Deck 19: Accounting for Income Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/73

العب

ملء الشاشة (f)

Deck 19: Accounting for Income Taxes

1

Assuming there are no prior period adjustments during the fiscal year, net income would be affected by

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

III

2

Which of the following statements regarding the allocation of income taxes is not true?

A)With comprehensive tax allocation, income taxes on all transactions and events are viewed as affecting cash flows in both the period of origination and the period of reversal.

B)The deferred method is income-statement oriented.

C)The asset/liability method is balance-sheet oriented.

D)Partial tax allocation includes income tax expenses only for those timing differences expected to reverse in the future.

A)With comprehensive tax allocation, income taxes on all transactions and events are viewed as affecting cash flows in both the period of origination and the period of reversal.

B)The deferred method is income-statement oriented.

C)The asset/liability method is balance-sheet oriented.

D)Partial tax allocation includes income tax expenses only for those timing differences expected to reverse in the future.

A

3

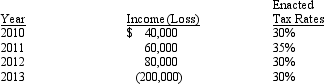

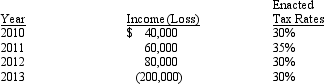

Exhibit 19-1 On December 31, 2009, Fort Stockton, Inc.had no temporary differences that created deferred income taxes.On January 2, 2010, a new machine was purchased for $30, 000.Straight-line depreciation over a four-year life (no residual value)was used for financial accounting.Depreciation expense for tax purposes was $11, 000 in 2010, $9, 000 in 2011, $6, 000 in 2012, and $4, 000 in 2013.In each year, the income tax rate was 20% and Fort Stockton had no other items that created differences between pretax financial income and taxable income.Fort Stockton reported the following pretax financial income for 2010 through 2013:

- Refer to Exhibit 19-1.The entry to record income taxes on December 31, 2011, would include a

A)debit to Deferred Tax Liability for $300

B)credit to Income Taxes Payable for $8, 000

C)debit to Income Tax Expense for $7, 700

D)credit to Deferred Tax Liability for $300

- Refer to Exhibit 19-1.The entry to record income taxes on December 31, 2011, would include a

A)debit to Deferred Tax Liability for $300

B)credit to Income Taxes Payable for $8, 000

C)debit to Income Tax Expense for $7, 700

D)credit to Deferred Tax Liability for $300

credit to Deferred Tax Liability for $300

4

Interperiod income tax allocation is based on the assumption that

A)permanent differences ultimately reverse and require interperiod tax allocation

B)permanent differences do not have deferred tax consequences

C)total income tax expense should be apportioned among numerous line items on the income statement

D)the amount of income tax expense reported on the income statement should be the same as the income tax obligation on the corporation's income tax return

A)permanent differences ultimately reverse and require interperiod tax allocation

B)permanent differences do not have deferred tax consequences

C)total income tax expense should be apportioned among numerous line items on the income statement

D)the amount of income tax expense reported on the income statement should be the same as the income tax obligation on the corporation's income tax return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following transactions would typically result in the creation of a deferred tax liability?

A)Rents received in advance are taxable when received but are not recognized in pretax financial income until earned.

B)Gross profit on installment sales is recognized currently in pretax financial income but is not taxable for income tax purposes until cash is received.

C)Losses recognized in pretax accounting income from an investment in a subsidiary are accounted for by the equity method but not deductible for income tax purposes until the investment is sold.

D)A contingent liability is recognized as an expense currently in pretax financial income but not deductible for income tax purposes until paid.

A)Rents received in advance are taxable when received but are not recognized in pretax financial income until earned.

B)Gross profit on installment sales is recognized currently in pretax financial income but is not taxable for income tax purposes until cash is received.

C)Losses recognized in pretax accounting income from an investment in a subsidiary are accounted for by the equity method but not deductible for income tax purposes until the investment is sold.

D)A contingent liability is recognized as an expense currently in pretax financial income but not deductible for income tax purposes until paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

6

In 2010, Weatherford Corporation reported pretax financial income of $400, 000.Included in that pretax financial income was $150, 000 of nontaxable life insurance proceeds received as a result of the death of an officer; $120, 000 of warranty expenses accrued but unpaid as of December 31, 2010; and $10, 000 of bad debts estimated to be uncollectible (but not written off as of December 31, 2010).Assuming that no income taxes were previously paid during the year and an income tax rate of 30%, the amount of income taxes payable on December 31, 2010, would be

A)$ 42, 000

B)$108, 000

C)$114, 000

D)$126, 000

A)$ 42, 000

B)$108, 000

C)$114, 000

D)$126, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

7

Each of the following can result in a temporary difference between pretax financial income and taxable income except

A)depreciation expense

B)product warranty costs

C)percentage depletion in excess of cost depletion on wasting assets

D)contingent liabilities

A)depreciation expense

B)product warranty costs

C)percentage depletion in excess of cost depletion on wasting assets

D)contingent liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is not a timing difference that would cause pretax financial accounting income to differ from taxable income?

A)Investment revenue is recognized under the equity method for financial reporting purposes but in a later period as dividends are received for income tax purposes.

B)Life insurance proceeds are received by a corporation upon the death of an insured employee of the corporation.

C)Rent received in advance is taxable when received but is not reported as revenue for financial reporting purposes until the service has actually been provided.

D)MACRS depreciation is used for income tax purposes, and straight-line depreciation is used for financial reporting purposes.

A)Investment revenue is recognized under the equity method for financial reporting purposes but in a later period as dividends are received for income tax purposes.

B)Life insurance proceeds are received by a corporation upon the death of an insured employee of the corporation.

C)Rent received in advance is taxable when received but is not reported as revenue for financial reporting purposes until the service has actually been provided.

D)MACRS depreciation is used for income tax purposes, and straight-line depreciation is used for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

9

Differences between pretax financial accounting and taxable income that are expected to reverse in one or more future accounting periods are called

A)temporary differences

B)permanent differences

C)material differences

D)quasi differences

A)temporary differences

B)permanent differences

C)material differences

D)quasi differences

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

10

In pushing for comprehensive allocation of income taxes, FASB argued that

A)income tax expense should be based on all permanent differences

B)income tax expense should be based on all temporary differences

C)income tax rates expected to be enacted should be taken into consideration when valuing permanent differences

D)income tax rates expected to be enacted should be taken into consideration when valuing temporary differences

A)income tax expense should be based on all permanent differences

B)income tax expense should be based on all temporary differences

C)income tax rates expected to be enacted should be taken into consideration when valuing permanent differences

D)income tax rates expected to be enacted should be taken into consideration when valuing temporary differences

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

11

Differences between pretax financial income and taxable income in an accounting period that will not reverse in a later accounting period are called

A)temporary differences

B)permanent differences

C)deductible temporary differences

D)deferred tax consequences

A)temporary differences

B)permanent differences

C)deductible temporary differences

D)deferred tax consequences

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

12

Exhibit 19-1 On December 31, 2009, Fort Stockton, Inc.had no temporary differences that created deferred income taxes.On January 2, 2010, a new machine was purchased for $30, 000.Straight-line depreciation over a four-year life (no residual value)was used for financial accounting.Depreciation expense for tax purposes was $11, 000 in 2010, $9, 000 in 2011, $6, 000 in 2012, and $4, 000 in 2013.In each year, the income tax rate was 20% and Fort Stockton had no other items that created differences between pretax financial income and taxable income.Fort Stockton reported the following pretax financial income for 2010 through 2013:

-Refer to Exhibit 19-1.The entry to record income taxes on December 31, 2012, would include a

A)debit to Deferred Tax Asset for $300

B)credit to Income Taxes Payable for $7, 700

C)debit to Income Tax Expense for $8, 000

D)debit to Deferred Tax Liability for $300

-Refer to Exhibit 19-1.The entry to record income taxes on December 31, 2012, would include a

A)debit to Deferred Tax Asset for $300

B)credit to Income Taxes Payable for $7, 700

C)debit to Income Tax Expense for $8, 000

D)debit to Deferred Tax Liability for $300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following would not result in a permanent difference between pretax financial income and taxable income?

A)product warranty costs

B)premiums paid for life insurance policies on officers of the company

C)interest revenue received from investments in municipal bonds

D)percentage depletion in excess of cost depletion on wasting assets

A)product warranty costs

B)premiums paid for life insurance policies on officers of the company

C)interest revenue received from investments in municipal bonds

D)percentage depletion in excess of cost depletion on wasting assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

14

The asset/liability method of tax allocation should be followed for

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

15

When Congress changes the tax laws or rates, a corporation's deferred tax liability and asset accounts

A)are not adjusted

B)are adjusted as of the end of the year in which the change occurred

C)are adjusted as of the beginning of the year in which the change occurred

D)are adjusted using the average of the old and new tax rates

A)are not adjusted

B)are adjusted as of the end of the year in which the change occurred

C)are adjusted as of the beginning of the year in which the change occurred

D)are adjusted using the average of the old and new tax rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

16

Permanent differences between pretax financial income and taxable income result when

A)a company engages in fraudulent activity

B)the SEC imposes a penalty on a company

C)the IRS imposes interest on a late payment

D)the FTC changes how an advertisement can be shown on TV even though the company has paid for the ad

A)a company engages in fraudulent activity

B)the SEC imposes a penalty on a company

C)the IRS imposes interest on a late payment

D)the FTC changes how an advertisement can be shown on TV even though the company has paid for the ad

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

17

The amount owed the IRS is recorded in the accounting records in which account?

A)Income Tax Expense

B)Income Tax Liability

C)Deferred Tax Expense

D)Deferred Tax Liability

A)Income Tax Expense

B)Income Tax Liability

C)Deferred Tax Expense

D)Deferred Tax Liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which statement regarding the objectives of financial accounting and the Internal Revenue Code is true?

A)The objectives of financial accounting and the Internal Revenue Code are the same.

B)The overall objective of the Internal Revenue Code is to enable investors to make buy-hold-sell decisions.

C)Most accountants favor conformity between financial accounting and the Internal Revenue Code in all instances.

D)An objective in financial accounting is to provide useful information to decision makers about companies.

A)The objectives of financial accounting and the Internal Revenue Code are the same.

B)The overall objective of the Internal Revenue Code is to enable investors to make buy-hold-sell decisions.

C)Most accountants favor conformity between financial accounting and the Internal Revenue Code in all instances.

D)An objective in financial accounting is to provide useful information to decision makers about companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

19

In accounting for income taxes, percentage depletion in excess of cost depletion is an example of

A)intraperiod income tax allocation

B)a temporary difference

C)interperiod income tax allocation

D)a permanent difference

A)intraperiod income tax allocation

B)a temporary difference

C)interperiod income tax allocation

D)a permanent difference

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

20

Current GAAP requires which of the following tax allocation approaches and methods?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

21

All of the following involve a temporary difference for purposes of income tax allocation except

A)revenues or gains that are included in pretax financial income prior to the time they are included in taxable income

B)expenses or losses that are deducted to compute taxable income prior to the time they are deducted to compute pretax financial income

C)revenues or gains that are included in taxable income prior to the time they are included in pretax financial income

D)deductions that are allowed for income tax purposes but that do not qualify as expenses under generally accepted accounting principles

A)revenues or gains that are included in pretax financial income prior to the time they are included in taxable income

B)expenses or losses that are deducted to compute taxable income prior to the time they are deducted to compute pretax financial income

C)revenues or gains that are included in taxable income prior to the time they are included in pretax financial income

D)deductions that are allowed for income tax purposes but that do not qualify as expenses under generally accepted accounting principles

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements regarding current and deferred income taxes is not correct?

A)The amount of income tax expense must be allocated to various components of comprehensive income.

B)The income tax obligation is determined by applying the historical tax rates to the taxable income for the year.

C)The valuation allowance account is subtracted from the deferred tax asset account on the balance sheet.

D)Rent received in advance that will be earned within the next 12 months results in the creation of a current deferred tax asset.

A)The amount of income tax expense must be allocated to various components of comprehensive income.

B)The income tax obligation is determined by applying the historical tax rates to the taxable income for the year.

C)The valuation allowance account is subtracted from the deferred tax asset account on the balance sheet.

D)Rent received in advance that will be earned within the next 12 months results in the creation of a current deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

23

Sherman Company uses an accelerated depreciation method for income tax purposes and the straight-line depreciation method for financial reporting purposes.As of December 31, 2010, Sherman has a deferred tax liability balance related to depreciation temporary differences of $80, 000.In 2011, depreciation for income tax purposes was $260, 000, while depreciation for financial reporting purposes was $200, 000.If the income tax rate is 30%, no other temporary or permanent differences exist, and taxable income is $300, 000, the entry to record income tax expense on December 31, 2011, would include a

A)debit to Income Tax Expense for $108, 000

B)credit to Income Taxes Payable for $108, 000

C)debit to Deferred Tax Asset for $24, 000

D)credit to Deferred Tax Liability for $24, 000

A)debit to Income Tax Expense for $108, 000

B)credit to Income Taxes Payable for $108, 000

C)debit to Deferred Tax Asset for $24, 000

D)credit to Deferred Tax Liability for $24, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

24

During its first year of operations ending on December 31, 2010, the Laredo Company reported pretax accounting income of $600, 000.The only difference between taxable income and accounting income was $80, 000 of accrued warranty costs.These warranty costs are expected to be paid as follows:

Assuming an income tax rate of 30% in 2010, Laredo should report income tax expense on its 2010 income statement in the amount of

A)$175, 000

B)$180, 000

C)$185, 000

D)$204, 000

Assuming an income tax rate of 30% in 2010, Laredo should report income tax expense on its 2010 income statement in the amount of

A)$175, 000

B)$180, 000

C)$185, 000

D)$204, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Clear Lake Corporation reported the following differences between its taxable income and pretax financial income for the year ended December 31, 2010: $30, 000 of additional depreciation for tax purposes, $40, 000 of rent collected in advance (taxable when received), and $38, 000 of tax-exempt municipal interest revenue.Assuming an income tax rate of 30% for all years and a taxable income of $190, 000 for the year ended December 31, 2010, income tax expense for 2010 would be

A)$54, 000

B)$65, 400

C)$71, 400

D)$78, 400

A)$54, 000

B)$65, 400

C)$71, 400

D)$78, 400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

26

Life insurance proceeds payable to a corporation upon the death of an insured employee are an example of

A)intraperiod tax allocation

B)interperiod tax allocation

C)a permanent difference

D)a temporary difference

A)intraperiod tax allocation

B)interperiod tax allocation

C)a permanent difference

D)a temporary difference

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following would require interperiod tax allocation?

A)percentage depletion in excess of cost depletion

B)premiums paid on a life insurance policy of which the company is the beneficiary

C)interest on municipal bonds

D)investment income recognized by the equity method for accounting purposes but as income when received for tax purposes

A)percentage depletion in excess of cost depletion

B)premiums paid on a life insurance policy of which the company is the beneficiary

C)interest on municipal bonds

D)investment income recognized by the equity method for accounting purposes but as income when received for tax purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

28

In 2010, the San Marcos Company received insurance proceeds of $300, 000 payable upon the death of its previous top executive officer.For financial reporting purposes, San Marcos included the $300, 000 in pretax accounting income.The life insurance proceeds are exempt from income taxes.Assuming an income tax rate of 30%, what should be reported as deferred income taxes in the 2010 income statement of San Marcos for this event?

A)$ 0

B)$ 90, 000 deferred tax asset

C)$ 90, 000 deferred tax liability

D)$210, 000 deferred tax liability

A)$ 0

B)$ 90, 000 deferred tax asset

C)$ 90, 000 deferred tax liability

D)$210, 000 deferred tax liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

29

Permanent differences impact

A)current deferred taxes

B)current tax liabilities

C)deferred tax assets

D)deferred tax liabilities

A)current deferred taxes

B)current tax liabilities

C)deferred tax assets

D)deferred tax liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

30

All of the following involve a temporary difference for purposes of income tax allocation except

A)interest on municipal bonds

B)gross profit on installment sales for tax purposes

C)MACRS depreciation for tax purposes and straight-line for accounting purposes

D)product warranty expenses

A)interest on municipal bonds

B)gross profit on installment sales for tax purposes

C)MACRS depreciation for tax purposes and straight-line for accounting purposes

D)product warranty expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

31

Temporary differences arise when expenses or losses are deducted to compute taxable income

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

32

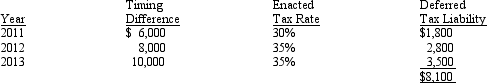

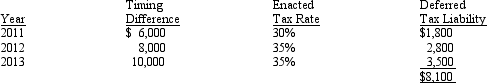

Langtry Corporation began operations in 2009 and appropriately recorded a deferred tax liability at the end of 2009 and 2010 based on the following depreciation temporary differences between pretax financial income and taxable income:

The income tax rate for 2009 and 2010 was 30%.In February 2011, due to budget constraints, Congress enacted an income tax rate of 35%.The journal entry required to adjust the Deferred Tax Liability account in February 2011 would be

A)

B)

C)

D)

The income tax rate for 2009 and 2010 was 30%.In February 2011, due to budget constraints, Congress enacted an income tax rate of 35%.The journal entry required to adjust the Deferred Tax Liability account in February 2011 would be

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

33

All of the following are conclusions reached by the FASB regarding accounting for deferred taxes except

A)the use of a present value approach is acceptable

B)interperiod tax allocation of temporary differences is appropriate

C)the comprehensive allocation approach should be applied

D)the asset/liability method of income tax allocation should be used

A)the use of a present value approach is acceptable

B)interperiod tax allocation of temporary differences is appropriate

C)the comprehensive allocation approach should be applied

D)the asset/liability method of income tax allocation should be used

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

34

Duncanville Company appropriately uses the installment sales method for tax purposes and the accrual method for revenue recognition for accounting purposes.Pertinent data at December 31, 2010, the close of the first year of operations, are as follows:

Duncanville's tax rate is 30%.What amount should be included in the deferred tax account at December 31, 2010 for these installment sales?

A)$150, 000 deferred tax asset

B)$150, 000 deferred tax liability

C)$500, 000 deferred tax asset

D)$500, 000 deferred tax liability

Duncanville's tax rate is 30%.What amount should be included in the deferred tax account at December 31, 2010 for these installment sales?

A)$150, 000 deferred tax asset

B)$150, 000 deferred tax liability

C)$500, 000 deferred tax asset

D)$500, 000 deferred tax liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

35

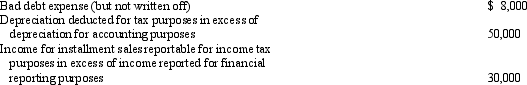

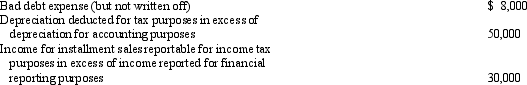

For the year ended December 31, 2010, the Huntsville Company reported income of $350, 000 before provision for income tax.In arriving at taxable income for income tax purposes, the following differences were identified:  Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, is

Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, is

A)$ 83, 400

B)$101, 400

C)$113, 400

D)$129, 000

E)none of these

Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, is

Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, isA)$ 83, 400

B)$101, 400

C)$113, 400

D)$129, 000

E)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

36

Interperiod tax allocation is required for all of the following situations except

A)warranty expenses that are expensed in the year of sale for accounting purposes but are deductible in the year of payment for tax purposes

B)percentage depletion that exceeds cost depletion for the current period

C)MACRS depreciation for tax purposes and straight-line method for accounting purposes

D)installment sales method for tax purposes and accrual method for accounting purposes

A)warranty expenses that are expensed in the year of sale for accounting purposes but are deductible in the year of payment for tax purposes

B)percentage depletion that exceeds cost depletion for the current period

C)MACRS depreciation for tax purposes and straight-line method for accounting purposes

D)installment sales method for tax purposes and accrual method for accounting purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

37

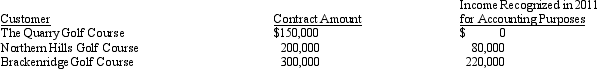

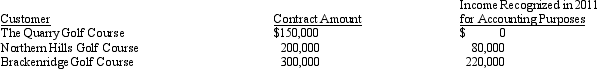

The Alamo Heights Company installs sprinkler systems for large manufacturing enterprises and golf courses.Due to the design of their systems, some projects frequently extend over a two-year period.Alamo Heights uses the percentage-of-completion method for financial accounting purposes and the completed-contract method for tax purposes.As of December 31, 2010, all projects were completed.The following information relates to projects started but not completed as of December 31, 2011:  Assuming an income tax rate of 30%, what amount should be included in the deferred tax liability account at December 31, 2011?

Assuming an income tax rate of 30%, what amount should be included in the deferred tax liability account at December 31, 2011?

A)$ 70, 000

B)$105, 000

C)$245, 000

D)$350, 000

Assuming an income tax rate of 30%, what amount should be included in the deferred tax liability account at December 31, 2011?

Assuming an income tax rate of 30%, what amount should be included in the deferred tax liability account at December 31, 2011?A)$ 70, 000

B)$105, 000

C)$245, 000

D)$350, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

38

Temporary differences arise when revenues or gains are included in pretax financial income

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

39

The interperiod tax allocation method that is balance-sheet oriented, reports deferred taxes based on the future enacted tax rates, and more closely meets the conceptual definitions of assets and liabilities established by the FASB is the

A)deferred method

B)net-of-tax method

C)partial income tax allocation approach

D)asset/liability method

A)deferred method

B)net-of-tax method

C)partial income tax allocation approach

D)asset/liability method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

40

In 2010, its first year of operations, Bandera Corporation reported pretax financial income of $80, 000 for the year ended December 31.Bandera depreciates its fixed assets using an accelerated cost recovery method for tax purposes and straight-line depreciation for financial reporting.On assets acquired in 2010, the following are differences between depreciation on the tax return and accounting income during the asset's five-year life:

Assuming no other temporary or permanent differences, Bandera's December 31, 2010 balance sheet should include

A)I

B)II

C)III

D)IV

Assuming no other temporary or permanent differences, Bandera's December 31, 2010 balance sheet should include

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

41

As of December 31, 2010, the Austin Company reported a deferred tax asset of $60, 000 related to accrued, unpaid warranty costs.However, since profits have been declining, Austin decides that it is more likely than not that $24, 000 of the deferred tax asset will not be realized.The entry to record the valuation allowance would include a

A)debit to Income Tax Expense for $60, 000

B)credit to Income Tax Expense for $24, 000

C)debit to Allowance to Reduce Deferred Tax Asset to Realizable Value for $24, 000

D)credit to Allowance to Reduce Deferred Tax Asset to Realizable Value for $24, 000

A)debit to Income Tax Expense for $60, 000

B)credit to Income Tax Expense for $24, 000

C)debit to Allowance to Reduce Deferred Tax Asset to Realizable Value for $24, 000

D)credit to Allowance to Reduce Deferred Tax Asset to Realizable Value for $24, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

42

Revenue from installment sales is recognized in the period received for tax purposes and recognized in the period earned for accounting purposes.If these periods are different, this is an example of a

A)permanent difference that gives rise to interperiod tax allocation

B)permanent difference that does not give rise to interperiod tax allocation

C)temporary difference that gives rise to interperiod tax allocation

D)temporary difference that does not give rise to interperiod tax allocation

A)permanent difference that gives rise to interperiod tax allocation

B)permanent difference that does not give rise to interperiod tax allocation

C)temporary difference that gives rise to interperiod tax allocation

D)temporary difference that does not give rise to interperiod tax allocation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

43

During its first year of operations, 2010, the Hico Company reported both a pretax financial and a taxable loss of $200, 000.The income tax rate is 30% for the current and future years.Due to a sufficient backlog of sales orders, Hico did not establish a valuation allowance to reduce the $60, 000 deferred tax asset.However, early in 2011, one major customer, representing 60% of the 2011 year-end sales backlog, went bankrupt.Hico now believes that it is more likely than not that 70% of the deferred tax asset will not be realized.The entry to record the valuation allowance would be

A)

B)

C)

Income Tax Expense

Allowance to Reduce Deferred

Tax Asset to Realizable Value 42,000

D)

Allowance to Reduce Deferred Tax

Asset to Realizable Value

Income Tax Expense 42,000

A)

B)

C)

Income Tax Expense

Allowance to Reduce Deferred

Tax Asset to Realizable Value 42,000

D)

Allowance to Reduce Deferred Tax

Asset to Realizable Value

Income Tax Expense 42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Brownwood Company reports the following for both pretax financial and taxable income:  Brownwood uses the carryback provision for net operating losses when possible.Congress has enacted a tax rate for 2014 and future years of 40%.The entry on December 31, 2013, to record income tax expense would include a

Brownwood uses the carryback provision for net operating losses when possible.Congress has enacted a tax rate for 2014 and future years of 40%.The entry on December 31, 2013, to record income tax expense would include a

A)debit to Income Tax Refund Receivable for $24, 000

B)debit to Income Tax Refund Receivable for $45, 000

C)credit to Income Tax Benefit from Operating Losses for $45, 000

D)credit to Income Tax Expense for $45, 000

Brownwood uses the carryback provision for net operating losses when possible.Congress has enacted a tax rate for 2014 and future years of 40%.The entry on December 31, 2013, to record income tax expense would include a

Brownwood uses the carryback provision for net operating losses when possible.Congress has enacted a tax rate for 2014 and future years of 40%.The entry on December 31, 2013, to record income tax expense would include aA)debit to Income Tax Refund Receivable for $24, 000

B)debit to Income Tax Refund Receivable for $45, 000

C)credit to Income Tax Benefit from Operating Losses for $45, 000

D)credit to Income Tax Expense for $45, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

45

Examples of positive evidence cited by the FASB to indicate that a valuation allowance for the tax benefits from a deferred tax asset is not needed include all of the following except

A)existing contract sale backlogs that will produce sufficient taxable income

B)excess of fair market value over the tax basis that is sufficient enough to realize the deferred tax asset

C)a history of using operating loss carryforwards

D)a strong earnings history exclusive of the loss that created the deferred tax asset

A)existing contract sale backlogs that will produce sufficient taxable income

B)excess of fair market value over the tax basis that is sufficient enough to realize the deferred tax asset

C)a history of using operating loss carryforwards

D)a strong earnings history exclusive of the loss that created the deferred tax asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Channelview Company incurred the following expenses in 2010, which are reported differently for financial reporting purposes and taxable income: Estimate of bad debts expense (but not written off)

If the tax rate is 40%, the total temporary difference is

A)$ 20, 000

B)$ 24, 000

C)$ 60, 000

D)$150, 000

If the tax rate is 40%, the total temporary difference is

A)$ 20, 000

B)$ 24, 000

C)$ 60, 000

D)$150, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

47

Harlingen Company reported the following operating results during its first three years of operations: 2010 Pretax operating loss

2011 Pretax operating loss

2012 Pretax operating income

No permanent or temporary differences occurred during these fiscal periods.Assuming an income tax rate of 30%, Harlingen should report a current income tax liability as of December 31, 2012, in the amount of

A)$ 0

B)$21, 000

C)$69, 000

D)$90, 000

2011 Pretax operating loss

2012 Pretax operating income

No permanent or temporary differences occurred during these fiscal periods.Assuming an income tax rate of 30%, Harlingen should report a current income tax liability as of December 31, 2012, in the amount of

A)$ 0

B)$21, 000

C)$69, 000

D)$90, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

48

A deferred tax asset would result if

A)a company recorded a tax penalty in 2010 that it paid in 2011

B)a company recorded more taxable depreciation in 2010 for an asset acquired in 2008

C)a company recorded more warranty expense in 2010 than cash paid in 2010 for warranty repairs

D)a company recorded more interest expense in 2010 than cash paid in 2010 for interest

A)a company recorded a tax penalty in 2010 that it paid in 2011

B)a company recorded more taxable depreciation in 2010 for an asset acquired in 2008

C)a company recorded more warranty expense in 2010 than cash paid in 2010 for warranty repairs

D)a company recorded more interest expense in 2010 than cash paid in 2010 for interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

49

At the end of its first year of operations on December 31, 2010, the Belton Company reported taxable income of $100, 000 and had a pretax financial loss of $60, 000.Differences between taxable income and pretax financial income included interest revenue received from municipal obligations of $20, 000 and warranty expense accruals of $180, 000.Warranty expenses of $90, 000 are expected to be paid in 2011 and $110, 000 in 2012.The enacted income tax rates for 2010, 2011, and 2012 are 30%, 35%, and 40%, respectively.The journal entry to record income tax expense on December 31, 2010, would be

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which one of the following requires interperiod tax allocation?

A)premium paid on key executives' life insurance

B)warranty expenses related to a three-year warranty period

C)interest received on municipal obligations

D)percentage depletion in excess of cost depletion

A)premium paid on key executives' life insurance

B)warranty expenses related to a three-year warranty period

C)interest received on municipal obligations

D)percentage depletion in excess of cost depletion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which one of the following statements regarding operating losses is not true?

A)The tax benefit of an operating loss carryback is recognized in the period of loss as a current receivable on the balance sheet.

B)Temporary differences and operating loss carryforwards are accounted for similarly.

C)The journal entry to recognize an operating loss carryback would include a credit to Income Tax Benefit from Operating Loss Carryback.

D)The tax benefit of an operating loss carryforward is to be recognized in the period of loss as a current receivable.

A)The tax benefit of an operating loss carryback is recognized in the period of loss as a current receivable on the balance sheet.

B)Temporary differences and operating loss carryforwards are accounted for similarly.

C)The journal entry to recognize an operating loss carryback would include a credit to Income Tax Benefit from Operating Loss Carryback.

D)The tax benefit of an operating loss carryforward is to be recognized in the period of loss as a current receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

52

In applying intraperiod income tax allocation to discontinued operations, extraordinary items, cumulative effects of changes in accounting principles, and prior period adjustments, what tax rate should be used?

A)expected future income tax rate

B)average income tax rate

C)marginal (incremental)income tax rate

D)normal income tax rate

A)expected future income tax rate

B)average income tax rate

C)marginal (incremental)income tax rate

D)normal income tax rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

53

When accounting for the current impact of loss carrybacks and carryforwards it is proper to

A)recognize the tax benefit of the operating loss carryback as an asset

B)recognize the tax benefit of the operating loss carryforward as an asset

C)recognize the tax benefit of the operating loss carryback as a deferred liability

D)recognize the tax benefit of the operating loss carryforward as a deferred liability

A)recognize the tax benefit of the operating loss carryback as an asset

B)recognize the tax benefit of the operating loss carryforward as an asset

C)recognize the tax benefit of the operating loss carryback as a deferred liability

D)recognize the tax benefit of the operating loss carryforward as a deferred liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

54

An operating loss carryforward occurs when

A)prior pretax financial income is insufficient to offset the current period operating loss

B)prior taxable income is insufficient to offset the current period operating loss

C)future pretax financial income is insufficient to offset a current period operating loss

D)future taxable income is insufficient to offset a current period operating loss

A)prior pretax financial income is insufficient to offset the current period operating loss

B)prior taxable income is insufficient to offset the current period operating loss

C)future pretax financial income is insufficient to offset a current period operating loss

D)future taxable income is insufficient to offset a current period operating loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Pilot Point Company began operations in 2010 and, for that calendar year, reported an operating loss of $230, 000.Due to sufficient verifiable positive evidence, no valuation allowance was established to reduce the deferred tax asset as of December 31, 2010.During 2011, Pilot Point reported pretax accounting income of $350, 000.Assuming an income tax rate of 30%, what should Pilot Point record in 2011 as income tax payable at the end of 2011?

A)$ 0

B)$ 36, 000

C)$ 69, 000

D)$105, 000

A)$ 0

B)$ 36, 000

C)$ 69, 000

D)$105, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following activities does not result in a "tax credit" for income tax purposes?

A)the use of certain fuels

B)foreign taxes paid

C)hiring certain employees

D)investing in certain municipal bonds

A)the use of certain fuels

B)foreign taxes paid

C)hiring certain employees

D)investing in certain municipal bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

57

Boerne Company received rent in advance of $9, 000 on December 31, 2010, which was taxable when received for income tax purposes.The company's effective tax rate was 30%, and this was the only temporary difference.Which of the following should be reported on the December 31, 2010 balance sheet?

A)$9, 000 as a current deferred tax liability

B)$2, 700 as a current deferred tax liability

C)$2, 700 as a current deferred tax asset

D)$9, 000 as a current deferred tax asset

A)$9, 000 as a current deferred tax liability

B)$2, 700 as a current deferred tax liability

C)$2, 700 as a current deferred tax asset

D)$9, 000 as a current deferred tax asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

58

On January 1, 2010, Bedford Company began recognizing revenues from all sales under the accrual method for financial reporting purposes and under the installment sales method for income tax purposes.Bedford reported the following gross margin on sales for 2010 and 2011:

The enacted tax rate for both 2010 and 2011 was 30%.Assuming there are no other temporary differences, Bedford's December 31, 2011 balance sheet would report a deferred tax liability of

A)$ 60, 000

B)$120, 000

C)$180, 000

D)$450, 000

The enacted tax rate for both 2010 and 2011 was 30%.Assuming there are no other temporary differences, Bedford's December 31, 2011 balance sheet would report a deferred tax liability of

A)$ 60, 000

B)$120, 000

C)$180, 000

D)$450, 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

59

Intraperiod tax allocation would be appropriate for

A)an extraordinary gain

B)a loss from operations of a discontinued segment

C)the cumulative effects of changes in accounting principles

D)all of these

A)an extraordinary gain

B)a loss from operations of a discontinued segment

C)the cumulative effects of changes in accounting principles

D)all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

60

In 2010, its first year of operations, Wichita Falls Company reported pretax accounting income of $60, 000.Included in the $60, 000 was an expense for accrued, unpaid warranty costs of $8, 000, which are not deductible until paid for income tax purposes.Wichita Falls' income tax rate was 20%.The entry to record the income tax expense would include a

A)credit to Income Tax Expense for $12, 000

B)credit to Income Taxes Payable for $12, 000

C)credit to Deferred Tax Liability for $1, 600

D)debit to Deferred Tax Asset for $1, 600

A)credit to Income Tax Expense for $12, 000

B)credit to Income Taxes Payable for $12, 000

C)credit to Deferred Tax Liability for $1, 600

D)debit to Deferred Tax Asset for $1, 600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

61

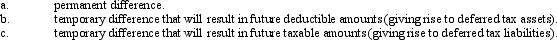

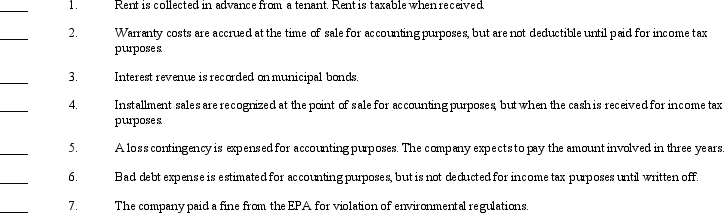

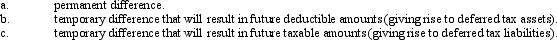

For each item listed below, indicate whether it involves a:

Required:

Required:

Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

Required:

Required:Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

62

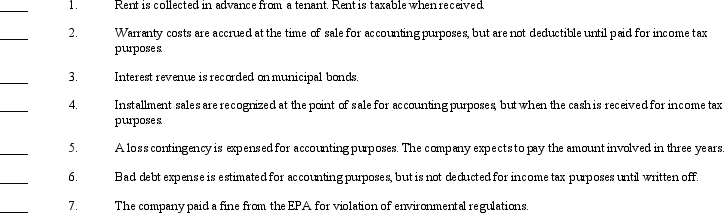

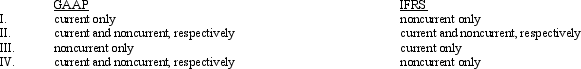

The acceptable balance sheet classifications for deferred tax assets and deferred tax liabilities under GAAP and IFRS are

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

63

The recognition of gross profit on installment sales at point of sale for financial reporting purposes but reporting the profit when the cash is received for income tax purposes results in deferred taxes reported in which section of the balance sheet?

A)current liabilities section

B)current assets section

C)noncurrent liabilities section

D)noncurrent assets section

A)current liabilities section

B)current assets section

C)noncurrent liabilities section

D)noncurrent assets section

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

64

FASB Statement No.109 allows the recognition of a deferred tax asset, subject to an asset impairment test.Discuss what criteria a company should employ to determine whether a deferred tax asset is considered impaired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which one of the following requires intraperiod tax allocation?

A)installment sales for tax purposes and accrued revenue recognition for accounting purposes

B)the excess of accelerated depreciation for tax purposes over depreciation for accounting purposes

C)interest income on municipal obligations

D)prior period adjustments

A)installment sales for tax purposes and accrued revenue recognition for accounting purposes

B)the excess of accelerated depreciation for tax purposes over depreciation for accounting purposes

C)interest income on municipal obligations

D)prior period adjustments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

66

FASB Statement No.109 discussed deferred tax asset measurement in the context of the FASB Conceptual Framework.

Required:

Identify the three essential characteristics of an asset and explain how deferred tax assets meet these characteristics.

Required:

Identify the three essential characteristics of an asset and explain how deferred tax assets meet these characteristics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

67

On December 31, 2010, the South Padre Company had a deferred tax liability balance of $8, 100, arising from an excess of MACRS depreciation for tax purposes over straight-line depreciation for accounting purposes.The tax effects of that timing difference are expected to reverse in the following years:

On January 27, 2011, Congress raised the effective income tax rate to 38% for all future years, including the current year, 2011.

On January 27, 2011, Congress raised the effective income tax rate to 38% for all future years, including the current year, 2011.

Required:

Prepare the entry to record any adjustments necessary due to the income tax rate increase on January 27, 2011.

On January 27, 2011, Congress raised the effective income tax rate to 38% for all future years, including the current year, 2011.

On January 27, 2011, Congress raised the effective income tax rate to 38% for all future years, including the current year, 2011.Required:

Prepare the entry to record any adjustments necessary due to the income tax rate increase on January 27, 2011.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

68

On December 31, 2009, Lake Jackson, Inc.reported a deferred tax liability of $1, 875, based on the following schedule of future taxable amounts and enacted tax rates:

On February 7, 2010, Congress amended a previously passed tax law.The amendment changed the tax rate to 35% for 2010 and all future years.

On February 7, 2010, Congress amended a previously passed tax law.The amendment changed the tax rate to 35% for 2010 and all future years.

Required:

Prepare the income tax journal entry for Lake Jackson, Inc.necessary on February 7, 2010.

On February 7, 2010, Congress amended a previously passed tax law.The amendment changed the tax rate to 35% for 2010 and all future years.

On February 7, 2010, Congress amended a previously passed tax law.The amendment changed the tax rate to 35% for 2010 and all future years.Required:

Prepare the income tax journal entry for Lake Jackson, Inc.necessary on February 7, 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

69

Deferred tax liabilities and deferred tax assets must be reported on the balance sheet.

Required:

Explain the process of classifying and reporting deferred tax liabilities and deferred tax assets.

Required:

Explain the process of classifying and reporting deferred tax liabilities and deferred tax assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which one of the following transactions would result in the creation of a noncurrent deferred tax liability?

A)interest received on municipal bonds

B)a contingent liability expensed in the current period that is expected to require a cash payment in three years

C)royalties received in advance that are taxable when received, but that will be earned within the next three months

D)using an accelerated depreciation method for income tax purposes and the straight-line method for financial reporting purposes

A)interest received on municipal bonds

B)a contingent liability expensed in the current period that is expected to require a cash payment in three years

C)royalties received in advance that are taxable when received, but that will be earned within the next three months

D)using an accelerated depreciation method for income tax purposes and the straight-line method for financial reporting purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

71

Income taxes for financial accounting purposes are apportioned to each of the following items except

A)extraordinary gains and losses

B)discontinued operations

C)other revenues and expenses

D)prior period adjustments

A)extraordinary gains and losses

B)discontinued operations

C)other revenues and expenses

D)prior period adjustments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

72

Briefly describe the four major differences between IFRS and GAAP in the measurement procedures used in accounting for deferred income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

74

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck