Deck 12: Wealth Transfer Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 12: Wealth Transfer Taxes

1

_____ 9.Only gift taxes on a present interest in property are eligible for the unified credit.

False

2

The estate tax

A)applies to the person inheriting property.

B)was first imposed in 1932

C)facilitates wealth distribution.

D)was enacted at the same time as the gift tax.

A)applies to the person inheriting property.

B)was first imposed in 1932

C)facilitates wealth distribution.

D)was enacted at the same time as the gift tax.

B

3

_____ 8.Gifts are valued at their fair market value on the date of gift and the donee takes this fair market value as basis.

False

4

_____ 16.No estate tax is due if a husband leaves his entire estate to his wife.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following does not apply to the estate tax in effect in 2013?

A)The tax is assessed on the adjusted basis of the decedent's estate.

B)Taxable gifts are integrated with the estate value to determine the estate tax.

C)The gift and estate tax rate schedules are the same.

D)The unified credit applies to gifts and estates.

A)The tax is assessed on the adjusted basis of the decedent's estate.

B)Taxable gifts are integrated with the estate value to determine the estate tax.

C)The gift and estate tax rate schedules are the same.

D)The unified credit applies to gifts and estates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

_____ 6.With a revocable trust,the grantor can change the terms of a trust at will.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

_____ 3.Painting a house for your mother is not a taxable gift.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

Carl gave his six children gifts of $15,000 each in the current year.

A)Carl has made $90,000 of taxable gifts.

B)Carl has made $6,000 of taxable gifts.

C)Carl has made no taxable gifts if he and his wife elect gift splitting.

D)(a)and (b)are both true.

E)(b)and (c)are both true.

A)Carl has made $90,000 of taxable gifts.

B)Carl has made $6,000 of taxable gifts.

C)Carl has made no taxable gifts if he and his wife elect gift splitting.

D)(a)and (b)are both true.

E)(b)and (c)are both true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

_____ 13.Probate determines the property included in a decedent's taxable estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

_____ 17.The tax on generation skipping transfers has been repealed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

_____ 4.Putting cash into a joint bank account results in a gift to the joint tenant when deposited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

_____ 11.Gifts to most charities are not subject to gift taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

_____ 1.The gift tax and estate taxes were imposed in 1932 and 1916,respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

_____ 7.Payment to a college for a grandchild's tuition is not a taxable gift.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

_____ 10.Gift splitting allows a married couple to use both their annual exclusions in determining taxable gifts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

_____ 14.A taxpayer must not retain any incidents of ownership in a life insurance policy on his or her life to have it excluded from his or her taxable estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

_____ 12.The kiddie tax applies to all unearned income of a child under 19.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

_____ 2.A taxpayer can elect to pay a gift tax rather than use part of his or her unified credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

_____ 5.A trust always involves at least three different individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

_____ 15.The executor can elect the alternative valuation date only if both the value of the estate and the estate tax are reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is a taxable gift?

A)$25,000 given to the Democratic party.

B)$24,000 paid to Stanford University by Joel for the tuition for his best friend's son.

C)$100,000 given to the Red Cross.

D)All are taxable gifts.

E)None are taxable gifts.

A)$25,000 given to the Democratic party.

B)$24,000 paid to Stanford University by Joel for the tuition for his best friend's son.

C)$100,000 given to the Red Cross.

D)All are taxable gifts.

E)None are taxable gifts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

A fiduciary tax return is filed by

A)a trustee.

B)a grantor.

C)an executor.

D)Both (a)and (b).

E)Both (a)and (c).

A)a trustee.

B)a grantor.

C)an executor.

D)Both (a)and (b).

E)Both (a)and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

The gift tax

A)can apply to tuition paid directly to a school by an unrelated party.

B)is not levied when setting up a revocable trust.

C)applies to property transfers between divorcing parties.

D)Both (a)and (b).

E)Both (b)and (c).

A)can apply to tuition paid directly to a school by an unrelated party.

B)is not levied when setting up a revocable trust.

C)applies to property transfers between divorcing parties.

D)Both (a)and (b).

E)Both (b)and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following gifts is not eligible for the annual exclusion?

A)$20,000 given to a spouse

B)The remainder interest in a trust

C)$100,000 given to North Carolina State University.

D)All are eligible for the annual exclusion.

E)None are eligible for the annual exclusion.

A)$20,000 given to a spouse

B)The remainder interest in a trust

C)$100,000 given to North Carolina State University.

D)All are eligible for the annual exclusion.

E)None are eligible for the annual exclusion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

The donor of a trust is the same as

A)the beneficiary.

B)the trustee.

C)the grantor.

D)the fiduciary.

A)the beneficiary.

B)the trustee.

C)the grantor.

D)the fiduciary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

What is the benefit(s)of a living trust?

A)Keeps assets in the trust out of the gross estate.

B)Keeps assets in the trust out of the probate estate.

C)Maintains privacy for the beneficiaries.

D)Both (a)and (b).

E)Both (b)and (c).

A)Keeps assets in the trust out of the gross estate.

B)Keeps assets in the trust out of the probate estate.

C)Maintains privacy for the beneficiaries.

D)Both (a)and (b).

E)Both (b)and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

Chloe gave $15,000 to her son,$20,000 to her daughter,and paid $18,000 to the University of Delaware for her niece's tuition.She gave $12,000 to the United Way campaign,and $18,000 to her church.What is the amount of Chloe's taxable gifts?

A)$ 7,000

B)$15,000

C)$35,000

D)$53,000

E)$83,000

A)$ 7,000

B)$15,000

C)$35,000

D)$53,000

E)$83,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

Refer to the information in the preceding problem.What are Charles and Marla's taxable gifts if they elect gift splitting?

A)$68,000

B)$90,000

C)$145,000

D)$193,000

A)$68,000

B)$90,000

C)$145,000

D)$193,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

An income interest in a trust

A)must be established for a fixed term in years.

B)is not eligible for the annual exclusion.

C)must be irrevocable to be eligible for the annual exclusion.

D)is irrevocable if the donor only controls who may receive trust income.

A)must be established for a fixed term in years.

B)is not eligible for the annual exclusion.

C)must be irrevocable to be eligible for the annual exclusion.

D)is irrevocable if the donor only controls who may receive trust income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following transfer(s)is excluded from gift taxes:

A)John makes a $15,000 payment to Shands Hospital on behalf of Marth

A)

B)Cal transferred his half of their house to Colleen as part of their divorce settlement.

C)Jonathon gave his grandson a Jaguar automobile when he graduated from College.

D)Both (a)and (b).

E)Both (a)and (c).

A)John makes a $15,000 payment to Shands Hospital on behalf of Marth

A)

B)Cal transferred his half of their house to Colleen as part of their divorce settlement.

C)Jonathon gave his grandson a Jaguar automobile when he graduated from College.

D)Both (a)and (b).

E)Both (a)and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

The amount of the kiddie tax is the sum of

A)the child's tax on the child's earned income and the tax on all the child's unearned income at the parents' rates.

B)the parents' tax on the child's unearned income and the child's tax on the earned income.

C)the parent's tax on the child's unearned income in excess of $2,000 and the child's tax on the balance of his or her taxable income.

D)$1,000 or the tax on unearned income.

E)None of the above.

A)the child's tax on the child's earned income and the tax on all the child's unearned income at the parents' rates.

B)the parents' tax on the child's unearned income and the child's tax on the earned income.

C)the parent's tax on the child's unearned income in excess of $2,000 and the child's tax on the balance of his or her taxable income.

D)$1,000 or the tax on unearned income.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Silvia has three grandchildren.What is the maximum amount that she can contribute this year to a Section 529 education plan without incurring a gift tax?

A)$14,000

B)$42,000

C)$70,000

D)$210,000

E)$630,000

A)$14,000

B)$42,000

C)$70,000

D)$210,000

E)$630,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

Cheryl bought some stock for $110,000.Two years later,she gave the stock to her brother,Harold,when its value was $100,000.Three years later,Harold sold the stock for $105,000.What is the value of the gift to Harold,and his gain or loss on the sale,respectively?

A)$100,000;0 gain/loss

B)$100,000;$5,000 gain

C)$110,000;0 gain/loss

D)$110,000;$5,000 loss

A)$100,000;0 gain/loss

B)$100,000;$5,000 gain

C)$110,000;0 gain/loss

D)$110,000;$5,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

When will an insurance policy on the decedent's life be included in a decedent's gross estate?

A)The decedent could change the beneficiary.

B)The decedent paid the premiums.

C)The decedent gave the policy to his daughter two years ago.

D)Both (a)and (c).

E)Both (b)and (c).

A)The decedent could change the beneficiary.

B)The decedent paid the premiums.

C)The decedent gave the policy to his daughter two years ago.

D)Both (a)and (c).

E)Both (b)and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

A trust that features a demand provision by a beneficiary equal to the annual exclusion is

A)an irrevocable trust.

B)a revocable trust.

C)a Crummy trust.

D)a trust established under the UTM

A)

A)an irrevocable trust.

B)a revocable trust.

C)a Crummy trust.

D)a trust established under the UTM

A)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

When Shipley died,he owned $100,000 in bonds that he left to his church,a $400,000 house held in joint tenancy with right of survivorship with his brother,and a collection of antique automobiles valued at $1,300,000 that he left to his son.What are Shipley's probate estate and his gross estate,respectively?

A)$1,600,000;$1,300,000

B)$1,400,000;$1,300,000

C)$1,600,000;$1,600,000

D)$1,400,000;$1,600,000

A)$1,600,000;$1,300,000

B)$1,400,000;$1,300,000

C)$1,600,000;$1,600,000

D)$1,400,000;$1,600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

All of the following apply to the Coverdell education savings account except:

A)Beneficiaries may be able to be changed.

B)Allows the same contribution as a Section 529 qualified tuition plan.

C)Has a $2,000 annual contribution limit.

D)Limits the contribution of higher income taxpayers.

A)Beneficiaries may be able to be changed.

B)Allows the same contribution as a Section 529 qualified tuition plan.

C)Has a $2,000 annual contribution limit.

D)Limits the contribution of higher income taxpayers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

Charles gave his three grandsons $20,000 each,his friend,Joe,$15,000,and his daughter $30,000.His second wife,Marla,gave her three children $50,000 each and $50,000 to her church.What are their combined taxable gifts if they do not elect gift splitting?

A)$305,000

B)$255,000

C)$143,000

D)$ 71,000

A)$305,000

B)$255,000

C)$143,000

D)$ 71,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

The kiddie tax can only be imposed on

A)the earned income of a child under 18.

B)unearned income of a child in excess of $2,000.

C)income only from property given to a child

D)the unearned income of a child in excess of the standard deduction

E)None of the above.

A)the earned income of a child under 18.

B)unearned income of a child in excess of $2,000.

C)income only from property given to a child

D)the unearned income of a child in excess of the standard deduction

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

The annual gift tax exclusion

A)cannot increase beyond $14,000 per donor.

B)does not apply to a bargain purchase between related persons.

C)applies to future interests.

D)removes small gifts from taxation.

E)Both (a)and (d).

A)cannot increase beyond $14,000 per donor.

B)does not apply to a bargain purchase between related persons.

C)applies to future interests.

D)removes small gifts from taxation.

E)Both (a)and (d).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

Distributable net income

A)limits the amount of a distribution that is taxable to the beneficiary.

B)is only made up of taxable income.

C)is the minimum amount that must be distributed by a complex trust.

D)is the dividend and interest earned by a trust in a year less expenses.

A)limits the amount of a distribution that is taxable to the beneficiary.

B)is only made up of taxable income.

C)is the minimum amount that must be distributed by a complex trust.

D)is the dividend and interest earned by a trust in a year less expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

The following gifts could be subject to the generation skipping transfer tax except:

A)A gift from a grandmother to her grandson.

B)A gift of a great grandfather to his great granddaughter.

C)A gift from a great uncle to a great niece.

D)A gift from a grandson to a grandfather.

A)A gift from a grandmother to her grandson.

B)A gift of a great grandfather to his great granddaughter.

C)A gift from a great uncle to a great niece.

D)A gift from a grandson to a grandfather.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

The federal gift tax is:

A)imposed upon the recipient of gifts

B)imposed upon property in the estate of a deceased person

C)imposed upon the donor on lifetime gift transfers

D)imposed upon the donee only if a gift is not subject to income taxes

A)imposed upon the recipient of gifts

B)imposed upon property in the estate of a deceased person

C)imposed upon the donor on lifetime gift transfers

D)imposed upon the donee only if a gift is not subject to income taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

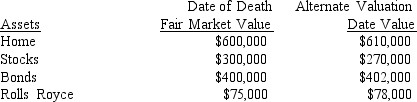

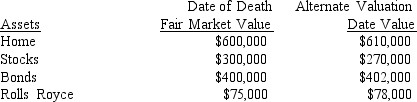

Morrow died on January 15,2013 leaving the following assets:  What is the value of the estate if the alternative valuation date is elected and the house was sold on March 10 for $605,000 and the stocks were sold on June 30 for $265,000?

What is the value of the estate if the alternative valuation date is elected and the house was sold on March 10 for $605,000 and the stocks were sold on June 30 for $265,000?

A)$1,375,000

B)$1,360,000

C)$1,350,000

D)$1,343,000

What is the value of the estate if the alternative valuation date is elected and the house was sold on March 10 for $605,000 and the stocks were sold on June 30 for $265,000?

What is the value of the estate if the alternative valuation date is elected and the house was sold on March 10 for $605,000 and the stocks were sold on June 30 for $265,000?A)$1,375,000

B)$1,360,000

C)$1,350,000

D)$1,343,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

The unified credit for 2013 gifts is equivalent to an exemption amount of:

A)$1,000,000

B)$3,500,000

C)$5,000,000

D)$5,250,000

A)$1,000,000

B)$3,500,000

C)$5,000,000

D)$5,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following transfers is taxable under the gift tax statutes?

A)Mark sold land to an unrelated party for less than its fair market value because he needed cash in a hurry.

B)After a friend's death,Sharron wrote a check to the university to pay the college tuition for the friend's son.

C)Marilynn wrote checks to the landlord to pay her aunt's rent for ten months when her aunt was unemployed.

D)Jose wrote a check to the doctor to pay a friend's medical bill when he had surgery.

A)Mark sold land to an unrelated party for less than its fair market value because he needed cash in a hurry.

B)After a friend's death,Sharron wrote a check to the university to pay the college tuition for the friend's son.

C)Marilynn wrote checks to the landlord to pay her aunt's rent for ten months when her aunt was unemployed.

D)Jose wrote a check to the doctor to pay a friend's medical bill when he had surgery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following would not be income in respect of a decedent who dies on January 4?

A)Interest credited a savings account on January 2 but not withdrawn.

B)A dividend declared on December 31 payable on January 15.

C)Salary payable on January 10.

D)$30,000 in the decedent's 401-K plan.

A)Interest credited a savings account on January 2 but not withdrawn.

B)A dividend declared on December 31 payable on January 15.

C)Salary payable on January 10.

D)$30,000 in the decedent's 401-K plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

All of the following are deductions from the gross estate except

A)the decedent's funeral expenses.

B)charitable bequests.

C)the annual exclusion.

D)a credit card bill of the decedent.

E)Property bequeathed to the surviving spouse.

A)the decedent's funeral expenses.

B)charitable bequests.

C)the annual exclusion.

D)a credit card bill of the decedent.

E)Property bequeathed to the surviving spouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

Both gross annual gifts and the gross estate are reduced for

A)charitable gifts.

B)gifts to a spouse.

C)annual exclusion.

D)Both (a)and (b).

E)Both (a)and (c).

A)charitable gifts.

B)gifts to a spouse.

C)annual exclusion.

D)Both (a)and (b).

E)Both (a)and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

Jessica is doing her year-end tax planning and is concerned about gift taxes.If she comes to you for advice,which of the following would you tell her is a taxable gift?

A)Payment to the doctor for her gardener's medical expenses

B)Tuition paid to Norden University for her hairdresser's daughter,Trish

A)

C)A donation to her favorite political organization

D)Buying a $20,000 car for Trisha when she goes away to Norden University

A)Payment to the doctor for her gardener's medical expenses

B)Tuition paid to Norden University for her hairdresser's daughter,Trish

A)

C)A donation to her favorite political organization

D)Buying a $20,000 car for Trisha when she goes away to Norden University

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is the limit on the amount of property that can be transferred to a spouse free of any transfer taxes?

A)$12,000 per year

B)$1,000,000

C)An unlimited amount

D)All transfers to a spouse are subject to transfer taxes

A)$12,000 per year

B)$1,000,000

C)An unlimited amount

D)All transfers to a spouse are subject to transfer taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not an advantage of lifetime gifts?

A)The annual exclusion can shield thousands of dollars from taxation.

B)Property appreciation does not enter the estate tax calculation.

C)A stepped-up basis is secured for appreciated gifts.

D)Gift-splitting allows spouses to combine their annual exclusions

A)The annual exclusion can shield thousands of dollars from taxation.

B)Property appreciation does not enter the estate tax calculation.

C)A stepped-up basis is secured for appreciated gifts.

D)Gift-splitting allows spouses to combine their annual exclusions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

William set up a trust for his parents.Each parent is to receive one-half of the income for his or her lifetime;when one parent dies,all income is to go to the surviving parent.When the other parent dies,the remainder is to go to William.This trust is:

A)A revocable trust.

B)An irrevocable trust.

C)A grantor trust.

D)A complex trust.

A)A revocable trust.

B)An irrevocable trust.

C)A grantor trust.

D)A complex trust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

Carey is trustee of the Floyd Family Trust.The trust distributes $20,000 income to George,$10,000 to Linda,and $5,000 to George and Linda's church.The Floyd Family trust is:

A)A revocable trust.

B)An irrevocable trust.

C)A simple trust.

D)A complex trust.

A)A revocable trust.

B)An irrevocable trust.

C)A simple trust.

D)A complex trust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following transactions is a taxable gift (before applying the unified credit)?

A)Christian transfers $5,000 to his friend Crystal

B)Carmen gives $5,000 in stocks to her church

C)Yamile gives $30,000 to her husband,Jose.

D)Jessica transfers $30,000 into an irrevocable trust for the benefit of her two children.

A)Christian transfers $5,000 to his friend Crystal

B)Carmen gives $5,000 in stocks to her church

C)Yamile gives $30,000 to her husband,Jose.

D)Jessica transfers $30,000 into an irrevocable trust for the benefit of her two children.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

Appreciated property that was inherited in 2013

A)will have a stepped-up basis.

B)avoids income tax on the appreciation prior to the date of death.

C)avoids income tax on any post inheritance appreciation on a future sale.

D)All of the above.

E)(a)and (b)only.

A)will have a stepped-up basis.

B)avoids income tax on the appreciation prior to the date of death.

C)avoids income tax on any post inheritance appreciation on a future sale.

D)All of the above.

E)(a)and (b)only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

The alternate valuation date is:

A)3 months after the date of death

B)6 months after the date of death

C)9 months after the date of death

D)12 months after the date of death

A)3 months after the date of death

B)6 months after the date of death

C)9 months after the date of death

D)12 months after the date of death

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

Crystal deposited $50,000 into a joint savings account in her name and the name of her son,Jason.Later that same year,Jason withdrew $16,000 from the account.If Crystal made no other gifts to Jason during that year,what is the value of Crystal's taxable gifts (before applying the unified credit)?

A)$2,000

B)$12,000

C)$16,000

D)$25,000

A)$2,000

B)$12,000

C)$16,000

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck