Deck 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/64

العب

ملء الشاشة (f)

Deck 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations

1

Which of the following is not an example of general and educational expenses recorded by a college or university?

A) purchase of sweatshirts for sale in the college bookstore

B) expenses paid for instructors in the continuing education, non-degree program

C) consultant fees paid for a report on increasing the enrollment

D) salary of the football coach

A) purchase of sweatshirts for sale in the college bookstore

B) expenses paid for instructors in the continuing education, non-degree program

C) consultant fees paid for a report on increasing the enrollment

D) salary of the football coach

A

2

A public university's long-term bonds issued to build dormitories would be recorded in the

A) Current-Unrestricted Fund.

B) Agency Fund.

C) Retirement of Indebtedness Plant Fund.

D) Investment in Plant Fund.

A) Current-Unrestricted Fund.

B) Agency Fund.

C) Retirement of Indebtedness Plant Fund.

D) Investment in Plant Fund.

D

3

Farley College budgets funds for the maintenance and repair of its buildings. Where would these funds be accounted for?

A) Unexpended Plant Fund

B) Renewal and Replacement

C) Retirement of Indebtedness

D) Investment in Plant

A) Unexpended Plant Fund

B) Renewal and Replacement

C) Retirement of Indebtedness

D) Investment in Plant

B

4

Currently, which organization has jurisdiction over accounting and reporting standards for private colleges and universities?

A) National Association of College and University Business Officers

B) the Governmental Accounting Standards Board

C) the Financial Accounting Standards Board

D) the U.S. Department of Education

A) National Association of College and University Business Officers

B) the Governmental Accounting Standards Board

C) the Financial Accounting Standards Board

D) the U.S. Department of Education

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is a mandatory transfer by a University?

A) preliminary design fees to an architect to plan a building

B) purchase of land

C) principal and interest payments on long-term debt

D) dormitory maintenance.

A) preliminary design fees to an architect to plan a building

B) purchase of land

C) principal and interest payments on long-term debt

D) dormitory maintenance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

6

The loan fund would account for loans

A) to hospital patients.

B) to purchase assets.

C) to University students.

D) due to another fund.

A) to hospital patients.

B) to purchase assets.

C) to University students.

D) due to another fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

7

Al Alumni donates $5,000,000 to Great University for a new Women's Studies program. Al wants the principal to remain intact but the investment earnings can be expended to support the Women's Studies Program. This donation would be accounted for in the

A) Quasi-Endowment Fund.

B) Endowment Fund.

C) Term Endowment Fund.

D) Agency Fund.

A) Quasi-Endowment Fund.

B) Endowment Fund.

C) Term Endowment Fund.

D) Agency Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

8

With the adoption of GASB statement #35 in 1999, public colleges and universities are required to report their activities in a manner more like a(n):

A) general fund

B) special revenue fund

C) enterprise fund

D) fiduciary fund

A) general fund

B) special revenue fund

C) enterprise fund

D) fiduciary fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

9

The quasi-endowment fund of a University would account for funds set aside by

A) the governing board of the University for a future purpose.

B) a donor who is uncertain how they want the funds spent.

C) a legal restriction on an endowment which may change.

D) a trustee who makes the donation contingent upon a future event.

A) the governing board of the University for a future purpose.

B) a donor who is uncertain how they want the funds spent.

C) a legal restriction on an endowment which may change.

D) a trustee who makes the donation contingent upon a future event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

10

Income earned on restricted endowment resources should

A) remain in the endowment fund.

B) be transferred and recorded directly in the unrestricted fund.

C) be recorded in the endowment fund with a liability established for future transfer to an unrestricted fund.

D) transferred immediately and recorded directly to the fund the donor designate to receive the income/benefit.

A) remain in the endowment fund.

B) be transferred and recorded directly in the unrestricted fund.

C) be recorded in the endowment fund with a liability established for future transfer to an unrestricted fund.

D) transferred immediately and recorded directly to the fund the donor designate to receive the income/benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

11

Government grants, like Pell Grants, which are essentially pass through financial aid to students are accounted for as

A) temporary restricted funds

B) unrestricted funds

C) loan funds

D) agency transactions

A) temporary restricted funds

B) unrestricted funds

C) loan funds

D) agency transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is the basis of accounting used in accounting for not-for-profit universities?

A) fund accounting

B) accrual basis

C) modified accrual basis

D) cash basis

A) fund accounting

B) accrual basis

C) modified accrual basis

D) cash basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is NOT an example of one of the major categories of funds for a college or university?

A) current funds

B) proprietary funds

C) plant funds

D) trust and agency funds

A) current funds

B) proprietary funds

C) plant funds

D) trust and agency funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

14

Where should an alumnus contribution of $10,000 to pay for scholarships for international study-abroad be accounted for?

A) scholarship fund

B) current-unrestricted fund

C) current-restricted fund

D) loan fund

A) scholarship fund

B) current-unrestricted fund

C) current-restricted fund

D) loan fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following receipts should be recorded in the restricted-current fund of a public university?

A) endowment income to provide for faculty travel

B) a cash donation to provide loans to students

C) a cash donation to provide scholarships

D) a term endowment

A) endowment income to provide for faculty travel

B) a cash donation to provide loans to students

C) a cash donation to provide scholarships

D) a term endowment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under new governmental standards, which of the following financial statements is required for the annual financial reports of public colleges and universities?

A) statement of revenues, expenses, and changes in net assets

B) statement of activities

C) single audit report

D) statement of changes in fund balances

A) statement of revenues, expenses, and changes in net assets

B) statement of activities

C) single audit report

D) statement of changes in fund balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

17

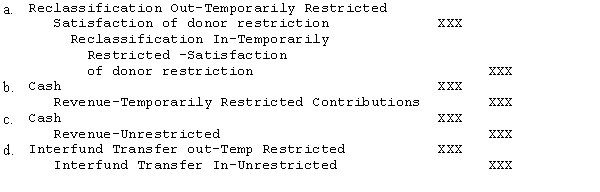

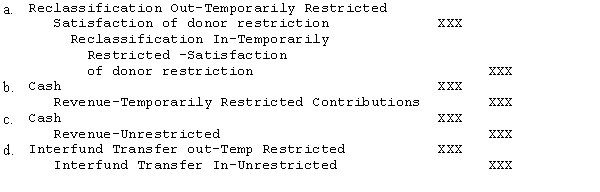

As expenses are made in compliance with donor restrictions on previously made contributions, what type of journal entry must be made to record the transaction from the aspect of the current, unrestricted fund?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is NOT an example of Educational and General Revenue in a college or university?

A) student athletic fees

B) room and board fees received by the dormitory

C) governmental grants

D) endowment income

A) student athletic fees

B) room and board fees received by the dormitory

C) governmental grants

D) endowment income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

19

Frank Bowers decides to contribute $1,000,000 to his almamater. Cape University agrees to pay Frank a fixed amount every month for the next 20 years in exchange for the donation. Frank's donation would be accounted for in the

A) Annuity Fund.

B) Endowment Fund.

C) Restricted Current Fund.

D) Agency Fund.

A) Annuity Fund.

B) Endowment Fund.

C) Restricted Current Fund.

D) Agency Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

20

The Great Gap University issues long-term debt to build a bridge over the gap between its two main campuses. The debt would be accounted for in the

A) Unexpended Plant Fund.

B) Plant Fund for Renewals and Replacement.

C) Plant Fund for Retirement of Indebtedness.

D) Investment in Plant.

A) Unexpended Plant Fund.

B) Plant Fund for Renewals and Replacement.

C) Plant Fund for Retirement of Indebtedness.

D) Investment in Plant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

21

A contribution is given without donor restrictions. Under which fund group would this be recorded?

A) Current unrestricted funds

B) Current restricted funds

C) Loan fund

D) Endowment fund

A) Current unrestricted funds

B) Current restricted funds

C) Loan fund

D) Endowment fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

22

A public or governmental healthcare organization would provide which of the following combinations of financial statements to their users?

A) Statement of Activities; Statement of Financial Position; Statement of Cash Flows

B) Statement of Net Assets; Statement of Revenue, Expenses, and Change in Net Assets; Statement of Cash Flows

C) Statement of Activities; Statement of Financial Position; Statement of Cash Flows

D) Statement of Net Assets; Statement of Functional Expenses; Statement of Cash Flows

A) Statement of Activities; Statement of Financial Position; Statement of Cash Flows

B) Statement of Net Assets; Statement of Revenue, Expenses, and Change in Net Assets; Statement of Cash Flows

C) Statement of Activities; Statement of Financial Position; Statement of Cash Flows

D) Statement of Net Assets; Statement of Functional Expenses; Statement of Cash Flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

23

Plant replacement and expansion funds account for:

A) landscaping.

B) long-term debt issued to purchase buildings.

C) land.

D) none of the above

A) landscaping.

B) long-term debt issued to purchase buildings.

C) land.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

24

A pledge is unconditional if it

A) depends only on the passage of time.

B) depends on the demand by the university to be paid.

C) can be spent on any purpose.

D) a and b are correct.

A) depends only on the passage of time.

B) depends on the demand by the university to be paid.

C) can be spent on any purpose.

D) a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

25

Differences in accounting for private colleges and universities as compared to public universities do not include which of the following:

A) Financial statements may be presented on a fund group basis.

B) A statement of cash flows is not required.

C) Donor restricted contributions and unconditional pledges are recognized as revenue in the period received or promised.

D) Donated services may be recognized as contributions if they meet FASB criteria.

A) Financial statements may be presented on a fund group basis.

B) A statement of cash flows is not required.

C) Donor restricted contributions and unconditional pledges are recognized as revenue in the period received or promised.

D) Donated services may be recognized as contributions if they meet FASB criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

26

Other Operating Revenue includes:

A) revenues from outpatient surgery.

B) revenues from educational programs.

C) revenue from nursing services for post-operative care.

D) revenue from radiology services.

A) revenues from outpatient surgery.

B) revenues from educational programs.

C) revenue from nursing services for post-operative care.

D) revenue from radiology services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

27

Atlee makes a cash gift to a not-for-profit hospital which is restricted by the donor to buy toys for the pediatric ward. It should be recorded in the:

A) General Fund.

B) Specific-Purpose Fund.

C) Endowment Fund.

D) Enterprise Fund.

A) General Fund.

B) Specific-Purpose Fund.

C) Endowment Fund.

D) Enterprise Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Board of Trustees decides to set aside $30,000 to consider purchasing additional land on the first day of the next fiscal year. What type of transfer is this?

A) Mandatory

B) Restricted

C) Discretionary (or nonmandatory)

D) Unrestricted

A) Mandatory

B) Restricted

C) Discretionary (or nonmandatory)

D) Unrestricted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which university fund is most similar to the governmental general fund?

A) Agency

B) Annuity and Life income

C) Current-unrestricted

D) Loan

A) Agency

B) Annuity and Life income

C) Current-unrestricted

D) Loan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

30

The account, Cash--Limited in Use Under Malpractice Funding Arrangement, would be found in the:

A) Trust Account for self-insurance.

B) Specific-Purpose Funds.

C) Annuity Funds.

D) Endowment Funds.

A) Trust Account for self-insurance.

B) Specific-Purpose Funds.

C) Annuity Funds.

D) Endowment Funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is an example of an interfund transaction?

A) A retired professor donates $100,000 to be used for student aid.

B) Investments and $18,000 from Annuity fund investment is received.

C) A construction contract is completed and paid in full.

D) Cash is set aside for payment of a mortgage.

A) A retired professor donates $100,000 to be used for student aid.

B) Investments and $18,000 from Annuity fund investment is received.

C) A construction contract is completed and paid in full.

D) Cash is set aside for payment of a mortgage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

32

Malpractice claims recorded as IBNR claims represent

A) an estimated amount of current lawsuits pending in court

B) claims asserted and filed, but not settled on the balance sheet date

C) estimated claims for incidents occurring before the balance sheet date with no claim filed as of yet

D) estimated amount of malpractice loss not covered by physician's malpractice insurance

A) an estimated amount of current lawsuits pending in court

B) claims asserted and filed, but not settled on the balance sheet date

C) estimated claims for incidents occurring before the balance sheet date with no claim filed as of yet

D) estimated amount of malpractice loss not covered by physician's malpractice insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

33

A collection of first editions is donated to the university for its library. Which is the correct credit?

A) Net investment in Plant

B) No entry is required

C) Revenues, temporarily unrestricted contributions

D) Fund Balance, restricted

A) Net investment in Plant

B) No entry is required

C) Revenues, temporarily unrestricted contributions

D) Fund Balance, restricted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

34

Alice makes a cash gift which has no strings attached to a not-for-profit hospital. It is recorded as:

A) Patient Service Revenue.

B) Other Operating Revenue--Unrestricted Contribution.

C) Nonoperating Revenue--Unrestricted Contribution.

D) an increase in the fund balance of the General Fund.

A) Patient Service Revenue.

B) Other Operating Revenue--Unrestricted Contribution.

C) Nonoperating Revenue--Unrestricted Contribution.

D) an increase in the fund balance of the General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

35

Endowment income was restricted to student aid activities. Cash is paid for all activities. Which is the credit necessary for classification?

A) Reclassification In--unrestricted, satisfaction of program restrictions

B) Reclassification Out--unrestricted, satisfaction of program restrictions

C) Reclassification In--temporarily restricted, satisfaction of program restrictions

D) Reclassification Out--temporarily restricted, satisfaction of program restrictions.

A) Reclassification In--unrestricted, satisfaction of program restrictions

B) Reclassification Out--unrestricted, satisfaction of program restrictions

C) Reclassification In--temporarily restricted, satisfaction of program restrictions

D) Reclassification Out--temporarily restricted, satisfaction of program restrictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is not correct?

A) The difference in private vs. public colleges or universities focuses on expenses rather than expenditures.

B) All expenses are changes in unrestricted net assets.

C) Expenses denote outlays of resources.

D) Expenses denote "using up" of resources.

A) The difference in private vs. public colleges or universities focuses on expenses rather than expenditures.

B) All expenses are changes in unrestricted net assets.

C) Expenses denote outlays of resources.

D) Expenses denote "using up" of resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

37

A federal grant was received for research. Which is the correct credit?

A) Deferred Revenue--U.S. Government grants

B) Revenues--U.S. Government grants

C) U.S. Government grants refundable

D) Revenues, Temporarily restricted

A) Deferred Revenue--U.S. Government grants

B) Revenues--U.S. Government grants

C) U.S. Government grants refundable

D) Revenues, Temporarily restricted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

38

In which of the plant fund subgroups would you find the following transaction: A bond principal payment is made on a bond that was issued with the proceeds being designated for construction of a new athletic facility?

A) Unexpended plant fund

B) Investment in plant asset

C) Plant fund for retirement of indebtedness

D) Plant fund for renewals

A) Unexpended plant fund

B) Investment in plant asset

C) Plant fund for retirement of indebtedness

D) Plant fund for renewals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

39

A contribution is a(n)

A) conditional transfer of cash.

B) unconditional transfer of cash.

C) donation of services which would not be purchased otherwise.

D) donation of unskilled services which you might purchase.

A) conditional transfer of cash.

B) unconditional transfer of cash.

C) donation of services which would not be purchased otherwise.

D) donation of unskilled services which you might purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

40

A life income fund is used when:

A) resources are accepted with a stipulation that periodic payments will be made to the donor for a specified number of years

B) endowments are made to the college or university

C) resources are accepted with a stipulation that periodic payments will be made to the donor for the lifetime of the donor

D) All income earned on donated assets is to be paid to the donor over their lifetime.

A) resources are accepted with a stipulation that periodic payments will be made to the donor for a specified number of years

B) endowments are made to the college or university

C) resources are accepted with a stipulation that periodic payments will be made to the donor for the lifetime of the donor

D) All income earned on donated assets is to be paid to the donor over their lifetime.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

41

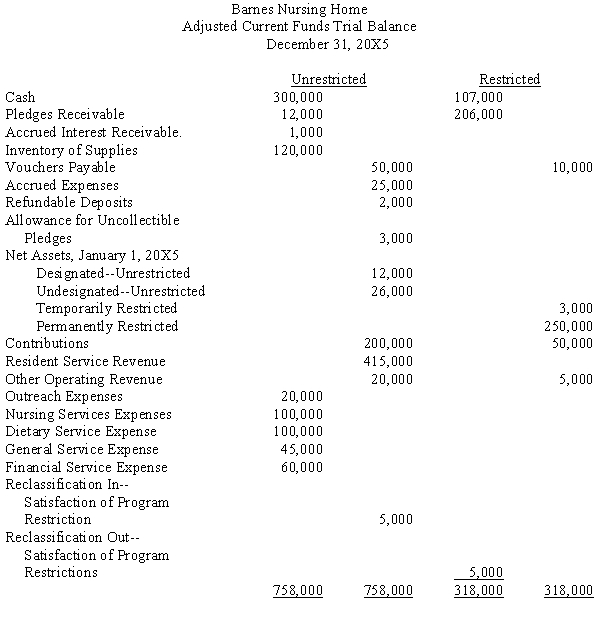

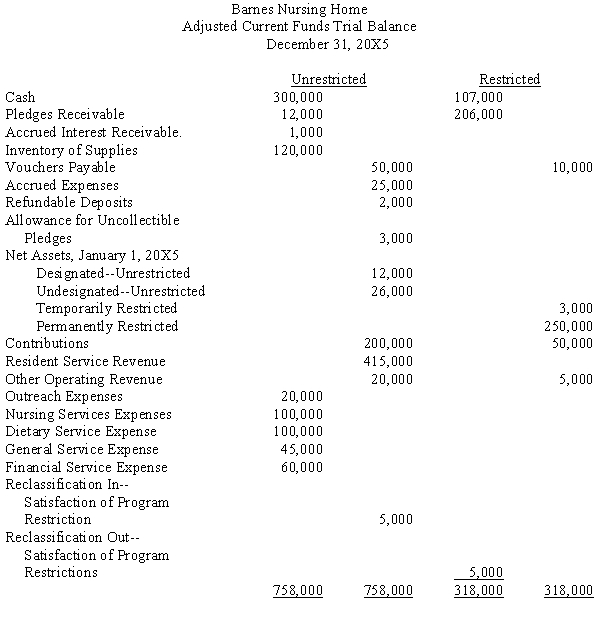

The following is an adjusted preclosing trial balance of the General Funds of Barnes Nursing Home (non-profit).

Required:

Required:

Prepare a statement of activities and a statement of financial position as of December 31, 20X5.

Required:

Required:Prepare a statement of activities and a statement of financial position as of December 31, 20X5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

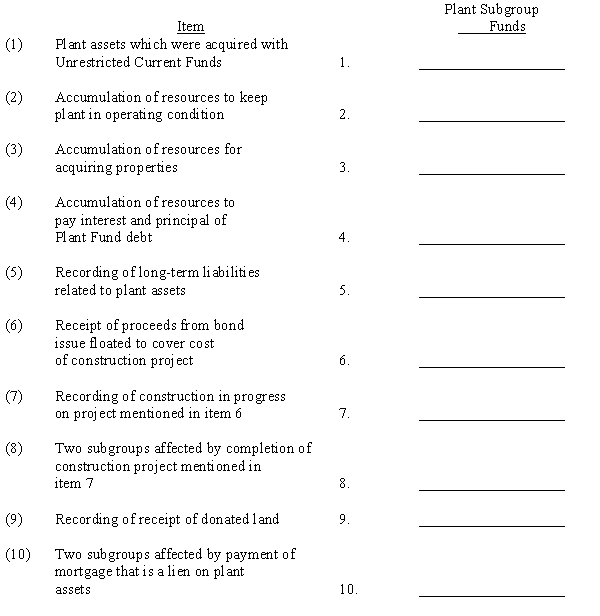

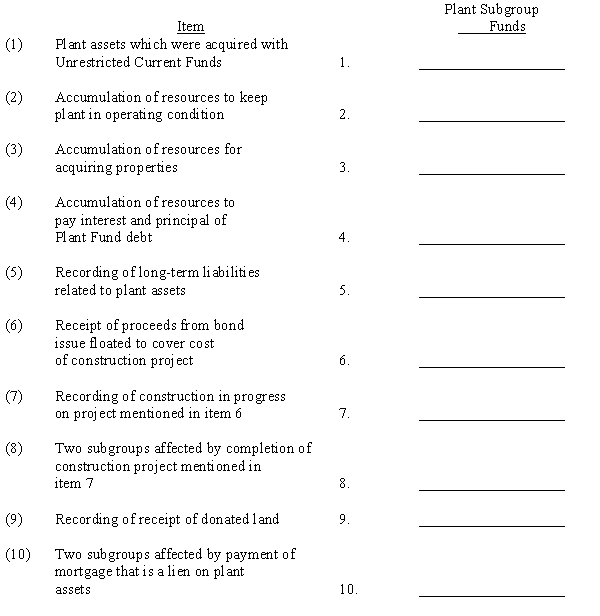

42

Records of the items that follow are maintained in a public university's Plant Fund. Fill in the name or names of the appropriate plant subgroup funds in which the items are recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

43

The following selected transactions affected the Franklin State (public) University during the current fiscal year:

a.

Student tuition and feels billed for the year for $8,000,000, which was used for educational and general purposes. Prior experience shows $100,000 will be uncollectible.

b.

$7,200,000 of the billings in 'a' were collected.

c.

Unrestricted income from endowment funds amounted to $185,000.

d.

Auxiliary enterprise included $175,000 form student residence halls; $200,000 from cafeterias; and $750,000 from the college store sales. All amounts have been collected.

e.

$300,000 of Term Endowments funds are now available for unrestricted use.

f. Operating Expenses are paid as follows: Instruction $300,000; Research $150,000; Academic Support $50,000; Student Services $25,000; Institutional Support $120,000

g. University's student aid committee granted student tuition and fee reductions of $200,000.

h. Auxiliary expenses amounted to $750,000

i. The trustees have specified certain current fund revenues must be transferred to meet the debt service provisions relating to the university's institutional properties. These mandatory transfers amount to $550,000.

a.

Student tuition and feels billed for the year for $8,000,000, which was used for educational and general purposes. Prior experience shows $100,000 will be uncollectible.

b.

$7,200,000 of the billings in 'a' were collected.

c.

Unrestricted income from endowment funds amounted to $185,000.

d.

Auxiliary enterprise included $175,000 form student residence halls; $200,000 from cafeterias; and $750,000 from the college store sales. All amounts have been collected.

e.

$300,000 of Term Endowments funds are now available for unrestricted use.

f. Operating Expenses are paid as follows: Instruction $300,000; Research $150,000; Academic Support $50,000; Student Services $25,000; Institutional Support $120,000

g. University's student aid committee granted student tuition and fee reductions of $200,000.

h. Auxiliary expenses amounted to $750,000

i. The trustees have specified certain current fund revenues must be transferred to meet the debt service provisions relating to the university's institutional properties. These mandatory transfers amount to $550,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

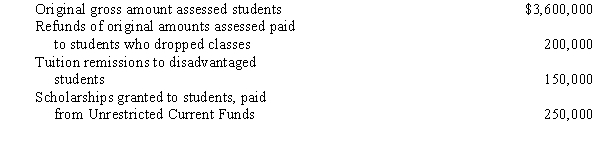

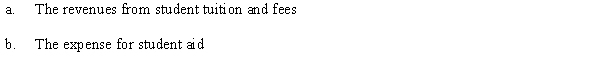

44

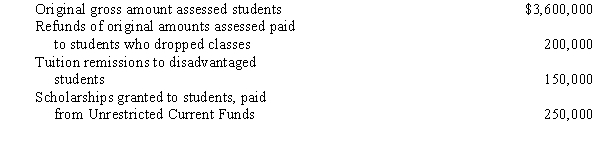

The registrar at Eastern West Virginia (public) University has summarized the current semester's student fees and tuition as follows:

Required:

Required:

Determine the following for the Statement of Current Funds Revenues, Expenses, and Other Changes:

Required:

Required:Determine the following for the Statement of Current Funds Revenues, Expenses, and Other Changes:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

45

Carlton (private) University received the following pledges during 20X5:

a.

Jane Baker pledges $30,000 to be used for student scholarships.

b.

As a result of a pledge drive, $400,000 is pledged to be paid by the end of the accounting year. Ten percent of pledges in the past have been shown to be uncollectible. These pledges are unrestricted.

Required:

Make the journal entries necessary to record the pledges.

a.

Jane Baker pledges $30,000 to be used for student scholarships.

b.

As a result of a pledge drive, $400,000 is pledged to be paid by the end of the accounting year. Ten percent of pledges in the past have been shown to be uncollectible. These pledges are unrestricted.

Required:

Make the journal entries necessary to record the pledges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

46

Prepare the journal entries to record the following events for Cost (private) University:

a.

A federal grant of $100,000 was received for research.

b.

Expenses for the research project totaled $50,000 to date.

c.

Endowment income of $10,000 is restricted to student aid activities.

d.

All but $2,000 of expenses are paid for student aid.

a.

A federal grant of $100,000 was received for research.

b.

Expenses for the research project totaled $50,000 to date.

c.

Endowment income of $10,000 is restricted to student aid activities.

d.

All but $2,000 of expenses are paid for student aid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

47

Consider the following events for Chase Private University:

Consider the following events for Chase Private University

a. Unrestricted contributions are pledged in the amount of $500,000.

b. Purchase of material and supplies totaling $100,000 of which $25,000 is not yet paid.

c. Endowment income of $8,000 is restricted to student aid activities.

d. A federal grant for $200,000 was awarded for research.

e. Materials and supplies used were as follows: Student services $10,000, Auxiliary enterprise $25,000

f. Federal government monies of $50,000 restricted for student loans are received.

g. Expenses for the research project in d. totaled $100,000 to date.

h. Term endowments expire, making $10,000 cash available

i. Cash of $10,000 from Life Income Fund Investments is received.

j. Stock with a market value of $45,000 is received from an art patron to finance art gallery improvements.

k. Federal grants for student awards through the Pell Grant program are received in the amount of $175,000.

l. Bills went out for dormitory fees of which $250,000 is paid and $50,000 is still not received.

m. Payment of $100,000 is made on the mortgage.

n. Depreciation on all assets total $125,000. Of this depreciation charge, $25,000 represents depreciation on assets classified as donor restricted. Chase Private University elects to release donor restrictions when assets are placed in service.

o. Art gallery improvements of $25,000 were made with donor-restricted contributions

Required:

Assuming that fund accounting is used, record the events. Identify the appropriate fund for each transaction.

Consider the following events for Chase Private University

a. Unrestricted contributions are pledged in the amount of $500,000.

b. Purchase of material and supplies totaling $100,000 of which $25,000 is not yet paid.

c. Endowment income of $8,000 is restricted to student aid activities.

d. A federal grant for $200,000 was awarded for research.

e. Materials and supplies used were as follows: Student services $10,000, Auxiliary enterprise $25,000

f. Federal government monies of $50,000 restricted for student loans are received.

g. Expenses for the research project in d. totaled $100,000 to date.

h. Term endowments expire, making $10,000 cash available

i. Cash of $10,000 from Life Income Fund Investments is received.

j. Stock with a market value of $45,000 is received from an art patron to finance art gallery improvements.

k. Federal grants for student awards through the Pell Grant program are received in the amount of $175,000.

l. Bills went out for dormitory fees of which $250,000 is paid and $50,000 is still not received.

m. Payment of $100,000 is made on the mortgage.

n. Depreciation on all assets total $125,000. Of this depreciation charge, $25,000 represents depreciation on assets classified as donor restricted. Chase Private University elects to release donor restrictions when assets are placed in service.

o. Art gallery improvements of $25,000 were made with donor-restricted contributions

Required:

Assuming that fund accounting is used, record the events. Identify the appropriate fund for each transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

48

Consider the following events affecting Private University:

a.

A $2,000,000, 10% serial bond issue, paying interest semiannually, was sold at face value on an interest payment date. Proceeds of the bond issue are to be used to add a wing to the library.

b.

A lot valued at $30,000 was donated by a former librarian to permit building of the proposed library wing. No permanent restrictions were stipulated by the donor.

c.

The State Building Board approved the plans submitted by the architect, who was paid $20,000. A contract for $1,900,000 was signed for construction of the library wing.

d.

The bond interest was paid.

e.

At year end, approximately two-thirds of the construction was completed. A payment of $1,200,000 was made to the contractor.

f. Tuckpointing and other repairs to university buildings amounting to $35,000 were paid from resources previously provided specifically for that purpose by a retired faculty member.

g. The library wing was completed. The remaining contract price is paid, and the building cost and bond payable are transferred to the proper fund.

h. Payments of the second six months' interest on bonds ($100,000) and the first bond serial ($200,000) were made.

i. A donation made last year by a public accounting firm was expanded to acquire a specified collection of books on accounting, dating back to the 16th and 17th centuries, at a cost of $85,000.

Required:

Prepare journal entries to record the events.

a.

A $2,000,000, 10% serial bond issue, paying interest semiannually, was sold at face value on an interest payment date. Proceeds of the bond issue are to be used to add a wing to the library.

b.

A lot valued at $30,000 was donated by a former librarian to permit building of the proposed library wing. No permanent restrictions were stipulated by the donor.

c.

The State Building Board approved the plans submitted by the architect, who was paid $20,000. A contract for $1,900,000 was signed for construction of the library wing.

d.

The bond interest was paid.

e.

At year end, approximately two-thirds of the construction was completed. A payment of $1,200,000 was made to the contractor.

f. Tuckpointing and other repairs to university buildings amounting to $35,000 were paid from resources previously provided specifically for that purpose by a retired faculty member.

g. The library wing was completed. The remaining contract price is paid, and the building cost and bond payable are transferred to the proper fund.

h. Payments of the second six months' interest on bonds ($100,000) and the first bond serial ($200,000) were made.

i. A donation made last year by a public accounting firm was expanded to acquire a specified collection of books on accounting, dating back to the 16th and 17th centuries, at a cost of $85,000.

Required:

Prepare journal entries to record the events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

49

Southern Coast (private) University received the following pledges during 20X4:

a.

Joy Dance pledges $60,000 to be paid over a three-year period beginning at the end of this year. Southern Coast discounts this contribution at 10%. The present value is $49,737.

b.

As a result of a pledge drive, $500,000 is pledged to be paid by the end of the accounting year. Ten percent of pledges in the past have been shown to be uncollectible.

Required:

Make the necessary journal entries to record the pledges.

a.

Joy Dance pledges $60,000 to be paid over a three-year period beginning at the end of this year. Southern Coast discounts this contribution at 10%. The present value is $49,737.

b.

As a result of a pledge drive, $500,000 is pledged to be paid by the end of the accounting year. Ten percent of pledges in the past have been shown to be uncollectible.

Required:

Make the necessary journal entries to record the pledges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following events occurred as part of operations in Hard Knocks (private) University:

a.

To construct a new computer center, the University floated at par a $10,000,000 10% serial bond issued on January 1, paying interest December 31 and June 30.

b.

$100,000 for computer equipment was donated by a wealthy alumnus.

c.

Payments for construction to date total $5,000,000.

d.

Interest payments are made on June 30th.

e.

Construction of the center is completed at an additional cost of $7,000,000 and it is paid in full.

f. The first serial bond of $2,000,000 is paid.

g. A building valued at $100,000 is received as a gift on the condition the university assumes the $50,000 mortgage and uses the building for classroom purposes only. The University elects to "release" the restriction over the useful life of the building.

h. Depreciation on the building totaled $10,000.

Required:

Prepare journal entries for the above events.

a.

To construct a new computer center, the University floated at par a $10,000,000 10% serial bond issued on January 1, paying interest December 31 and June 30.

b.

$100,000 for computer equipment was donated by a wealthy alumnus.

c.

Payments for construction to date total $5,000,000.

d.

Interest payments are made on June 30th.

e.

Construction of the center is completed at an additional cost of $7,000,000 and it is paid in full.

f. The first serial bond of $2,000,000 is paid.

g. A building valued at $100,000 is received as a gift on the condition the university assumes the $50,000 mortgage and uses the building for classroom purposes only. The University elects to "release" the restriction over the useful life of the building.

h. Depreciation on the building totaled $10,000.

Required:

Prepare journal entries for the above events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

51

Consider the following transactions for the University of Northland (private):

a.

On January 1st a gift of $100,000 was received from an alumnus. She requested one half be used for student loans and the other as a pure endowment contribution.

b.

Loans totaling $25,000 are made to students. Collections from other loans made to students total $30,000 plus $3,000 interest.

c.

During the year, investments of $20,000 were sold for $30,000. Any gain is restricted for improvements in classroom instruction.

d.

During the year, interest charges of $5,000 were earned and collected on late student fee payments.

e.

A student loan of $500 is deemed uncollectible.

f. During the year, operating expenses of $150,000 were recorded. At the end of the year, $25,000 remains unpaid.

Required:

Prepare journal entries necessary to record the transactions.

a.

On January 1st a gift of $100,000 was received from an alumnus. She requested one half be used for student loans and the other as a pure endowment contribution.

b.

Loans totaling $25,000 are made to students. Collections from other loans made to students total $30,000 plus $3,000 interest.

c.

During the year, investments of $20,000 were sold for $30,000. Any gain is restricted for improvements in classroom instruction.

d.

During the year, interest charges of $5,000 were earned and collected on late student fee payments.

e.

A student loan of $500 is deemed uncollectible.

f. During the year, operating expenses of $150,000 were recorded. At the end of the year, $25,000 remains unpaid.

Required:

Prepare journal entries necessary to record the transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

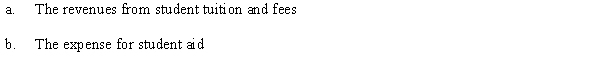

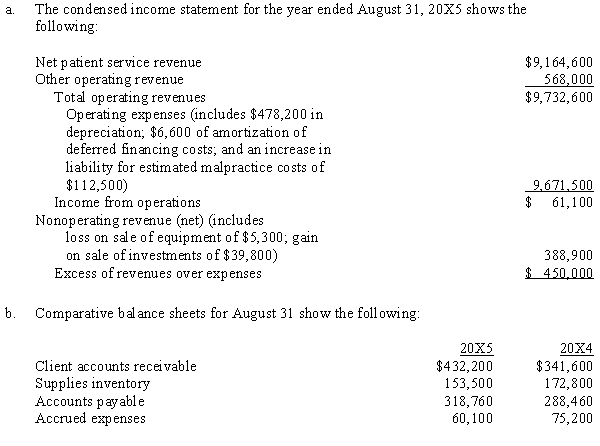

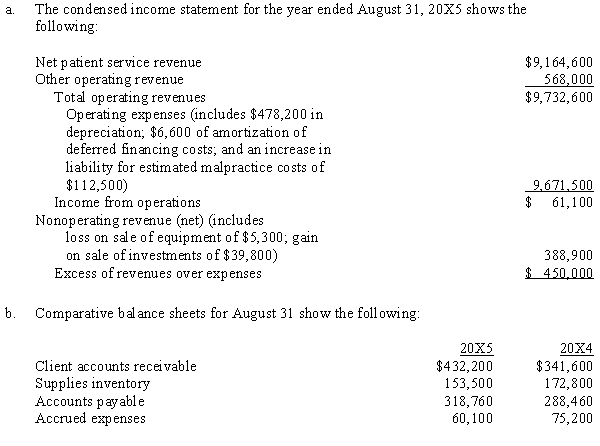

52

Elder Care Services is a not-for-profit provider of health care services.

Required:

Required:

Prepare a schedule showing net cash provided by operating activities and nonoperating activities and nonoperating revenue that is presented under the indirect method of preparing a statement of cash flows.

Required:

Required:Prepare a schedule showing net cash provided by operating activities and nonoperating activities and nonoperating revenue that is presented under the indirect method of preparing a statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

53

The following events are for Tubac Center, a not-for-profit hospital. The hospital records expense data based on the nature of the expense, such as wages, salaries, and benefits.

a.

Patient services amounting to $300,000 were billed. A 5% allowance for uncollectibles is to be recorded.

b.

Of $70,000 gross billings in part (a), third-party payers remitted $62,000 in full settlement. The remaining $8,000 is a contractual adjustment.

c.

The board of trustees authorized $90,000 to increase the malpractice fund held by a trustee.

d.

Supplies costing $77,000 were requisitioned from inventory maintained on a perpetual basis. These supplies were used by professional services.

e.

Nurses' salaries of $110,000 were incurred. Of this amount, $8,000 of accrued benefits were unpaid. Ignore payroll deductions.

f. $200,000 of the temporarily restricted net assets are reclassified to cover specified, current operations.

Required:

Prepare the necessary journal entries.

a.

Patient services amounting to $300,000 were billed. A 5% allowance for uncollectibles is to be recorded.

b.

Of $70,000 gross billings in part (a), third-party payers remitted $62,000 in full settlement. The remaining $8,000 is a contractual adjustment.

c.

The board of trustees authorized $90,000 to increase the malpractice fund held by a trustee.

d.

Supplies costing $77,000 were requisitioned from inventory maintained on a perpetual basis. These supplies were used by professional services.

e.

Nurses' salaries of $110,000 were incurred. Of this amount, $8,000 of accrued benefits were unpaid. Ignore payroll deductions.

f. $200,000 of the temporarily restricted net assets are reclassified to cover specified, current operations.

Required:

Prepare the necessary journal entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

54

The following selected transactions affecting the Annuity and Life Income Funds of Tremper State University (public) occurred during the current fiscal year.

a.

Upon his death, John Sooner, a local businessman, donates a portfolio of stock with a cost basis of $100,000 and a market value of $125,000. John's wife is to receive an annuity of $8,000 per year for life. Her life expectancy is ten years. An estimated rate of return of 8% yields a present value of $53,681 for the annuity.

b.

Dividends of $7,500 are received from Life Income Fund investments.

c.

Annuity fund investments with a book value of $6,000 are sold for $6,500.

d.

The beneficiary of the life income investments described in part (b) are paid.

e.

The first annuity payment to John Sooner's wife is made from part (a).

Required:

Make the journal entries necessary to record the transactions.

a.

Upon his death, John Sooner, a local businessman, donates a portfolio of stock with a cost basis of $100,000 and a market value of $125,000. John's wife is to receive an annuity of $8,000 per year for life. Her life expectancy is ten years. An estimated rate of return of 8% yields a present value of $53,681 for the annuity.

b.

Dividends of $7,500 are received from Life Income Fund investments.

c.

Annuity fund investments with a book value of $6,000 are sold for $6,500.

d.

The beneficiary of the life income investments described in part (b) are paid.

e.

The first annuity payment to John Sooner's wife is made from part (a).

Required:

Make the journal entries necessary to record the transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

55

Are not-for-profit universities required to use fund accounting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

56

The following events involve a loan fund of East York public University:

a.

To establish the Hanson Student Loan Fund, two brothers donated $40,000 cash and securities that cost $80,000. Market value of the securities at time of donation was $160,000.

b.

The securities were later sold for $189,000. The original agreement stipulated that any gain on the sale or income received from the securities be added to the loan fund.

c.

An appreciative board of trustees transferred $30,000 cash from the Unrestricted Current Fund to the loan fund.

d.

Loans of $140,000 were made to students at 6% annual interest.

e.

The board of trustees agreed that loans to students in the amounts of $9,000 were uncollectible. At year end, the board took action to write off the uncollectible loans outstanding of $9,000.

f. Collections on Hanson loans amounted to $13,000 plus $450 in interest.

Required:

Prepare journal entries to record the above events.

a.

To establish the Hanson Student Loan Fund, two brothers donated $40,000 cash and securities that cost $80,000. Market value of the securities at time of donation was $160,000.

b.

The securities were later sold for $189,000. The original agreement stipulated that any gain on the sale or income received from the securities be added to the loan fund.

c.

An appreciative board of trustees transferred $30,000 cash from the Unrestricted Current Fund to the loan fund.

d.

Loans of $140,000 were made to students at 6% annual interest.

e.

The board of trustees agreed that loans to students in the amounts of $9,000 were uncollectible. At year end, the board took action to write off the uncollectible loans outstanding of $9,000.

f. Collections on Hanson loans amounted to $13,000 plus $450 in interest.

Required:

Prepare journal entries to record the above events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

57

Consider the following unrestricted donations to a not-for-profit health care facility:

a.

Donation of property and equipment.

b.

Donation of substantial amount of medical supplies.

c.

Donation of resources to endow a fund.

d.

Donation of cash to be used to conduct cancer research.

e.

Volunteer provision of services by local high school students involving visiting and reading to patients.

Required:

Using the following format, indicate what entries would be recorded:

a.

Donation of property and equipment.

b.

Donation of substantial amount of medical supplies.

c.

Donation of resources to endow a fund.

d.

Donation of cash to be used to conduct cancer research.

e.

Volunteer provision of services by local high school students involving visiting and reading to patients.

Required:

Using the following format, indicate what entries would be recorded:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

58

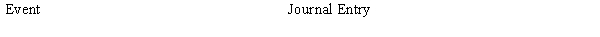

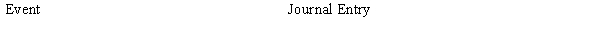

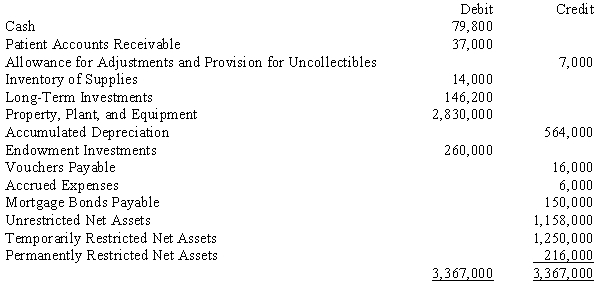

The post-closing trial balance for Blakely Hospital as of January 1, 20X5, is as follows:

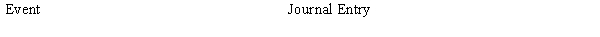

The following events occurred during 20X5:

The following events occurred during 20X5:

Required:

Required:

Using the following format, prepare journal entries for the events. Expense data are recorded based on types of services provided.

The following events occurred during 20X5:

The following events occurred during 20X5: Required:

Required:Using the following format, prepare journal entries for the events. Expense data are recorded based on types of services provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

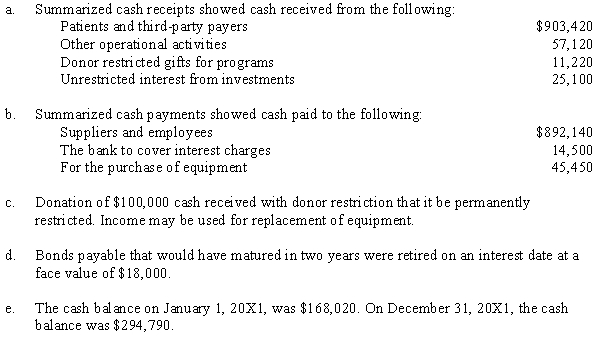

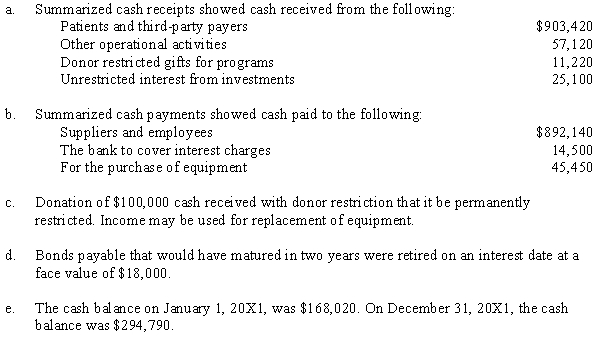

59

The following data apply to Riverside Hospital, a not-for-profit organization.

Required:

Required:

Using the direct method, prepare a statement of cash flows for the year ended December 31, 20X1.

Required:

Required:Using the direct method, prepare a statement of cash flows for the year ended December 31, 20X1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

60

The following selected transactions affected the Unrestricted Current Funds of Tiger State University (public) during the current fiscal year:

a.

The Board of Control approved a budget estimating $10,000,000 in revenues and expenses of $9,850,000.

b.

Student tuition assessed during the year was $4,000,000, of which $3,700,000 had been collected, with 3% considered uncollectible.

c.

Student aid included $500,000 in cash scholarships and $75,000 in tuition remission.

d.

Salary and wages during the year included $5,500,000 for instruction, $500,000 for academic support, and $700,000 for institutional support.

e.

Transfers to the Plant Funds included $450,000 in transfers for a mortgage payment and $155,000 in discretionary transfers.

f. A grant received of $10,000 in cash was restricted to use for laser technology research.

a.

The Board of Control approved a budget estimating $10,000,000 in revenues and expenses of $9,850,000.

b.

Student tuition assessed during the year was $4,000,000, of which $3,700,000 had been collected, with 3% considered uncollectible.

c.

Student aid included $500,000 in cash scholarships and $75,000 in tuition remission.

d.

Salary and wages during the year included $5,500,000 for instruction, $500,000 for academic support, and $700,000 for institutional support.

e.

Transfers to the Plant Funds included $450,000 in transfers for a mortgage payment and $155,000 in discretionary transfers.

f. A grant received of $10,000 in cash was restricted to use for laser technology research.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

61

How has the adoption of GASB Statement No. 35 changed the reporting standards for colleges and universities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

62

Explain how certain transactions that traditionally were reported as restricted by private universities will now be categorized as unrestricted exchange transaction. Describe how they will be accounted for per FASB 116.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

63

In accounting for health care services, several methods are utilized.

Required:

a.

List and briefly define the three types of classifications of health care facilities

b.

Describe the effects of third party payer arrangements on revenue recognition procedures for health care organizations.

c.

Describe the classification of expenses in a health care environment.

Required:

a.

List and briefly define the three types of classifications of health care facilities

b.

Describe the effects of third party payer arrangements on revenue recognition procedures for health care organizations.

c.

Describe the classification of expenses in a health care environment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

64

In accounting for not-for-profit public universities, Endowment and Similar Funds are commonly used.

Required:

a.

List and briefly define the three types of endowments often found in the university environment.

b.

Describe the accounting procedures for income earned on endowment funds.

c.

Explain the use of investment pools.

Required:

a.

List and briefly define the three types of endowments often found in the university environment.

b.

Describe the accounting procedures for income earned on endowment funds.

c.

Explain the use of investment pools.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck