Deck 1: Accounting for Decision Making and Control

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 1: Accounting for Decision Making and Control

1

Cost-volume-profit of a Make/buy Decision

Elly Industries is a multiproduct company that currently manufactures 30,000 units of Part MR24 each month for use in production. The facilities now being used to produce Part MR24 have affixed monthly cost of $150,000 and a capacity to produce 84,000 units per month. If Elly were to buy Part MR24 from an outside supplier, the facilities would be idle, but its fixed costs would continue at 40 percent of its present amount. The variable production costs of Part MR24 are $11 per unit.

Required:

a. If Elly Industries continues to use 30,000 units of Part MR24 each month, it would realize a net benefit by purchasing Part MR24 from an outside supplier only if the supplier's unit price is less than how much?

b. If Elly Industries can obtain Part MR24 from an outside supplier at a unit purchase price of $12.875, what is the monthly usage at which it will be indifferent between purchasing and making Part MR24?

Source: CMA adapted

Elly Industries is a multiproduct company that currently manufactures 30,000 units of Part MR24 each month for use in production. The facilities now being used to produce Part MR24 have affixed monthly cost of $150,000 and a capacity to produce 84,000 units per month. If Elly were to buy Part MR24 from an outside supplier, the facilities would be idle, but its fixed costs would continue at 40 percent of its present amount. The variable production costs of Part MR24 are $11 per unit.

Required:

a. If Elly Industries continues to use 30,000 units of Part MR24 each month, it would realize a net benefit by purchasing Part MR24 from an outside supplier only if the supplier's unit price is less than how much?

b. If Elly Industries can obtain Part MR24 from an outside supplier at a unit purchase price of $12.875, what is the monthly usage at which it will be indifferent between purchasing and making Part MR24?

Source: CMA adapted

Cost-Volume-Profit of a Make/Buy Decision

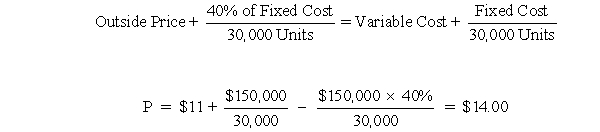

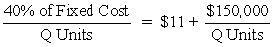

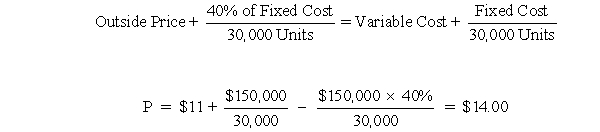

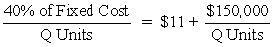

a. Each month Elly incurs $150,000 of fixed cost to have capacity to produce 84,000 units. They are only using 30,000 units of that capacity now. If they outsource MR24, they will continue to incur 40% of the fixed costs, or $60,000. However, they save $90,000 ($150,000 - $60,000). Besides saving the fixed costs they save $330,000 of variable costs ($11 × 30,000) or a total cost savings of $420,000. To be indifferent between outsourcing and continuing to produce, the outside price must be $14 ($420,000 ÷ 30,000). An alternative way to solve the problem and get the same answer is: b. $12.875 +

b. $12.875 +  $12.875Q + $60,000 = $11Q + $150,000

$12.875Q + $60,000 = $11Q + $150,000

$1.875Q = $90,000

Q = 48,000 units

a. Each month Elly incurs $150,000 of fixed cost to have capacity to produce 84,000 units. They are only using 30,000 units of that capacity now. If they outsource MR24, they will continue to incur 40% of the fixed costs, or $60,000. However, they save $90,000 ($150,000 - $60,000). Besides saving the fixed costs they save $330,000 of variable costs ($11 × 30,000) or a total cost savings of $420,000. To be indifferent between outsourcing and continuing to produce, the outside price must be $14 ($420,000 ÷ 30,000). An alternative way to solve the problem and get the same answer is:

b. $12.875 +

b. $12.875 +  $12.875Q + $60,000 = $11Q + $150,000

$12.875Q + $60,000 = $11Q + $150,000$1.875Q = $90,000

Q = 48,000 units

2

Choosing Performance Measures

Jen and Barry opened an ice cream shop in Eugene. It was a big success, so they decide to open a ice cream shops in many cities including Portland. They hire Dante to manage the shop in Portland. Jen and Barry are considering two different sets of performance measures for Dante. The first set would grade Dante based on the cleanliness of the restaurant and customer service. The second set would use accounting numbers including the profit of the shop in Portland.

What are the advantages and disadvantages of each set of performance measures?

Jen and Barry opened an ice cream shop in Eugene. It was a big success, so they decide to open a ice cream shops in many cities including Portland. They hire Dante to manage the shop in Portland. Jen and Barry are considering two different sets of performance measures for Dante. The first set would grade Dante based on the cleanliness of the restaurant and customer service. The second set would use accounting numbers including the profit of the shop in Portland.

What are the advantages and disadvantages of each set of performance measures?

Choosing Performance Measures

Cleanliness and customer service are important to the success of the ice cream shop. The advantage of using cleanliness and customer service as performance measures is to motivate managers to make the business appealing to customers. Customers will be more likely to return and frequent other outlets of the company. Another advantage of using cleanliness and customer service as performance measures is their controllability by the manager. The disadvantage of using cleanliness and customer service as performance measures is that managers may ignore the costs of providing customer service. Without some measure of cost or profit as part of the manager's performance measure, a manager will be less likely to make the appropriate cost/benefit trade-off.

The benefit of using profit as a performance measure is that profit tends to include all aspects of operating the business. To improve profit, the manager should also be motivated to improve customer service because profit will increase with satisfied customers. If revenues and costs are accurately measured, then managers will make the appropriate cost/benefit trade-offs if evaluated on profit. One disadvantage of using profit as a performance measure is that profit is not completely controllable by the manager. There are uncontrollable environmental factors, such as the economy of Portland, that affect profit. Also, revenues and costs may not be appropriately measured in the short-run. If costs used to calculate profit don't reflect the opportunity cost, the manager may be motivated to make inappropriate decisions, such as postponing maintenance.

Cleanliness and customer service are important to the success of the ice cream shop. The advantage of using cleanliness and customer service as performance measures is to motivate managers to make the business appealing to customers. Customers will be more likely to return and frequent other outlets of the company. Another advantage of using cleanliness and customer service as performance measures is their controllability by the manager. The disadvantage of using cleanliness and customer service as performance measures is that managers may ignore the costs of providing customer service. Without some measure of cost or profit as part of the manager's performance measure, a manager will be less likely to make the appropriate cost/benefit trade-off.

The benefit of using profit as a performance measure is that profit tends to include all aspects of operating the business. To improve profit, the manager should also be motivated to improve customer service because profit will increase with satisfied customers. If revenues and costs are accurately measured, then managers will make the appropriate cost/benefit trade-offs if evaluated on profit. One disadvantage of using profit as a performance measure is that profit is not completely controllable by the manager. There are uncontrollable environmental factors, such as the economy of Portland, that affect profit. Also, revenues and costs may not be appropriately measured in the short-run. If costs used to calculate profit don't reflect the opportunity cost, the manager may be motivated to make inappropriate decisions, such as postponing maintenance.

3

Cost, Volume, Profit Analysis

With the possibility of the US Congress relaxing restrictions on cutting old growth, a local lumber company is considering an expansion of its facilities. The company believes it can sell lumber for $0.18/board foot. A board foot is a measure of lumber. The tax rate for the company is 30 percent. The company has the following two opportunities:

• Build Factory A with annual fixed costs of $20 million and variable costs of $0.10/board foot. This factory has an annual capacity of 500 million board feet.

• Build Factory B with annual fixed costs of $10 million and variable costs of $0.12/board foot. This factory has an annual capacity of 300 million board feet.

Required:

a. What is the break-even point in board feet for Factory A?

b. If the company wants to generate an after tax profit of $2 million with Factory B, how many board feet would the company have to process and sell?

c. If demand for lumber is uncertain, which factory is riskier?

d. At what level of board feet would the after-tax profit of the two factories be the same?

With the possibility of the US Congress relaxing restrictions on cutting old growth, a local lumber company is considering an expansion of its facilities. The company believes it can sell lumber for $0.18/board foot. A board foot is a measure of lumber. The tax rate for the company is 30 percent. The company has the following two opportunities:

• Build Factory A with annual fixed costs of $20 million and variable costs of $0.10/board foot. This factory has an annual capacity of 500 million board feet.

• Build Factory B with annual fixed costs of $10 million and variable costs of $0.12/board foot. This factory has an annual capacity of 300 million board feet.

Required:

a. What is the break-even point in board feet for Factory A?

b. If the company wants to generate an after tax profit of $2 million with Factory B, how many board feet would the company have to process and sell?

c. If demand for lumber is uncertain, which factory is riskier?

d. At what level of board feet would the after-tax profit of the two factories be the same?

Cost, Volume, Profit Analysis

a. Break-even point of Factory A = $20,000,000/($0.18 - $0.10) = 250,000,000 board-feet

b. To achieve an after-tax profit of $2,000,000:

[$10,000,000 + ($2,000,000/(1 - .3))]/($0.18 - $0.12) = 14,285,717 board-feet

c. Factory A has higher fixed costs, but lower variable costs per unit because of its larger capacity. If the demand for lumber is lower than expected, Factory A will have a more difficult time recovering its fixed costs. The break-even point for factory B is lower than the break-even point for factory

RRR

a. Break-even point of Factory A = $20,000,000/($0.18 - $0.10) = 250,000,000 board-feet

b. To achieve an after-tax profit of $2,000,000:

[$10,000,000 + ($2,000,000/(1 - .3))]/($0.18 - $0.12) = 14,285,717 board-feet

c. Factory A has higher fixed costs, but lower variable costs per unit because of its larger capacity. If the demand for lumber is lower than expected, Factory A will have a more difficult time recovering its fixed costs. The break-even point for factory B is lower than the break-even point for factory

RRR

4

Financing Charges and Net Present Value

The president of the company is not convinced that the interest expense should be excluded from the calculation of the net present value. He points out that, "Interest is a cash flow. You are supposed to discount cash flows. We borrowed money to completely finance this project. Why not discount interest expenditures?" The president is so convinced that he asks you, the controller, to calculate the net present value including the interest expense.

How can you adjust the net present value analysis to compensate for the inclusion of the interest expense?

The president of the company is not convinced that the interest expense should be excluded from the calculation of the net present value. He points out that, "Interest is a cash flow. You are supposed to discount cash flows. We borrowed money to completely finance this project. Why not discount interest expenditures?" The president is so convinced that he asks you, the controller, to calculate the net present value including the interest expense.

How can you adjust the net present value analysis to compensate for the inclusion of the interest expense?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fixed and Variable Costs

The university athletic department has been asked to host a professional basketball game at the campus sports center. The athletic director must estimate the opportunity cost of holding the event at the sports center. The only other event scheduled for the sports center that evening is a fencing match that would not have generated any additional costs or revenues. The fencing match can be held at the local high school, but the rental cost of the high school gym would be $200. The athletic director estimates that the professional basketball game will require 20 hours of labor to prepare the building. Clean-up depends on the number of spectators. The athletic director estimates the time of clean-up to be equal to 2 minutes per spectator. The labor would be hired especially for the basketball game and would cost $8 per hour. Utilities will be $500 greater if the basketball game is held at the sports center. All other costs would be covered by the professional basketball team.

Required:

a. What is the variable cost of having one more spectator?

b. What is the opportunity cost of allowing the professional basketball team to use the sports center if 10,000 spectators are expected?

c. What is the opportunity cost of allowing the professional basketball team to use the sports center if 12,000 spectators are expected?

The university athletic department has been asked to host a professional basketball game at the campus sports center. The athletic director must estimate the opportunity cost of holding the event at the sports center. The only other event scheduled for the sports center that evening is a fencing match that would not have generated any additional costs or revenues. The fencing match can be held at the local high school, but the rental cost of the high school gym would be $200. The athletic director estimates that the professional basketball game will require 20 hours of labor to prepare the building. Clean-up depends on the number of spectators. The athletic director estimates the time of clean-up to be equal to 2 minutes per spectator. The labor would be hired especially for the basketball game and would cost $8 per hour. Utilities will be $500 greater if the basketball game is held at the sports center. All other costs would be covered by the professional basketball team.

Required:

a. What is the variable cost of having one more spectator?

b. What is the opportunity cost of allowing the professional basketball team to use the sports center if 10,000 spectators are expected?

c. What is the opportunity cost of allowing the professional basketball team to use the sports center if 12,000 spectators are expected?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

Monitoring Computer Use

Samson Company is an engineering firm. Many of the employees are engineers who are working individually on different projects. Most of the design work takes place on computers. The computers are connected by a network and employees can also "surf" the internet through their desk top computers.

The president is concerned about productivity among his engineers. He has acquired software that allows him to monitor each engineer's computer work. At anytime during the day, the president can observe on her screen exactly what the different engineers are working on. The engineers are quite unhappy with this monitoring process. They feel it is unethical for the president to be able to access what they are working on without their knowledge.

Describe the pros and cons of monitoring through observing the computer work of the engineers.

Samson Company is an engineering firm. Many of the employees are engineers who are working individually on different projects. Most of the design work takes place on computers. The computers are connected by a network and employees can also "surf" the internet through their desk top computers.

The president is concerned about productivity among his engineers. He has acquired software that allows him to monitor each engineer's computer work. At anytime during the day, the president can observe on her screen exactly what the different engineers are working on. The engineers are quite unhappy with this monitoring process. They feel it is unethical for the president to be able to access what they are working on without their knowledge.

Describe the pros and cons of monitoring through observing the computer work of the engineers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

Opportunity Costs

The First Church has been asked to operate a homeless shelter in part of the church. To operate a homeless shelter the church would have to hire a full time employee for $1,200/month to manage the shelter. In addition, the church would have to purchase $400 of supplies/month for the people using the shelter. The space that would be used by the shelter is rented for wedding parties. The church averages about 5 wedding parties a month that pay rent of $200 per party. Utilities are normally $1,000 per month. With the homeless shelter, the utilities will increase to $1,300 per month.

What is the opportunity cost to the church of operating a homeless shelter in the church?

The First Church has been asked to operate a homeless shelter in part of the church. To operate a homeless shelter the church would have to hire a full time employee for $1,200/month to manage the shelter. In addition, the church would have to purchase $400 of supplies/month for the people using the shelter. The space that would be used by the shelter is rented for wedding parties. The church averages about 5 wedding parties a month that pay rent of $200 per party. Utilities are normally $1,000 per month. With the homeless shelter, the utilities will increase to $1,300 per month.

What is the opportunity cost to the church of operating a homeless shelter in the church?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

Cost, Volume, Profit Analysis

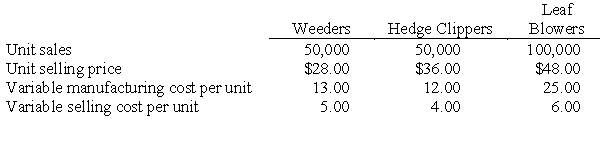

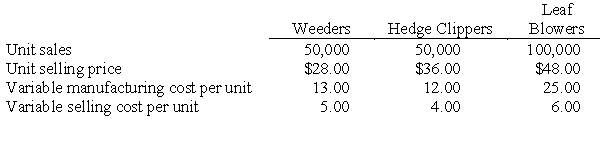

Kalifo Company manufactures a line of electric garden tools that are sold in general hardware stores. The company's controller, Sylvia Harlow, has just received the sales forecast for the coming year for Kalifo's three products: weeders, hedge clippers, and leaf blowers. Kalifo has experienced considerable variations in sales volumes and variable costs over the past two years, and Harlow believes the forecast should be carefully evaluated from a cost-volume-profit viewpoint. The preliminary budget information for 1996 is presented below. For 1996, Kalifo's fixed factory overhead is budgeted at $2 million, and the company's fixed selling and administrative expenses are forecast to be $600,000. Kalifo has a tax rate of 40 percent.

For 1996, Kalifo's fixed factory overhead is budgeted at $2 million, and the company's fixed selling and administrative expenses are forecast to be $600,000. Kalifo has a tax rate of 40 percent.

Required:

a. Determine Kalifo Co.'s budgeted net income for 1996.

b. Assuming that the sales mix remains as budgeted, determine how many units of each product Kalifo must sell in order to break even in 1996.

c. Determine the total dollar sales Kalifo must sell in 1996 in order to earn an after-tax net income of $450,000.

d. After preparing the original estimates, Kalifo determines that its variable manufacturing cost of leaf blowers will increase 20 percent and the variable selling cost of hedge clippers can be expected to increase $1 per unit. However, Kalifo has decided not to change the selling price of either product. In addition, Kalifo learns that its leaf blower is perceived as the best value on the market, and it can expect to sell three times as many leaf blowers as any other product. Under these circumstances, determine how many units of each product Kalifo will have to sell to break even in 1996.

e. Explain the limitations of cost-volume-profit analysis that Sylvia Harlow should consider when evaluating Kalifo's 1996 budget.

Kalifo Company manufactures a line of electric garden tools that are sold in general hardware stores. The company's controller, Sylvia Harlow, has just received the sales forecast for the coming year for Kalifo's three products: weeders, hedge clippers, and leaf blowers. Kalifo has experienced considerable variations in sales volumes and variable costs over the past two years, and Harlow believes the forecast should be carefully evaluated from a cost-volume-profit viewpoint. The preliminary budget information for 1996 is presented below.

For 1996, Kalifo's fixed factory overhead is budgeted at $2 million, and the company's fixed selling and administrative expenses are forecast to be $600,000. Kalifo has a tax rate of 40 percent.

For 1996, Kalifo's fixed factory overhead is budgeted at $2 million, and the company's fixed selling and administrative expenses are forecast to be $600,000. Kalifo has a tax rate of 40 percent.Required:

a. Determine Kalifo Co.'s budgeted net income for 1996.

b. Assuming that the sales mix remains as budgeted, determine how many units of each product Kalifo must sell in order to break even in 1996.

c. Determine the total dollar sales Kalifo must sell in 1996 in order to earn an after-tax net income of $450,000.

d. After preparing the original estimates, Kalifo determines that its variable manufacturing cost of leaf blowers will increase 20 percent and the variable selling cost of hedge clippers can be expected to increase $1 per unit. However, Kalifo has decided not to change the selling price of either product. In addition, Kalifo learns that its leaf blower is perceived as the best value on the market, and it can expect to sell three times as many leaf blowers as any other product. Under these circumstances, determine how many units of each product Kalifo will have to sell to break even in 1996.

e. Explain the limitations of cost-volume-profit analysis that Sylvia Harlow should consider when evaluating Kalifo's 1996 budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

Identifying the Opportunity Cost of Capital

Don Phelps recently started a dry cleaning business. He would like to expand the business and have a coin-operated laundry also. The expansion of the building and the washing and drying machines will cost $100,000. The bank will lend the business $100,000 at 12 percent interest rate. Don could get a 10 percent interest rate loan if he uses his personal house as collateral. The lower interest rate reflects the increased security of the loan to the bank, because the bank could take Don's home if he doesn't pay back the loan. Don currently can put money in the bank and receive 6 percent interest.

Required:

Provide arguments for using 12 percent, 10 percent, and 6 percent as the opportunity cost of capital for evaluating the investment.

Don Phelps recently started a dry cleaning business. He would like to expand the business and have a coin-operated laundry also. The expansion of the building and the washing and drying machines will cost $100,000. The bank will lend the business $100,000 at 12 percent interest rate. Don could get a 10 percent interest rate loan if he uses his personal house as collateral. The lower interest rate reflects the increased security of the loan to the bank, because the bank could take Don's home if he doesn't pay back the loan. Don currently can put money in the bank and receive 6 percent interest.

Required:

Provide arguments for using 12 percent, 10 percent, and 6 percent as the opportunity cost of capital for evaluating the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Choosing Performance Measures

The president of the Canby Insurance Company has just read an article on the balanced scorecard. A company has a balanced scorecard when there is a set of performance measures that reflect the diverse interests and goals of all the stakeholders (shareholders, customers, employees, and society) of the organization. Presently, Canby Insurance Company has only one performance measure for the top executives: profit. The board of directors claims that profit as the sole performance measure is sufficient. If customers are satisfied and employees are productive, then the company will be profitable. Any other performance measure will detract from the basic goal of making a profit.

Required:

Explain the costs and benefits of only having profit as a performance measure.

The president of the Canby Insurance Company has just read an article on the balanced scorecard. A company has a balanced scorecard when there is a set of performance measures that reflect the diverse interests and goals of all the stakeholders (shareholders, customers, employees, and society) of the organization. Presently, Canby Insurance Company has only one performance measure for the top executives: profit. The board of directors claims that profit as the sole performance measure is sufficient. If customers are satisfied and employees are productive, then the company will be profitable. Any other performance measure will detract from the basic goal of making a profit.

Required:

Explain the costs and benefits of only having profit as a performance measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

Breakeven and Cost-Volume-Profit with Taxes

DisKing Company is a retailer for video disks. The projected after-tax net income for the current year is $120,000 based on a sales volume of 200,000 video disks. DisKing has been selling the disks at $16 each. The variable costs consist of the $10 unit purchase price of the disks and a handling cost of $2 per disk. DisKing's annual fixed costs are $600,000 and DisKing is subject to a 40 percent income tax rate.

Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent.

Required:

a. Calculate DisKing Company's break-even point for the current year in number of video disks.

b. Calculate the increased after-tax income for the current year from an increase of 10 percent in projected unit sales volume.

c. If the unit selling price remains at $16, calculate the volume of sales in dollars that DisKing Company must achieve in the coming year to maintain the same after-tax net income as projected for the current year.

Source: CMA adapted

DisKing Company is a retailer for video disks. The projected after-tax net income for the current year is $120,000 based on a sales volume of 200,000 video disks. DisKing has been selling the disks at $16 each. The variable costs consist of the $10 unit purchase price of the disks and a handling cost of $2 per disk. DisKing's annual fixed costs are $600,000 and DisKing is subject to a 40 percent income tax rate.

Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent.

Required:

a. Calculate DisKing Company's break-even point for the current year in number of video disks.

b. Calculate the increased after-tax income for the current year from an increase of 10 percent in projected unit sales volume.

c. If the unit selling price remains at $16, calculate the volume of sales in dollars that DisKing Company must achieve in the coming year to maintain the same after-tax net income as projected for the current year.

Source: CMA adapted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

Opportunity Cost of Attracting Industry

The Itagi Computer Company From Japan is looking to build a factory for making CD-ROM's in the United States. The company is concerned about the safety and well-being of its employees and wants to locate in a community with good schools. The company also wants the factory to be profitable and is looking for subsidies from potential communities. Encouraging new business to create jobs for citizens is important for communities, especially communities with high unemployment.

Wellville has not been very well since the shoe factory left town. The city officials have been working on a deal with Itagi to get the company to locate in Wellville. Itagi officials have identified a 20 acre undeveloped site. The city has tentatively agreed to buy the site for $50,000 for Itagi and not require any payment of property taxes on the factory by Itagi for the first five years of operation. The property tax deal will save Itagi $3,000,000 in taxes over the five years. This deal was leaked to the local newspaper. The headlines the next day were: "Wellville Gives Away $3,000,000+ to Japanese Company".

Required:

a. Do the headlines accurately describe the deal with Itagi?

b. What are the relevant costs and benefits to the citizens of Wellville of making this deal?

The Itagi Computer Company From Japan is looking to build a factory for making CD-ROM's in the United States. The company is concerned about the safety and well-being of its employees and wants to locate in a community with good schools. The company also wants the factory to be profitable and is looking for subsidies from potential communities. Encouraging new business to create jobs for citizens is important for communities, especially communities with high unemployment.

Wellville has not been very well since the shoe factory left town. The city officials have been working on a deal with Itagi to get the company to locate in Wellville. Itagi officials have identified a 20 acre undeveloped site. The city has tentatively agreed to buy the site for $50,000 for Itagi and not require any payment of property taxes on the factory by Itagi for the first five years of operation. The property tax deal will save Itagi $3,000,000 in taxes over the five years. This deal was leaked to the local newspaper. The headlines the next day were: "Wellville Gives Away $3,000,000+ to Japanese Company".

Required:

a. Do the headlines accurately describe the deal with Itagi?

b. What are the relevant costs and benefits to the citizens of Wellville of making this deal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

Annuity

Suppose the opportunity cost of capital is 10 percent and you have just won a $1 million lottery that entitles you to $100,000 at the end of each of the next ten years.

Required:

a. What is the minimum lump sum cash payment you would be willing to take now in lieu of the ten-year annuity?

b. What is the minimum lump sum you would be willing to accept at the end of the ten years in lieu of the annuity?

c. Suppose three years have passed and you have just received the third payment and you have seven left when the lottery promoters approach you with an offer to "settle-up for cash." What is the minimum you would accept (the end of year three)?

d. How would your answer to part (a) change if the first payment came immediately (at t = 0) and the remaining payments were at the beginning instead of at the end of each year?

Suppose the opportunity cost of capital is 10 percent and you have just won a $1 million lottery that entitles you to $100,000 at the end of each of the next ten years.

Required:

a. What is the minimum lump sum cash payment you would be willing to take now in lieu of the ten-year annuity?

b. What is the minimum lump sum you would be willing to accept at the end of the ten years in lieu of the annuity?

c. Suppose three years have passed and you have just received the third payment and you have seven left when the lottery promoters approach you with an offer to "settle-up for cash." What is the minimum you would accept (the end of year three)?

d. How would your answer to part (a) change if the first payment came immediately (at t = 0) and the remaining payments were at the beginning instead of at the end of each year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

Linking Decision Rights and Knowledge

Professional football teams have both a coach and a general manager. The general manager is usually responsible for the general operations of the organization and maintains the decision rights for selecting personnel on the football team. The coach is responsible for the training of the football team and making decisions on game day. Many coaches have been unhappy with their relationship with the general manager and feel they should have more decision rights in choosing the players on the team. Some of the top coaches are now insisting on also being general managers.

What are the advantages and disadvantages of separating the duties of the coach and general manager with respect to selecting members of the football team?

Professional football teams have both a coach and a general manager. The general manager is usually responsible for the general operations of the organization and maintains the decision rights for selecting personnel on the football team. The coach is responsible for the training of the football team and making decisions on game day. Many coaches have been unhappy with their relationship with the general manager and feel they should have more decision rights in choosing the players on the team. Some of the top coaches are now insisting on also being general managers.

What are the advantages and disadvantages of separating the duties of the coach and general manager with respect to selecting members of the football team?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Transfer Prices

The Alpha Division of the Carlson Company manufactures product X at a variable cost of $40 per unit. Alpha Division's fixed costs, which are sunk, are $20 per unit. The market price of X is $70 per unit. Beta Division of Carlson Company uses product X to make Y. The variable costs to convert X to Y are $20 per unit and the fixed costs, which are sunk, are $10 per unit. The product Y sells for $80 per unit.

Required:

a. What transfer price of X causes divisional managers to make decentralized decisions that maximize Carlson Company's profit if each division is treated as a profit center?

b. Given the transfer price from part (a), what should the manager of the Beta Division do?

c. Suppose there is no market price for product X. What transfer price should be used for decentralized decision-making?

d. If there is no market for product X, is the operations of the Beta Division profitable?

The Alpha Division of the Carlson Company manufactures product X at a variable cost of $40 per unit. Alpha Division's fixed costs, which are sunk, are $20 per unit. The market price of X is $70 per unit. Beta Division of Carlson Company uses product X to make Y. The variable costs to convert X to Y are $20 per unit and the fixed costs, which are sunk, are $10 per unit. The product Y sells for $80 per unit.

Required:

a. What transfer price of X causes divisional managers to make decentralized decisions that maximize Carlson Company's profit if each division is treated as a profit center?

b. Given the transfer price from part (a), what should the manager of the Beta Division do?

c. Suppose there is no market price for product X. What transfer price should be used for decentralized decision-making?

d. If there is no market for product X, is the operations of the Beta Division profitable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Accounting and Control

The controller of a small private college is complaining about the amount of work she is required to do at the beginning of each month. The president of the university requires the controller to submit a monthly report by the fifth day of the following month. The monthly report contains pages of financial data from operations. The controller was heard saying, "Why does the president need all this information? He probably doesn't read half of the report. He's an old English professor and probably doesn't know the difference between a cost and a revenue."

Required:

a. What is the probable role of the monthly report?

b. What is the controller's responsibility with respect to a president who doesn't know much accounting?

The controller of a small private college is complaining about the amount of work she is required to do at the beginning of each month. The president of the university requires the controller to submit a monthly report by the fifth day of the following month. The monthly report contains pages of financial data from operations. The controller was heard saying, "Why does the president need all this information? He probably doesn't read half of the report. He's an old English professor and probably doesn't know the difference between a cost and a revenue."

Required:

a. What is the probable role of the monthly report?

b. What is the controller's responsibility with respect to a president who doesn't know much accounting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

Opportunity Cost of Purchase Discounts and Lost Sales

Winter Company is a medium-size manufacturer of disk drives that are sold to computer manufacturers. At the beginning of 2010, Winter began shipping a much-improved disk drive, Model W899. The W899 was an immediate success and accounted for $5 million in revenues for Winter in 2010.

While the W899 was in the development stage, Winter planned to price it at $130. In preliminary discussions with customers about the W899 design, no resistance was detected to suggestions that the price might be $130. The $130 price was considerably higher than the estimated variable cost of $70 per unit to produce the W899, and it would provide Winter with ample profits.

Shortly before setting the price of the W899, Winter discovered that a competitor was reading a product very similar to the W899 and was no more than 60 days behind Winter's own schedule. No information could be obtained on the competitor's planned price, although it had a reputation for aggressive pricing. Worried about the competitor, and unsure of the market size, Winter lowered the price of the W899 to $100. It maintained the price although, to Winter's surprise, the competitor announced a price of $130 for its product.

After reviewing the 2010 sales of the W899, Winter's management concluded that unit sales would have been the same if the product had been marketed at the original price of $130 each. Management has predicted that 2011 sales of the W899 would be either 85,000 units at $100 each or 60,000 units at $130 each. Winter has decided to raise the price of the disk drive to $130 effective immediately.

Having supported the higher price from the beginning, Sharon Daley, Winter's marketing director, believes that the opportunity cost of selling the W899 for $100 during 2010 should be reflected in the company's internal records and reports. In support of her recommendation, Daley explained that the company has booked these types of costs on other occasions when purchase discounts not taken for early payment have been recorded.

Required:

a. Define opportunity cost and explain why opportunity costs are not usually recorded.

b. Winter Company's management is considering Sharon Daley's recommendation to book the opportunity costs and have them reflected in its internal records and reports. If one were to record a nonzero opportunity cost, calculate the dollar amount of the opportunity cost that would be recorded by Winter Company for 2010 and explain how this cost might be reflected on its internal reports.

c. Explain the impact of Winter Company's selection of the $130 selling price for the W899 on 2011 operating income. Support your answer with appropriate calculations.

Source: CMA adapted

Winter Company is a medium-size manufacturer of disk drives that are sold to computer manufacturers. At the beginning of 2010, Winter began shipping a much-improved disk drive, Model W899. The W899 was an immediate success and accounted for $5 million in revenues for Winter in 2010.

While the W899 was in the development stage, Winter planned to price it at $130. In preliminary discussions with customers about the W899 design, no resistance was detected to suggestions that the price might be $130. The $130 price was considerably higher than the estimated variable cost of $70 per unit to produce the W899, and it would provide Winter with ample profits.

Shortly before setting the price of the W899, Winter discovered that a competitor was reading a product very similar to the W899 and was no more than 60 days behind Winter's own schedule. No information could be obtained on the competitor's planned price, although it had a reputation for aggressive pricing. Worried about the competitor, and unsure of the market size, Winter lowered the price of the W899 to $100. It maintained the price although, to Winter's surprise, the competitor announced a price of $130 for its product.

After reviewing the 2010 sales of the W899, Winter's management concluded that unit sales would have been the same if the product had been marketed at the original price of $130 each. Management has predicted that 2011 sales of the W899 would be either 85,000 units at $100 each or 60,000 units at $130 each. Winter has decided to raise the price of the disk drive to $130 effective immediately.

Having supported the higher price from the beginning, Sharon Daley, Winter's marketing director, believes that the opportunity cost of selling the W899 for $100 during 2010 should be reflected in the company's internal records and reports. In support of her recommendation, Daley explained that the company has booked these types of costs on other occasions when purchase discounts not taken for early payment have been recorded.

Required:

a. Define opportunity cost and explain why opportunity costs are not usually recorded.

b. Winter Company's management is considering Sharon Daley's recommendation to book the opportunity costs and have them reflected in its internal records and reports. If one were to record a nonzero opportunity cost, calculate the dollar amount of the opportunity cost that would be recorded by Winter Company for 2010 and explain how this cost might be reflected on its internal reports.

c. Explain the impact of Winter Company's selection of the $130 selling price for the W899 on 2011 operating income. Support your answer with appropriate calculations.

Source: CMA adapted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Fixed, Variable, and Average Costs

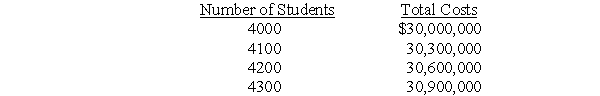

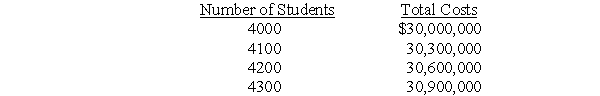

Midstate University is trying to decide whether to allow 100 more students into the university. Tuition is $5000 per year. The controller has determined the following schedule of costs to educate students: The current enrollment is 4200 students. The president of the university has calculated the cost per student in the following manner: $30,600,000/4200 students = $7286 per student. The president was wondering why the university should accept more students if the tuition is only $5000.

The current enrollment is 4200 students. The president of the university has calculated the cost per student in the following manner: $30,600,000/4200 students = $7286 per student. The president was wondering why the university should accept more students if the tuition is only $5000.

Required:

a. What is wrong with the president's calculation?

b. What are the fixed and variable costs of operating the university?

Midstate University is trying to decide whether to allow 100 more students into the university. Tuition is $5000 per year. The controller has determined the following schedule of costs to educate students:

The current enrollment is 4200 students. The president of the university has calculated the cost per student in the following manner: $30,600,000/4200 students = $7286 per student. The president was wondering why the university should accept more students if the tuition is only $5000.

The current enrollment is 4200 students. The president of the university has calculated the cost per student in the following manner: $30,600,000/4200 students = $7286 per student. The president was wondering why the university should accept more students if the tuition is only $5000.Required:

a. What is wrong with the president's calculation?

b. What are the fixed and variable costs of operating the university?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

ROI and Residual Income

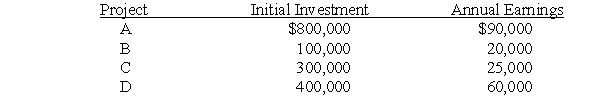

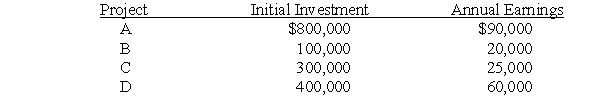

The following investment opportunities are available to an investment center manager: Required:

Required:

a. If the investment manager is currently making a return on investment of 16 percent, which project(s) would the manager want to pursue?

b. If the cost of capital is 10 percent and the annual earnings approximate cash flows excluding finance charges, which project(s) should be chosen?

c. Suppose only one project can be chosen and the annual earnings approximate cash flows excluding finance charges. Which project should be chosen?

The following investment opportunities are available to an investment center manager:

Required:

Required:a. If the investment manager is currently making a return on investment of 16 percent, which project(s) would the manager want to pursue?

b. If the cost of capital is 10 percent and the annual earnings approximate cash flows excluding finance charges, which project(s) should be chosen?

c. Suppose only one project can be chosen and the annual earnings approximate cash flows excluding finance charges. Which project should be chosen?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Cost, Volume, Profit Analysis

Leslie Mittelberg is considering the wholesaling of a leather handbag from Kenya. She must travel to Kenya to check on quality and transportation. The trip will cost $3000. The cost of the handbag is $10 and shipping to the United States can occur through the postal system for $2 per handbag or through a freight company which will ship a container that can hold up to a 1000 handbags at a cost of $1000. The freight company will charge $1000 even if less than 1000 handbags are shipped. Leslie will try to sell the handbags to retailers for $20. Assume there are no other costs and benefits.

Required:

a. What is the break-even point if shipping is through the postal system?

b. How many units must be sold if Leslie uses the freight company and she wants to have a profit of $1000?

c. At what output level would the two shipping methods yield the same profit?

d. Suppose a large discount store asks to buy an additional 1000 handbags beyond normal sales. Which shipping method should be used and what is the minimum sales price Leslie should consider in selling those 1000 handbags?

Leslie Mittelberg is considering the wholesaling of a leather handbag from Kenya. She must travel to Kenya to check on quality and transportation. The trip will cost $3000. The cost of the handbag is $10 and shipping to the United States can occur through the postal system for $2 per handbag or through a freight company which will ship a container that can hold up to a 1000 handbags at a cost of $1000. The freight company will charge $1000 even if less than 1000 handbags are shipped. Leslie will try to sell the handbags to retailers for $20. Assume there are no other costs and benefits.

Required:

a. What is the break-even point if shipping is through the postal system?

b. How many units must be sold if Leslie uses the freight company and she wants to have a profit of $1000?

c. At what output level would the two shipping methods yield the same profit?

d. Suppose a large discount store asks to buy an additional 1000 handbags beyond normal sales. Which shipping method should be used and what is the minimum sales price Leslie should consider in selling those 1000 handbags?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

Flexible Budgets

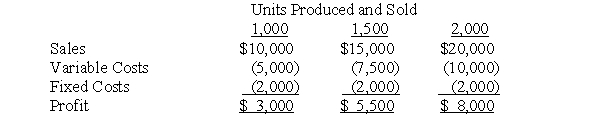

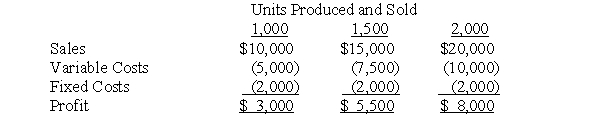

A chair manufacturer has established the following flexible budget for the month. Required:

Required:

a. What is the sales price per chair?

b. What is the expected profit if 1,600 chairs are made?

A chair manufacturer has established the following flexible budget for the month.

Required:

Required:a. What is the sales price per chair?

b. What is the expected profit if 1,600 chairs are made?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

Responsibility Centers

The Maple Way Golf Course is a private club that is owned by the members. It has the following managers and organizational structure:

Eric Olson: General manager responsible for all the operations of the golf course and other facilities (swimming pool, restaurant, golf shop).

Jennifer Jones: Manager of the golf course and responsible for its maintenance.

Edwin Moses: Manager of the restaurant.

Mabel Smith: Head golf professional and responsible for golf lessons, the golf shop, and reserving times for starting golfers on the course.

Wanda Itami: Manager of the swimming pool and family recreational activities.

Jake Reece: Manager of golf carts rented to golfers.

Describe each of the managers in terms of being responsible for a cost, profit, or investment center and possible performance measures for each manager.

The Maple Way Golf Course is a private club that is owned by the members. It has the following managers and organizational structure:

Eric Olson: General manager responsible for all the operations of the golf course and other facilities (swimming pool, restaurant, golf shop).

Jennifer Jones: Manager of the golf course and responsible for its maintenance.

Edwin Moses: Manager of the restaurant.

Mabel Smith: Head golf professional and responsible for golf lessons, the golf shop, and reserving times for starting golfers on the course.

Wanda Itami: Manager of the swimming pool and family recreational activities.

Jake Reece: Manager of golf carts rented to golfers.

Describe each of the managers in terms of being responsible for a cost, profit, or investment center and possible performance measures for each manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

Transfer Prices and Divisional Profit

A chair manufacturer has two divisions: framing and upholstering. The framing costs are $100 per chair and the upholstering costs are $200 per chair. The company makes 5,000 chairs each year, which are sold for $500.

Required:

a. What is the profit of each division if the transfer price is $150?

b. What is the profit of each division if the transfer price is $200?

A chair manufacturer has two divisions: framing and upholstering. The framing costs are $100 per chair and the upholstering costs are $200 per chair. The company makes 5,000 chairs each year, which are sold for $500.

Required:

a. What is the profit of each division if the transfer price is $150?

b. What is the profit of each division if the transfer price is $200?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

Job Cost Flows

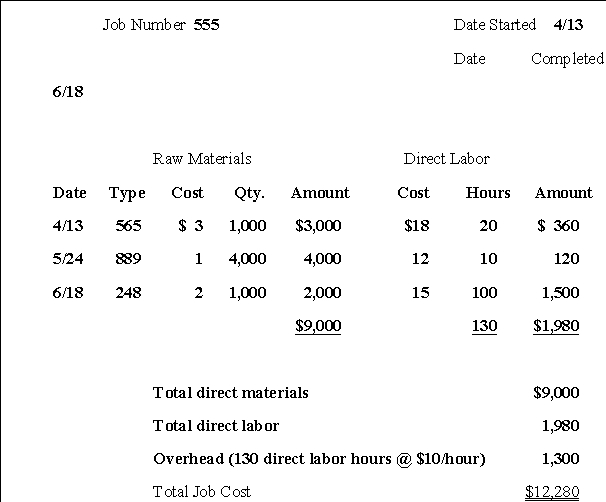

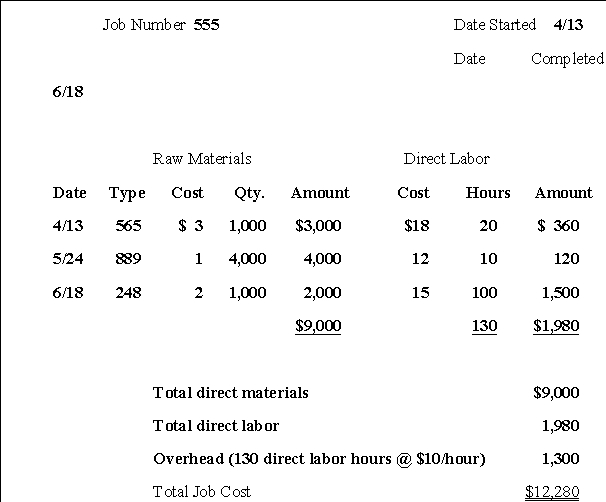

The job cost sheet for 1,000 units of toy trucks is: All of the materials for the job were purchased on 4/10. The batch of 1,000 toy trucks is sold on 7/10.

All of the materials for the job were purchased on 4/10. The batch of 1,000 toy trucks is sold on 7/10.

What are the costs of this job order in the raw materials account, the work-in-process account, the finished goods account, and the cost of goods account on 4/30, 5/31, 6/30 and 7/31?

The job cost sheet for 1,000 units of toy trucks is:

All of the materials for the job were purchased on 4/10. The batch of 1,000 toy trucks is sold on 7/10.

All of the materials for the job were purchased on 4/10. The batch of 1,000 toy trucks is sold on 7/10.What are the costs of this job order in the raw materials account, the work-in-process account, the finished goods account, and the cost of goods account on 4/30, 5/31, 6/30 and 7/31?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

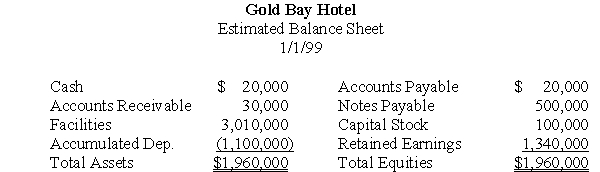

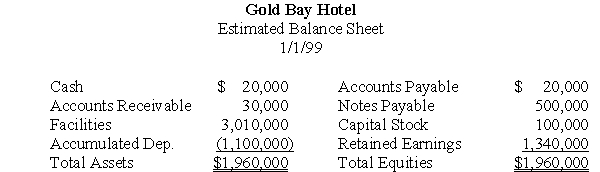

Pro-Forma Financial Statements

The Gold Bay Hotel is in the process of developing a master budget and pro-forma financial statements for 1999. The beginning balance sheet for the fiscal year 1999 is estimated to be: During the year the hotel expects to rent 30,000 rooms. Rooms rent for an average of $90 per night. The hotel expects to sell 40,000 meals during the year at an average price of $20 per meal. The variable cost per room rented is $30 and the variable cost per meal is $8. The fixed costs not including depreciation is expected to be $2,000,000. Depreciation is expected to be $500,000. The hotel also expects to refurbish the kitchen at a cost of $200,000, which is capitalized (included in the facility account). Interest of the note payable is expected to be $50,000 and $100,000 of the note payable will be retired during the year. The ending accounts receivable amount is expected to be $40,000 and the ending accounts payable is expected to be $30,000.

During the year the hotel expects to rent 30,000 rooms. Rooms rent for an average of $90 per night. The hotel expects to sell 40,000 meals during the year at an average price of $20 per meal. The variable cost per room rented is $30 and the variable cost per meal is $8. The fixed costs not including depreciation is expected to be $2,000,000. Depreciation is expected to be $500,000. The hotel also expects to refurbish the kitchen at a cost of $200,000, which is capitalized (included in the facility account). Interest of the note payable is expected to be $50,000 and $100,000 of the note payable will be retired during the year. The ending accounts receivable amount is expected to be $40,000 and the ending accounts payable is expected to be $30,000.

Prepare pro-forma financial statements for the end of the year.

The Gold Bay Hotel is in the process of developing a master budget and pro-forma financial statements for 1999. The beginning balance sheet for the fiscal year 1999 is estimated to be:

During the year the hotel expects to rent 30,000 rooms. Rooms rent for an average of $90 per night. The hotel expects to sell 40,000 meals during the year at an average price of $20 per meal. The variable cost per room rented is $30 and the variable cost per meal is $8. The fixed costs not including depreciation is expected to be $2,000,000. Depreciation is expected to be $500,000. The hotel also expects to refurbish the kitchen at a cost of $200,000, which is capitalized (included in the facility account). Interest of the note payable is expected to be $50,000 and $100,000 of the note payable will be retired during the year. The ending accounts receivable amount is expected to be $40,000 and the ending accounts payable is expected to be $30,000.

During the year the hotel expects to rent 30,000 rooms. Rooms rent for an average of $90 per night. The hotel expects to sell 40,000 meals during the year at an average price of $20 per meal. The variable cost per room rented is $30 and the variable cost per meal is $8. The fixed costs not including depreciation is expected to be $2,000,000. Depreciation is expected to be $500,000. The hotel also expects to refurbish the kitchen at a cost of $200,000, which is capitalized (included in the facility account). Interest of the note payable is expected to be $50,000 and $100,000 of the note payable will be retired during the year. The ending accounts receivable amount is expected to be $40,000 and the ending accounts payable is expected to be $30,000.Prepare pro-forma financial statements for the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

Cost Allocation and Contingency Fees

A lawyer allocates overhead costs based on his hours working with different clients. The lawyer expects to have $200,000 in overhead during the year and expects to work on clients' cases 2,000 hours during the year. In addition he wants to pay himself $50 per hour for working with clients. The lawyer, however, does not bill all of his clients based on covering overhead costs and his own salary. Some clients pay her on contingency fees. If the lawyer works with a client on a contingency fee basis, the lawyer receives half of any settlement for his client. During the year the lawyer works 1,200 hours that are billable to clients. The remaining hours are worked on a contingency basis. The lawyer wins $300,000 in settlements for his clients of which he receives half. Actual overhead was $210,000,

What does the lawyer earn during the year after expenses?

A lawyer allocates overhead costs based on his hours working with different clients. The lawyer expects to have $200,000 in overhead during the year and expects to work on clients' cases 2,000 hours during the year. In addition he wants to pay himself $50 per hour for working with clients. The lawyer, however, does not bill all of his clients based on covering overhead costs and his own salary. Some clients pay her on contingency fees. If the lawyer works with a client on a contingency fee basis, the lawyer receives half of any settlement for his client. During the year the lawyer works 1,200 hours that are billable to clients. The remaining hours are worked on a contingency basis. The lawyer wins $300,000 in settlements for his clients of which he receives half. Actual overhead was $210,000,

What does the lawyer earn during the year after expenses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

Top-down versus Bottom-up Budgets

Describe (a) the benefits of top-down budgeting and (b) the benefits of bottom-up budgeting.

Describe (a) the benefits of top-down budgeting and (b) the benefits of bottom-up budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

Prorating Over/Underabsorbed Overhead

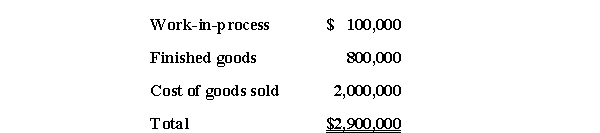

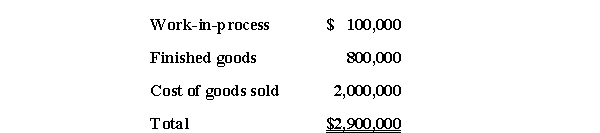

A computer manufacturer has the following account balances at the end of the year. These accounts contain $500,000 of allocated overhead. Actual overhead, however, is $600,000.

These accounts contain $500,000 of allocated overhead. Actual overhead, however, is $600,000.

What are the account balances after prorating the underabsorbed overhead?

A computer manufacturer has the following account balances at the end of the year.

These accounts contain $500,000 of allocated overhead. Actual overhead, however, is $600,000.

These accounts contain $500,000 of allocated overhead. Actual overhead, however, is $600,000.What are the account balances after prorating the underabsorbed overhead?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Fixed Costs and Allocated Costs

The maintenance department's costs are allocated to other departments based on the number of hours of maintenance use by each department. The maintenance department has fixed costs of $500,000 and variable costs of $30 per hour of maintenance provided. The variable costs include the salaries of the maintenance workers. More maintenance workers can be added if greater maintenance is demanded by the other departments without affecting the fixed costs of the maintenance department. The maintenance department expects to provide 10,000 hours of maintenance.

Required:

a. What is the application rate for the maintenance department?

b. What is the additional cost to the maintenance department of providing another hour of maintenance?

c. What problem exists if the managers of other departments can choose how much maintenance to be performed?

d. What problem exists if the other departments are allowed to go outside the organization to buy maintenance services?

The maintenance department's costs are allocated to other departments based on the number of hours of maintenance use by each department. The maintenance department has fixed costs of $500,000 and variable costs of $30 per hour of maintenance provided. The variable costs include the salaries of the maintenance workers. More maintenance workers can be added if greater maintenance is demanded by the other departments without affecting the fixed costs of the maintenance department. The maintenance department expects to provide 10,000 hours of maintenance.

Required:

a. What is the application rate for the maintenance department?

b. What is the additional cost to the maintenance department of providing another hour of maintenance?

c. What problem exists if the managers of other departments can choose how much maintenance to be performed?

d. What problem exists if the other departments are allowed to go outside the organization to buy maintenance services?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

Choosing Allocation Bases For Levying Taxes

The town of Seaside has decided to construct a new sea aquarium to attract tourist. The cost of the measure is to be paid by a special tax. although most of the townspeople believe the sea aquarium is a good idea, there is disagreement about how the tax should be levied.

Required:

Suggest three different methods of levying the tax and the advantages and disadvantages of each.

The town of Seaside has decided to construct a new sea aquarium to attract tourist. The cost of the measure is to be paid by a special tax. although most of the townspeople believe the sea aquarium is a good idea, there is disagreement about how the tax should be levied.

Required:

Suggest three different methods of levying the tax and the advantages and disadvantages of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Job Order Sheet

The Talbott Company has received an order (#324) for 100 widgets. On January 20 the shop supervisor requisitioned 100 units of part 503 at a cost of $5 per unit and 500 units part 456 at a cost of $3 per unit to begin work on the 100 widgets. On the same day 20 hours of direct labor at $20 per hour are used to work on the widgets. On January 21, 200 units of part 543 at $6 per unit are requisitioned and 10 hours of direct labor at $15 per hour are performed on the 100 units of widgets to complete the job. Overhead is allocated to the job based on $5 per direct labor hour.

Required:

Make a job order cost sheet for the 100 widgets.

The Talbott Company has received an order (#324) for 100 widgets. On January 20 the shop supervisor requisitioned 100 units of part 503 at a cost of $5 per unit and 500 units part 456 at a cost of $3 per unit to begin work on the 100 widgets. On the same day 20 hours of direct labor at $20 per hour are used to work on the widgets. On January 21, 200 units of part 543 at $6 per unit are requisitioned and 10 hours of direct labor at $15 per hour are performed on the 100 units of widgets to complete the job. Overhead is allocated to the job based on $5 per direct labor hour.

Required:

Make a job order cost sheet for the 100 widgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

Budgeting Direct Materials

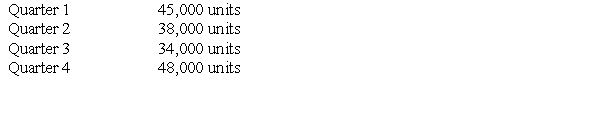

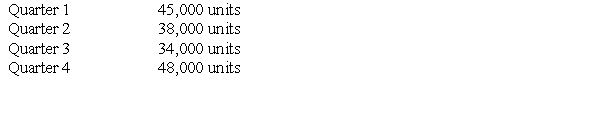

The Jung Corporation's budget calls for the following production: Each unit of production requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30 percent of that quarter's direct material requirements. Compute budgeted direct materials purchases for the third quarter.

Each unit of production requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30 percent of that quarter's direct material requirements. Compute budgeted direct materials purchases for the third quarter.

The Jung Corporation's budget calls for the following production:

Each unit of production requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30 percent of that quarter's direct material requirements. Compute budgeted direct materials purchases for the third quarter.

Each unit of production requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30 percent of that quarter's direct material requirements. Compute budgeted direct materials purchases for the third quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Transfer Pricing in the Presence of Divisional Interdependencies

Prior to 1997, PepsiCo, a major soft drink company, had a restaurant division consisting of Kentucky Fried Chicken, Taco Bell, and Pizza Hut. The only cola beverage these restaurants served was Pepsi. Assume that the major reason PepsiCo owned fast food restaurants is an attempt to increase its share of the cola market. Under this assumption, some Pizza Hut patrons who order a cola at the restaurant and are told they are drinking a Pepsi will switch and become Pepsi drinkers instead of Coke drinkers on other purchase occasions. However, studies have shown that some customers refuse to eat at restaurants unless they can get a Coke.

PepsiCo sells Pepsi Cola to non-PepsiCo restaurants at $0.53 per gallon. This is the market price of Pepsi-Cola. Pepsi-Cola's variable manufacturing cost is $0.09 per gallon and its total (fixed and variable) manufacturing cost is $0.22 per gallon. PepsiCo produces Pepsi-Cola in numerous plants located around the world. Plant capacity can be added in small increments (e.g., a half-million gallons per year). The cost of additional capacity is approximately equal to the fixed costs per gallon of $0.13.

Required:

What transfer price should be set for Pepsi transferred from the soft drink division of PepsiCo to a PepsiCo restaurant such as Taco Bell? Justify your answer.

Prior to 1997, PepsiCo, a major soft drink company, had a restaurant division consisting of Kentucky Fried Chicken, Taco Bell, and Pizza Hut. The only cola beverage these restaurants served was Pepsi. Assume that the major reason PepsiCo owned fast food restaurants is an attempt to increase its share of the cola market. Under this assumption, some Pizza Hut patrons who order a cola at the restaurant and are told they are drinking a Pepsi will switch and become Pepsi drinkers instead of Coke drinkers on other purchase occasions. However, studies have shown that some customers refuse to eat at restaurants unless they can get a Coke.

PepsiCo sells Pepsi Cola to non-PepsiCo restaurants at $0.53 per gallon. This is the market price of Pepsi-Cola. Pepsi-Cola's variable manufacturing cost is $0.09 per gallon and its total (fixed and variable) manufacturing cost is $0.22 per gallon. PepsiCo produces Pepsi-Cola in numerous plants located around the world. Plant capacity can be added in small increments (e.g., a half-million gallons per year). The cost of additional capacity is approximately equal to the fixed costs per gallon of $0.13.

Required:

What transfer price should be set for Pepsi transferred from the soft drink division of PepsiCo to a PepsiCo restaurant such as Taco Bell? Justify your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

Transfer Pricing in Universities

The Eastern University Business School teaches some undergraduate business courses for students in the Eastern University College of Arts and Science (CAS). The 6,000 undergraduates generate 2,000 undergraduate student course enrollments in business courses per year. The B-school and CAS are treated as profit centers in that their budgets contain student tuition revenues as well as costs. The deans have discretion to set tuition and salaries and determine hiring as long as they operate with no deficit (revenues = expenses). Undergraduate tuition is $12,000 per year and each student takes eight courses per year. Average undergraduate financial aid amounts to 20% of gross tuition. The current transfer price rule is gross tuition per course less average financial aid.

This transfer price rule gives net tuition to the B-school as a revenue and deducts an equal amount from the CAS budget. The CAS dean argues that the current system is grossly unfair. CAS must provide costly services for undergraduates to maintain a top-rated undergraduate program. For example, career counseling, academic advising, sports programs, and the admissions office are costs that must be incurred if undergraduates are to enroll at Eastern. Therefore, the CAS dean argues, the average cost of these services per undergraduate student course enrollment should be deducted from the tuition transfer price. These undergraduate student services total $9.6 million per year.

Required:

a. Calculate the current revenue the B-school is receiving from undergraduate business courses. What will it be if the CAS dean's proposal is adopted?

b. Discuss the pros and cons of the CAS dean's proposal.

c. As special assistant to the B-school dean, prepare a response to the proposed tuition transfer pricing scheme.

The Eastern University Business School teaches some undergraduate business courses for students in the Eastern University College of Arts and Science (CAS). The 6,000 undergraduates generate 2,000 undergraduate student course enrollments in business courses per year. The B-school and CAS are treated as profit centers in that their budgets contain student tuition revenues as well as costs. The deans have discretion to set tuition and salaries and determine hiring as long as they operate with no deficit (revenues = expenses). Undergraduate tuition is $12,000 per year and each student takes eight courses per year. Average undergraduate financial aid amounts to 20% of gross tuition. The current transfer price rule is gross tuition per course less average financial aid.

This transfer price rule gives net tuition to the B-school as a revenue and deducts an equal amount from the CAS budget. The CAS dean argues that the current system is grossly unfair. CAS must provide costly services for undergraduates to maintain a top-rated undergraduate program. For example, career counseling, academic advising, sports programs, and the admissions office are costs that must be incurred if undergraduates are to enroll at Eastern. Therefore, the CAS dean argues, the average cost of these services per undergraduate student course enrollment should be deducted from the tuition transfer price. These undergraduate student services total $9.6 million per year.

Required:

a. Calculate the current revenue the B-school is receiving from undergraduate business courses. What will it be if the CAS dean's proposal is adopted?

b. Discuss the pros and cons of the CAS dean's proposal.

c. As special assistant to the B-school dean, prepare a response to the proposed tuition transfer pricing scheme.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

Transfer Prices and Capacity

Jefferson Company has two divisions: Jefferson Bottles and Jefferson Juice. Jefferson Bottles makes glass containers, which it sells to Jefferson Juice and other companies. Jefferson Bottles has a capacity of 10 million bottles a year. Jefferson Juice currently has a capacity of 3 million bottles of juice per year. Jefferson Bottles has a fixed cost of $100,000 per year and a variable cost of $0.01/bottle. Jefferson Bottles can currently sell all of its output at $0.03/bottle.

Required:

a. What should Jefferson Bottles charge Jefferson Juice for bottles so that both divisions will make appropriate decentralized planning decisions?

b. If Jefferson Bottles can only sell 5 million bottles to outside buyers, what should Jefferson Bottles charge Jefferson Juice for bottles so that both divisions will make appropriate decentralized planning decisions?

Jefferson Company has two divisions: Jefferson Bottles and Jefferson Juice. Jefferson Bottles makes glass containers, which it sells to Jefferson Juice and other companies. Jefferson Bottles has a capacity of 10 million bottles a year. Jefferson Juice currently has a capacity of 3 million bottles of juice per year. Jefferson Bottles has a fixed cost of $100,000 per year and a variable cost of $0.01/bottle. Jefferson Bottles can currently sell all of its output at $0.03/bottle.

Required:

a. What should Jefferson Bottles charge Jefferson Juice for bottles so that both divisions will make appropriate decentralized planning decisions?

b. If Jefferson Bottles can only sell 5 million bottles to outside buyers, what should Jefferson Bottles charge Jefferson Juice for bottles so that both divisions will make appropriate decentralized planning decisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Estimating Production Costs

The Fancy Umbrella Company makes beach umbrellas. The production process requires 3 square meters of plastic sheeting and a metal pole. The plastic sheeting costs $0.50 per square meter and each metal pole costs $1.00. At the beginning of the month, the company has 5,000 square feet of plastic and 1,000 poles in raw materials inventory. The preferred raw material amount at the end of the month is 3,000 square feet of plastic sheeting and 600 poles. The company has 300 finished umbrellas in inventory at the beginning of the month and plans to have 200 finished umbrellas at the end of the month. Sales in the coming month are expected to be 5,000 umbrellas.

Required:

a. How many umbrellas must the company produce to meet demand and have sufficient ending inventory?

b. What is the cost of materials that must be purchased?

The Fancy Umbrella Company makes beach umbrellas. The production process requires 3 square meters of plastic sheeting and a metal pole. The plastic sheeting costs $0.50 per square meter and each metal pole costs $1.00. At the beginning of the month, the company has 5,000 square feet of plastic and 1,000 poles in raw materials inventory. The preferred raw material amount at the end of the month is 3,000 square feet of plastic sheeting and 600 poles. The company has 300 finished umbrellas in inventory at the beginning of the month and plans to have 200 finished umbrellas at the end of the month. Sales in the coming month are expected to be 5,000 umbrellas.

Required:

a. How many umbrellas must the company produce to meet demand and have sufficient ending inventory?

b. What is the cost of materials that must be purchased?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Performance Measures for Cost Centers

A soft drink company has three bottling plants throughout the country. Bottling occurs at the regional level because of the high cost of transporting bottled soft drinks. The parent company supplies each plant with the syrup. The bottling plants combine the syrup with carbonated soda to make and bottle the soft drinks. The bottled soft drinks are then sent to regional grocery stores.

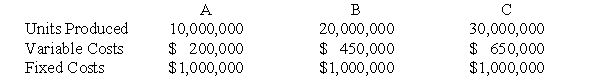

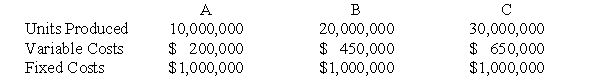

The bottling plants are treated as costs centers. The managers of the bottling plants are evaluated based on minimizing the cost per soft drink bottled and delivered. Each bottling plant uses the same equipment, but some produce more bottles of soft drinks because of different demand. The costs and output for each bottling plant are: Required:

Required: