Deck 9: The Tax System

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

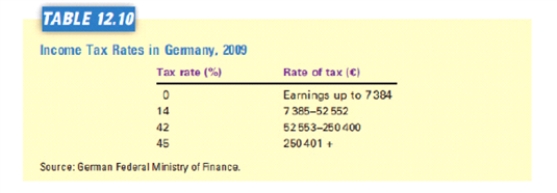

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/48

العب

ملء الشاشة (f)

Deck 9: The Tax System

1

If the supply curve is perfectly price elastic, a per-unit tax

A) does not create a deadweight loss.

B) does not reduce consumer surplus.

C) does not reduce producer surplus.

D) reduces consumer surplus but increases producer surplus.

A) does not create a deadweight loss.

B) does not reduce consumer surplus.

C) does not reduce producer surplus.

D) reduces consumer surplus but increases producer surplus.

C

2

The chief advantage of replacing personal income tax with a consumption tax is that it would remove the disincentive to saving that arises from the levying of personal income tax on income from savings.

D

3

A larger tax always generates more tax revenue.

False

4

Deadweight loss is greatest when

A) supply is elastic and demand is perfectly inelastic.

B) demand is elastic and supply is perfectly inelastic.

C) both supply and demand are relatively inelastic.

D) both supply and demand are relatively elastic.

A) supply is elastic and demand is perfectly inelastic.

B) demand is elastic and supply is perfectly inelastic.

C) both supply and demand are relatively inelastic.

D) both supply and demand are relatively elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

5

When a tax on a good starts small and is gradually increased, tax revenue will

A) fall.

B) rise.

C) first rise and then fall.

D) first fall and then rise.

E) not change at all

A) fall.

B) rise.

C) first rise and then fall.

D) first fall and then rise.

E) not change at all

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

6

Since the supply of undeveloped land is relatively inelastic, a tax on undeveloped land would generate

A) a small deadweight loss and the burden of the tax would fall on the renter.

B) a large deadweight loss and the burden of the tax would fall on the landlord.

C) a large deadweight loss and the burden of the tax would fall on the renter.

D) a small deadweight loss and the burden of the tax would fall on the landlord.

A) a small deadweight loss and the burden of the tax would fall on the renter.

B) a large deadweight loss and the burden of the tax would fall on the landlord.

C) a large deadweight loss and the burden of the tax would fall on the renter.

D) a small deadweight loss and the burden of the tax would fall on the landlord.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

7

A tax system with a low marginal tax rate generates less deadweight loss and is more efficient than a similar tax system with a higher marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is true with regard to a tax on labour income? Taxes on labour income tend to encourage

A) the unscrupulous to enter the underground economy.

B) the elderly to retire early.

C) all of the things described in these answers.

D) second earners to stay home.

E) workers to work fewer hours.

A) the unscrupulous to enter the underground economy.

B) the elderly to retire early.

C) all of the things described in these answers.

D) second earners to stay home.

E) workers to work fewer hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

9

Lump-sum taxes are equitable but not efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a tax distorts incentives to buyers and sellers so that fewer goods are produced and sold than otherwise, the tax has

A) caused a deadweight loss.

B) decreased equity.

C) generated no tax revenue.

D) increased efficiency.

A) caused a deadweight loss.

B) decreased equity.

C) generated no tax revenue.

D) increased efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

11

An efficient tax is one that generates minimal deadweight losses and minimal administrative burdens.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

12

A per-unit tax on a good creates deadweight loss because

A) it makes demand more price inelastic.

B) it makes supply more price elastic.

C) by increasing the price consumers pay, and reducing the price sellers receive, it prevents some mutually beneficial trades.

D) the government wastes the tax revenues it receives.

A) it makes demand more price inelastic.

B) it makes supply more price elastic.

C) by increasing the price consumers pay, and reducing the price sellers receive, it prevents some mutually beneficial trades.

D) the government wastes the tax revenues it receives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

13

A larger tax always generates a larger deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

14

Heike values a pair of blue jeans at €40. If the price is €35, Heike buys the jeans and generates consumer surplus of €5. Suppose a tax is placed on blue jeans that causes the price of blue jeans to rise to €45. Now Heike chooses not to buy a pair of jeans. This example has demonstrated

A) the deadweight loss from a tax.

B) the ability-to-pay principle.

C) the benefits principle.

D) horizontal equity.

E) the administrative burden of a tax.

A) the deadweight loss from a tax.

B) the ability-to-pay principle.

C) the benefits principle.

D) horizontal equity.

E) the administrative burden of a tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

15

When a tax is placed on a good, the revenue the government collects is exactly equal to the loss of consumer and producer surplus from the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

16

A tax for which high income taxpayers pay a smaller fraction of their income than do low income taxpayers is known as

A) a proportional tax.

B) a regressive tax.

C) an equitable tax.

D) a progressive tax.

A) a proportional tax.

B) a regressive tax.

C) an equitable tax.

D) a progressive tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

17

A tax collected from buyers generates a smaller deadweight loss than a tax collected from sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

18

In general, a tax raises the price the buyers pay, lowers the price the sellers receive, and reduces the quantity sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a tax is placed on a good in a market where supply is perfectly inelastic, there is no deadweight loss and the sellers bear the entire burden of the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

20

If a tax on a good is doubled, the deadweight loss from the tax

A) doubles.

B) stays the same.

C) increases by a factor of four.

D) could rise or fall.

A) doubles.

B) stays the same.

C) increases by a factor of four.

D) could rise or fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

21

A tax is __________ if it takes a constant fraction of income as income rises.

A) regressive

B) proportional

C) progressive

D) aggressive

A) regressive

B) proportional

C) progressive

D) aggressive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

22

The appropriate tax rate to consider to gauge how much the tax system distorts incentives and decision making is the

A) proportional tax rate.

B) average tax rate.

C) marginal tax rate.

D) vertical tax rate.

E) horizontal tax rate.

A) proportional tax rate.

B) average tax rate.

C) marginal tax rate.

D) vertical tax rate.

E) horizontal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

23

In choosing the form of a tax, there is a trade-off between

A) allocative and productive efficiency.

B) profits and revenues.

C) efficiency and equity.

D) equity and profits.

A) allocative and productive efficiency.

B) profits and revenues.

C) efficiency and equity.

D) equity and profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following taxes is the most efficient tax?

A) a consumption tax

B) a lump-sum tax

C) a progressive income tax

D) a proportional income tax

A) a consumption tax

B) a lump-sum tax

C) a progressive income tax

D) a proportional income tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

25

An individual's tax total tax payments divided by income is called the

A) marginal social tax rate.

B) marginal private tax rate.

C) marginal tax rate.

D) average tax rate.

A) marginal social tax rate.

B) marginal private tax rate.

C) marginal tax rate.

D) average tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

26

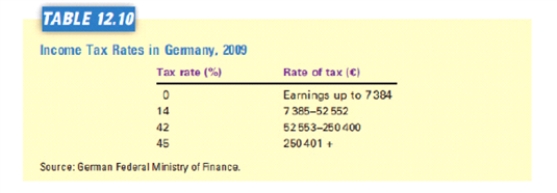

Refer to the table below. The average tax rate for a taxpayer earning €40,000 (rounded up) is

A) 0 per cent.

B) 5 per cent

C) 7 per cent

D) 12 per cent

E) 14 per cent

A) 0 per cent.

B) 5 per cent

C) 7 per cent

D) 12 per cent

E) 14 per cent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

27

The marginal tax rate is

A) the taxes paid by the marginal worker.

B) total income divided by total taxes paid.

C) the extra taxes paid on an additional unit of income.

D) total taxes paid divided by total income.

A) the taxes paid by the marginal worker.

B) total income divided by total taxes paid.

C) the extra taxes paid on an additional unit of income.

D) total taxes paid divided by total income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

28

Discuss the two main reasons why governments levy taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

29

An individual's marginal tax rate equals

A) total tax payments divided by the average tax rate.

B) the increase in taxes the individual would pay when income rises, expressed as a percentage of the rise in income.

C) total tax payments divided by income.

D) the increase in taxes the individual would pay if the average tax rate were to rise 1%.

A) total tax payments divided by the average tax rate.

B) the increase in taxes the individual would pay when income rises, expressed as a percentage of the rise in income.

C) total tax payments divided by income.

D) the increase in taxes the individual would pay if the average tax rate were to rise 1%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

30

The appropriate tax rate to consider to judge the vertical equity of a tax system is the

A) marginal tax rate.

B) average tax rate.

C) horizontal tax rate.

D) proportional tax rate.

A) marginal tax rate.

B) average tax rate.

C) horizontal tax rate.

D) proportional tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

31

The main arguments in favour of a modified flat-rate tax system (such as a proposal to place a 19% tax on all income over €20,000 with no deductions) are it would

A) raise more revenue than the current tax system, and it would be simpler.

B) raise more revenue than the current tax system, and it would lower marginal tax rates.

C) be simpler and it would lower average tax rates.

D) be simpler and it would lower marginal tax rates.

A) raise more revenue than the current tax system, and it would be simpler.

B) raise more revenue than the current tax system, and it would lower marginal tax rates.

C) be simpler and it would lower average tax rates.

D) be simpler and it would lower marginal tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

32

If the government imposed a €1,000 tax on every individual,

A) this would be an equitable tax.

B) allocative efficiency would have to be sacrificed.

C) this would be an efficient tax.

D) this would be an income tax.

A) this would be an equitable tax.

B) allocative efficiency would have to be sacrificed.

C) this would be an efficient tax.

D) this would be an income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following taxes can be supported by the benefits principle of taxation?

A) All of these answers can be supported by the benefits principle of taxation.

B) progressive income taxes used to pay for national defence

C) petrol taxes used to pay for roads

D) property taxes used to pay for police and the court system

E) progressive income taxes used to pay for antipoverty programs

A) All of these answers can be supported by the benefits principle of taxation.

B) progressive income taxes used to pay for national defence

C) petrol taxes used to pay for roads

D) property taxes used to pay for police and the court system

E) progressive income taxes used to pay for antipoverty programs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

34

The ability-to-pay principle of taxation suggests that if a tax system is to be vertically equitable, it should be

A) efficient.

B) progressive.

C) regressive.

D) proportional.

E) lump-sum.

A) efficient.

B) progressive.

C) regressive.

D) proportional.

E) lump-sum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

35

Corporate taxes are levied on companies

A) and the burden of corporate taxes falls only on companies' owners and workers.

B) but the burden of corporate taxes falls solely on customers.

C) but the burden of corporate taxes falls on the workers and customers as well as on the owners of companies.

D) but governments generally try to avoid taxing companies.

A) and the burden of corporate taxes falls only on companies' owners and workers.

B) but the burden of corporate taxes falls solely on customers.

C) but the burden of corporate taxes falls on the workers and customers as well as on the owners of companies.

D) but governments generally try to avoid taxing companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

36

A tax is __________ if it takes a smaller fraction of income as income rises.

A) regressive

B) proportional

C) progressive

D) aggressive

A) regressive

B) proportional

C) progressive

D) aggressive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

37

The average tax rate is

A) total taxes paid divided by total income.

B) the extra taxes paid on an additional dollar of income.

C) the taxes paid by the marginal worker.

D) total income divided by total taxes paid.

A) total taxes paid divided by total income.

B) the extra taxes paid on an additional dollar of income.

C) the taxes paid by the marginal worker.

D) total income divided by total taxes paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

38

A progressive tax system is one where

A) marginal tax rates are high.

B) higher income taxpayers pay more taxes than do lower income taxpayers.

C) marginal tax rates are low.

D) higher income taxpayers pay a greater percentage of their income in taxes than do lower income taxpayers.

A) marginal tax rates are high.

B) higher income taxpayers pay more taxes than do lower income taxpayers.

C) marginal tax rates are low.

D) higher income taxpayers pay a greater percentage of their income in taxes than do lower income taxpayers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

39

A tax system is regarded as horizontally equitable if

A) all taxpayers pay the same amount of tax

B) taxes on all goods are levied at the same rate

C) taxes are as low as possible

D) the system comprises only lump sum taxes

E) taxpayers with similar abilities to pay taxes pay the same amount

A) all taxpayers pay the same amount of tax

B) taxes on all goods are levied at the same rate

C) taxes are as low as possible

D) the system comprises only lump sum taxes

E) taxpayers with similar abilities to pay taxes pay the same amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

40

An efficient tax

A) minimizes the administrative burden from the tax.

B) does all of the things described in these answers.

C) raises revenue at the smallest possible cost to taxpayers.

D) minimizes the deadweight loss from the tax.

A) minimizes the administrative burden from the tax.

B) does all of the things described in these answers.

C) raises revenue at the smallest possible cost to taxpayers.

D) minimizes the deadweight loss from the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

41

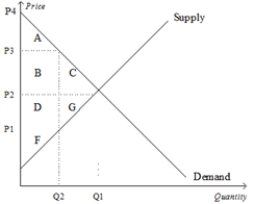

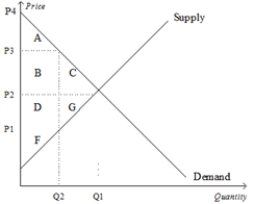

Using demand and supply diagrams, show the difference in deadweight loss between (a) a market with inelastic demand and supply and (b) a market with elastic demand and supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

42

Illustrate on three demand-and-supply graphs how the size of a tax (small, medium and large) can alter total revenue and deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

43

John has been gardening for Sally once a week for €20. John's opportunity cost is €15, and Sally would be willing to pay €25 for the gardening tasks. What is the maximum tax the government could impose on gardening without discouraging John and Sally from continuing their mutually beneficial arrangement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

44

Why do experts disagree about whether labour taxes have small or large deadweight losses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

45

A government raises €100m through a €0.05 tax on widgets. It raises another €100m through a €0.10 tax on gadgets. It decides to eliminate the tax on gadgets and double the tax on widgets. Would it raise more, les or the same amount of money in tax revenue? Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following graph shown to fill in the table that follows.  WITHOUT TAX

WITHOUT TAX

WITH TAX

CHANGE

Consumer surplus

Producer surplus

Tax revenue

Total surplus

WITHOUT TAX

WITHOUT TAXWITH TAX

CHANGE

Consumer surplus

Producer surplus

Tax revenue

Total surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

47

Why do some economists advocate taxing consumption rather than income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

48

In what way is raising tax on food a good way and bad way to raise revenue?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck