Deck 23: Accounting for Changes and Errors

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/85

العب

ملء الشاشة (f)

Deck 23: Accounting for Changes and Errors

1

The Brown Company changed its method of determining inventories from LIFO to FIFO.This change represents a

A)change in accounting estimate that should be treated prospectively

B)change in accounting principle that should be treated prospectively

C)change in accounting estimate for which the financial results of previous years are restated

D)change in accounting principle for which the financial statements of prior periods included for comparative purposes are restated

A)change in accounting estimate that should be treated prospectively

B)change in accounting principle that should be treated prospectively

C)change in accounting estimate for which the financial results of previous years are restated

D)change in accounting principle for which the financial statements of prior periods included for comparative purposes are restated

D

2

A retrospective adjustment requires a change in the

A)prior period financial statements to look like the current period financial statements

B)current period income to reflect the cumulative effect of new method

C)prior period financial statements to reflect how they would have been presented had the new method been used in prior periods

D)current period accounts in the financial statements to what they would have been had the previous method been used in the current period

A)prior period financial statements to look like the current period financial statements

B)current period income to reflect the cumulative effect of new method

C)prior period financial statements to reflect how they would have been presented had the new method been used in prior periods

D)current period accounts in the financial statements to what they would have been had the previous method been used in the current period

C

3

When making a retrospective adjustment, all of the following steps are included except

A)computing the cumulative effect of the new accounting principle as of the beginning of the first period presented

B)adjusting the current period net income for the cumulative effect of the change

C)adjusting the carrying value of impacted assets and liabilities

D)restating the financial statements of each period presented to reflect the effects of the change

A)computing the cumulative effect of the new accounting principle as of the beginning of the first period presented

B)adjusting the current period net income for the cumulative effect of the change

C)adjusting the carrying value of impacted assets and liabilities

D)restating the financial statements of each period presented to reflect the effects of the change

B

4

The Zack Company began its operations on January 1, 2010, and used an accelerated method of depreciation for its machinery and equipment.On January 1, 2012, Zack adopted the straight-line method of depreciation.The following information is available regarding depreciation expense for each method:

What is the before-tax cumulative effect on prior years' income that would be reported as of January 1, 2012, due to changing to a different depreciation method?

A)$0

B)a decrease of $45, 000

C)an increase of $45, 000

D)an increase of $60, 000

What is the before-tax cumulative effect on prior years' income that would be reported as of January 1, 2012, due to changing to a different depreciation method?

A)$0

B)a decrease of $45, 000

C)an increase of $45, 000

D)an increase of $60, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

5

On January 1, 2010, Willis Company acquired equipment at a cost of $400, 000.Willis used the double-declining-balance method to depreciate the equipment with a ten-year life and no salvage value.On January 1, 2012, Willis changed to straight-line depreciation for this equipment, and the IRS accepted this change as being eligible as a change in accounting estimate with prospective treatment.Assuming an income tax rate of 30%, the restatement of January 1, 2012 retained earnings is

A)$ 0

B)$44, 800

C)$52, 640

D)$72, 100

A)$ 0

B)$44, 800

C)$52, 640

D)$72, 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which statement concerning accounting for accounting changes and errors is not true?

A)An error is accounted for retrospectively.

B)A change in accounting principle is accounted for prospectively.

C)A change in accounting principle may be accounted for retrospectively.

D)A change in accounting estimate is accounted for prospectively.

A)An error is accounted for retrospectively.

B)A change in accounting principle is accounted for prospectively.

C)A change in accounting principle may be accounted for retrospectively.

D)A change in accounting estimate is accounted for prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

7

When changing from LIFO to FIFO, the least likely result would be

A)disclosing an increase in the inventory balance

B)disclosing an increase in the deferred taxes account

C)removing the LIFO reserve

D)obtaining a tax refund from the IRS

A)disclosing an increase in the inventory balance

B)disclosing an increase in the deferred taxes account

C)removing the LIFO reserve

D)obtaining a tax refund from the IRS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements does not properly state a basic principle for reporting an accounting change?

A)retrospectively apply a change in accounting principle

B)prospectively account for a change in accounting estimate

C)retrospectively adjust for a change in reporting entity

D)retrospectively apply a change in accounting estimate

A)retrospectively apply a change in accounting principle

B)prospectively account for a change in accounting estimate

C)retrospectively adjust for a change in reporting entity

D)retrospectively apply a change in accounting estimate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

9

Generally accepted methods of accounting for a change in accounting principle include

A)restating prior years' financial statements presented for comparative purposes

B)including the cumulative effect of the change in net income

C)prospective changes

D)making a prior period adjustment

A)restating prior years' financial statements presented for comparative purposes

B)including the cumulative effect of the change in net income

C)prospective changes

D)making a prior period adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

10

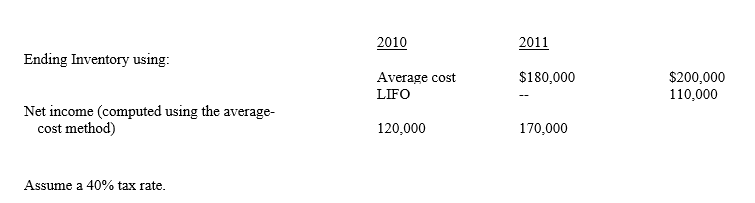

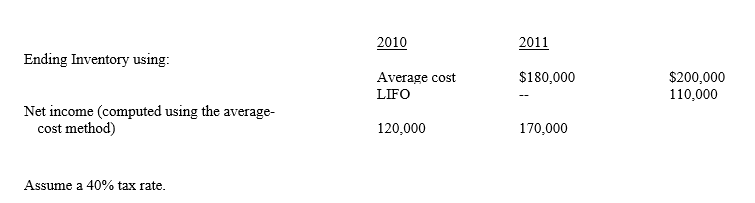

Wilma Company began operations in 2010 and uses the average cost method in costing its inventory.In 2011, Wilma is investigating a change to the LIFO method.Before making that determination, Wilma desires to determine what effect such a change will have on net income.Wilma has compiled the following information:  Assume a 40% tax rate.

Assume a 40% tax rate.

If Wilma adopted LIFO in 2011, net income would be

A)$ 80, 000

B)$116, 000

C)$170, 000

D)$224, 000

Assume a 40% tax rate.

Assume a 40% tax rate.If Wilma adopted LIFO in 2011, net income would be

A)$ 80, 000

B)$116, 000

C)$170, 000

D)$224, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

11

A change in accounting principle from one that is not generally accepted to one that is generally accepted should be treated as

A)an error and corrected by prior period adjustment

B)a change in accounting principle and the cumulative effect included in net income

C)a change in accounting principle and prior period financial statements are restated

D)a change in accounting principle and adjustments made prospectively

A)an error and corrected by prior period adjustment

B)a change in accounting principle and the cumulative effect included in net income

C)a change in accounting principle and prior period financial statements are restated

D)a change in accounting principle and adjustments made prospectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

12

The accounting changes identified by current GAAP include all of the following except

A)correction of an error

B)change in accounting principle

C)change in accounting estimate

D)change in reporting entity

A)correction of an error

B)change in accounting principle

C)change in accounting estimate

D)change in reporting entity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

13

Exhibit 23-1 On January 1, 2010, the Carol Company purchased a machine for $450, 000 with an estimate useful life of six years and a $30, 000 salvage value.Straight-line depreciation was used for financial reporting purposes and MACRS depreciation for income tax reporting.Effective January 1, 2012, Carol switched to the double-declining-balance depreciation method for financial statement reporting but not for income tax purposes.Carol can justify the change.

-

Refer to Exhibit 23-1.Assuming an income tax rate of 30%, depreciation expense related to the equipment reported in Carol's 2012 income statement would be

A)$ 70, 000

B)$108, 500

C)$140, 000

D)$155, 000

-

Refer to Exhibit 23-1.Assuming an income tax rate of 30%, depreciation expense related to the equipment reported in Carol's 2012 income statement would be

A)$ 70, 000

B)$108, 500

C)$140, 000

D)$155, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

14

A change from LIFO to FIFO should be accounted for

A)by footnote disclosure only

B)prospectively only

C)currently and prospectively

D)retrospectively

A)by footnote disclosure only

B)prospectively only

C)currently and prospectively

D)retrospectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

15

Exhibit 23-1 On January 1, 2010, the Carol Company purchased a machine for $450, 000 with an estimate useful life of six years and a $30, 000 salvage value.Straight-line depreciation was used for financial reporting purposes and MACRS depreciation for income tax reporting.Effective January 1, 2012, Carol switched to the double-declining-balance depreciation method for financial statement reporting but not for income tax purposes.Carol can justify the change.

-

Refer to Exhibit 23-1.Assuming an income tax rate of 30%, the cumulative effect change reported in Carol's 2012 income statement would be

A)$ 0

B)$ 77, 000

C)$ 93, 333

D)$110, 000

-

Refer to Exhibit 23-1.Assuming an income tax rate of 30%, the cumulative effect change reported in Carol's 2012 income statement would be

A)$ 0

B)$ 77, 000

C)$ 93, 333

D)$110, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Lawrence Company began its operations on January 1, 2010, and used the LIFO method of accounting for its inventory.On January 1, 2012, Lawrence Company adopted FIFO in accounting for its inventory.The following information is available regarding cost of goods sold for each method:

Assuming a tax rate of 30% and the same accounting change adopted for tax purposes, how would the effect of the accounting change be reported in opening retained earnings on the 2012 financial statements?

A)+$360, 000 restatement

B)+$252, 000 restatement

C)no restatement

D)($700, 000)restatement

Assuming a tax rate of 30% and the same accounting change adopted for tax purposes, how would the effect of the accounting change be reported in opening retained earnings on the 2012 financial statements?

A)+$360, 000 restatement

B)+$252, 000 restatement

C)no restatement

D)($700, 000)restatement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

17

When disclosing the impact of a retrospective adjustment for the change from LIFO to FIFO in 2011, which of the following impacts is not expected to be reported in the comparative financial statements when two-year comparative statements are presented?

A)impact on beginning inventory for 2010

B)impact on 2010 net income

C)impact on ending inventory for 2011

D)impact on cost of goods sold for 2010

A)impact on beginning inventory for 2010

B)impact on 2010 net income

C)impact on ending inventory for 2011

D)impact on cost of goods sold for 2010

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

18

On January 1, 2010, Chester Company acquired machinery at a cost of $60, 000.This machinery was being depreciated by the double-declining-balance method over an estimated life of five years with no salvage value.At the beginning of 2012, Chester changed to and could justify straight-line depreciation.Chester's tax rate is 30 percent.The depreciation expense to be included in 2012 net income was

A)$ 7, 200

B)$12, 000

C)$14, 400

D)$36, 000

A)$ 7, 200

B)$12, 000

C)$14, 400

D)$36, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

19

The mandatory adoption of a new accounting principle as a result of a new FASB statement requires

A)footnote disclosure only

B)a cumulative effect adjustment

C)retrospective adjustment

D)prospective restatement

A)footnote disclosure only

B)a cumulative effect adjustment

C)retrospective adjustment

D)prospective restatement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

20

Disclosure of a retrospective adjustment should include

A)why the new principle is preferable

B)the net impact on assets of the retrospective adjustment

C)the retrospective computation of earnings per share only for the current period

D)ending balance in Retained Earnings before and after the retrospective adjustment

A)why the new principle is preferable

B)the net impact on assets of the retrospective adjustment

C)the retrospective computation of earnings per share only for the current period

D)ending balance in Retained Earnings before and after the retrospective adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

21

A change in accounting estimate effected by a change in accounting principle should be reported as

A)a change in accounting principle

B)a change in accounting estimate and a change in accounting principle

C)a change in accounting estimate

D)neither a change in accounting estimate nor a change in accounting principle

A)a change in accounting principle

B)a change in accounting estimate and a change in accounting principle

C)a change in accounting estimate

D)neither a change in accounting estimate nor a change in accounting principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

22

Changes in accounting entities that require retrospective restatement of past financial statements occur when

A)there is a change in the specific subsidiaries that make up the group of companies that are consolidated when financial statements are presented

B)consolidated or combined statements are presented in place of the statements of individual companies

C)the companies included in the combined financial statements change

D)all of these

A)there is a change in the specific subsidiaries that make up the group of companies that are consolidated when financial statements are presented

B)consolidated or combined statements are presented in place of the statements of individual companies

C)the companies included in the combined financial statements change

D)all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following accounting changes is always accounted for prospectively?

A)change in accounting estimate

B)change in reporting entity

C)change in accounting principle

D)correction of an error

A)change in accounting estimate

B)change in reporting entity

C)change in accounting principle

D)correction of an error

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

24

Exhibit 23-2 On January 1, 2010, Michelle, Inc.purchased a machine for $48, 000.Eight-year, straight-line depreciation with no salvage value was used through December 31, 2013.On January 1, 2014, it was estimated that the total useful life of the machine from acquisition date was ten years.

-

Refer to Exhibit 23-2.The adjusting entry that should be made on January 1, 2014, will be in the amount of

A)$4, 000

B)$4, 800

C)$2, 400

D)$ 0

-

Refer to Exhibit 23-2.The adjusting entry that should be made on January 1, 2014, will be in the amount of

A)$4, 000

B)$4, 800

C)$2, 400

D)$ 0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

25

Exhibit 23-2 On January 1, 2010, Michelle, Inc.purchased a machine for $48, 000.Eight-year, straight-line depreciation with no salvage value was used through December 31, 2013.On January 1, 2014, it was estimated that the total useful life of the machine from acquisition date was ten years.

-

Refer to Exhibit 23-2.Accordingly, the appropriate accounting change was made in 2014.How much depreciation expense for this machine should Michelle record for the year ended December 31, 2014?

A)$4, 800

B)$4, 000

C)$2, 400

D)$ 0

-

Refer to Exhibit 23-2.Accordingly, the appropriate accounting change was made in 2014.How much depreciation expense for this machine should Michelle record for the year ended December 31, 2014?

A)$4, 800

B)$4, 000

C)$2, 400

D)$ 0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

26

When applying retrospective adjustments, current GAAP requires the change to be applied so that it includes

A)only the years disclosed in the currently published financial statements

B)all possible years

C)only the earliest possible date from which it can be applied prospectively

D)retroactive application for up to two years and prospective application for the remainder of the periods

A)only the years disclosed in the currently published financial statements

B)all possible years

C)only the earliest possible date from which it can be applied prospectively

D)retroactive application for up to two years and prospective application for the remainder of the periods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

27

Lavonne Company purchased a machine on July 1, 2010, for $80, 000.The machine has an estimated useful life of 5 years with a salvage value of $10, 000.It is being depreciated using the straight-line method.On January 1, 2012, Lavonne reevaluated the machine's useful life and now believes it will continue for another 6 years (for a total of 7 1/2 years)and have no salvage value at the end of its useful life.Depreciation expense for the year ended December 31, 2012, related to this machine would be

A)$14, 000

B)$10, 667

C)$ 9, 833

D)$ 8, 167

A)$14, 000

B)$10, 667

C)$ 9, 833

D)$ 8, 167

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

28

A change in accounting estimate is always accounted for

A)using a prior period adjustment

B)retrospectively

C)using the cumulative effect method

D)prospectively

A)using a prior period adjustment

B)retrospectively

C)using the cumulative effect method

D)prospectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

29

An item that would not be accounted for under current GAAP as a change in estimate would be

A)an increase in the expected life of a piece of manufacturing equipment

B)a decrease in the estimated residual value of a delivery van

C)a change from FIFO to LIFO for a small subsidiary

D)an increase in defective items for the best selling video game

A)an increase in the expected life of a piece of manufacturing equipment

B)a decrease in the estimated residual value of a delivery van

C)a change from FIFO to LIFO for a small subsidiary

D)an increase in defective items for the best selling video game

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

30

Mary Company purchased equipment on January 1, 2008, for $400, 000.At the date of acquisition, the equipment had an estimated useful life of eight years with a $40, 000 salvage value, and it was depreciated using the straight-line method.On January 1, 2013, based on updated information, Mary decided that the equipment had a total estimated life of ten years and no salvage value.Depreciation expense on the equipment in 2013 should be

A)$40, 000

B)$45, 000

C)$25, 000

D)$35, 000

A)$40, 000

B)$45, 000

C)$25, 000

D)$35, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

31

Shelley Construction began operations in 2010 and appropriately used the completed-contract method in accounting for its long-term construction contracts.Effective January 1, 2012, Shelley changed to the percentage-of-completion method for both financial and tax reporting and can justify the change.Although cumulative pretax income up to January 1, 2012, was $800, 000 using the completed-contract method, cumulative pretax income would have totaled $1, 100, 000 had the percentage-of-completion method been used.Assuming an income tax rate of 30%, Shelley's 2012 financial statements should report a marginal change in its January 1, 2012 balance in Retained Earnings to restate it for the effect of the accounting change in the amount of

A)$ 0

B)$ 90, 000

C)$210, 000

D)$300, 000

A)$ 0

B)$ 90, 000

C)$210, 000

D)$300, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

32

Exhibit 23-3 Kathy Company acquired a truck on January 1, 2010, for $140, 000.The truck had an estimated useful life of five years with no salvage value.Kathy used straight-line depreciation for the truck.On January 1, 2011, Kathy revises the estimated useful life of the truck.Kathy made the accounting change in 2011 to reflect the extended useful life.

-

Refer to Exhibit 23-3.If the revised estimated useful life of the truck is a total of eight years, Kathy should report in its 2011 income statement depreciation expense of

A)$14, 000

B)$16, 000

C)$17, 500

D)$28, 000

-

Refer to Exhibit 23-3.If the revised estimated useful life of the truck is a total of eight years, Kathy should report in its 2011 income statement depreciation expense of

A)$14, 000

B)$16, 000

C)$17, 500

D)$28, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

33

Linda Company has been depreciating equipment for 10 years with an estimated total useful life of 25 years.Linda has revised the estimated life to be only 17 years, with 7 years remaining in the asset's useful life.Linda should

A)record a change in estimate by recomputing depreciation of prior periods and restating prior period financial results accordingly

B)record a change in estimate by recomputing depreciation of prior periods and presenting the net depreciation adjustment as a cumulative effect change in accounting principle in the current period

C)continue to depreciate the equipment over the original 25-year life

D)depreciate the remaining book value over the remaining 7 years of the asset's useful life

A)record a change in estimate by recomputing depreciation of prior periods and restating prior period financial results accordingly

B)record a change in estimate by recomputing depreciation of prior periods and presenting the net depreciation adjustment as a cumulative effect change in accounting principle in the current period

C)continue to depreciate the equipment over the original 25-year life

D)depreciate the remaining book value over the remaining 7 years of the asset's useful life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

34

During 2012, Kramer Company determined, based on new information, that equipment previously depreciated using a ten-year life and a salvage value of $100, 000 had a total estimated life of only six years and a salvage value of $50, 000.The equipment was acquired on January 1, 2010, and was depreciated using the straight-line method.Kramer made an accounting change in 2012 to reflect this additional information, and the change was approved by the IRS.Kramer has an income tax rate of 30%.Assuming Kramer's income before depreciation, before income taxes, and before any retroactive effect of the accounting change (if any)for the year ended December 31, 2012, was $180, 000, Kramer's net income for 2012 should be

A)$80, 000

B)$67, 500

C)$56, 000

D)$47, 250

A)$80, 000

B)$67, 500

C)$56, 000

D)$47, 250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

35

Exhibit 23-3 Kathy Company acquired a truck on January 1, 2010, for $140, 000.The truck had an estimated useful life of five years with no salvage value.Kathy used straight-line depreciation for the truck.On January 1, 2011, Kathy revises the estimated useful life of the truck.Kathy made the accounting change in 2011 to reflect the extended useful life.

-

Refer to Exhibit 23-3.If the revised estimated useful life of the truck is a total of seven years, and assuming an income tax rate of 30%, Kathy should report in its 2011 income statement an effect on prior years of changing the useful life of the truck of

A)$ 0

B)$16, 800

C)$ 5, 600

D)$58, 800

-

Refer to Exhibit 23-3.If the revised estimated useful life of the truck is a total of seven years, and assuming an income tax rate of 30%, Kathy should report in its 2011 income statement an effect on prior years of changing the useful life of the truck of

A)$ 0

B)$16, 800

C)$ 5, 600

D)$58, 800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company changes from capitalizing and amortizing preproduction costs to recording them as an expense when incurred, because future benefits associated with those costs have become doubtful.This accounting change should be recognized as a

A)change in accounting estimate

B)change in accounting principle

C)change in reporting entity

D)correction of an error

A)change in accounting estimate

B)change in accounting principle

C)change in reporting entity

D)correction of an error

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

37

On January 1, 2010, the MMA Company purchased a machine for $36, 000 that had a ten-year estimated useful life and no estimated salvage value.At the start of the seventh year of use, a new energy saving device was added to the machine that extended its original useful life an additional two years.This change should be accounted for in the seventh year by

A)including the cumulative effect of the change in net income for the current period

B)depreciating the remaining book value over four years

C)retroactively adjusting income of prior periods using the newly adjusted useful life

D)depreciating the remaining book value over six years

A)including the cumulative effect of the change in net income for the current period

B)depreciating the remaining book value over four years

C)retroactively adjusting income of prior periods using the newly adjusted useful life

D)depreciating the remaining book value over six years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

38

On January 1, 2010, Patti Company purchased a machine for $140, 000.Patti depreciated the machine over ten years with a $40, 000 salvage value.On January 1, 2014, Patti determined that the total useful life of the machine should be eight years with a salvage value of $18, 000.What is the depreciation expense on the machine for 2014?

A)$10, 500

B)$12, 500

C)$14, 000

D)$20, 500

A)$10, 500

B)$12, 500

C)$14, 000

D)$20, 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

39

Current GAAP requires a company to account for a change in accounting estimate that impacts multiple periods during

A)the period of change

B)the period of change and future periods

C)the period of change and past periods

D)the period of change, past periods, and future periods

A)the period of change

B)the period of change and future periods

C)the period of change and past periods

D)the period of change, past periods, and future periods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

40

Brockway, Inc.purchased some equipment on January 1, 2010, for $300, 000 that had a five-year useful life and no salvage value.Brockway used double-declining-balance depreciation for both financial reporting and income tax purposes.On January 1, 2012, Brockway changed to the straight-line depreciation method for this equipment and can justify the change.Brockway will continue to use double-declining balance depreciation for income tax reporting.Brockway's income tax rate is 30%.Assuming Brockway's 2012 income before depreciation and tax is $800, 000, Brockway's net income for 2012 would be

A)$534, 800

B)$570, 800

C)$764, 000

D)$800, 000

A)$534, 800

B)$570, 800

C)$764, 000

D)$800, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

41

Leigh Co.reported $7, 000 of net income for 2010.The following errors were then discovered: -Ending 2008 accrued expense was understated by

-Ending 2009 unearned revenue was overstated by .

-Ending 2008 unearned revenue was overstated by

Ignoring income taxes, compute correct 2010 net income.

A)$6, 505

B)$5, 895

C)$7, 495

D)$6, 655

-Ending 2009 unearned revenue was overstated by .

-Ending 2008 unearned revenue was overstated by

Ignoring income taxes, compute correct 2010 net income.

A)$6, 505

B)$5, 895

C)$7, 495

D)$6, 655

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

42

An overstatement of reported net income for the current year may result from

A)an overstatement of ending inventory in the previous period

B)an overstatement of ending inventory in the current period

C)failure to record accrued payroll liabilities

D)failure to record expiration of prepaid insurance

A)an overstatement of ending inventory in the previous period

B)an overstatement of ending inventory in the current period

C)failure to record accrued payroll liabilities

D)failure to record expiration of prepaid insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

43

If consolidated statements are presented for the first time instead of statements of several individual companies, this change should be accounted for

A)retrospectively

B)prospectively

C)by cumulative effect adjustment

D)by footnote disclosure only

A)retrospectively

B)prospectively

C)by cumulative effect adjustment

D)by footnote disclosure only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

44

Disadvantages of using the retrospective application method do not include which of the following?

A)Numbers must be changed on previously released financial statements.

B)It is inconsistent with the "all-inclusive income concept."

C)It has possible impacts on contractual arrangements.

D)All financial statements consistently apply the same revenue recognition principles.

A)Numbers must be changed on previously released financial statements.

B)It is inconsistent with the "all-inclusive income concept."

C)It has possible impacts on contractual arrangements.

D)All financial statements consistently apply the same revenue recognition principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

45

On January 1, 2006, the Rita Company purchased for $80, 000 a building that was expected to have a 20-year useful life with no residual value at the end of its useful life.The straight-line method of depreciation was used.On January 1, 2012, Rita Company determined that the remaining life of the building was four years, and there was no change in residual value.What is the balance in Accumulated Depreciation: Building at December 31, 2012, assuming that Rita properly accounted for the change?

A)$14, 000

B)$28, 000

C)$38, 000

D)$56, 000

A)$14, 000

B)$28, 000

C)$38, 000

D)$56, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

46

An understatement of reported net income for the current year may result from

A)an understatement of beginning inventory in the previous period

B)an overstatement of ending inventory in the current period

C)failure to record accrued payroll liabilities

D)failure to record accrued interest revenue

A)an understatement of beginning inventory in the previous period

B)an overstatement of ending inventory in the current period

C)failure to record accrued payroll liabilities

D)failure to record accrued interest revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

47

On December 31, 2010, the Molly Company recognized $12, 000 in revenue from rent of $5, 000 due in 2011 and $7, 000 due in 2012, all collected in advance from another company.Ignoring income taxes, if this error is not detected

A)Retained Earnings at December 31, 2011, will be overstated by $7, 000

B)Retained Earnings at December 31, 2011, will be understated by $7, 000

C)Retained Earnings will be overstated by $12, 000 until the error is discovered

D)Retained Earnings at December 31, 2011, will be understated by $12, 000

A)Retained Earnings at December 31, 2011, will be overstated by $7, 000

B)Retained Earnings at December 31, 2011, will be understated by $7, 000

C)Retained Earnings will be overstated by $12, 000 until the error is discovered

D)Retained Earnings at December 31, 2011, will be understated by $12, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

48

The correct 2010 net income for Margie Company, after error corrections, was $56, 000.Two errors were found after net income was first reported.The January 1, 2010 inventory and the December 31, 2010, inventory were overstated by $4, 000 and $9, 000, respectively.The net income that must have been originally reported was

A)$43, 000

B)$51, 000

C)$61, 000

D)$69, 000

A)$43, 000

B)$51, 000

C)$61, 000

D)$69, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following errors normally would not be automatically corrected over two accounting periods?

A)failure to record prepaid revenue

B)failure to record accrued payroll liabilities

C)failure to record depreciation expense

D)failure to count inventory in transit at year-end

A)failure to record prepaid revenue

B)failure to record accrued payroll liabilities

C)failure to record depreciation expense

D)failure to count inventory in transit at year-end

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following changes would normally require some footnote disclosure?

A)a correction of an error

B)a change in reporting entity

C)a change in accounting estimate

D)all of these

A)a correction of an error

B)a change in reporting entity

C)a change in accounting estimate

D)all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

51

Arguments in favor of the retrospective application method include

A)the adjustments to be made when reading the financial statements are easier to determine

B)a company's current years earnings should not be penalized (decreased)by events beyond the control of company's management

C)all financial statements presented at a given date are consistent

D)evaluating financial statements is easier when all principles used are known by the reader

A)the adjustments to be made when reading the financial statements are easier to determine

B)a company's current years earnings should not be penalized (decreased)by events beyond the control of company's management

C)all financial statements presented at a given date are consistent

D)evaluating financial statements is easier when all principles used are known by the reader

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

52

On January 1, 2010, Teresa loaned $12, 000 to another company on a three-year, 4% note.No interest was accrued in 2010.Cash will not be received for the interest until the end of the three-year period.The error was discovered before adjusting and closing entries were posted on December 31, 2011.Ignoring income taxes, the correct entry on December 31, 2011, should be

A)

B)

C)Interest Receivable

Interest Revenue

D)

A)

B)

C)Interest Receivable

Interest Revenue

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

53

Laura Company received merchandise on December 31, 2010.Laura failed to record the purchase on account because the invoice was inadvertently destroyed.The merchandise was, however, included in ending inventory.The effect of this event on the financial statements as of December 31, 2010, would be

A)assets and liabilities would be understated

B)assets and owners' equity would be overstated

C)liabilities would be understated and retained earnings overstated

D)liabilities would be overstated and retained earnings understated

A)assets and liabilities would be understated

B)assets and owners' equity would be overstated

C)liabilities would be understated and retained earnings overstated

D)liabilities would be overstated and retained earnings understated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

54

Wendy Co.made the following errors in 2010: -Ending inventory was overstated by .

-Beginning inventory was understated by

-Purchaseswere overstated by .

Reported net income was $15, 000.The correct 2010 net income was

A)$26, 000

B)$20, 000

C)$10, 000

D)$ 4, 000

-Beginning inventory was understated by

-Purchaseswere overstated by .

Reported net income was $15, 000.The correct 2010 net income was

A)$26, 000

B)$20, 000

C)$10, 000

D)$ 4, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

55

Belinda Corp.reported $80, 000 of net income for 2010.The following errors were then discovered: -Ending 2010 accrued expense was overstated by

-2010 eame drevenue was overstated by .

-Ending 2010 prepaid expense was overstated by .

Ignoring income taxes, the correct 2010 net income is

A)$85, 500

B)$84, 500

C)$78, 500

D)$76, 500

-2010 eame drevenue was overstated by .

-Ending 2010 prepaid expense was overstated by .

Ignoring income taxes, the correct 2010 net income is

A)$85, 500

B)$84, 500

C)$78, 500

D)$76, 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

56

Elizabeth Company discovered the following errors in 2010: Ending inventory at December 31,2009 , was understated by .

Accrued expenses of were not recorded at December 31,2009 Elizabeth reported net income of $35, 000 for the year 2009.The corrected net income (ignoring income taxes)for 2009 should be

A)$40, 000

B)$30, 000

C)$36, 000

D)$34, 000

Accrued expenses of were not recorded at December 31,2009 Elizabeth reported net income of $35, 000 for the year 2009.The corrected net income (ignoring income taxes)for 2009 should be

A)$40, 000

B)$30, 000

C)$36, 000

D)$34, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Tricia Co.presented financial statements for 2010 and 2011 that contained the following errors: Assuming that no correcting entries were made, by how much would retained earnings be understated at January 1, 2012?

A)$1, 200

B)$1, 100

C)$ 800

D)$ 700

A)$1, 200

B)$1, 100

C)$ 800

D)$ 700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following errors will normally result in overstatement of 2011 net income?

A)failure to record merchandise purchases in 2010

B)understatement of 2010 ending merchandise inventory

C)failure to record accrued salaries expense in 2010

D)overstatement of prepaid expense in 2010

A)failure to record merchandise purchases in 2010

B)understatement of 2010 ending merchandise inventory

C)failure to record accrued salaries expense in 2010

D)overstatement of prepaid expense in 2010

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

59

All of the following would be reported retrospectively by restating prior period's financial results except for a

A)change from the completed-contract method to the percentage-of-completion method for long-term construction contracts

B)correction of an error in previous periods

C)change to the full cost method (from the successful efforts method)for the extractive industry

D)change from the straight-line depreciation method to the sum-of-the-years'-digits method

A)change from the completed-contract method to the percentage-of-completion method for long-term construction contracts

B)correction of an error in previous periods

C)change to the full cost method (from the successful efforts method)for the extractive industry

D)change from the straight-line depreciation method to the sum-of-the-years'-digits method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements is not an example of a correction of an error in previously issued financial statements?

A)adopting the allowance method for bad debts when the direct write-off method had been used because direct write-off was used for tax purposes

B)recording depreciation on plant assets that were not depreciated last year because of a computer problem

C)adopting straight-line depreciation for newly acquired assets and continuing to use the double-declining-balance method for existing assets

D)correcting the ending inventory amount from last year because inventory in transit was missed

A)adopting the allowance method for bad debts when the direct write-off method had been used because direct write-off was used for tax purposes

B)recording depreciation on plant assets that were not depreciated last year because of a computer problem

C)adopting straight-line depreciation for newly acquired assets and continuing to use the double-declining-balance method for existing assets

D)correcting the ending inventory amount from last year because inventory in transit was missed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

61

Exhibit 23-5 Nan Company, having a fiscal year ending on December 31, discovered the following errors in 2010:

A collection of from a customer for rent related to January, 2011 , was recorded as revenue in 2010

Depreciation was under state d by in 2010.

The January 1, 2009, invento1y was overstated by .

The January 1,2010, inventory was understated by

Insurance premiums of that relate to 2011 were expensed in 2010 when paid.

- Assume no other errors have occurred and ignore income taxes.

Refer to Exhibit 23-5.Total assets at December 31, 2010, were

A)overstated by $1, 400

B)overstated by $4, 600

C)understated by $4, 600

D)understated by $1, 400

A collection of from a customer for rent related to January, 2011 , was recorded as revenue in 2010

Depreciation was under state d by in 2010.

The January 1, 2009, invento1y was overstated by .

The January 1,2010, inventory was understated by

Insurance premiums of that relate to 2011 were expensed in 2010 when paid.

- Assume no other errors have occurred and ignore income taxes.

Refer to Exhibit 23-5.Total assets at December 31, 2010, were

A)overstated by $1, 400

B)overstated by $4, 600

C)understated by $4, 600

D)understated by $1, 400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

62

IFRS differ from U.S.GAAP regarding the indirect effects of a change in accounting principle in that IFRS

A)do not specify when the indirect effects should be reported or what disclosures are required

B)do not specify when the indirect effects should be reported

C)do not specify what disclosures are required

D)specify when the indirect effects should be reported and what disclosures are required

A)do not specify when the indirect effects should be reported or what disclosures are required

B)do not specify when the indirect effects should be reported

C)do not specify what disclosures are required

D)specify when the indirect effects should be reported and what disclosures are required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

63

Myrna Company overstated the beginning inventory on January 1, 2010, by $20, 000.No other errors were identified.If the error is not discovered, which of the following net income effects related to the inventory error are true?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

64

On January 1, 2010, Jennifer Company purchased for $40, 000 a truck that had an estimated life of five years and no residual value at the end of its useful life.Jennifer uses straight-line depreciation.The cost of the truck was charged to Repairs Expense when purchased in 2010.

Required:

a. Ignoring income taxes, prepare the journal entry to correct the error if it was discovered and corrected on January 1,2013 (Jennifer's year ends on December 31).

b. When preparing the 2013 financial statements, how much depreciation expense should be reported on the comparative 2011 and 2012 income statements?

Required:

a. Ignoring income taxes, prepare the journal entry to correct the error if it was discovered and corrected on January 1,2013 (Jennifer's year ends on December 31).

b. When preparing the 2013 financial statements, how much depreciation expense should be reported on the comparative 2011 and 2012 income statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

65

Exceptions exist in the retrospective restatement requirements when accounting for errors under

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

66

Exhibit 23-5 Nan Company, having a fiscal year ending on December 31, discovered the following errors in 2010:

A collection of from a customer for rent related to January, 2011 , was recorded as revenue in 2010

Depreciation was under state d by in 2010.

The January 1, 2009, invento1y was overstated by .

The January 1,2010, inventory was understated by

Insurance premiums of that relate to 2011 were expensed in 2010 when paid.

-Assume no other errors have occurred and ignore income taxes.

Refer to Exhibit 23-5.Net income for 2010 was

A)overstated by $4, 600

B)overstated by $16, 600

C)understated by $5, 400

D)understated by $5, 200

A collection of from a customer for rent related to January, 2011 , was recorded as revenue in 2010

Depreciation was under state d by in 2010.

The January 1, 2009, invento1y was overstated by .

The January 1,2010, inventory was understated by

Insurance premiums of that relate to 2011 were expensed in 2010 when paid.

-Assume no other errors have occurred and ignore income taxes.

Refer to Exhibit 23-5.Net income for 2010 was

A)overstated by $4, 600

B)overstated by $16, 600

C)understated by $5, 400

D)understated by $5, 200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

67

On January 1, 2010, Arlene Company bought a machine for $60, 000.It was then estimated that the useful life of the machine would be eight years with a salvage value of $8, 000.On January 1, 2014, it was decided that the machine's total life from acquisition date should have been only six years with a salvage value of only $2000.The company used straight-line depreciation.

Required:

a. If an adjusting entry is necessary on January 1,2014 , prepare it.

b. Compute depreciation expense for 2014.

Required:

a. If an adjusting entry is necessary on January 1,2014 , prepare it.

b. Compute depreciation expense for 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

68

Exhibit 23-6 Nora Company has a fiscal year ending on December 31.Its financial statements for the years ended December 31, 2010 and 2011, contained the following errors:

- Assume no correcting entries have been made.

Refer to Exhibit 23-6.By how much was Nora's 2011 net income overstated or understated?

A)$23, 000 understated

B)$14, 000 overstated

C)$ 7, 000 understated

D)$25, 000 overstated

- Assume no correcting entries have been made.

Refer to Exhibit 23-6.By how much was Nora's 2011 net income overstated or understated?

A)$23, 000 understated

B)$14, 000 overstated

C)$ 7, 000 understated

D)$25, 000 overstated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

69

Exhibit 23-4 Bonnie Company's year-end December 31, 2010, financial statements contained the following errors:

Ending inventory on December 31,2010 , was overstated by .

Depre ciation expense was underst at ed by .

A two-year insurance policy for 2010 and 2011 in the amount of was entirely expensed in 2010.

Investments in common stock of other companieswere sold in 2010 at a gain of , but the sale was not recorded until 2011

-Refer to Exhibit 23-4.The effect of the above errors on the December 31, 2010, reported assets of Bonnie is that assets are

A)understated by $52, 000

B)overstated by $40, 000

C)overstated by $58, 000

D)overstated by $52, 000

Ending inventory on December 31,2010 , was overstated by .

Depre ciation expense was underst at ed by .

A two-year insurance policy for 2010 and 2011 in the amount of was entirely expensed in 2010.

Investments in common stock of other companieswere sold in 2010 at a gain of , but the sale was not recorded until 2011

-Refer to Exhibit 23-4.The effect of the above errors on the December 31, 2010, reported assets of Bonnie is that assets are

A)understated by $52, 000

B)overstated by $40, 000

C)overstated by $58, 000

D)overstated by $52, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

70

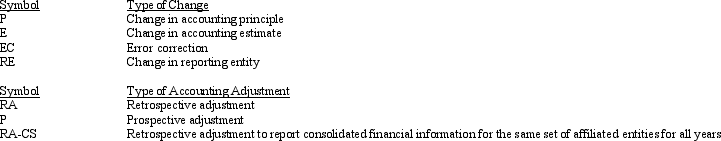

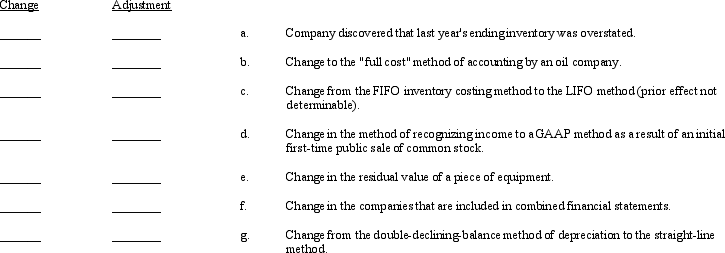

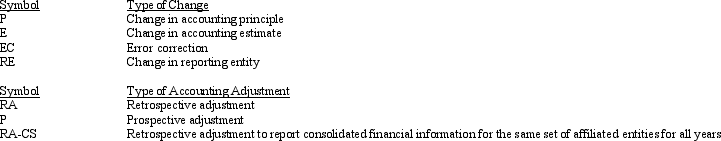

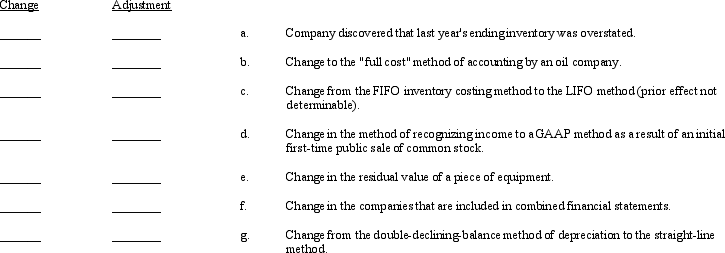

Generally accepted accounting principles have identified four types of accounting changes and two possible methods to use in accounting for these changes, as follows:

Required:

Required:

Following is a list of errors and changes.In the spaces provided, use the appropriate symbols selected from the above lists to indicate the type of change and how the change should be treated in the financial statements.

Required:

Required:Following is a list of errors and changes.In the spaces provided, use the appropriate symbols selected from the above lists to indicate the type of change and how the change should be treated in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

71

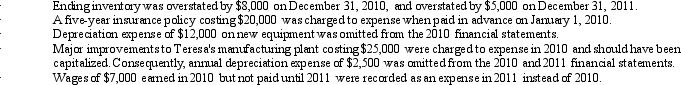

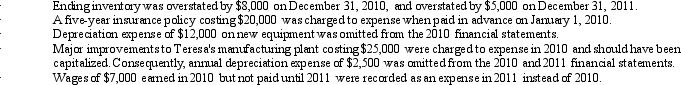

The 2010 and 2011 financial statements for Teresa Company had the following errors:

Teresa Company had reported net income of $90, 000 in 2010 and $95, 000 in 2011.

Teresa Company had reported net income of $90, 000 in 2010 and $95, 000 in 2011.

Required:

Prepare a schedule to determine the correct net income for 2010 and 2011.Begin the schedule with reported net income for 2010 and 2011 and work to a corrected figure.Ignore income taxes.

Teresa Company had reported net income of $90, 000 in 2010 and $95, 000 in 2011.

Teresa Company had reported net income of $90, 000 in 2010 and $95, 000 in 2011.Required:

Prepare a schedule to determine the correct net income for 2010 and 2011.Begin the schedule with reported net income for 2010 and 2011 and work to a corrected figure.Ignore income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

72

Retrospective adjustments are expected to

A)impact financial statements of only previous years

B)impact financial statements of previous years and current years as if the accounting principle had always been used

C)produce no impact on the financial statements of previous years

D)produce no impact on the financial statements of the current year

A)impact financial statements of only previous years

B)impact financial statements of previous years and current years as if the accounting principle had always been used

C)produce no impact on the financial statements of previous years

D)produce no impact on the financial statements of the current year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

73

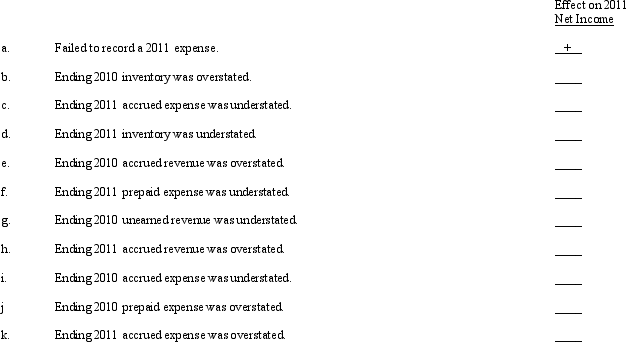

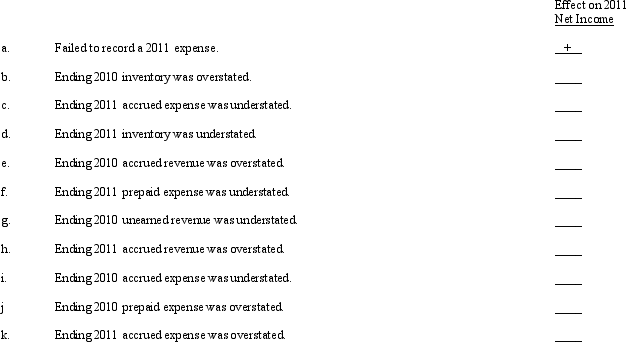

Several errors are listed below.

Required:

Required:

Indicate the effect each error would have on 2011 net income by placing a plus sign (+), minus sign (-)or NI (no impact)in the space provided.Part (a)has been completed as an example.

Required:

Required:Indicate the effect each error would have on 2011 net income by placing a plus sign (+), minus sign (-)or NI (no impact)in the space provided.Part (a)has been completed as an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

74

Exhibit 23-4 Bonnie Company's year-end December 31, 2010, financial statements contained the following errors:

Ending inventory on December 31,2010 , was overstated by .

Depre ciation expense was underst at ed by .

A two-year insurance policy for 2010 and 2011 in the amount of was entirely expensed in 2010.

Investments in common stock of other companieswere sold in 2010 at a gain of , but the sale was not recorded until 2011

- Refer to Exhibit 23-4.What is the effect of the above errors on 2010 net income?

A)Net income is understated by $52, 000.

B)Net income is overstated by $40, 000.

C)Net income is overstated by $58, 000.

D)Net income is overstated by $52, 000.

Ending inventory on December 31,2010 , was overstated by .

Depre ciation expense was underst at ed by .

A two-year insurance policy for 2010 and 2011 in the amount of was entirely expensed in 2010.

Investments in common stock of other companieswere sold in 2010 at a gain of , but the sale was not recorded until 2011

- Refer to Exhibit 23-4.What is the effect of the above errors on 2010 net income?

A)Net income is understated by $52, 000.

B)Net income is overstated by $40, 000.

C)Net income is overstated by $58, 000.

D)Net income is overstated by $52, 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

75

Iris Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2012.The following data were available:

The income tax rate is 40%.The company began operations on January 1, 2010, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2011-2012 comparative financial statements.

a. What is net income for 2012 ?

b. What is restated net income for 2011?

c. Prepare the 2011 statement of reteined earnings as it would appear in the comprative 2011-2012 financial statements

The income tax rate is 40%.The company began operations on January 1, 2010, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2011-2012 comparative financial statements.

a. What is net income for 2012 ?

b. What is restated net income for 2011?

c. Prepare the 2011 statement of reteined earnings as it would appear in the comprative 2011-2012 financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

76

The December 31, 2010, ending inventory failed to include $10, 000 of inventory that was received on December 27, 2010.The purchase on account was, however, properly recorded on the date of delivery.What effect will this error have on the December 31, 2010, assets, liabilities, and net income for the year then ended?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

77

During a year-end evaluation of the financial records of the Gretchen Company for the year ended December 31, 2010, the following was discovered: Inventory on Januaty 1,2010, was understated by .

Invent ofy on December 31,2010 , was under st at ed by .

Rent of collected in advance on December 29,2010 , was included in income for 2010.

A probable, reasonably estimated contingent liability of was not recorded as of December 31,2010

Net income for 2010 (before any of the above items)was $100, 000.The corrected net income, ignoring income taxes, for 2010 should be

A)$50, 000

B)$58, 000

C)$62, 000

D)$68, 000

Invent ofy on December 31,2010 , was under st at ed by .

Rent of collected in advance on December 29,2010 , was included in income for 2010.

A probable, reasonably estimated contingent liability of was not recorded as of December 31,2010

Net income for 2010 (before any of the above items)was $100, 000.The corrected net income, ignoring income taxes, for 2010 should be

A)$50, 000

B)$58, 000

C)$62, 000

D)$68, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

78

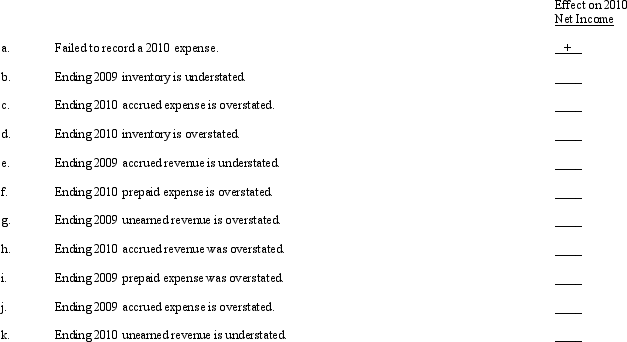

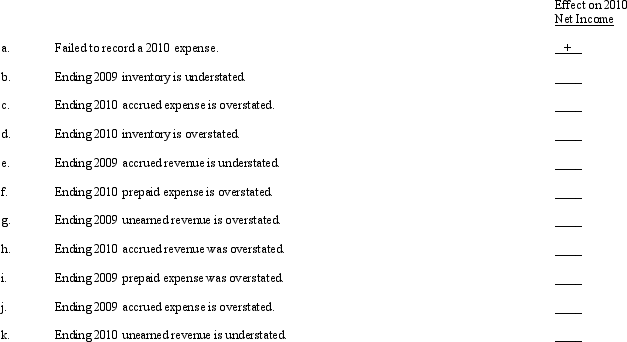

Several errors are listed below.

Required:

Required:

Indicate the effect each error would have on 2010 net income by placing a plus sign (+), minus sign (-)or NI (no impact)in the space provided.Part (a)has been completed as an example.

Required:

Required:Indicate the effect each error would have on 2010 net income by placing a plus sign (+), minus sign (-)or NI (no impact)in the space provided.Part (a)has been completed as an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

79

Prospective adjustments are expected to

A)impact financial statements of only previous years

B)impact financial statements of previous years and current years as if the accounting principle had always been used

C)produce no impact on the financial statements of previous years

D)impact the financial statements of the current year only

A)impact financial statements of only previous years

B)impact financial statements of previous years and current years as if the accounting principle had always been used

C)produce no impact on the financial statements of previous years

D)impact the financial statements of the current year only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

80

Exhibit 23-6 Nora Company has a fiscal year ending on December 31.Its financial statements for the years ended December 31, 2010 and 2011, contained the following errors:

- Assume no correcting entries have been made.

Refer to Exhibit 23-6.By how much was Nora's 2010 net income overstated or understated?

A)$11, 000 overstated

B)$ 7, 000 overstated

C)$ 7, 000 understated

D)$11, 000 understated

- Assume no correcting entries have been made.

Refer to Exhibit 23-6.By how much was Nora's 2010 net income overstated or understated?

A)$11, 000 overstated

B)$ 7, 000 overstated

C)$ 7, 000 understated

D)$11, 000 understated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck