Deck 5: Operating and Financial Leverage

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/97

العب

ملء الشاشة (f)

Deck 5: Operating and Financial Leverage

1

If a firm has a DFL of 2.0, EPS will change 2% for every 1% change in volume.

False

2

The degree of financial leverage measures the percentage change in EPS for every 1 percent move in EBIT.

True

3

The degree of combined leverage is the sum of the degree of operating leverage and the degree of financial leverage.

False

4

The closer a firm is to its break-even point, the lower the degree of operating leverage will be.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

5

Operating leverage is concerned with the use of capital assets in the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

6

Operating leverage determines how income from operations is to be divided between debtholders and shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

7

If economic conditions were expected to be favourable, an investor would likely prefer a firm with a low degree of leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

8

Linear break-even analysis assumes that costs are linear functions of volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

9

The degree of operating leverage is a number indicating the relationship between the percentage change in sales to the percentage change in earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

10

Firms with cyclical sales should employ a high degree of leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

11

Financial leverage is concerned with the use of debt in the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

12

The contribution margin is equal to price per unit minus total costs per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

13

Operating leverage influences the bottom half of the income statement while financial leverage deals with the top half.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

14

Cash break-even analysis eliminates the amortization expense and other non-cash charges from capital costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

15

Financial leverage primarily affects the left-hand side of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

16

Managers who are risk averse and uncertain about the future would most likely minimize combined leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

17

Leverage is the use of fixed costs to magnify returns at high levels of operation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

18

Operating income is not the same thing as EBIT.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

19

As the contribution margin rises, the break-even point goes down.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

20

Leverage works best when volume is increasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use of financial leverage must consider risk, not just maximizing profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

22

A highly automated plant would generally have

A) more variable than fixed costs.

B) more fixed than variable costs.

C) all fixed costs.

D) all variable costs.

A) more variable than fixed costs.

B) more fixed than variable costs.

C) all fixed costs.

D) all variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

23

For Japanese firms that have high levels of operating and financial leverage, maintaining sales volume is of critical importance even at the cost of price cuts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

24

At the break-even point, a firm's profits are

A) greater than zero.

B) less than zero.

C) equal to zero.

D) not enough information to tell

A) greater than zero.

B) less than zero.

C) equal to zero.

D) not enough information to tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm with a high degree of combined leverage will, other things being equal, experience higher earnings in the expansionary part of the business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

26

The concept of operating leverage involves the use of __________ to magnify returns at high levels of operation.

A) fixed costs

B) variable costs

C) marginal costs

D) semi-variable costs

A) fixed costs

B) variable costs

C) marginal costs

D) semi-variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

27

If sales volume exceeds the break-even point, the firm will experience

A) an operating loss.

B) an operating profit.

C) an increase in plant and equipment.

D) an increase in share price.

A) an operating loss.

B) an operating profit.

C) an increase in plant and equipment.

D) an increase in share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

28

For firms in industries that offer some degree of stability, are in a positive stage of growth, and are operating in favourable economic conditions, the use of debt is not needed or recommended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

29

A firm with a high degree of financial leverage could face financial difficulty even though it is in a stable industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

30

In break-even analysis the contribution margin is defined as

A) sales minus variable costs.

B) sales minus fixed costs.

C) variable costs minus fixed costs.

D) fixed costs minus variable costs.

A) sales minus variable costs.

B) sales minus fixed costs.

C) variable costs minus fixed costs.

D) fixed costs minus variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

31

The degree of financial leverage is not influenced by the interest rate on debt, only the amount borrowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

32

The analysis of operating leverage assumes that relationships between revenues and costs are constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

33

The break-even point can be calculated as

A) variable costs divided by contribution margin.

B) total costs divided by contribution margin.

C) variable cost times contribution margin.

D) fixed cost divided by contribution margin.

A) variable costs divided by contribution margin.

B) total costs divided by contribution margin.

C) variable cost times contribution margin.

D) fixed cost divided by contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

34

Operating leverage will change when a firm alters the mix of capital resources and labour that it uses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

35

A lower price for the firm's product will reduce the firm's break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

36

The interwoven boundaries of banks and different trading companies in Japan make it easier to acquire credit in Japan than in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

37

Linear break-even analysis and operating leverage are only valid within a relevant range of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

38

Management should tailor the use of leverage to meet its own risk-taking desires.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

39

Operating leverage primarily affects the left hand side of the balance sheet while financial leverage affects the right hand side of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a firm has a break-even point of 20,000 units and the contribution margin on the firm's single product is $3.00 per unit and fixed costs are $60,000, what will the firm's net income be at sales of 30,000 units?

A) $90,000

B) $30,000

C) $15,000

D) $45,000

A) $90,000

B) $30,000

C) $15,000

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

41

A firm would be indifferent between financing plans when

A) debt is equal to equity.

B) return on assets equals return on equity.

C) the cost of borrowed funds equals the return on equity.

D) the cost of borrowed funds equals the return on assets.

A) debt is equal to equity.

B) return on assets equals return on equity.

C) the cost of borrowed funds equals the return on equity.

D) the cost of borrowed funds equals the return on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

42

Heavy use of long-term debt may be beneficial in an inflationary economy because

A) the debt may be repaid in more "expensive" dollars.

B) nominal interest rates exceed real interest rates.

C) inflation is associated with the peak of a business cycle.

D) the debt may be repaid in "cheaper" dollars.

A) the debt may be repaid in more "expensive" dollars.

B) nominal interest rates exceed real interest rates.

C) inflation is associated with the peak of a business cycle.

D) the debt may be repaid in "cheaper" dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

43

Combined leverage is concerned with the relationship between

A) changes in EBIT and changes in EPS.

B) changes in volume and changes in EPS.

C) changes in volume and changes in EBIT.

D) changes in EBIT and changes in net income.

A) changes in EBIT and changes in EPS.

B) changes in volume and changes in EPS.

C) changes in volume and changes in EBIT.

D) changes in EBIT and changes in net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under which of the following conditions could the overuse of financial leverage be detrimental to the firm?

A) stable industry

B) cyclical demand for the firm's products

C) upswing of business cycle

D) low interest cost compared to return on assets

A) stable industry

B) cyclical demand for the firm's products

C) upswing of business cycle

D) low interest cost compared to return on assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the price per unit decreases because of competition but the cost structure remains the same

A) the break-even point rises.

B) the degree of combined leverage declines.

C) the degree of financial leverage declines.

D) all of the other answers are correct

A) the break-even point rises.

B) the degree of combined leverage declines.

C) the degree of financial leverage declines.

D) all of the other answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

46

If fixed costs rise while other variables stay constant

A) the break-even point rises.

B) degree of operating leverage increases.

C) total profit declines.

D) all of the other answers are correct

A) the break-even point rises.

B) degree of operating leverage increases.

C) total profit declines.

D) all of the other answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

47

Firms with a high degree of operating leverage are

A) easily capable of surviving large changes in sales volume

B) usually trading off lower levels of risk for higher profits.

C) significantly affected by changes in interest rates.

D) trading off higher fixed costs for lower per-unit variable costs.

A) easily capable of surviving large changes in sales volume

B) usually trading off lower levels of risk for higher profits.

C) significantly affected by changes in interest rates.

D) trading off higher fixed costs for lower per-unit variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

48

When a firm employs no debt

A) it has a financial leverage of one.

B) it has a financial leverage of zero

C) its operating leverage is equal to its financial leverage.

D) it will not be profitable.

A) it has a financial leverage of one.

B) it has a financial leverage of zero

C) its operating leverage is equal to its financial leverage.

D) it will not be profitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not true about leverage?

A) Operating leverage influences the top half of the income statement, determining EBIT.

B) Financial leverage deals with the bottom half of the income statement, determining EPS.

C) Combined leverage utilizes the entire income statement, showing the impact of change in volume on EBIT.

D) none of the other answers are correct

A) Operating leverage influences the top half of the income statement, determining EBIT.

B) Financial leverage deals with the bottom half of the income statement, determining EPS.

C) Combined leverage utilizes the entire income statement, showing the impact of change in volume on EBIT.

D) none of the other answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

50

The degree of operating leverage may be defined as

A) the percent change in operating income divided by the percent change in unit volume.

B) Q (P-VC) divided by Q (P-VC) - FC.

C) S - TVC divided by S - TVC - FC.

D) all of the other answers are correct

A) the percent change in operating income divided by the percent change in unit volume.

B) Q (P-VC) divided by Q (P-VC) - FC.

C) S - TVC divided by S - TVC - FC.

D) all of the other answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is true about the concept of leverage?

A) at the break-even point, operating leverage is equal to zero.

B) combined leverage measures the impact of operating and financial leverage on EBIT.

C) financial leverage measures the impact of fixed costs on earnings.

D) combined leverage measures the impact of operating and financial leverage on EPS.

A) at the break-even point, operating leverage is equal to zero.

B) combined leverage measures the impact of operating and financial leverage on EBIT.

C) financial leverage measures the impact of fixed costs on earnings.

D) combined leverage measures the impact of operating and financial leverage on EPS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is concerned with the change in operating profit as a result of a change in volume?

A) financial leverage

B) break-even point

C) operating leverage

D) combined leverage

A) financial leverage

B) break-even point

C) operating leverage

D) combined leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

53

The degree of operating leverage is computed as

A) percent change in operating profit divided by percent change in net income.

B) percent change in volume divided by percent change in operating profit.

C) percent change in EPS divided by percent change in operating income.

D) percent change in operating income divided by percent change in volume.

A) percent change in operating profit divided by percent change in net income.

B) percent change in volume divided by percent change in operating profit.

C) percent change in EPS divided by percent change in operating income.

D) percent change in operating income divided by percent change in volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

54

Firm A employs a high degree of operating leverage; Firm B takes a more conservative approach. Which of the following comparative statements about firms A and B is true?

A) A has a lower break-even point than B, but A's profit grows faster after the break-even.

B) A has a higher break-even point than B, but A's profit grows slower after the break-even.

C) B has a lower break-even point than A, but A's profit grows faster after the break-even.

D) B has a lower break-even point than A, and profit grows the same rate for both companies after the break-even point.

A) A has a lower break-even point than B, but A's profit grows faster after the break-even.

B) A has a higher break-even point than B, but A's profit grows slower after the break-even.

C) B has a lower break-even point than A, but A's profit grows faster after the break-even.

D) B has a lower break-even point than A, and profit grows the same rate for both companies after the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the business cycle were just beginning its upswing, which firm would you anticipate would be likely to show the best growth in EPS over the next year? Firm A has high combined leverage and Firm B has low combined leverage.

A) firm A

B) firm B

C) indifferent between the two

D) it depends on how much financial leverage each firm has

A) firm A

B) firm B

C) indifferent between the two

D) it depends on how much financial leverage each firm has

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

56

Financial leverage is concerned with the relation between

A) changes in volume and changes in EPS.

B) changes in volume and changes in EBIT.

C) changes in EBIT and changes in EPS.

D) changes in EBIT and changes in operating income.

A) changes in volume and changes in EPS.

B) changes in volume and changes in EBIT.

C) changes in EBIT and changes in EPS.

D) changes in EBIT and changes in operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

57

Conservatively leveraged Firm C and highly leveraged Firm H operate at the same level of earnings before interest and taxes where the return on assets is greater than the cost of debt.

A) Firm C will have a higher return on equity than H.

B) Firm H will have a higher return on equity than C .

C) The return on equity will not be affected by financial leverage.

D) The return on equity will be the same at an equal level of earnings.

A) Firm C will have a higher return on equity than H.

B) Firm H will have a higher return on equity than C .

C) The return on equity will not be affected by financial leverage.

D) The return on equity will be the same at an equal level of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

58

Cash break-even analysis

A) is helpful in analyzing the short-term outlook of the firm, particularly when it is in trouble financially.

B) is important when analyzing long-term profitability.

C) includes amortization expense as a fixed cost when calculating the degree of financial leverage.

D) none of the other answers are correct

A) is helpful in analyzing the short-term outlook of the firm, particularly when it is in trouble financially.

B) is important when analyzing long-term profitability.

C) includes amortization expense as a fixed cost when calculating the degree of financial leverage.

D) none of the other answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

59

A conservative financing plan involves

A) heavy reliance on debt.

B) heavy reliance on equity.

C) high degree of financial leverage.

D) high degree of combined leverage.

A) heavy reliance on debt.

B) heavy reliance on equity.

C) high degree of financial leverage.

D) high degree of combined leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

60

If EBIT equals $140,000 and interest equals $21,000, with a tax rate of 31%, what is the degree of financial leverage?

A) 6.67x

B) 5.67

C) 3.91x

D) 1.18x

A) 6.67x

B) 5.67

C) 3.91x

D) 1.18x

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

61

If a firm has fixed costs of $30,000, a price of $4.00, and a break-even point of 15,000 units, the variable cost per unit is

A) $5.00.

B) $2.00.

C) $0.50.

D) $4.00.

A) $5.00.

B) $2.00.

C) $0.50.

D) $4.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

62

If a firm has fixed costs of $20,000, variable cost per unit of $0.50, and a break-even point of 5,000 units, the price is

A) $2.50.

B) $5.00.

C) $4.00.

D) $4.50.

A) $2.50.

B) $5.00.

C) $4.00.

D) $4.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

63

-The Degree of Financial Leverage is

A) 1.29x.

B) 4.50x.

C) 3.50x.

D) 1.32x.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

64

If a firm has a price of $4.00, variable cost per unit of $2.50, and a break-even point of 20,000 units, fixed costs are equal to

A) $13,333.

B) $10,000.

C) $30,000.

D) $50,000.

A) $13,333.

B) $10,000.

C) $30,000.

D) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

65

Financial leverage is determined to a large extent by the firm's

A) working capital choice.

B) capital budgeting choice.

C) capital structure choice.

D) dividend policy choice.

A) working capital choice.

B) capital budgeting choice.

C) capital structure choice.

D) dividend policy choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

66

A firm's indifference point between debt and equity financing plans would occur when the

A) amount of debt used is equal to the amount of equity.

B) cost of borrowing is low.

C) cost of borrowed funds equals return on equity.

D) current level of EBIT generates the same EPS under both plans.

A) amount of debt used is equal to the amount of equity.

B) cost of borrowing is low.

C) cost of borrowed funds equals return on equity.

D) current level of EBIT generates the same EPS under both plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

67

-The Degree of Financial Leverage (DFL) is

A) 3.50x.

B) 1.40x.

C) 1.95x.

D) 1.58x.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

68

-The Degree of Operating Leverage is

A) 1.43x.

B) 1.56x.

C) 3.33x.

D) 2.22x.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following questions does break-even analysis attempt to address?

A) How much do changes in volume affect costs and profits?

B) At what point does the firm break even?

C) What is the most efficient level of capital assets to employ?

D) All of the other answers are correct

A) How much do changes in volume affect costs and profits?

B) At what point does the firm break even?

C) What is the most efficient level of capital assets to employ?

D) All of the other answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

70

A high DOL means

A) there are high labour costs.

B) there is high debt.

C) there is a large amount of equity.

D) there are high fixed costs.

A) there are high labour costs.

B) there is high debt.

C) there is a large amount of equity.

D) there are high fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

71

-The Degree of Operating Leverage (DOL) is

A) 1.58x.

B) 1.95x.

C) 3.50x.

D) 1.40x.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

72

A weakness of break-even analysis is that it assumes

A) revenue and costs are a linear (constant) function of volume.

B) prices and costs increase when the economy is strong and confidence is high.

C) cost of goods sold go up as revenue increase.

D) there is no weakness

A) revenue and costs are a linear (constant) function of volume.

B) prices and costs increase when the economy is strong and confidence is high.

C) cost of goods sold go up as revenue increase.

D) there is no weakness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

73

-The Degree of Combined Leverage (D.C.L.) is

A) 3.08x.

B) 5.45x.

C) 2.73x.

D) 6.83x.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

74

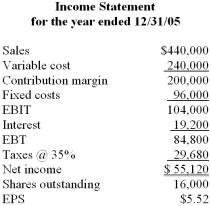

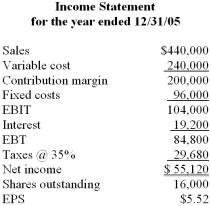

From the following income statement for 2005, calculate:

A) Degree of financial leverage

B) Degree of operating leverage

C) Degree of combined leverage

A) Degree of financial leverage

B) Degree of operating leverage

C) Degree of combined leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

75

Heister Corporation produces class rings to sell to college and high school students. These rings sell for $75 each, and cost $35 each to produce. Heister has fixed costs of $50,000.

A) Calculate Heister's break-even point.

B) How much profit (loss) will Heister have if it sells 1,000 rings? 8,000 rings?

C) Heister's president, J. R. D'Angelo, expects an annual profit of $100,000. How many rings must be sold to attain this profit?

A) Calculate Heister's break-even point.

B) How much profit (loss) will Heister have if it sells 1,000 rings? 8,000 rings?

C) Heister's president, J. R. D'Angelo, expects an annual profit of $100,000. How many rings must be sold to attain this profit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

76

Operating leverage primarily affects the __________ while financial leverage primarily affects the __________.

A) left-hand side of the balance sheet: the lower part of the income statement

B) right-hand side of the balance sheet: the upper part of the income statement

C) the lower part of the income statement: the right-hand part of the balance sheet

D) the upper part of the income statement: the left-hand side of the balance sheet

A) left-hand side of the balance sheet: the lower part of the income statement

B) right-hand side of the balance sheet: the upper part of the income statement

C) the lower part of the income statement: the right-hand part of the balance sheet

D) the upper part of the income statement: the left-hand side of the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

77

Financial leverage primarily affects the _________ while operating leverage primarily affects the __________.

A) left-hand side of the balance sheet: the right-hand side of the balance sheet

B) right-hand side of the balance sheet: the upper part of the income statement

C) lower part of the income statement: the right-hand side of the balance sheet

D) the upper part of the income statement: the left-hand side of the balance sheet

A) left-hand side of the balance sheet: the right-hand side of the balance sheet

B) right-hand side of the balance sheet: the upper part of the income statement

C) lower part of the income statement: the right-hand side of the balance sheet

D) the upper part of the income statement: the left-hand side of the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

78

-This firm's break-even point is

A) 4,800 units.

B) 14,634 units.

C) 7,142 units.

D) 18,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

79

Financial leverage deals with

A) the relationship of fixed and variable costs.

B) the relationship of debt and equity in the capital structure.

C) the entire income statement.

D) the entire balance sheet.

A) the relationship of fixed and variable costs.

B) the relationship of debt and equity in the capital structure.

C) the entire income statement.

D) the entire balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

80

-The Degree of Combined Leverage is

A) 2.1x.

B) 1.9x.

C) 2.9x.

D) 2.0x.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck