Deck 8: Absorption and Variable Costing,and Inventory Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

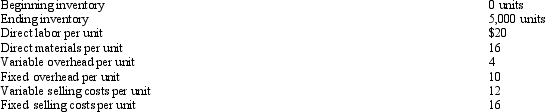

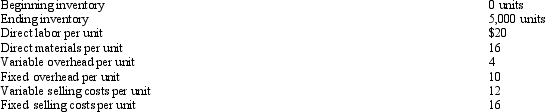

سؤال

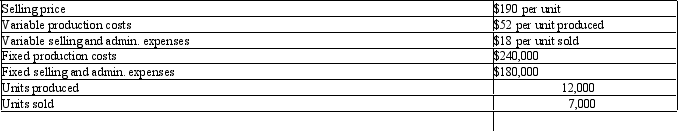

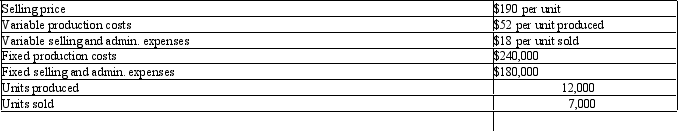

سؤال

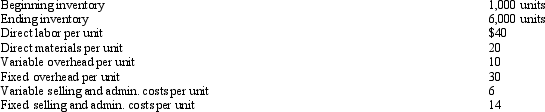

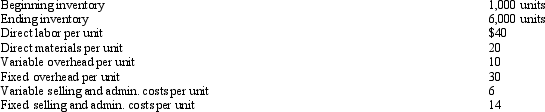

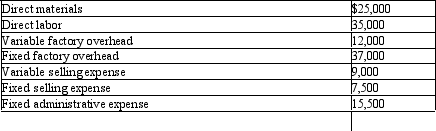

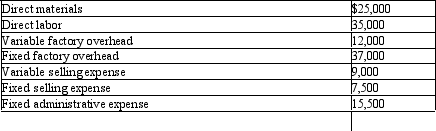

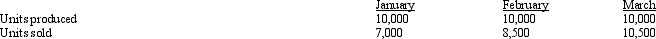

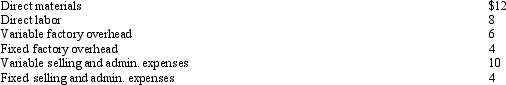

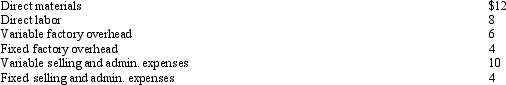

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

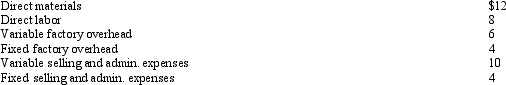

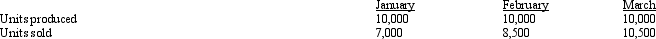

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

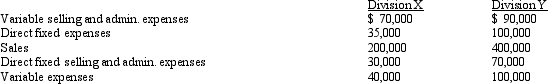

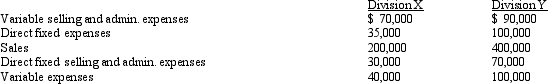

سؤال

سؤال

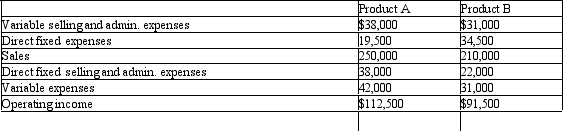

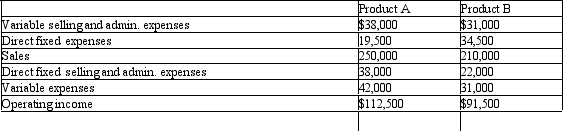

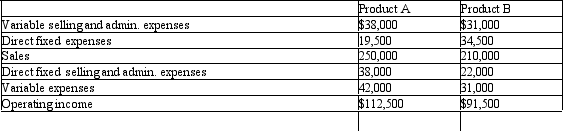

سؤال

سؤال

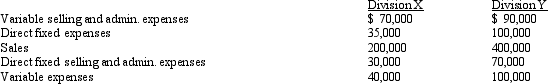

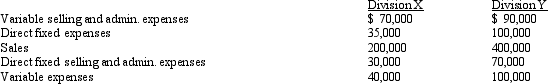

سؤال

سؤال

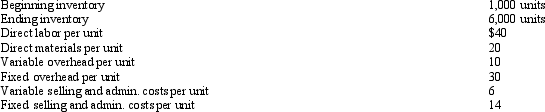

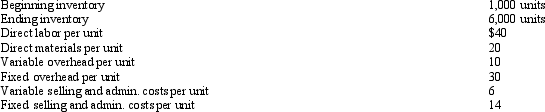

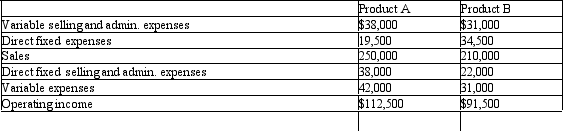

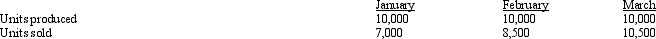

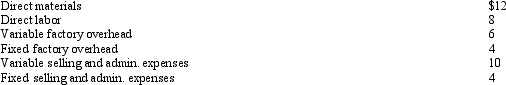

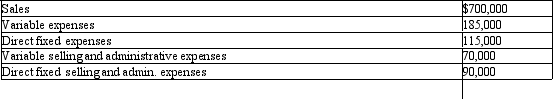

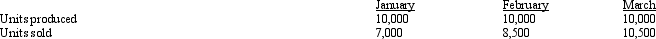

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

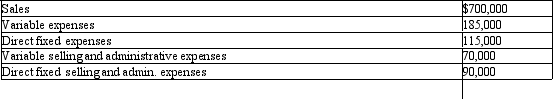

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/110

العب

ملء الشاشة (f)

Deck 8: Absorption and Variable Costing,and Inventory Management

1

The costs of not having a product available when demanded by a customer are called stockout costs.

True

2

Absorption costing treats fixed factory overhead as a ____________.

product cost

3

A major drawback to the JIT inventory approach is that it increases carrying costs.

False

4

If the number of units produced in a period is larger than the number of units sold in a period,absorption costing income will be higher than variable costing income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

5

Generally accepted accounting principles require ______________ for external reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

6

Product cost includes all costs of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

7

Expenses that persist even if one of the segments to which they relate is eliminated are known as ________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

8

The ___________________ income statement groups expenses according to function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

9

The _______________ income statement groups expenses according to cost behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

10

Inventory under absorption costing includes only direct materials and direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

11

Total inventory-related cost consists of ordering cost and carrying cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

12

JIT relies on a push system to control finished good inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

13

Inventory costs under variable costing include only direct materials,direct labor,and variable factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

14

Variable costing treats fixed factory overhead as a ______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

15

For internal reporting ________________ is an important managerial tool because it provides vital cost information for decision making and control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the number of units produced in a period is smaller than the number of units sold in period,absorption costing income will be higher than variable costing income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

17

On a segmented income statement,fixed costs are broken down into direct fixed costs and common fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

18

When using _______________ a company only assigns variable manufacturing costs to the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

19

Variable costing and absorption costing income statements may differ because of their treatment of fixed factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

20

_______________ assigns all manufacturing costs to the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

21

A ____________ is a subunit of a company of sufficient importance to warrant the production of performance reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

22

Inventory values calculated using variable costing as opposed to absorption costing will generally be

A)equal.

B)less.

C)greater.

D)twice as much.

A)equal.

B)less.

C)greater.

D)twice as much.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

23

When a company needs to place a new order for goods,they have reached the ___________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

24

All ______________ expenses will vanish if a particular segment is eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

25

On a segmented income statement,fixed expenses are broken down into _____________ and ______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

26

The _______________________ is the number of units in the optimal size order quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

27

When production is less than sales volume,income under absorption costing will be ____ income using variable costing procedures.

A)greater than

B)less than

C)equal to

D)randomly different than

A)greater than

B)less than

C)equal to

D)randomly different than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

28

________________ is the time required to receive the economic order quantity once an order is placed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following types of costs does not appear on a variable costing income statement?

A)direct materials

B)direct labor

C)fixed factory overhead per unit sold

D)variable selling expense

E)total administrative expense

A)direct materials

B)direct labor

C)fixed factory overhead per unit sold

D)variable selling expense

E)total administrative expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

30

Inventory taxes,obsolescence,and insurance are examples of _______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

31

Gross margin is to absorption costing as ____ is to variable costing.

A)gross profit

B)contribution margin

C)income

D)territory margin

A)gross profit

B)contribution margin

C)income

D)territory margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

32

Lost sales and costs of expediting shipments of goods are examples of _______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

33

______________ is computed by multiplying the lead time by the difference between the maximum rate of usage and the average rate of usage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

34

The profit contribution each segment makes toward covering a company's common fixed costs is called ______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

35

Generally Accepted Accounting Principles (GAAP)require the use of which accounting method for external reporting?

A)absorption costing.

B)variable costing.

C)transfer price costing.

D)responsibility costing.

E)all of these are acceptable for GAAP.

A)absorption costing.

B)variable costing.

C)transfer price costing.

D)responsibility costing.

E)all of these are acceptable for GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

36

Variable costing is

A)a good way to value inventories for the balance sheet.

B)used for external reporting purposes.

C)not useful for companies with multiple segments.

D)a useful tool for management decision making.

E)can only be used by start-up companies.

A)a good way to value inventories for the balance sheet.

B)used for external reporting purposes.

C)not useful for companies with multiple segments.

D)a useful tool for management decision making.

E)can only be used by start-up companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

37

The ______________ approach maintains that goods should be pulled through the system by present demand rather than being pushed through on a fixed schedule based on anticipated demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is never included in product cost?

A)overhead

B)direct materials

C)variable selling expense

D)fixed factory overhead

E)direct labor

A)overhead

B)direct materials

C)variable selling expense

D)fixed factory overhead

E)direct labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

39

A disadvantage of absorption costing is

A)that it is not a useful format for decision making.

B)that it assigns only manufacturing costs to the product.

C)all of these

D)none of these

A)that it is not a useful format for decision making.

B)that it assigns only manufacturing costs to the product.

C)all of these

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

40

When monthly production volume is constant and sales volume is less than production,income determined with variable costing procedures will

A)always be greater than income determined using absorption costing.

B)always be less than income determined using absorption costing.

C)be equal to income determined using absorption costing.

D)be equal to contribution margin per unit times units sold.

A)always be greater than income determined using absorption costing.

B)always be less than income determined using absorption costing.

C)be equal to income determined using absorption costing.

D)be equal to contribution margin per unit times units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

41

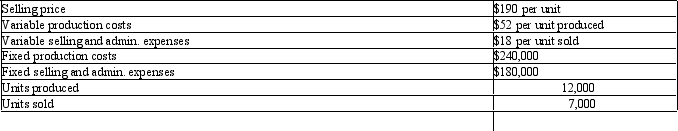

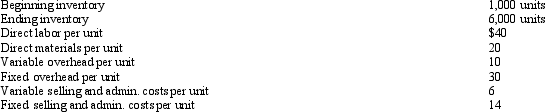

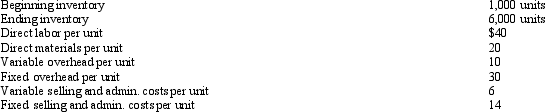

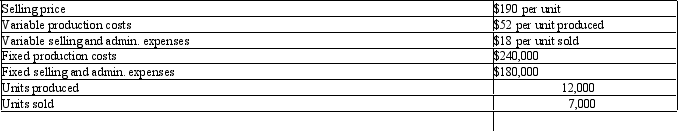

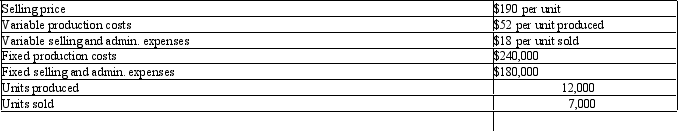

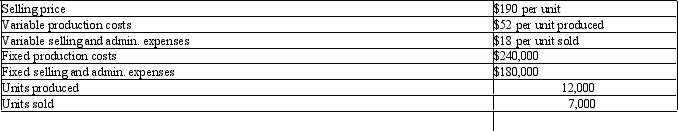

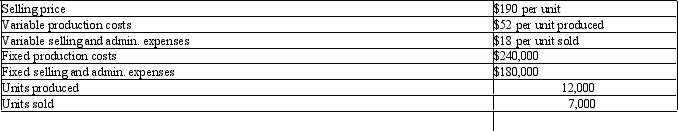

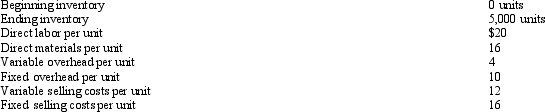

Figure 8-4. The following information pertains to Mayberry Corporation:

Refer to Figure 8-4.What is the value of the ending inventory using the absorption costing method?

Refer to Figure 8-4.What is the value of the ending inventory using the absorption costing method?

A)$240,000

B)$360,000

C)$600,000

D)$420,000

Refer to Figure 8-4.What is the value of the ending inventory using the absorption costing method?

Refer to Figure 8-4.What is the value of the ending inventory using the absorption costing method?A)$240,000

B)$360,000

C)$600,000

D)$420,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

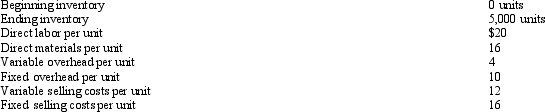

42

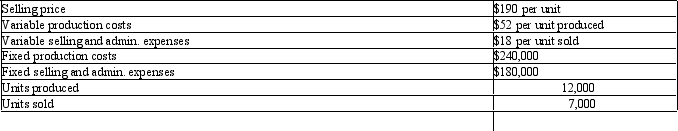

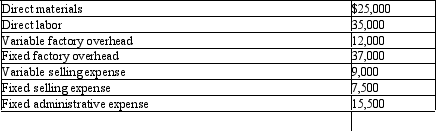

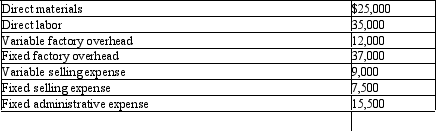

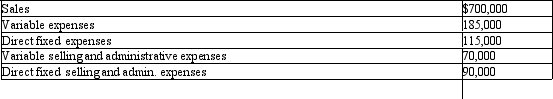

Figure 8-5. Sanders Company has the following information for 2011:

There were no beginning inventories.

There were no beginning inventories.

Refer to Figure 8-5.What is the income for Eastwood using the variable costing method?

A)$420,000

B)$480,000

C)$520,000

D)$500,000

There were no beginning inventories.

There were no beginning inventories.Refer to Figure 8-5.What is the income for Eastwood using the variable costing method?

A)$420,000

B)$480,000

C)$520,000

D)$500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

43

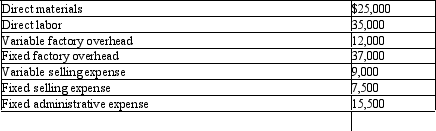

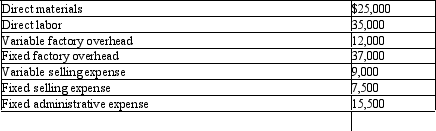

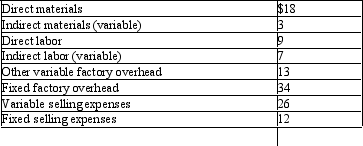

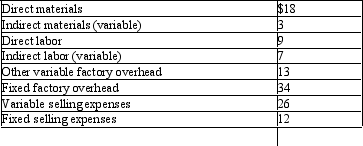

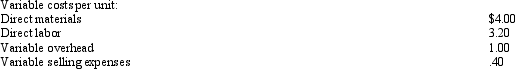

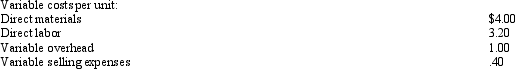

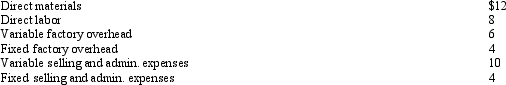

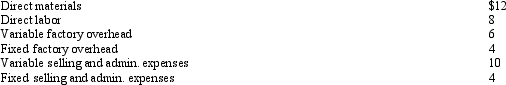

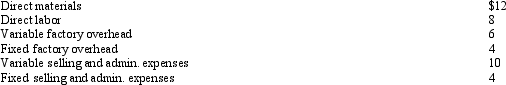

Figure 8-1. Last year,Fabre Company produced 20,000 units and sold 18,000 units at a price of $12.Costs for last year were as follows:

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Refer to Figure 8-1.What is operating income for last year under absorption costing?

A)$41,000

B)$67,520

C)$85,900

D)$111,300

E)$45,000

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.Refer to Figure 8-1.What is operating income for last year under absorption costing?

A)$41,000

B)$67,520

C)$85,900

D)$111,300

E)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

44

Figure 8-4. The following information pertains to Mayberry Corporation:

Refer to Figure 8-4.What is the value of the ending inventory using the variable costing method?

Refer to Figure 8-4.What is the value of the ending inventory using the variable costing method?

A)$240,000

B)$360,000

C)$350,000

D)$420,000

Refer to Figure 8-4.What is the value of the ending inventory using the variable costing method?

Refer to Figure 8-4.What is the value of the ending inventory using the variable costing method?A)$240,000

B)$360,000

C)$350,000

D)$420,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

45

Figure 8-1. Last year,Fabre Company produced 20,000 units and sold 18,000 units at a price of $12.Costs for last year were as follows:

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Refer to Figure 8-1.Assuming that beginning inventory was zero,what is the value of ending inventory under absorption costing?

A)$5,480

B)$4,500

C)$10,900

D)$12,600

E)$5,750

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.Refer to Figure 8-1.Assuming that beginning inventory was zero,what is the value of ending inventory under absorption costing?

A)$5,480

B)$4,500

C)$10,900

D)$12,600

E)$5,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

46

Figure 8-2. Loring Company had the following data for the month:

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Refer to Figure 8-2.What is operating income under variable costing?

A)$3,540

B)$7,980

C)$11,340

D)-$540

E)$3,740

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.Refer to Figure 8-2.What is operating income under variable costing?

A)$3,540

B)$7,980

C)$11,340

D)-$540

E)$3,740

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

47

Figure 8-5. Sanders Company has the following information for 2011:

There were no beginning inventories.

There were no beginning inventories.

Refer to Figure 8-5.What is the value of ending inventory for Sanders using the absorption costing method?

A)$360,000

B)$280,000

C)$220,000

D)$380,000

There were no beginning inventories.

There were no beginning inventories.Refer to Figure 8-5.What is the value of ending inventory for Sanders using the absorption costing method?

A)$360,000

B)$280,000

C)$220,000

D)$380,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

48

All of the following costs are included in inventory under absorption costing except

A)direct materials.

B)direct labor.

C)fixed selling expenses.

D)fixed factory overhead.

A)direct materials.

B)direct labor.

C)fixed selling expenses.

D)fixed factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is the primary difference between variable and absorption costing?

A)inclusion of fixed selling expenses in product costs

B)inclusion of variable factory overhead in period costs

C)inclusion of fixed selling expenses in period costs

D)inclusion of fixed factory overhead in product costs

A)inclusion of fixed selling expenses in product costs

B)inclusion of variable factory overhead in period costs

C)inclusion of fixed selling expenses in period costs

D)inclusion of fixed factory overhead in product costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

50

Figure 8-2. Loring Company had the following data for the month:

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Refer to Figure 8-2.What is the unit product cost under absorption costing?

A)$8.60

B)$10.60

C)$8.20

D)$10.20

E)$7.20

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.Refer to Figure 8-2.What is the unit product cost under absorption costing?

A)$8.60

B)$10.60

C)$8.20

D)$10.20

E)$7.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

51

Figure 8-4. The following information pertains to Mayberry Corporation:

Refer to Figure 8-4.Absorption costing income would be ____ variable costing income.

Refer to Figure 8-4.Absorption costing income would be ____ variable costing income.

A)$150,000 greater than

B)$150,000 less than

C)$240,000 less than

D)$240,000 greater than

Refer to Figure 8-4.Absorption costing income would be ____ variable costing income.

Refer to Figure 8-4.Absorption costing income would be ____ variable costing income.A)$150,000 greater than

B)$150,000 less than

C)$240,000 less than

D)$240,000 greater than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

52

Figure 8-1. Last year,Fabre Company produced 20,000 units and sold 18,000 units at a price of $12.Costs for last year were as follows:

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Refer to Figure 8-1.What is operating income for last year under variable costing?

A)$111,800

B)$91,780

C)$82,200

D)$78,400

E)$66,350

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.Refer to Figure 8-1.What is operating income for last year under variable costing?

A)$111,800

B)$91,780

C)$82,200

D)$78,400

E)$66,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

53

Figure 8-5. Sanders Company has the following information for 2011:

There were no beginning inventories.

There were no beginning inventories.

Refer to Figure 8-5.What is the income for Sanders using the absorption costing method?

A)$520,000

B)$480,000

C)$1,200,000

D)$500,000

There were no beginning inventories.

There were no beginning inventories.Refer to Figure 8-5.What is the income for Sanders using the absorption costing method?

A)$520,000

B)$480,000

C)$1,200,000

D)$500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

54

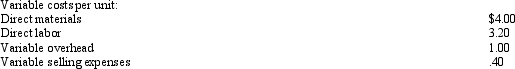

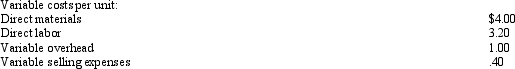

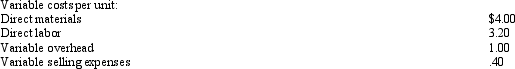

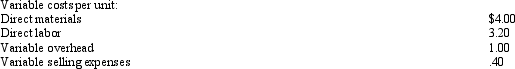

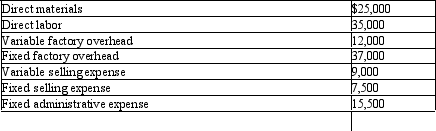

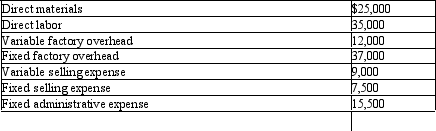

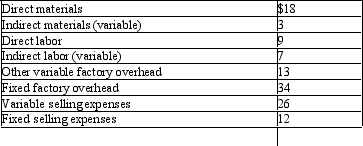

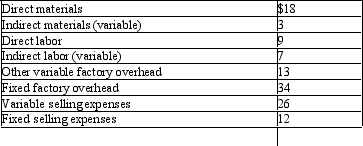

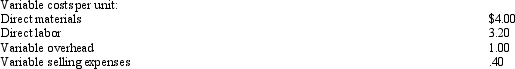

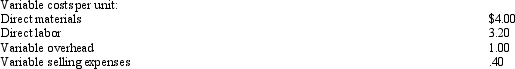

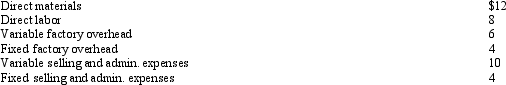

Figure 8-6. Bailey Company incurred the following costs in manufacturing desk calculators:

During the period,the company produced and sold 2,000 units.

During the period,the company produced and sold 2,000 units.

Refer to Figure 8-6.What is the inventory cost per unit using absorption costing?

A)$104

B)$77

C)$84

D)$32

During the period,the company produced and sold 2,000 units.

During the period,the company produced and sold 2,000 units.Refer to Figure 8-6.What is the inventory cost per unit using absorption costing?

A)$104

B)$77

C)$84

D)$32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

55

Figure 8-5. Sanders Company has the following information for 2011:

There were no beginning inventories.

There were no beginning inventories.

Refer to Figure 8-5.What is the cost of ending inventory for Sanders using the variable costing method?

A)$300,000

B)$280,000

C)$120,000

D)$260,000

There were no beginning inventories.

There were no beginning inventories.Refer to Figure 8-5.What is the cost of ending inventory for Sanders using the variable costing method?

A)$300,000

B)$280,000

C)$120,000

D)$260,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

56

Figure 8-2. Loring Company had the following data for the month:

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Refer to Figure 8-2.What is the unit product cost under variable costing?

A)$8.60

B)$10.60

C)$8.20

D)$10.20

E)$7.20

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.Refer to Figure 8-2.What is the unit product cost under variable costing?

A)$8.60

B)$10.60

C)$8.20

D)$10.20

E)$7.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements is true?

A)Absorption costing income exceeds variable costing income when units produced and sold are equal.

B)Variable costing income exceeds absorption costing income when units produced exceed units sold.

C)Absorption costing income exceeds variable costing income when units produced are less than units sold.

D)Absorption costing income exceeds variable costing income when units produced are greater than units sold.

A)Absorption costing income exceeds variable costing income when units produced and sold are equal.

B)Variable costing income exceeds absorption costing income when units produced exceed units sold.

C)Absorption costing income exceeds variable costing income when units produced are less than units sold.

D)Absorption costing income exceeds variable costing income when units produced are greater than units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

58

Figure 8-6. Bailey Company incurred the following costs in manufacturing desk calculators:

During the period,the company produced and sold 2,000 units.

During the period,the company produced and sold 2,000 units.

Refer to Figure 8-6.What is the inventory cost per unit using variable costing?

A)$52

B)$66

C)$72

D)$50

During the period,the company produced and sold 2,000 units.

During the period,the company produced and sold 2,000 units.Refer to Figure 8-6.What is the inventory cost per unit using variable costing?

A)$52

B)$66

C)$72

D)$50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

59

Figure 8-1. Last year,Fabre Company produced 20,000 units and sold 18,000 units at a price of $12.Costs for last year were as follows:

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Refer to Figure 8-1.Assuming that beginning inventory was zero,what is the value of ending inventory under variable costing?

A)$3,300

B)$2,500

C)$5,000

D)$3,720

E)$7,200

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.

Fixed factory overhead is applied based on expected production.Last year,Fabre expected to produce 20,000 units.Refer to Figure 8-1.Assuming that beginning inventory was zero,what is the value of ending inventory under variable costing?

A)$3,300

B)$2,500

C)$5,000

D)$3,720

E)$7,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

60

Figure 8-2. Loring Company had the following data for the month:

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Refer to Figure 8-2.What is operating income under absorption costing?

A)$3,540

B)$7,980

C)$11,340

D)-$540

E)$3,740

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units.During the month,2,000 units were produced.Loring started the month with 300 units in beginning inventory,with unit product cost equal to this month's unit product cost.A total of 2,100 units were sold during the month at price of $14.Selling and administrative expense for the month,all fixed,totaled $3,600.Refer to Figure 8-2.What is operating income under absorption costing?

A)$3,540

B)$7,980

C)$11,340

D)-$540

E)$3,740

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

61

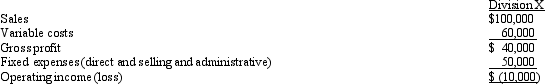

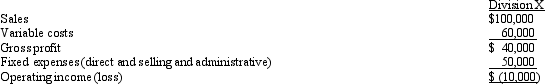

Consider the following portion of a segmented income statement for the year just ended.Assume fixed expenses of Division X include $30,000 of direct expenses and that the discontinuance of the department will not affect the sales of the other departments nor reduce the common expenses.  What is X's divisional segment margin?

What is X's divisional segment margin?

A)($10,000)

B)$40,000

C)$10,000

D)$100,000

What is X's divisional segment margin?

What is X's divisional segment margin?A)($10,000)

B)$40,000

C)$10,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

62

Grass Valley Mining mines three products.Gold ore sells for $1,000 per ton,variable costs are $400 per ton,and fixed mining costs are $250,000.The segment margin for 2011 was $(100,000). What were the sales (in tons)for 2011?

A)375 tons

B)1,000 tons

C)250 tons

D)200 tons

A)375 tons

B)1,000 tons

C)250 tons

D)200 tons

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

63

Figure 8-11. Tyler Company has the following information pertaining to its two product lines for 2011:

Common expenses are $105,000 for 2011.

Common expenses are $105,000 for 2011.

Refer to Figure 8-11.What is the income for Tyler Company?

A)$101,000

B)$120,500

C)$99,000

D)$102,500

Common expenses are $105,000 for 2011.

Common expenses are $105,000 for 2011.Refer to Figure 8-11.What is the income for Tyler Company?

A)$101,000

B)$120,500

C)$99,000

D)$102,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following could be considered a segment?

A)Division

B)product-line

C)sales territory

D)all of these

A)Division

B)product-line

C)sales territory

D)all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

65

Figure 8-10. Nauman Company has the following information pertaining to its two divisions for 2011:

Common expenses are $24,000 for 2011.

Common expenses are $24,000 for 2011.

Refer to Figure 8-10.What is the income for Nauman Company?

A)$65,000

B)$325,000

C)$300,000

D)$41,000

Common expenses are $24,000 for 2011.

Common expenses are $24,000 for 2011.Refer to Figure 8-10.What is the income for Nauman Company?

A)$65,000

B)$325,000

C)$300,000

D)$41,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

66

Figure 8-11. Tyler Company has the following information pertaining to its two product lines for 2011:

Common expenses are $105,000 for 2011.

Common expenses are $105,000 for 2011.

Refer to Figure 8-11.What is the segment margin for Product B?

A)$155,000

B)$105,000

C)$85,000

D)$91,500

Common expenses are $105,000 for 2011.

Common expenses are $105,000 for 2011.Refer to Figure 8-11.What is the segment margin for Product B?

A)$155,000

B)$105,000

C)$85,000

D)$91,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

67

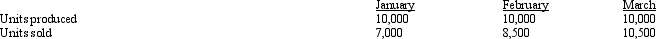

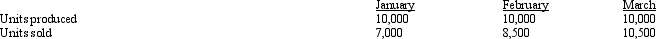

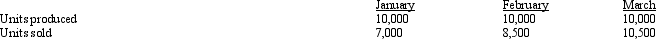

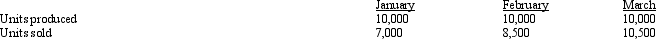

Figure 8-8. Steele Corporation has the following information for January,February,and March 2011:

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows:

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

Refer to Figure 8-8.What is the February ending inventory for Steele Corporation using the absorption costing method?

A)$39,000

B)$45,000

C)$135,000

D)$300,000

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows: There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.Refer to Figure 8-8.What is the February ending inventory for Steele Corporation using the absorption costing method?

A)$39,000

B)$45,000

C)$135,000

D)$300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

68

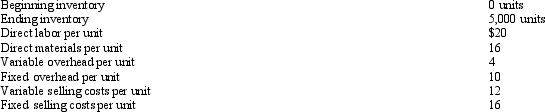

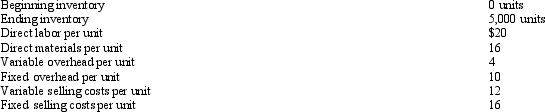

Figure 8-9. The following information pertains to Stark Corporation:

Refer to Figure 8-9.Absorption costing income would be ____ the variable costing income.

Refer to Figure 8-9.Absorption costing income would be ____ the variable costing income.

A)$50,000 greater than

B)$70,000 greater than

C)$70,000 less than

D)$50,000 less than

Refer to Figure 8-9.Absorption costing income would be ____ the variable costing income.

Refer to Figure 8-9.Absorption costing income would be ____ the variable costing income.A)$50,000 greater than

B)$70,000 greater than

C)$70,000 less than

D)$50,000 less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

69

Redding Company has two divisions with the following segment margins for the current year: Northern,$200,000; Southern,$400,000.Common expenses of the company are $50,000.What is Redding Company's income?

A)$150,000

B)$550,000

C)$600,000

D)$650,000

A)$150,000

B)$550,000

C)$600,000

D)$650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

70

Figure 8-8. Steele Corporation has the following information for January,February,and March 2011:

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows:

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

Refer to Figure 8-8.What is the February contribution margin for Steele Corporation using the variable costing method?

A)$240,000

B)$170,000

C)$119,000

D)$204,000

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows: There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.Refer to Figure 8-8.What is the February contribution margin for Steele Corporation using the variable costing method?

A)$240,000

B)$170,000

C)$119,000

D)$204,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

71

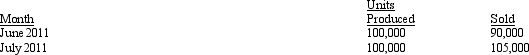

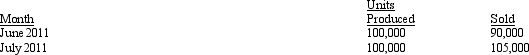

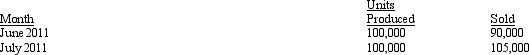

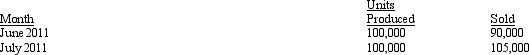

Figure 8-7. Ramon Company reported the following units of production and sales for June and July 2011:

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.

Refer to Figure 8-7.How much was income for July using absorption costing?

A)$50,000

B)$20,000

C)$80,000

D)$40,000

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.Refer to Figure 8-7.How much was income for July using absorption costing?

A)$50,000

B)$20,000

C)$80,000

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

72

Figure 8-7. Ramon Company reported the following units of production and sales for June and July 2011:

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.

Refer to Figure 8-7.How much was income for June using variable costing?

A)$40,000

B)$20,000

C)$(40,000)

D)$(20,000)

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.

Income under absorption costing for June was $40,000; income under variable costing for July was $50,000.Fixed costs were $600,000 for each month.Refer to Figure 8-7.How much was income for June using variable costing?

A)$40,000

B)$20,000

C)$(40,000)

D)$(20,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

73

Figure 8-10. Nauman Company has the following information pertaining to its two divisions for 2011:

Common expenses are $24,000 for 2011.

Common expenses are $24,000 for 2011.

Refer to Figure 8-10.What is the segment margin for Division Y?

A)$310,000

B)$210,000

C)$240,000

D)$40,000

Common expenses are $24,000 for 2011.

Common expenses are $24,000 for 2011.Refer to Figure 8-10.What is the segment margin for Division Y?

A)$310,000

B)$210,000

C)$240,000

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

74

Figure 8-9. The following information pertains to Stark Corporation:

Refer to Figure 8-9.What is the value of ending inventory using the absorption costing method?

Refer to Figure 8-9.What is the value of ending inventory using the absorption costing method?

A)$310,000

B)$250,000

C)$200,000

D)$390,000

Refer to Figure 8-9.What is the value of ending inventory using the absorption costing method?

Refer to Figure 8-9.What is the value of ending inventory using the absorption costing method?A)$310,000

B)$250,000

C)$200,000

D)$390,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

75

Figure 8-9. The following information pertains to Stark Corporation:

Refer to Figure 8-9.What is the value of ending inventory using the variable costing method?

Refer to Figure 8-9.What is the value of ending inventory using the variable costing method?

A)$310,000

B)$250,000

C)$200,000

D)$390,000

Refer to Figure 8-9.What is the value of ending inventory using the variable costing method?

Refer to Figure 8-9.What is the value of ending inventory using the variable costing method?A)$310,000

B)$250,000

C)$200,000

D)$390,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

76

Segment margin is equal to segment sales revenue minus

A)variable cost of goods sold,variable selling expense,and direct fixed costs.

B)variable cost of goods sold,variable selling expense,and common fixed costs.

C)variable cost of goods sold,total selling expense,and direct fixed costs.

D)variable cost of goods sold,variable selling expense,administrative expense,and direct fixed costs.

E)cost of goods sold,variable selling expense,and fixed factory overhead.

A)variable cost of goods sold,variable selling expense,and direct fixed costs.

B)variable cost of goods sold,variable selling expense,and common fixed costs.

C)variable cost of goods sold,total selling expense,and direct fixed costs.

D)variable cost of goods sold,variable selling expense,administrative expense,and direct fixed costs.

E)cost of goods sold,variable selling expense,and fixed factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

77

Figure 8-8. Steele Corporation has the following information for January,February,and March 2011:

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows:

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

Refer to Figure 8-8.What is the January ending inventory for Steele Corporation using the variable costing method?

A)$260,000

B)$78,000

C)$108,000

D)$90,000

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows: There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.Refer to Figure 8-8.What is the January ending inventory for Steele Corporation using the variable costing method?

A)$260,000

B)$78,000

C)$108,000

D)$90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

78

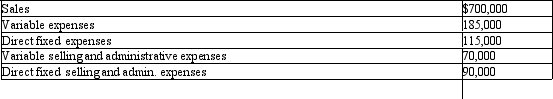

Figure 8-12. Assume the following information for a product line:

Refer to Figure 8-12.What is the segment margin of the product line?

Refer to Figure 8-12.What is the segment margin of the product line?

A)$200,000

B)$325,000

C)$350,000

D)$240,000

Refer to Figure 8-12.What is the segment margin of the product line?

Refer to Figure 8-12.What is the segment margin of the product line?A)$200,000

B)$325,000

C)$350,000

D)$240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

79

Figure 8-12. Assume the following information for a product line:

Refer to Figure 8-12.What is the contribution margin of the product line?

Refer to Figure 8-12.What is the contribution margin of the product line?

A)$400,000

B)$525,000

C)$445,000

D)$515,000

Refer to Figure 8-12.What is the contribution margin of the product line?

Refer to Figure 8-12.What is the contribution margin of the product line?A)$400,000

B)$525,000

C)$445,000

D)$515,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

80

Figure 8-8. Steele Corporation has the following information for January,February,and March 2011:

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows:

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

Refer to Figure 8-8.What is the March ending inventory for Steele Corporation using the variable costing method?

A)$120,000

B)$104,000

C)$260,000

D)$15,000

Production costs per unit (based on 10,000 units)are as follows:

Production costs per unit (based on 10,000 units)are as follows: There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.

There were no beginning inventories for January 2011,and all units were sold for $50.Costs are stable over the three months.Refer to Figure 8-8.What is the March ending inventory for Steele Corporation using the variable costing method?

A)$120,000

B)$104,000

C)$260,000

D)$15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck