Deck 3: Computing the Tax

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/185

العب

ملء الشاشة (f)

Deck 3: Computing the Tax

1

An increase in a taxpayer's AGI could decrease the amount of charitable contribution that can be claimed.

False

2

Many taxpayers who previously itemized will start claiming the standard deduction when they purchase a home.

False

3

After Ellie moves out of the apartment she had rented as her personal residence, she recovers her damage deposit of $1,000. The $1,000 is not income to Ellie.

True

4

An "above the line" deduction refers to a deduction for AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

5

The additional standard deduction for age and blindness is greater for married taxpayers than for single taxpayers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

6

All exclusions from gross income are reported on Form 1040.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

7

The filing status of a taxpayer (e.g., single, head of household) must be identified before the applicable standard deduction is determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

8

Claude's deductions from AGI exceed the standard deduction allowed for 2014. Under these circumstances, Claude cannot claim the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

9

As opposed to itemizing deductions from AGI, the majority of individual taxpayers choose the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

10

The basic and additional standard deductions both are subject to an annual adjustment for inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under the Federal income tax formula for individuals, a choice must be made between claiming deductions for AGI and itemized deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

12

Because they appear on page 1 of Form 1040, itemized deductions are also referred to as "page 1 deductions."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

13

Lee, a citizen of Korea, is a resident of the U.S. Any rent income Lee receives from land he owns in Korea is not subject to the U.S. income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

14

Once they reach age 65, many taxpayers will switch from itemizing their deductions from AGI and start claiming the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the Federal income tax formula for individuals, the determination of adjusted gross income (AGI) precedes that of taxable income (TI).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

16

A decrease in a taxpayer's AGI could increase the amount of medical expenses that can be deducted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

17

Jason and Peg are married and file a joint return. Both are over 65 years of age and Jason is blind. Their standard deduction for 2014 is $16,000 ($12,400 + $1,200 + $1,200 + $1,200).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

18

In 2014, Ed is 66 and single. If he has itemized deductions of $7,400, he should not claim the standard deduction alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

19

Howard, age 82, dies on January 2, 2014. On Howard's final income tax return, the full amount of the basic and additional standard deductions will be allowed even though Howard lived for only 2 days during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the income tax formula, a taxpayer must choose between deductions for AGI and the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

21

Dan and Donna are husband and wife and file separate returns for the year. If Dan itemizes his deductions from AGI, Donna cannot claim the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

22

Lucas, age 17 and single, earns $6,000 during 2014. Lucas's parents cannot claim him as a dependent if he does not live with them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

23

Buddy and Hazel are ages 72 and 71 and file a joint return. If they have itemized deductions of $14,600 for 2014, they should not claim the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

24

In 2014, Hal furnishes more than half of the support of his ex-wife and her father, both of whom live with him. The divorce occurred in 2013. Hal may claim the father-in-law and the ex-wife as dependents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

25

Clara, age 68, claims head of household filing status. If she has itemized deductions of $10,250 for 2014, she should not claim the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

26

Benjamin, age 16, is claimed as a dependent by his parents. During 2014, he earned $700 at a car wash.

Benjamin's standard deduction is $1,350 ($1,000 + $350).

Benjamin's standard deduction is $1,350 ($1,000 + $350).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

27

A dependent cannot claim a personal exemption on his or her own return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

28

Derek, age 46, is a surviving spouse. If he has itemized deductions of $12,700 for 2014, Derek should not claim the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

29

Debby, age 18, is claimed as a dependent by her mother. During 2014, she earned $1,100 in interest income on a savings account. Debby's standard deduction is $1,450 ($1,100 + $350).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

30

Katrina, age 16, is claimed as a dependent by her parents. During 2014, she earned $5,600 as a checker at a grocery store. Her standard deduction is $5,950 ($5,600 earned income + $350).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

31

Butch and Minerva are divorced in December of 2014. Since they were married for more than one-half of the year, they are considered as married for 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

32

Roy and Linda were divorced in 2013. The divorce decree awards custody of their children to Linda but is silent as to who is entitled to claim them as dependents. If Roy furnished more than half of their support, he can claim them as dependents in 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

33

Monique is a resident of the U.S. and a citizen of France. If she files a U.S. income tax return, Monique cannot claim the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

34

After her divorce, Hope continues to support her exhusband's sister, Cindy, who does not live with her. Hope can claim Cindy as a dependent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

35

For the year a spouse dies, the surviving spouse is considered married for the entire year for income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

36

Darren, age 20 and not disabled, earns $4,000 during 2014. Darren's parents cannot claim him as a dependent unless he is a full-time student.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

37

When separate income tax returns are filed by married taxpayers, one spouse cannot claim the other spouse as an exemption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

38

In determining whether the gross income test is met for dependency exemption purposes, only the taxable portion of a scholarship is considered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

39

Using borrowed funds from a mortgage on her home, Leah provides 52% of her own support, while her sons furnished the rest. Leah can be claimed as a dependent under a multiple support agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

40

Albert buys his mother a TV. For purposes of meeting the support test, Albert cannot include the cost of the TV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

41

Surviving spouse filing status begins in the year in which the deceased spouse died.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

42

When the kiddie tax applies and the parents are divorced, the applicable parent (for determining the parental tax) is the one with the greater taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

43

Currently, the top income tax rate in effect is not the highest it has ever been.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

44

An individual taxpayer uses a fiscal year March 1February 28. The due date of this taxpayer's Federal income tax return is May 15 of each tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

45

For tax purposes, married persons filing separate returns are treated the same as single taxpayers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

46

Katelyn is divorced and maintains a household in which she and her daughter, Crissa, live. Crissa, age 22, earns $11,000 during 2014 as a model. Katelyn does not qualify for head of household filing status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

47

Since an abandoned spouse is treated as not married and has one or more dependent children, he or she qualifies for the standard deduction available to head of household.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

48

Kim, a resident of Oregon, supports his parents who are residents of Canada but citizens of Korea. Kim can claim his parents as dependents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

49

In terms of income tax consequences, abandoned spouses are treated the same way as married persons filing separate returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

50

Once a child reaches age 19, the kiddie tax no longer applies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

51

Married taxpayers who file a joint return cannot later (i.e., after the filing due date) switch to separate returns for that year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

52

Married taxpayers who file separately cannot later (i.e., after the due date for filing) change to a joint return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

53

In terms of timing as to any one year, the Tax Tables are available before the Tax Rate Schedules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

54

In January 2014, Jake's wife dies and he does not remarry. For tax year 2014, Jake may not be able to use the filing status available to married persons filing joint returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

55

Ed is divorced and maintains a home in which he and a dependent friend live. Ed does not qualify for head of household filing status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

56

The kiddie tax does not apply to a child whose earned income is more than one-half of his or her support.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

57

Sarah furnishes more than 50% of the support of her son and daughter-in-law who live with her. If the son and daughter-in-law file a joint return, Sarah cannot claim them as dependents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

58

For dependents who have income, special filing requirements apply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

59

A taxpayer who itemizes must use Form 1040, and cannot use Form 1040EZ or Form 1040A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

60

In determining the filing requirement based on gross income received, both additional standard deductions (i.e., age and blindness) are taken into account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

61

In terms of the tax formula applicable to individual taxpayers, which, if any, of the following statements is correct?

A) In arriving at AGI, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

B) In arriving at taxable income, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

C) If a taxpayer has deductions for AGI, the standard deduction is not available.

D) In arriving at taxable income, a taxpayer must elect between deductions for AGI and the standard deduction.

E) None of the above.

A) In arriving at AGI, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

B) In arriving at taxable income, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

C) If a taxpayer has deductions for AGI, the standard deduction is not available.

D) In arriving at taxable income, a taxpayer must elect between deductions for AGI and the standard deduction.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

62

For 2014, Stuart has a short-term capital loss, a collectible long-term capital gain, and a long-term capital gain from land held as investment. The short-term loss is first applied to the collectible capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

63

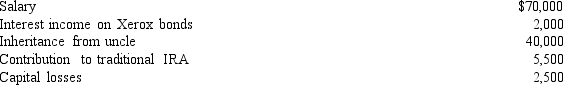

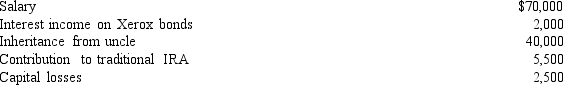

During 2014, Esther had the following transactions:

Esther's AGI is:

Esther's AGI is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

64

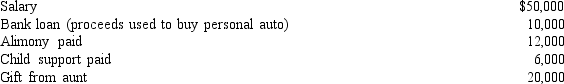

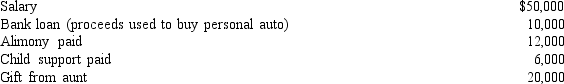

During 2014, Marvin had the following transactions:

Marvin's AGI is:

Marvin's AGI is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

65

Regarding the tax formula and its relationship to Form 1040, which, if any, of the following statements is correct?

A) Most exclusions from gross income are reported on page 2 of Form 1040.

B) An "above the line deduction" refers to a deduction from AGI.

C) A "page 1 deduction" refers to a deduction for AGI.

D) The taxable income (TI) amount appears both at the bottom of page 1 and at the top of page 2 of Form 1040.

E) None of the above.

A) Most exclusions from gross income are reported on page 2 of Form 1040.

B) An "above the line deduction" refers to a deduction from AGI.

C) A "page 1 deduction" refers to a deduction for AGI.

D) The taxable income (TI) amount appears both at the bottom of page 1 and at the top of page 2 of Form 1040.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

66

In 2014, Frank sold his personal use automobile for a loss of $9,000. He also sold a personal coin collection for a gain of $10,000. As a result of these sales, $10,000 is subject to income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which, if any, of the statements regarding the standard deduction is correct?

A) Some taxpayers may qualify for two types of standard deductions.

B) Not available to taxpayers who choose to deduct their personal and dependency exemptions.

C) May be taken as a for AGI deduction.

D) The basic standard deduction is indexed for inflation but the additional standard deduction is not.

E) None of the above.

A) Some taxpayers may qualify for two types of standard deductions.

B) Not available to taxpayers who choose to deduct their personal and dependency exemptions.

C) May be taken as a for AGI deduction.

D) The basic standard deduction is indexed for inflation but the additional standard deduction is not.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

68

In 2014, Cindy had the following transactions:

Cindy's AGI is:

Cindy's AGI is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

69

In terms of the tax formula applicable to individual taxpayers, which, if any, of the following statements is correct?

A) In arriving at taxable income, a taxpayer must choose between the standard deduction and deductions from AGI.

B) In arriving at AGI, personal and dependency exemptions must be subtracted from gross income.

C) In arriving at taxable income, a taxpayer must choose between the standard deduction and claiming personal and dependency exemptions.

D) The formula does not apply if a taxpayer elects to claim the standard deduction.

E) None of the above.

A) In arriving at taxable income, a taxpayer must choose between the standard deduction and deductions from AGI.

B) In arriving at AGI, personal and dependency exemptions must be subtracted from gross income.

C) In arriving at taxable income, a taxpayer must choose between the standard deduction and claiming personal and dependency exemptions.

D) The formula does not apply if a taxpayer elects to claim the standard deduction.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

70

During 2014, Sarah had the following transactions:

Sarah's AGI is:

A)

B)

C)

D)

E)

Sarah's AGI is:

A)

B)

C)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

71

Gain on the sale of collectibles held for more than 12 months always is subject to a tax rate of 28%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

72

When the kiddie tax applies, the child need not file an income tax return because the child's income will be reported on the parents' return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

73

A child who has unearned income of $2,000 or less cannot be subject to the kiddie tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which, if any, of the following is a deduction for AGI?

A) State and local sales taxes.

B) Interest on home mortgage.

C) Charitable contributions.

D) Unreimbursed moving expenses of an employee.

E) None of the above.

A) State and local sales taxes.

B) Interest on home mortgage.

C) Charitable contributions.

D) Unreimbursed moving expenses of an employee.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following items, if any, is deductible?

A) Parking expenses incurred in connection with jury duty-taxpayer is a dentist.

B) Substantiated gambling losses (not in excess of gambling winnings) from state lottery.

C) Contributions to mayor's reelection campaign.

D) Speeding ticket incurred while on business.

E) Premiums paid on personal life insurance policy.

A) Parking expenses incurred in connection with jury duty-taxpayer is a dentist.

B) Substantiated gambling losses (not in excess of gambling winnings) from state lottery.

C) Contributions to mayor's reelection campaign.

D) Speeding ticket incurred while on business.

E) Premiums paid on personal life insurance policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

76

Sylvia, age 17, is claimed by her parents as a dependent. During 2014, she had interest income from a bank savings account of $2,000 and income from a parttime job of $4,200. Sylvia's taxable income is:

A) $4,200 - $4,550 = $0.

B) $6,200 - $5,700 = $500.

C) $6,200 - $4,550 = $1,650.

D) $6,200 - $1,000 = $5,200.

E) None of the above.

A) $4,200 - $4,550 = $0.

B) $6,200 - $5,700 = $500.

C) $6,200 - $4,550 = $1,650.

D) $6,200 - $1,000 = $5,200.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

77

Tony, age 15, is claimed as a dependent by his grandmother. During 2014, Tony had interest income from Boeing Corporation bonds of $1,000 and earnings from a parttime job of $700. Tony's taxable income is:

A) $1,700.

B) $1,700 - $700 - $1,000 = $0.

C) $1,700 - $1,050 = $650.

D) $1,700 - $1,000 = $700.

E) None of the above.

A) $1,700.

B) $1,700 - $700 - $1,000 = $0.

C) $1,700 - $1,050 = $650.

D) $1,700 - $1,000 = $700.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

78

A child who is married cannot be subject to the kiddie tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which, if any, of the following statements relating to the standard deduction is correct?

A) If a taxpayer dies during the year, his (or her) standard deduction must be prorated.

B) If a taxpayer is claimed as a dependent of another, his (or her) additional standard deduction is allowed in full (i.e., no adjustment is necessary).

C) If spouses file separate returns, both spouses must claim the standard deduction (rather than itemize their deductions from AGI).

D) If a taxpayer is claimed as a dependent of another, no basic standard deduction is allowed.

E) None of the above.

A) If a taxpayer dies during the year, his (or her) standard deduction must be prorated.

B) If a taxpayer is claimed as a dependent of another, his (or her) additional standard deduction is allowed in full (i.e., no adjustment is necessary).

C) If spouses file separate returns, both spouses must claim the standard deduction (rather than itemize their deductions from AGI).

D) If a taxpayer is claimed as a dependent of another, no basic standard deduction is allowed.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which, if any, of the following is a deduction for AGI?

A) Contributions to a traditional Individual Retirement Account.

B) Child support payments.

C) Funeral expenses.

D) Loss on the sale of a personal residence.

E) Medical expenses.

A) Contributions to a traditional Individual Retirement Account.

B) Child support payments.

C) Funeral expenses.

D) Loss on the sale of a personal residence.

E) Medical expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck