Deck 11: Income Taxation of Individuals

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 11: Income Taxation of Individuals

1

_____ 2.The deduction for student loan interest has limits placed on it based on the taxpayer's AGI.

True

2

_____ 10.A parent cannot be claimed as a dependent if his or her gross income equals or exceeds the amount of the dependency exemption.

True

3

_____ 8.Under a multiple support agreement,Jim may claim an exemption for his mother if he supplies 25 percent,his brother supplies 40 percent,and his sister supplies 8 percent of the support for their mother.

True

4

_____ 11.The basic and additional standard deductions are both indexed for inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

_____ 13.Each separate item of miscellaneous itemized deductions must exceed two percent of AGI to be deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

___ 16.Sales taxes levied on the purchase of depreciable business property are deductible as part of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

_____ 6.To qualify as head of household,the taxpayer must pay more than half of the costs of a home in which a qualifying person lives for the entire year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

_____ 14.Single individuals must reduce their personal exemption if their AGI exceeds $250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

_____ 17.A taxpayer's exemptions and itemized deductions are limited by the taxpayer's AGI if AGI exceeds a certain threshold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

_____ 4.Surviving spouse status may be claimed for three years after the year of the spouse's death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

_____ 9.Jan and James's divorce is final on December 31 of the current year.They must file married filing separately for the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

_____ 7.An abandoned spouse must only live apart from his or her spouse during the last six months of the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

_____ 1.Contributions to health savings accounts are made with before-tax dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

_____ 5.A legally married couple can elect to file as married filing jointly or single individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

_____ 18.A personal theft loss can be deducted if it exceeds $100 plus 10 percent of AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

_____ 20.The itemized deduction for medical expenses is subject to the phase-out applicable to total itemized deductions based on the taxpayer's AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

_____ 19.A homeowner who itemizes his or her deductions can only deduct the property taxes on his or her primary residence and one other residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

_____ 12.To be deductible for regular income tax purposes,qualified medical expenses for a 66-year-old single individual must exceed 10 percent of AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

_____ 15.Real property taxes are deductible for state,local,and foreign real property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

_____ 3.To file as a surviving spouse,a taxpayer must maintain a home for a dependent child for the entire year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

All of the following are a common filing status for a married person except:

A)Married filing jointly

B)Head of household

C)Married filing separately

D)Surviving spouse

A)Married filing jointly

B)Head of household

C)Married filing separately

D)Surviving spouse

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

Toni is 61 and blind;her husband,Saul,is 67.What is their standard deduction if they file a joint tax return and what is the minimum amount of income they must have to be required to file a tax return,respectively?

A)$13,500;$20,800

B)$14,600;$21,200

C)$14,600;$22,400

D)$12,200;$21,200

A)$13,500;$20,800

B)$14,600;$21,200

C)$14,600;$22,400

D)$12,200;$21,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

_____ 21.The dependent care credit and the earned income credit are both refundable credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

Charlotte,Ray,Susan,and Corinne provide 80 percent of their mother's support.Charlotte provides 10 percent,Ray 9 percent,Susan 45 percent,and Corinne 16 percent.Which of these persons could claim their mother as a dependent under a multiple support agreement?

A)Charlotte,Ray,Susan,or Corinne

B)Charlotte,Susan or Corinne

C)Susan or Corinne

D)Susan only

A)Charlotte,Ray,Susan,or Corinne

B)Charlotte,Susan or Corinne

C)Susan or Corinne

D)Susan only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is Cheryl's AGI if she has a taxable salary of $34,000,receives $6,000 of alimony and $600 of interest on her various savings accounts,contributes $3,000 to her traditional IRA,and paid a $100 penalty for cashing in her Certificates of Deposit early?

A)$40,000

B)$39,600

C)$37,500

D)$36,900

A)$40,000

B)$39,600

C)$37,500

D)$36,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

_____ 23.Qualifying low income wage earners may not only deduct their IRA contributions but they may take a credit for their contribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

A single taxpayer,studying for his master's degree,has an AGI of $57,000.In 2013 he paid $8,000 for college tuition and $2,500 interest on his student loan.In 2013:

A)He may deduct $2,500 of student loan interest and claim a lifetime learning credit of $1,600.

B)He may deduct $2,500 of student loan interest but must begin to phase out his $1,600 lifetime learning credit.

C)He must begin to phase out part of his deductions for both student loan interest and his college tuition.

D)He gets no deduction for student loan interest and must reduce his deduction for college tuition.

A)He may deduct $2,500 of student loan interest and claim a lifetime learning credit of $1,600.

B)He may deduct $2,500 of student loan interest but must begin to phase out his $1,600 lifetime learning credit.

C)He must begin to phase out part of his deductions for both student loan interest and his college tuition.

D)He gets no deduction for student loan interest and must reduce his deduction for college tuition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

To claim a 21-year-old child as a dependent in 2013:

A)The child must be a full-time student the entire year

B)The child's income must be less than $3,900

C)The child must be a full-time student for at least 5 months during the year

D)Either (a)or (b)

E)Either (b)or (c)

A)The child must be a full-time student the entire year

B)The child's income must be less than $3,900

C)The child must be a full-time student for at least 5 months during the year

D)Either (a)or (b)

E)Either (b)or (c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

All of the following are deductions for AGI except:

A)IRA contributions

B)Student loan interest

C)Interest on loan to purchase stocks

D)Health Savings Account contribution

A)IRA contributions

B)Student loan interest

C)Interest on loan to purchase stocks

D)Health Savings Account contribution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

Carl,age 42,is married and has three children.In preparing to go to his accountant,he determines that he has $63,100 of salary income and $250 in dividends.He contributes $4,000 to a Roth IRA and has $6,800 of itemized deductions.His wife has no income.What is the taxable income on their 2013 joint return?

A)$46,100

B)$37,050

C)$31,400

D)$31,650

A)$46,100

B)$37,050

C)$31,400

D)$31,650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following filing statuses can never be used by a single individual?

A)Surviving spouse

B)Head of household

C)Married filing separately

D)Single

A)Surviving spouse

B)Head of household

C)Married filing separately

D)Single

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is a requirement to file for head of household?

A)A single individual (except abandoned spouse)

B)Provides over one-half the cost of maintaining a household for a dependent or a child

C)Qualifying dependent (except a parent)or child must live in the taxpayer's household

D)All of the above are requirements

A)A single individual (except abandoned spouse)

B)Provides over one-half the cost of maintaining a household for a dependent or a child

C)Qualifying dependent (except a parent)or child must live in the taxpayer's household

D)All of the above are requirements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

_____ 27.The additional 0.9 percent Medicare surtax applies to earned income of individuals with wages in excess of $200,000 but does not apply to self-employed individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

All of the following are qualifying relatives who can be claimed as dependents except:

A)Cousin

B)Father-in-law

C)Mother's sister

D)Sister

A)Cousin

B)Father-in-law

C)Mother's sister

D)Sister

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

_____ 24.The tax rate applied to the AMTI for individuals is the same as the tax rate applied to the AMTI for corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

John and Mary have two children,Anna,age 16,and Tammy,age 21.Anna works after school and earned $4,000 in 2013.Tammy works 30 hours per week and is a part-time student at the local community college.She earned $8,400 in 2013.John's mother also lives with them;she receives $7,800 in Social Security and $2,000 in interest income from some bonds.John and Mary provide over $10,000 towards her support.How many dependency exemptions may John and Mary claim on their joint tax return?

A)1

B)2

C)3

D)5

A)1

B)2

C)3

D)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

_____ 25.The maximum annual lifetime learning credit is $2,000 per student.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

Cleo's husband died in January of 2012.She has a 20 year-old son and a sister who live with her.Her son attends a trade school part-time and earned $11,000 from his part-time job.Cleo's sister is a full-time student and only earned $2,800 from her part-time job.How many personal and dependency exemptions can Cleo claim in 2013 and what is her filing status?

A)3;surviving spouse

B)2;surviving spouse

C)2;head of household

D)3;head of household

E)1;single

A)3;surviving spouse

B)2;surviving spouse

C)2;head of household

D)3;head of household

E)1;single

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

39

_____ 22.Taxpayers can apply any excess FICA tax paid to their income tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

_____ 26.Any homeowner who received a first-time homebuyer credit after 2008 must repay the entire credit if the home is sold prior to completing three full years of ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

Cindy has taxable income of $67,000 excluding a $20,000 taxable gain on the sale of bonds she purchased 7 years ago.If Cindy is single,what is her total tax liability?

a.$12,678.75

b.$15,678.75

c.$16,678.75

d.$17,678.75

a.$12,678.75

b.$15,678.75

c.$16,678.75

d.$17,678.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following expenditures is not subject to some form of limitation on its deductibility based on AGI?

A)Interest on a home equity loan

B)Surgery to replace a hip joint

C)Contribution to a university endowment fund

D)Job-hunting expenses

A)Interest on a home equity loan

B)Surgery to replace a hip joint

C)Contribution to a university endowment fund

D)Job-hunting expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

43

Sean bought a home in 2009 for $625,000 financing $550,000 of the purchase price with a 30 year mortgage.In 2013 when his existing mortgage balance was $520,000,he took out a home equity loan for $150,000.He used the proceeds to pay off credit card debt of $40,000 and purchase a car for $85,000;the balance he used to buy an engagement ring for his girlfriend.He paid $30,000 interest on the mortgage and paid interest only of $6,600 on the home equity loan.What is his deduction for qualified residential interest?

A)$36,600

B)$34,400

C)$30,000

D)$6,600

Questions 18 through 21 are based on the following data:

Colin (age 40)is single and itemizes his deductions.His AGI is $100,000.Colin provided the following information about his cash expenditures for 2013:

Interest on loan to purchase corporate securities $ 900

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

A)$36,600

B)$34,400

C)$30,000

D)$6,600

Questions 18 through 21 are based on the following data:

Colin (age 40)is single and itemizes his deductions.His AGI is $100,000.Colin provided the following information about his cash expenditures for 2013:

Interest on loan to purchase corporate securities $ 900

Interest on American Express card 1,200

Points to refinance his home at the end of December 2,600

Mortgage interest payments 11,800

Real estate taxes 2,100

State income taxes withheld on salary 5,400

Additional state income tax estimated payment 1,200

Contribution to Republican Party 2,000

Contribution to United Way 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

To qualify as a dependent,most individuals (except a qualifying child)must earn gross income that is less than an amount equal to:

A)The personal exemption

B)The standard deduction

C)The standard deduction plus the personal exemption

D)There is no gross income test to determine dependency status.

A)The personal exemption

B)The standard deduction

C)The standard deduction plus the personal exemption

D)There is no gross income test to determine dependency status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

Stephanie and Cal have three dependent children in college.Sally is a freshman and Teri is a sophomore at a small private college in their town where their expenses are $6,500 per year for each student;Lexi is in her third year of medical school in Wisconsin and her related expenses are $12,500 per year.What is the maximum education credit allowed Stephanie and Cal on their joint tax return if their AGI is $117,000 in 2013?

A)$5,000

B)$6,000

C)$7,000

D)$7,500

A)$5,000

B)$6,000

C)$7,000

D)$7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is Colin's deduction for taxes?

A)$8,700

B)$7,500

C)$5,400

D)$2,100

A)$8,700

B)$7,500

C)$5,400

D)$2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

How much can Colin deduct for his contributions?

A)$500

B)$1,000

C)$1,500

D)$2,500

A)$500

B)$1,000

C)$1,500

D)$2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

Ikito had a bad year.In 2013,his home was broken into and his TV,DVD,VCR and computer were all stolen.The properties had a basis of $15,000 and a current fair market value of $9,000.Later that year,his car was hit by a garbage truck.It cost Ikito $9,000 to have the car repaired.Ikito didn't believe in insurance,so he received no reimbursements.In addition,the garbage company filed for bankruptcy after the accident.How much may Ikito deduct as an itemized deduction in 2013 if his AGI is $68,000?

A)$18,000

B)$17,800

C)$11,000

D)$10,200

A)$18,000

B)$17,800

C)$11,000

D)$10,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

In 2013,which of the following is allowed as an addition to a nonitemizer's standard deduction?

A)Sales tax on new automobile purchases

B)$500 for real property taxes

C)The allowable casualty deduction for disaster areas

D)None of the above

A)Sales tax on new automobile purchases

B)$500 for real property taxes

C)The allowable casualty deduction for disaster areas

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

If Colin failed to itemize,what would be his total deduction from AGI in 2013:

A)$3,900

B)$6,100

C)$10,000

D)$11,000

A)$3,900

B)$6,100

C)$10,000

D)$11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is a refundable credit?

A)Childcare

B)Plug-in electric drive vehicle

C)Lifetime learning credit

D)Earned income credit

A)Childcare

B)Plug-in electric drive vehicle

C)Lifetime learning credit

D)Earned income credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

52

Holly and Ken are married and have three children living at home: Ken,Jr. ,age 21,goes to college full-time and earned $7,000 from his part-time job;Sara is 19 and earned $19,000 as a secretary;Claudia is 15 and is in high school.Claudia made $42,000 as a model this year,all of which was put into a trust account except for her manager's fee.Ken made $65,000 in 2013 as an engineer and Holly earned $7,000 as a substitute teacher.If they have $18,000 of itemized deductions,what is Holly and Ken's tax liability on their joint return in 2013?

a.$4,877.50

b.$4,867.50

c.$5,452.50

d.$6,027.50

a.$4,877.50

b.$4,867.50

c.$5,452.50

d.$6,027.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

What is the difference in tax savings between a $1,000 tax credit and a $1,000 tax deduction for a single taxpayer with $45,000 in taxable income?

A)0

B)$850

C)$750

D)$300

E)$250

A)0

B)$850

C)$750

D)$300

E)$250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sonjay had AGI of $60,000 in 2013 and made several charitable contributions as follows: Land donated to county for new school: FMV = $30,000;basis = $20,000

Appraisal fee for the land: $2,500

Contributions to his church: $4,000

Contributions to the Red Cross: $1,000

What is the maximum charitable contribution deduction that Sonjay could claim in 2013:

A)$30,000

B)$27,500

C)$25,000

D)$24,000

Appraisal fee for the land: $2,500

Contributions to his church: $4,000

Contributions to the Red Cross: $1,000

What is the maximum charitable contribution deduction that Sonjay could claim in 2013:

A)$30,000

B)$27,500

C)$25,000

D)$24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

What is the amount of Colin's deductible interest expense if he received $600 in corporate dividends that are taxed at the 15% tax rate?

A)$11,800

B)$12,400

C)$12,700

D)$14,400

A)$11,800

B)$12,400

C)$12,700

D)$14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

Justin,age 42 and divorced,is the sole support of his mother,age 69,who resided in a local nursing home for the entire year.Justin's mother had no income for the year.Justin's filing status and the number of exemptions he can claim are:

A)Single and 1 exemption

B)Single and 2 exemptions

C)Head of household and 1 exemption

D)Head of household and 2 exemptions

A)Single and 1 exemption

B)Single and 2 exemptions

C)Head of household and 1 exemption

D)Head of household and 2 exemptions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

Manuel,age 66 and Angela,age 54,have one child who lives with them and for whom they provide total support.The child is 24 years old and blind;she is not a full-time student and has no income.How many personal and dependency exemptions can Manual and Angela claim on their joint tax return?

A)2

B)3

C)4

D)5

A)2

B)3

C)4

D)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

The 2013 standard deduction for a married taxpayer,age 68,who files a separate return is:

A)$6,100

B)$6,600

C)$7,300

D)$12,200

A)$6,100

B)$6,600

C)$7,300

D)$12,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

Tina is 68 and single.She has AGI of $71,000.If she has a $4,300 deduction for medical expenses for regular tax purposes,what is her medical deduction for AMTI?

A)$9,625

B)$4,300

C)$3,870

D)$2,525

A)$9,625

B)$4,300

C)$3,870

D)$2,525

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

In 2013,Carol,who is 54 and single,earned a salary of $54,000 and $6,000 of interest on State of Nevada bonds.She contributed $2,000 to her Roth IRA,paid a $4,000 hospital bill,state income taxes of $1,500,real estate taxes of $900,mortgage interest of $4,500,and $2,000 interest on her margin account under which she purchased the bonds.What is Carol's taxable income?

A)$41,200

B)$43,200

C)$44,800

D)$47,500

A)$41,200

B)$43,200

C)$44,800

D)$47,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

Patricia's AGI was $80,000 in both 2012 and 2013.She made cash contributions to public charities of $43,000 in 2012 and $45,000 in 2013.Patricia's charitable contribution carryover to 2014 is:

A)$4,000

B)$5,000

C)$8,000

D)$44,000

A)$4,000

B)$5,000

C)$8,000

D)$44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

Lisa's husband died in 2010.Lisa did not remarry,and continued to maintain a home for herself and her dependent daughter during 2011,2012,and 2013 providing full support for herself and her daughter during these years.For 2013,Lisa's filing status is:

A).Single

B)Married filing separately

C)Head of household

D)Surviving Spouse,using married filing jointly rate

A).Single

B)Married filing separately

C)Head of household

D)Surviving Spouse,using married filing jointly rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is included in the miscellaneous itemized deduction category,and deductible only if the total expenses in this category exceed 2% of the taxpayer's adjusted gross income?

A)Investment interest expense

B)Tax return preparation fees

C)Property taxes

D)Medical expenses

A)Investment interest expense

B)Tax return preparation fees

C)Property taxes

D)Medical expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is true regarding the deductibility of investment interest expense?

A)Deductible in full subject to the 2% of AGI floor that applies to miscellaneous itemized deductions.

B)Deductible only to the extent of net investment income,excess amounts cannot be carried forward and thus are non-deductible.

C)Deductible only to the extent of the interest on a principal amount that does not exceed $1,000,000.

D)Deductible only to the extent of net investment income;any excess amounts can be carried forward indefinitely.

A)Deductible in full subject to the 2% of AGI floor that applies to miscellaneous itemized deductions.

B)Deductible only to the extent of net investment income,excess amounts cannot be carried forward and thus are non-deductible.

C)Deductible only to the extent of the interest on a principal amount that does not exceed $1,000,000.

D)Deductible only to the extent of net investment income;any excess amounts can be carried forward indefinitely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

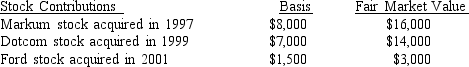

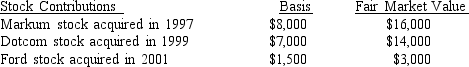

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

A)$45,000

B)$33,000

C)$27,000

D)$16,500

A)$45,000

B)$33,000

C)$27,000

D)$16,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck