Deck 13: Measuring and Evaluating Financial Performance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/147

العب

ملء الشاشة (f)

Deck 13: Measuring and Evaluating Financial Performance

1

Liquidity measures the ability of a company to meet its current financial obligations.

True

2

In general,P/E ratios are fairly consistent across industries,regardless of the goods or services sold.

False

3

The fixed asset turnover ratio is a measure of the efficiency of a company.

True

4

The asset turnover ratio is a profitability ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

5

If EPS (earnings per share)decreases,it must mean that the company's net income has fallen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

6

The going-concern assumption is also known as the continuity assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

7

Trend data can be measured in dollar amounts or percentages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

8

Gains or losses from discontinued operations are reported on a separate line on the income statement net of income tax effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company with a high inventory turnover requires a larger investment in inventory than another company of similar sales with a lower inventory turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

10

Horizontal analysis is the comparison of a company's financial information to a base amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

11

Special items such as gains or losses relating to changes in the value of certain balance sheet accounts are reported below the net income line on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

12

When companies switch from GAAP to IFRS,their financial ratios would not be expected to change significantly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

13

Trend analysis is a form of horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

14

Common size financial statements are not useful in analyzing companies of different size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the debt-to-assets ratio is 0.63,it means that 37% of the company's financing has been provided by stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

16

Benchmarks are required to evaluate a company's performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

17

Vertical analysis is the comparison of a company's financial information over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

18

The higher the times interest earned ratio,the greater the risk of nonpayment of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

19

The higher the accounts receivable turnover,the slower accounts receivable are being collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

20

According to the full disclosure principle,financial reports should present detailed information about every transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements regarding the effects of a business decision on a financial ratio is true?

A)If a company is expanding its facilities,its fixed asset turnover ratio is likely to fall temporarily.

B)If a company extends its payment period for customers,its accounts receivable ratio is likely to rise.

C)If a company eases its credit granting policies,its days to collect ratio is likely to fall.

D)If a company builds up inventories,its days to sell ratio is likely to fall.

A)If a company is expanding its facilities,its fixed asset turnover ratio is likely to fall temporarily.

B)If a company extends its payment period for customers,its accounts receivable ratio is likely to rise.

C)If a company eases its credit granting policies,its days to collect ratio is likely to fall.

D)If a company builds up inventories,its days to sell ratio is likely to fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

22

If you wish to examine how one aspect of a business is doing relative to other aspects of the business at the current time,you are most likely to use:

A)time-series analysis.

B)ratio analysis.

C)horizontal analysis.

D)cross-sectional analysis.

A)time-series analysis.

B)ratio analysis.

C)horizontal analysis.

D)cross-sectional analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements regarding trend analysis is true?

A)Time-series analysis is an example of trend analysis.

B)Trend data are always in dollars.

C)Trend analysis is also known as vertical analysis.

D)Common-size analysis is an example of trend analysis.

A)Time-series analysis is an example of trend analysis.

B)Trend data are always in dollars.

C)Trend analysis is also known as vertical analysis.

D)Common-size analysis is an example of trend analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following measures would assist in assessing the profitability of a company?

A)Debt-to-assets ratio.

B)Fixed asset turnover ratio.

C)Receivables turnover ratio.

D)Current ratio.

A)Debt-to-assets ratio.

B)Fixed asset turnover ratio.

C)Receivables turnover ratio.

D)Current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

25

If an analyst wanted to examine a company's long-run ability to survive,which of the following would best be considered?

A)Liquidity.

B)Market share.

C)Profitability.

D)Solvency.

A)Liquidity.

B)Market share.

C)Profitability.

D)Solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

26

Net income was $418,600 in 2014 and $364,000 in 2013.The year-to-year percentage change in net income is closest to:

A)15%.

B)55%.

C)87%.

D)13%.

A)15%.

B)55%.

C)87%.

D)13%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements regarding nonrecurring and other special items is true?

A)Some special items,such as changes in the value of certain balance sheet accounts,are excluded from the calculation of net income.

B)Nonrecurring items such as discontinued operations are presented above the income tax expense line on the income statement.

C)Discontinued operations are reported net of tax as part of the income from continuing operations.

D)The cumulative effect of change in accounting principles is reported on the income statement as part of income from continuing operations.

A)Some special items,such as changes in the value of certain balance sheet accounts,are excluded from the calculation of net income.

B)Nonrecurring items such as discontinued operations are presented above the income tax expense line on the income statement.

C)Discontinued operations are reported net of tax as part of the income from continuing operations.

D)The cumulative effect of change in accounting principles is reported on the income statement as part of income from continuing operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not a profitability ratio?

A)Return on equity (ROE).

B)Earnings per share.

C)Asset turnover.

D)Days to sell.

A)Return on equity (ROE).

B)Earnings per share.

C)Asset turnover.

D)Days to sell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not a similarity of GAAP and IFRS?

A)They both generally require that an exchange take place before a transaction is recorded.

B)They both promote information that is relevant and that faithfully represents the underlying transactions.

C)They both include rules regarding recognition,classification,and measurement of transactions.

D)They both allow fixed assets to be reported at fair values.

A)They both generally require that an exchange take place before a transaction is recorded.

B)They both promote information that is relevant and that faithfully represents the underlying transactions.

C)They both include rules regarding recognition,classification,and measurement of transactions.

D)They both allow fixed assets to be reported at fair values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following measures would assist in assessing the profitability of a company?

A)Asset turnover.

B)Times interest earned ratio.

C)Inventory turnover ratio.

D)Debt to assets ratio.

A)Asset turnover.

B)Times interest earned ratio.

C)Inventory turnover ratio.

D)Debt to assets ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is a liquidity ratio?

A)Inventory turnover.

B)Price earnings (P/E).

C)Net profit margin.

D)Times interest earned.

A)Inventory turnover.

B)Price earnings (P/E).

C)Net profit margin.

D)Times interest earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

32

If an analyst wants to examine a company's short-run ability to survive,which of the following would best be considered?

A)Liquidity.

B)Market share.

C)Profitability.

D)Solvency.

A)Liquidity.

B)Market share.

C)Profitability.

D)Solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements regarding liquidity and solvency ratios is true?

A)Unlike solvency ratios,liquidity ratios relate to the company's long-run survival.

B)Both liquidity ratios and solvency ratios measure a company's ability to meet its financial obligations.

C)Liquidity ratios include the return on equity ratio and the times interest earned ratio.

D)Solvency ratios include the current ratio and the net profit margin ratio.

A)Unlike solvency ratios,liquidity ratios relate to the company's long-run survival.

B)Both liquidity ratios and solvency ratios measure a company's ability to meet its financial obligations.

C)Liquidity ratios include the return on equity ratio and the times interest earned ratio.

D)Solvency ratios include the current ratio and the net profit margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

34

Company X has net sales revenue of $1,250,000,cost of goods sold of $760,000,and all other expenses of $290,000.The beginning balance of stockholders' equity is $400,000 and the beginning balance of fixed assets is $361,000.The ending balance of stockholders' equity is $600,000 and the ending balance of fixed assets is $389,000.The return on equity (ROE)ratio is closest to:

A)0.53.

B)2.50.

C)3.33.

D)0.40.

A)0.53.

B)2.50.

C)3.33.

D)0.40.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements regarding the P/E ratio is not true?

A)The P/E ratio indicates how much investors are willing to pay for a share of a company's stock as a multiple of current earnings.

B)A high P/E ratio may mean that investors have pushed the price of the stock up in anticipation of higher future net income.

C)If EPS decreases and there is no change in the market price of the stock,the P/E ratio will decrease.

D)If the market price of the stock increases and there is no change in EPS,the P/E ratio will increase.

A)The P/E ratio indicates how much investors are willing to pay for a share of a company's stock as a multiple of current earnings.

B)A high P/E ratio may mean that investors have pushed the price of the stock up in anticipation of higher future net income.

C)If EPS decreases and there is no change in the market price of the stock,the P/E ratio will decrease.

D)If the market price of the stock increases and there is no change in EPS,the P/E ratio will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following measures would assist in assessing the liquidity of a company?

A)Return on equity.

B)Fixed asset turnover ratio.

C)Receivables turnover ratio.

D)Times interest earned ratio.

A)Return on equity.

B)Fixed asset turnover ratio.

C)Receivables turnover ratio.

D)Times interest earned ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

37

Solvency ratio data are primarily concerned with the ability of a company to:

A)produce profits.

B)handle its debt.

C)manage its cash flow.

D)provide income for stockholders.

A)produce profits.

B)handle its debt.

C)manage its cash flow.

D)provide income for stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following analysis techniques does not pertain to changes over time?

A)Trend analysis.

B)Horizontal analysis.

C)Time-series analysis.

D)Vertical analysis.

A)Trend analysis.

B)Horizontal analysis.

C)Time-series analysis.

D)Vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following ratios is used to evaluate solvency?

A)Earnings per share.

B)Fixed asset turnover.

C)Debt-to-assets.

D)Quick ratio.

A)Earnings per share.

B)Fixed asset turnover.

C)Debt-to-assets.

D)Quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

40

If an analyst wants to examine a company's current ability to generate income,which of the following would best be considered?

A)Liquidity.

B)Market share.

C)Profitability.

D)Solvency.

A)Liquidity.

B)Market share.

C)Profitability.

D)Solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company has $72,500 of inventory at the beginning of the year and $65,500 at the end of the year.Sales revenue is $986,400,cost of goods sold is $572,700,and net income is $124,200 for the year.The inventory turnover ratio is closest to:

A)1.8.

B)8.3.

C)6.0.

D)14.3.

A)1.8.

B)8.3.

C)6.0.

D)14.3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

42

During the current accounting period,revenue from credit sales is $671,000.The accounts receivable balance is $51,480 at the beginning of the period and $52,200 at the end of the period.Which of the following statements is true?

A)The receivables turnover ratio is 12.9.

B)On average,it takes 12.9 days to collect payment from credit customers.

C)The receivables turnover ratio is 28.3.

D)On average,the company sells its inventory every 28.3 days.

A)The receivables turnover ratio is 12.9.

B)On average,it takes 12.9 days to collect payment from credit customers.

C)The receivables turnover ratio is 28.3.

D)On average,the company sells its inventory every 28.3 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

43

A times interest earned ratio of 11 means that the company's:

A)net income is large enough to pay interest and taxes 11 times.

B)net cash flow from operations before taxes and interest is large enough to pay interest and taxes 11 times.

C)net cash flow from operations is large enough to pay interest and taxes 11 times.

D)income before taxes and interest is large enough to pay interest 11 times.

A)net income is large enough to pay interest and taxes 11 times.

B)net cash flow from operations before taxes and interest is large enough to pay interest and taxes 11 times.

C)net cash flow from operations is large enough to pay interest and taxes 11 times.

D)income before taxes and interest is large enough to pay interest 11 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following measures would assist in assessing the solvency of a company?

A)Debt-to-assets ratio.

B)Fixed asset turnover ratio.

C)Return on equity ratio.

D)Quick ratio.

A)Debt-to-assets ratio.

B)Fixed asset turnover ratio.

C)Return on equity ratio.

D)Quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

45

When evaluating its net profit margin for 2015,Coca Cola would most likely use all of the following benchmarks except:

A)Anheuser Busch's net profit margin for 2015.

B)Coca Cola's net profit margin for 2014.

C)Pepsico's net profit margin for 2015.

D)The average net profit margin for the soft drink manufacturing industry for 2015.

A)Anheuser Busch's net profit margin for 2015.

B)Coca Cola's net profit margin for 2014.

C)Pepsico's net profit margin for 2015.

D)The average net profit margin for the soft drink manufacturing industry for 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

46

A company has $72,500 in inventory at the beginning of the accounting period and $65,500 at the end of the accounting period.Sales revenue is $986,400,cost of goods sold is $572,700,and net income is $124,200 for the accounting period.On average,this company has inventory on hand for approximately:

A)203 days.

B)44 days.

C)61 days.

D)26 days.

A)203 days.

B)44 days.

C)61 days.

D)26 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company that has a current ratio less than one cannot cover:

A)current liabilities with its current cash flow.

B)current expenses with its current sales revenue.

C)expenses with its current revenues.

D)current liabilities with its current assets.

A)current liabilities with its current cash flow.

B)current expenses with its current sales revenue.

C)expenses with its current revenues.

D)current liabilities with its current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

48

Company X has net sales revenue of $1,250,000,cost of goods sold of $760,000,and all other expenses of $290,000.The beginning balance of stockholders' equity is $400,000 and the beginning balance of fixed assets is $361,000.The ending balance of stockholders' equity is $600,000 and the ending balance of fixed assets is $389,000.The fixed asset turnover ratio is closest to:

A)0.53.

B)2.50.

C)3.33.

D)0.80.

A)0.53.

B)2.50.

C)3.33.

D)0.80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

49

The debt-to-assets ratio is the:

A)ratio of current liabilities to current assets.

B)ratio of long term liabilities to fixed assets.

C)ratio of total liabilities to total assets.

D)proportion of short-term liabilities to total liabilities.

A)ratio of current liabilities to current assets.

B)ratio of long term liabilities to fixed assets.

C)ratio of total liabilities to total assets.

D)proportion of short-term liabilities to total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

50

Company X has net sales revenue of $436,000,cost of goods sold of $343,000,and all other expenses of $90,000.If interest expense is $10,000 and income tax expense is $1,000,the times interest earned ratio is closest to

A)1.4.

B).33.

C)1.3.

D).40.

A)1.4.

B).33.

C)1.3.

D).40.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

51

Although the inventory turnover ratio is an important analytical tool for many companies,it would be most crucial for a company that:

A)provides legal services.

B)sells cell phones and notebook computers.

C)manufactures steel.

D)sells paint.

A)provides legal services.

B)sells cell phones and notebook computers.

C)manufactures steel.

D)sells paint.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

52

How competitors calculate inventory cost is least likely to affect comparisons between competitors if inventory makes up a:

A)large percentage of assets and inventory costs are stable.

B)large percentage of assets and inventory costs are not stable.

C)small percentage of assets and inventory costs are not stable.

D)small percentage of assets and inventory costs are stable.

A)large percentage of assets and inventory costs are stable.

B)large percentage of assets and inventory costs are not stable.

C)small percentage of assets and inventory costs are not stable.

D)small percentage of assets and inventory costs are stable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

53

If net income is rising,but sales and the gross profit percentage remain the same,then:

A)operating expenses are falling.

B)operating expenses are rising.

C)cost of goods sold is falling.

D)cost of goods sold is rising.

A)operating expenses are falling.

B)operating expenses are rising.

C)cost of goods sold is falling.

D)cost of goods sold is rising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

54

A current ratio of less than one is not so much of a concern when the company has a:

A)low fixed asset turnover ratio.

B)high days to collect number.

C)high inventory turnover ratio.

D)high debt-to-equity ratio.

A)low fixed asset turnover ratio.

B)high days to collect number.

C)high inventory turnover ratio.

D)high debt-to-equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

55

How competitors calculate depreciation is most likely to affect comparisons between competitors if property,plant and equipment:

A)makes up a large percentage of assets and average useful lives are fairly different.

B)makes up a small percentage of assets and assets are financed in a different way.

C)makes up a small percentage of assets and average useful lives are fairly similar.

D)is primarily leased in the industry,not purchased.

A)makes up a large percentage of assets and average useful lives are fairly different.

B)makes up a small percentage of assets and assets are financed in a different way.

C)makes up a small percentage of assets and average useful lives are fairly similar.

D)is primarily leased in the industry,not purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

56

Significant differences between GAAP and IFRS exist in all of the following areas except:

A)classification of preferred stock.

B)allowability of LIFO for inventory costing.

C)depreciation of equipment.

D)the order in which current and noncurrent accounts are presented on the balance sheet.

A)classification of preferred stock.

B)allowability of LIFO for inventory costing.

C)depreciation of equipment.

D)the order in which current and noncurrent accounts are presented on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

57

Company X has net sales revenue of $780,000,cost of goods sold of $343,200,and all other expenses of $327,600.The gross profit percentage is closest to:

A)32%.

B)56%.

C)86%.

D)14%.

A)32%.

B)56%.

C)86%.

D)14%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

58

Company X has net sales revenue of $780,000,cost of goods sold of $343,200 and all other expenses of $327,600 for the current year.At the beginning of the year,503,000 shares of common stock were outstanding,and,at the end of the year,537,000 shares of common stock were outstanding.The basic EPS for the company is:

A)$1.50.

B)$0.84.

C)$0.21.

D)$0.87.

A)$1.50.

B)$0.84.

C)$0.21.

D)$0.87.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following could explain why a company has a lower net profit margin ratio but a higher EPS than one of its competitors?

A)The company sells a higher percentage of goods on credit.

B)The company has fewer shares of outstanding common stock relative to its net income.

C)The company earns a higher percentage of net income from non-operating activities.

D)The company pays a higher dividend.

A)The company sells a higher percentage of goods on credit.

B)The company has fewer shares of outstanding common stock relative to its net income.

C)The company earns a higher percentage of net income from non-operating activities.

D)The company pays a higher dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

60

Company X has net sales revenue of $780,000,cost of goods sold of $343,200,and all other expenses of $327,600.The net profit margin is closest to:

A)0.32.

B)0.56.

C)0.86.

D)0.14.

A)0.32.

B)0.56.

C)0.86.

D)0.14.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

61

Use the information above to answer the following question.The fixed asset turnover ratio for 2014 is closest to:

A)1.28.

B)1.24.

C)0.75.

D)1.64.

A)1.28.

B)1.24.

C)0.75.

D)1.64.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

62

A company has current assets of $450,000 and a current ratio is 2.5.Assume that the company prepays rent for 9 months in the amount of $20,000.The current ratio after this transaction is closest to

A)2.39

B)2.61

C)2.5

D)2.81

A)2.39

B)2.61

C)2.5

D)2.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

63

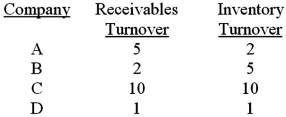

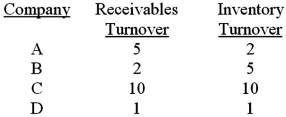

Judging only from the ratios below,which of the following clothing wholesalers is least likely to be having cash flow problems?

A)Company A

B)Company B

C)Company C

D)Company D

A)Company A

B)Company B

C)Company C

D)Company D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

64

Special items reported as part of comprehensive income,but not included in net income,might include:

A)gains or losses on foreign currency exchange.

B)interest expense.

C)extraordinary gains and losses.

D)income tax expense.

A)gains or losses on foreign currency exchange.

B)interest expense.

C)extraordinary gains and losses.

D)income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

65

A current ratio of 2.5 means that for every dollar of:

A)accounts payable,there is $2.50 of cash.

B)current liabilities,there is $2.50 of current assets.

C)current assets,there is $2.50 of current liabilities.

D)total liabilities,there is $2.50 of cash.

A)accounts payable,there is $2.50 of cash.

B)current liabilities,there is $2.50 of current assets.

C)current assets,there is $2.50 of current liabilities.

D)total liabilities,there is $2.50 of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following financial factors is most likely to be a cause of a going-concern problem?

A)Return on assets is substantially lower than return on equity.

B)Inventory turnover is lower than the industry average.

C)The current ratio exceeds the quick ratio.

D)Fluctuating net income growth.

A)Return on assets is substantially lower than return on equity.

B)Inventory turnover is lower than the industry average.

C)The current ratio exceeds the quick ratio.

D)Fluctuating net income growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

67

An increase in the gross profit percentage indicates that:

A)cost of goods sold as a percentage of sales has decreased.

B)cost of goods sold as a percentage of sales has increased.

C)operating expenses as a percentage of sales have increased.

D)operating expenses as a percentage of sales have decreased.

A)cost of goods sold as a percentage of sales has decreased.

B)cost of goods sold as a percentage of sales has increased.

C)operating expenses as a percentage of sales have increased.

D)operating expenses as a percentage of sales have decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

68

A trend analysis to determine a year-to-year dollar amount change is calculated by:

A)subtracting the previous period amount from the current amount.

B)subtracting the current period amount from the previous period amount.

C)subtracting the current period amount from the previous period amount and then dividing the result by the previous period amount.

D)subtracting the previous period amount from the current period amount and then dividing the result by the current period amount.

A)subtracting the previous period amount from the current amount.

B)subtracting the current period amount from the previous period amount.

C)subtracting the current period amount from the previous period amount and then dividing the result by the previous period amount.

D)subtracting the previous period amount from the current period amount and then dividing the result by the current period amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following types of items would you be most likely to see below the income tax expense line on an income statement prepared in 2014?

A)Gain on Sale of Discontinued Operations,Net of Tax

B)Gross Profit

C)Cumulative Effect of Accounting Change

D)Salaries Expense

A)Gain on Sale of Discontinued Operations,Net of Tax

B)Gross Profit

C)Cumulative Effect of Accounting Change

D)Salaries Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

70

If cost of goods sold remains unchanged,an increase in the inventory turnover rate is indicative of:

A)a reduction in the cost of goods sold.

B)a decrease in inventory.

C)an increase in inventory.

D)an increase in sales revenue.

A)a reduction in the cost of goods sold.

B)a decrease in inventory.

C)an increase in inventory.

D)an increase in sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the information above to answer the following question.The gross profit percentage for 2014 is closest to:

A)42%.

B)13.5%.

C)57.7%.

D)21.15%.

A)42%.

B)13.5%.

C)57.7%.

D)21.15%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

72

The primary objective of external financial reporting is:

A)to enhance the ability of the company to acquire financial capital from external sources.

B)to accurately provide financial results for tax purposes.

C)to comply with external regulations and requirements of government and professional associations.

D)to provide useful information to decision makers,especially investors and creditors.

A)to enhance the ability of the company to acquire financial capital from external sources.

B)to accurately provide financial results for tax purposes.

C)to comply with external regulations and requirements of government and professional associations.

D)to provide useful information to decision makers,especially investors and creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

73

Nonrecurring items such as a loss from discontinued operations is reported on the income statement:

A)net of income tax.

B)before income tax expense.

C)below the net income line.

D)Nonrecurring items are not subject to income taxes;therefore,they are not reported on the income statement.

A)net of income tax.

B)before income tax expense.

C)below the net income line.

D)Nonrecurring items are not subject to income taxes;therefore,they are not reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

74

A company's sales in 2013 are $200,000 and in 2014 sales are $285,000.The percentage change is:

A)42.5%.

B)70%.

C)29.8%.

D)130%.

A)42.5%.

B)70%.

C)29.8%.

D)130%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

75

A share of stock sells for $20.The company has $64 million in earnings and 200 million outstanding shares.The P/E ratio for the company is closest to:

A)62.5.

B)200.

C)0.31.

D)6.4.

A)62.5.

B)200.

C)0.31.

D)6.4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statements is true regarding the relationship of the debt-to-assets ratio and the debt-to-equity ratio?

A)Debt to assets is usually greater than debt to equity.

B)Debt to assets is usually less than debt to equity

C)Debt to assets is usually equal to debt to equity.

D)There is no constant relationship between these two ratios.

A)Debt to assets is usually greater than debt to equity.

B)Debt to assets is usually less than debt to equity

C)Debt to assets is usually equal to debt to equity.

D)There is no constant relationship between these two ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following factors would not necessarily contribute to a going-concern problem?

A)Excessive reliance on debt financing.

B)Loss of key personnel without comparable replacement.

C)Inadequate maintenance of long-lived assets.

D)Declining profit margins.

A)Excessive reliance on debt financing.

B)Loss of key personnel without comparable replacement.

C)Inadequate maintenance of long-lived assets.

D)Declining profit margins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

78

A decrease in accounts receivable turnover ratio is indicative of:

A)an increase in sales revenue.

B)slower-selling inventory.

C)an increase in accounts receivable.

D)a decline in cost of goods sold.

A)an increase in sales revenue.

B)slower-selling inventory.

C)an increase in accounts receivable.

D)a decline in cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following nonfinancial factors is most likely to be a cause of a going-concern problem?

A)Hiring a new CEO.

B)Loss of a key patent.

C)Announcing a new stock issue.

D)Replacing an old product line.

A)Hiring a new CEO.

B)Loss of a key patent.

C)Announcing a new stock issue.

D)Replacing an old product line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

80

The going-concern assumption states that the:

A)company will always maximize the profit for stockholders.

B)company is not expected to go out of business in the near future.

C)company is a separate concern from the stockholders.

D)company's results will be reported in a consistent manner from period to period.

A)company will always maximize the profit for stockholders.

B)company is not expected to go out of business in the near future.

C)company is a separate concern from the stockholders.

D)company's results will be reported in a consistent manner from period to period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck