Deck 7: Accounting for Sales and Accounts Receivable

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

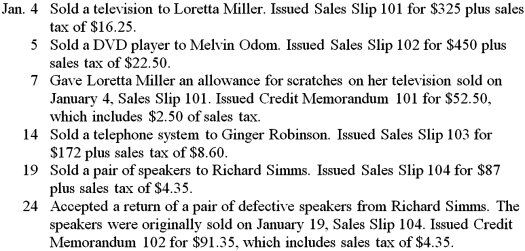

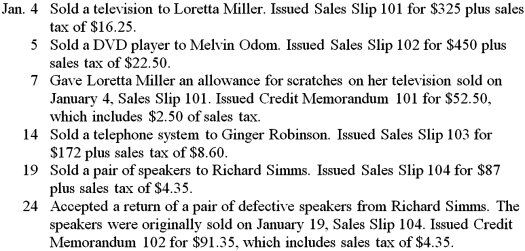

سؤال

سؤال

سؤال

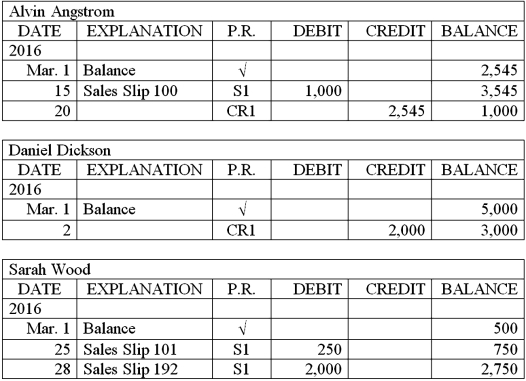

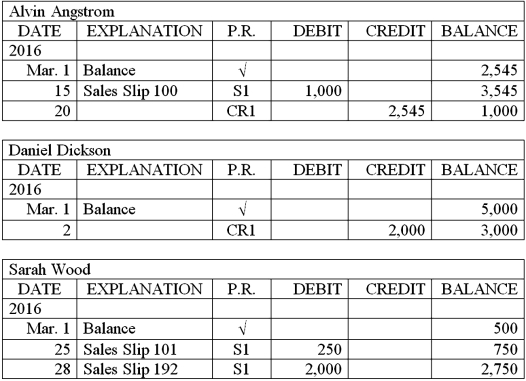

سؤال

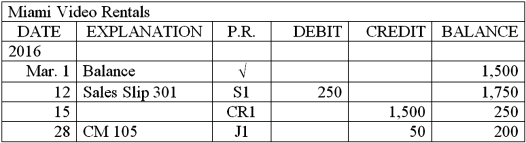

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/76

العب

ملء الشاشة (f)

Deck 7: Accounting for Sales and Accounts Receivable

1

A ledger that contains accounts of a single type is called a(n)____________________ ledger.

subsidiary

2

The entry to record a sale of merchandise on credit that is subject to sales tax includes a(n)____________________ to Sales Tax Payable.

credit

3

In some states,a firm receives a discount for paying the amount of sales tax due on time.

True

4

A merchandising business sells goods that it produces.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

5

Sales Tax Payable is classified as a(n)____________________ account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

6

The abbreviation S1 in the Posting Reference column of an account shows that the data was posted from page 1 of the sales journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

7

The individual amounts in the Accounts Receivable Debit column of a sales journal should be posted to the accounts receivable subsidiary ledger,and the column total should be posted to the Accounts Receivable account in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

8

The ____________________ ledger contains accounts for credit customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

9

To indicate that the column totals of the sales journal have been posted,a check mark is entered under the column total.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

10

A(n)____________________ journal is a journal that is used to record only one type of transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

11

A(n)____________________ business sells goods that it purchases in finished form for resale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

12

A business that sells goods and services directly to individual consumers is called a(n)____________________ business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

13

The stock of goods kept on hand to sell to consumers is called ________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a business makes a sale on a bank credit card,the business is ultimately responsible for collecting the amount owed from the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

15

The balance of the Sales Returns and Allowances account is subtracted from the balance of the Accounts Receivable account in the Assets section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

16

After all postings have been made,the totals of the balances in the accounts receivable subsidiary ledger should equal the balance of the Accounts Receivable account in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

17

A customer who returns goods or receives an allowance is entitled to a credit for the appropriate amount of sales tax if tax was charged on the original sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

18

To indicate that an amount has been posted from the sales journal to the accounts receivable subsidiary ledger,a(n)____________________ is placed in the Posting Reference column of the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

19

A sales return or a sales allowance is usually recorded in the sales journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

20

The Sales Returns and Allowances account has a normal debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Sales account is classified as a(n)

A) asset account.

B) liability account.

C) revenue account.

D) expense account.

A) asset account.

B) liability account.

C) revenue account.

D) expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

22

The reductions from list prices that many wholesale businesses offer their customers are called ____________________ discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

23

In May,a retailer recorded credit sales of $10,000.Assuming the sales tax rate is 7 percent,the entry to record the sales in the sales journal would include:

A) a debit to Accounts Receivable of $10,700.

B) a debit to Accounts Receivable of $10,000.

C) a credit to Sales of $10,700.

D) a debit to Sales Tax Payable of $700.

A) a debit to Accounts Receivable of $10,700.

B) a debit to Accounts Receivable of $10,000.

C) a credit to Sales of $10,700.

D) a debit to Sales Tax Payable of $700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

24

To find the balance due from an individual customer,the accountant would refer to

A) the sales journal.

B) the Sales account in the general ledger.

C) the accounts receivable subsidiary ledger.

D) the Accounts Receivable account in the general ledger.

A) the sales journal.

B) the Sales account in the general ledger.

C) the accounts receivable subsidiary ledger.

D) the Accounts Receivable account in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

25

ABC Company uses special journals.When making a credit sale of $700 to a customer,the company would record the sale by:

A) entering $700 in the Accounts Receivable Debit column and $700 in the Sales Credit column of the sales journal.

B) entering $700 in the Accounts Receivable Credit column and $700 in the Sales Debit column of the sales journal.

C) entering $700 in the Accounts Payable Credit column and $700 in the Sales Credit column of the sales journal.

D) entering $700 in the Sales Returns and Allowances Debit column and $700 in the Sales Credit column of the general journal.

A) entering $700 in the Accounts Receivable Debit column and $700 in the Sales Credit column of the sales journal.

B) entering $700 in the Accounts Receivable Credit column and $700 in the Sales Debit column of the sales journal.

C) entering $700 in the Accounts Payable Credit column and $700 in the Sales Credit column of the sales journal.

D) entering $700 in the Sales Returns and Allowances Debit column and $700 in the Sales Credit column of the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a sales journal used to record taxable sales,the total of the Accounts Receivable column should equal

A) the sum of the totals of the Sales Tax Payable column and the Sales column.

B) the difference between the total of the Sales Tax Payable column and the total of the Sales column.

C) the total of the Sales column.

D) the total of the Sales Tax Payable column.

A) the sum of the totals of the Sales Tax Payable column and the Sales column.

B) the difference between the total of the Sales Tax Payable column and the total of the Sales column.

C) the total of the Sales column.

D) the total of the Sales Tax Payable column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements is correct?

A) The sales journal is used for recording both cash sales and credit sales.

B) Since the sales journal is used for a single purpose,there is no need to enter any descriptions.

C) To provide an adequate audit trail,sales on credit should be recorded in both the sales journal and the general journal.

D) The complete information for each sale of merchandise on credit can be recorded on one line of the general journal.

A) The sales journal is used for recording both cash sales and credit sales.

B) Since the sales journal is used for a single purpose,there is no need to enter any descriptions.

C) To provide an adequate audit trail,sales on credit should be recorded in both the sales journal and the general journal.

D) The complete information for each sale of merchandise on credit can be recorded on one line of the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

28

Identify the statement below that correctly describes the Sales Returns and Allowances account.

A) It is an expense account.

B) It is a liability account.

C) It normally has a credit balance.

D) It normally has a debit balance.

A) It is an expense account.

B) It is a liability account.

C) It normally has a credit balance.

D) It normally has a debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

29

In a firm that uses special journals,an allowance given for damaged merchandise is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) purchases journal.

D) general journal.

A) cash payments journal.

B) cash receipts journal.

C) purchases journal.

D) general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

30

In a firm that uses special journals,the sale of merchandise for cash is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Sales account is classified as

A) a liability account.

B) an asset account.

C) a contra account.

D) a revenue account.

A) a liability account.

B) an asset account.

C) a contra account.

D) a revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

32

In a firm that uses special journals,a sale of merchandise on credit is recorded in the

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

A) cash payments journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is not correct?

A) Postings to the accounts receivable subsidiary ledger are usually made once a month on the last day of the month.

B) Before any posting to the subsidiary ledger takes place,the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

C) Before any posting to the general ledger takes place,the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

D) When special journals are used,postings to the accounts receivable account in the general ledger are usually made once a month on the last day of the month.

A) Postings to the accounts receivable subsidiary ledger are usually made once a month on the last day of the month.

B) Before any posting to the subsidiary ledger takes place,the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

C) Before any posting to the general ledger takes place,the equality of the debits and credits recorded in the sales journal are proved by comparing the column totals.

D) When special journals are used,postings to the accounts receivable account in the general ledger are usually made once a month on the last day of the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

34

In a firm that uses special journals,the acceptance of a return of merchandise from a credit customer is recorded in the

A) cash receipts journal.

B) sales journal.

C) cash payments journal.

D) general journal.

A) cash receipts journal.

B) sales journal.

C) cash payments journal.

D) general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is not correct?

A) Use of a sales journal eliminates repetition in posting individual entries to the Accounts Receivable account in the general ledger.

B) A journal that is used to record only one type of a transaction is called a special journal.

C) The sales slip is the source document for sales on credit transactions.

D) If the firm must collect sales tax on retail transactions,the sales journal should have a Sales Tax Payable Debit column.

A) Use of a sales journal eliminates repetition in posting individual entries to the Accounts Receivable account in the general ledger.

B) A journal that is used to record only one type of a transaction is called a special journal.

C) The sales slip is the source document for sales on credit transactions.

D) If the firm must collect sales tax on retail transactions,the sales journal should have a Sales Tax Payable Debit column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

36

Merchandise is sold on credit for $600 plus 5 percent sales tax.The entry in the sales journal will include a debit to Accounts Receivable for

A) $600.00.

B) $603.50.

C) $605.50.

D) $630.00.

A) $600.00.

B) $603.50.

C) $605.50.

D) $630.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

37

A list of all unpaid balances in the accounts receivable subsidiary ledger is called a(n)____________________ of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

38

When an accounts receivable subsidiary ledger is used,the Accounts Receivable account in the general ledger is considered to be a(n)____________________ account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

39

A firm that sells goods that it purchases for re-sale is a

A) service business.

B) merchandising business.

C) manufacturing business.

D) non-profit business.

A) service business.

B) merchandising business.

C) manufacturing business.

D) non-profit business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Sales Returns and Allowances account has a normal ____________________ balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Sales Returns and Allowances account is classified as

A) an asset account.

B) a contra asset account.

C) an expense account.

D) a contra revenue account.

A) an asset account.

B) a contra asset account.

C) an expense account.

D) a contra revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a firm had sales of $50,000 during a period and sales returns and allowances of $4,000,its net sales were

A) $54,000.

B) $50,000.

C) $46,000.

D) $4,000.

A) $54,000.

B) $50,000.

C) $46,000.

D) $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

43

A retailer recorded the following in June: cash sales $2,000;credit sales,$9,000;sales returns and allowances,$1,000.Assuming the sales tax rate is 7 percent,the entry to record the sales tax payment includes a debit to Sales Tax Payable for

A) $560.

B) $630.

C) $700.

D) $770.

A) $560.

B) $630.

C) $700.

D) $770.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

44

The entry to record a return by a credit customer of defective merchandise on which no sales tax was charged includes

A) a debit to Sales and a credit to Accounts Receivable.

B) a debit to Sales and a credit to Sales Returns and Allowances.

C) a debit to Sales Returns and Allowances and a credit to Accounts Receivable.

D) a debit to Accounts Receivable and a credit to Sales Returns and Allowances.

A) a debit to Sales and a credit to Accounts Receivable.

B) a debit to Sales and a credit to Sales Returns and Allowances.

C) a debit to Sales Returns and Allowances and a credit to Accounts Receivable.

D) a debit to Accounts Receivable and a credit to Sales Returns and Allowances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

45

An example of a merchandising company is a

A) bookstore.

B) restaurant.

C) hair salon.

D) real estate office.

A) bookstore.

B) restaurant.

C) hair salon.

D) real estate office.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

46

Hour Place Clock Shop sold a grandfather clock for $2,250 subject to a 9% sales tax.The entry in the sales journal will include a debit to Accounts Receivable for

A) $2,250.00.

B) $2,092.50.

C) $2,452.50.

D) $2,362.00.

A) $2,250.00.

B) $2,092.50.

C) $2,452.50.

D) $2,362.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

47

A wholesale business sells goods with a list price of $900 and a trade discount of 40 percent.The net price is

A) $360.00.

B) $540.00.

C) $900.00.

D) $940.00.

A) $360.00.

B) $540.00.

C) $900.00.

D) $940.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

48

Hugh Snow returned merchandise to Farley Co.The entry on the books of Farley company to record the return of merchandise from Hugh Snow would include a:

A) Debit Accounts Payable

B) Credit to Purchase Returns and Allowances

C) Debit to Account Receivable

D) Debit Sales Returns and Allowances

A) Debit Accounts Payable

B) Credit to Purchase Returns and Allowances

C) Debit to Account Receivable

D) Debit Sales Returns and Allowances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

49

Hour Place Clock Shop sold a grandfather clock for $2,250 subject to a 9% sales tax.The entry in the sales journal will include a credit to Sales for

A) $2,250.00.

B) $2,092.50.

C) $2,452.50.

D) $2,362.00.

A) $2,250.00.

B) $2,092.50.

C) $2,452.50.

D) $2,362.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

50

On Deck Sports Memorabilia store sells a Babe Ruth rookie card for $4,600 on account.If the sales tax on the sale is 8%,what is the amount debited to Accounts Receivable.

A) $4,232

B) $4,968

C) $4,600

D) $4,592

A) $4,232

B) $4,968

C) $4,600

D) $4,592

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

51

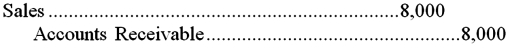

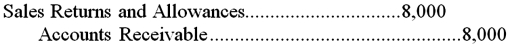

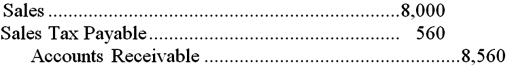

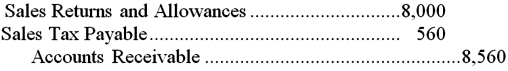

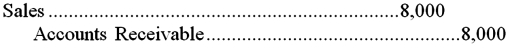

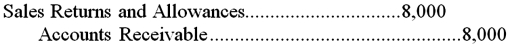

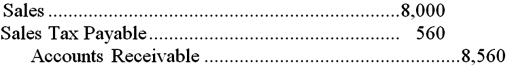

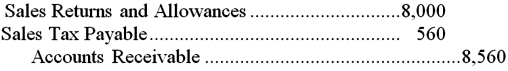

ABC Skiing Essentials uses special journals.If a credit customer returns $8,000 of goods on which $560 of sales tax was charged,select the correct entry to record the return:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following describes Sales Tax Payable?

A) A revenue account with a normal credit balance.

B) A liability account with a normal debit balance.

C) A liability account with a normal credit balance.

D) An asset account with a normal debit balance.

A) A revenue account with a normal credit balance.

B) A liability account with a normal debit balance.

C) A liability account with a normal credit balance.

D) An asset account with a normal debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Sales Returns and Allowances account is presented

A) on the balance sheet as a deduction from Accounts Receivable.

B) on the income statement as a deduction from Sales.

C) on the income statement as an addition to Sales.

D) on the balance sheet as a deduction from Capital.

A) on the balance sheet as a deduction from Accounts Receivable.

B) on the income statement as a deduction from Sales.

C) on the income statement as an addition to Sales.

D) on the balance sheet as a deduction from Capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

54

A wholesale firm made sales with a list price of $1,500 and trade discounts of 25 and 15 percent.Calculate the amount the firm will use to record the sale in the sales journal.

A) Invoice price will be equal to $956.25

B) Invoice price will be equal to $900

C) Invoice price will be equal to $600

D) Invoice price will be equal to $543.75

A) Invoice price will be equal to $956.25

B) Invoice price will be equal to $900

C) Invoice price will be equal to $600

D) Invoice price will be equal to $543.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

55

If a firm does not have a sales returns and allowances journal,the entries for these transactions are made in

A) the sales journal.

B) the general journal.

C) the cash receipts journal.

D) the cash payments journal.

A) the sales journal.

B) the general journal.

C) the cash receipts journal.

D) the cash payments journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

56

Ables Budget Boutique uses special journals.If a credit customer returns $40 of goods on which $3 of sales tax was charged,identify the statement below that would be correct when posting the transaction.

A) A debit of $43 would be posted to the customer's account in the accounts receivable ledger.

B) A debit of $40 would be posted to the customer's account in the accounts receivable ledger.

C) A credit of $40 would be posted to the customer's account in the accounts receivable ledger.

D) A credit of $43 would be posted to the customer's account in the accounts receivable ledger.

A) A debit of $43 would be posted to the customer's account in the accounts receivable ledger.

B) A debit of $40 would be posted to the customer's account in the accounts receivable ledger.

C) A credit of $40 would be posted to the customer's account in the accounts receivable ledger.

D) A credit of $43 would be posted to the customer's account in the accounts receivable ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

57

On the Income Statement,Sales Returns and Allowances have the effect of

A) increasing total revenue.

B) increasing total expenses.

C) decreasing total revenue.

D) decreasing total expenses.

A) increasing total revenue.

B) increasing total expenses.

C) decreasing total revenue.

D) decreasing total expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

58

The amount used by wholesalers to record sales in its sales journal is

A) the retail price.

B) the list price.

C) the net price.

D) the original price.

A) the retail price.

B) the list price.

C) the net price.

D) the original price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

59

After all postings have been made,the total of the schedule of accounts receivable should equal

A) the balance of the Sales account.

B) the total of the Accounts Receivable Debit column in the sales journal.

C) the balance of the Accounts Receivable account in the general ledger.

D) the total of all sales on account for the accounting period.

A) the balance of the Sales account.

B) the total of the Accounts Receivable Debit column in the sales journal.

C) the balance of the Accounts Receivable account in the general ledger.

D) the total of all sales on account for the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

60

GiGi's Sporting Goods uses special journals.If a credit customer returns $400 of goods on which $24 of sales tax was charged,the journal entry to record the return would include:

A) a debit to the Sales account for $424.

B) a credit to the Sales Tax Payable account for $24.

C) a debit to the Sales Returns and Allowances account for $400.

D) a credit to the Accounts Receivable account for $400.

A) a debit to the Sales account for $424.

B) a credit to the Sales Tax Payable account for $24.

C) a debit to the Sales Returns and Allowances account for $400.

D) a credit to the Accounts Receivable account for $400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following describes Sales Returns and Allowances?

A) A revenue account with a normal credit balance.

B) An expense account with a normal debit balance.

C) A contra revenue account with a normal debit balance.

D) A contra expense account with a normal credit balance.

A) A revenue account with a normal credit balance.

B) An expense account with a normal debit balance.

C) A contra revenue account with a normal debit balance.

D) A contra expense account with a normal credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

62

Kay Sadia sold merchandise for $8,750 subject to a 6% sales tax.The entry in the sales journal will include a debit to Accounts Receivable for

A) $9,275.00.

B) $8,225.00.

C) $8,750.00.

D) $8,462.00.

A) $9,275.00.

B) $8,225.00.

C) $8,750.00.

D) $8,462.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

63

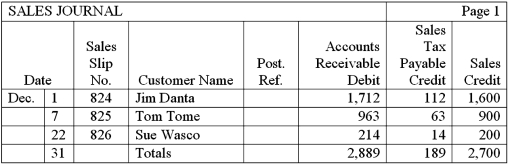

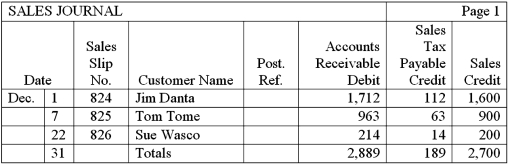

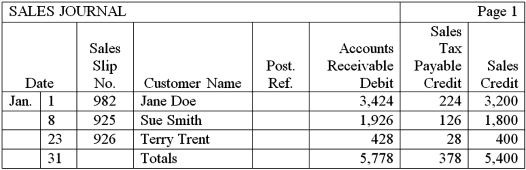

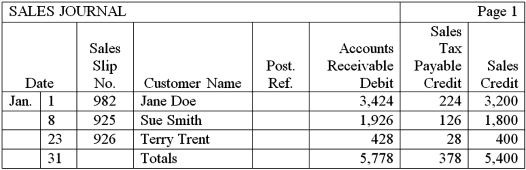

The sales journal for Carothers Company is shown below.Describe how the amounts would be posted to the general ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

64

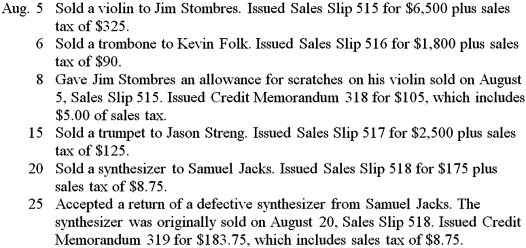

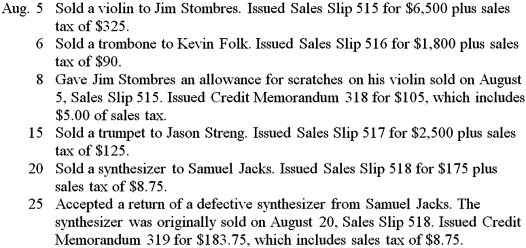

All That Jazz Music Store had the following transactions during the month of August 2016.Record the transactions on page 15 of a sales journal and page 18 of a general journal.Total,prove,and rule the sales journal as of August 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

65

Barnett's Electronics Store had the following transactions during the month of January 2016.Record the transactions on page 1 of a sales journal and page 1 of a general journal.Total,prove,and rule the sales journal as of January 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

66

JCPenney issues its own credit cards to its customers who have established credit with them.It's customers used these cards to charge $300 worth of sales.JCPenney would record these sales by:

A) debiting Cash $300 and crediting Sales $300.

B) debiting Sales $300 and crediting Accounts Receivable $300.

C) debiting Charge Card Sales $300 and crediting Sales Returns and Allowances $300.

D) debiting Accounts Receivable $300 and crediting Sales $300.

A) debiting Cash $300 and crediting Sales $300.

B) debiting Sales $300 and crediting Accounts Receivable $300.

C) debiting Charge Card Sales $300 and crediting Sales Returns and Allowances $300.

D) debiting Accounts Receivable $300 and crediting Sales $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

67

Selected balances from the general ledger of the Loren Company on March 31,2016,are listed below.Use the appropriate data to prepare the Revenue section of the firm's income statement for the month ended March 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

68

The accounts receivable ledger for Acme Auto Parts is shown below.Prepare a schedule of accounts receivable as of March 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

69

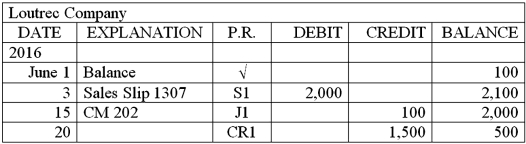

One of the customer accounts from the accounts receivable ledger for Toulouse Company is shown below.Explain each of the entries that have been posted to this customer's subsidiary ledger account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

70

The amount of the trade discount taken by the customer is recorded as a(n)

A) asset.

B) liability.

C) expense.

D) sales recorded net of trade discounts.

A) asset.

B) liability.

C) expense.

D) sales recorded net of trade discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

71

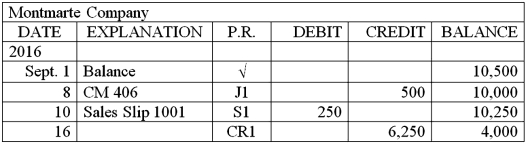

One of the customer accounts from the accounts receivable ledger for Rogers Flooring is shown below.Explain each of the entries that have been posted to this customer's subsidiary ledger account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

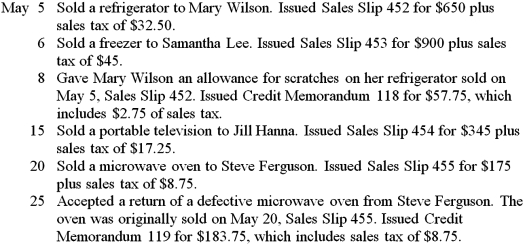

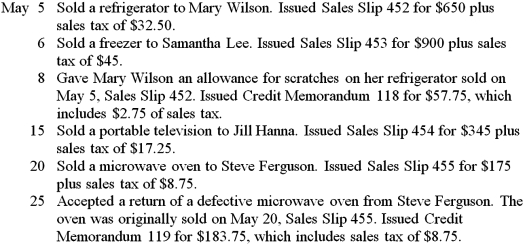

72

Bradley's Appliance Store had the following transactions during the month of May 2016.Record the transactions on page 5 of a sales journal and page 8 of a general journal.Total,prove,and rule the sales journal as of May 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

73

Selected balances from the general ledger of the All Star Video Rentals on July 31,2016,are listed below.Use the appropriate data to prepare the Revenue section of the firm's income statement for the month ended July 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

74

The sales journal for Simon Company is shown below.Describe how the amounts would be posted to the accounts receivable subsidiary ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

75

Selected balances from the general ledger of the Valley Video Rentals on May 31,2016,are listed below.Use the appropriate data to prepare the Revenue section of the firm's income statement for the month ended May 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

76

One of the customer accounts from the accounts receivable ledger for Paragon Consulting Services is shown below.Explain each of the entries that have been posted to this customer's subsidiary ledger account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck