Deck 20: International Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/144

العب

ملء الشاشة (f)

Deck 20: International Finance

1

In-kind transfers

A) Are a payment for work.

B) Increase the poverty index.

C) Are one way to reduce the moral hazards of the welfare system.

D) Provide the direct transfer of goods and services.

A) Are a payment for work.

B) Increase the poverty index.

C) Are one way to reduce the moral hazards of the welfare system.

D) Provide the direct transfer of goods and services.

D

2

Which of the following programs is the largest federal income transfer program?

A) Welfare.

B) Social Security.

C) Unemployment compensation.

D) Food stamps.

A) Welfare.

B) Social Security.

C) Unemployment compensation.

D) Food stamps.

B

3

The percentage of income transfers that go to the intended recipients and purposes refers to the

A) Target welfare population.

B) Target efficiency.

C) Efficiency coefficient.

D) Market efficiency.

A) Target welfare population.

B) Target efficiency.

C) Efficiency coefficient.

D) Market efficiency.

B

4

Transfer payments include all of the following except

A) Government-subsidized loans for students.

B) Federal crop assistance for farmers.

C) A church-run thrift store for the poor.

D) Social Security benefits for retirees.

A) Government-subsidized loans for students.

B) Federal crop assistance for farmers.

C) A church-run thrift store for the poor.

D) Social Security benefits for retirees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

5

Transfer payments are

A) Payments to individuals for which no current goods or services are exchanged.

B) Government tax receipts.

C) Government expenditures on goods and services.

D) Social Security taxes paid by employers.

A) Payments to individuals for which no current goods or services are exchanged.

B) Government tax receipts.

C) Government expenditures on goods and services.

D) Social Security taxes paid by employers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following programs is likely to have low target efficiency?

A) An insurance card that allows the elderly to obtain health care.

B) A cash payment directly to the landlord to offset the cost of housing for certain individuals.

C) Food stamps that can only be used for food.

D) A cash payment that the recipient is encouraged to use for housing.

A) An insurance card that allows the elderly to obtain health care.

B) A cash payment directly to the landlord to offset the cost of housing for certain individuals.

C) Food stamps that can only be used for food.

D) A cash payment that the recipient is encouraged to use for housing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is an example of an in-kind transfer?

A) Income transfers.

B) TANF.

C) Medicaid.

D) Social Security.

A) Income transfers.

B) TANF.

C) Medicaid.

D) Social Security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following student aid programs is likely to have the highest target efficiency?

A) Direct payment of tuition to the university.

B) Direct cash payments to the student.

C) Low-interest loans.

D) Job opportunities for students.

A) Direct payment of tuition to the university.

B) Direct cash payments to the student.

C) Low-interest loans.

D) Job opportunities for students.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

9

Means-tested income transfer programs are referred to as

A) In-kind transfer programs.

B) Welfare programs.

C) Cash transfer programs.

D) Social insurance programs.

A) In-kind transfer programs.

B) Welfare programs.

C) Cash transfer programs.

D) Social insurance programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

10

Social Security benefits paid by the federal government

A) Are income transfers financed by taxes on workers and employers.

B) Are classified as in-kind benefits.

C) Have no effect on the decision of for whom output is to be produced.

D) Are not a transfer program because people must contribute to the fund in order to receive benefits.

A) Are income transfers financed by taxes on workers and employers.

B) Are classified as in-kind benefits.

C) Have no effect on the decision of for whom output is to be produced.

D) Are not a transfer program because people must contribute to the fund in order to receive benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

11

To be eligible for a welfare program, the recipient must

A) Be elderly.

B) Be poor.

C) Be in need of medical care.

D) Have contributed to the fund.

A) Be elderly.

B) Be poor.

C) Be in need of medical care.

D) Have contributed to the fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is most likely to occur if Medicare is converted from an in-kind transfer program to a cash transfer program?

A) A more equitable distribution of health care.

B) Increased target efficiency.

C) Increased poverty.

D) A reduction in health care for the elderly.

A) A more equitable distribution of health care.

B) Increased target efficiency.

C) Increased poverty.

D) A reduction in health care for the elderly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following programs is the second-largest federal income transfer program?

A) Medicare.

B) Social Security.

C) Unemployment compensation.

D) Medicaid.

A) Medicare.

B) Social Security.

C) Unemployment compensation.

D) Medicaid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is not an example of in-kind income?

A) Food stamps.

B) Unemployment benefits.

C) Housing assistance.

D) Subsidized school lunches.

A) Food stamps.

B) Unemployment benefits.

C) Housing assistance.

D) Subsidized school lunches.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is a goal of an in-kind transfer program but not a cash transfer program?

A) To change the market's answer to the FOR WHOM question.

B) To address the issue of inequity.

C) To ensure that recipients get the type of aid intended.

D) To change the market's answer to the HOW question.

A) To change the market's answer to the FOR WHOM question.

B) To address the issue of inequity.

C) To ensure that recipients get the type of aid intended.

D) To change the market's answer to the HOW question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

16

In-kind transfers

A) Are received as cash.

B) Are more target-efficient than cash.

C) Encourage the poor to earn more income.

D) Decrease the real income of poor families.

A) Are received as cash.

B) Are more target-efficient than cash.

C) Encourage the poor to earn more income.

D) Decrease the real income of poor families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

17

In-kind transfers are

A) The transfer of goods and services, instead of income, to those in need.

B) Paid to individuals in a form that gives them the maximum flexibility to buy what they need.

C) A means to allow the poor to make financial transactions between private providers of their own choosing.

D) Programs for job relocation and training of poor people who wish to work in other geographic areas.

A) The transfer of goods and services, instead of income, to those in need.

B) Paid to individuals in a form that gives them the maximum flexibility to buy what they need.

C) A means to allow the poor to make financial transactions between private providers of their own choosing.

D) Programs for job relocation and training of poor people who wish to work in other geographic areas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

18

Social Security is an example of

A) An in-kind transfer program.

B) A cash transfer program.

C) A welfare program.

D) Neither a transfer nor welfare program since individuals must contribute to the fund.

A) An in-kind transfer program.

B) A cash transfer program.

C) A welfare program.

D) Neither a transfer nor welfare program since individuals must contribute to the fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

19

Income transfers that entail direct payments to recipients, such as unemployment benefits, are known as

A) In-kind transfers.

B) Money transfers.

C) Cash transfers.

D) Dollar transfers.

A) In-kind transfers.

B) Money transfers.

C) Cash transfers.

D) Dollar transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

20

When a program is means-tested, it means that

A) To be eligible, the recipient must be poor.

B) It is a social insurance program.

C) It is an in-kind program.

D) The target efficiency is high.

A) To be eligible, the recipient must be poor.

B) It is a social insurance program.

C) It is an in-kind program.

D) The target efficiency is high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

21

A market failure exists when an imperfection in

A) Federal government policies prevents an optimal outcome.

B) Welfare programs prevents an optimal outcome.

C) The market mechanism prevents an optimal outcome.

D) State government policies prevents an optimal outcome.

A) Federal government policies prevents an optimal outcome.

B) Welfare programs prevents an optimal outcome.

C) The market mechanism prevents an optimal outcome.

D) State government policies prevents an optimal outcome.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

22

The shortfall between actual income and the poverty threshold is the

A) Welfare gap.

B) Poverty gap.

C) Target efficiency.

D) Moral hazard.

A) Welfare gap.

B) Poverty gap.

C) Target efficiency.

D) Moral hazard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

23

Social insurance programs

A) Are event-conditional.

B) Involve an income eligibility test.

C) Are a type of welfare program.

D) Are means-tested.

A) Are event-conditional.

B) Involve an income eligibility test.

C) Are a type of welfare program.

D) Are means-tested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

24

Welfare programs differ from social insurance programs in that welfare programs

A) Are event-based.

B) Are available only to people who do not work.

C) Offer benefits only to the needy.

D) Have low target efficiency.

A) Are event-based.

B) Are available only to people who do not work.

C) Offer benefits only to the needy.

D) Have low target efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is a welfare program?

A) Food stamps.

B) Social Security.

C) Medicare.

D) Disaster relief.

A) Food stamps.

B) Social Security.

C) Medicare.

D) Disaster relief.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

26

The existence of income transfer programs can

A) Decrease the birth rate.

B) Increase the wage rate as the labor supply decreases.

C) Decrease the wage rate as labor supply increases.

D) Encourage workers to enter the labor force more quickly.

A) Decrease the birth rate.

B) Increase the wage rate as the labor supply decreases.

C) Decrease the wage rate as labor supply increases.

D) Encourage workers to enter the labor force more quickly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

27

Medicaid and food stamps are received by

A) Anyone that applies.

B) Only the elderly.

C) Only the poor.

D) Mostly upper-income households in the United States due to inequities in the system.

A) Anyone that applies.

B) Only the elderly.

C) Only the poor.

D) Mostly upper-income households in the United States due to inequities in the system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

28

Social insurance programs are

A) Event-conditional.

B) Means-tested.

C) Available only to those at least 65 years old.

D) Considered a welfare program.

A) Event-conditional.

B) Means-tested.

C) Available only to those at least 65 years old.

D) Considered a welfare program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

29

A goal of income transfer programs is to do all of the following except

A) Alter the distribution of income.

B) Reduce income inequalities.

C) Change the mix of output.

D) Change how output is produced.

A) Alter the distribution of income.

B) Reduce income inequalities.

C) Change the mix of output.

D) Change how output is produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

30

The existence of income transfer programs is likely to

A) Result in recipients having fewer children.

B) Change the distribution of income but not the mix of output.

C) Decrease the supply of labor.

D) Discourage people from overusing health care services.

A) Result in recipients having fewer children.

B) Change the distribution of income but not the mix of output.

C) Decrease the supply of labor.

D) Discourage people from overusing health care services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

31

The existence of transfer programs implies that

A) Government failure has occurred.

B) Market failure has occurred.

C) Technical efficiency exists.

D) Allocative efficiency exists.

A) Government failure has occurred.

B) Market failure has occurred.

C) Technical efficiency exists.

D) Allocative efficiency exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

32

The poverty gap is the

A) Shortfall between a household's actual income and the poverty threshold.

B) Percentage of families under the poverty level.

C) Difference between the income of a household in poverty and the average income.

D) Difference between the incomes of the richest and poorest households.

A) Shortfall between a household's actual income and the poverty threshold.

B) Percentage of families under the poverty level.

C) Difference between the income of a household in poverty and the average income.

D) Difference between the incomes of the richest and poorest households.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

33

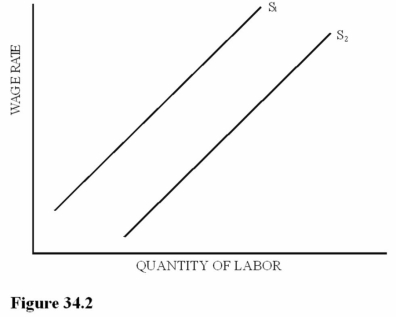

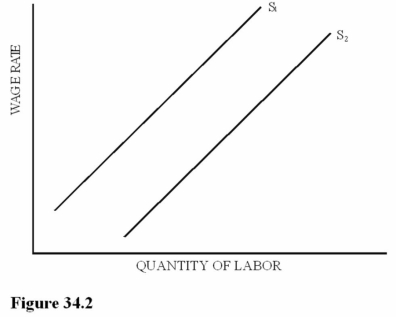

Figure 34.2 illustrates two labor supply curves. If in-kind payments become less available in this economy and marginal tax rates decrease significantly, we would expect a shift from

Figure 34.2 illustrates two labor supply curves. If in-kind payments become less available in this economy and marginal tax rates decrease significantly, we would expect a shift fromA) S1 to S2 only.

B) S1 to S2 and a movement up S2.

C) S2 to S1 only.

D) S2 to S1 and a movement up S1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

34

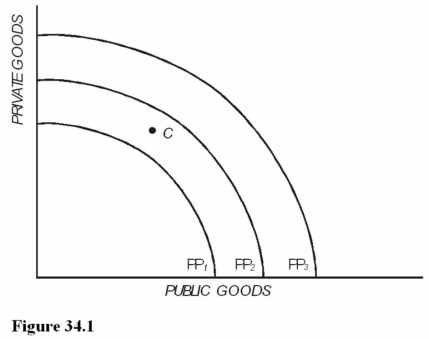

Refer to Figure 34.1. Suppose the production possibilities curve PP2 represents the goods and services produced in the U.S. economy. If welfare discourages people from seeking work, and laws change so that more people receive welfare benefits, the most likely result would be

Refer to Figure 34.1. Suppose the production possibilities curve PP2 represents the goods and services produced in the U.S. economy. If welfare discourages people from seeking work, and laws change so that more people receive welfare benefits, the most likely result would beA) A movement from point C to point PP2.

B) A shift from PP2 to PP1.

C) A shift from PP2 to PP3.

D) No change from PP2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

35

Refer to Figure 34.1. Suppose the production possibilities curve PP2 represents the U.S. economy and point C represents the combination of goods and services currently being produced. If welfare discourages people from seeking work, the most likely result of eliminating welfare in the United States would be C. By eliminating disincentives to work, the economy could encourage greater efficiency, leading to a movement from point C to a point along the production possibilities curve.

Refer to Figure 34.1. Suppose the production possibilities curve PP2 represents the U.S. economy and point C represents the combination of goods and services currently being produced. If welfare discourages people from seeking work, the most likely result of eliminating welfare in the United States would be C. By eliminating disincentives to work, the economy could encourage greater efficiency, leading to a movement from point C to a point along the production possibilities curve.A) A movement from point C to a point on PP2.

B) A shift from PP2 to PP1.

C) A shift from PP2 to PP3.

D) No change from PP2 or point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

36

The existence of income transfer programs can

A) Increase the work incentive and increase GDP.

B) Increase the work incentive and increase total income.

C) Decrease the incentive to work, but still increase GDP.

D) Decrease the incentive to work and reduce income and output.

A) Increase the work incentive and increase GDP.

B) Increase the work incentive and increase total income.

C) Decrease the incentive to work, but still increase GDP.

D) Decrease the incentive to work and reduce income and output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

37

Figure 34.2 illustrates two labor supply curves. If in-kind payments become readily available in this economy and marginal tax rates increase significantly, we would expect a shift from

Figure 34.2 illustrates two labor supply curves. If in-kind payments become readily available in this economy and marginal tax rates increase significantly, we would expect a shift fromA) S1 to S2 only.

B) S2 to S1 and a movement up S1.

C) S2 to S1 only.

D) S2 to S1 and a movement down S1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is least likely to be the case?

A) Food stamps encourage the production of more food.

B) Housing subsidies encourage the production of additional housing.

C) Medicare changes the mix of output away from medical services.

D) Student loans change the mix of output in favor of educational services.

A) Food stamps encourage the production of more food.

B) Housing subsidies encourage the production of additional housing.

C) Medicare changes the mix of output away from medical services.

D) Student loans change the mix of output in favor of educational services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

39

In 2011, the largest U.S. in-kind transfer program was

A) Medicare.

B) Food stamps.

C) Unemployment insurance.

D) Housing aid.

A) Medicare.

B) Food stamps.

C) Unemployment insurance.

D) Housing aid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

40

Welfare benefits reduce the need to work and result in a shift in the

A) Labor supply curve to the left.

B) Labor supply curve to the right.

C) Labor demand curve to the left.

D) Labor demand curve to the right.

A) Labor supply curve to the left.

B) Labor supply curve to the right.

C) Labor demand curve to the left.

D) Labor demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.4 [Wages - (Work expenses + Child care costs)]

Suppose Shanika works 2,000 hours per year at a wage of $6 per hour, has child care expenses of $3,000 per year, and has work expenses of $900. If the state maximum welfare benefit is $11,000 per year, based on the welfare formula given, Shanika's welfare benefit will be

A) $2,900.

B) $8,100.

C) $7,760.

D) Zero because her income exceeds the limit.

Suppose Shanika works 2,000 hours per year at a wage of $6 per hour, has child care expenses of $3,000 per year, and has work expenses of $900. If the state maximum welfare benefit is $11,000 per year, based on the welfare formula given, Shanika's welfare benefit will be

A) $2,900.

B) $8,100.

C) $7,760.

D) Zero because her income exceeds the limit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

42

Welfare support creates a moral hazard by

A) Reducing the need to work.

B) Encouraging workfare.

C) Encouraging individuals to help themselves.

D) Solving the equity and efficiency conflict.

A) Reducing the need to work.

B) Encouraging workfare.

C) Encouraging individuals to help themselves.

D) Solving the equity and efficiency conflict.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

43

Moral hazard is

A) The risk involved in accepting welfare.

B) An incentive to engage in undesirable behavior.

C) The involvement in illegal activity.

D) The abuse of the welfare system by some nonneedy recipients.

A) The risk involved in accepting welfare.

B) An incentive to engage in undesirable behavior.

C) The involvement in illegal activity.

D) The abuse of the welfare system by some nonneedy recipients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.7 [Wages - (Work expenses + Child care costs)]

Suppose Ramirez works 1,800 hours per year at a wage of $7 per hour, has no child care expenses, and has work expenses of $600. If the state maximum welfare benefit is $13,000 per year, based on the welfare formula given, Ramirez's welfare benefit will be

A) Zero because his income has exceeded the limit.

B) $400.

C) $1,000.

D) $4,600.

Suppose Ramirez works 1,800 hours per year at a wage of $7 per hour, has no child care expenses, and has work expenses of $600. If the state maximum welfare benefit is $13,000 per year, based on the welfare formula given, Ramirez's welfare benefit will be

A) Zero because his income has exceeded the limit.

B) $400.

C) $1,000.

D) $4,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.4 [Wages - (Work expenses + Child care costs)]

Based on the information given, the marginal tax rate is

A) Zero percent.

B) 40 percent.

C) 60 percent.

D) 100 percent.

Based on the information given, the marginal tax rate is

A) Zero percent.

B) 40 percent.

C) 60 percent.

D) 100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.7 [Wages - (Work expenses + Child care costs)]

Suppose Carter works 1,200 hours per year at a wage of $6 per hour, has child care expenses of $2,200 per year, and has work expenses of $800. If the state maximum welfare benefit is $12,000 per year, based on the welfare formula given, Carter's welfare benefit will be

A) $3,000.

B) $10,200.

C) $9,060.

D) $12,000.

Suppose Carter works 1,200 hours per year at a wage of $6 per hour, has child care expenses of $2,200 per year, and has work expenses of $800. If the state maximum welfare benefit is $12,000 per year, based on the welfare formula given, Carter's welfare benefit will be

A) $3,000.

B) $10,200.

C) $9,060.

D) $12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

47

Higher marginal tax rates for welfare programs will

A) Increase total welfare costs.

B) Decrease the incentive to work.

C) Increase the number of people eligible for welfare.

D) Decrease the moral hazard associated with welfare.

A) Increase total welfare costs.

B) Decrease the incentive to work.

C) Increase the number of people eligible for welfare.

D) Decrease the moral hazard associated with welfare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.7 [Wages - (Work expenses + Child care costs)]

Based on the information given, the marginal tax rate is

A) Zero percent.

B) 30 percent.

C) 70 percent.

D) 100 percent.

Based on the information given, the marginal tax rate is

A) Zero percent.

B) 30 percent.

C) 70 percent.

D) 100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

49

If welfare benefits equal the poverty gap for each household in poverty, then the

A) Effective marginal tax rate for welfare recipients is 100 percent.

B) Poor have a strong incentive to begin working.

C) The poverty gap will become greater.

D) Production possibilities curve will shift to the right.

A) Effective marginal tax rate for welfare recipients is 100 percent.

B) Poor have a strong incentive to begin working.

C) The poverty gap will become greater.

D) Production possibilities curve will shift to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

50

If welfare benefits equal the poverty gap for each household in poverty, then

A) The effective marginal tax rate for welfare recipients is 50 percent.

B) Every dollar of wages results in a lost dollar of welfare benefits.

C) Total output for the economy will increase.

D) People who are classified as poor will have a strong incentive to work.

A) The effective marginal tax rate for welfare recipients is 50 percent.

B) Every dollar of wages results in a lost dollar of welfare benefits.

C) Total output for the economy will increase.

D) People who are classified as poor will have a strong incentive to work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

51

If welfare benefits equaled the poverty gap for each household in poverty, then

A) Work effort would increase.

B) Production possibilities would expand.

C) Poverty would be eliminated.

D) The mix of output would not change.

A) Work effort would increase.

B) Production possibilities would expand.

C) Poverty would be eliminated.

D) The mix of output would not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

52

A lower marginal tax rate for welfare recipients will

A) Decrease work incentives.

B) Reduce the possibility of moral hazard.

C) Increase the poverty gap.

D) Reduce total welfare expenditures.

A) Decrease work incentives.

B) Reduce the possibility of moral hazard.

C) Increase the poverty gap.

D) Reduce total welfare expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is used to determine if a family is in poverty?

A) The level of education attained.

B) The level of current income.

C) The medical needs of the family.

D) The work ethic of the family.

A) The level of education attained.

B) The level of current income.

C) The medical needs of the family.

D) The work ethic of the family.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

54

The official poverty index is based on

A) Family size and income.

B) In-kind income.

C) An event condition.

D) The number in the family who are employed.

A) Family size and income.

B) In-kind income.

C) An event condition.

D) The number in the family who are employed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - Wages

Suppose Parker works 2,000 hours per year at a wage of $12 per hour. If the state maximum welfare benefit is $14,000 per year, based on the welfare formula given, Parker's welfare benefit will be

A) Zero.

B) $7,000.

C) $14,000.

D) $28,000.

Suppose Parker works 2,000 hours per year at a wage of $12 per hour. If the state maximum welfare benefit is $14,000 per year, based on the welfare formula given, Parker's welfare benefit will be

A) Zero.

B) $7,000.

C) $14,000.

D) $28,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.4 [Wages - (Work expenses + Child care costs)]

Suppose Emily works 1,800 hours per year at a wage of $8 per hour, has child care expenses of $4,000 per year, and has work expenses of $1,000. If the state maximum welfare benefit is $12,000 per year, based on the welfare formula given, Emily's welfare benefit will be

A) $8,240.

B) $2,600.

C) $3,760.

D) Zero because her income exceeds the limit.

Suppose Emily works 1,800 hours per year at a wage of $8 per hour, has child care expenses of $4,000 per year, and has work expenses of $1,000. If the state maximum welfare benefit is $12,000 per year, based on the welfare formula given, Emily's welfare benefit will be

A) $8,240.

B) $2,600.

C) $3,760.

D) Zero because her income exceeds the limit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - 0.7 [Wages - (Work expenses + Child care costs)]

Suppose Miller works 2,000 hours per year at a wage of $8 per hour, has child care expenses of $3,000 per year, and has work expenses of $2,000. If the state maximum welfare benefit is $10,000 per year, based on the welfare formula given, Miller's welfare benefit will be

A) Zero because his income has exceeded the limit.

B) $2,300.

C) $10,000.

D) $14,400.

Suppose Miller works 2,000 hours per year at a wage of $8 per hour, has child care expenses of $3,000 per year, and has work expenses of $2,000. If the state maximum welfare benefit is $10,000 per year, based on the welfare formula given, Miller's welfare benefit will be

A) Zero because his income has exceeded the limit.

B) $2,300.

C) $10,000.

D) $14,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

58

Lower marginal tax rates for welfare programs will

A) Decrease the incentive to work.

B) Decrease total welfare costs.

C) Make more people eligible for welfare.

D) Increase the moral hazard associated with welfare.

A) Decrease the incentive to work.

B) Decrease total welfare costs.

C) Make more people eligible for welfare.

D) Increase the moral hazard associated with welfare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - Wages

Based on the information given, the marginal tax rate is

A) Zero percent.

B) 33 percent.

C) 67 percent.

D) 100 percent.

Based on the information given, the marginal tax rate is

A) Zero percent.

B) 33 percent.

C) 67 percent.

D) 100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the following formula to answer the indicated question: Welfare benefit = Maximum benefit - Wages

A welfare system based on the welfare formula given

A) Will increase the risk of moral hazard.

B) Will increase work incentives.

C) Will increase the number of people eligible for welfare.

D) Has an effective marginal tax rate of 50 percent for welfare recipients.

A welfare system based on the welfare formula given

A) Will increase the risk of moral hazard.

B) Will increase work incentives.

C) Will increase the number of people eligible for welfare.

D) Has an effective marginal tax rate of 50 percent for welfare recipients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

61

Welfare costs can be reduced by

A) Decreasing the breakeven level of income.

B) Reducing the marginal tax rate.

C) Increasing earnings disregards.

D) Decreasing the tax elasticity of labor supply.

A) Decreasing the breakeven level of income.

B) Reducing the marginal tax rate.

C) Increasing earnings disregards.

D) Decreasing the tax elasticity of labor supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements concerning lower marginal tax rates is correct?

A) They encourage work effort and make more people eligible for welfare benefits.

B) They discourage work effort and make more people eligible for welfare benefits.

C) They encourage work effort and make fewer people eligible for welfare benefits.

D) They discourage work effort and make fewer people eligible for welfare benefits.

A) They encourage work effort and make more people eligible for welfare benefits.

B) They discourage work effort and make more people eligible for welfare benefits.

C) They encourage work effort and make fewer people eligible for welfare benefits.

D) They discourage work effort and make fewer people eligible for welfare benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

63

Higher breakeven levels of income can be achieved by decreasing

A) In-kind benefits.

B) Earnings disregards.

C) Basic benefits.

D) The marginal tax rate.

A) In-kind benefits.

B) Earnings disregards.

C) Basic benefits.

D) The marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

64

Suppose a poverty program has a basic benefit of $5,000, zero deductions, and a marginal tax rate of 0.50. The breakeven level of income is

A) $2,500.

B) $25,000.

C) $15,000.

D) $10,000.

A) $2,500.

B) $25,000.

C) $15,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

65

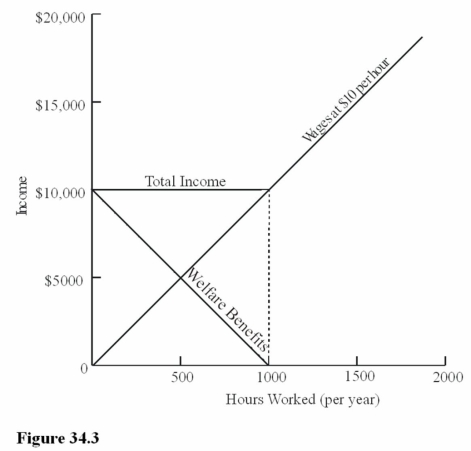

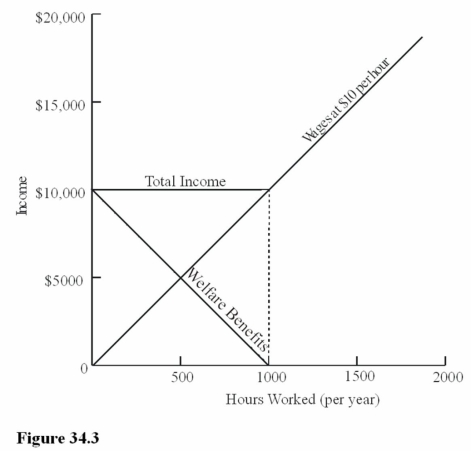

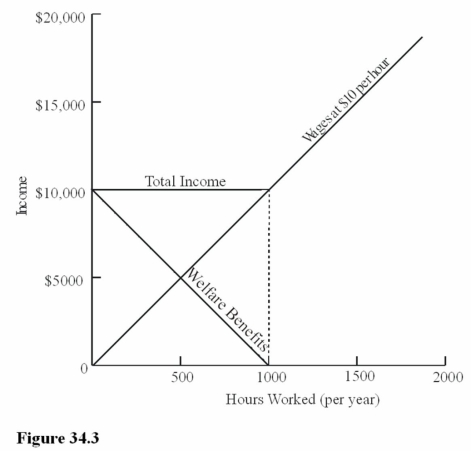

Refer to Figure 34.3. If a welfare recipient did not work, he or she would receive welfare benefits of

Refer to Figure 34.3. If a welfare recipient did not work, he or she would receive welfare benefits ofA) $0.

B) $1,000.

C) $5,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

66

Refer to Figure 34.3. The implied marginal tax rate is

Refer to Figure 34.3. The implied marginal tax rate isA) 0 percent.

B) 50 percent.

C) 100 percent.

D) Greater than 100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

67

Suppose a poverty program has a basic benefit of $12,000, zero deductions, and a marginal tax rate of 0.80. The breakeven level of income is

A) $12,000.

B) $9,600.

C) $15,000.

D) $2,400.

A) $12,000.

B) $9,600.

C) $15,000.

D) $2,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

68

The breakeven level of income is the

A) Lowest level of income at which in-kind benefits are no longer necessary.

B) Level of income at which an individual household begins to have some discretionary income.

C) Level of income above which a person loses all welfare benefits.

D) Amount of income a person must have to reach the poverty line.

A) Lowest level of income at which in-kind benefits are no longer necessary.

B) Level of income at which an individual household begins to have some discretionary income.

C) Level of income above which a person loses all welfare benefits.

D) Amount of income a person must have to reach the poverty line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

69

The breakeven level of income is

A) The amount of welfare benefits that can be received without taxation.

B) The amount of income that can be earned without a loss of welfare benefits.

C) A welfare recipient who is ignored or who does not receive benefits.

D) The highest level of income a household can earn and still receive welfare benefits.

A) The amount of welfare benefits that can be received without taxation.

B) The amount of income that can be earned without a loss of welfare benefits.

C) A welfare recipient who is ignored or who does not receive benefits.

D) The highest level of income a household can earn and still receive welfare benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

70

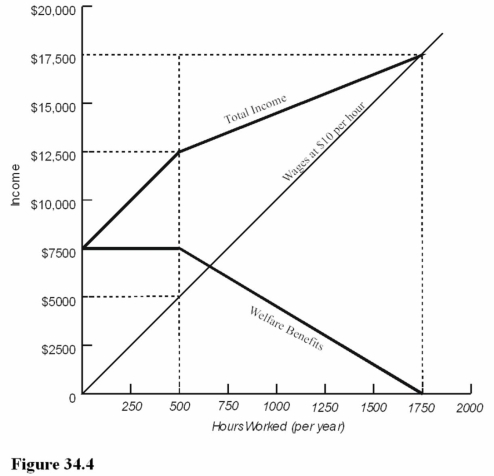

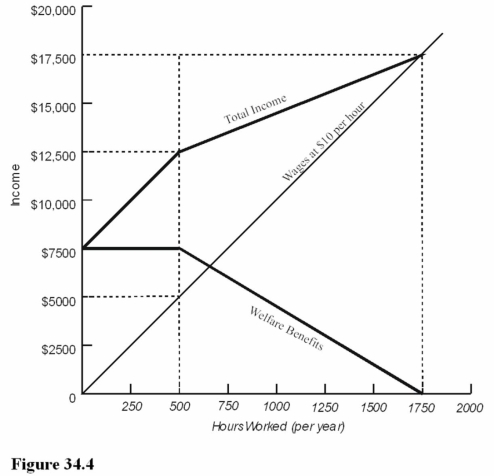

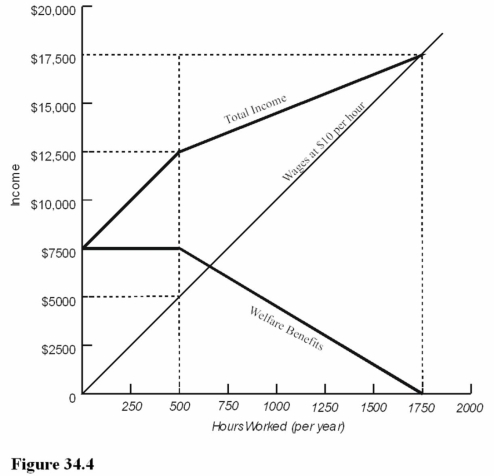

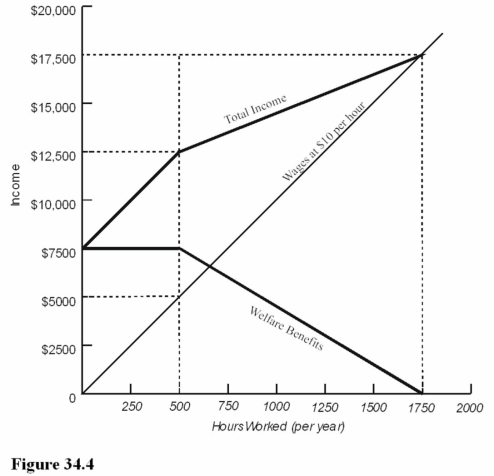

Refer to Figure 34.4. If an individual does not work, she or he will receive welfare benefits of

Refer to Figure 34.4. If an individual does not work, she or he will receive welfare benefits ofA) $0.

B) $5,000.

C) $7,500.

D) $12,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements concerning higher marginal tax rates is correct?

A) They encourage work effort and make more people eligible for welfare benefits.

B) They discourage work effort and make fewer people eligible for welfare benefits.

C) They encourage work effort and make fewer people eligible for welfare benefits.

D) They discourage work effort and make more people eligible for welfare benefits.

A) They encourage work effort and make more people eligible for welfare benefits.

B) They discourage work effort and make fewer people eligible for welfare benefits.

C) They encourage work effort and make fewer people eligible for welfare benefits.

D) They discourage work effort and make more people eligible for welfare benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

72

Refer to Figure 34.3. The disincentive to work caused by this welfare program

Refer to Figure 34.3. The disincentive to work caused by this welfare programA) Ends as soon as any income is earned.

B) Ends at $5,000 where benefits equal wages.

C) Ends at $10,000.

D) Exists at all income levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

73

Refer to Figure 34.4. The implied marginal tax rate in this example is

Refer to Figure 34.4. The implied marginal tax rate in this example isA) 0 percent.

B) Between 0 and 100 percent.

C) 100 percent.

D) Greater than 100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

74

An assistance program that guarantees a minimum income, regardless of the family's earned income, has a

A) Marginal tax rate of zero percent.

B) Breakeven income level equal to the need standard.

C) Zero disregard.

D) High tax elasticity of labor supply.

A) Marginal tax rate of zero percent.

B) Breakeven income level equal to the need standard.

C) Zero disregard.

D) High tax elasticity of labor supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

75

Suppose a poverty program has a basic benefit of $14,000, zero deductions, and a marginal tax rate of 0.70. The breakeven level of income is

A) $14,000.

B) $9,800.

C) $4,200.

D) $20,000.

A) $14,000.

B) $9,800.

C) $4,200.

D) $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

76

Suppose a poverty program provides a basic benefit of $6,000, zero deductions, and a marginal tax rate of 0.6. The breakeven level of income is

A) $10,000.

B) $3,600.

C) $6,000.

D) $2,400.

A) $10,000.

B) $3,600.

C) $6,000.

D) $2,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

77

The breakeven level of income equals the

A) Minimum amount of income society considers desirable for households to have.

B) Amount of income a family may earn without losing any welfare benefits.

C) Need standard with a marginal tax rate of zero percent.

D) The highest level of income at which a household ceases to receive welfare benefits.

A) Minimum amount of income society considers desirable for households to have.

B) Amount of income a family may earn without losing any welfare benefits.

C) Need standard with a marginal tax rate of zero percent.

D) The highest level of income at which a household ceases to receive welfare benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

78

A marginal tax rate of zero for welfare programs will

A) Increase work effort.

B) Reduce welfare costs.

C) Increase the number of people eligible for welfare.

D) Increase the risk of moral hazard.

A) Increase work effort.

B) Reduce welfare costs.

C) Increase the number of people eligible for welfare.

D) Increase the risk of moral hazard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

79

Refer to Figure 34.4. The breakeven level of income in this example is

Refer to Figure 34.4. The breakeven level of income in this example isA) $5,000.

B) $7,500.

C) $12,500.

D) $17,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

80

Refer to Figure 34.4. There is a welfare-induced disincentive to work starting at

Refer to Figure 34.4. There is a welfare-induced disincentive to work starting atA) $5,000.

B) $7,500.

C) $12,500.

D) $17,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck