Deck 19: Accounting for Partnerships

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/106

العب

ملء الشاشة (f)

Deck 19: Accounting for Partnerships

1

The assets of a sole proprietorship are revalued before they are assumed by a partnership.

True

2

Each partner is empowered to act as an agent for the partnership creating binding agreements no matter what the agreement concerns.

False

3

The journal entry to record the division of a partnership profit consists of a debit to each partner's capital account and a credit to Cash.

False

4

Some partners,known as limited partners,may not be personally liable for the debts of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

5

Establishing a fiscal year and specifying the accounting method to be used in the partnership are important elements of the partnership agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

6

A legal partnership does not exist unless there is a written partnership agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

7

Salary and interest allowances for partners are treated as expenses of the firm and are used in the determination of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

8

When a partner makes a cash withdrawal that is intended to be a permanent reduction in his/her investment,the withdrawal account is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

9

The separate entity assumption requires personal expenses paid by the business be charged to a partner's drawing account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost of merchandise withdrawn by a partner for personal use is recorded as a debit to the partner's drawing account and a credit to the Purchases account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

11

Unlike a corporation,a partnership does not pay income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

12

Family partnerships enable family members to pool funds for investment purposes and are designed to minimize tax obligations on the transfer of property,business interests and investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Articles of Organization are the legal agreement of the partnership that specifies the names of partners,the name,location and nature of the partnership business;the starting date and life of the partnership as well as the rights and duties of each partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

14

Salary and interest allowances are considered in distributing net income to partners but not in distributing a net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

15

At the end of each fiscal year,cash is distributed to each partner in accordance with the profit distribution included in the partnership agreement and is reported on the partner's individual tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

16

A partnership has a limited life.It ends with the death or withdrawal of a partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

17

Limited partners are only liable for their investment in the partnership and are therefore prohibited from having their names in the partnership's name.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

18

Investments by a partner are credited to that partner's capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

19

A pool of talented professionals can form as a Not-for-Profit partnership and provide needed community services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

20

The entry to record the salary and interest allowance on capital invested but not withdrawn from the partnership requires a debit to the Income Summary account and a credit to the partner's capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

21

A gain or loss on revaluation of assets should be allocated to the partners according to the balances of their capital accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

22

A dissolution has little impact on the business activities of the partnership whereas a liquidation occurs when the business ceases to exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

23

It is customary for a partnership's income statement to show the division of net income or loss for the year between the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

24

Upon withdrawal,the withdrawing partner(s)may receive less than their capital account balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

25

Withdrawals of assets from a partnership that are intended to permanently reduce the invested capital are recorded as debits to the partners' ____________________ accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a new partner purchases an interest in a partnership firm directly from an existing partner,the Cash account is debited and the new partner's capital account is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

27

If plant and equipment are transferred from a sole proprietorship to a partnership,the Accumulated Depreciation accounts start with ____________________ balances in the partnership records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

28

The characteristic of a partnership that means that any partner can make valid contracts for the partnership is known as ___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

29

The entry to record a partner's interest allowance includes a debit to the ____________________ account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

30

Each general partner has ____________________ liability for the debts of a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

31

Amounts withdrawn by partners to pay personal living expenses are recorded in their ____________________ accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

32

The entry to close a partner's drawing account at the end of a fiscal period includes a debit to the partner's drawing account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

33

A partnership has a(n)____________________ life because it ends with the death or withdrawal of any partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

34

The partnership ____________________ is a written contract that specifies the rights and responsibilities of the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

35

Gains on the revaluation of assets and liabilities upon the dissolution of a partnership are taxable to each partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

36

The partners of Jones & Wesson agreed that Jones can sell his $50,000 investment in the firm to Smith.Smith pays Jones $60,000.The entry to record the transfer of capital to Smith will include a credit to Smith,Capital for $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

37

The dissolution of a partnership and the formation of a new partnership may have no noticeable effect on the continuing operations of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

38

An association of two or more persons to carry on,as co-owners,a business for profit is called a(n)___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the withdrawing partner receives more cash than their capital account balances,the excess is debited to the capital accounts of the remaining partners according to their income and loss ratios specified in the partnership agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

40

James Cavanaugh,proprietor has agreed to take on a partner.His net assets are market valued at $105,000 with book assets having a net value of $95,000.In the newly created partnership,Cavanaugh's capital will reflect the $95,000 book value of existing assets contributed to the new organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is not a characteristic of a partnership?

A) Each general partner has unlimited liability for the debts of the partnership.

B) If one partner dies or leaves the partnership,the existing partnership is terminated.

C) The partnership income is subject to a federal income tax that is levied on the business but not on the partners.

D) The existing partnership agreement is dissolved and a new agreement is formed when a new partner joins the partnership.

A) Each general partner has unlimited liability for the debts of the partnership.

B) If one partner dies or leaves the partnership,the existing partnership is terminated.

C) The partnership income is subject to a federal income tax that is levied on the business but not on the partners.

D) The existing partnership agreement is dissolved and a new agreement is formed when a new partner joins the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

42

Ryan Fuller,a sole proprietor,entered into partnership with another individual.Fuller's investment in the partnership included equipment that cost $32,000 when it was purchased.The equipment has a book value of $13,000 and a net agreed-on value of $16,000.In the financial records of the partnership,this equipment and its accumulated depreciation should be recorded at

A) $16,000 and $0,respectively.

B) $13,000 and $0,respectively.

C) $32,000 and $19,000,respectively.

D) $16,000 and $3,000,respectively.

A) $16,000 and $0,respectively.

B) $13,000 and $0,respectively.

C) $32,000 and $19,000,respectively.

D) $16,000 and $3,000,respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

43

A partnership ____________________ occurs when the partnership's assets are sold,debts are paid off,and the remaining cash is distributed to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

44

If a partnership's net income is in excess of the salary and interest allowances,the entry to close Income Summary after the allowances are recorded will include a(n)____________________ to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

45

The financial statement prepared to summarize the changes in partner's capital accounts is the __________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

46

The amount that each partner withdraws from a partnership

A) cannot exceed the net income reported by the partnership.

B) should be specified in the partnership agreement.

C) is the base on which federal income taxes are levied on the partnership income.

D) is usually determined by the amount of the net income.

A) cannot exceed the net income reported by the partnership.

B) should be specified in the partnership agreement.

C) is the base on which federal income taxes are levied on the partnership income.

D) is usually determined by the amount of the net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

47

When dividing partnership net income,the consideration given to the amount of time a partner devotes to the business is called a salary ___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

48

If an individual invests more cash for an interest in an existing partnership than the book value of his or her interest,the old partners are said to receive a(n)___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is not correct?

A) Each general partner has unlimited liability for the debts of a partnership.

B) Federal income tax is levied on the net income of a partnership and on the earnings of the individual partners when the net income is distributed to them.

C) Any general partner can make valid contracts for a partnership and can otherwise conduct its affairs.

D) When a partner dies or is incapacitated,the partnership is dissolved.

A) Each general partner has unlimited liability for the debts of a partnership.

B) Federal income tax is levied on the net income of a partnership and on the earnings of the individual partners when the net income is distributed to them.

C) Any general partner can make valid contracts for a partnership and can otherwise conduct its affairs.

D) When a partner dies or is incapacitated,the partnership is dissolved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

50

When the owner of a sole proprietorship accepts a partner,the assets of the proprietorship

A) must be transferred to the partnership at the values reflected in the financial records of the proprietorship.

B) must be converted to cash and used to pay any debts of the proprietorship,with excess cash available for investment in the new partnership.

C) cannot be invested in the new partnership.

D) may be adjusted to reflect current values before being transferred to the partnership.

A) must be transferred to the partnership at the values reflected in the financial records of the proprietorship.

B) must be converted to cash and used to pay any debts of the proprietorship,with excess cash available for investment in the new partnership.

C) cannot be invested in the new partnership.

D) may be adjusted to reflect current values before being transferred to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements is correct?

A) The general ledger of a partnership will include a single capital account,whose balance represents the combined equity of all the partners.

B) Past-due accounts receivable should not be transferred from the financial records of a sole proprietorship to a newly formed partnership.

C) The financial records of a new partnership are opened with a memorandum entry in the general journal.

D) A new partner must purchase the partnership interest of another partner.

A) The general ledger of a partnership will include a single capital account,whose balance represents the combined equity of all the partners.

B) Past-due accounts receivable should not be transferred from the financial records of a sole proprietorship to a newly formed partnership.

C) The financial records of a new partnership are opened with a memorandum entry in the general journal.

D) A new partner must purchase the partnership interest of another partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

52

If a partnership's salary and interest allowances are in excess of the net income,the entry to close Income Summary after the allowances are recorded will include a(n)____________________ to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

53

The entry to record the investment of cash in a partnership by one partner would consist of a debit to

A) the partner's capital account and a credit to Cash.

B) Cash and a credit to an account called Partners' Equities.

C) Cash and a credit to the partner's capital account.

D) Cash and a credit to the partner's drawing account.

A) the partner's capital account and a credit to Cash.

B) Cash and a credit to an account called Partners' Equities.

C) Cash and a credit to the partner's capital account.

D) Cash and a credit to the partner's drawing account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

54

The statement of partners' equities summarizes the changes in the partners' _________________ accounts in an accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

55

Federal income tax is levied on

A) a partnership based on its total net income when earned.

B) the partners for their individual shares of the reported partnership income.

C) the partners only when they withdraw earnings from the partnership for personal use.

D) the partnership at the end of the fiscal period.

A) a partnership based on its total net income when earned.

B) the partners for their individual shares of the reported partnership income.

C) the partners only when they withdraw earnings from the partnership for personal use.

D) the partnership at the end of the fiscal period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

56

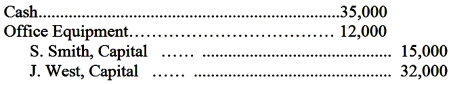

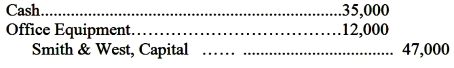

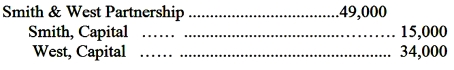

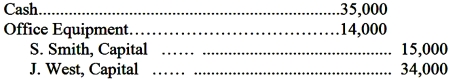

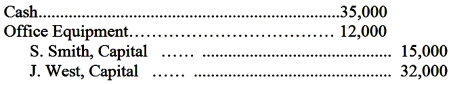

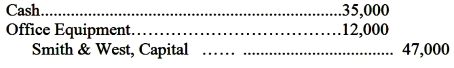

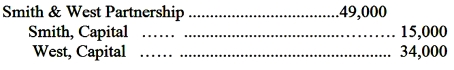

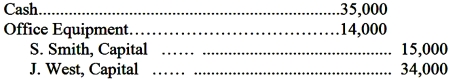

Smith contributed $15,000 cash while J.West contributed $20,000 cash and office equipment costing $14,000 currently valued at $12,000 to a new partnership.The journal entry to record the partnership investments of Smith and West is

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

57

Robert Ballard,a sole proprietor,entered into partnership with another individual.Ballard's investment in the partnership included equipment that cost $64,000 when it was purchased.The equipment has a book value of $26,000 and a net agreed-on value of $32,000.In the financial records of the partnership,this equipment and its accumulated depreciation should be recorded at

A) $64,000 and $38,000,respectively.

B) $32,000 and $6,000,respectively.

C) $32,000 and $0,respectively.

D) $26,000 and $0,respectively.

A) $64,000 and $38,000,respectively.

B) $32,000 and $6,000,respectively.

C) $32,000 and $0,respectively.

D) $26,000 and $0,respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a partner submits personal living expenses for company reimbursement and the expense is reflected as a reduction of period profits,the company has violated the

A) Conservatism principle.

B) Going concern assumption.

C) Separate entity assumption.

D) Full disclosure principle.

A) Conservatism principle.

B) Going concern assumption.

C) Separate entity assumption.

D) Full disclosure principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

59

On November 1,Jackson and Kiln formed a partnership with Jackson contributing land valued at $100,000 and a building valued at $125,000.Kiln contributed $55,000 in cash.The partnership assumed the mortgage on Jackson's property of $85,000.Profits and losses are to be shared equally.What are the balances of the partner's capital accounts after recording these transactions?

A) Jackson: $97,500 and Kiln:$97,500

B) Jackson: $55,000 and Kiln: $140,000

C) Jackson: $140,000 and Kiln: $55,000

D) Jackson: $225,000 and Kiln: $55,000

A) Jackson: $97,500 and Kiln:$97,500

B) Jackson: $55,000 and Kiln: $140,000

C) Jackson: $140,000 and Kiln: $55,000

D) Jackson: $225,000 and Kiln: $55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

60

The financial statement that shows the division of profits and losses among partners is the _______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

61

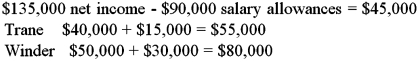

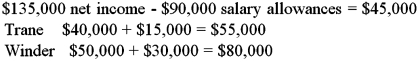

Partnership net income of $135,000 is to be divided between two partners,Ross Trane and Jane Winder,according to the following arrangement: There will be salary allowances of $40,000 for Trane and $50,000 for Winder,with the remainder divided one-third and two-thirds respectively per their partnership agreement.How much of the net income will be distributed to Trane and Winder,respectively?

A) $45,000 and $90,000

B) $30,000 and 15,000

C) $15,000 and $30,000

D) $55,000 and $80,000

A) $45,000 and $90,000

B) $30,000 and 15,000

C) $15,000 and $30,000

D) $55,000 and $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

62

The general ledger of a partnership will

A) not contain a separate drawing account for each partner.

B) contain one capital account that reflects the total equity of all partners.

C) not contain a capital account or accounts.

D) contain a separate capital account for each partner.

A) not contain a separate drawing account for each partner.

B) contain one capital account that reflects the total equity of all partners.

C) not contain a capital account or accounts.

D) contain a separate capital account for each partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

63

Valerie Wone and Samantha Wall are partners and together have equity of $150,000 in the partnership.Sarah wishes to become a partner with ¼ interest in the firm.If her investment reflects the cash paid,how much will she contribute to the partnership?

A) $37,500.

B) $50,000.

C) $87,500.

D) $200,000.

A) $37,500.

B) $50,000.

C) $87,500.

D) $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

64

Sam Sung and Mitchell Vaughn are partners,and each has a capital balance of $50,000.To gain admission to the partnership,Amanda Scott pays $35,000 directly to Vaughn for one-half of his equity.Scott's capital account will reflect an equity interest of:

A) $25,000.

B) $35,000.

C) $33,333.

D) $33,750.

A) $25,000.

B) $35,000.

C) $33,333.

D) $33,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

65

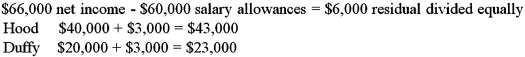

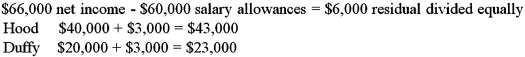

Partnership net income of $66,000 is to be divided between two partners,Julia Hood and Brian Duffy,according to the following arrangement: There will be salary allowances of $40,000 for Hood and $20,000 for Duffy,with the remainder divided equally.How much of the net income will be distributed to Hood and Duffy,respectively?

A) $33,000 and $33,000

B) $42,000 and $24,000

C) $43,000 and $23,000

D) $44,000 and $22,000

A) $33,000 and $33,000

B) $42,000 and $24,000

C) $43,000 and $23,000

D) $44,000 and $22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

66

Sam McGuire and Marcos Valle are partners,and each has a capital balance of $50,000.To gain admission to the partnership,Scott Jordan pays $35,000 directly to Valle for one-half of his equity.After the admission of Jordan,the total partners' equity in the records of the partnership will be

A) $50,000.

B) $67,500.

C) $85,000.

D) $100,000.

A) $50,000.

B) $67,500.

C) $85,000.

D) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

67

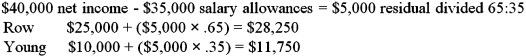

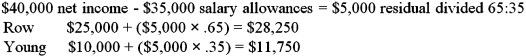

Partnership net income of $40,000 is to be divided between two partners,Reese Row and Andrew Young,according to the following arrangement: There will be salary allowances of $25,000 for Row and $10,000 for Young,with the remainder divided 65:35.How much of the net income will be distributed to Row and Young,respectively?

A) $27,500 and $12,500

B) $26,000 and $14,000

C) $28,250 and $11,750

D) $28,500 and $11,500

A) $27,500 and $12,500

B) $26,000 and $14,000

C) $28,250 and $11,750

D) $28,500 and $11,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

68

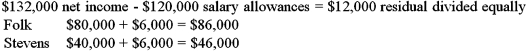

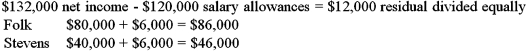

Partnership net income of $132,000 is to be divided between two partners,Jessie Folk and Jessica Stephens,according to the following arrangement: There will be salary allowances of $80,000 for Folk and $40,000 for Stephens,with the remainder divided equally.How much of the net income will be distributed to Folk and Stephens,respectively?

A) $88,000 and $44,000

B) $86,000 and $46,000

C) $84,000 and $48,000

D) $66,000 and $66,000

A) $88,000 and $44,000

B) $86,000 and $46,000

C) $84,000 and $48,000

D) $66,000 and $66,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

69

Danny Ortiz and Angela Hufford are partners,and each has a capital balance of $25,000.To gain admission to the partnership,Derek Peters pays $15,000 directly to Ortiz for one-half of his equity.After the admission of Peters,the total partners' equity in the records of the partnership will be

A) $65,000.

B) $62,500.

C) $50,000.

D) $75,000.

A) $65,000.

B) $62,500.

C) $50,000.

D) $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

70

The entry to record a partner's salary allowance consists of a debit to

A) the partner's capital account and a credit to Cash.

B) Salaries Expense and a credit to the partner's drawing account.

C) Income Summary and a credit to the partner's capital account.

D) Income Summary and a credit to the partner's drawing account.

A) the partner's capital account and a credit to Cash.

B) Salaries Expense and a credit to the partner's drawing account.

C) Income Summary and a credit to the partner's capital account.

D) Income Summary and a credit to the partner's drawing account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

71

The entry to record the equal distribution of net income between two partners consists of a debit to

A) Income Summary and a credit to each partner's capital account.

B) each partner's capital account and a credit to Cash.

C) Income Summary and a credit to each partner's drawing account.

D) each partner's capital account and a credit to Income Summary.

A) Income Summary and a credit to each partner's capital account.

B) each partner's capital account and a credit to Cash.

C) Income Summary and a credit to each partner's drawing account.

D) each partner's capital account and a credit to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements is correct?

A) If partners consider their cash withdrawals to be compensation for the work they do for the partnership,the amounts of the withdrawals should be charged to Salaries Expense.

B) If there is no specific agreement on the division of partnership profits and losses,they are divided equally among the partners.

C) If a salary is allowed to one partner,other partners also must receive a salary allowance.

D) None of these statements are correct.

A) If partners consider their cash withdrawals to be compensation for the work they do for the partnership,the amounts of the withdrawals should be charged to Salaries Expense.

B) If there is no specific agreement on the division of partnership profits and losses,they are divided equally among the partners.

C) If a salary is allowed to one partner,other partners also must receive a salary allowance.

D) None of these statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

73

Ben White and Lisa Caputi are partners,and each has a capital balance of $75,000.To gain admission to the partnership,Tim Smith pays $50,000 directly to White for one-half of his equity.After the admission of Smith,the total partners' equity in the records of the partnership will be

A) $150,000.

B) $130,000.

C) $125,000.

D) $100,000.

A) $150,000.

B) $130,000.

C) $125,000.

D) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

74

The partners' salary and interest allowances are recorded in

A) expense accounts.

B) drawing accounts.

C) capital accounts.

D) liability accounts.

A) expense accounts.

B) drawing accounts.

C) capital accounts.

D) liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

75

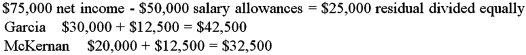

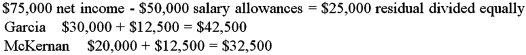

Partnership net income of $75,000 is to be divided between two partners,Bob Garcia and Jerry McKernan,according to the following arrangement: There will be salary allowances of $30,000 for Garcia and $20,000 for McKernan,with the remainder divided equally.How much of the net income will be distributed to Garcia and McKernan,respectively?

A) $40,000 and $30,000

B) $42,500 and $32,500

C) $45,000 and $35,000

D) $67,500 and $57,500

A) $40,000 and $30,000

B) $42,500 and $32,500

C) $45,000 and $35,000

D) $67,500 and $57,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

76

All of the following are included on the statement of partners' equities except

A) withdrawals.

B) additional investments.

C) salary allowances.

D) share of net income or net loss.

A) withdrawals.

B) additional investments.

C) salary allowances.

D) share of net income or net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

77

The salary and interest allowances in a partnership profit-sharing agreement can best be described as

A) expenses of the business that are deducted from revenue in the determination of net income.

B) amounts on which each partner will not have to pay income tax.

C) a means of distributing net income in relation to the services provided and the capital invested by each partner after which profits or losses are distributed as specified in the partnership agreement.

D) a legal requirement in order for a partnership to be formed.

A) expenses of the business that are deducted from revenue in the determination of net income.

B) amounts on which each partner will not have to pay income tax.

C) a means of distributing net income in relation to the services provided and the capital invested by each partner after which profits or losses are distributed as specified in the partnership agreement.

D) a legal requirement in order for a partnership to be formed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

78

Kara Johnson and Tyler Jones are partners,and each has a capital balance of $100,000.To gain admission to the partnership,Raiden Nash pays $60,000 directly to Johnson for one-half of her equity.After the admission of Nash,the total partners' equity in the records of the partnership will be

A) $200,000.

B) $250,000.

C) $260,000.

D) $300,000.

A) $200,000.

B) $250,000.

C) $260,000.

D) $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

79

If no other method of dividing net income or net losses is specified in the partnership agreement,it is divided

A) in relation to the partners' capital account balances.

B) in relation to the amount of time each partner devotes to the business.

C) in relation to the original investment by each partner.

D) equally.

A) in relation to the partners' capital account balances.

B) in relation to the amount of time each partner devotes to the business.

C) in relation to the original investment by each partner.

D) equally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

80

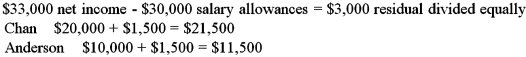

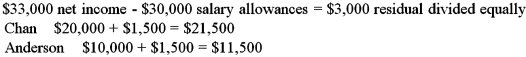

Partnership net income of $33,000 is to be divided between two partners,Elan Chan and Roy Anderson,according to the following arrangement: There will be salary allowances of $20,000 for Chan and $10,000 for Anderson,with the remainder divided equally.How much of the net income will be distributed to Chan and Anderson,respectively?

A) $22,000 and $11,000

B) $21,500 and $11,500

C) $16,500 and $16,500

D) $21,000 and $12,000

A) $22,000 and $11,000

B) $21,500 and $11,500

C) $16,500 and $16,500

D) $21,000 and $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck