Deck 20: Accounting for Postemployment Benefits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 20: Accounting for Postemployment Benefits

1

Code: Which equation is correct?

A)F = A - E + B + D C

B)F = B + D A C + E

C)F = D - B C - E A

D)F = B C - E - D A

A)F = A - E + B + D C

B)F = B + D A C + E

C)F = D - B C - E A

D)F = B C - E - D A

F = A - E + B + D C

2

GAAP for pension plans requires companies with defined benefit pension plans to

A)recognize pension expense based on accrual-basis concepts

B)recognize pension expense as an amount equal to the actual cash paid to retired employees for the current year

C)recognize a pension liability based on the projected benefit obligation concept

D)disclose annual pension cost in a footnote only; pension cost was not required to be reported on the income statement

A)recognize pension expense based on accrual-basis concepts

B)recognize pension expense as an amount equal to the actual cash paid to retired employees for the current year

C)recognize a pension liability based on the projected benefit obligation concept

D)disclose annual pension cost in a footnote only; pension cost was not required to be reported on the income statement

A

3

A pension plan provides for future retirement income based on the employee's income and length of service with the company.This type of pension plan is termed a

A)contributory plan

B)defined contribution plan

C)noncontributory plan

D)defined benefit plan

A)contributory plan

B)defined contribution plan

C)noncontributory plan

D)defined benefit plan

D

4

An Internal Revenue Code rule that impacts the design of pension plans is

A)employee contributions to the pension fund are not taxable until pension benefits are actually received

B)pension fund earnings are taxable

C)employer contributions to the pension fund are not taxable to the employee when pension benefits are actually received

D)all employer pension expenses are deductible for income tax purposes

A)employee contributions to the pension fund are not taxable until pension benefits are actually received

B)pension fund earnings are taxable

C)employer contributions to the pension fund are not taxable to the employee when pension benefits are actually received

D)all employer pension expenses are deductible for income tax purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a pension plan amendment is adopted and retroactive benefits are granted to employees, the amount of the prior service cost at the date of grant is accounted for

A)as an intangible asset and liability that are recognized on the plan amendment date

B)as a prior period adjustment for the total amount of the prior service cost that is reported on the statement of retained earnings

C)as the total amount of the prior service cost that is recognized as an expense on the current period's income statement

D)initially as an unamortized amount to be included in the computation of pension expense over future periods

A)as an intangible asset and liability that are recognized on the plan amendment date

B)as a prior period adjustment for the total amount of the prior service cost that is reported on the statement of retained earnings

C)as the total amount of the prior service cost that is recognized as an expense on the current period's income statement

D)initially as an unamortized amount to be included in the computation of pension expense over future periods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

The accumulated benefit obligation is equal to the

A)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

C)difference between the annual pension expense and the amount actually funded during the year

D)actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

A)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

C)difference between the annual pension expense and the amount actually funded during the year

D)actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

The cost of retroactive benefits granted in a plan amendment or at the initial adoption of a pension plan is called

A)accumulated benefit cost

B)service cost benefits

C)prior service cost

D)vested benefits

A)accumulated benefit cost

B)service cost benefits

C)prior service cost

D)vested benefits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is not a component of the net periodic pension expense to be reported on a company's income statement?

A)interest cost

B)unrecognized past service cost

C)service cost

D)expected return on plan assets

A)interest cost

B)unrecognized past service cost

C)service cost

D)expected return on plan assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

Current GAAP defines the required calculations for all of the following items except

A)periodic pension expense

B)the funded status of the plan

C)the accrued/prepaid pension cost to be reported by the employer

D)the minimum required amount to be funded

A)periodic pension expense

B)the funded status of the plan

C)the accrued/prepaid pension cost to be reported by the employer

D)the minimum required amount to be funded

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is true regarding a defined contribution pension plan?

A)The pension benefits to be received by the employee during retirement are defined in the plan.

B)Defined contribution plans are the most popular type of pension plan for large corporations.

C)Defined contribution plans do not define the required benefits that must be paid to retired employees.

D)Employers that use defined contribution plans are assuming more risks than employers that use defined benefit plans.

A)The pension benefits to be received by the employee during retirement are defined in the plan.

B)Defined contribution plans are the most popular type of pension plan for large corporations.

C)Defined contribution plans do not define the required benefits that must be paid to retired employees.

D)Employers that use defined contribution plans are assuming more risks than employers that use defined benefit plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

Current GAAP regarding employers' accounting for defined benefit pension plans defines an underfunded pension at the end of the period when the

A)fair value of plan assets exceeds the projected benefit obligation

B)projected benefit obligation exceeds the fair value of plan assets

C)accumulated benefit obligation exceeds the fair value of the plan assets

D)fair value of the plan assets exceed the accumulated benefit obligation

A)fair value of plan assets exceeds the projected benefit obligation

B)projected benefit obligation exceeds the fair value of plan assets

C)accumulated benefit obligation exceeds the fair value of the plan assets

D)fair value of the plan assets exceed the accumulated benefit obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following pension-related definitions is not correct?

A)Vested benefits are payments that are not contingent on the employee's continuing in the service of the employer.

B)Present value is the current worth of an amount or amounts payable or receivable in the future.

C)Actuarial assumptions are those made by actuaries concerning future events affecting pension costs.

D)Service cost is the amount paid annually to a funding agency under an unfunded pension plan.

A)Vested benefits are payments that are not contingent on the employee's continuing in the service of the employer.

B)Present value is the current worth of an amount or amounts payable or receivable in the future.

C)Actuarial assumptions are those made by actuaries concerning future events affecting pension costs.

D)Service cost is the amount paid annually to a funding agency under an unfunded pension plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

The projected benefit obligation is equal to the

A)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B)difference between the annual pension expense and the amount actually funded during the year

C)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

D)actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

A)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B)difference between the annual pension expense and the amount actually funded during the year

C)actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

D)actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

A company's net periodic pension cost (expense)includes all of the following items except

A)service cost

B)employer's contribution to the pension fund

C)amortization of unrecognized prior service cost

D)interest cost on the projected benefit obligation

A)service cost

B)employer's contribution to the pension fund

C)amortization of unrecognized prior service cost

D)interest cost on the projected benefit obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which statement is not true?

A)In the computation of pension expense, a negative return on plan assets can be added.

B)The amount of prior service cost is not included as an asset or a liability.

C)Interest cost is equal to the projected benefit obligation at the end of the period multiplied by the discount rate used by the company.

D)A lower-than-expected mortality rate creates a pension loss to a company.

A)In the computation of pension expense, a negative return on plan assets can be added.

B)The amount of prior service cost is not included as an asset or a liability.

C)Interest cost is equal to the projected benefit obligation at the end of the period multiplied by the discount rate used by the company.

D)A lower-than-expected mortality rate creates a pension loss to a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Amortization of any unrecognized net gain or loss is included in pension expense of a given year if at the

A)end of the year, the cumulative unrecognized net gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

B)beginning of the year, the cumulative unrecognized net gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

C)end of the year, the cumulative gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

D)beginning of the year, the unrecognized cumulative gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

A)end of the year, the cumulative unrecognized net gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

B)beginning of the year, the cumulative unrecognized net gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

C)end of the year, the cumulative gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

D)beginning of the year, the unrecognized cumulative gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

Benefits for which the employee's right to receive a present or future pension benefit is no longer contingent on remaining in the service of the employer are called

A)vested benefits

B)accumulated benefits

C)service benefits

D)prior service benefits

A)vested benefits

B)accumulated benefits

C)service benefits

D)prior service benefits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

If an employer were to account for a defined benefit pension plan on the cash basis, it would be a violation of the

A)going-concern assumption

B)accrual concept

C)separate entity concept

D)double-entry accounting

A)going-concern assumption

B)accrual concept

C)separate entity concept

D)double-entry accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

According to current GAAP, termination benefits paid to an employee should be

A)charged to an intangible asset and amortized straight-line over the next 15 years

B)charged to a loss

C)charged to retained earnings

D)charged to an intangible asset and amortized over the projected years of service of the remaining work force

A)charged to an intangible asset and amortized straight-line over the next 15 years

B)charged to a loss

C)charged to retained earnings

D)charged to an intangible asset and amortized over the projected years of service of the remaining work force

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements is true regarding a defined benefit pension plan?

A)Defined benefit plans are relatively easy to handle from an accounting perspective.

B)Employers that use defined benefit plans are assuming more risks than employers that use defined contribution plans.

C)Defined benefit plans require an employer to contribute a defined sum each period to a pension fund.

D)A defined benefit plan requires the employer to fund the plan each year for an amount equal to the pension expense.

A)Defined benefit plans are relatively easy to handle from an accounting perspective.

B)Employers that use defined benefit plans are assuming more risks than employers that use defined contribution plans.

C)Defined benefit plans require an employer to contribute a defined sum each period to a pension fund.

D)A defined benefit plan requires the employer to fund the plan each year for an amount equal to the pension expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

The interest rate that may be used to compute the interest cost component of pension expense is equal to the

A)company's expected long-term rate of return on plan assets

B)rate of return on high quality fixed-income investments

C)rate of interest at which the pension benefits could be effectively settled

D)rate of return on high quality fixed-income investments or rate of interest at which the pension benefits could be effectively settled

A)company's expected long-term rate of return on plan assets

B)rate of return on high quality fixed-income investments

C)rate of interest at which the pension benefits could be effectively settled

D)rate of return on high quality fixed-income investments or rate of interest at which the pension benefits could be effectively settled

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

Exhibit 20-1 Given the following information:

Average remaining service life = 5 years

An unrecognized net loss existed at the beginning of 2010 in the amount of $100.An additional unrecognized net loss of $20 is reported by actuaries as of the end of 2011.

-

Refer to Exhibit 20-1.What amount of loss should be added to pension expense in 2010?

A)$ 8

B)$10

C)$12

D)$20

Average remaining service life = 5 years

An unrecognized net loss existed at the beginning of 2010 in the amount of $100.An additional unrecognized net loss of $20 is reported by actuaries as of the end of 2011.

-

Refer to Exhibit 20-1.What amount of loss should be added to pension expense in 2010?

A)$ 8

B)$10

C)$12

D)$20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

On January 1, 2010, a company had $84, 000 of unrecognized prior service cost.The years-of-future-service method of amortization is used.The company has seven employees, as indicated below:

What amount of prior service cost should be included in pension expense for 2010?

A)$ 2, 000

B)$ 9, 333

C)$12, 000

D)$14, 000

What amount of prior service cost should be included in pension expense for 2010?

A)$ 2, 000

B)$ 9, 333

C)$12, 000

D)$14, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

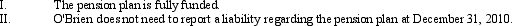

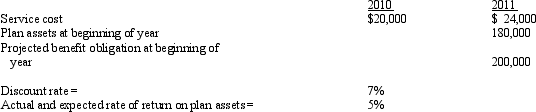

O'Brien began a defined benefit pension plan on January 1, 2010.During 2010, the service cost was $450, 000.O'Brien contributed $450, 000 to the pension plan for 2010.The actuary said the projected benefit obligation at December 31, 2010 was $450, 000.As of December 31, 2010, what statements can O'Brien make about the pension plan?

A)I

B)II

C)both I and II

D)neither I nor II

A)I

B)II

C)both I and II

D)neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

The McMurry Company offers employees a defined contribution pension plan.In 2010, McMurry contributed $75, 000 to the plan, which paid $95, 000 to retired employees.Which of the following statements is true?

A)McMurry will record an accrued liability of $20, 000.

B)McMurry will report pension expense of $75, 000.

C)McMurry will recognize prior service cost of $20, 000.

D)McMurry will recognize actuarial gains and losses on the plan over current and future periods.

A)McMurry will record an accrued liability of $20, 000.

B)McMurry will report pension expense of $75, 000.

C)McMurry will recognize prior service cost of $20, 000.

D)McMurry will recognize actuarial gains and losses on the plan over current and future periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following would not be a component of pension expense?

A)prior service cost amortization

B)interest cost

C)deferred compensation

D)return on assets

A)prior service cost amortization

B)interest cost

C)deferred compensation

D)return on assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

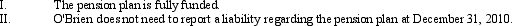

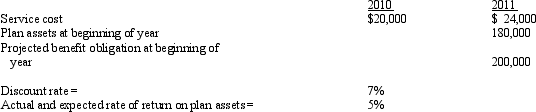

Given the following information  What is pension expense for 2011?

What is pension expense for 2011?

A)$24, 000

B)$29, 000

C)$38, 000

D)$47, 000

What is pension expense for 2011?

What is pension expense for 2011?A)$24, 000

B)$29, 000

C)$38, 000

D)$47, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

Exhibit 20-3 The Grace Company adopted a defined benefit pension plan on January 1, 2010, and prior service credit was granted to employees.The present value of those benefits was calculated to be $1, 351, 800 at that date.The service cost is funded in full at the end of each year, plus an additional amount of $220, 000 is funded each year-end.The unrecognized prior service cost is being amortized by the straight-line method over the remaining 10-year service life of the company's active employees.Additional information relating to the company's pension plan is presented below:

- Refer to Exhibit 20-3.What is the correct balance in Prepaid/Accrued Pension Cost at December 31, 2010?

A)$ 84, 820 debit

B)$ 50, 360 credit

C)$1, 266, 980 credit

D)none of these

- Refer to Exhibit 20-3.What is the correct balance in Prepaid/Accrued Pension Cost at December 31, 2010?

A)$ 84, 820 debit

B)$ 50, 360 credit

C)$1, 266, 980 credit

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Susan Company has a defined benefit pension plan for its employees.The following information pertains to the pension plan:

The December 31, 2010 adjusting journal entries include a

A)debit to Accrued/Prepaid Pension Cost for $7, 700

B)debit to Other Comprehensive Income for $7, 700

C)credit to Other Comprehensive Income for $110, 300

D)credit to Accrued/Prepaid Pension Cost for $110, 300

The December 31, 2010 adjusting journal entries include a

A)debit to Accrued/Prepaid Pension Cost for $7, 700

B)debit to Other Comprehensive Income for $7, 700

C)credit to Other Comprehensive Income for $110, 300

D)credit to Accrued/Prepaid Pension Cost for $110, 300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Margie Company has a defined benefit pension plan for its employees.The following information pertains to the pension plan as of December 31, 2010:

The amount of the December 31, 2010, pension benefit obligation is

A)$2, 250, 000

B)$2, 270, 400

C)$2, 370, 000

D)$2, 450, 000

The amount of the December 31, 2010, pension benefit obligation is

A)$2, 250, 000

B)$2, 270, 400

C)$2, 370, 000

D)$2, 450, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Exhibit 20-2 Minnie Co.has an unfunded prepaid/accrued pension cost of $2, 000 (debit balance)at December 31, 2010.The following information pertains to 2011:

-Refer to Exhibit 20-2.The balance in Prepaid/Accrued Pension Cost at December 31, 2011, should be

A)$30, 000 debit

B)$30, 000 credit

C)$ 8, 000 credit

D)$10, 000 credit

-Refer to Exhibit 20-2.The balance in Prepaid/Accrued Pension Cost at December 31, 2011, should be

A)$30, 000 debit

B)$30, 000 credit

C)$ 8, 000 credit

D)$10, 000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

Danielle Company adopted a defined benefit pension plan on January 1, 2010, and prior service credit was granted to employees.The present value of that prior service obligation as of January 1, 2010 was $1, 400, 000 and is being amortized by the straight-line method over the remaining 20-year service life of the company's active employees.Additional information relating to the company's pension plan for 2010 is presented below:

What amount should be recorded in Prepaid/Accrued Pension Cost when recording the 2010 pension expense and funding at December 31, 2010?

A)$ 1, 200 credit

B)$48, 000 credit

C)$87, 000 credit

D)$94, 800 credit

What amount should be recorded in Prepaid/Accrued Pension Cost when recording the 2010 pension expense and funding at December 31, 2010?

A)$ 1, 200 credit

B)$48, 000 credit

C)$87, 000 credit

D)$94, 800 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Exhibit 20-3 The Grace Company adopted a defined benefit pension plan on January 1, 2010, and prior service credit was granted to employees.The present value of those benefits was calculated to be $1, 351, 800 at that date.The service cost is funded in full at the end of each year, plus an additional amount of $220, 000 is funded each year-end.The unrecognized prior service cost is being amortized by the straight-line method over the remaining 10-year service life of the company's active employees.Additional information relating to the company's pension plan is presented below:

- Refer to Exhibit 20-3.What is the pension expense for 2010?

A)$ 95, 000

B)$230, 180

C)$315, 000

D)$365, 360

- Refer to Exhibit 20-3.What is the pension expense for 2010?

A)$ 95, 000

B)$230, 180

C)$315, 000

D)$365, 360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

In 2010, the Barbara Company initiated a defined benefit pension plan.It recorded $240, 000 as pension expense and paid $280, 000 to a funding agency.As a result, Barbara will report

A)pension assets of $280, 000 and pension liabilities of $240, 000

B)an accrued liability of $50, 000

C)service cost of $280, 000 and unfunded prior service cost of $40, 000

D)prepaid pension cost of $40, 000

E)none of these

A)pension assets of $280, 000 and pension liabilities of $240, 000

B)an accrued liability of $50, 000

C)service cost of $280, 000 and unfunded prior service cost of $40, 000

D)prepaid pension cost of $40, 000

E)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

Exhibit 20-3 The Grace Company adopted a defined benefit pension plan on January 1, 2010, and prior service credit was granted to employees.The present value of those benefits was calculated to be $1, 351, 800 at that date.The service cost is funded in full at the end of each year, plus an additional amount of $220, 000 is funded each year-end.The unrecognized prior service cost is being amortized by the straight-line method over the remaining 10-year service life of the company's active employees.Additional information relating to the company's pension plan is presented below:

-Refer to Exhibit 20-3.What is the pension expense for 2011?

A)$221, 706

B)$325, 000

C)$398, 378

D)$473, 198

-Refer to Exhibit 20-3.What is the pension expense for 2011?

A)$221, 706

B)$325, 000

C)$398, 378

D)$473, 198

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Exhibit 20-1 Given the following information:

Average remaining service life = 5 years

An unrecognized net loss existed at the beginning of 2010 in the amount of $100.An additional unrecognized net loss of $20 is reported by actuaries as of the end of 2011.

-

Refer to Exhibit 20-1.What amount of loss should be added to pension expense in 2012?

A)$0

B)$2.40

C)$4.00

D)$6.40

Average remaining service life = 5 years

An unrecognized net loss existed at the beginning of 2010 in the amount of $100.An additional unrecognized net loss of $20 is reported by actuaries as of the end of 2011.

-

Refer to Exhibit 20-1.What amount of loss should be added to pension expense in 2012?

A)$0

B)$2.40

C)$4.00

D)$6.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Exhibit 20-3 The Grace Company adopted a defined benefit pension plan on January 1, 2010, and prior service credit was granted to employees.The present value of those benefits was calculated to be $1, 351, 800 at that date.The service cost is funded in full at the end of each year, plus an additional amount of $220, 000 is funded each year-end.The unrecognized prior service cost is being amortized by the straight-line method over the remaining 10-year service life of the company's active employees.Additional information relating to the company's pension plan is presented below:

- Refer to Exhibit 20-3.What is the correct amount of the projected benefit obligation as of December 31, 2011?

A)$ 200, 000

B)$ 493, 378

C)$1, 205, 178

D)$1, 845, 178

- Refer to Exhibit 20-3.What is the correct amount of the projected benefit obligation as of December 31, 2011?

A)$ 200, 000

B)$ 493, 378

C)$1, 205, 178

D)$1, 845, 178

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

In 2011, the Marsha Company closed a manufacturing plant.The resulting actuarial loss should be

A)recognized over current and future periods using the straight-line method

B)recognized over current and future periods through adjustments to the service cost and prior service cost

C)included in income for 2011

D)matched to past results with a prior period adjustment

A)recognized over current and future periods using the straight-line method

B)recognized over current and future periods through adjustments to the service cost and prior service cost

C)included in income for 2011

D)matched to past results with a prior period adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

Exhibit 20-2 Minnie Co.has an unfunded prepaid/accrued pension cost of $2, 000 (debit balance)at December 31, 2010.The following information pertains to 2011:

- Refer to Exhibit 20-2.The December 31, 2011, adjusting entry should be

A)

Other Comprehensive Income

Accrued/Prepaid Pension Cost

B)

Accrued/Prepaid Pension Cost 30,000

Other Comprehensive Income 30,000

C)

D)

Accrued/Prepaid Pension Cost

Other Comprehensive Income

- Refer to Exhibit 20-2.The December 31, 2011, adjusting entry should be

A)

Other Comprehensive Income

Accrued/Prepaid Pension Cost

B)

Accrued/Prepaid Pension Cost 30,000

Other Comprehensive Income 30,000

C)

D)

Accrued/Prepaid Pension Cost

Other Comprehensive Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

ACME has a defined benefit pension plan.ACME is preparing the December 31, 2010 financial statement disclosures related to the plan assets.It should disclose which of the following? I.Expected Return on Plan Assets

II.Actual Return on Plan Assets

A)I

B)II

C)both I and II

D)neither I nor II

II.Actual Return on Plan Assets

A)I

B)II

C)both I and II

D)neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

Vested benefits are

A)estimated benefits

B)not contingent on future service to a company

C)to be received as a lump sum payment

D)lost when employment is terminated

A)estimated benefits

B)not contingent on future service to a company

C)to be received as a lump sum payment

D)lost when employment is terminated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements is true?

A)Funding for postretirement health care benefits is legally required, and contributions are tax deductible.

B)Funding for postretirement health care benefits is legally required, but contributions are not tax deductible.

C)Funding for postretirement health care benefits is not legally required, and contributions are not tax deductible.

D)Funding for postretirement health care benefits is not legally required, but contributions are tax deductible.

A)Funding for postretirement health care benefits is legally required, and contributions are tax deductible.

B)Funding for postretirement health care benefits is legally required, but contributions are not tax deductible.

C)Funding for postretirement health care benefits is not legally required, and contributions are not tax deductible.

D)Funding for postretirement health care benefits is not legally required, but contributions are tax deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

ERISA (Pension Reform Act of 1974)provides guidance for

A)accumulated benefit obligation

B)actual return on plan assets

C)minimum funding during the year

D)projected benefit obligations

A)accumulated benefit obligation

B)actual return on plan assets

C)minimum funding during the year

D)projected benefit obligations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

Current GAAP requires that the financial statements issued by a funding agency for a company's pension plan include all of the following except

A)information about the net assets (at fair value)available for benefits at the end of the plan year

B)a financial statement (on a cash basis)presenting information about the pension payments to retirees

C)a financial statement containing information about the changes during the year in the net assets available for benefits

D)information about the actuarial present value of accumulated plan benefits

A)information about the net assets (at fair value)available for benefits at the end of the plan year

B)a financial statement (on a cash basis)presenting information about the pension payments to retirees

C)a financial statement containing information about the changes during the year in the net assets available for benefits

D)information about the actuarial present value of accumulated plan benefits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

Unrecognized prior service cost would be reported on the balance sheet and affect the amount(s)reported for

A)accrued/prepaid pension cost only

B)accumulated other comprehensive income only

C)both accrued/prepaid pension cost and accumulated other comprehensive income

D)neither accrued/prepaid pension cost nor accumulated other comprehensive income

A)accrued/prepaid pension cost only

B)accumulated other comprehensive income only

C)both accrued/prepaid pension cost and accumulated other comprehensive income

D)neither accrued/prepaid pension cost nor accumulated other comprehensive income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

Corporate employees are expected to retire on average in 25 years and to live 16 years after retiring.The pension plan's interest (discount)rate is 12% and the expected return on plan assets is 10%.Compute the PBO (Projected Benefit Obligation)if total annual benefits expected to be paid out to retirees is expected to be $210, 000.The following factors are available:

A)$ 86, 261

B)$ 96, 775

C)$135, 177

D)$152, 653

A)$ 86, 261

B)$ 96, 775

C)$135, 177

D)$152, 653

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

Accounting principles for defined benefit pension plans under IFRS differ from U.S.GAAP in all of the following areas except that under IFRS

A)certain components of pension expense may be reported as a part of different line items in the income statement

B)actuarial gains and losses may be recognized in full in the period in which they occur directly into equity

C)any portion of prior service cost that is not vested must be recognized on the balance sheet as a component of other comprehensive income

D)any portion of prior service cost that is immediately vested must be expensed

A)certain components of pension expense may be reported as a part of different line items in the income statement

B)actuarial gains and losses may be recognized in full in the period in which they occur directly into equity

C)any portion of prior service cost that is not vested must be recognized on the balance sheet as a component of other comprehensive income

D)any portion of prior service cost that is immediately vested must be expensed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

Samantha Co.has a defined benefit pension plan that has experienced differences between its expected and actual projected benefit obligation.Data on the plan as of January 1, 2010, follow:

There was no difference between the company's expected and actual return on plan assets during 2010.The average remaining service life of the company's employees is 12 years.

Required:

Determine the amount of the net gain or loss to be included in pension expense for 2010 and indicate whether it is an increase or decrease in the pension expense calculation.

There was no difference between the company's expected and actual return on plan assets during 2010.The average remaining service life of the company's employees is 12 years.

Required:

Determine the amount of the net gain or loss to be included in pension expense for 2010 and indicate whether it is an increase or decrease in the pension expense calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

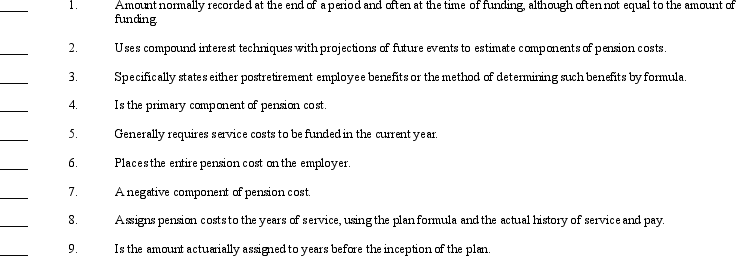

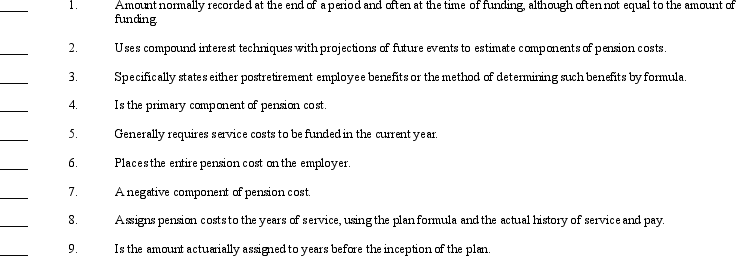

A list of terms (a-i)and a list of descriptive phrases (1-9)related to pension accounting are provided below:

a. actuary

b. expectedretum on plan assets

c. defined benefit plan

d. noncontribut ory plan

e. prior service cost

f. service cost

g. accumulated benefits approach

h. pension expense

i.Pension Reform Act of 1974 (ERISA)

Required:

Required:

Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

a. actuary

b. expectedretum on plan assets

c. defined benefit plan

d. noncontribut ory plan

e. prior service cost

f. service cost

g. accumulated benefits approach

h. pension expense

i.Pension Reform Act of 1974 (ERISA)

Required:

Required:Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

Matilda, Inc.amended its defined benefit pension plan as of January 1, 2010.Matilda received a report from its actuary stating that at the beginning of 2010 unrecognized prior service cost resulting from the amendment amounted to $144, 000.The company's work force was composed of twelve people.Four were expected to retire at the end of 2012.Two were expected to retire at the end of 2014, two more at the end of 2016, and four at the end of 2018.

Required:

Using the years-of-future-service method, compute the amount of prior service cost to be amortized in the first year.

Required:

Using the years-of-future-service method, compute the amount of prior service cost to be amortized in the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following items attributable to a defined benefit pension plan would be recognized on a company's balance sheet?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

Tina Company had the following information related to its pension plan:

The average remaining service life = 3 years

An additional unrecognized net loss of $990 was reported as of January 1, 2011 (see table).This amount has been included in the January 1, 2011.projected benefit obligation balance.

Required:

Compute the amount of unrecognized loss that should be included in pension expense in:

a. 2011

b. 2012

The average remaining service life = 3 years

An additional unrecognized net loss of $990 was reported as of January 1, 2011 (see table).This amount has been included in the January 1, 2011.projected benefit obligation balance.

Required:

Compute the amount of unrecognized loss that should be included in pension expense in:

a. 2011

b. 2012

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Disclosures for vested benefits

A)are not required

B)are related to the projected benefit obligation

C)are related to the accumulated benefit obligation

D)are related to the plan assets

A)are not required

B)are related to the projected benefit obligation

C)are related to the accumulated benefit obligation

D)are related to the plan assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Pension Benefit Guaranty Corporation's purpose is to

A)allow companies to exit bankruptcy.

B)insure defined contribution pension plans.

C)insure defined benefit pension plans.

D)guarantee taxpayers that the federal government will pay pension benefits.

A)allow companies to exit bankruptcy.

B)insure defined contribution pension plans.

C)insure defined benefit pension plans.

D)guarantee taxpayers that the federal government will pay pension benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

The expense for other postretirement benefits, such as health care benefits, dental benefits, and eye care benefits, currently is accounted for

A)on an accrual basis

B)on a cash basis

C)on either a cash basis or an accrual basis; both methods are acceptable

D)by footnote disclosure only

A)on an accrual basis

B)on a cash basis

C)on either a cash basis or an accrual basis; both methods are acceptable

D)by footnote disclosure only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

Disclosures for a defined benefit pension plan should include which of the following?

A)I, II, III, IV

B)I, III, V, VI

C)II, III, V, VI

D)III, IV, V, VI

A)I, II, III, IV

B)I, III, V, VI

C)II, III, V, VI

D)III, IV, V, VI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Current GAAP requires that the net gain or loss from a settlement or curtailment be included in the

A)statement of retained earnings

B)income statement

C)balance sheet

D)statement of cash flows

A)statement of retained earnings

B)income statement

C)balance sheet

D)statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Because of significant government funding of benefits to retirees, it is likely that total pension costs are

A)more material for U.S.companies than foreign companies

B)more material for foreign companies than U.S.companies

C)the same for all companies worldwide

D)not material for any companies worldwide

A)more material for U.S.companies than foreign companies

B)more material for foreign companies than U.S.companies

C)the same for all companies worldwide

D)not material for any companies worldwide

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following statements regarding postretirement benefits other than pensions is true?

A)A liability for postretirement benefits other than pensions is not required to be reported on the balance sheet.

B)The interest component of the net postretirement benefit expense is based on the accumulated postretirement benefit obligation (APBO).

C)The interest component of the net postretirement benefit expense is based on the expected postretirement benefit obligation (EPBO).

D)An intangible asset for other postemployment benefits (OPEB)is required to be reported on a company's balance sheet.

A)A liability for postretirement benefits other than pensions is not required to be reported on the balance sheet.

B)The interest component of the net postretirement benefit expense is based on the accumulated postretirement benefit obligation (APBO).

C)The interest component of the net postretirement benefit expense is based on the expected postretirement benefit obligation (EPBO).

D)An intangible asset for other postemployment benefits (OPEB)is required to be reported on a company's balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

Mandy Co.has a defined benefit pension plan for its employees.The plan was amended at the beginning of 2010 which increased benefits based on services rendered by certain employees in prior periods.The actuary has reported that unrecognized prior service cost resulting from the amendment is $385, 000.Five employees expect to receive the increased benefits.Shown below is a schedule of the employees and their expected years of future service:

Required:

Using the straight-line method:

a. Compute the average remaining service life.

b. Determine the amount of unrecopnized prior service cost to be included in the 2010 persion expense calculation.

Required:

Using the straight-line method:

a. Compute the average remaining service life.

b. Determine the amount of unrecopnized prior service cost to be included in the 2010 persion expense calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

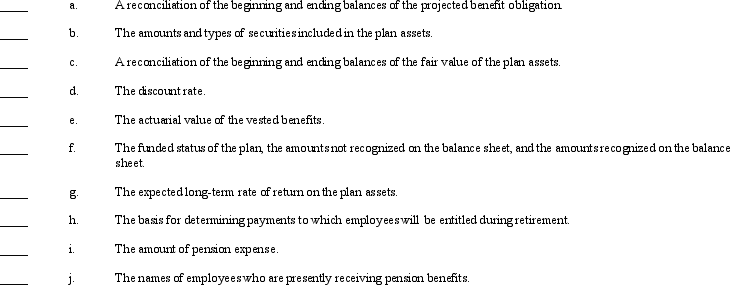

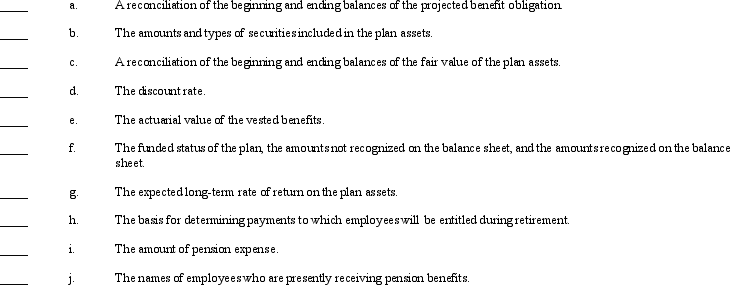

A list of descriptive phrases related to pension plan accounting is shown below:

Required:

Required:

In the space preceding each phrase, indicate whether the item described must be disclosed per the requirements of current GAAP regarding an employer's disclosures about pensions and other postemployment benefits.Use "Y" if the item is a required disclosure and "N" if it is not a required disclosure.

Required:

Required:In the space preceding each phrase, indicate whether the item described must be disclosed per the requirements of current GAAP regarding an employer's disclosures about pensions and other postemployment benefits.Use "Y" if the item is a required disclosure and "N" if it is not a required disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

Betsy Company estimated that at the end of seven years, it will be necessary to have $90, 000 available in a pension fund.The correct interest rate was 9%.Actuarial information for seven periods at 9% follows:

Required:

Compute the amount that the company must deposit at the end of each year in order to have the necessary funds available at the end of the seventh year.

Required:

Compute the amount that the company must deposit at the end of each year in order to have the necessary funds available at the end of the seventh year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

In addition to providing pensions to their employees, many companies also offer postemployment benefits.These are benefits going to former employees after employment but before retirement.

Required:

Describe how the cost of these benefits is to be accounted for under current GAAP.

Required:

Describe how the cost of these benefits is to be accounted for under current GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Current GAAP requires that a company with a defined benefit pension plan disclose a reconciliation of the beginning and ending balances of the projected benefit obligation.

Required:

State the items that must be included in this disclosure.

Required:

State the items that must be included in this disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

One type of post-retirement benefit other than pensions is healthcare benefits.

Required:

Discuss the major differences between postretirement healthcare benefits and pensions.

Required:

Discuss the major differences between postretirement healthcare benefits and pensions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

67

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck