Deck 36: Supply-Side Policies

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 36: Supply-Side Policies

1

While taxes distort market outcomes, welfare payments do not.

False

2

The aggregate supply curve would shift to the right if a country saw advances in technology.

True

3

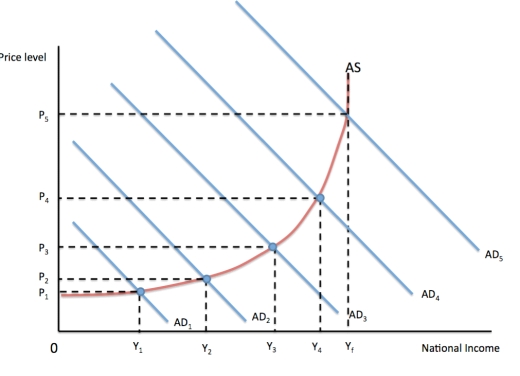

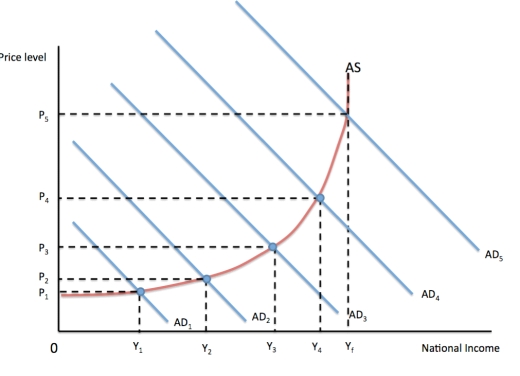

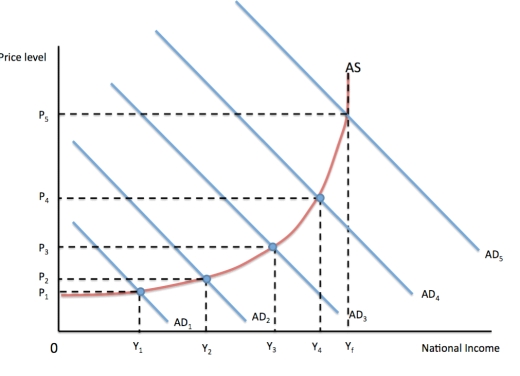

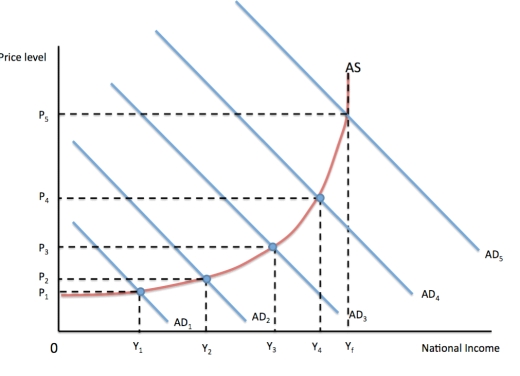

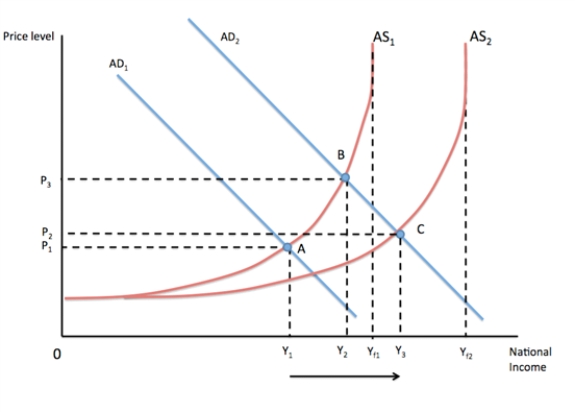

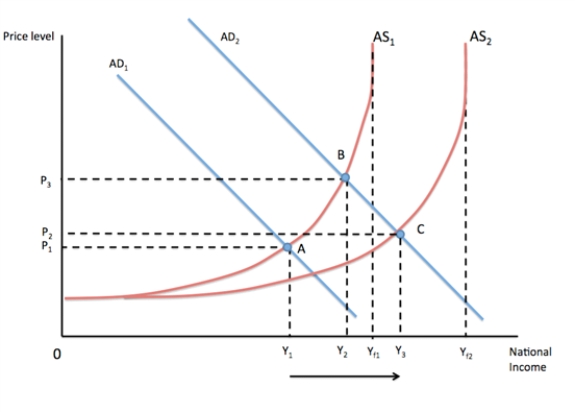

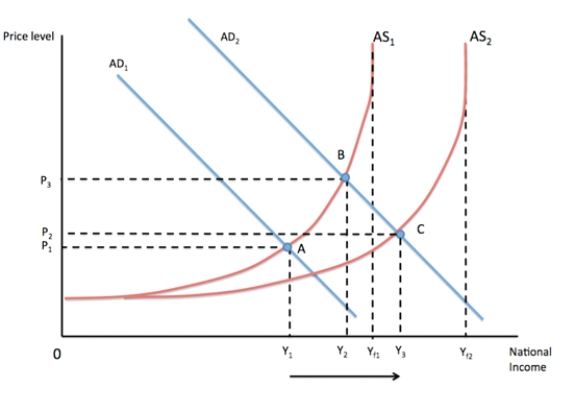

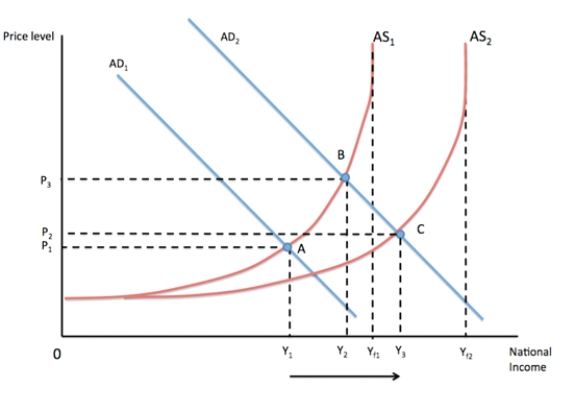

Diagram 1  Refer to Diagram 1 above, a shift in aggregate demand would lead to only modest inflation in the case of:

Refer to Diagram 1 above, a shift in aggregate demand would lead to only modest inflation in the case of:

A) AD1 to AD2

B) AD2 to AD1

C) AD4 to AD5

D) AD5 to AD4

Refer to Diagram 1 above, a shift in aggregate demand would lead to only modest inflation in the case of:

Refer to Diagram 1 above, a shift in aggregate demand would lead to only modest inflation in the case of:A) AD1 to AD2

B) AD2 to AD1

C) AD4 to AD5

D) AD5 to AD4

A

4

The aggregate supply curve can shift because of any of the following except:

A) Changes in labour.

B) Changes in technology.

C) Increases in income tax.

D) The availability of natural resources.

A) Changes in labour.

B) Changes in technology.

C) Increases in income tax.

D) The availability of natural resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

The actual output gap is difficult to determine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

The new Keynesian short-run aggregate supply is horizontal as it approaches full employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

If AD shifts to the right when the output gap is small then both national income and prices will rise quickly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

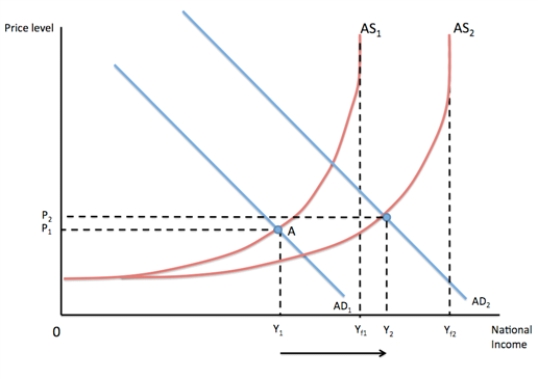

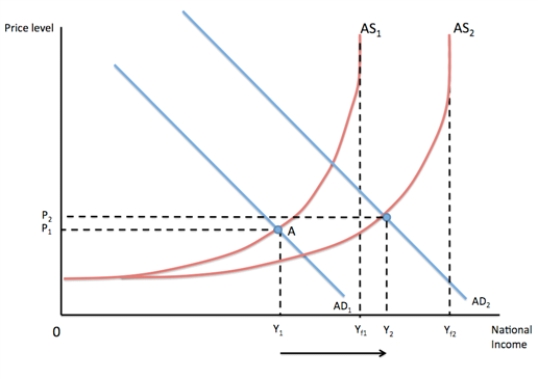

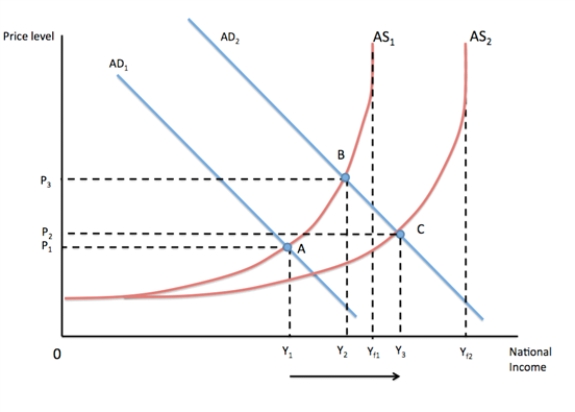

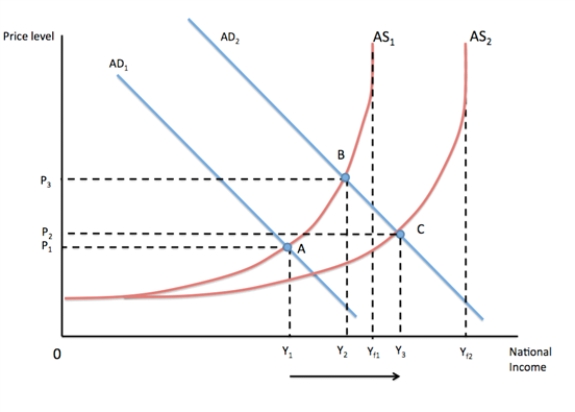

Refer to diagram 2 below, if supply-side policies succeeded in shifting the aggregate supply curve to the right to AS2 then a shift in aggregate demand curve from AD1 to AD2 would see national income: Diagram 2

A) Rise from Y1 to Yf2

B) Rise from Y1 to Y2

C) Rise from Yf1 to Yf2

D) Rise from Y2 to Yf2

A) Rise from Y1 to Yf2

B) Rise from Y1 to Y2

C) Rise from Yf1 to Yf2

D) Rise from Y2 to Yf2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

The aggregate supply curve shifts to the right when:

A) The labour force declines.

B) Technology improves.

C) There is a substantial decline in the numbers attending university.

D) There is a decrease in net immigration.

A) The labour force declines.

B) Technology improves.

C) There is a substantial decline in the numbers attending university.

D) There is a decrease in net immigration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

The more elastic that supply and demand are in any market, the more taxes in that market distorts behaviour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

Diagram 1  Refer to Diagram 1 above, a shift in aggregate demand would lead to a substantial drop in inflation and for a moderate decline in national income in the case of:

Refer to Diagram 1 above, a shift in aggregate demand would lead to a substantial drop in inflation and for a moderate decline in national income in the case of:

A) AD4 to AD3

B) AD2 to AD3

C) AD4 to AD5

D) AD5 to AD4

Refer to Diagram 1 above, a shift in aggregate demand would lead to a substantial drop in inflation and for a moderate decline in national income in the case of:

Refer to Diagram 1 above, a shift in aggregate demand would lead to a substantial drop in inflation and for a moderate decline in national income in the case of:A) AD4 to AD3

B) AD2 to AD3

C) AD4 to AD5

D) AD5 to AD4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

When the output gap is large then the aggregate supply curve will tend to be close to:

A) Horizontal

B) 45 degrees

C) Vertical

D) Full employment

A) Horizontal

B) 45 degrees

C) Vertical

D) Full employment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

Refer to diagram 2. Shifting the aggregate supply curve to the right:

A) Makes no change to the full employment level of output.

B) Increases the full employment level of output.

C) Decreases the full employment level of output.

D) Leads to a change in aggregate demand.

A) Makes no change to the full employment level of output.

B) Increases the full employment level of output.

C) Decreases the full employment level of output.

D) Leads to a change in aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

Shifting the aggregate demand curve to the right can lead to sustained growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

The trade-off between an increase in both national income and price levels depends on how large the output gap is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

Higher tax rates reduce the opportunity cost of leisure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

Bottlenecks will occur when:

A) The output gap is large and the aggregate supply curve is horizontal.

B) The output gap is small and the aggregate supply curve is vertical.

C) The output gap is small and the aggregate supply curve is horizontal.

D) The output gap is large and there is a decrease in aggregate demand.

A) The output gap is large and the aggregate supply curve is horizontal.

B) The output gap is small and the aggregate supply curve is vertical.

C) The output gap is small and the aggregate supply curve is horizontal.

D) The output gap is large and there is a decrease in aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

Supply-side policies became a focus of many governments in:

A) After the 1930s Great Depression

B) The 1960s and into the 1970s

C) The 1980s and into the 1990s

D) After to 2008 economic crises

A) After the 1930s Great Depression

B) The 1960s and into the 1970s

C) The 1980s and into the 1990s

D) After to 2008 economic crises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

Supply-side policies focus on policies that

A) Shift the aggregate demand curve to the left.

B) Shift the aggregate demand curve to the right.

C) Shift the aggregate supply curve to the left.

D) Shift the aggregate supply curve to the right.

A) Shift the aggregate demand curve to the left.

B) Shift the aggregate demand curve to the right.

C) Shift the aggregate supply curve to the left.

D) Shift the aggregate supply curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

Market orientated supply policies aim to improve price signals by rolling back the influence of the state.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

Policy makers who believe in the Laffer curve should:

A) Increase income tax rates for highest wage earners.

B) Increase income tax rates for the lowest wage earners.

C) Decrease income tax rates for the lowest wage earners.

D) Decrease income tax rates for the highest wage earners.

A) Increase income tax rates for highest wage earners.

B) Increase income tax rates for the lowest wage earners.

C) Decrease income tax rates for the lowest wage earners.

D) Decrease income tax rates for the highest wage earners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

Raising the tax threshold serves to

A) Increase the gap between welfare payments and potential earnings.

B) Makes those on benefits less fussy about which job to go for.

C) Reduces those who are voluntarily unemployed.

D) All of the above.

A) Increase the gap between welfare payments and potential earnings.

B) Makes those on benefits less fussy about which job to go for.

C) Reduces those who are voluntarily unemployed.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

Refer to table 1. A person earning €100,100 pays income tax equal to ?

Table 1

?

A) The same as someone earning €100,000

B) €30,030

C) €20,030

D) €30 more than someone earning €100,000

Table 1

?

A) The same as someone earning €100,000

B) €30,030

C) €20,030

D) €30 more than someone earning €100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which can be considered a supply-side policy?

A) Increasing the minimum wage.

B) Increase in government spending on welfare.

C) Provision of free university places.

D) Greater regulation of markets.

A) Increasing the minimum wage.

B) Increase in government spending on welfare.

C) Provision of free university places.

D) Greater regulation of markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

If tax rates are increased then:

A) The substitution effect is greater than the income effect

B) The income effect is greater than the substitution effect.

C) There is only an income effect.

D) There is only a substitution effect.

A) The substitution effect is greater than the income effect

B) The income effect is greater than the substitution effect.

C) There is only an income effect.

D) There is only a substitution effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

Financial deregulation can lead to:

A) An explosion of new financial products.

B) Greater freedom to access credit.

C) The global financial crises in 2007-09.

D) All of the above.

A) An explosion of new financial products.

B) Greater freedom to access credit.

C) The global financial crises in 2007-09.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

Market orientated supply-side policy makers believe all the following except that:

A) Higher tax rates increase the opportunity cost of leisure.

B) Taxes need to be cut, as they are a disincentive to work.

C) Welfare payments need to be cut, as they are a disincentive to work.

D) Labour markets need to be more flexible to encourage firms to take on more workers.

A) Higher tax rates increase the opportunity cost of leisure.

B) Taxes need to be cut, as they are a disincentive to work.

C) Welfare payments need to be cut, as they are a disincentive to work.

D) Labour markets need to be more flexible to encourage firms to take on more workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

Privatization is when:

A) The government deregulates markets.

B) The government cuts back spending.

C) There is a transfer of public ownership of assets to the private sector

D) All of the above.

A) The government deregulates markets.

B) The government cuts back spending.

C) There is a transfer of public ownership of assets to the private sector

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

Deregulation is when:

A) The government sub-contracts with private businesses.

B) Reduces the amount of government controls on business.

C) There is a transfer of public ownership of assets to the private sector

D) All of the above.

A) The government sub-contracts with private businesses.

B) Reduces the amount of government controls on business.

C) There is a transfer of public ownership of assets to the private sector

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

Refer to table 1, which shows the tax levels in an economy. A person earning €12,000 pays income tax equal to ?

Table 1

?

A) €0

B) €400

C) €2,000

D) €2,400

Table 1

?

A) €0

B) €400

C) €2,000

D) €2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Laffer curve shows the relationship between

A) Employment and income tax rates.

B) Tax revenues and employment.

C) Tax revenues and income tax rates.

D) VAT and income tax rates.

A) Employment and income tax rates.

B) Tax revenues and employment.

C) Tax revenues and income tax rates.

D) VAT and income tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

Crowding-in would occur if a:

A) Government increased public spending.

B) Government reduced public spending.

C) Government increased borrowing.

D) Increased regulation.

A) Government increased public spending.

B) Government reduced public spending.

C) Government increased borrowing.

D) Increased regulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

A cut in higher rate taxes has two effects. Which statement is correct?

A) The substitution and income effect work in the same direction.

B) The substitution effect increases the opportunity cost of leisure.

C) The income effect increases the opportunity cost of leisure.

D) The substitution effect will decrease the opportunity cost of leisure

A) The substitution and income effect work in the same direction.

B) The substitution effect increases the opportunity cost of leisure.

C) The income effect increases the opportunity cost of leisure.

D) The substitution effect will decrease the opportunity cost of leisure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

An example of deregulation is:

A) Allowing different bus companies to compete with each other in the same city.

B) Making sure health and safety is maintained.

C) Reducing competition to encourage economies of scale.

D) Protecting workers rights.

A) Allowing different bus companies to compete with each other in the same city.

B) Making sure health and safety is maintained.

C) Reducing competition to encourage economies of scale.

D) Protecting workers rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which is illegal?

A) Tax avoidance.

B) Tax evasion.

C) Both tax avoidance and tax evasion.

D) Tax avoidance and tax evasion are both legal but are forms of evasion.

A) Tax avoidance.

B) Tax evasion.

C) Both tax avoidance and tax evasion.

D) Tax avoidance and tax evasion are both legal but are forms of evasion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

Raising thresholds at which people pay tax means.

A) People pay more in indirect taxes.

B) The level of tax paid by high earners increases

C) The level of earnings before anyone pays tax rises.

D) The level of earning before anyone pays tax falls.

A) People pay more in indirect taxes.

B) The level of tax paid by high earners increases

C) The level of earnings before anyone pays tax rises.

D) The level of earning before anyone pays tax falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which is not an example of a flexible labour market?

A) The government tightens regulations on zero hour contracts.

B) Firms have greater rights to make redundancies.

C) The government passes a law reducing minimum redundancy payments

D) More recruitment websites.

A) The government tightens regulations on zero hour contracts.

B) Firms have greater rights to make redundancies.

C) The government passes a law reducing minimum redundancy payments

D) More recruitment websites.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

Refer to diagram 2. All other things being equal, the aggregate demand curve will shift to the right:

A) The government decreases taxation.

B) If technology improves.

C) The government raises taxation.

D) Exports fall.

A) The government decreases taxation.

B) If technology improves.

C) The government raises taxation.

D) Exports fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

Refer to diagram 2. The effect of deregulation should result in

A) A shift to the right of the aggregate demand curve.

B) A shift to the left of the aggregate demand curve.

C) A shift to the right of the aggregate supply curve.

D) A shift to the left of the aggregate supply curve.

A) A shift to the right of the aggregate demand curve.

B) A shift to the left of the aggregate demand curve.

C) A shift to the right of the aggregate supply curve.

D) A shift to the left of the aggregate supply curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

Higher tax rates:

A) Reduce the opportunity cost of leisure.

B) Increase the opportunity cost of leisure.

C) Has no impact on the opportunity cost of leisure.

D) Incentivize people to work harder.

A) Reduce the opportunity cost of leisure.

B) Increase the opportunity cost of leisure.

C) Has no impact on the opportunity cost of leisure.

D) Incentivize people to work harder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use a diagram to show how an increase in AS can lead to sustained growth of stable prices and increased national income even when accompanied by a boost in aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

What is the Laffer curve and how has it influenced government taxation policies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is the output gap and why is it significant?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

Reducing government spending leads to:

A) A reduction in the crowding out effect.

B) No change in the crowding out effect.

C) An increase in the crowding out effect.

D) Less efficiency in the market.

A) A reduction in the crowding out effect.

B) No change in the crowding out effect.

C) An increase in the crowding out effect.

D) Less efficiency in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

How can a government reduce the numbers of people who are voluntarily unemployed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which best describes an example of a regional industrial policy??

A) Building new roads.

B) Investment in Education and Training

C) Relocate some government activities.

D) Providing grants for research and development.

A) Building new roads.

B) Investment in Education and Training

C) Relocate some government activities.

D) Providing grants for research and development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following reduces labour flexibility?

A) Setting up more government run job centres.

B) Forcing firms to cut back on 'zero hours' contracts.

C) Legislating against trade unions.

D) Encouraging local labour agreements.

A) Setting up more government run job centres.

B) Forcing firms to cut back on 'zero hours' contracts.

C) Legislating against trade unions.

D) Encouraging local labour agreements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which is an interventionist supply-side policy?

A) The government encouraging research and development.

B) The government investing in training and education.

C) The government providing funds to improve the infrastructure.

D) All of the above.

A) The government encouraging research and development.

B) The government investing in training and education.

C) The government providing funds to improve the infrastructure.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

Improving the flexibility of labour markets:

A) Can worsen the rights of employees.

B) Makes it easier to hire and fire labour.

C) Results in less ridged labour markets.

D) All of the above.

A) Can worsen the rights of employees.

B) Makes it easier to hire and fire labour.

C) Results in less ridged labour markets.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

What leads to an outward shift in the supply curve?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

Why do governments accept a target inflation rate of around 2 per cent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

What is the difference between tax evasion and tax avoidance and what is their relationship with tax rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which term describes the selling off of public assets to the business sector?

A) Deregulation.

B) Relocation of government activities.

C) Privatization.

D) Regional policy

A) Deregulation.

B) Relocation of government activities.

C) Privatization.

D) Regional policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

With deregulated markets the government should:

A) Ensure that it has checks and balances in place to monitor the market.

B) Leave the market completely alone as free markets are best.

C) Get rid of the competition commission.

D) Ensure it owns at least one company in each industrial sector as a control.

A) Ensure that it has checks and balances in place to monitor the market.

B) Leave the market completely alone as free markets are best.

C) Get rid of the competition commission.

D) Ensure it owns at least one company in each industrial sector as a control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

Explain what is meant by the free-rider problem arising from firms investing too much in training.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

Explain why the new Keynesian supply curve is vertical at full employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is meant by freeing up the markets and improving market signals?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck