Deck 9: Reporting and Interpreting Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 9: Reporting and Interpreting Liabilities

1

A contingent liability is reported on the balance sheet if it is probable and can be estimated.

True

2

The accrual of interest on a short-term note payable decreases working capital and current assets.

False

3

An accounts payable turnover ratio of 12 indicates that a company takes approximately 30 days,on average,to pay its suppliers.

True

4

The accounts payable turnover ratio is calculated by dividing accounts payable by cash payments to suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

The FICA (social security)tax is a matching tax with a portion paid by both the employer and the employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

Cash received from customers may result in a current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

Accounts payable and accrued liabilities are interchangeable account titles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

The accrual of interest results in an increase liabilities and a decrease in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

The choice of inventory method has an impact on the accounts payable turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

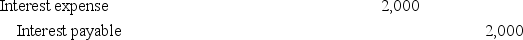

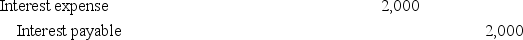

A company borrowed $100,000 at 6% interest on September 1,2019.Assuming adjusting entries have not been made during the year,the entry to record interest accrued on December 31,2019 would include a debit to interest expense and a credit to interest payable for $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

A current liability is always a short-term obligation expected to be paid within one year of the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

An employee has an obligation to pay his payroll taxes to the employer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

Wages expense is an example of an accrued liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

Deferred revenues can be classified as either current or long term liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

A current liability is created when a customer pays cash for services to be provided in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

When a liability is initially recorded,it is recorded at the future amount of all payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

Income taxes payable is an example of an accrued liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

A contingent liability is disclosed in a note to the financial statements when the liability is reasonably possible and can be estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

Purchasing inventory on account increases the accounts payable turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

The journal entry to record a contingent liability creates an accrued liability on the balance sheet and a loss on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is incorrect?

A)Current liabilities are those that will be satisfied within one year or the operating cycle,whichever is longer.

B)Interest that will be paid in the future is included in the reported amount of a current liability.

C)Current liabilities impact a company's liquidity.

D)Working capital is equal to current assets minus current liabilities.

A)Current liabilities are those that will be satisfied within one year or the operating cycle,whichever is longer.

B)Interest that will be paid in the future is included in the reported amount of a current liability.

C)Current liabilities impact a company's liquidity.

D)Working capital is equal to current assets minus current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a company receives cash before products or services are provided the following results:

A)Assets and stockholders' equity increase.

B)Assets and revenue increase.

C)Liabilities and revenues increase.

D)Liabilities and assets increase.

A)Assets and stockholders' equity increase.

B)Assets and revenue increase.

C)Liabilities and revenues increase.

D)Liabilities and assets increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not a current liability?

A)A liability due within one year for a business with a fifteen-month operating cycle.

B)A liability due within three months for a business with a two-month operating cycle.

C)A liability due within one year for a business with a nine-month operating cycle.

D)A liability due within fifteen months for a business with a one-year operating cycle.

A)A liability due within one year for a business with a fifteen-month operating cycle.

B)A liability due within three months for a business with a two-month operating cycle.

C)A liability due within one year for a business with a nine-month operating cycle.

D)A liability due within fifteen months for a business with a one-year operating cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

Working capital decreases when a company pays taxes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

Working capital decreases when accrued wages expense is recorded at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

An annuity is a series of consecutive and unequal payments over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following describes an accrued liability?

A)It is an expense that has been both incurred and paid.

B)It is an expense that has been incurred but not yet paid.

C)It is an expense that has been prepaid but not yet consumed.

D)It is a liability where the cash flow has taken place but the revenue has yet to be earned.

A)It is an expense that has been both incurred and paid.

B)It is an expense that has been incurred but not yet paid.

C)It is an expense that has been prepaid but not yet consumed.

D)It is a liability where the cash flow has taken place but the revenue has yet to be earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following statements is correct?

A)Current liabilities are initially recorded at the amount of their principal plus interest.

B)Current liabilities are those liabilities due within the shorter of one year or one operating cycle.

C)Liquidity refers to the ability to pay all debts within one year.

D)Current liabilities affect working capital and the cash flows from operating activities.

A)Current liabilities are initially recorded at the amount of their principal plus interest.

B)Current liabilities are those liabilities due within the shorter of one year or one operating cycle.

C)Liquidity refers to the ability to pay all debts within one year.

D)Current liabilities affect working capital and the cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

For the present value of a single amount,only one compounding period per year is permitted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

Working capital is a measure of long-term liquidity and is calculated by subtracting the current liabilities from the current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

A contingent liability cannot be disclosed in a note to the financial statements unless it can be estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following statements is correct?

A)Social Security tax is paid only by the employer.

B)The pay period always ends in conjunction with the company's fiscal year-end.

C)Employee benefits such as vacation time and sick days should be recognized when the employees earn the benefit and not when they take the days off from work.

D)Unemployment taxes are paid by both the employer and the employee.

A)Social Security tax is paid only by the employer.

B)The pay period always ends in conjunction with the company's fiscal year-end.

C)Employee benefits such as vacation time and sick days should be recognized when the employees earn the benefit and not when they take the days off from work.

D)Unemployment taxes are paid by both the employer and the employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

Working capital increases when a company purchases equipment and signs a 2-year note payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

Operating leases are reported on the balance sheet at an amount equal to the present value of the future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

An annuity is a series of consecutive payments,each one increasing by a fixed dollar amount over the payment amount of the prior year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

In order to calculate the cost of a long-term asset that is financed with long-term debt,present values concepts are used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

Working capital increases when a company accrues sales revenue at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

Working capital is a measure of short-run liquidity and is measured by dividing current assets by current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is correct?

A)Deferred revenues are considered increases to stockholders' equity.

B)Working capital is measured as current liabilities minus current assets.

C)Working capital increases when a company pays the principal on a long-term note.

D)Deferred revenues will eventually become revenue earned.

A)Deferred revenues are considered increases to stockholders' equity.

B)Working capital is measured as current liabilities minus current assets.

C)Working capital increases when a company pays the principal on a long-term note.

D)Deferred revenues will eventually become revenue earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

Long-term liabilities are reported on the balance sheet at an amount equal to the future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

Mission Corp.borrowed $50,000 cash on April 1,2019,and signed a one-year 12%,interest-bearing note payable.The interest and principal are both due on March 31,2020.

-Assume that the appropriate adjusting entry was made on December 31,2019 and that no adjusting entries have been made during 2020.What is the amount of interest expense to be recorded when the interest and principal are paid on March 31,2020?

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

-Assume that the appropriate adjusting entry was made on December 31,2019 and that no adjusting entries have been made during 2020.What is the amount of interest expense to be recorded when the interest and principal are paid on March 31,2020?

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

Phipps Company borrowed $25,000 cash on October 1,2019,and signed a nine-month,8% interest-bearing note payable with interest payable at maturity.Assuming that adjusting entries have not been made during the year,the amount of accrued interest payable to be reported on the December 31,2019 balance sheet is which of the following?

A)$250.

B)$300.

C)$500.

D)$750.

A)$250.

B)$300.

C)$500.

D)$750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

Landseeker's Restaurants reported cost of goods sold of $322 million and accounts payable of $84 million for 2020.In 2019,cost of goods sold was $258 million and accounts payable was $72 million.Landseeker's accounts payable turnover ratio in 2020 is closest to:

A)4.25

B)4.13

C)3.45

D)3.31

A)4.25

B)4.13

C)3.45

D)3.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following best describes the accrual of interest?

A)Assets and stockholders' equity decrease.

B)Assets and liabilities decrease.

C)Net income and expenses decrease.

D)Expenses and liabilities increase.

A)Assets and stockholders' equity decrease.

B)Assets and liabilities decrease.

C)Net income and expenses decrease.

D)Expenses and liabilities increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

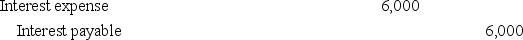

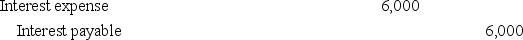

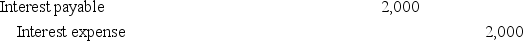

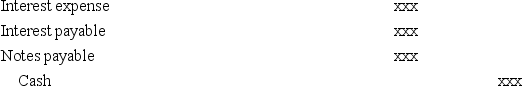

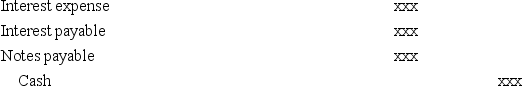

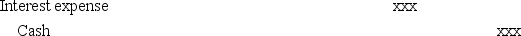

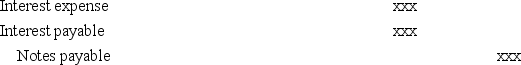

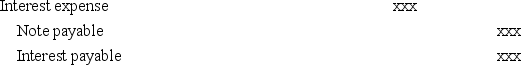

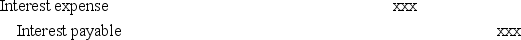

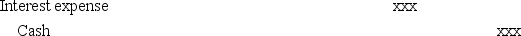

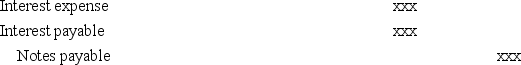

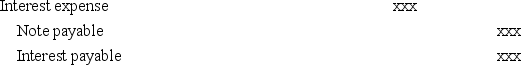

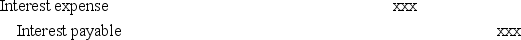

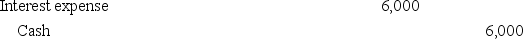

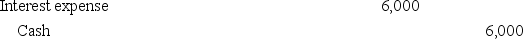

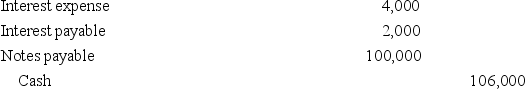

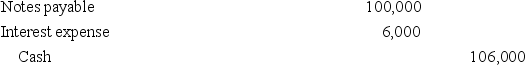

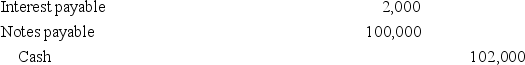

Miranda Company borrowed $100,000 cash on September 1,2019,and signed a one-year 6%,interest-bearing note payable.Assume no adjusting entries have been made during the year.Which of the following would be the required adjusting entry at the end of the December 31,2019 accounting period?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

The accrual of interest results in the following:

A)Increase in assets and liabilities.

B)Increase in assets and stockholders' equity.

C)Increase in liabilities and decrease in stockholders' equity.

D)Increase in liabilities and increase in stockholders' equity.

A)Increase in assets and liabilities.

B)Increase in assets and stockholders' equity.

C)Increase in liabilities and decrease in stockholders' equity.

D)Increase in liabilities and increase in stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following statements is incorrect?

A)The currently maturing portion of long-term debt must be classified as a current liability.

B)The non-current portion of long-term debt will be correctly reported as a long-term liability.

C)When a company plans to refinance the currently maturing debt on a long-term basis,and has the ability to do so,it may report the currently maturing debt as a long-term liability.

D)The currently maturing portion of long-term debt is a current liability if it is due within one year from the date of the balance sheet,or within the operating cycle,whichever is longer.

A)The currently maturing portion of long-term debt must be classified as a current liability.

B)The non-current portion of long-term debt will be correctly reported as a long-term liability.

C)When a company plans to refinance the currently maturing debt on a long-term basis,and has the ability to do so,it may report the currently maturing debt as a long-term liability.

D)The currently maturing portion of long-term debt is a current liability if it is due within one year from the date of the balance sheet,or within the operating cycle,whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

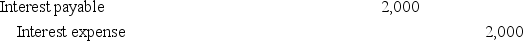

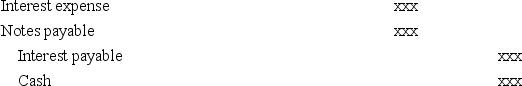

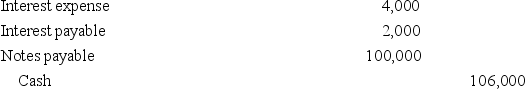

Mission Corp.borrowed $50,000 cash on April 1,2019,and signed a one-year 12%,interest-bearing note payable.The interest and principal are both due on March 31,2020.

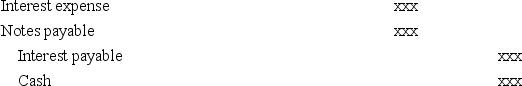

-Assume that the appropriate adjusting entry was made on December 31,2019 and that no adjusting entries have been made during 2020.Which of the following would be the required journal entry to pay the entire amount due on March 31,2020?

A)

B)

C)

D)

-Assume that the appropriate adjusting entry was made on December 31,2019 and that no adjusting entries have been made during 2020.Which of the following would be the required journal entry to pay the entire amount due on March 31,2020?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

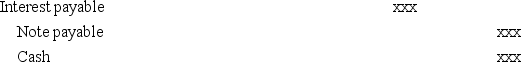

Mission Corp.borrowed $50,000 cash on April 1,2019,and signed a one-year 12%,interest-bearing note payable.The interest and principal are both due on March 31,2020.

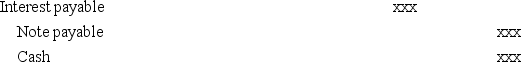

-Assume that no adjusting entries had been made before December 31,2019.Which of the following would be the required adjusting entry on December 31,2019?

A)

B)

C)

D)

-Assume that no adjusting entries had been made before December 31,2019.Which of the following would be the required adjusting entry on December 31,2019?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

Phipps Company borrowed $25,000 cash on October 1,2019,and signed a nine-month,8% interest-bearing note payable with interest payable at maturity.The amount of interest expense to be reported during 2020 is which of the following?

A)$1,000.

B)$300.

C)$500.

D)$750.

A)$1,000.

B)$300.

C)$500.

D)$750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

Failure to make a necessary adjusting entry for accrued interest on a note payable would result in which of the following?

A)Liabilities and stockholders' equity would both be understated.

B)Net income would be overstated and assets would be understated.

C)Net income would be understated and liabilities would be understated.

D)Net income and stockholders' equity would be overstated and liabilities would be understated.

A)Liabilities and stockholders' equity would both be understated.

B)Net income would be overstated and assets would be understated.

C)Net income would be understated and liabilities would be understated.

D)Net income and stockholders' equity would be overstated and liabilities would be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements incorrectly describes the accounts payable turnover ratio?

A)A high ratio indicates that suppliers are being paid in a timely manner.

B)The ratio increases when inventory is sold on account regardless of the sales price.

C)The ratio can be manipulated by aggressively paying off accounts payable at year-end.

D)The ratio is not affected by the choice of inventory accounting methods.

A)A high ratio indicates that suppliers are being paid in a timely manner.

B)The ratio increases when inventory is sold on account regardless of the sales price.

C)The ratio can be manipulated by aggressively paying off accounts payable at year-end.

D)The ratio is not affected by the choice of inventory accounting methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

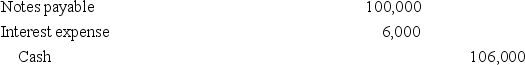

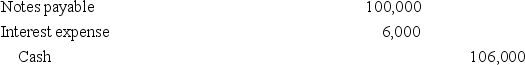

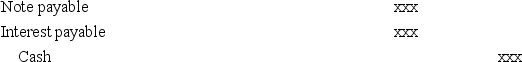

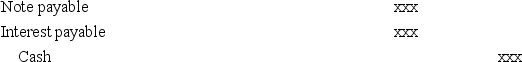

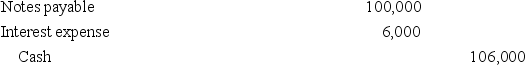

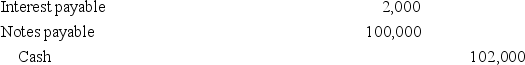

Melanie Corp.borrowed $100,000 cash on September 1,2019,and signed a one-year 6%,interest-bearing note payable.The interest and principal are both due on August 31,2020.Assume that the appropriate adjusting entry was made on December 31,2019 and that no adjusting entries have been made during 2020.Which of the following would be the required journal entry to pay the note on August 31,2020?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

Thomas Company borrowed $30,000 on March 1,2019.Thomas signed a 2-year 6% interest-bearing note.What is the adjustment amount to accrue interest on December 31,2020?

A)$1,800.

B)$3,600.

C)$300.

D)$1,200.

A)$1,800.

B)$3,600.

C)$300.

D)$1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following would not be a result of the adjusting entry to record accrued interest on a note payable?

A)A decrease in net income.

B)A decrease in stockholders' equity.

C)An increase in liabilities.

D)A decrease in current assets.

A)A decrease in net income.

B)A decrease in stockholders' equity.

C)An increase in liabilities.

D)A decrease in current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

Mission Corp.borrowed $50,000 cash on April 1,2019,and signed a one-year 12%,interest-bearing note payable.The interest and principal are both due on March 31,2020.

-The amount of interest expense for the year ended December 31,2019 is:

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

-The amount of interest expense for the year ended December 31,2019 is:

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

Purdum Farms borrowed $10 million by signing a five-year note on December 31,2017.Repayments of the principal are payable annually in installments of $2 million each.Purdum Farms makes the first payment on December 31,2018 and then prepares its balance sheet.What amount will be reported as current and long-term liabilities,respectively,in connection with the note at December 31,2018,after the first payment is made?

A)$2 million in current liabilities and $8 million in long-term liabilities.

B)$2 million in current liabilities and $6 million in long-term liabilities.

C)Zero in current liabilities and $8 million in long-term liabilities.

D)Zero in current liabilities and $10 million in long-term liabilities.

A)$2 million in current liabilities and $8 million in long-term liabilities.

B)$2 million in current liabilities and $6 million in long-term liabilities.

C)Zero in current liabilities and $8 million in long-term liabilities.

D)Zero in current liabilities and $10 million in long-term liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following transactions will decrease the accounts payable turnover ratio?

A)Using cash to pay an accounts payable balance.

B)Selling inventory on account.

C)Selling inventory for cash.

D)A customer returning inventory sold on account.

A)Using cash to pay an accounts payable balance.

B)Selling inventory on account.

C)Selling inventory for cash.

D)A customer returning inventory sold on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

Mission Corp.borrowed $50,000 cash on April 1,2019,and signed a one-year 12%,interest-bearing note payable.The interest and principal are both due on March 31,2020.

-What is the amount to be paid to the bank on March 31,2020 for interest and principal?

A)$50,000.

B)$51,500.

C)$54,000.

D)$56,000.

-What is the amount to be paid to the bank on March 31,2020 for interest and principal?

A)$50,000.

B)$51,500.

C)$54,000.

D)$56,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

On October 1,2019,Donna Equipment signed a one-year,8% interest-bearing note payable for $50,000.Assuming that Donna Equipment maintains its books on a calendar year basis,how much interest expense should be reported in the 2020 income statement?

A)$1,000.

B)$2,000.

C)$3,000.

D)$4,000.

A)$1,000.

B)$2,000.

C)$3,000.

D)$4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

Rice Corporation's attorney has provided the following summaries of three lawsuits against Rice: • Lawsuit A: The loss is probable,but the loss cannot be reasonably estimated.

• Lawsuit B: The loss is reasonably possible,but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

-

Which of the following statements is correct?

A)A disclosure note is required for each of the three lawsuits.

B)A disclosure note is required only for lawsuits A & C.

C)A disclosure note is required only for lawsuit A.

D)A disclosure note is required only for lawsuits B & C.

• Lawsuit B: The loss is reasonably possible,but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

-

Which of the following statements is correct?

A)A disclosure note is required for each of the three lawsuits.

B)A disclosure note is required only for lawsuits A & C.

C)A disclosure note is required only for lawsuit A.

D)A disclosure note is required only for lawsuits B & C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

Houston Company is involved in a lawsuit.In which of the following situations is only a note disclosure of the contingent liability reported within the financial statements?

A)When the loss is remote and the amount cannot be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss is reasonably possible and the amount can be reasonably estimated.

D)When the loss is remote and the amount can be reasonably estimated.

A)When the loss is remote and the amount cannot be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss is reasonably possible and the amount can be reasonably estimated.

D)When the loss is remote and the amount can be reasonably estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

SRJ Corporation entered into the following transactions: • The accrual of interest expense on a six-month note payable.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

-

Which of the following statements is correct with respect to determining the net cash flow from operating activities on a statement of cash flows?

A)The increase in interest payable for the accrual of interest expense is added to net income.

B)Collecting cash for services to be provided in the future is subtracted from net income.

C)The reclassification of short-term debt to long-term debt is subtracted from net income.

D)Collecting cash for services to be provided in the future does not require an adjustment to net income.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

-

Which of the following statements is correct with respect to determining the net cash flow from operating activities on a statement of cash flows?

A)The increase in interest payable for the accrual of interest expense is added to net income.

B)Collecting cash for services to be provided in the future is subtracted from net income.

C)The reclassification of short-term debt to long-term debt is subtracted from net income.

D)Collecting cash for services to be provided in the future does not require an adjustment to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

How should a contingent liability that is reasonably possible but cannot reasonably be estimated be reported within the financial statements?

A)It must be recorded and reported as a liability.

B)It does not need to be recorded as a liability nor disclosed in a note.

C)It must only be disclosed as a note to the financial statements.

D)It must be reported as a liability,but not disclosed in a note.

A)It must be recorded and reported as a liability.

B)It does not need to be recorded as a liability nor disclosed in a note.

C)It must only be disclosed as a note to the financial statements.

D)It must be reported as a liability,but not disclosed in a note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

Darwin Corporation's attorney has provided the following summaries of three lawsuits against Darwin: • Lawsuit A: The loss is probable and the loss can be reasonably estimated.

• Lawsuit B: The loss is reasonably possible and the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and the loss can be reasonably estimated.

-

Which of the following statements is incorrect?

A)There is a 70% chance that lawsuit A will result in a future economic sacrifice for Darwin.

B)A disclosure note is required for lawsuit C.

C)A disclosure note is not required for lawsuit B.

D)Lawsuit A is reported on the balance sheet as a liability.

• Lawsuit B: The loss is reasonably possible and the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and the loss can be reasonably estimated.

-

Which of the following statements is incorrect?

A)There is a 70% chance that lawsuit A will result in a future economic sacrifice for Darwin.

B)A disclosure note is required for lawsuit C.

C)A disclosure note is not required for lawsuit B.

D)Lawsuit A is reported on the balance sheet as a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

Smith Corporation entered into the following transactions: • Purchased inventory on account.

• Collected an account receivable.

• Purchased equipment using cash.

-

Which of the following statements about Smith's transactions is correct?

A)The inventory purchase on account increased working capital.

B)Collecting an account receivable increases working capital.

C)The equipment purchase decreases working capital.

D)The inventory purchase on account decreases working capital.

• Collected an account receivable.

• Purchased equipment using cash.

-

Which of the following statements about Smith's transactions is correct?

A)The inventory purchase on account increased working capital.

B)Collecting an account receivable increases working capital.

C)The equipment purchase decreases working capital.

D)The inventory purchase on account decreases working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following statements about contingent liabilities is incorrect?

A)A disclosure note is required when the loss is reasonably possible and the amount cannot be reasonably estimated.

B)A disclosure note is required when the loss is probable and the amount cannot be reasonably estimated.

C)A disclosure note is required when the loss is reasonably possible and the amount can be reasonably estimated.

D)A disclosure note is required when the loss is remote and the amount can be reasonably estimated.

A)A disclosure note is required when the loss is reasonably possible and the amount cannot be reasonably estimated.

B)A disclosure note is required when the loss is probable and the amount cannot be reasonably estimated.

C)A disclosure note is required when the loss is reasonably possible and the amount can be reasonably estimated.

D)A disclosure note is required when the loss is remote and the amount can be reasonably estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

Young Company is involved in a lawsuit.When would the lawsuit be recorded as a liability on the balance sheet?

A)When the loss probability is remote and the amount can be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss probability is reasonably possible and the amount can be reasonably estimated.

D)When the loss is probable regardless of whether the loss can be reasonably estimated.

A)When the loss probability is remote and the amount can be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss probability is reasonably possible and the amount can be reasonably estimated.

D)When the loss is probable regardless of whether the loss can be reasonably estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

With regard to reporting of contingent liabilities,U.S.GAAP and International Financial Reporting Standards (IFRS)differ in defining the term "probable".Which of the following is correct with regard to defining "probable"?

A)Under U.S.GAAP,"probable" means an event is more likely than not to occur.

B)Under IFRS,"probable" means the chance of an event occurring is slight.

C)Under IFRS,"probable" means an event is more likely than not to occur.

D)Under U.S.GAAP,"probable" means the chance of an event occurring is slight but less than likely.

A)Under U.S.GAAP,"probable" means an event is more likely than not to occur.

B)Under IFRS,"probable" means the chance of an event occurring is slight.

C)Under IFRS,"probable" means an event is more likely than not to occur.

D)Under U.S.GAAP,"probable" means the chance of an event occurring is slight but less than likely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

SRJ Corporation entered into the following transactions: • The accrual of interest expense on a six-month note payable.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

-

Which of the transactions for SRJ Corporation resulted in an increase in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)The reclassification of short-term debt to long-term debt.

D)Both the reclassification of short-term debt to long-term debt and the collection of cash for future services.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

-

Which of the transactions for SRJ Corporation resulted in an increase in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)The reclassification of short-term debt to long-term debt.

D)Both the reclassification of short-term debt to long-term debt and the collection of cash for future services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

Rice Corporation's attorney has provided the following summaries of three lawsuits against Rice: • Lawsuit A: The loss is probable,but the loss cannot be reasonably estimated.

• Lawsuit B: The loss is reasonably possible,but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

-

Which of the following statements is incorrect?

A)A disclosure note is required for lawsuit A.

B)A disclosure note is required for lawsuit B.

C)A disclosure note is required for lawsuit C.

D)Lawsuit A is reported on the balance sheet as a liability.

• Lawsuit B: The loss is reasonably possible,but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

-

Which of the following statements is incorrect?

A)A disclosure note is required for lawsuit A.

B)A disclosure note is required for lawsuit B.

C)A disclosure note is required for lawsuit C.

D)Lawsuit A is reported on the balance sheet as a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

Rocket Corporation entered into the following transactions: • The accrual of wages and salaries expense.

• The cash payment of a six-month note payable.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Rocket's working capital? Assume that Rocket's operating cycle is four months.

A)The accrual of wages and salaries expense decreases working capital.

B)The cash payment on the note payable decreases working capital.

C)The purchase of the insurance policy increases working capital.

D)The cash payments for the note and insurance both decrease working capital.

• The cash payment of a six-month note payable.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Rocket's working capital? Assume that Rocket's operating cycle is four months.

A)The accrual of wages and salaries expense decreases working capital.

B)The cash payment on the note payable decreases working capital.

C)The purchase of the insurance policy increases working capital.

D)The cash payments for the note and insurance both decrease working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

Libby Company purchased equipment by paying $5,000 cash on the purchase date and agreeing to pay $5,000 every six months during the next four years.The first payment is due six months after the purchase date.Libby's incremental borrowing rate is 8%.(FV of $1,PV of $1,FVA of $1,and PVA of $1)(Use the appropriate factor(s)from the tables provided. )

- The equipment reported on the balance sheet as of the purchase date is closest to:

A)$45,000.

B)$38,664.

C)$33,664.

D)$40,000.

- The equipment reported on the balance sheet as of the purchase date is closest to:

A)$45,000.

B)$38,664.

C)$33,664.

D)$40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

SRJ Corporation entered into the following transactions: • The accrual of interest expense on a six-month note payable.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

-

Which of the transactions for SRJ Corporation resulted in a decrease in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)Collecting cash on accounts receivable.

D)Both the accrual of interest expense and collecting cash for services to be provided in the future.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

-

Which of the transactions for SRJ Corporation resulted in a decrease in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)Collecting cash on accounts receivable.

D)Both the accrual of interest expense and collecting cash for services to be provided in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

Short Company purchased land by paying $10,000 cash on the purchase date and agreeing to pay $10,000 for each of the next ten years beginning one-year from the purchase date.Short's incremental borrowing rate is 10%.(FV of $1,PV of $1,FVA of $1,and PVA of $1)(Use the appropriate factor(s)from the tables provided. )

- On the balance sheet as of the purchase date,after the initial $10,000 payment was made,the liability reported is closest to:

A)$100,000.

B)$38,550.

C)$61,446.

D)$71,446.

- On the balance sheet as of the purchase date,after the initial $10,000 payment was made,the liability reported is closest to:

A)$100,000.

B)$38,550.

C)$61,446.

D)$71,446.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

Short Company purchased land by paying $10,000 cash on the purchase date and agreeing to pay $10,000 for each of the next ten years beginning one-year from the purchase date.Short's incremental borrowing rate is 10%.(FV of $1,PV of $1,FVA of $1,and PVA of $1)(Use the appropriate factor(s)from the tables provided. )

- The land reported on the balance sheet is closest to:

A)$100,000.

B)$38,550.

C)$110,000.

D)$71,446.

- The land reported on the balance sheet is closest to:

A)$100,000.

B)$38,550.

C)$110,000.

D)$71,446.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

Smith Corporation entered into the following transactions: • Purchased inventory on account.

• Collected an account receivable.

• Purchased equipment using cash.

-

Which of the transactions for Smith Corporation resulted in an increase in working capital?

A)The inventory purchase on account.

B)Collecting an account receivable.

C)The purchase of equipment using cash.

D)None of the transactions resulted in an increase in working capital.

• Collected an account receivable.

• Purchased equipment using cash.

-

Which of the transactions for Smith Corporation resulted in an increase in working capital?

A)The inventory purchase on account.

B)Collecting an account receivable.

C)The purchase of equipment using cash.

D)None of the transactions resulted in an increase in working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following results in a decrease in working capital?

A)Supplies purchased with cash.

B)Purchase of a truck in exchange for factory machinery.

C)Acquisition of land in exchange for stock.

D)Purchase of equipment with cash.

A)Supplies purchased with cash.

B)Purchase of a truck in exchange for factory machinery.

C)Acquisition of land in exchange for stock.

D)Purchase of equipment with cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

Libby Company purchased equipment by paying $5,000 cash on the purchase date and agreeing to pay $5,000 every six months during the next four years.The first payment is due six months after the purchase date.Libby's incremental borrowing rate is 8%.(FV of $1,PV of $1,FVA of $1,and PVA of $1)(Use the appropriate factor(s)from the tables provided. )

- The liability reported on the balance sheet as of the purchase date,after the initial $5,000 payment was made,is closest to:

A)$45,000.

B)$33,664.

C)$38,664.

D)$40,000.

- The liability reported on the balance sheet as of the purchase date,after the initial $5,000 payment was made,is closest to:

A)$45,000.

B)$33,664.

C)$38,664.

D)$40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

80

Black Corporation entered into the following transactions: • The accrual of wages and salaries expense.

• The cash sale of equipment for a loss.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Black's cash flows from operating activities on the statement of cash flows?

A)The accrual of wages and salaries expense resulted in a cash outflow.

B)The purchase of a one-year insurance policy resulted in a cash inflow.

C)The cash sale of equipment for a loss resulted in a cash inflow.

D)The accrual of wages and the equipment loss both resulted in cash outflows.

• The cash sale of equipment for a loss.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Black's cash flows from operating activities on the statement of cash flows?

A)The accrual of wages and salaries expense resulted in a cash outflow.

B)The purchase of a one-year insurance policy resulted in a cash inflow.

C)The cash sale of equipment for a loss resulted in a cash inflow.

D)The accrual of wages and the equipment loss both resulted in cash outflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck