Deck 20: External Growth Through Mergers

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

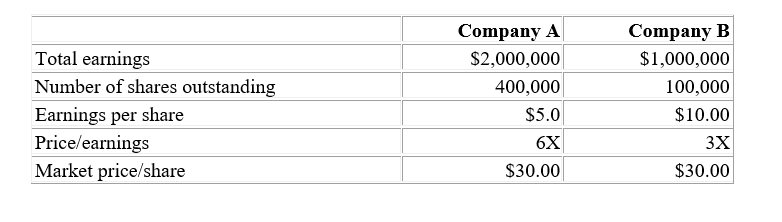

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/107

العب

ملء الشاشة (f)

Deck 20: External Growth Through Mergers

1

The price that a company has to pay to purchase another firm is typically:

A) the book value.

B) the market value.

C) some premium over current market value.

D) some discount of current market value.

A) the book value.

B) the market value.

C) some premium over current market value.

D) some discount of current market value.

C

2

Which of the following is not a form of compensation that selling shareholders could receive?

A) Stock

B) Cash

C) Stock options

D) Fixed income securities

A) Stock

B) Cash

C) Stock options

D) Fixed income securities

C

3

Dilution in earnings per share occurs when a company with:

A) a high P/E ratio buys a company with a low P/E ratio.

B) a low P/E ratio buys a company with a high P/E ratio.

C) a high growth rate in earnings per share buys a company with a low growth rate in earnings per share.

D) a low growth rate in earnings per share buys a company with a high growth rate in earnings per share.

A) a high P/E ratio buys a company with a low P/E ratio.

B) a low P/E ratio buys a company with a high P/E ratio.

C) a high growth rate in earnings per share buys a company with a low growth rate in earnings per share.

D) a low growth rate in earnings per share buys a company with a high growth rate in earnings per share.

B

4

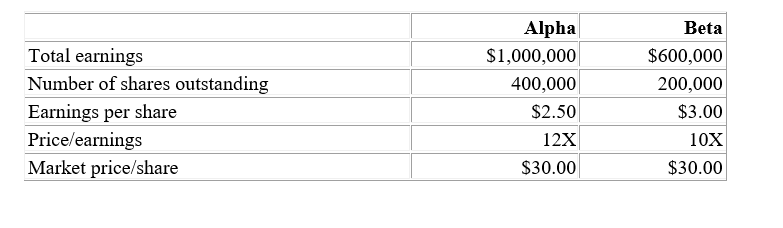

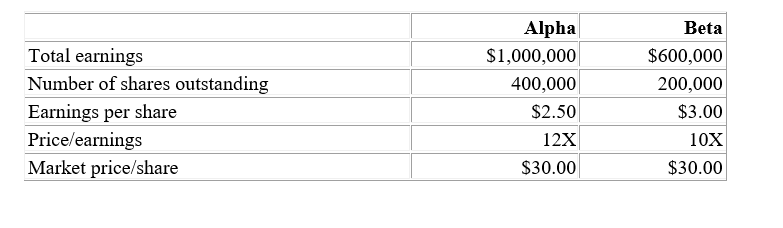

-Alpha has a growth rate in EPS of 12%. Beta's growth rate in EPS is 9%. What is the post-merger growth rate assuming the facts as previously stated? (Assume no Synergy.)

A) 10.50%

B) 10.88%

C) 11.37%

D) 11.87%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

5

A business combination of two or more companies in which the resulting firm maintains the identity of the acquiring company is defined as a:

A) consolidation.

B) holding company.

C) conglomerate.

D) statutory amalgamation.

A) consolidation.

B) holding company.

C) conglomerate.

D) statutory amalgamation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

6

-Assume Alpha pays a 20% premium for Beta in a pooling of interests' transaction. Calculate the post-merger EPS for Alpha.

A) $2.50

B) $3.00

C) $3.50

D) $4.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Investment Canada Act is intended to:

A) lower interest rates in foreign investments.

B) change regulation of Canadian companies investing abroad.

C) increasing foreign competition in Canada.

D) ensure that the takeover of a Canadian company by a foreign entity will result in a net gain for Canada.

A) lower interest rates in foreign investments.

B) change regulation of Canadian companies investing abroad.

C) increasing foreign competition in Canada.

D) ensure that the takeover of a Canadian company by a foreign entity will result in a net gain for Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following would be true concerning the EPS of Alpha Corp. in 5 years? Alpha's EPS would be:

A) higher due to the merger.

B) the same with or without the merger.

C) lower without the merger.

D) lower with the merger.

A) higher due to the merger.

B) the same with or without the merger.

C) lower without the merger.

D) lower with the merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

9

The impact on EPS is influenced by all but the:

A) relative debt/equity ratios of the firms.

B) exchange ratio.

C) relative earnings growth rates of the firms.

D) premium paid above market value for the acquired firm.

A) relative debt/equity ratios of the firms.

B) exchange ratio.

C) relative earnings growth rates of the firms.

D) premium paid above market value for the acquired firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following firms would be a takeover candidate?

A) A firm with strong market position, high earnings and low current assets.

B) A firm with strong market position, low earnings and low cash balances.

C) A firm with strong market position, low earnings and high cash balances.

D) A firm with high non-current assets, high earnings and low current assets.

A) A firm with strong market position, high earnings and low current assets.

B) A firm with strong market position, low earnings and low cash balances.

C) A firm with strong market position, low earnings and high cash balances.

D) A firm with high non-current assets, high earnings and low current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

11

Historically, the Foreign Investment Review Agency:

A) ensured no large takeovers of Canadian firms by foreigners occurred.

B) established Canada as a place for large foreign investment.

C) allowed an increasing number of unfriendly mergers and buyouts.

D) was a created through the passing of the Investment Canada Act.

A) ensured no large takeovers of Canadian firms by foreigners occurred.

B) established Canada as a place for large foreign investment.

C) allowed an increasing number of unfriendly mergers and buyouts.

D) was a created through the passing of the Investment Canada Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements is true of mergers and amalgamations in Canada?

A) The terms "merger" and "amalgamation" have no legal definition.

B) The term "merger" is legally defined and the term "amalgamation" is not.

C) The term "amalgamation" is legally defined and the term "merger" is not.

D) Amalgamation means one company purchases the shares of another and merger means a statutory combination under one of the Provincial Corporations Act, the Canada Corporations Act, or the Canada Business Corporations Act.

A) The terms "merger" and "amalgamation" have no legal definition.

B) The term "merger" is legally defined and the term "amalgamation" is not.

C) The term "amalgamation" is legally defined and the term "merger" is not.

D) Amalgamation means one company purchases the shares of another and merger means a statutory combination under one of the Provincial Corporations Act, the Canada Corporations Act, or the Canada Business Corporations Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

13

In the event that Active Corp., which has a low P/E ratio, acquires Basic Corp., which has a higher P/E ratio, we could be assured one of the following would occur.

A) Active Corp. will have an immediate increase in EPS.

B) Active Corp. will have an immediate decrease in EPS.

C) Active Corp. will have an immediate increase in the growth rate of EPS.

D) Active Corp. will have an immediate decrease in P/E.

A) Active Corp. will have an immediate increase in EPS.

B) Active Corp. will have an immediate decrease in EPS.

C) Active Corp. will have an immediate increase in the growth rate of EPS.

D) Active Corp. will have an immediate decrease in P/E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

14

Company A buys Company B for $3,500,000. Company A had a pre-merger net worth of $8,000,000; Company B's net worth was $2,000,000. The transaction was accounted for as a pooling of interests. Company A wants to write off any available goodwill as slowly as allowable.

-Over how many years can goodwill be written off for accounting purposes?

A) 0 years

B) 20 years

C) 40 years

D) 50 years

-Over how many years can goodwill be written off for accounting purposes?

A) 0 years

B) 20 years

C) 40 years

D) 50 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

15

Synergy is said to occur when the whole is:

A) equal to the sum of the parts.

B) less than the sum of the parts.

C) greater than the sum of the parts.

D) greater than or equal to the sum of the parts.

A) equal to the sum of the parts.

B) less than the sum of the parts.

C) greater than the sum of the parts.

D) greater than or equal to the sum of the parts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

16

Hostile takeovers are less common in Canada because:

A) Canadian use of IFRS makes companies appear less profitable.

B) share ownership is not widely held.

C) companies have greater regulatory requirements.

D) the government does not allow hostile takeovers.

A) Canadian use of IFRS makes companies appear less profitable.

B) share ownership is not widely held.

C) companies have greater regulatory requirements.

D) the government does not allow hostile takeovers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is a tender offer that utilizes borrowed funds and the acquired firm's assets as collateral?

A) Unfriendly take-over

B) Divestiture

C) Repurchase

D) Leveraged buyout

A) Unfriendly take-over

B) Divestiture

C) Repurchase

D) Leveraged buyout

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

18

White knights:

A) advise companies on ways to avoid being taken over.

B) offer a higher purchase price and a friendlier offer in the event of an unsolicited and unfriendly takeover attempt.

C) attempt to make money in the stock market on shares that are likely merger candidates.

D) buy depressed stock of quality companies when merger talks are discontinued.

A) advise companies on ways to avoid being taken over.

B) offer a higher purchase price and a friendlier offer in the event of an unsolicited and unfriendly takeover attempt.

C) attempt to make money in the stock market on shares that are likely merger candidates.

D) buy depressed stock of quality companies when merger talks are discontinued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is not a potential benefit of a merger?

A) Improved financing posture.

B) Portfolio effect.

C) Dilution of earnings per share.

D) Tax loss carry-forward.

A) Improved financing posture.

B) Portfolio effect.

C) Dilution of earnings per share.

D) Tax loss carry-forward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

20

Company A buys Company B for $3,500,000. Company A had a pre-merger net worth of $8,000,000; Company B's net worth was $2,000,000. The transaction was accounted for as a pooling of interests. Company A wants to write off any available goodwill as slowly as allowable.

-How much would Company A write off each year?

A) $112,500

B) $37,500

C) $150,000

D) $0

-How much would Company A write off each year?

A) $112,500

B) $37,500

C) $150,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

21

A white knight benefits the:

A) acquiring firm.

B) acquiring firm's shareholders.

C) officers of the acquired company.

D) potential acquired firm.

A) acquiring firm.

B) acquiring firm's shareholders.

C) officers of the acquired company.

D) potential acquired firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a tobacco firm merges with a steel company, it would be called:

A) a horizontal merger.

B) a vertical merger.

C) a conglomerate merger.

D) a consolidation.

A) a horizontal merger.

B) a vertical merger.

C) a conglomerate merger.

D) a consolidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

23

Aardvark Software, Inc. can purchase all the stock of Zebra Computer Services for $1,000,000 in cash. Zebra is expected to generate net after-tax cash flows of $100,000 per year for each of the next 10 years. Aardvark should:

A) not purchase Zebra Computer Services.

B) purchase Zebra Computer Services.

C) purchase Zebra only if Aardvark's cost of capital is between 5% and 10%.

D) purchase Zebra only if Aardvark's cost of capital is above 10%.

A) not purchase Zebra Computer Services.

B) purchase Zebra Computer Services.

C) purchase Zebra only if Aardvark's cost of capital is between 5% and 10%.

D) purchase Zebra only if Aardvark's cost of capital is above 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

24

Non-financial motives for mergers include:

A) marketing expansion.

B) portfolio effect.

C) access to capital.

D) tax loss carry-forward.

A) marketing expansion.

B) portfolio effect.

C) access to capital.

D) tax loss carry-forward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

25

The elimination of overlapping functions and the meshing of two firms' strong areas or products creates the managerial incentive for mergers known as:

A) horizontal integration.

B) vertical integration.

C) synergy.

D) the portfolio effect.

A) horizontal integration.

B) vertical integration.

C) synergy.

D) the portfolio effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following type of merger is most likely to lead to diversification benefits?

A) Horizontal merger

B) Vertical merger

C) Tax free exchange

D) Conglomerate

A) Horizontal merger

B) Vertical merger

C) Tax free exchange

D) Conglomerate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

27

All of the following are potential benefits to a corporation in offering share purchases rather than non-equity compensation except:

A) a share purchase more readily qualifies a merger for a tax-free exchange.

B) a corporation may diminish the perceived dilutive effect of a merger.

C) the shareholders of the acquired firm may defer any capital gains taxes.

D) when the stock is sold, the tax is recognized.

A) a share purchase more readily qualifies a merger for a tax-free exchange.

B) a corporation may diminish the perceived dilutive effect of a merger.

C) the shareholders of the acquired firm may defer any capital gains taxes.

D) when the stock is sold, the tax is recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not a potential benefit of a merger?

A) Greater access to financial markets, and thus, be in a better position to raise debt and equity capital.

B) Achieving risk reduction while perhaps maintaining the firm's rate of return.

C) Tax loss carry-forward might be available in a merger if one of the firms has previously sustained a tax loss.

D) Increased standard deviation of earnings per share.

A) Greater access to financial markets, and thus, be in a better position to raise debt and equity capital.

B) Achieving risk reduction while perhaps maintaining the firm's rate of return.

C) Tax loss carry-forward might be available in a merger if one of the firms has previously sustained a tax loss.

D) Increased standard deviation of earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Celluloid Collar Corporation has $360,000 in tax loss carry-forwards. The Bowstring Shirt Company, a firm in the 30% tax bracket, would be willing to pay (on a non-discounted basis) the sum of ______________ for the carry-forward alone.

A) $108,000

B) $252,000

C) $350,000

D) $200,000

A) $108,000

B) $252,000

C) $350,000

D) $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Prad Corporation is considering a merger with the Stone Company which has 400,000 outstanding shares selling for $25. An investment dealer has advised that to succeed in its merger Prad Corp. would have to offer $45 per share for Stones' stock. Prad Corp. stock is selling for $30. How many shares of Prad Corp. stock would have to be exchanged to acquire all of Stones' stock?

A) 266,667 shares

B) 600,000 shares

C) 720,000 shares

D) 800,000 shares

A) 266,667 shares

B) 600,000 shares

C) 720,000 shares

D) 800,000 shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not a motive for selling by the shareholders of the acquired company?

A) Opportunity to diversify

B) Tax advantage

C) Attractive price

D) Avoid bias against smaller businesses

A) Opportunity to diversify

B) Tax advantage

C) Attractive price

D) Avoid bias against smaller businesses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

32

The portfolio effect in a merger has to do with:

A) increasing EPS.

B) reducing risk.

C) creating tax advantages.

D) writing off goodwill.

A) increasing EPS.

B) reducing risk.

C) creating tax advantages.

D) writing off goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

33

Synergy is:

A) the 2 + 2 = 3 effect.

B) the 2 + 2 = 4 effect.

C) the 2 + 2 = 5 effect.

D) always present in a merger.

A) the 2 + 2 = 3 effect.

B) the 2 + 2 = 4 effect.

C) the 2 + 2 = 5 effect.

D) always present in a merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

34

Selling shareholders who are offered cash in a merger may be willing to part with the shares they hold because:

A) the offered shares may be less marketable.

B) a merger can create improved financing posture as a result of expansion in size.

C) they can attain a lower degree of market concentration as a result.

D) the price they are offered for their shares may be above book value or market value.

A) the offered shares may be less marketable.

B) a merger can create improved financing posture as a result of expansion in size.

C) they can attain a lower degree of market concentration as a result.

D) the price they are offered for their shares may be above book value or market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following type of merger creates goodwill?

A) Horizontal merger

B) Vertical merger

C) Pooling of interests

D) Purchase of assets

A) Horizontal merger

B) Vertical merger

C) Pooling of interests

D) Purchase of assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

36

The financial motives for merger activity include all of the following except:

A) the portfolio effect.

B) improved financial posture and greater debt.

C) the utilization of tax loss carry-forwards.

D) vertical integration.

A) the portfolio effect.

B) improved financial posture and greater debt.

C) the utilization of tax loss carry-forwards.

D) vertical integration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

37

In planning mergers, there is a tendency to _____ synergistic benefits.

A) overestimate

B) underestimate

C) correctly estimate

D) need more information

A) overestimate

B) underestimate

C) correctly estimate

D) need more information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

38

The portfolio effect after a merger should provide the firm with risk reduction benefits that result in:

A) the expected value of earnings per share may increase as a result of the merger, the standard deviation of possible outcomes may increase as a result of risk reduction through diversification.

B) the expected value of earnings per share may remain relatively constant as a result of the merger, the standard deviation of possible outcomes may increase as a result of risk reduction through diversification.

C) the expected value of earnings per share may decline as a result of the merger, the standard deviation of possible outcomes may decline as a result of risk reduction through diversification.

D) the expected value of earnings per share may remain relatively constant as a result of the merger, the standard deviation of possible outcomes may decline as a result of risk reduction through diversification.

A) the expected value of earnings per share may increase as a result of the merger, the standard deviation of possible outcomes may increase as a result of risk reduction through diversification.

B) the expected value of earnings per share may remain relatively constant as a result of the merger, the standard deviation of possible outcomes may increase as a result of risk reduction through diversification.

C) the expected value of earnings per share may decline as a result of the merger, the standard deviation of possible outcomes may decline as a result of risk reduction through diversification.

D) the expected value of earnings per share may remain relatively constant as a result of the merger, the standard deviation of possible outcomes may decline as a result of risk reduction through diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a financial motive but rather an operating motive for merger and consolidation?

A) The portfolio diversification effect.

B) Tax-loss carry-forward.

C) Greater financing capability.

D) Desire for greater size.

A) The portfolio diversification effect.

B) Tax-loss carry-forward.

C) Greater financing capability.

D) Desire for greater size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

40

An example of a horizontal merger would be:

A) Husky Oil and Hudson Bay.

B) McDonalds and Pillsbury.

C) Pepsi and Frito Lay.

D) Coca Cola and Canada Dry.

A) Husky Oil and Hudson Bay.

B) McDonalds and Pillsbury.

C) Pepsi and Frito Lay.

D) Coca Cola and Canada Dry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

41

Leveraged buyout occur to firms that have an unusually large cash/total assets position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

42

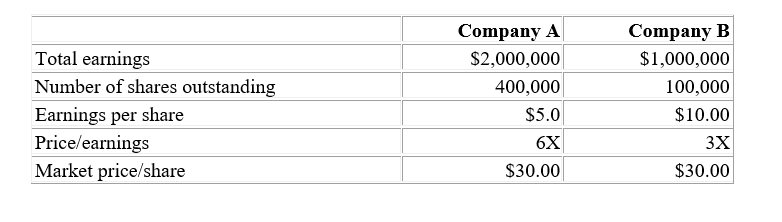

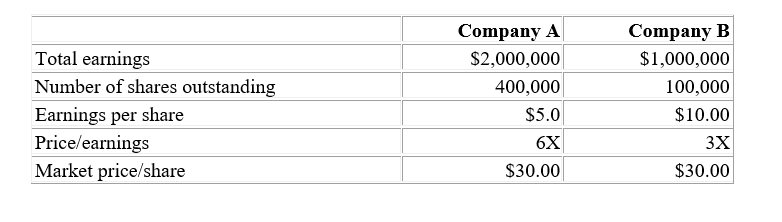

-Company A has a growth rate in EPS of 14%. Company B's growth rate in EPS is 10%. What is the post-merger growth rate assuming the facts as previously stated? (Assume no Synergy.)

A) 13.20%

B) 10.88%

C) 12.00%

D) 12.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

43

The advantage of a holding company:

A) is that it seems to afford opportunities for leverage.

B) is that it always prevents foreign acquisition.

C) is the avoidance of competition laws.

D) is that it magnifies poor returns.

A) is that it seems to afford opportunities for leverage.

B) is that it always prevents foreign acquisition.

C) is the avoidance of competition laws.

D) is that it magnifies poor returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

44

The term "Reverse Leveraged Buyout" refers to a company that had previously gone from a public company to a private company and sells stock to the public years later.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

45

When analyzing a going concern acquisition the financial manager should consider:

A) the net present value of the firm post-acquisition.

B) the net book value of the firm post-acquisition.

C) the net present value of the firm pre-acquisition.

D) the net book value of the firm pre-acquisition.

A) the net present value of the firm post-acquisition.

B) the net book value of the firm post-acquisition.

C) the net present value of the firm pre-acquisition.

D) the net book value of the firm pre-acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

46

The potential of a tax loss carry-forward has no effect when considering the acquisition of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

47

If the acquiring firm's P/E ratio is greater than the P/E of the acquired firm, the surviving firm will automatically get an increase in EPS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

48

A purchase of assets merger recording is desirable due to the possibility of the creation of goodwill on the books of the surviving firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is a form of compensation that selling shareholders could receive?

A) Non-taxable interest income

B) Retirement savings top up

C) Fixed income securities

D) Management stock options

A) Non-taxable interest income

B) Retirement savings top up

C) Fixed income securities

D) Management stock options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

50

Synergy is said to take place when the whole is less than the sum of the parts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

51

Laura's Design Corporation has $400,000 in tax loss carry-forwards. Vandenbosch Investment Consulting, a firm in the 40% tax bracket, would be willing to pay (on a non-discounted basis) the sum of ______________ for the carry-forward alone.

A) $240,000

B) $160,000

C) $400,000

D) $100,000

A) $240,000

B) $160,000

C) $400,000

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

52

Shareholders of acquired firms in mergers tend to be more concerned with future earnings and dividends exchanged than with the market value exchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

53

-Which of the following would be true concerning the EPS of Company A in 5 years? Company A's EPS would be:

A) higher due to the merger.

B) the same with or without the merger.

C) lower without the merger.

D) lower with the merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

54

Hostile takeovers may be avoided in Canada due to:

A) Canadians are more risk oriented.

B) A white knight investor.

C) companies have cyclical cash flows.

D) closely held companies.

A) Canadians are more risk oriented.

B) A white knight investor.

C) companies have cyclical cash flows.

D) closely held companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Sheridan Corporation is considering a merger with the Kent Company which has 600,000 outstanding shares selling for $20. An investment dealer has advised that to succeed in its merger Sheridan Corp. would have to offer $40 per share for Kent's stock. Sheridan Corp. stock is selling for $25. How many shares of Sheridan Corp. stock would have to be exchanged to acquire all of Kent's stock?

A) 960,000 shares

B) 600,000 shares

C) 750,000 shares

D) 480,000 shares

A) 960,000 shares

B) 600,000 shares

C) 750,000 shares

D) 480,000 shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

56

-Assume Company A pays a 20% premium for Company B in a pooling of interests' transaction. Calculate the post-merger EPS for CompanyA.

A) $10.00

B) $5.00

C) $7.50

D) $6.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

57

Mergers after the financial crisis of 2008 were driven by which of the following factors?

A) High interest rates

B) Large cash positions

C) Less global competition

D) High price earnings ratios

A) High interest rates

B) Large cash positions

C) Less global competition

D) High price earnings ratios

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

58

A tender offer describes the attempted purchase of a firm with the consent of that firm's management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

59

One of the primary motives of merger activity is that acquiring companies find it less expensive to buy assets than to build.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

60

One potential advantage of a merger to the acquiring firm is the portfolio effect which attempts to achieve risk reduction while perhaps maintaining the rate of return for the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

61

Most mergers are horizontal in nature in order to avoid the potential complications involved with the elimination of competition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

62

Leveraged buyouts are restricted to "outside" tender offers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

63

When negotiating a merger offer, management and shareholders may disagree on whether a bid should be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

64

Goodwill may be created when a pooling of interests' merger is utilized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

65

Too much diversification has led some companies to sell off companies previously acquired during the merger boom.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

66

In a merger, the short-term and long-term effect on EPS varies according to the relative P/E ratios and the differential future growth rates of the two firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

67

In a merger, two or more companies are combined to form an entirely new entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

68

Existing management of a firm is almost always ready to accept an offer for the purchase of the firm at a price above the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

69

The write off of goodwill is a tax deductible expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

70

The primary advantage of a holding company is that it affords opportunities for leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

71

The subsidiaries of a holding company are separate legal entities, and one cannot force the bankruptcy of another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

72

One advantage of receiving stock instead of cash in a buy-out is the deferment of the tax payment until the stock received is actually sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

73

Statutory amalgamation under the Canada Business Corporations Act requires all merger combinations of two or more firms to form an entirely new entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

74

United States style mergers rarely happen in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

75

"Poison pills" are strategies that reduce the value of a firm if it is taken over by a corporate raider.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

76

Poison pills are usually put in place when one shareholder acquires a certain number of outstanding shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

77

An unfriendly takeover can always be stopped by invoking a poison pill under the Companies Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

78

The earnings per share impact of a merger are influenced by relative price-earnings ratios and the terms of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

79

Shareholders do not like a white knight since it always results in their receiving a lower share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

80

The desire to expand management and marketing capabilities is a financial motive for merging.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck