Deck 10: Reporting and Interpreting Bonds

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 10: Reporting and Interpreting Bonds

1

A bond's interest payments are determined by multiplying the bond's principal amount by the stated interest rate.

True

2

A convertible bond can be called for early retirement at the option of the issuing company.

False

3

The issuing company and the bond underwriter determine the selling price of a bond.

False

4

An advantage of issuing a bond relative to stock is that the bond interest payments are tax deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

A bond will sell at a premium when the market rate of interest is greater than the stated rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

When the market rate of interest is greater than the stated interest rate, the bond will sell at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

Increases in the market rate of interest subsequent to a bond issue increase the discount on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

Amortization of a discount on a bond payable will result in an increase in the book value of the bond liability on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

The payment of bond interest on the interest payment date, for bonds issued at par value, reduces both the bond liability and assets, assuming that interest expense is recorded at the time of the cash payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

The major disadvantages of issuing a bond are the risk of bankruptcy and the negative impact on cash flow because debt must be repaid at a specified date in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

The journal entry to record the interest cash payment for a bond issued at a discount results in an increase in the book value of the bond liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

A bond issued at a discount will pay total cash payments for interest that are more than the total interest expense recognized over the life of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

Issuing bonds dilutes the voting power of the common shareholders because bonds have preferential voting rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

A company has a December 31 fiscal year-end. If the interest is paid annually on December 31, the bond interest expense on the income statement is the amount of the interest cash payment when the bond initially sells at par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

A bond will sell at its par value when the market rate of interest equals the stated rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

The proceeds received from a bond issue will be greater than the bond maturity value when the stated interest rate exceeds the market rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

The journal entry to record the interest cash payment for a bond issued at a premium results in an increase in the book value of the bond liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

The issuance price of a bond is the present value of both the principal plus the cash interest to be received over the life of the bond discounted at the stated (coupon) rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

Amortization of discount on bonds payable will make the amount of interest expense reported on the income statement less than the cash paid for that year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

Either straight-line or effective-interest amortization may be used for bond premiums or discounts regardless of the amounts involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

Issuing bonds rather than stock will result in an increase in the debt-to-equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

Issues of bonds in exchange for cash are reported as a cash flow from financing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a company repurchases bonds with a $1,000,000 maturity value for $1,020,000 when the book value is $950,000, a loss of $20,000 will be reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

Interest expense decreases over time when a bond is initially issued at a premium and the effective-interest method is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

A bond issued at a premium will pay cash interest in excess of the amount of interest expense recognized for accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements best describes convertible bonds?

A) They can be turned in for early retirement at the option of the bondholder.

B) They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be converted to common stock at the option of the issuer.

A) They can be turned in for early retirement at the option of the bondholder.

B) They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be converted to common stock at the option of the issuer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following types of bonds has specific assets pledged to guarantee repayment?

A) Debenture bond.

B) Callable bond.

C)Secured bond.

D)Convertible bonD.A secured bond has specific assets pledged as a guarantee of repayment at maturity.

A) Debenture bond.

B) Callable bond.

C)Secured bond.

D)Convertible bonD.A secured bond has specific assets pledged as a guarantee of repayment at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

When a company needs funds to finance the expansion of its operations, which of the following is not an advantage of issuing bonds rather than issuing stock?

A) Stockholders remain in control as bondholders cannot vote or share in the company's earnings.

B) Interest expense is tax deductible but dividends are not.

C)Bonds can usually be issued at a low interest rate and the proceeds can be invested to earn a higher rate.

D)The dates for the interest and maturity payments are fixeD.The fixed payment dates create inflexibility and therefore increase bankruptcy risk.

A) Stockholders remain in control as bondholders cannot vote or share in the company's earnings.

B) Interest expense is tax deductible but dividends are not.

C)Bonds can usually be issued at a low interest rate and the proceeds can be invested to earn a higher rate.

D)The dates for the interest and maturity payments are fixeD.The fixed payment dates create inflexibility and therefore increase bankruptcy risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

When a company prepares a bond indenture, certain provisions of the bonds are included. Which of the following is/are not specified in the indenture?

A) Dates of each interest payment.

B) The stated interest rate.

C)The maturity date.

D)The market rate of interest.

A) Dates of each interest payment.

B) The stated interest rate.

C)The maturity date.

D)The market rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

The debt-to-equity ratio assesses the amount of capital provided by creditors relative to stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

The cash payment for interest on a bond payable is reported as a cash flow from financing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

The annual interest rate specified within a bond indenture is called which of the following?

A) The stated rate of interest.

B) The market rate of interest.

C)The effective rate of interest.

D)The actual rate of interest.

A) The stated rate of interest.

B) The market rate of interest.

C)The effective rate of interest.

D)The actual rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a reason that a corporation would want to issue bonds instead of stock?

A) Interest payments can be deducted for income tax purposes.

B) Stockholders maintain control.

C)The impact on earnings from using borrowed money may be positive.

D)There is less risk associated with a bond issue.

A) Interest payments can be deducted for income tax purposes.

B) Stockholders maintain control.

C)The impact on earnings from using borrowed money may be positive.

D)There is less risk associated with a bond issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements best describes callable bonds?

A) They can be turned in for early retirement at the option of the bondholder.

B) They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be called for early retirement at the option of the lien holder.

A) They can be turned in for early retirement at the option of the bondholder.

B) They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be called for early retirement at the option of the lien holder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

When a company purchases and retires its outstanding bonds payable for an amount less than their book value, a decrease in stockholders' equity results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is correct?

A) A secured bond has specific assets pledged as collateral to secure it.

B) An unsecured bond can be paid at the option of the issuer.

C)A bond trustee is appointed to represent the issuing company.

D)The bond indenture specifies the market rate of interest the investors will earn.

A) A secured bond has specific assets pledged as collateral to secure it.

B) An unsecured bond can be paid at the option of the issuer.

C)A bond trustee is appointed to represent the issuing company.

D)The bond indenture specifies the market rate of interest the investors will earn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

The debt-to-equity ratio is calculated by dividing total liabilities by total liabilities plus stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

38

The journal entry to record the issue of a bond when the stated interest rate exceeds the market rate of interest debits premium on bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

Interest expense increases over time when a bond is initially issued at a premium and the effective-interest method is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements is not correct?

A) The bond principal is the amount due at the maturity date of the bond.

B) The stated interest rate is used to determine the cash interest payments.

C)The bond principal is used to determine the cash interest payments.

D)The market rate of interest is used to determine the cash interest payments.

A) The bond principal is the amount due at the maturity date of the bond.

B) The stated interest rate is used to determine the cash interest payments.

C)The bond principal is used to determine the cash interest payments.

D)The market rate of interest is used to determine the cash interest payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

The journal entry to record the sale of bonds at their par value results in which of the following?

A) An increase in assets and liabilities equal to the par value of the bonds.

B) An increase in assets and liabilities equal to the par value of the bonds and their associated interest payments.

C)An increase in assets equal to the par value of the bonds and an increase in liabilities equal to the bonds' future cash flows.

D)An increase in assets and liabilities equal to the bonds' future cash flows.

A) An increase in assets and liabilities equal to the par value of the bonds.

B) An increase in assets and liabilities equal to the par value of the bonds and their associated interest payments.

C)An increase in assets equal to the par value of the bonds and an increase in liabilities equal to the bonds' future cash flows.

D)An increase in assets and liabilities equal to the bonds' future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

On January 1, 2014, Tonika Corporation issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Assuming effective-interest amortization is used, the 2015 interest expense is closest to:

A) $779.

B) $796.

C)$677.

D)$700.

A) $779.

B) $796.

C)$677.

D)$700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

Halverson's times interest earned ratio was 2.98 in 2014, 2.79 in 2013, and 2.31 in 2012. Which of the following statements about the ratio is possibly correct?

A) The increasing ratio indicates decreasing levels of debt on which interest is incurred.

B) The increasing ratio indicates the strategy of pursuing growth by investment in other companies, which has increased debt, but Halverson's profits have not yet increased from those investments.

C)The increasing ratio implies increased long-term debt financing.

D)The increasing ratio would be considered by creditors to be an indicator of higher risk.

A) The increasing ratio indicates decreasing levels of debt on which interest is incurred.

B) The increasing ratio indicates the strategy of pursuing growth by investment in other companies, which has increased debt, but Halverson's profits have not yet increased from those investments.

C)The increasing ratio implies increased long-term debt financing.

D)The increasing ratio would be considered by creditors to be an indicator of higher risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

On November 1, 2013, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2013, and interest is payable each November 1 and May 1. How much is the amount of straight-line discount amortization on each semi-annual interest date?

A) $90.

B) $45.

C)$900.

D)$450.

A) $90.

B) $45.

C)$900.

D)$450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

Skylar Corporation issued $50,000,000 of its 10% bonds at par on January 1, 2014. On December 31, 2014 the bonds were trading on the bond exchange at 102.5. Since the issue date, what has happened to the market rate of interest?

A) The market rate increased.

B) The market rate decreased.

C)The market rate stayed the same.

D)The change in the market rate can not be determineD.The bonds sold for par value on January 1, 2014 so the stated interest rate equaled the market rate of interest. As of December 31, 2014, the bonds were selling at a premium, which means that the stated rate was greater than the market rate on December 31, 2014. Therefore, the market rate of interest decreased.

A) The market rate increased.

B) The market rate decreased.

C)The market rate stayed the same.

D)The change in the market rate can not be determineD.The bonds sold for par value on January 1, 2014 so the stated interest rate equaled the market rate of interest. As of December 31, 2014, the bonds were selling at a premium, which means that the stated rate was greater than the market rate on December 31, 2014. Therefore, the market rate of interest decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

On November 1, 2013, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2013, and interest is payable each November 1 and May 1. Which of the following is incorrect assuming the straight-line method of amortization is utilized?

A) The market rate of interest exceeded the stated rate of interest when the bonds were issued.

B) The semi-annual interest expense is $1,095.

C)The book value of the bonds increases $45 every six months.

D)The semi-annual interest expense is less than the semi-annual cash interest payment.

A) The market rate of interest exceeded the stated rate of interest when the bonds were issued.

B) The semi-annual interest expense is $1,095.

C)The book value of the bonds increases $45 every six months.

D)The semi-annual interest expense is less than the semi-annual cash interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

Eaton Company issued bonds when the stated rate of interest was 10% and the market rate was 10%. Which of the following statements is incorrect?

A) The bonds were issued at par.

B) Annual interest expense will equal the company's annual cash payments for interest.

C)The book value of the bonds will decrease as cash interest payments are made.

D)Annual interest expense is the same regardless of whether the effective-interest or straight-line method of amortization is useD.The cash payment of interest on the due date increases expenses and decreases assets. The payment does not affect the book value of the bond liability.

A) The bonds were issued at par.

B) Annual interest expense will equal the company's annual cash payments for interest.

C)The book value of the bonds will decrease as cash interest payments are made.

D)Annual interest expense is the same regardless of whether the effective-interest or straight-line method of amortization is useD.The cash payment of interest on the due date increases expenses and decreases assets. The payment does not affect the book value of the bond liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

On November 1, 2013, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2013, and interest is payable each November 1 and May 1. How much is the book value of the bonds after the November 1, 2014 interest payment was recorded, assuming the straight-line method of amortization is utilized?

A) $29,010.

B) $29,100.

C)$29,190.

D)$29,280.

A) $29,010.

B) $29,100.

C)$29,190.

D)$29,280.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

Assuming no adjusting journal entries have been made, the journal entry to record the cash interest payment on the due date for bonds issued at their par value results in which of the following?

A) An increase in expenses and a decrease in liabilities.

B) An increase in expenses and a decrease in assets.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

A) An increase in expenses and a decrease in liabilities.

B) An increase in expenses and a decrease in assets.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

Assuming no adjusting journal entries have been made, the journal entry to record the cash interest payment on the due date for bonds issued at a discount results in which of the following?

A) An increase in expenses and a decrease in liabilities.

B) An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

A) An increase in expenses and a decrease in liabilities.

B) An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

Eaton Company issued $5 million of bonds. The stated rate of interest was 10% and the market rate was 11%. Which of the following statements is correct?

A) The bonds were issued at a premium.

B) Annual interest expense will exceed the company's actual cash payments for interest.

C)Annual interest expense will be $500,000.

D)The book value of the bond will decrease as the bond matures.

A) The bonds were issued at a premium.

B) Annual interest expense will exceed the company's actual cash payments for interest.

C)Annual interest expense will be $500,000.

D)The book value of the bond will decrease as the bond matures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements does not correctly describe the accounting for bonds that were issued at their face (maturity) value?

A) The market rate of interest equals the stated interest rate.

B) The interest expense over the life of the bonds will equal the cash interest payments.

C)The present value of the bonds' future cash flows equals the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

A) The market rate of interest equals the stated interest rate.

B) The interest expense over the life of the bonds will equal the cash interest payments.

C)The present value of the bonds' future cash flows equals the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

During 2014, Patty's Pizza reported net income of $4,212 million, interest expense of $167 million and income tax expense of $1,372 million. During 2013, they reported net income of $3,568 million, interest expense of $163 million and income tax expense of $1,424 million. The times interest earned ratios for 2014 and 2013, respectively, are closest to:

A) 32.2 and 29.4 times.

B) 28.4 and 23.8 times.

C)34.4 and 31.6 times.

D)34.1 and 26.6 times.

A) 32.2 and 29.4 times.

B) 28.4 and 23.8 times.

C)34.4 and 31.6 times.

D)34.1 and 26.6 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

On November 1, 2013, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2013, and interest is payable each November 1 and May 1. How much is the semi-annual interest expense when the straight-line method is utilized?

A) $2,010.

B) $2,190.

C)$1,095.

D)$2,055.

A) $2,010.

B) $2,190.

C)$1,095.

D)$2,055.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

Eaton Company issued bonds when the stated rate of interest was 10% and the market rate was 8%. Which of the following statements is incorrect?

A) The bonds were issued at a premium.

B) Annual interest expense will be less than the company's annual cash payments for interest.

C)The book value of the bonds will decrease as the bond matures.

D)The annual interest expense will increase if the effective-interest method of amortization was useD.Given that the market rate of interest was less than the stated rate of interest, the bonds sold at a premium. Therefore, the book value decreases as the premium on bond payable account is amortized, as a result interest expense decreases.

A) The bonds were issued at a premium.

B) Annual interest expense will be less than the company's annual cash payments for interest.

C)The book value of the bonds will decrease as the bond matures.

D)The annual interest expense will increase if the effective-interest method of amortization was useD.Given that the market rate of interest was less than the stated rate of interest, the bonds sold at a premium. Therefore, the book value decreases as the premium on bond payable account is amortized, as a result interest expense decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 1, 2014, Tonika Corporation issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Assuming effective-interest amortization is used, the book value of the bonds as of December 31, 2014 is closest to:

A) $8,968.

B) $9,945.

C)$9,641.

D)$9,741.

A) $8,968.

B) $9,945.

C)$9,641.

D)$9,741.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements correctly describes the accounting for bonds that were issued at a discount?

A) The market rate of interest is less than the stated interest rate.

B) The interest expense over the life of the bonds will be less than the cash interest payments.

C)The present value of the bonds' future cash flows is greater than the bonds' maturity value.

D)The book value of the bond liability increases when interest payments are made on the due dates.

A) The market rate of interest is less than the stated interest rate.

B) The interest expense over the life of the bonds will be less than the cash interest payments.

C)The present value of the bonds' future cash flows is greater than the bonds' maturity value.

D)The book value of the bond liability increases when interest payments are made on the due dates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following statements does not correctly describe the accounting for bonds that were issued at a discount?

A) The interest expense over the life of the bond exceeds the cash interest payments.

B) The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the discount on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a discount, their book value increases over time and eventually reach the bonds' maturity value. Interest expense increases because the book value increases. The amortization of discount on bonds payable is the difference between the increasing interest expense and the constant cash interest payment.

A) The interest expense over the life of the bond exceeds the cash interest payments.

B) The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the discount on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a discount, their book value increases over time and eventually reach the bonds' maturity value. Interest expense increases because the book value increases. The amortization of discount on bonds payable is the difference between the increasing interest expense and the constant cash interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1, 2014, Tonika Corporation issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Assuming effective-interest amortization is used, the interest expense on the income statement for the year ended December 31, 2014 is closest to:

A) $677.

B) $883.

C)$773.

D)$700.

A) $677.

B) $883.

C)$773.

D)$700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

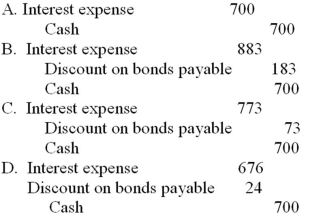

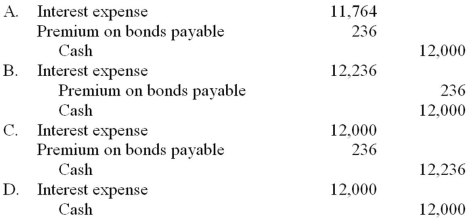

On January 1, 2014, Tonika Corporation issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Assuming the effective-interest amortization is used, and rounding calculations to the nearest whole dollar, which of the following journal entries correctly records the 2014 interest expense?

A) Option A

B) Option B

C)Option C

D)Option D

A) Option A

B) Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

On January 1, 2014, a corporation issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% effective (market) interest rate. Assuming the effective-interest method of amortization is used, what is the book value of the bond liability on December 31, 2014 is closest to:

A) $400,000.

B) $413,320.

C)$406,302.

D)$407,432.

A) $400,000.

B) $413,320.

C)$406,302.

D)$407,432.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

On January 1, 2014, a corporation issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153. Assuming the effective-interest method of amortization is used, which of the following statements is incorrect?

A) The market rate of interest on the sale date was less than the stated rate of interest.

B) The book value of the bond will decrease as the bond reaches maturity.

C)The interest expense will decrease as the bond reaches maturity.

D)The amortization of the premium on bonds payable will decrease as the bond matures.

A) The market rate of interest on the sale date was less than the stated rate of interest.

B) The book value of the bond will decrease as the bond reaches maturity.

C)The interest expense will decrease as the bond reaches maturity.

D)The amortization of the premium on bonds payable will decrease as the bond matures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

On January 1, 2013, Jason Company issued $5 million of 10-year bonds at a 10% stated interest rate to be paid annually. The following present value factors have been provided: Calculate the issuance price if the market rate of interest is 12%.

A) $4,427,500.

B) $4,477,500.

C)$4,435,000.

D)$5,000,000.

A) $4,427,500.

B) $4,477,500.

C)$4,435,000.

D)$5,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

Gammell Company issued $50,000 of 9% bonds with annual interest payments. The bonds mature in ten years. The bonds were issued at $48,000. Gammel Company uses the straight-line method of amortization. Which of the following statements is incorrect?

A) The market rate of interest exceeded the stated rate of interest when the bonds were issued.

B) The annual interest expense exceeds the annual cash interest payment by $200.

C)The annual increase in the bond book value is $200.

D)The annual interest expense is $4,300.

A) The market rate of interest exceeded the stated rate of interest when the bonds were issued.

B) The annual interest expense exceeds the annual cash interest payment by $200.

C)The annual increase in the bond book value is $200.

D)The annual interest expense is $4,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

On January 1, 2014, Broker Corp. issued $3,000,000 par value 12%, 10 year bonds which pay interest each December 31. If the market rate of interest was 14%, what was the issue price of the bonds? (The present value factor for $1 in 10 periods at 12% is .3220 and at 14% is .2697. The present value of an annuity of $1 factor for 10 periods at 12% is 5.6502 and at 14% is 5.2161.)

A) $3,339,084.

B) $2,843,172.

C)$3,000,000.

D)$2,686,896.

A) $3,339,084.

B) $2,843,172.

C)$3,000,000.

D)$2,686,896.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

On July 1, 2014, Garden Works, Inc. issued $300,000 of ten-year, 7% bonds for $303,000. The bonds were dated July 1, 2014, and semi-annual interest will be paid each December 31 and June 30. Garden Works Inc. uses the straight-line method of amortization. How much is the semi-annual interest expense?

A) $14,000.

B) $14,150.

C)$10,350.

D)$11,000.

A) $14,000.

B) $14,150.

C)$10,350.

D)$11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

Assuming no adjusting journal entries have been made during the year, the journal entry on the due date of the cash interest payment for bonds issued at a premium has just been prepared. Which of the following is not an effect of the entry?

A) An increase in expenses and a decrease in liabilities.

B) An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

A) An increase in expenses and a decrease in liabilities.

B) An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

Gammell Company issued $50,000 of 9% bonds with annual interest payments. The bonds mature in ten years. The bonds were issued at $48,000. Gammel Company uses the straight-line method of amortization. How much is the annual interest expense?

A) $4,700.

B) $4,300.

C)$4,500.

D)$4,680.

A) $4,700.

B) $4,300.

C)$4,500.

D)$4,680.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements correctly describes the accounting for bonds that were issued at a premium?

A) The interest expense over the life of the bond is less than the cash interest payments.

B) The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the premium on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a premium, interest expense over the life of the bonds equals the total payments for interest minus the premium on bonds payable at the issue date.

A) The interest expense over the life of the bond is less than the cash interest payments.

B) The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the premium on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a premium, interest expense over the life of the bonds equals the total payments for interest minus the premium on bonds payable at the issue date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

On January 1, 2014, a corporation issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% effective (market) interest rate. Assuming the effective-interest method of amortization is used, what is the book value of the bond liability as of June 30, 2014 (to the nearest dollar)?

A) $400,000.

B) $416,495.

C)$409,811.

D)$403,342.

A) $400,000.

B) $416,495.

C)$409,811.

D)$403,342.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

On January 1, 2014, a corporation issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% effective (market) interest rate. Assuming the effective-interest method of amortization is used, the interest expense for the six-month period ending December 31, 2014 is closest to:

A) $24,000.

B) $20,491.

C)$20,000.

D)$20,825.

A) $24,000.

B) $20,491.

C)$20,000.

D)$20,825.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

On January 1, 2014, Tonika Corporation issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Assuming effective-interest amortization is used, the December 31, 2015 book value after the December 31, 2015 interest payment was made is closest to:

A) $9,662.

B) $9,820.

C)$9,668.

D)$9,723.

A) $9,662.

B) $9,820.

C)$9,668.

D)$9,723.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

On July 1, 2014, Garden Works, Inc. issued $300,000 of ten-year, 7% bonds for $303,000. The bonds were dated July 1, 2014, and semi-annual interest will be paid each December 31 and June 30. Garden Works Inc. uses straight-line amortization. What is the bond liability to be reported on the December 31, 2014 balance sheet?

A) $300,000.

B) $302,850.

C)$302,700.

D)$303,000.

A) $300,000.

B) $302,850.

C)$302,700.

D)$303,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

On January 1, 2014, a corporation issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% market interest rate. Assuming the effective-interest method of amortization is used, and rounding all calculations to the nearest whole dollar, what is the interest expense for the six-month period ending June 30, 2014?

A) $24,000.

B) $24,789.

C)$20,000.

D)$20,658.

A) $24,000.

B) $24,789.

C)$20,000.

D)$20,658.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

On January 1, 2013, Jason Company issued $5 million of 10-year bonds at a 10% stated interest rate to be paid annually. The following present value factors have been provided: What was the issuance price of the bonds if the market rate of interest was 8%?

A) $5,000,000.

B) $5,670,000.

C)$5,387,500.

D)$5,712,500.

A) $5,000,000.

B) $5,670,000.

C)$5,387,500.

D)$5,712,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

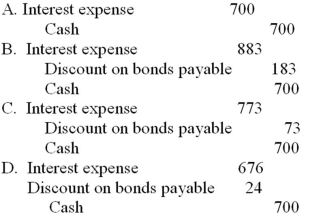

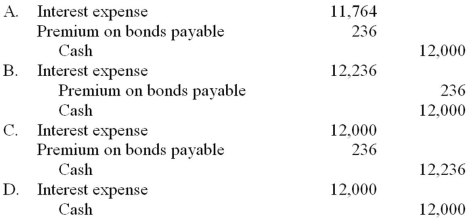

Mayberry, Inc., issued $100,000 of 10 year, 12% bonds dated April 1, 2013, for $102,360 on April 1, 2013. The bonds pay interest annually on April 1. Straight-line amortization is used by the company. What entry is required at April 1, 2014 for the first interest payment?

A) Option A

B) Option B

C)Option C

D)Option D

A) Option A

B) Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

On July 1, 2014, Garden Works, Inc. issued $300,000 of ten-year, 7% bonds for $303,000. The bonds were dated July 1, 2014, and semi-annual interest will be paid each December 31 and June 30. Garden Works Inc. uses straight-line amortization. Which of the following statements is incorrect?

A) The market rate of interest was less than the stated rate of interest on July 1, 2014.

B) The interest expense during the life of the bonds is $3,000 less than the cash interest payments during the life of the bonds.

C)The book value of the bond liability decreases by $300 per year.

D)The semi-annual interest expense is $300 less than the semi-annual interest payment.

A) The market rate of interest was less than the stated rate of interest on July 1, 2014.

B) The interest expense during the life of the bonds is $3,000 less than the cash interest payments during the life of the bonds.

C)The book value of the bond liability decreases by $300 per year.

D)The semi-annual interest expense is $300 less than the semi-annual interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

On January 1, 2013, Jason Company issued $5 million of 10-year bonds at a 10% stated interest rate to be paid annually. The following present value factors have been provided: Calculate the issuance price if the market rate of interest was 10%.

A) $5,427,000.

B) $4,477,000.

C)$4,435,000.

D)$5,000,000.

A) $5,427,000.

B) $4,477,000.

C)$4,435,000.

D)$5,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

On July 1, 2014, Garden Works, Inc. issued $300,000 of ten-year, 7% bonds for $303,000. The bonds were dated July 1, 2014, and semi-annual interest will be paid each December 31 and June 30. Garden Works Inc. uses straight-line amortization. What is the bond liability to be reported on the December 31, 2015 balance sheet?

A) $300,000.

B) $302,550.

C)$302,700.

D)$303,000.

A) $300,000.

B) $302,550.

C)$302,700.

D)$303,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements incorrectly describes the accounting for bonds that were issued at a premium?

A) The market rate of interest is less than the stated interest rate.

B) The interest expense over the life of the bonds will be less than the cash interest payments.

C)The present value of the bonds' future cash flows is less than the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

A) The market rate of interest is less than the stated interest rate.

B) The interest expense over the life of the bonds will be less than the cash interest payments.

C)The present value of the bonds' future cash flows is less than the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck