Deck 4: The Balance Sheet and the Statement of Changes in Stockholders Equity

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

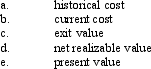

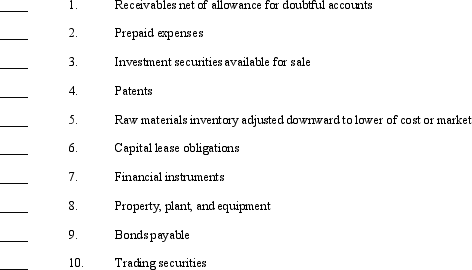

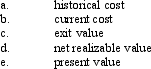

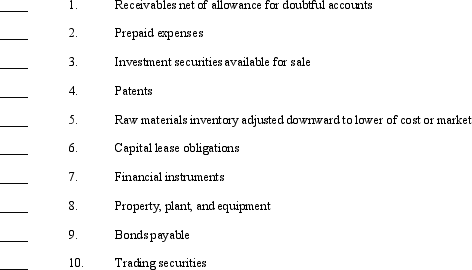

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

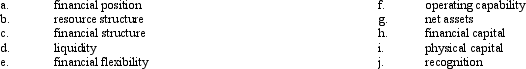

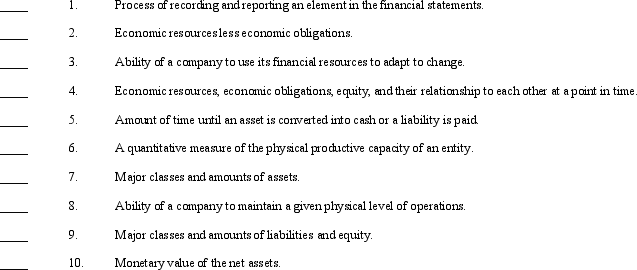

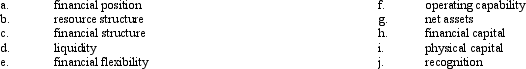

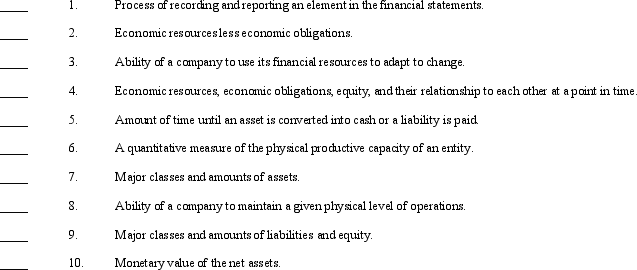

Match between columns

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/75

العب

ملء الشاشة (f)

Deck 4: The Balance Sheet and the Statement of Changes in Stockholders Equity

1

Which statement is false?

A)The balance sheet of an entity purports to show the true value of the entity.

B)The balance sheet should show a company's liquidity.

C)The balance sheet reflects the financial capital of a company.

D)The balance sheet summarizes the financial position of an entity at a point in time.

A)The balance sheet of an entity purports to show the true value of the entity.

B)The balance sheet should show a company's liquidity.

C)The balance sheet reflects the financial capital of a company.

D)The balance sheet summarizes the financial position of an entity at a point in time.

A

2

Assume an asset is measured by the amount of cash (or its equivalent)into which it is expected to be converted in an orderly transaction between market participants on the date of measurement.Which measurement alternative is in use in this case?

A)fair value

B)historical cost

C)present value

D)reliable value

A)fair value

B)historical cost

C)present value

D)reliable value

A

3

The valuation method primarily used in the balance sheets of business entities is

A)current exit value

B)historical cost

C)present value

D)net realizable value

A)current exit value

B)historical cost

C)present value

D)net realizable value

B

4

To be recognized in the financial statements, an item must meet the definition of an element and be

A)measurable, understandable, and relevant

B)reliable, measurable, and realized

C)realized, relevant, and reliable

D)relevant, measurable, and reliable

A)measurable, understandable, and relevant

B)reliable, measurable, and realized

C)realized, relevant, and reliable

D)relevant, measurable, and reliable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

5

The ability of a company to adapt its resources to create change and react to change is called

A)financial flexibility

B)liquidity

C)operating capability

D)resource structure

A)financial flexibility

B)liquidity

C)operating capability

D)resource structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

6

The ease with which an asset can be converted into cash is termed

A)financial flexibility

B)liquidity

C)operating capability

D)capital maintenance

A)financial flexibility

B)liquidity

C)operating capability

D)capital maintenance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following assets is most likely reported at its historical cost on the balance sheet?

A)short-term investments

B)merchandise inventory

C)net accounts receivable

D)prepaid insurance

A)short-term investments

B)merchandise inventory

C)net accounts receivable

D)prepaid insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

8

The amount of cash (or equivalent)that currently would be required to replace the service capacity of the asset is called the asset's

A)historical cost

B)current cost

C)current exit value

D)present value

A)historical cost

B)current cost

C)current exit value

D)present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is not a characteristic of a liability?

A)It involves a responsibility to another company.

B)The company has little or no discretion to avoid the future sacrifice.

C)The sacrifice contributes directly or indirectly to the company's future cash inflows.

D)The transaction obligating the company has already occurred.

A)It involves a responsibility to another company.

B)The company has little or no discretion to avoid the future sacrifice.

C)The sacrifice contributes directly or indirectly to the company's future cash inflows.

D)The transaction obligating the company has already occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following characteristics must an economic resource have in order to be classified as an asset?

A)acquired as a result of a past transaction

B)future service potential

C)under the control of the business entity

D)all of these

E)none of these

A)acquired as a result of a past transaction

B)future service potential

C)under the control of the business entity

D)all of these

E)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

11

The residual interest in a company's assets is represented by its

A)net assets

B)stockholders' equity

C)ownership interest

D)all of these

A)net assets

B)stockholders' equity

C)ownership interest

D)all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

12

The expected exit value is also referred to as the

A)fair value

B)present value

C)input value

D)current market value

A)fair value

B)present value

C)input value

D)current market value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

13

Probable future sacrifices of economic benefits arising from past transactions or events are

A)liabilities

B)revenues

C)assets

D)retained earnings

A)liabilities

B)revenues

C)assets

D)retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

14

The measurement of an asset's value that considers the discounted future cash inflows (and outflows)relating to the asset is called the

A)net realizable value

B)current cost

C)historical value

D)present value

A)net realizable value

B)current cost

C)historical value

D)present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

15

GAAP disclosures for fair value measurements now require that fair value measurements using Level 3 inputs include all of the following except

A)the valuation technique used to measure the fair value

B)a reconciliation of the Level 3 values to each of the corresponding Level 1 and Level 2 values that were not chosen

C)a reconciliation of the changes in fair value during the period

D)a related discussion

A)the valuation technique used to measure the fair value

B)a reconciliation of the Level 3 values to each of the corresponding Level 1 and Level 2 values that were not chosen

C)a reconciliation of the changes in fair value during the period

D)a related discussion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which statement is not true?

A)To be a liability, the transaction or event obligating the entity must already have occurred.

B)The net worth of an entity is equal to its assets.

C)The specific identity of the "creditor" need not be known with certainty for a liability to exist.

D)Stockholders' equity may not exist apart from the corporate assets and liabilities.

A)To be a liability, the transaction or event obligating the entity must already have occurred.

B)The net worth of an entity is equal to its assets.

C)The specific identity of the "creditor" need not be known with certainty for a liability to exist.

D)Stockholders' equity may not exist apart from the corporate assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which is not a characteristic of an asset?

A)The resource must be useful only in the entity's activities and have been acquired by purchase, production, or stockholder investment.

B)The entity must be able to obtain the future benefit and control others' access to it.

C)The transaction or event giving rise to the entity's right to or control over the benefit must have already occurred.

D)The resource must singly, or in combination with other resources, have the capacity to contribute directly, or indirectly, to the entity's future net cash inflows.

A)The resource must be useful only in the entity's activities and have been acquired by purchase, production, or stockholder investment.

B)The entity must be able to obtain the future benefit and control others' access to it.

C)The transaction or event giving rise to the entity's right to or control over the benefit must have already occurred.

D)The resource must singly, or in combination with other resources, have the capacity to contribute directly, or indirectly, to the entity's future net cash inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the owners' equity at the end of the accounting period is greater than the owners' equity at the beginning of the accounting period, the firm's

A)capital has increased

B)working capital has increased

C)cash has increased

D)capital has been maintained

A)capital has increased

B)working capital has increased

C)cash has increased

D)capital has been maintained

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

19

All of the following items would appear on the balance sheet except

A)an investment in another company's bonds

B)an investment in marketable securities

C)a realized gain on the sale of a patent

D)the premium related to a bond liability that is still two years from maturity

A)an investment in another company's bonds

B)an investment in marketable securities

C)a realized gain on the sale of a patent

D)the premium related to a bond liability that is still two years from maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

20

The quantity of goods or services produced in a given period or the physical capacity of the operating assets used to produce goods or services are measures of

A)financial flexibility

B)liquidity

C)operating capability

D)capital maintenance

A)financial flexibility

B)liquidity

C)operating capability

D)capital maintenance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

21

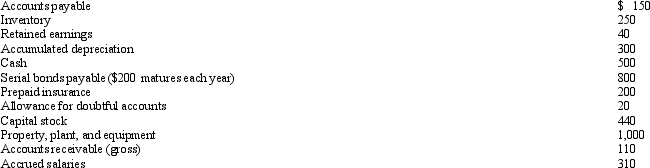

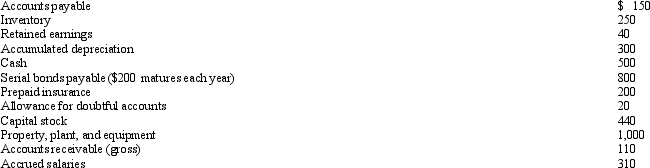

Selected information from a company's balance sheet follows:

Working capital amounts to

A)$150

B)$130

C)$120

D)$100

Working capital amounts to

A)$150

B)$130

C)$120

D)$100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is typically recorded at its present value?

A)long-term investments

B)long-term liabilities

C)intangible assets

D)contingent liabilities

A)long-term investments

B)long-term liabilities

C)intangible assets

D)contingent liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

23

Cash equivalents are securities that

A)management intends to convert into cash within one year

B)have maturity dates of at least six months

C)management intends to convert into cash within the normal operating cycle

D)have maturity dates of three months or less

A)management intends to convert into cash within one year

B)have maturity dates of at least six months

C)management intends to convert into cash within the normal operating cycle

D)have maturity dates of three months or less

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

24

The FASB has suggested guidelines for developing homogenous classes of assets and liabilities.For assets, this can be accomplished by following guidelines that include

A)reporting assets according to their use outside the activities of the corporation

B)reporting all assets the same regardless of the implications on a company's financial flexibility

C)reporting the valuation of assets at their net realizable value

D)reporting assets at their fair value

A)reporting assets according to their use outside the activities of the corporation

B)reporting all assets the same regardless of the implications on a company's financial flexibility

C)reporting the valuation of assets at their net realizable value

D)reporting assets at their fair value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

25

Current liabilities would include all of the following except

A)wages payable

B)obligations under capital lease contracts

C)current portion of long-term debt

D)unearned rent revenue

A)wages payable

B)obligations under capital lease contracts

C)current portion of long-term debt

D)unearned rent revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following would typically be recorded as an intangible asset?

A)computer software costs

B)bond issue costs

C)idle fixed assets

D)prepaid pension costs

A)computer software costs

B)bond issue costs

C)idle fixed assets

D)prepaid pension costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

27

Current liabilities are defined as

A)obligations that will be paid by refinancing through issuing new long-term liabilities

B)obligations that will be paid by using existing resources properly classified as current assets

C)obligations that will be paid out of a fund classified as a long-term investment

D)obligations that will be paid by using existing resources, regardless of their classification

A)obligations that will be paid by refinancing through issuing new long-term liabilities

B)obligations that will be paid by using existing resources properly classified as current assets

C)obligations that will be paid out of a fund classified as a long-term investment

D)obligations that will be paid by using existing resources, regardless of their classification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which statement is not true?

A)Not all obligations that become due and will be paid within the next accounting period are classified as current liabilities.

B)The components of working capital are disclosed on the balance sheet.

C)An increasing current ratio could result from decreasing liquidity.

D)An operating cycle is the average time taken by a company to convert receivables back into cash.

A)Not all obligations that become due and will be paid within the next accounting period are classified as current liabilities.

B)The components of working capital are disclosed on the balance sheet.

C)An increasing current ratio could result from decreasing liquidity.

D)An operating cycle is the average time taken by a company to convert receivables back into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

29

A leased asset under capital lease is disclosed on the balance sheet at its

A)present value

B)historical cost

C)current cost

D)net realizable value

A)present value

B)historical cost

C)current cost

D)net realizable value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which is a component of stockholders' equity?

A)sinking funds

B)deferred charges

C)accumulated other comprehensive income

D)realized capital

A)sinking funds

B)deferred charges

C)accumulated other comprehensive income

D)realized capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following liabilities is properly classified as a current liability?

A)currently maturing bonds payable that will be paid out of a fund accumulated for that purpose

B)short-term notes payable being refinanced with long-term notes

C)obligations that will be paid outside the operating cycle

D)obligations for goods and services that have entered the operating cycle

A)currently maturing bonds payable that will be paid out of a fund accumulated for that purpose

B)short-term notes payable being refinanced with long-term notes

C)obligations that will be paid outside the operating cycle

D)obligations for goods and services that have entered the operating cycle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which is classified as a long-term investment?

A)bond issue costs

B)cash surrender value of life insurance

C)capital lease

D)three-year prepaid insurance policy

A)bond issue costs

B)cash surrender value of life insurance

C)capital lease

D)three-year prepaid insurance policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

33

The balance sheet account that is usually reported at its fair market value is

A)short-term marketable securities

B)land

C)current liabilities

D)inventory

A)short-term marketable securities

B)land

C)current liabilities

D)inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

34

Current assets are cash or other assets that are reasonably expected to be converted into cash, sold, or consumed within one year or a normal operating cycle.An operating cycle is defined as the company's ability to

A)spend cash to payoff the company's liabilities

B)spend cash to acquire inventory, which is sold and returned to cash

C)spend cash to acquire inventory, which is sold to customers in the normal course of business

D)spend cash in the generation of services, which can result in an increase in revenue and net income from operations

A)spend cash to payoff the company's liabilities

B)spend cash to acquire inventory, which is sold and returned to cash

C)spend cash to acquire inventory, which is sold to customers in the normal course of business

D)spend cash in the generation of services, which can result in an increase in revenue and net income from operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

35

Justification for having both intangible assets and other assets listed on a balance sheet include

A)that intangible assets have no physical existence and other assets are deferred charges

B)that having more items listed on the balance sheet improves the users' understanding of the company

C)that the intangible assets are more important than the tangible assets

D)that the other asset classification is important because goodwill cannot be amortized, so it needs to be recorded on the balance sheet

A)that intangible assets have no physical existence and other assets are deferred charges

B)that having more items listed on the balance sheet improves the users' understanding of the company

C)that the intangible assets are more important than the tangible assets

D)that the other asset classification is important because goodwill cannot be amortized, so it needs to be recorded on the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is not true regarding the hierarchy of fair value measurements now provided in GAAP?

A)The hierarchy clarified the inputs a company is to use to measure fair value.

B)The valuation method selected must be consistent with the market approach, the income approach, or the cost approach.

C)The three levels of inputs provide defined priorities for sources of available inputs for valuation.

D)The hierarchy eliminates all subjectivity and estimation from the valuation process.

A)The hierarchy clarified the inputs a company is to use to measure fair value.

B)The valuation method selected must be consistent with the market approach, the income approach, or the cost approach.

C)The three levels of inputs provide defined priorities for sources of available inputs for valuation.

D)The hierarchy eliminates all subjectivity and estimation from the valuation process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is not a limitation of the balance sheet?

A)In periods of inflation, lack of disclosure makes it impossible to determine which amounts reported show purchasing power of the assets and liabilities.

B)It fails to include all of a company's economic resources and obligations.

C)Many of the amounts reported are based on estimates, which are subject to change.

D)Valuing assets and liabilities using historical costs does not help in assessing a company's future cash flows.

A)In periods of inflation, lack of disclosure makes it impossible to determine which amounts reported show purchasing power of the assets and liabilities.

B)It fails to include all of a company's economic resources and obligations.

C)Many of the amounts reported are based on estimates, which are subject to change.

D)Valuing assets and liabilities using historical costs does not help in assessing a company's future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is least likely to be included in long-term liabilities?

A)obligations for future pension payments

B)capital leases payable

C)liabilities on options to sell stock

D)unearned revenues

A)obligations for future pension payments

B)capital leases payable

C)liabilities on options to sell stock

D)unearned revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following formulas represents working capital?

A)Current Assets - Current Liabilities

B)Liquid Assets - Liquid Liabilities

C)Current Assets ¸ Current Liabilities

D)Liquid Assets ¸ Liquid Liabilities

A)Current Assets - Current Liabilities

B)Liquid Assets - Liquid Liabilities

C)Current Assets ¸ Current Liabilities

D)Liquid Assets ¸ Liquid Liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

40

Obligations that are not expected to require the use of current assets or the creation of other current liabilities within one year or the normal operating cycle, if longer than a year, are called

A)other liabilities

B)current liabilities

C)long-term liabilities

D)contingent liabilities

A)other liabilities

B)current liabilities

C)long-term liabilities

D)contingent liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

41

According to APB Opinion No.22, the initial note to the financial statements should describe

A)the calculation of comprehensive income

B)the significant concentrations of credit risk

C)the significant accounting policies

D)the objectives of holding derivatives and the strategies for achieving them

A)the calculation of comprehensive income

B)the significant concentrations of credit risk

C)the significant accounting policies

D)the objectives of holding derivatives and the strategies for achieving them

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

42

A reader of a set of financial statements would expect to be able to find in the statement of changes in stockholders' equity

A)increases in total assets

B)increases in total liabilities

C)increases to net income

D)increases from comprehensive income

A)increases in total assets

B)increases in total liabilities

C)increases to net income

D)increases from comprehensive income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

43

The SEC established integrated disclosures to

A)establish full disclosure

B)demonstrate its legal authority to establish GAAP

C)satisfy the form 10-K disclosure requirements

D)control Management's Discussion and Analysis

A)establish full disclosure

B)demonstrate its legal authority to establish GAAP

C)satisfy the form 10-K disclosure requirements

D)control Management's Discussion and Analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following account titles would not be included in contributed capital?

A)Treasury Stock

B)Common Stock-Stated Value

C)Donated Capital

D)Premium on Preferred Stock

A)Treasury Stock

B)Common Stock-Stated Value

C)Donated Capital

D)Premium on Preferred Stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

45

Under international accounting standards, liabilities and owners' equity on the balance sheet usually appear in which order?

A)capital, noncurrent liabilities, and current liabilities

B)current liabilities, noncurrent liabilities, and capital

C)capital, current liabilities, and noncurrent liabilities

D)noncurrent liabilities, current liabilities, and capital

A)capital, noncurrent liabilities, and current liabilities

B)current liabilities, noncurrent liabilities, and capital

C)capital, current liabilities, and noncurrent liabilities

D)noncurrent liabilities, current liabilities, and capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

46

Certain differences exist between IFRS and U.S.GAAP financial statement reporting.These include that

A)IFRS presents a different ordering of the liabilities and owners' equity sections

B)IFRS allows the upward revaluation of property, plant, and equipment

C)IFRS does not require a statement of cash flows

D)IFRS permits the presentation of either a classified or nonclassified balance sheet

A)IFRS presents a different ordering of the liabilities and owners' equity sections

B)IFRS allows the upward revaluation of property, plant, and equipment

C)IFRS does not require a statement of cash flows

D)IFRS permits the presentation of either a classified or nonclassified balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which statement is true?

A)Stock must have either a par or stated value.

B)If nominal, par value does not need to be disclosed on the balance sheet.

C)In most states, stock may be issued at more or less than par value.

D)Par value does not suggest current fair value.

A)Stock must have either a par or stated value.

B)If nominal, par value does not need to be disclosed on the balance sheet.

C)In most states, stock may be issued at more or less than par value.

D)Par value does not suggest current fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

48

On the balance sheet, treasury stock is classified as a(n)

A)long-term investment account

B)contra stockholders' equity account

C)capital stock account

D)other asset account

A)long-term investment account

B)contra stockholders' equity account

C)capital stock account

D)other asset account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

49

The integrated disclosures required by the SEC for all regulated companies include all of the following except

A)dividends on common stock

B)management's discussion

C)common stock market prices

D)book value of common shares

A)dividends on common stock

B)management's discussion

C)common stock market prices

D)book value of common shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

50

Changes in the separate stockholders' equity accounts can be disclosed in all of the following ways, except

A)a financial statement

B)a note to the financial statements

C)a parenthetical remark

D)a supporting schedule

A)a financial statement

B)a note to the financial statements

C)a parenthetical remark

D)a supporting schedule

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

51

GAAP requires that all derivative financial instruments be reported at their

A)historical cost

B)fair value

C)present value

D)par value

A)historical cost

B)fair value

C)present value

D)par value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

52

State law may require that capital stock have which of the following values?

A)stated value

B)market value

C)no-par value

D)present value

A)stated value

B)market value

C)no-par value

D)present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following would not be classified as contributed capital?

A)additional paid-in capital

B)unrealized capital

C)common stock

D)preferred stock

A)additional paid-in capital

B)unrealized capital

C)common stock

D)preferred stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

54

The rationale for disclosing material subsequent events include all of the following except

A)these events may affect the users predictions about future cash flows

B)without the disclosures the financial information may be misleading

C)such disclosures will help convict management of hiding significant economic transactions

D)reporting such events is consistent with the concept of full disclosure

A)these events may affect the users predictions about future cash flows

B)without the disclosures the financial information may be misleading

C)such disclosures will help convict management of hiding significant economic transactions

D)reporting such events is consistent with the concept of full disclosure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

55

In preparing a statement of changes in stockholders' equity, the company includes land given to a stockholder as a dividend.This transaction is included in the statement because it represents

A)an investment by an owner that increases equity.

B)an investment by an owner that decreases equity.

C)a distribution to an owner that increases equity.

D)a distribution to an owner that decreases equity.

A)an investment by an owner that increases equity.

B)an investment by an owner that decreases equity.

C)a distribution to an owner that increases equity.

D)a distribution to an owner that decreases equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

56

A deficit occurs when a company's

A)retained earnings are less than it's common stock

B)dividends distributed are greater than comprehensive income

C)dividends and cumulative losses are greater than cumulative net income

D)retained earnings are less than assets minus liabilities

A)retained earnings are less than it's common stock

B)dividends distributed are greater than comprehensive income

C)dividends and cumulative losses are greater than cumulative net income

D)retained earnings are less than assets minus liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is not included in comprehensive income?

A)net income

B)unrealized gains in the fair market value of equipment

C)foreign currency translation adjustments

D)certain pension plan gains (losses)and prior service cost adjustments

A)net income

B)unrealized gains in the fair market value of equipment

C)foreign currency translation adjustments

D)certain pension plan gains (losses)and prior service cost adjustments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

58

A reader might find information about gain contingencies in an annual report by examining

A)a contingent account receivable

B)an accrued revenue

C)a deferred revenue

D)footnote disclosures

A)a contingent account receivable

B)an accrued revenue

C)a deferred revenue

D)footnote disclosures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

59

All of the following are examples of subsequent events that would be disclosed in the footnotes to the financial statements except

A)fire or flood loss

B)a litigation settlement

C)a bond issuance after the balance sheet date

D)the inability to collect a major customer's accounts receivable

A)fire or flood loss

B)a litigation settlement

C)a bond issuance after the balance sheet date

D)the inability to collect a major customer's accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

60

Activities between affiliated entities such as subsidiaries must be disclosed in the financial statements of a corporation as

A)segment analysis

B)significant relationships

C)related-party transactions

D)contingent activities

A)segment analysis

B)significant relationships

C)related-party transactions

D)contingent activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

61

If the balance sheet lists liabilities and stockholders' equity sequentially under the assets, the format being used is the

A)account form

B)report form

C)working capital form

D)financial position form

A)account form

B)report form

C)working capital form

D)financial position form

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

62

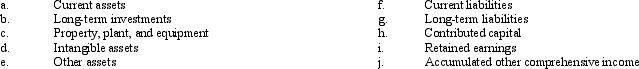

Listed below are ten terms describing the purposes of the balance sheet.Following the list is a series of descriptive phrases.

Required:

Required:

Match each term with its descriptive statement by placing the appropriate letter in the space provided.

Required:

Required:Match each term with its descriptive statement by placing the appropriate letter in the space provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

63

A friend comes to you with a set of financial statements that he thinks contains an error.The footnotes contain a note on a bond issue sold after the end of the reporting period.Your friend is sure this is an error because the transaction occurred after the cutoff date for the financial statements.

Required:

Explain to your friend why certain items that occur after the end of an accounting period are included in the financial statements and the manner in which they can be disclosed.

Required:

Explain to your friend why certain items that occur after the end of an accounting period are included in the financial statements and the manner in which they can be disclosed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

64

A client of your accounting firm is impressed with the precision and detail in the financial statements that you have just prepared for his company.However, he wants to know if there are any limitations to the information contained in them.

Required:

Describe four limitations of the balance sheet.

Required:

Describe four limitations of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

65

A corporation's balance sheet is usually divided into three sections with various subclassifications reported within each group in an informative manner.Listed below are some typical subclassifications.

Required:

Identify each of the three balance sheet sections and list the subclassifications within each section in the appropriate order.

Required:

Identify each of the three balance sheet sections and list the subclassifications within each section in the appropriate order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

66

Listed below are the five alternatives identified by the FASB for measuring balance sheet elements.Following the list is a series of balance sheet elements.

Required:

Required:

Match each measurement alternative to its balance sheet element by placing the appropriate letter in the space provided.

Required:

Required:Match each measurement alternative to its balance sheet element by placing the appropriate letter in the space provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

67

A list of statements follows:

a. A balance sheet summarzes the of a comparyy.

b. GAAP defines the of a corporate balance sheet.

c. Temporay investments in marketable securities are clas ified as and securities available for sale.

d. is the amount of stockholders' equity that a corporation may not distribute as dividends.

e. Unrealized increase in the value of available-for-sale securities is an example of

f. OpinionNo. 22 recommends that the first footnote to the financial statements describe a company's

g. A(n) is one that occurs between the balance she date and the date the anmual repor Required:

Fill in the words necessary to complete the statements.

a. A balance sheet summarzes the of a comparyy.

b. GAAP defines the of a corporate balance sheet.

c. Temporay investments in marketable securities are clas ified as and securities available for sale.

d. is the amount of stockholders' equity that a corporation may not distribute as dividends.

e. Unrealized increase in the value of available-for-sale securities is an example of

f. OpinionNo. 22 recommends that the first footnote to the financial statements describe a company's

g. A(n) is one that occurs between the balance she date and the date the anmual repor Required:

Fill in the words necessary to complete the statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

68

With all of the turmoil in the financial markets in 2008, one of your friends has emailed you because she has been wondering about the financial disclosure requirements for the banks and brokerage firms affected by the market turbulence.Explain to your friend the general accounting requirements for financial instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

69

According to a recent issue of Accounting Trends and Techniques, the most frequently used balance sheet format is the

A)financial position form

B)report form

C)account form

D)combined form

A)financial position form

B)report form

C)account form

D)combined form

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

70

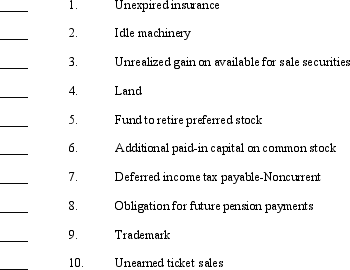

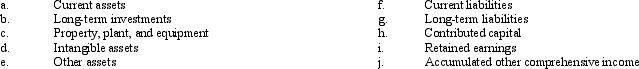

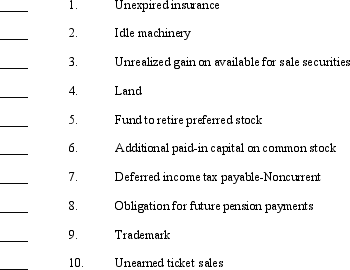

The balance sheet contains the major sections (a-j)listed below.A listing of balance sheet accounts (1-10)follows.

Required:

Required:

Using the letters (a-j), indicate in which section of the balance sheet the accounts (1-10)would most likely be classified.

Required:

Required:Using the letters (a-j), indicate in which section of the balance sheet the accounts (1-10)would most likely be classified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

71

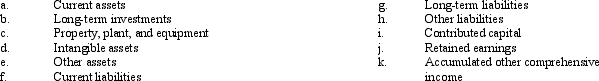

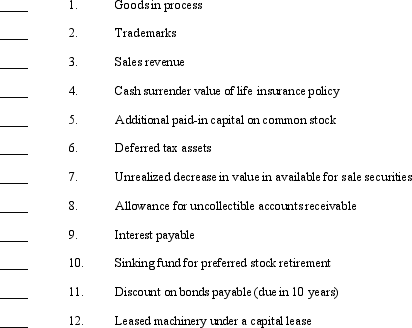

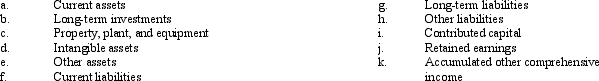

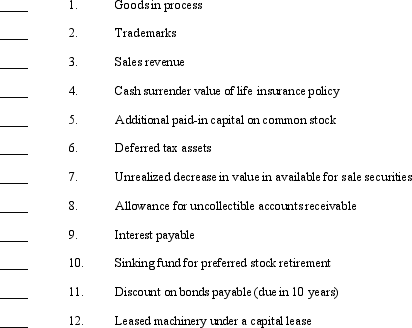

The balance sheet contains the major sections (a-k)listed below.A listing of balance sheet accounts (1-12)follows.

Required:

Required:

Using the letters (a-k), indicate in which section of the balance sheet each of the accounts (1-12)would be classified.Put parentheses around the letter used if it represents a contra account.If the account does not appear on the balance sheet, place an "X" in the space provided.

Required:

Required:Using the letters (a-k), indicate in which section of the balance sheet each of the accounts (1-12)would be classified.Put parentheses around the letter used if it represents a contra account.If the account does not appear on the balance sheet, place an "X" in the space provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

72

The following data were taken from the Otay, Inc.balance sheet:

Required:

Required:

Compute working capital.

Required:

Required:Compute working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

73

Individual assets are measured using one of five alternative methods.These methods are listed below, followed by a series of descriptive statements.

a. historical cost

b. current cost

c. exit value

d. netrealizable value

e. present value

Required:

Required:

Match each measurement alternative with its descriptive statement by placing the appropriate letter in the space provided.

a. historical cost

b. current cost

c. exit value

d. netrealizable value

e. present value

Required:

Required:Match each measurement alternative with its descriptive statement by placing the appropriate letter in the space provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

74

A friend of the family has just received her first set of financial statements from her accountant.When she finds out that you are an accounting major, she asks you the following question: "Why aren't my employees listed as an asset on my company's balance sheet?"

Required:

Write an explanation describing the characteristics that an economic resource must possess in order to be considered an asset.Include in your discussion the primary reason why "human resources" are not recognized as assets.

Required:

Write an explanation describing the characteristics that an economic resource must possess in order to be considered an asset.Include in your discussion the primary reason why "human resources" are not recognized as assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

76

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck