowance ratio is 3.29% in 2012.

B) The allowance ratio is 3.85% in 2012.

C) The allowance ratio is 4.89% in 2012.

D) The allowance ratio is 2.97% in 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. What is Max's allowance ratio in 2012?

A) The allowance ratio is 3.29% in 2012.

B) The allowance ratio is 3.85% in 2012.

C) The allowance ratio is 4.89% in 2012.

D) The allowance ratio is 2.97% in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

58

The total amount of interest for one year calculated annually on a $18,000 promissory note payable for 3 years at 11% is:

A) $1,980.

B) $5,940.

C) $3,960.

D) $990.

A) $1,980.

B) $5,940.

C) $3,960.

D) $990.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

59

Max's Tire Center Company

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. What is Max's days-in-receivables ratio in 2012?

A) The days-in-receivables ratio is 50.62 in 2012.

B) The days-in-receivables ratio is 54.75 in 2012.

C) The days-in-receivables ratio is 42.62 in 2012.

D) The days-in-receivables ratio is 60.04 in 2012.

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. What is Max's days-in-receivables ratio in 2012?

A) The days-in-receivables ratio is 50.62 in 2012.

B) The days-in-receivables ratio is 54.75 in 2012.

C) The days-in-receivables ratio is 42.62 in 2012.

D) The days-in-receivables ratio is 60.04 in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

60

The days-in-receivables ratio:

A) is an estimate of the length of time the receivables have been outstanding.

B) measures the cash discount period for credit sales.

C) is net credit sales divided by average receivables.

D) is not meaningful and therefore is not used.

A) is an estimate of the length of time the receivables have been outstanding.

B) measures the cash discount period for credit sales.

C) is net credit sales divided by average receivables.

D) is not meaningful and therefore is not used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

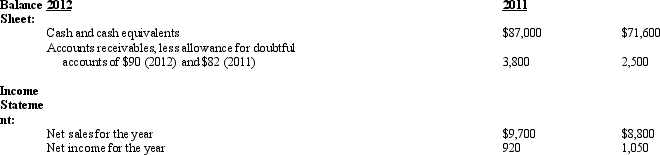

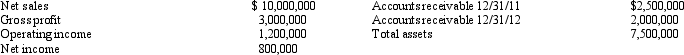

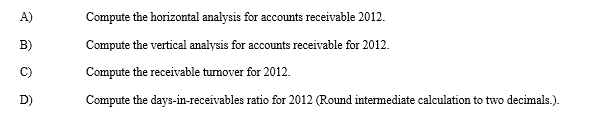

61

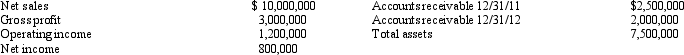

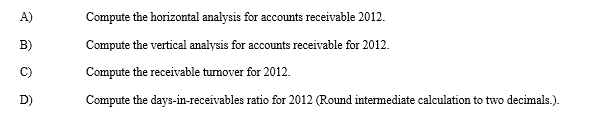

The comparative financial statements for the years ended December 31, 2012 and 2011, for Rimm Company reported the following information.

Answer these questions concerning Rimm Company's receivables:

Answer these questions concerning Rimm Company's receivables:

Answer these questions concerning Rimm Company's receivables:

Answer these questions concerning Rimm Company's receivables:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

62

Metal Company

Metal Company sold merchandise to Steel Corporation on December 1, 2012, for $150,000, and accepted a promissory note for payment in the same amount. The note has a term of three months and an annual interest rate of 8%. Metal's accounting period ends on December 31.

-

Refer to the data provided for Metal Company. What is the maturity date of the note?

A) December 31, 2012

B) January 31, 2013

C) February 28, 2013

D) March 31, 2013

Metal Company sold merchandise to Steel Corporation on December 1, 2012, for $150,000, and accepted a promissory note for payment in the same amount. The note has a term of three months and an annual interest rate of 8%. Metal's accounting period ends on December 31.

-

Refer to the data provided for Metal Company. What is the maturity date of the note?

A) December 31, 2012

B) January 31, 2013

C) February 28, 2013

D) March 31, 2013

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is the distinguishing characteristic between accounts receivable and notes receivable?

A) Accounts receivable are usually current assets while notes receivable are usually long-term assets.

B) Accounts receivable require payment of interest while notes receivable does not have payment of interest.

C) Notes receivable result from credit sale transactions for merchandising companies, while accounts receivable result from credit sale transactions for service companies.

D) Notes receivable generally specify an interest rate and a maturity date at which any interest and principle must be repaid.

A) Accounts receivable are usually current assets while notes receivable are usually long-term assets.

B) Accounts receivable require payment of interest while notes receivable does not have payment of interest.

C) Notes receivable result from credit sale transactions for merchandising companies, while accounts receivable result from credit sale transactions for service companies.

D) Notes receivable generally specify an interest rate and a maturity date at which any interest and principle must be repaid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

64

Land Shoes

Land Shoes received a promissory note from a customer on July 1, 2012. The face value of the note is $45,000; the terms are 12 months and 10% annual interest.

-

Refer to the information provided for Land Shoes. How much interest revenue will Land Shoes recognize for the year ended December 31, 2012?

A) $ 0

B) $9,000

C) $2,250

D) $4,500

Land Shoes received a promissory note from a customer on July 1, 2012. The face value of the note is $45,000; the terms are 12 months and 10% annual interest.

-

Refer to the information provided for Land Shoes. How much interest revenue will Land Shoes recognize for the year ended December 31, 2012?

A) $ 0

B) $9,000

C) $2,250

D) $4,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

65

Lubing Company

Lubing Company sold merchandise to Lewing Corporation. on December 1, 2012, for $100,000. Lubing accepted a promissory note from Lewing Corporation for $100,000. The note has a term of 6 months and an annual interest rate of 9%. Lubing's accounting period ends on December 31, 2012.

-

Refer to the information provided for Lubing Company. What amount should Lubing recognize as interest revenue on the maturity date of the note?

A) $ -0-

B) $4,500

C) $3,750

D) $9,000

Lubing Company sold merchandise to Lewing Corporation. on December 1, 2012, for $100,000. Lubing accepted a promissory note from Lewing Corporation for $100,000. The note has a term of 6 months and an annual interest rate of 9%. Lubing's accounting period ends on December 31, 2012.

-

Refer to the information provided for Lubing Company. What amount should Lubing recognize as interest revenue on the maturity date of the note?

A) $ -0-

B) $4,500

C) $3,750

D) $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

66

Hammer Associates

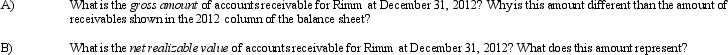

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. Determine the effect on Hammer's accounting equation of the year-end adjustment of bad debts using the aging approach.

Refer to the information provided for Hammer Associates. Determine the effect on Hammer's accounting equation of the year-end adjustment of bad debts using the aging approach.

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. Determine the effect on Hammer's accounting equation of the year-end adjustment of bad debts using the aging approach.

Refer to the information provided for Hammer Associates. Determine the effect on Hammer's accounting equation of the year-end adjustment of bad debts using the aging approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

67

Hammer Associates

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much is the net realizable value of the accounts receivable at December 31, 2012?

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much is the net realizable value of the accounts receivable at December 31, 2012?

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much is the net realizable value of the accounts receivable at December 31, 2012?

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much is the net realizable value of the accounts receivable at December 31, 2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

68

Hammer Associates

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. If bad debts are estimated at 1% of net credit sales, how much will Hammer report as bad debts expense for 2012?

Refer to the information provided for Hammer Associates. If bad debts are estimated at 1% of net credit sales, how much will Hammer report as bad debts expense for 2012?

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. If bad debts are estimated at 1% of net credit sales, how much will Hammer report as bad debts expense for 2012?

Refer to the information provided for Hammer Associates. If bad debts are estimated at 1% of net credit sales, how much will Hammer report as bad debts expense for 2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

69

Peach Tree Farm

Peach Tree Farm received a promissory note from a customer on March 1, 2012. The principal amount of the note is $20,000; the terms are 3 months and 9% annual interest.

-

Refer to the information for Peach Tree Farm. At the maturity date, the customer pays the amount due for the note and interest. What entry is required on the books of Peach Tree Farm on the maturity date assuming that none of the interest had already been recognized?

A) Decrease cash and notes receivable by $20,000

B) Increase cash by $20,450, increase interest revenue by $450, and decrease notes receivable by $20,000

C) Increase cash by $20,450, increase notes receivable by $20,000, and increase interest revenue by $450

D) No entry is required; the customer pays the amount due to Peach Tree Farm.

Peach Tree Farm received a promissory note from a customer on March 1, 2012. The principal amount of the note is $20,000; the terms are 3 months and 9% annual interest.

-

Refer to the information for Peach Tree Farm. At the maturity date, the customer pays the amount due for the note and interest. What entry is required on the books of Peach Tree Farm on the maturity date assuming that none of the interest had already been recognized?

A) Decrease cash and notes receivable by $20,000

B) Increase cash by $20,450, increase interest revenue by $450, and decrease notes receivable by $20,000

C) Increase cash by $20,450, increase notes receivable by $20,000, and increase interest revenue by $450

D) No entry is required; the customer pays the amount due to Peach Tree Farm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

70

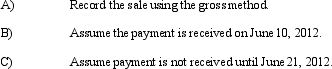

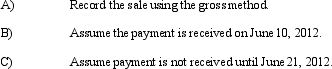

On June 3, 2012, Irvine Corporation sells $45,000 of merchandise to a customer on account with terms of 2/10, n/30.

Prepare the journal entries to:

Prepare the journal entries to:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

71

Harper Company lends Hewell Company $40,000 on March 1, accepting a four-month, 6% interest note. Harper Company prepares financial statements on March 31. What adjusting entry Harper should make before the financial statements can be prepared?

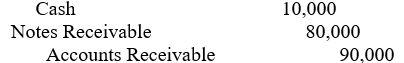

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

72

Hammer Associates

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much bad debts expense will Hammer report for 2012?

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much bad debts expense will Hammer report for 2012?

The following information concerns Hammer Associates at the end of 2012.

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much bad debts expense will Hammer report for 2012?

Refer to the information provided for Hammer Associates. If the aging approach is used to estimate bad debts, how much bad debts expense will Hammer report for 2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

73

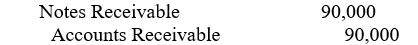

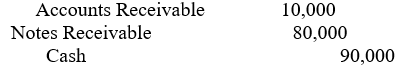

On March 1, 2012, Mack Corporation accepted cash of $10,000 and a six-month, $80,000 interest-bearing note from Gee, Inc., as settlement of an account receivable. Mack has a fiscal year-end of July 31st and Gee paid the principle and the interest on time. Select the appropriate journal entry that reflects the acceptance of the note on March 1, 2012?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

74

Metal Company

Metal Company sold merchandise to Steel Corporation on December 1, 2012, for $150,000, and accepted a promissory note for payment in the same amount. The note has a term of three months and an annual interest rate of 8%. Metal's accounting period ends on December 31.

-

Refer to the data provided for Metal Company. What amount should Metal recognize as interest revenue on the maturity date of the note?

A) $ -0-

B) $1,000

C) $2,000

D) $3,000

Metal Company sold merchandise to Steel Corporation on December 1, 2012, for $150,000, and accepted a promissory note for payment in the same amount. The note has a term of three months and an annual interest rate of 8%. Metal's accounting period ends on December 31.

-

Refer to the data provided for Metal Company. What amount should Metal recognize as interest revenue on the maturity date of the note?

A) $ -0-

B) $1,000

C) $2,000

D) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

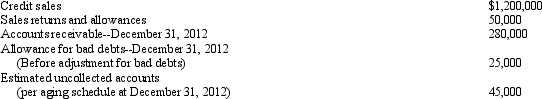

75

The following information is available for Spin Corporation for the year ending December 31, 2012:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

76

What should a company do to improve its accounts receivable turnover ratio?

A) Lower its selling prices.

B) Increase its sales force.

C) Give customers credit terms of 2/10, n/30 rather than 1/10, n/30.

D) Reduce the number of employees working in the credit department.

A) Lower its selling prices.

B) Increase its sales force.

C) Give customers credit terms of 2/10, n/30 rather than 1/10, n/30.

D) Reduce the number of employees working in the credit department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

77

Land Shoes

Land Shoes received a promissory note from a customer on July 1, 2012. The face value of the note is $45,000; the terms are 12 months and 10% annual interest.

-

Refer to the information provided for Land Shoes. At the maturity date, the customer pays for the note and interest. Land Shoes made the proper adjustment at the end of December 2012 for interest. The effect of recognizing the transaction on the maturity date is:

A) a decrease to cash.

B) a decrease to interest receivable.

C) an increase to interest receivable.

D) a decrease to notes receivable.

Land Shoes received a promissory note from a customer on July 1, 2012. The face value of the note is $45,000; the terms are 12 months and 10% annual interest.

-

Refer to the information provided for Land Shoes. At the maturity date, the customer pays for the note and interest. Land Shoes made the proper adjustment at the end of December 2012 for interest. The effect of recognizing the transaction on the maturity date is:

A) a decrease to cash.

B) a decrease to interest receivable.

C) an increase to interest receivable.

D) a decrease to notes receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

78

Peach Tree Farm

Peach Tree Farm received a promissory note from a customer on March 1, 2012. The principal amount of the note is $20,000; the terms are 3 months and 9% annual interest.

-

Refer to the information for Peach Tree Farm. What is the total amount of interest that Peach Tree Farm will receive when the note is collected?

A) $ 300

B) $ 150

C) $ 450

D) $1,800

Peach Tree Farm received a promissory note from a customer on March 1, 2012. The principal amount of the note is $20,000; the terms are 3 months and 9% annual interest.

-

Refer to the information for Peach Tree Farm. What is the total amount of interest that Peach Tree Farm will receive when the note is collected?

A) $ 300

B) $ 150

C) $ 450

D) $1,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

79

Lubing Company

Lubing Company sold merchandise to Lewing Corporation. on December 1, 2012, for $100,000. Lubing accepted a promissory note from Lewing Corporation for $100,000. The note has a term of 6 months and an annual interest rate of 9%. Lubing's accounting period ends on December 31, 2012.

-

Refer to the information provided for Lubing Company. What amount should Lubing recognize as interest revenue on December 31, 2012?

A) $ -0-

B) $ 750

C) $1,500

D) $9,000

Lubing Company sold merchandise to Lewing Corporation. on December 1, 2012, for $100,000. Lubing accepted a promissory note from Lewing Corporation for $100,000. The note has a term of 6 months and an annual interest rate of 9%. Lubing's accounting period ends on December 31, 2012.

-

Refer to the information provided for Lubing Company. What amount should Lubing recognize as interest revenue on December 31, 2012?

A) $ -0-

B) $ 750

C) $1,500

D) $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

80

Metal Company

Metal Company sold merchandise to Steel Corporation on December 1, 2012, for $150,000, and accepted a promissory note for payment in the same amount. The note has a term of three months and an annual interest rate of 8%. Metal's accounting period ends on December 31.

-

Refer to the data provided for Metal Company. What amount should Metal recognize as interest revenue on December 31, 2012?

A) $ -0-

B) $ 1,000

C) $12,000

D) $11,000

Metal Company sold merchandise to Steel Corporation on December 1, 2012, for $150,000, and accepted a promissory note for payment in the same amount. The note has a term of three months and an annual interest rate of 8%. Metal's accounting period ends on December 31.

-

Refer to the data provided for Metal Company. What amount should Metal recognize as interest revenue on December 31, 2012?

A) $ -0-

B) $ 1,000

C) $12,000

D) $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck