Deck 6: Closing Entries and the Postclosing Trial Balance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

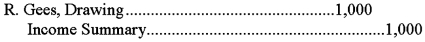

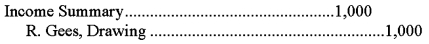

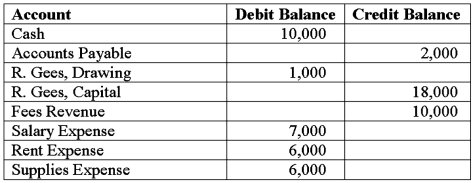

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

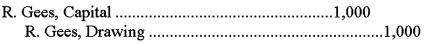

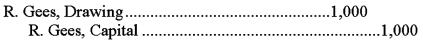

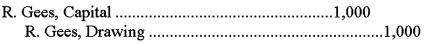

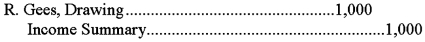

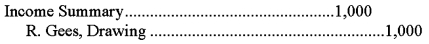

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

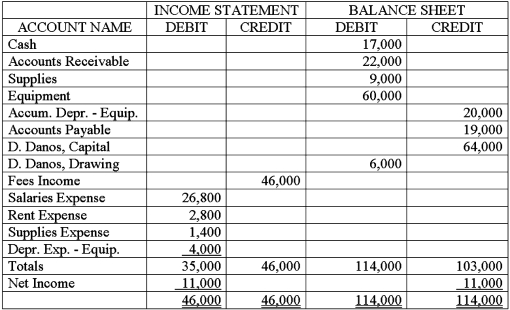

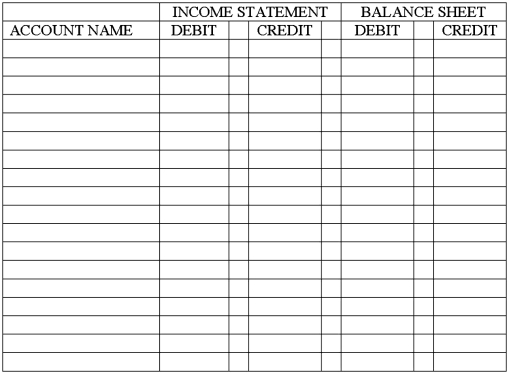

سؤال

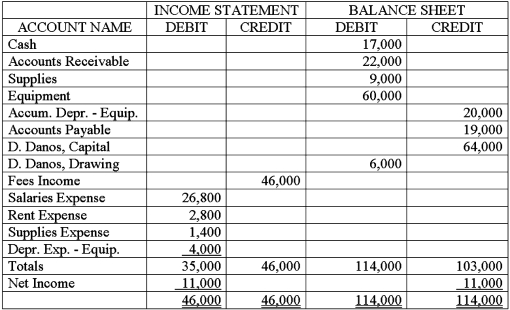

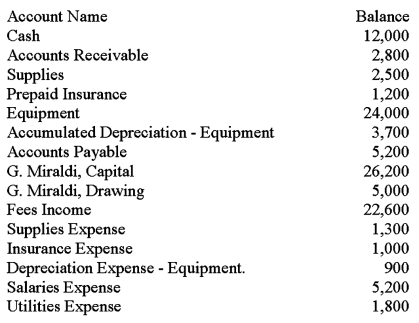

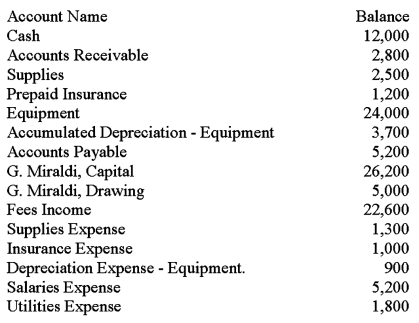

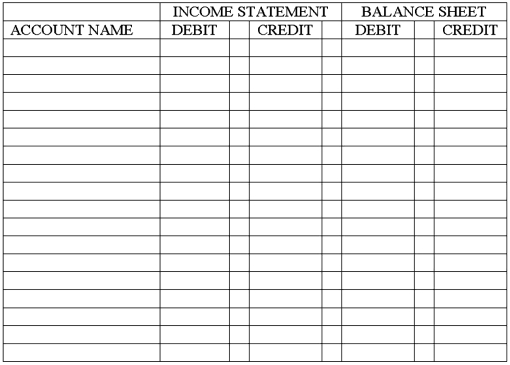

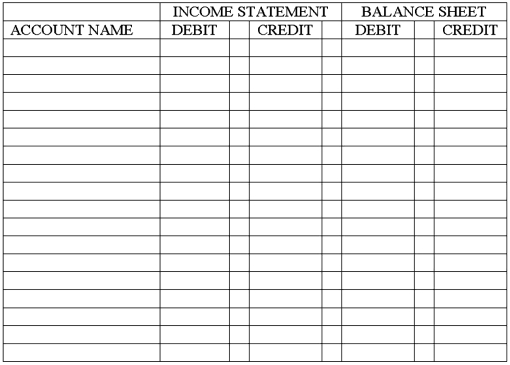

سؤال

سؤال

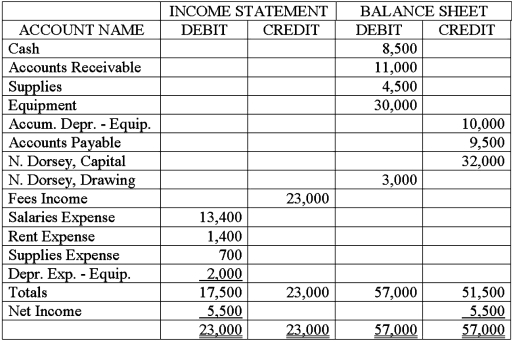

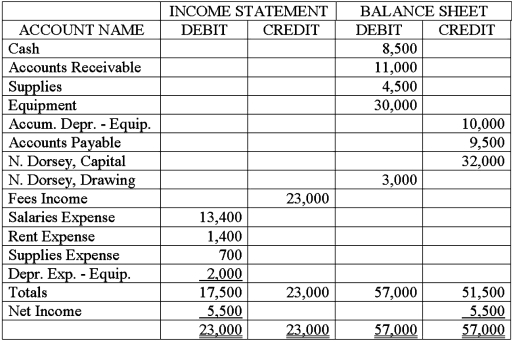

سؤال

سؤال

سؤال

سؤال

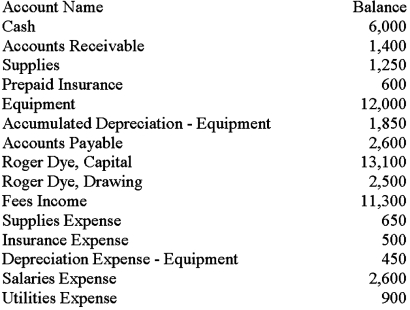

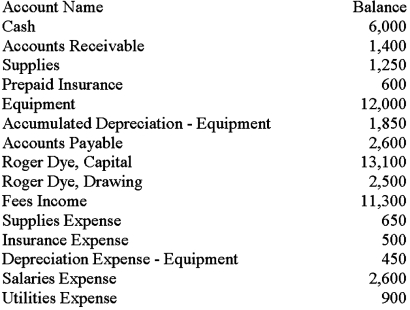

سؤال

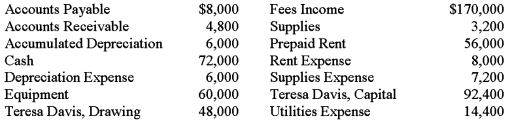

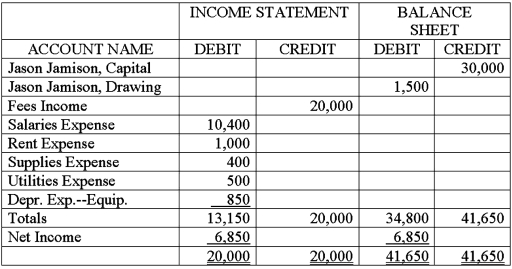

سؤال

سؤال

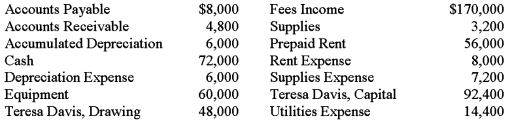

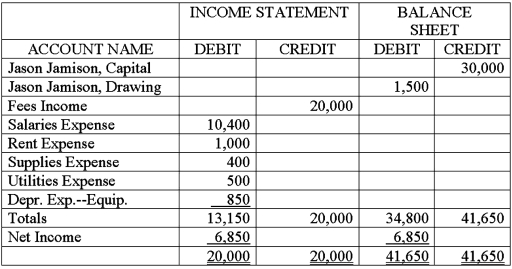

سؤال

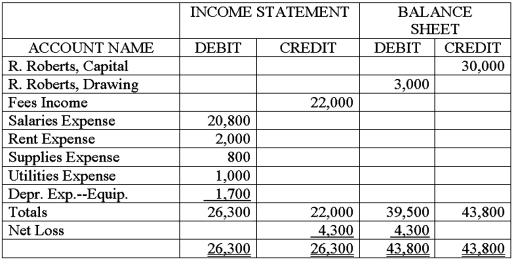

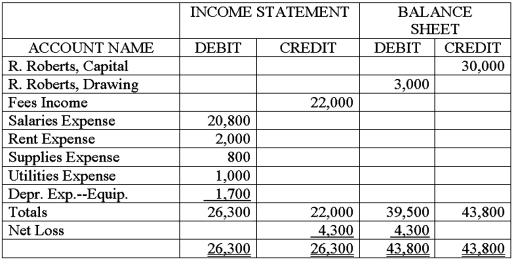

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 6: Closing Entries and the Postclosing Trial Balance

1

At the end of the accounting period,the balances of the revenue and expense accounts are transferred to the ____________________ account.

Income Summary

2

The entry to close the revenue account,Fees Income,requires a debit to that account.

True

3

The ____________________ entries transfer the results of operations to owner's equity.

closing

4

The balance of the Income Summary account is transferred to the ____________________ account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

The entry to close an expense account requires a credit to the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

A compound entry in the general journal is made to close expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

If the Income Summary account has a debit balance before it is closed,the firm experienced a net ____________________ from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

"Income and Expense Summary" is another name for the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

The heading "Closing Entries" is usually written in the Description column of the general journal above the first closing entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

One of the purposes of closing entries is to transfer net income or net loss for the period to the owner's capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the closing procedure,the ____________________ account balances are transferred to the debit side of the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

Data for the closing entries is taken from the ____________________ section of the worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

The postclosing trial balance contains balance sheet accounts only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

The owner's capital account is closed at the end of each accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

The entry to transfer net income to the owner's capital account would include a debit to the owner's capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

"Closing" is written in the Description column of the individual revenue and expense accounts in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

Withdrawals by the owner for personal use do not affect net income or net loss of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

The final closing entry transfers the balance of the ____________________ account to the owner's capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

After the closing entries are posted,the balance of the owner's capital account agrees with the amount of owner's equity shown on the balance sheet for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

The temporary owner's equity accounts are closed because they apply to only one accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

After the closing entries are posted to the ledger,each expense account will have

A) a debit balance.

B) a credit balance.

C) a negative balance.

D) a zero balance.

A) a debit balance.

B) a credit balance.

C) a negative balance.

D) a zero balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

One purpose of closing entries is to

A) transfer the results of operations to owner's equity.

B) reduce the owner's capital account balance to zero so that the account is ready for the next period.

C) adjust the ledger account balances to provide complete and accurate figures for use on financial statements.

D) close all accounts so that the ledger is ready for the next accounting period.

A) transfer the results of operations to owner's equity.

B) reduce the owner's capital account balance to zero so that the account is ready for the next period.

C) adjust the ledger account balances to provide complete and accurate figures for use on financial statements.

D) close all accounts so that the ledger is ready for the next accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following accounts will not normally have a zero balance after the closing entries have been posted?

A) Income Summary

B) Fees Income

C) The owner's capital account

D) Rent Expense

A) Income Summary

B) Fees Income

C) The owner's capital account

D) Rent Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

The post-closing trial balance lists only the asset,____________________,and owner's capital accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

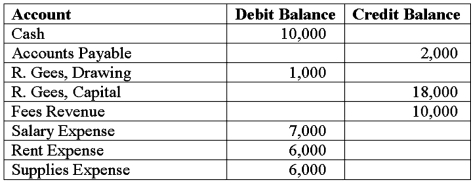

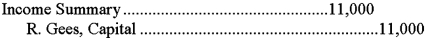

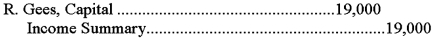

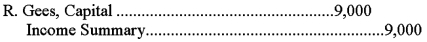

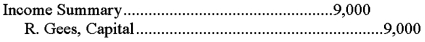

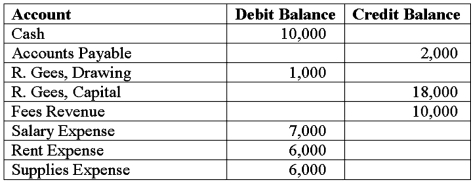

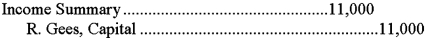

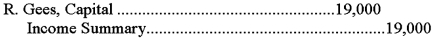

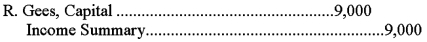

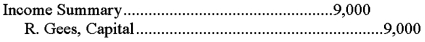

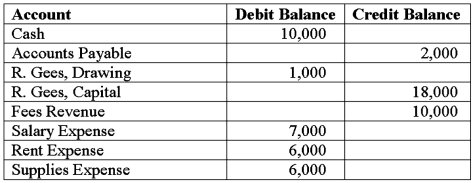

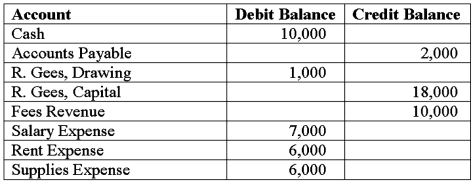

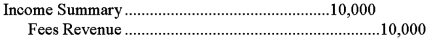

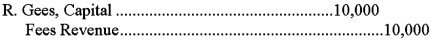

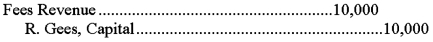

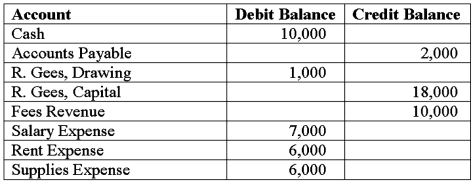

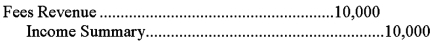

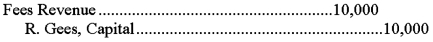

Use the following account balances from the adjusted trial balance of Gees Catering  Select the correct closing entry that Gees Catering would make to close their Income Summary account at the end of the accounting period.

Select the correct closing entry that Gees Catering would make to close their Income Summary account at the end of the accounting period.

A)

B)

C)

D)

Select the correct closing entry that Gees Catering would make to close their Income Summary account at the end of the accounting period.

Select the correct closing entry that Gees Catering would make to close their Income Summary account at the end of the accounting period.A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

The revenue account Fees Income is closed by debiting

A) Cash and crediting Fees Income.

B) Fees Income and crediting Income Summary.

C) the owner's capital account and crediting Fees Income.

D) Income Summary and crediting Fees Income.

A) Cash and crediting Fees Income.

B) Fees Income and crediting Income Summary.

C) the owner's capital account and crediting Fees Income.

D) Income Summary and crediting Fees Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements is not correct?

A) Before the Income Summary account is closed,its balance represents the net income or net loss for the accounting period.

B) The Income Summary account is a temporary owner's equity account.

C) The Income Summary account is used only at the end of an accounting period to help with the closing procedure.

D) The owner's drawing account is closed to the Income Summary Statement.

A) Before the Income Summary account is closed,its balance represents the net income or net loss for the accounting period.

B) The Income Summary account is a temporary owner's equity account.

C) The Income Summary account is used only at the end of an accounting period to help with the closing procedure.

D) The owner's drawing account is closed to the Income Summary Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

After all the closing entries are posted to the ledger,the Income Summary account will have a ____________________ balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

The ____________________ trial balance is prepared to make sure that the general ledger is in balance after adjusting and closing entries have been recorded and posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

The owner's drawing account is closed by debiting

A) the owner's drawing account and crediting the owner's capital account.

B) the owner's capital account and crediting the owner's drawing account.

C) Income Summary and crediting the owner's drawing account.

D) the owner's drawing account and crediting Income Summary.

A) the owner's drawing account and crediting the owner's capital account.

B) the owner's capital account and crediting the owner's drawing account.

C) Income Summary and crediting the owner's drawing account.

D) the owner's drawing account and crediting Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

The ____________________ entries reduce the balances of the revenue,expense,and drawing accounts to zero so that they are ready to receive data for the next period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

One purpose of closing entries is to give zero balances to

A) asset and liability accounts.

B) liability and capital accounts.

C) revenue and expense accounts.

D) expense and capital accounts.

A) asset and liability accounts.

B) liability and capital accounts.

C) revenue and expense accounts.

D) expense and capital accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

The entry to close the Income Summary account may include

A) a debit to Income Summary and a credit to the owner's capital account.

B) a debit to Income Summary and a credit to Cash.

C) a debit to Cash and a credit to Income Summary.

D) a debit to Income Summary and a credit to the owner's drawing account.

A) a debit to Income Summary and a credit to the owner's capital account.

B) a debit to Income Summary and a credit to Cash.

C) a debit to Cash and a credit to Income Summary.

D) a debit to Income Summary and a credit to the owner's drawing account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

After all the closing entries are posted,the ____________________ account reflects the results of operations for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

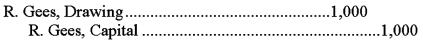

Use the following account balances from the adjusted trial balance of Gees Catering  Select the correct closing entry that Gees Catering would make to close the owner's withdrawal account at the end of the accounting period.

Select the correct closing entry that Gees Catering would make to close the owner's withdrawal account at the end of the accounting period.

A)

B)

C)

D)

Select the correct closing entry that Gees Catering would make to close the owner's withdrawal account at the end of the accounting period.

Select the correct closing entry that Gees Catering would make to close the owner's withdrawal account at the end of the accounting period.A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

The entry to transfer a net loss to the owner's capital account would include a debit to

A) the owner's capital account and a credit to Cash.

B) the owner's drawing account and a credit to the owner's capital account.

C) Income Summary and a credit to the owner's capital account.

D) the owner's capital account and a credit to Income Summary.

A) the owner's capital account and a credit to Cash.

B) the owner's drawing account and a credit to the owner's capital account.

C) Income Summary and a credit to the owner's capital account.

D) the owner's capital account and a credit to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

The firm had net income if the entry to close the Income Summary account is recorded as a ____________________ to the owner's capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following accounts is not closed?

A) Cash

B) Fees Income

C) Rent Expense

D) Joan Wilson,Drawing

A) Cash

B) Fees Income

C) Rent Expense

D) Joan Wilson,Drawing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

The entry to close the Depreciation Expense account would include a debit to

A) the Income Summary account and a credit to the Depreciation Expense account.

B) the Income Summary and a credit to Cash.

C) Cash and a credit to the Income Summary account.

D) the Depreciation Expense account and a credit to the Income Summary account.

A) the Income Summary account and a credit to the Depreciation Expense account.

B) the Income Summary and a credit to Cash.

C) Cash and a credit to the Income Summary account.

D) the Depreciation Expense account and a credit to the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

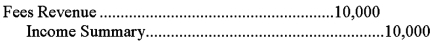

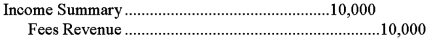

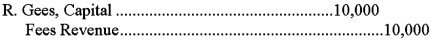

Use the following account balances from the adjusted trial balance of Gees Catering  Select the correct closing entry that Gees Catering would make to close their revenue account(s)at the end of the accounting period.

Select the correct closing entry that Gees Catering would make to close their revenue account(s)at the end of the accounting period.

A)

B)

C)

D)

Select the correct closing entry that Gees Catering would make to close their revenue account(s)at the end of the accounting period.

Select the correct closing entry that Gees Catering would make to close their revenue account(s)at the end of the accounting period.A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

After the closing entries are posted to the ledger,each revenue account will have

A) a zero balance.

B) a debit balance.

C) a credit balance.

D) either a debit or a credit balance.

A) a zero balance.

B) a debit balance.

C) a credit balance.

D) either a debit or a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

The entry to close the Depreciation Expense account may include a debit to

A) the Income Summary account and a credit to the Depreciation Expense account.

B) the Depreciation Expense account and a credit to the Accumulated Depreciation account.

C) the Accumulated Depreciation account and a credit to the Income Summary account.

D) the Depreciation Expense account and a credit to the Income Summary account.

A) the Income Summary account and a credit to the Depreciation Expense account.

B) the Depreciation Expense account and a credit to the Accumulated Depreciation account.

C) the Accumulated Depreciation account and a credit to the Income Summary account.

D) the Depreciation Expense account and a credit to the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements is not correct?

A) After closing entries are posted,the revenue,expense,and drawing accounts will have zero balances.

B) At the end of each accounting period,asset and liability account balances are reduced to zero.

C) A post-closing trial balance will not contain revenue and expense account balances.

D) Adjusting entries must be journalized and posted before the closing entries are journalized and posted.

A) After closing entries are posted,the revenue,expense,and drawing accounts will have zero balances.

B) At the end of each accounting period,asset and liability account balances are reduced to zero.

C) A post-closing trial balance will not contain revenue and expense account balances.

D) Adjusting entries must be journalized and posted before the closing entries are journalized and posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

If a business has a net loss for a fiscal period,the journal entry to close the Income Summary account is

A) a debit to Income Summary and a credit to Fees Income.

B) a debit to Income Summary and a credit to Capital.

C) a debit to Capital and a credit to Income Summary.

D) a debit to Capital and a credit to Drawing.

A) a debit to Income Summary and a credit to Fees Income.

B) a debit to Income Summary and a credit to Capital.

C) a debit to Capital and a credit to Income Summary.

D) a debit to Capital and a credit to Drawing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

All of the following accounts will appear on the post-closing trial balance except

A) Equipment.

B) Accumulated Depreciation-Equipment.

C) Depreciation Expense-Equipment.

D) Accounts Payable.

A) Equipment.

B) Accumulated Depreciation-Equipment.

C) Depreciation Expense-Equipment.

D) Accounts Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following accounts would not be involved in any of the closing entries?

A) Accounts Payable

B) Fred Sanford,Drawing

C) Income from Services

D) Advertising Expense

A) Accounts Payable

B) Fred Sanford,Drawing

C) Income from Services

D) Advertising Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

Entries required to zero the balances of the temporary accounts at the end of the year are called

A) posting entries.

B) adjusting entries.

C) closing entries.

D) correcting entries.

A) posting entries.

B) adjusting entries.

C) closing entries.

D) correcting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

The first two closing entries to the Income Summary account indicate a debit of $53,000 and a credit of $64,000.The third closing entry would be

A) debit Capital $11,000;credit Income Summary $11,000.

B) debit Income Summary $11,000;credit Capital $11,000.

C) debit Revenue $64,000;credit Expenses $53,000.

D) debit Income Summary $11,000;credit Drawing $11,000.

A) debit Capital $11,000;credit Income Summary $11,000.

B) debit Income Summary $11,000;credit Capital $11,000.

C) debit Revenue $64,000;credit Expenses $53,000.

D) debit Income Summary $11,000;credit Drawing $11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

The first step in the closing process is to close

A) the drawing account.

B) the capital account.

C) the revenue accounts.

D) the expense accounts.

A) the drawing account.

B) the capital account.

C) the revenue accounts.

D) the expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements is not correct?

A) If the post-closing trial balance does not balance,there are errors in the accounting records.

B) The audit trial should be used to trace data through the accounting records to find and correct errors.

C) The balance of the owner's capital account,as reflected on the post-closing trial balance,will match the amount reported on the income statement.

D) The balance of the owner's capital account on the adjusted trial balance will usually be different than that reported on the post-closing trial balance.

A) If the post-closing trial balance does not balance,there are errors in the accounting records.

B) The audit trial should be used to trace data through the accounting records to find and correct errors.

C) The balance of the owner's capital account,as reflected on the post-closing trial balance,will match the amount reported on the income statement.

D) The balance of the owner's capital account on the adjusted trial balance will usually be different than that reported on the post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following accounts has a normal debit balance?

A) Accounts Receivable

B) Accounts Payable

C) Fees Income

D) T.Stark,Capital

A) Accounts Receivable

B) Accounts Payable

C) Fees Income

D) T.Stark,Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

52

Identify the accounts below that are ALL permanent accounts.

A) Accounts Receivable,Accumulated Depreciation,Accounts Payable

B) Accounts Receivable,Depreciation Expense,Fees Income

C) Accounts Payable,Wages Expense,Income Summary

D) Accounts Payable,Owner's Capital,Income Summary

A) Accounts Receivable,Accumulated Depreciation,Accounts Payable

B) Accounts Receivable,Depreciation Expense,Fees Income

C) Accounts Payable,Wages Expense,Income Summary

D) Accounts Payable,Owner's Capital,Income Summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following accounts is a permanent account?

A) Supplies

B) Supplies Expense

C) Owner's drawing

D) Fees Income

A) Supplies

B) Supplies Expense

C) Owner's drawing

D) Fees Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following entries records the closing of Penny Pincher,Drawing at the end of the accounting period?

A) Debit Penny Pincer,Drawing;credit Penny Pincher,Capital

B) Debit Penny Pincher,Capital;credit Income Summary

C) Debit Income Summary;credit Penny Pincher,Drawing

D) Debit Penny Pincher,Capital;credit Penny Pincher,Drawing

A) Debit Penny Pincer,Drawing;credit Penny Pincher,Capital

B) Debit Penny Pincher,Capital;credit Income Summary

C) Debit Income Summary;credit Penny Pincher,Drawing

D) Debit Penny Pincher,Capital;credit Penny Pincher,Drawing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

55

The entry to close the owner's drawing account would include a debit to the

A) Income Summary account and a credit to the owner's drawing account.

B) owner's drawing account and a credit to Cash.

C) owner's capital account and a credit to the owner's drawing account.

D) owner's drawing account and a credit to the Income Summary account.

A) Income Summary account and a credit to the owner's drawing account.

B) owner's drawing account and a credit to Cash.

C) owner's capital account and a credit to the owner's drawing account.

D) owner's drawing account and a credit to the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

56

Identify the accounts below that are ALL classified as temporary accounts.

A) Wages Expense,Accumulated Depreciation,Fees Income

B) Accounts Receivable,Depreciation Expense,Fees Income

C) Owner's Drawing,Depreciation Expense,Income Summary

D) Owner's Drawing,Owner's Capital,Income Summary

A) Wages Expense,Accumulated Depreciation,Fees Income

B) Accounts Receivable,Depreciation Expense,Fees Income

C) Owner's Drawing,Depreciation Expense,Income Summary

D) Owner's Drawing,Owner's Capital,Income Summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

57

When done properly,how many journal entries are involved in the closing process?

A) 2

B) 3

C) 4

D) 5

A) 2

B) 3

C) 4

D) 5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following accounts would be closed?

A) Accounts Receivable

B) Accumulated Depreciation

C) Supplies Expense

D) Joan Wilson,Capital

A) Accounts Receivable

B) Accumulated Depreciation

C) Supplies Expense

D) Joan Wilson,Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

59

A post-closing trial balance could include all of the following except the

A) owner's capital account.

B) Cash account.

C) Fees Income account.

D) Accounts Receivable account.

A) owner's capital account.

B) Cash account.

C) Fees Income account.

D) Accounts Receivable account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

60

During the closing process,Accumulated Depreciation,Equipment will

A) be closed to the income summary account.

B) be closed to the capital account.

C) be closed to the drawing account.

D) not be used.

A) be closed to the income summary account.

B) be closed to the capital account.

C) be closed to the drawing account.

D) not be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

61

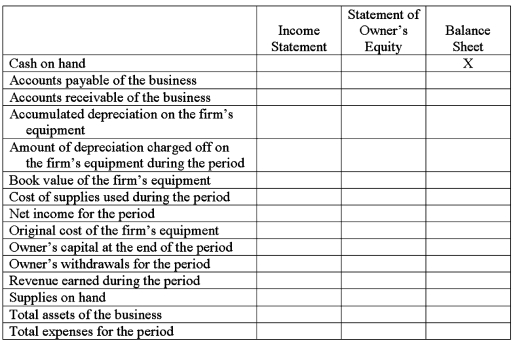

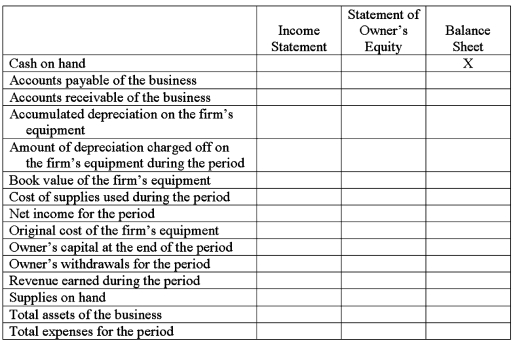

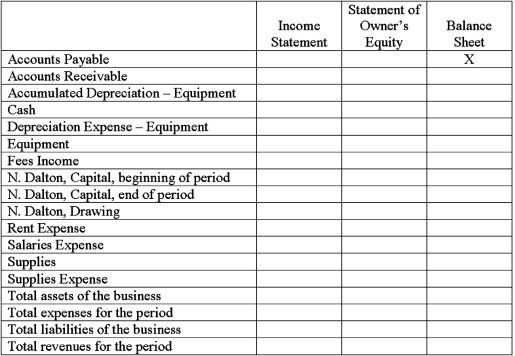

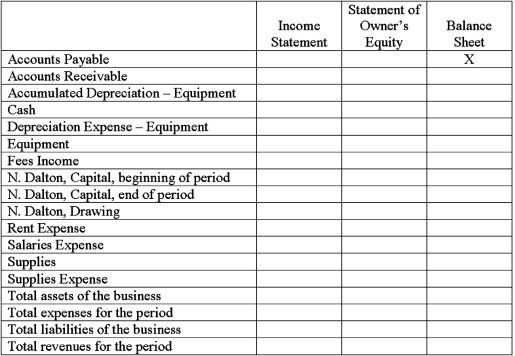

Managers often consult financial statements for specific types of information.Indicate whether each of the following items would appear on the income statement,statement of owner's equity,or the balance sheet.Note that an item may appear on more than one statement.The first item is completed as an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

62

Information in the financial statements provides answers to many questions,including:

A) How much do customers owe the business?

B) What are the business' current and long term plans for expansion?

C) Has the business achieved its net income goal for the year?

D) Has there been a lot of employee turnover?

A) How much do customers owe the business?

B) What are the business' current and long term plans for expansion?

C) Has the business achieved its net income goal for the year?

D) Has there been a lot of employee turnover?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

63

After the transactions have been posted,the next step in the accounting cycle is to

A) prepare the financial statements.

B) prepare the post-closing trial balance.

C) prepare the worksheet.

D) journalize and post the adjusting entries.

A) prepare the financial statements.

B) prepare the post-closing trial balance.

C) prepare the worksheet.

D) journalize and post the adjusting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

64

Trial balances are prepared in a certain order.Given the choices below,which one depicts the trial balances in the correct order in which they would be prepared?

A) trial balance,adjusted trial balance,post-closing trial balance.

B) adjusted trial balance,trial balance,post-closing trial balance.

C) post-closing trial balance,adjusted trial balance,trial balance.

D) trial balance,post-closing trial balance,adjusted trial balance.

A) trial balance,adjusted trial balance,post-closing trial balance.

B) adjusted trial balance,trial balance,post-closing trial balance.

C) post-closing trial balance,adjusted trial balance,trial balance.

D) trial balance,post-closing trial balance,adjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

65

Danos Company's partial worksheet for the month ended December 31,2016,is shown below.Open the owner's capital account (account number 301)in the general ledger and record the December 1,2016,balance of $64,000 shown on the worksheet.Journalize the closing entries on page 8 of a general journal.Post the closing entries to the owner's capital account.Prepare a post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

66

The adjusted ledger accounts of Miraldi Landscaping Design on December 31,2016,appear as follows.All accounts have normal balances and adjusting entries have been made.Extend the balances to the Balance Sheet and Income Statement columns of the worksheet.Then,journalize the closing entries on page 12 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

67

The asset,liability,and owner's capital accounts appear on all of the following except the

A) income statement.

B) balance sheet.

C) post-closing trial balance.

D) worksheet.

A) income statement.

B) balance sheet.

C) post-closing trial balance.

D) worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

68

Dorsey Company's partial worksheet for the month ended March 31,2016,is shown below.Open the owner's capital account (account number 301)in the general ledger and record the March 1,2016,balance of $32,000 shown on the worksheet.Journalize the closing entries on page 3 of a general journal.Post the closing entries to the owner's capital account.Prepare a post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

69

The adjusted ledger accounts of RD Consulting on December 31,2016,appear as follows.All accounts have normal balances and adjusting entries have been made.Extend the balances to the Balance Sheet and Income Statement columns of the worksheet.Then,journalize the closing entries on page 4 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

70

Managers often consult financial statements for specific types of information.Indicate whether each of the following items would appear on the income statement,statement of owner's equity,or the balance sheet.Note that an item may appear on more than one statement.The first item is completed as an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements is correct?

A) The Balance Sheet section of the worksheet contains the data that is used to make closing entries.

B) The balance of the owner's drawing account will appear on the post-closing trial balance.

C) Closing entries are entered directly on the worksheet.

D) Preparation of the post-closing trial balance is the last step in the end-of-period routine.

A) The Balance Sheet section of the worksheet contains the data that is used to make closing entries.

B) The balance of the owner's drawing account will appear on the post-closing trial balance.

C) Closing entries are entered directly on the worksheet.

D) Preparation of the post-closing trial balance is the last step in the end-of-period routine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

72

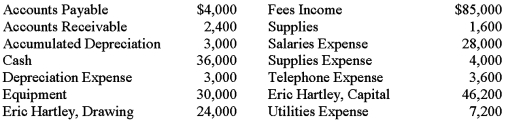

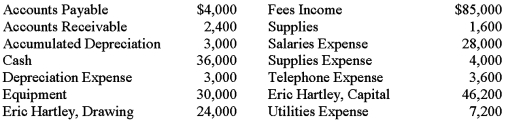

On December 31,the ledger of Hartley Engineering Company contained the following account balances:  All the accounts have normal balances.Journalize the closing entries.Use 6 as the general journal page number.

All the accounts have normal balances.Journalize the closing entries.Use 6 as the general journal page number.

All the accounts have normal balances.Journalize the closing entries.Use 6 as the general journal page number.

All the accounts have normal balances.Journalize the closing entries.Use 6 as the general journal page number.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

73

On December 31,the ledger of Davis Company contained the following account balances:  All the accounts have normal balances.Journalize the closing entries.Use 11 as the general journal page number.

All the accounts have normal balances.Journalize the closing entries.Use 11 as the general journal page number.

All the accounts have normal balances.Journalize the closing entries.Use 11 as the general journal page number.

All the accounts have normal balances.Journalize the closing entries.Use 11 as the general journal page number.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

74

Identify the item below that is NOT one of the steps in an accounting cycle.

A) prepare the financial statements

B) prepare the post-closing trial balance

C) journalize and post the adjusting entries

D) prepare invoices for customers

A) prepare the financial statements

B) prepare the post-closing trial balance

C) journalize and post the adjusting entries

D) prepare invoices for customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

75

The partial worksheet for the Jamison Company showed the following data on October 31,2016.Record the closing entries on page 6 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

76

The partial worksheet for the Roberts Company showed the following data on October 31,2016.Record the closing entries on page 9 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following accounts has a normal credit balance?

A) Accounts Receivable

B) Accounts Payable

C) Supplies Expense

D) T.Stark,Drawing

A) Accounts Receivable

B) Accounts Payable

C) Supplies Expense

D) T.Stark,Drawing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

78

On December 31,the Income Summary account of Coulter Company has a credit balance of $20,000 after revenue of $89,000 and expenses of $69,000 were closed to the account.Joseph Coulter,Drawing has a debit balance of $3,000 and Joseph Coulter,Capital has a credit balance of $45,000.Record the journal entries necessary to complete closing the accounts.Use 14 as the general journal page number.Then,post the closing entries to the Joseph Coulter,Capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

79

After the worksheet has been completed,the next step in the accounting cycle is to

A) journalize the closing entries.

B) post the closing entries.

C) prepare the post-closing trial balance.

D) prepare the financial statements.

A) journalize the closing entries.

B) post the closing entries.

C) prepare the post-closing trial balance.

D) prepare the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

80

On December 31 the Income Summary account of Cook Company has a debit balance of $18,000 after revenue of $49,000 and expenses of $67,000 were closed to the account.Maria Cook,Drawing has a debit balance of $23,000 and Maria Cook,Capital has a credit balance of $84,000.Record the journal entries necessary to complete closing the accounts.Use 22 as the general journal page number.Then,post the closing entries to the Maria Cook,Capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck