Deck 11: Payroll Taxes, Deposits, and Reports

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

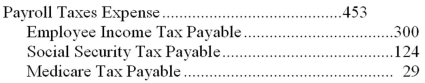

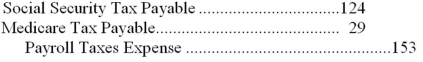

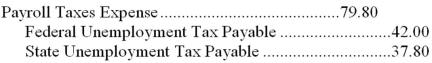

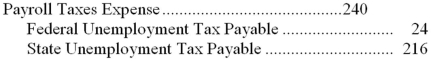

سؤال

سؤال

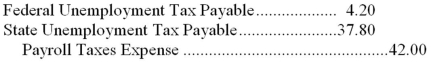

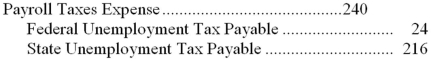

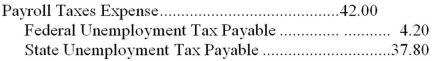

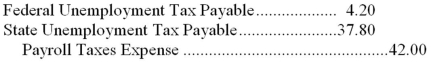

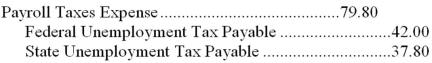

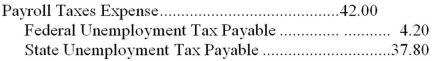

سؤال

سؤال

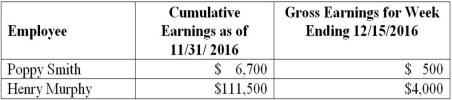

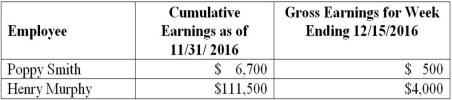

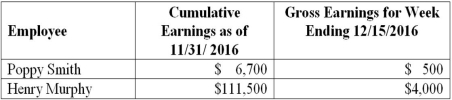

سؤال

سؤال

سؤال

سؤال

سؤال

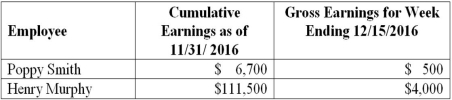

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/82

العب

ملء الشاشة (f)

Deck 11: Payroll Taxes, Deposits, and Reports

1

State Unemployment Tax Payable is ____________________ when the tax is paid to the state.

debited

2

The information for preparing Form W-2 is obtained from the employees' individual earnings records.

True

3

For the purpose of internal control,only the person who prepares payroll checks should distribute them.

False

4

If an employee leaves the firm before the end of the year,the employee may ask for and receive Form W-2 within 30 days after the request or after the final wage payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

5

Form 940 is used to report ____________________ taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

6

The entry to record the Social security and Medicare taxes levied on a business includes a debit to Payroll Taxes Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

7

Form ____________________ is often referred to as a withholding statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

8

The unemployment compensation tax program is often called the unemployment insurance program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

9

A business pays ____________________ and Medicare taxes at the same rate and on the same taxable wages as its employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

10

FUTA tax,like social security tax,is levied on both the employer and the employee and,therefore,is withheld from employee's pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

11

To achieve internal control over payroll operations,no changes in employee pay rates should be made without written authorization from management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

12

The entry to record the deposit of federal income taxes withheld includes a ____________________ to the Employee Income Tax Payable account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

13

At the end of each quarter,the individual earnings records are totaled.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

14

The entry to record the employer's payroll taxes would include a debit to an expense account and a credit to one or more liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

15

The frequency of deposits of federal income taxes withheld and social security and Medicare taxes is determined by the amount owed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

16

A business pays the social security tax at the same rate and on the same taxable wages as its employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

17

A firm must issue a Form ____________________ to each employee by January 31 of the year following the year during which the wages were earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

18

Form 940,which is used to report the employer's federal unemployment tax,must be filed quarterly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

19

Form 941 is used to report federal income taxes withheld,social security taxes,and ____________________ taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

20

The entry to record a payroll tax on the employer would include a debit to a(n)____________________ account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following forms is submitted with a copy of the Form W-2 for each employee to the Social Security Administration?

A) Form W-3

B) Form W-4

C) Form 940

D) Form 941

A) Form W-3

B) Form W-4

C) Form 940

D) Form 941

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

22

On Form 941,the Employer's Quarterly Federal Tax Return,a firm calculates its liability for the quarter for

A) federal income taxes withheld,social security and Medicare taxes,and FUTA taxes.

B) federal income taxes withheld and social security and Medicare taxes.

C) social security and Medicare taxes and FUTA taxes.

D) federal and state income taxes withheld.

A) federal income taxes withheld,social security and Medicare taxes,and FUTA taxes.

B) federal income taxes withheld and social security and Medicare taxes.

C) social security and Medicare taxes and FUTA taxes.

D) federal and state income taxes withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

23

Form 940 must be filed ____________________ time(s)a year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

24

The premium rate on workers' compensation insurance is determined by the ____________________ involved in the work performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

25

To record the deposit of FUTA tax,the accountant would

A) debit Payroll Taxes Expense and credit Federal Unemployment Tax Payable.

B) debit Payroll Taxes Expense and credit Cash.

C) debit Federal Unemployment Tax Payable and credit Cash.

D) debit Social Security Taxes Payable and credit Cash.

A) debit Payroll Taxes Expense and credit Federal Unemployment Tax Payable.

B) debit Payroll Taxes Expense and credit Cash.

C) debit Federal Unemployment Tax Payable and credit Cash.

D) debit Social Security Taxes Payable and credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is NOT correct?

A) The accountant obtains information about wages subject to payroll taxes from the payroll register.

B) Most commercial banks are authorized to accept the employee's tax deposits for federal income taxes withheld and the employer's and employees' shares of social security taxes.

C) Payroll tax deposits can be made electronically or using a Federal Tax Deposit Coupon,Form 8109.

D) The "lookback period",in regard to payroll taxes,is defined as the previous month.

A) The accountant obtains information about wages subject to payroll taxes from the payroll register.

B) Most commercial banks are authorized to accept the employee's tax deposits for federal income taxes withheld and the employer's and employees' shares of social security taxes.

C) Payroll tax deposits can be made electronically or using a Federal Tax Deposit Coupon,Form 8109.

D) The "lookback period",in regard to payroll taxes,is defined as the previous month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

27

A copy of the Form W-2 for each employee is submitted to the Social Security Administration along with

A) Form 940.

B) Form 941.

C) Form 8109.

D) Form W-3.

A) Form 940.

B) Form 941.

C) Form 8109.

D) Form W-3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

28

Employees' payments for federal income taxes withheld and social security and Medicare taxes are periodically

A) sent directly to the Internal Revenue Service.

B) deposited in a special-purpose bank account,controlled by the company,until year-end when the funds are sent to the U.S.Treasury Department.

C) sent to the local office of the Internal Revenue Service.

D) deposited in a government-authorized financial institution.

A) sent directly to the Internal Revenue Service.

B) deposited in a special-purpose bank account,controlled by the company,until year-end when the funds are sent to the U.S.Treasury Department.

C) sent to the local office of the Internal Revenue Service.

D) deposited in a government-authorized financial institution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

29

Form 941 is filed

A) monthly.

B) quarterly.

C) annually.

D) each payroll period.

A) monthly.

B) quarterly.

C) annually.

D) each payroll period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is correct?

A) Form 941 is often referred to as a withholding statement.

B) An employee must attach one copy of Form W-2 to his or her personal federal income tax return.

C) The employer sends one copy of the Form 941 for each employee to the Internal Revenue Service.

D) An employee must attach one copy of Form W-4 to his or her personal federal income tax return.

A) Form 941 is often referred to as a withholding statement.

B) An employee must attach one copy of Form W-2 to his or her personal federal income tax return.

C) The employer sends one copy of the Form 941 for each employee to the Internal Revenue Service.

D) An employee must attach one copy of Form W-4 to his or her personal federal income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

31

All of the following taxes are withheld from an employee's pay except

A) Federal income tax.

B) SUTA tax.

C) Medicare tax.

D) Social security tax.

A) Federal income tax.

B) SUTA tax.

C) Medicare tax.

D) Social security tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

32

Both the employer and the employee are responsible for paying

A) social security and Medicare taxes.

B) FUTA taxes.

C) social security,Medicare,and FUTA taxes.

D) SUTA taxes.

A) social security and Medicare taxes.

B) FUTA taxes.

C) social security,Medicare,and FUTA taxes.

D) SUTA taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is not correct?

A) A few states levy an unemployment tax on the employee that must be withheld from the employee's pay.

B) One of the purposes of the unemployment insurance program is to stabilize employment and reduce unemployment.

C) The reduction of state unemployment taxes because of favorable experience ratings reduces the credit allowable against the federal unemployment tax.

D) The unemployment insurance program is a federal program.

A) A few states levy an unemployment tax on the employee that must be withheld from the employee's pay.

B) One of the purposes of the unemployment insurance program is to stabilize employment and reduce unemployment.

C) The reduction of state unemployment taxes because of favorable experience ratings reduces the credit allowable against the federal unemployment tax.

D) The unemployment insurance program is a federal program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

34

To record a deposit of federal income taxes withheld and social security and Medicare taxes,the accountant would

A) debit an expense account and credit one or more liability accounts.

B) debit an asset account and credit an expense account.

C) debit one or more liability accounts and credit an asset account.

D) debit one or more expense accounts and credit one or more liability accounts.

A) debit an expense account and credit one or more liability accounts.

B) debit an asset account and credit an expense account.

C) debit one or more liability accounts and credit an asset account.

D) debit one or more expense accounts and credit one or more liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

35

Only the employer is responsible for paying

A) social security and Medicare taxes.

B) FUTA taxes.

C) social security,Medicare,and FUTA taxes.

D) federal income taxes.

A) social security and Medicare taxes.

B) FUTA taxes.

C) social security,Medicare,and FUTA taxes.

D) federal income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following taxes is not withheld from an employee's pay?

A) Federal income tax

B) Social security tax

C) FUTA tax

D) Medicare tax

A) Federal income tax

B) Social security tax

C) FUTA tax

D) Medicare tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

37

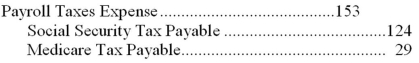

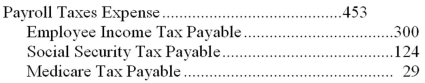

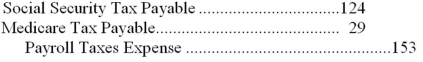

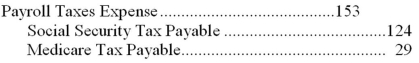

During the week ended June 15,Wiley Automotive's employees earned $2,000 of gross wages and had $300 of federal income tax withheld.All of their employees had already earned over $7,000 of gross wages for the year so none of their wages were subject to FUTA or SUTA tax.However,all of their wages were still subject to Social Security tax of 6.2% and Medicare tax of 1.45%.The journal entry to record Payroll Tax Expense for the pay period would be:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

38

The frequency of deposits of federal income taxes withheld and social security and Medicare taxes is most dependent on

A) the amount owed.

B) the number of payroll periods a firm has.

C) the profit reported by the firm.

D) the number of employees on the payroll.

A) the amount owed.

B) the number of payroll periods a firm has.

C) the profit reported by the firm.

D) the number of employees on the payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

39

Jackson Autos has one employee.As of March 30,their employee had already earned $6,300.For the pay period ending April 15,their employee earned an additional $4,000 of gross wages.Only the first $7,000 of annual earnings are subject to FUTA of .6% and SUTA of 5.4%.The journal entry to record the employer's unemployment payroll taxes for the period ending April 15,would be:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

40

Each employee of a firm will receive several copies of Form W-2,the Wage and Tax Statement,from the

A) employer with each paycheck.

B) employer once a year.

C) federal government once a year.

D) employer once a quarter.

A) employer with each paycheck.

B) employer once a year.

C) federal government once a year.

D) employer once a quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

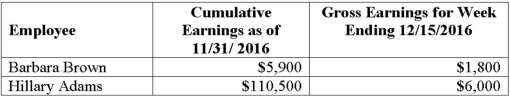

41

ABC Consulting had two employees with the following earnings information:  Use the table above and calculate the employer payroll income taxes associated with Henry's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

Use the table above and calculate the employer payroll income taxes associated with Henry's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

A) $194.40

B) $306.00

C) $546.00

D) $842.00

Use the table above and calculate the employer payroll income taxes associated with Henry's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

Use the table above and calculate the employer payroll income taxes associated with Henry's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.A) $194.40

B) $306.00

C) $546.00

D) $842.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

42

Rick O'Shea,the only employee of Hunter Furniture Company,makes $30,000 per year and is paid once a month.For the month of January,his federal income taxes withheld are $180,state income taxes withheld are $37,social security is 6.2% on a maximum wages of $113,700,Medicare tax is 1.45%,State Unemployment Tax is 4.2%,and Federal Unemployment tax is .6%,both on a maximum wages of $7,000 per employee.What is the employer's payroll tax expense associated with Rick's paycheck?

A) $120.00

B) $191.25

C) $311.25

D) $150.00

A) $120.00

B) $191.25

C) $311.25

D) $150.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

43

This preprinted government form is used to report federal unemployment taxes.

A) Form 940

B) Form 941

C) Form 8109

D) Form W-2

A) Form 940

B) Form 941

C) Form 8109

D) Form W-2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

44

To record the payment of SUTA tax,the accountant would

A) debit Payroll Taxes Expense and credit State Unemployment Tax Payable.

B) debit Payroll Taxes Expense and credit Cash.

C) debit Social Security Taxes Payable and credit Cash.

D) debit State Unemployment Tax Payable and credit Cash.

A) debit Payroll Taxes Expense and credit State Unemployment Tax Payable.

B) debit Payroll Taxes Expense and credit Cash.

C) debit Social Security Taxes Payable and credit Cash.

D) debit State Unemployment Tax Payable and credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

45

Tax returns for the federal unemployment tax are due

A) weekly.

B) monthly.

C) quarterly.

D) annually.

A) weekly.

B) monthly.

C) quarterly.

D) annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

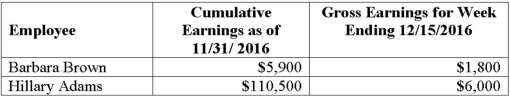

46

George's Gameroom had two employees with the following earnings information:  Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.

Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.

A) $2,500

B) $2,800

C) $3,200

D) $6,000

Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.

Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.A) $2,500

B) $2,800

C) $3,200

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

47

Kristy Casey earns $39,000 per year and is paid once a month.For January,she had $188 withheld from her pay for federal income taxes,and $52 withheld for health insurance.Social Security and is 6.2% and Medicare tax is 1.45%;the federal unemployment tax rate is .6% and state unemployment tax rates is 4.2%.What is the total employer payroll tax expense for Kristy's January paycheck?

A) $385.13

B) $162.50

C) $248.63

D) $404.63

A) $385.13

B) $162.50

C) $248.63

D) $404.63

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

48

Generally,the base earnings subject to state unemployment taxes is

A) smaller than the base for social security.

B) the same as the base for social security.

C) larger than the base for social security.

D) the amount of total earnings.

A) smaller than the base for social security.

B) the same as the base for social security.

C) larger than the base for social security.

D) the amount of total earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

49

Most states require that the employer file the state return for unemployment taxes

A) monthly.

B) quarterly.

C) annually.

D) each payroll period.

A) monthly.

B) quarterly.

C) annually.

D) each payroll period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

50

Jerry Little's gross wages as of October 31 were $110,000.He earned gross wages of $4,000 for the pay period ended November 15,2016.Deducted from his paycheck this period,were federal income taxes of $400,state income taxes of $150,social security of 6.2% on the first $113,700 and Medicare tax of 1.45%.State Unemployment Tax is 4%,and Federal Unemployment tax is .6% on the first $7,000 of annual earnings.Calculate the employer payroll income taxes associated with Jerry's November 15 paycheck.

A) $1,048.00

B) $498.00

C) $306.00

D) $287.40

A) $1,048.00

B) $498.00

C) $306.00

D) $287.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

51

Roy DeSoto earns a regular hourly salary of $24.50.He is paid time-and-a-half for all hours in excess of 40 in the week.For the week ended March 8,2016,he worked a total of 50 hours.His gross wages year to date prior to his March 8 paycheck are $11,980.Social Security Tax is 6.2%,Medicare Tax is 1.45%,federal unemployment tax is .6% and state unemployment tax is 4.2%,both on a maximum of $7,000 of gross wages per year.What is the employer's payroll tax expense for Roy for the week ended March 8,2016?

A) $154.96

B) $123.97

C) $170.47

D) $103.08

A) $154.96

B) $123.97

C) $170.47

D) $103.08

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

52

Alfred Spindle earned gross wages of $1,620 for the week ended June 21,2016.His gross wages year to date,prior to his June 21 paycheck,were $38,556.He had $88 withheld from his pay for federal income taxes,and $16 for health insurance.Social Security and is 6.2% and Medicare tax is 1.45%;the federal unemployment tax rate is .6% and the state unemployment tax rate is 4.2%,both on a maximum of $7,000 per each employee's annual earnings.What is the total employer payroll tax expense associated with Alfred's June 21,2016,paycheck?

A) $201.69

B) $123.93

C) $81.00

D) $0

A) $201.69

B) $123.93

C) $81.00

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

53

All of the following are internal control procedures that are recommended to protect payroll operations except

A) assign new employees to work in payroll operations.

B) keep payroll records in locked files.

C) make voluntary deductions from employee earnings based only on a signed authorization from the employee.

D) retain all Forms W-4.

A) assign new employees to work in payroll operations.

B) keep payroll records in locked files.

C) make voluntary deductions from employee earnings based only on a signed authorization from the employee.

D) retain all Forms W-4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

54

If at the end of the year the firm owes a balance for workers' compensation insurance,the adjusting entry includes a

A) debit to Workers' Compensation Insurance Payable a credit to Workers' Compensation Insurance Expense.

B) a debit to Workers' Compensation Refund Receivable and a credit to Workers' Compensation Insurance Expense.

C) a debit to Workers' Compensation Insurance Expense and a credit to Workers' Compensation Insurance Payable.

D) a debit to Payroll Taxes Expense and a credit to cash.

A) debit to Workers' Compensation Insurance Payable a credit to Workers' Compensation Insurance Expense.

B) a debit to Workers' Compensation Refund Receivable and a credit to Workers' Compensation Insurance Expense.

C) a debit to Workers' Compensation Insurance Expense and a credit to Workers' Compensation Insurance Payable.

D) a debit to Payroll Taxes Expense and a credit to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is not an employer payroll tax:

A) federal unemployment tax

B) federal income tax

C) state unemployment tax

D) FICA (Social Security and Medicare)

A) federal unemployment tax

B) federal income tax

C) state unemployment tax

D) FICA (Social Security and Medicare)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

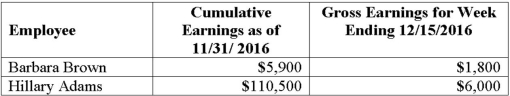

56

George's Gameroom had two employees with the following earnings information:  Use the table above and calculate how much of Barbara's December 15 paycheck is still subject to state unemployment tax given that the rate is 4% and federal unemployment tax is .6% and both taxes are levied on only the first $7,000 of each employee's annual earnings.

Use the table above and calculate how much of Barbara's December 15 paycheck is still subject to state unemployment tax given that the rate is 4% and federal unemployment tax is .6% and both taxes are levied on only the first $7,000 of each employee's annual earnings.

A) $700

B) $5,900

C) $1,800

D) $1,100

Use the table above and calculate how much of Barbara's December 15 paycheck is still subject to state unemployment tax given that the rate is 4% and federal unemployment tax is .6% and both taxes are levied on only the first $7,000 of each employee's annual earnings.

Use the table above and calculate how much of Barbara's December 15 paycheck is still subject to state unemployment tax given that the rate is 4% and federal unemployment tax is .6% and both taxes are levied on only the first $7,000 of each employee's annual earnings.A) $700

B) $5,900

C) $1,800

D) $1,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

57

Employers usually record unemployment taxes at the end of each

A) payroll.

B) month.

C) quarter.

D) year.

A) payroll.

B) month.

C) quarter.

D) year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

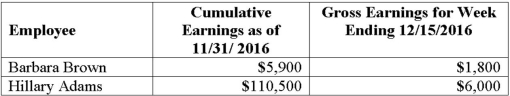

58

ABC Consulting had two employees with the following earnings information:  Use the table above and calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

Use the table above and calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

A) $622.65

B) $68.25

C) $56.25

D) $23.45

Use the table above and calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

Use the table above and calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.A) $622.65

B) $68.25

C) $56.25

D) $23.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

59

Mr.Zee worked 48 hours during the week ended January 18,2016.He is paid $10 per hour,and is paid time and a half for all hours over 40 in a week.He had $100 withheld from his pay for federal income taxes,and $20 withheld for health insurance.The combined social security and Medicare tax rate is 7.65%,and the federal and state unemployment tax rates are .6% and 3.8%,respectively.All earnings are taxable.What is the total employer payroll tax expense for Mr.Zee's current paycheck.

A) $62.66

B) $57.84

C) $82.66

D) $182.66

A) $62.66

B) $57.84

C) $82.66

D) $182.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

60

Samantha Rodriguez had gross earnings for the pay period ending 10/15/16 of $4,785.Her total gross earnings as of 9/30/16 were $111,400.Social Security taxes are 6.2% on a maximum earnings of $113,700 per year.The Social Security tax due by her employer from her 10/15/16 paychecks is:

A) $297.67

B) $142.60

C) $154.07

D) $192.75

A) $297.67

B) $142.60

C) $154.07

D) $192.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

61

The payroll register of the Hound Manufacturing Company showed total employee earnings of $36,000 for the week ended September 20,2016.Compute each of the employer's payroll taxes for the period.Use a rate of 6.2 percent for the employer's share of the social security tax,1.45 percent for Medicare tax,0.6 percent for FUTA tax,and 5.4 percent for SUTA tax.Assume all earnings are taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

62

After the ABC Corporation paid its employees on June 15,2016,and recorded the corporation's share of payroll taxes for the payroll paid that date,the firm's general ledger showed a balance of $1,620 in the Social Security Tax Payable account,a balance of $401 in the Medicare Tax Payable account,and a balance of $1,851 in the Employee Income Tax Payable account.On June 16,2016,the business issued a check to deposit the taxes owed in the local bank.Record this transaction on page 15 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

63

Compute and record workers' compensation insurance premiums for Fairlawn Manufacturing as follows:

1.The firm estimates that its office employees will earn $46,000 next year and its factory employees will earn $162,000.The firm pays the following rates for workers' compensation insurance: $0.40 per $100 of wages for the office employees and $3.50 per $100 of wages for the factory employees.Compute the estimated premiums for 2016.On page 9 of a general journal,record the payment of the estimated premium.Date the entry January 12,2016.

2.On January 3,2017,an audit of the firm's payroll records for 2016 showed that the firm had actually paid wages of $48,000 to its office employees and $165,000 to its factory employees.Compute the actual premium for the year and the balance due the insurance company or the credit due the firm.In the general journal,record the entry to adjust the Workers' Compensation Insurance Expense as of the end of 2016.Date the entry December 31,2016.

1.The firm estimates that its office employees will earn $46,000 next year and its factory employees will earn $162,000.The firm pays the following rates for workers' compensation insurance: $0.40 per $100 of wages for the office employees and $3.50 per $100 of wages for the factory employees.Compute the estimated premiums for 2016.On page 9 of a general journal,record the payment of the estimated premium.Date the entry January 12,2016.

2.On January 3,2017,an audit of the firm's payroll records for 2016 showed that the firm had actually paid wages of $48,000 to its office employees and $165,000 to its factory employees.Compute the actual premium for the year and the balance due the insurance company or the credit due the firm.In the general journal,record the entry to adjust the Workers' Compensation Insurance Expense as of the end of 2016.Date the entry December 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

64

After the Marion Corporation paid its employees on November 15,2016,and recorded the corporation's share of payroll taxes for the payroll paid that date,the firm's general ledger showed a balance of $1,925 in the Social Security Tax Payable account,a balance of $519 in the Medicare Tax Payable account,and a balance of $2,105 in the Employee Income Tax Payable account.On November 16,2016,the business issued a check to deposit the taxes owed in the local bank.Record this transaction on page 5 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

65

Wharfside Manufacturing estimates that its office employees will earn $50,000 next year and its factory employees will earn $260,000.The firm pays the following rates for workers' compensation insurance: $0.37 per $100 of wages for the office employees and $4.00 per $100 of wages for the factory employees.Compute the estimated premiums for the office and factory employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

66

The payroll register of the Retro Manufacturing Company showed total employee earnings of $25,000 for the week ended January 18,2016.Compute the employer's payroll taxes for the period.Use a rate of 6.2 percent for the employer's share of the social security tax,1.45 percent for Medicare tax,0.6 percent for FUTA tax,and 5.4 percent for SUTA tax.Assume all earnings are taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

67

The payroll register of Vtech Enterprises showed total employee earnings of $2,100 for the week ended August 2,2016.Compute the employer's payroll taxes for the period.The tax rates are: Social security tax,6.2 percent;Medicare tax,1.45 percent;FUTA tax,0.6 percent;SUTA tax,2.2 percent.All earnings are taxable.Record the employer's payroll taxes for the period on page 4 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

68

Mary Gonzalez had total cumulative gross earnings of $4,500 as of 1/30.Her gross earnings for the pay period ending 2/15 were $3,000.If federal unemployment taxes are .6% on a maximum earnings of $7,000 per year,how much federal unemployment tax will be paid by Mary and how much will be paid by her employer for her earnings of 2/15?

A) Mary will pay $0 and her employer will pay $15.

B) Mary will pay $0 and her employer will pay $18.

C) Mary will pay $15 and her employer will also pay $15.

D) Mary will pay $0 and her employer will pay $3.

A) Mary will pay $0 and her employer will pay $15.

B) Mary will pay $0 and her employer will pay $18.

C) Mary will pay $15 and her employer will also pay $15.

D) Mary will pay $0 and her employer will pay $3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

69

The payroll register of Reynolds Company showed total employee earnings of $2,320 for the week ended May 10,2016.Compute the employer's payroll taxes for the period.The tax rates are: Social security tax,6.2 percent;Medicare tax,1.45 percent;FUTA tax,0.6 percent;SUTA tax,2.2 percent.All earnings are taxable.Record the employer's payroll taxes for the period on page 4 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

70

For which of the following is there no limit to the amount of wages subject to the tax?

A) federal unemployment tax

B) Medicare tax

C) state unemployment tax

D) Social Security tax

A) federal unemployment tax

B) Medicare tax

C) state unemployment tax

D) Social Security tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following payroll taxes is not paid by the employee?

A) federal unemployment tax

B) federal income tax

C) state income tax

D) FICA (Social Security and Medicare)

A) federal unemployment tax

B) federal income tax

C) state income tax

D) FICA (Social Security and Medicare)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

72

After the JPR Corporation paid its employees on May 15,2016,and recorded the corporation's share of payroll taxes for the payroll paid that date,the firm's general ledger showed a balance of $1,730 in the Social Security Tax Payable account,a balance of $356 in the Medicare Tax Payable account,and a balance of $1,972 in the Employee Income Tax Payable account.On May 16,2016,the business issued a check to deposit the taxes owed in the local bank.Record this transaction on page 7 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

73

Identify the list of accounts below that would normally all have a credit balance.

A) Payroll Taxes Expense,State Unemployment Tax Payable,Wages Payable

B) Worker's Compensation Insurance Expense,Prepaid Insurance,Medicare Tax Payable

C) Worker's Compensation Insurance Payable,Salaries Payable,Salaries Expense

D) Social Security Tax Payable,Medicare Tax Payable,Employee Income Tax Payable

A) Payroll Taxes Expense,State Unemployment Tax Payable,Wages Payable

B) Worker's Compensation Insurance Expense,Prepaid Insurance,Medicare Tax Payable

C) Worker's Compensation Insurance Payable,Salaries Payable,Salaries Expense

D) Social Security Tax Payable,Medicare Tax Payable,Employee Income Tax Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

74

Orleans Manufacturing estimates that its office employees will earn $75,000 next year and its factory employees will earn $200,000.The firm pays the following rates for workers' compensation insurance: $0.55 per $100 of wages for the office employees and $4.75 per $100 of wages for the factory employees.Compute the estimated premiums for the office and factory employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

75

The payroll register of Burdick Travel Agency showed total employee earnings of $1,450 for the week ended June 7,2016.Compute the employer's payroll taxes for the period.The tax rates are: Social security tax,6.2 percent;Medicare tax,1.45 percent;FUTA tax,0.6 percent;SUTA tax,2.2 percent.All earnings are taxable.Record the employer's payroll taxes for the period on page 4 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following payroll taxes is not paid by the employee?

A) federal unemployment tax

B) federal income tax

C) state income tax

D) FICA (Social Security and Medicare)

A) federal unemployment tax

B) federal income tax

C) state income tax

D) FICA (Social Security and Medicare)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

77

The payroll register of the Fox Manufacturing Company showed total employee earnings of $28,000 for the week ended April 19,2016.Compute each of the employer's payroll taxes for the period.Use a rate of 6.2 percent for the employer's share of the social security tax,1.45 percent for Medicare tax,0.6 percent for FUTA tax,and 5.4 percent for SUTA tax.Assume all earnings are taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

78

After the Mansley Company paid its employees on July 15,2016,and recorded the corporation's share of payroll taxes for the payroll paid that date,the firm's general ledger showed a balance of $1,695 in the Social Security Tax Payable account,a balance of $321 in the Medicare Tax Payable account,and a balance of $1,968 in the Employee Income Tax Payable account.On July 16,2016,the business issued a check to deposit the taxes owed in the local bank.Record this transaction on page 23 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

79

The payroll register of Rapid Repairs showed total employee earnings of $1,870 for the week ended April 5,2016.Compute the employer's payroll taxes for the period.The tax rates are: Social security tax,6.2 percent;Medicare tax,1.45 percent;FUTA tax,0.6 percent;SUTA tax,2.2 percent.All earnings are taxable.Record the employer's payroll taxes for the period on page 4 of a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

80

Beachside Manufacturing estimates that its office employees will earn $54,000 next year and its factory employees will earn $280,000.The firm pays the following rates for workers' compensation insurance: $0.40 per $100 of wages for the office employees and $4.10 per $100 of wages for the factory employees.Compute the estimated premiums for the office and factory employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck