Deck 14: Exchange Rates and the Foreign Exchange Market: an Asset Approach

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

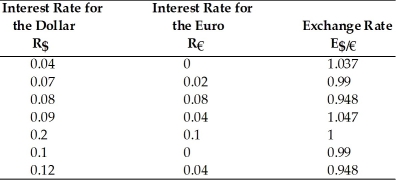

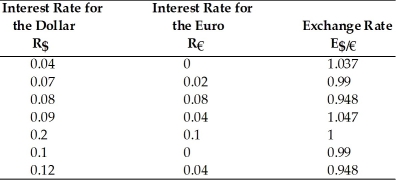

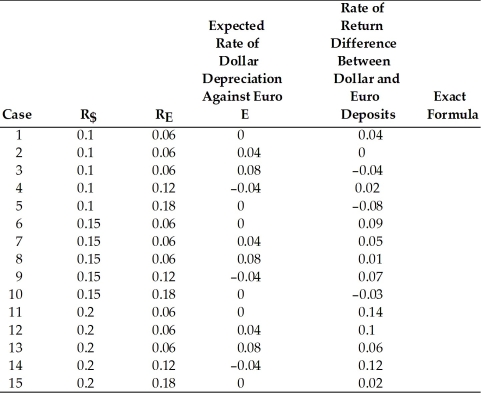

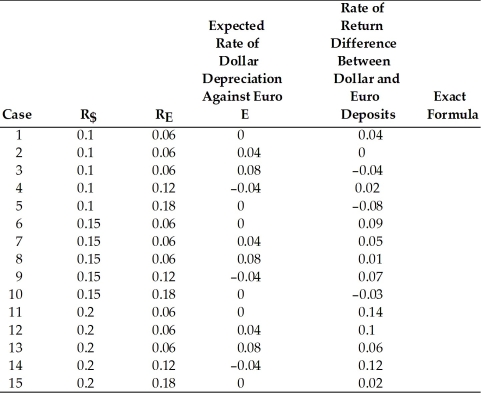

سؤال

سؤال

سؤال

سؤال

سؤال

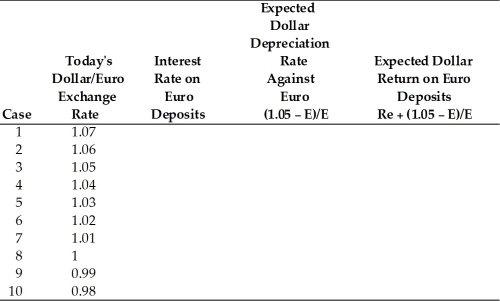

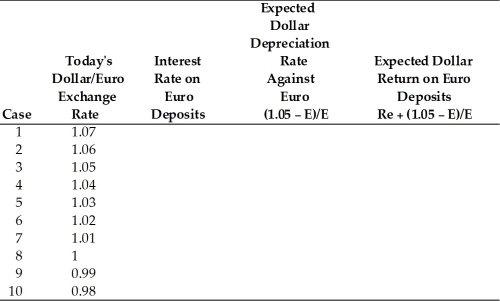

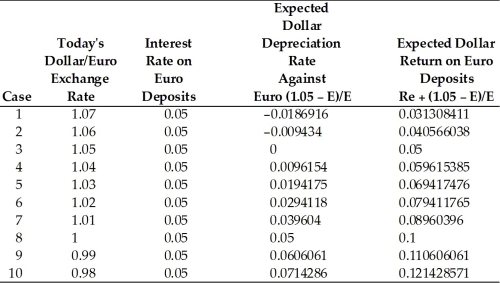

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

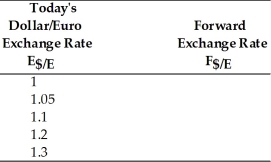

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 14: Exchange Rates and the Foreign Exchange Market: an Asset Approach

1

If the goods' money prices do NOT change,an appreciation of the dollar against the pound

A)makes British sweaters cheaper in terms of American jeans.

B)makes British sweaters more expensive in terms of American jeans.

C)doesn't change the relative price of sweaters and jeans.

D)makes American jeans cheaper in terms of British sweaters.

E)makes British jeans more expensive in Britain.

A)makes British sweaters cheaper in terms of American jeans.

B)makes British sweaters more expensive in terms of American jeans.

C)doesn't change the relative price of sweaters and jeans.

D)makes American jeans cheaper in terms of British sweaters.

E)makes British jeans more expensive in Britain.

makes British sweaters cheaper in terms of American jeans.

2

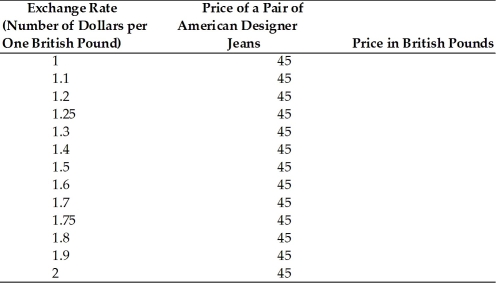

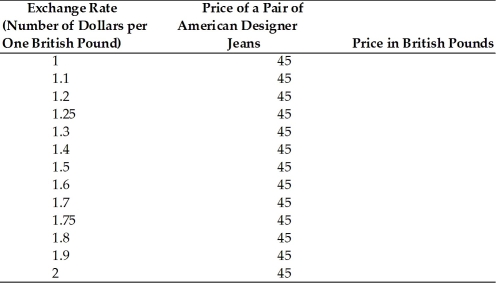

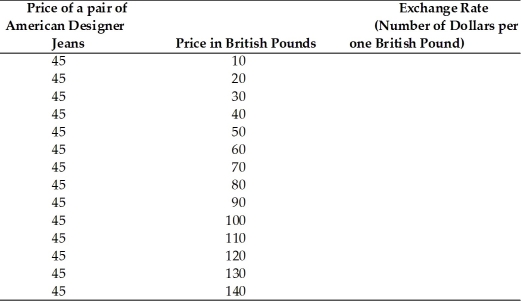

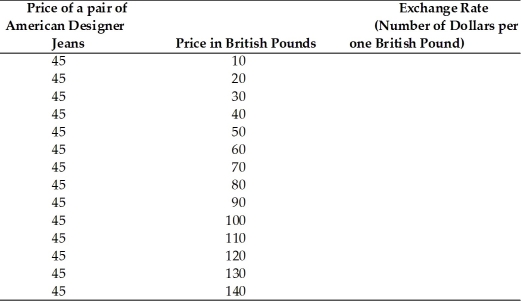

How many British pounds would it cost to buy a pair of American designer jeans costing $45 if the exchange rate is 1.80 dollars per British pound?

A)10 British pounds

B)25 British pounds

C)20 British pounds

D)30 British pounds

E)40 British pounds

A)10 British pounds

B)25 British pounds

C)20 British pounds

D)30 British pounds

E)40 British pounds

25 British pounds

3

What is the exchange rate between the dollar and the British pound if a pair of American jeans costs 60 dollars in New York and 30 Pounds in London?

A)1)5 dollars per British pound

B)0)5 dollars per British pound

C)2)5 dollars per British pound

D)3)5 dollars per British pound

E)2 dollars per British pound

A)1)5 dollars per British pound

B)0)5 dollars per British pound

C)2)5 dollars per British pound

D)3)5 dollars per British pound

E)2 dollars per British pound

2 dollars per British pound

4

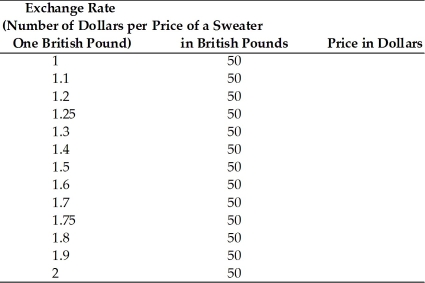

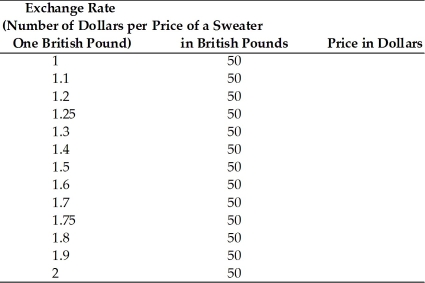

How many dollars would it cost to buy an Edinburgh Woolen Mill sweater costing 50 British pounds if the exchange rate is 1.50 dollars per one British pound?

A)50 dollars

B)60 dollars

C)70 dollars

D)80 dollars

E)75 dollars

A)50 dollars

B)60 dollars

C)70 dollars

D)80 dollars

E)75 dollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

An appreciation of a country's currency

A)decreases the relative price of its exports and lowers the relative price of its imports.

B)raises the relative price of its exports and raises the relative price of its imports.

C)lowers the relative price of its exports and raises the relative price of its imports.

D)raises the relative price of its exports and lowers the relative price of its imports.

E)raises the relative price of its exports and does not affect the relative price of its imports.

A)decreases the relative price of its exports and lowers the relative price of its imports.

B)raises the relative price of its exports and raises the relative price of its imports.

C)lowers the relative price of its exports and raises the relative price of its imports.

D)raises the relative price of its exports and lowers the relative price of its imports.

E)raises the relative price of its exports and does not affect the relative price of its imports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

How many British pounds would it cost to buy a pair of American designer jeans costing $45 if the exchange rate is 1.50 dollars per British pound?

A)10 British pounds

B)20 British pounds

C)30 British pounds

D)35 British pounds

E)25 British pounds

A)10 British pounds

B)20 British pounds

C)30 British pounds

D)35 British pounds

E)25 British pounds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

How many dollars would it cost to buy an Edinburgh Woolen Mill sweater costing 50 British pounds if the exchange rate is 1.25 dollars per one British pound?

A)50 dollars

B)60 dollars

C)70 dollars

D)62.5 dollars

E)40 British pounds

A)50 dollars

B)60 dollars

C)70 dollars

D)62.5 dollars

E)40 British pounds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the year 2012,Shinzo Abe became prime minister of Japan,promising bold policies to improve Japan's economy.What was the focus of his policies and how did they affect Japan's trade position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is the exchange rate between the dollar and the British pound if a pair of American jeans costs 50 dollars in New York and 100 Pounds in London?

A)1)5 dollars per British pound

B)0)5 dollars per British pound

C)2)5 dollars per British pound

D)3)5 dollars per British pound

E)2 dollars per British pound

A)1)5 dollars per British pound

B)0)5 dollars per British pound

C)2)5 dollars per British pound

D)3)5 dollars per British pound

E)2 dollars per British pound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a country's currency depreciates

A)foreigners find that its exports are more expensive,and domestic residents find that imports from abroad are more expensive.

B)foreigners find that its exports are more expensive,and domestic residents find that imports from abroad are cheaper.

C)foreigners find that its exports are cheaper;however,domestic residents are not affected.

D)foreigners are not affected,but domestic residents find that imports from abroad are more expensive.

E)foreigners find that its exports are cheaper and domestic residents find that imports from abroad are more expensive.

A)foreigners find that its exports are more expensive,and domestic residents find that imports from abroad are more expensive.

B)foreigners find that its exports are more expensive,and domestic residents find that imports from abroad are cheaper.

C)foreigners find that its exports are cheaper;however,domestic residents are not affected.

D)foreigners are not affected,but domestic residents find that imports from abroad are more expensive.

E)foreigners find that its exports are cheaper and domestic residents find that imports from abroad are more expensive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

Based on the case study,"Exchange Rates,Auto Prices,and Currency Wars," explain why exchange rates are of critical importance to firms in the automobile industry,and how Japan has benefited from changes in the value of the Yen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one of the following statements is the MOST accurate?

A)A depreciation of a country's currency makes its goods cheaper for foreigners.

B)A depreciation of a country's currency makes its goods more expensive for foreigners.

C)A depreciation of a country's currency makes its goods cheaper for its own residents.

D)A depreciation of a country's currency makes its goods cheaper.

E)An appreciation of a country's currency makes its goods more expensive.

A)A depreciation of a country's currency makes its goods cheaper for foreigners.

B)A depreciation of a country's currency makes its goods more expensive for foreigners.

C)A depreciation of a country's currency makes its goods cheaper for its own residents.

D)A depreciation of a country's currency makes its goods cheaper.

E)An appreciation of a country's currency makes its goods more expensive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

How many British pounds would it cost to buy a pair of American designer jeans costing $45 if the exchange rate is 2.00 dollars per British pound?

A)22.5 British pounds

B)32.5 British pounds

C)12.5 British pounds

D)40 British pounds

E)30 British pounds

A)22.5 British pounds

B)32.5 British pounds

C)12.5 British pounds

D)40 British pounds

E)30 British pounds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

Compute how many British pounds it would cost to buy a pair of American designer jeans costing $45.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

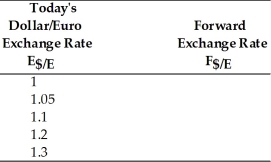

Compute how many dollars it would cost to buy an Edinburgh Woolen Mill sweater costing 50 British pounds for the following exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Japanese currency is called the

A)DM.

B)Yen.

C)Euro.

D)Dollar.

E)Pound.

A)DM.

B)Yen.

C)Euro.

D)Dollar.

E)Pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

How many British pounds would it cost to buy a pair of American designer jeans costing $45 if the exchange rate is 1.60 dollars per British pound?

A)38.125 British pounds

B)28.125 British pounds

C)48.125 British pounds

D)58.125 British pounds

E)18.125 British pounds

A)38.125 British pounds

B)28.125 British pounds

C)48.125 British pounds

D)58.125 British pounds

E)18.125 British pounds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the goods' money prices do NOT change,a depreciation of the dollar against the pound

A)makes British sweaters cheaper in terms of American jeans.

B)makes British sweaters more expensive in terms of American jeans.

C)makes American jeans more expensive in terms of British sweaters.

D)doesn't change the relative price of sweaters and jeans.

E)makes British jeans more expensive in Britain.

A)makes British sweaters cheaper in terms of American jeans.

B)makes British sweaters more expensive in terms of American jeans.

C)makes American jeans more expensive in terms of British sweaters.

D)doesn't change the relative price of sweaters and jeans.

E)makes British jeans more expensive in Britain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

A(n)________ of a nation's currency will cause imports to ________ and exports to ________,all other things held constant.

A)depreciation;increase;decrease

B)appreciation;decrease;increase

C)depreciation;decrease;increase

D)appreciation;increase;increase

E)depreciation;decrease;decrease

A)depreciation;increase;decrease

B)appreciation;decrease;increase

C)depreciation;decrease;increase

D)appreciation;increase;increase

E)depreciation;decrease;decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

How many dollars would it cost to buy an Edinburgh Woolen Mill sweater costing 50 British pounds if the exchange rate is 1.80 dollars per one British pound?

A)40 dollars

B)90 dollars

C)50 dollars

D)100 dollars

E)95 dollars

A)40 dollars

B)90 dollars

C)50 dollars

D)100 dollars

E)95 dollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following type of funds cater to wealthy individuals,are NOT bound by government regulations,and are actively traded in foreign exchange markets?

A)pension funds

B)mutual funds

C)hedge funds

D)exchange funds

A)pension funds

B)mutual funds

C)hedge funds

D)exchange funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

Find the exchange rate between the dollar and the British pounds for the following cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

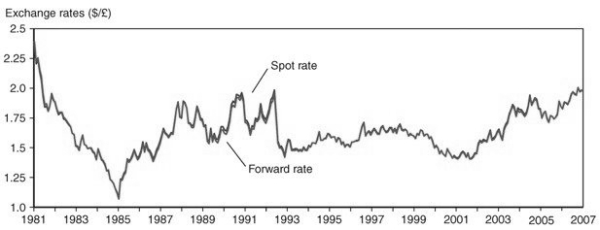

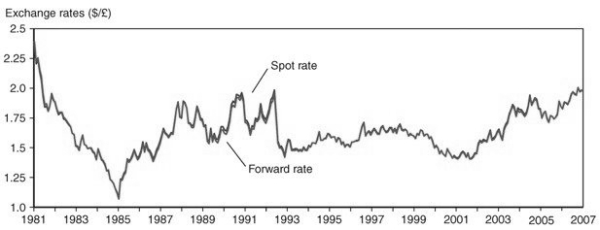

Forward and spot exchange rates

A)are necessarily equal.

B)do not move closely together.

C)are always such that the forward exchange rate is higher.

D)move closely together and are equal on the value date.

E)are unrelated to the value date.

A)are necessarily equal.

B)do not move closely together.

C)are always such that the forward exchange rate is higher.

D)move closely together and are equal on the value date.

E)are unrelated to the value date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which major actor is at the center of the foreign exchange market?

A)corporations

B)central banks

C)commercial banks

D)non-bank financial institutions

E)individual firms

A)corporations

B)central banks

C)commercial banks

D)non-bank financial institutions

E)individual firms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

25

In 2013,about

A)20 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

B)10 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

C)30 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

D)40 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

E)87 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

A)20 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

B)10 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

C)30 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

D)40 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

E)87 percent of foreign exchange transactions involved exchanges of foreign currencies for U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

Explain what is a "vehicle currency." Why is the U.S.dollar considered a vehicle currency?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

By April 2013

A)only about 10 percent of foreign exchange trades were against euros.

B)only about 24 percent of foreign exchange trades were against euros.

C)only about 33 percent of foreign exchange trades were against euros.

D)only about 42 percent of foreign exchange trades were against euros.

E)only about 60 percent of foreign exchange trades were against euros.

A)only about 10 percent of foreign exchange trades were against euros.

B)only about 24 percent of foreign exchange trades were against euros.

C)only about 33 percent of foreign exchange trades were against euros.

D)only about 42 percent of foreign exchange trades were against euros.

E)only about 60 percent of foreign exchange trades were against euros.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

Explain the purpose of the following figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

29

Who are the major participants in the foreign exchange market?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is NOT a major actor in the foreign exchange market?

A)corporations

B)central banks

C)commercial banks

D)non-bank financial institutions

E)tourists

A)corporations

B)central banks

C)commercial banks

D)non-bank financial institutions

E)tourists

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

The following is an example of Radio Shack hedging its foreign currency risk:

A)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack makes a forward-exchange deal to buy yen.

B)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack makes a forward-exchange deal to sell yen.

C)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack buys yen at a spot-exchange 1 month from now.

D)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack sells yen at a spot-exchange 1 month from now.

E)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack sells yen in a forward-exchange deal.

A)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack makes a forward-exchange deal to buy yen.

B)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack makes a forward-exchange deal to sell yen.

C)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack buys yen at a spot-exchange 1 month from now.

D)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack sells yen at a spot-exchange 1 month from now.

E)needing to pay 9,000 yen per radio to its suppliers in a month,Radio Shack sells yen in a forward-exchange deal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

32

The largest trading of foreign exchange occurs in

A)New York.

B)London.

C)Tokyo.

D)Frankfurt.

E)Singapore.

A)New York.

B)London.

C)Tokyo.

D)Frankfurt.

E)Singapore.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

33

Futures contracts differ from forward contracts in that

A)future contracts ensures you will receive a certain amount of foreign currency at a specified future date.

B)future contracts bind you into your end of the deal.

C)future contracts allow you to sell your contract on an organized futures exchange.

D)future contracts are a disadvantage if your views about the future spot exchange rate are to change.

E)futures contracts don't allow you to realize a profit or a loss right away.

A)future contracts ensures you will receive a certain amount of foreign currency at a specified future date.

B)future contracts bind you into your end of the deal.

C)future contracts allow you to sell your contract on an organized futures exchange.

D)future contracts are a disadvantage if your views about the future spot exchange rate are to change.

E)futures contracts don't allow you to realize a profit or a loss right away.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

The action of arbitrage is

A)the process of buying a currency cheap and selling it dear.

B)the process of buying a currency dear and selling it cheap.

C)the process of buying and selling currency at the same price.

D)the process of selling currency at different prices in different markets.

E)the process of buying a currency and holding onto it to take it off the market.

A)the process of buying a currency cheap and selling it dear.

B)the process of buying a currency dear and selling it cheap.

C)the process of buying and selling currency at the same price.

D)the process of selling currency at different prices in different markets.

E)the process of buying a currency and holding onto it to take it off the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

Exxon Mobil wants to pay  160,000 to a German supplier.They get an exchange rate quotation from its own commercial bank and instructs it to debit their dollar account and pay

160,000 to a German supplier.They get an exchange rate quotation from its own commercial bank and instructs it to debit their dollar account and pay  160,000 to the supplier's German account.If the exchange rate quoted is $1.2 per euro,how much is debited to Exxon Mobil's account?

160,000 to the supplier's German account.If the exchange rate quoted is $1.2 per euro,how much is debited to Exxon Mobil's account?

A)$160,000

B)$172,000

C)$180,000

D)$192,000

E)$150,000

160,000 to a German supplier.They get an exchange rate quotation from its own commercial bank and instructs it to debit their dollar account and pay

160,000 to a German supplier.They get an exchange rate quotation from its own commercial bank and instructs it to debit their dollar account and pay  160,000 to the supplier's German account.If the exchange rate quoted is $1.2 per euro,how much is debited to Exxon Mobil's account?

160,000 to the supplier's German account.If the exchange rate quoted is $1.2 per euro,how much is debited to Exxon Mobil's account?A)$160,000

B)$172,000

C)$180,000

D)$192,000

E)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

The future date on which the currencies are actually exchanged is called what?

A)the value date

B)the spot exchange date

C)the two-day window

D)the commitment date

E)the forward exchange rate

A)the value date

B)the spot exchange date

C)the two-day window

D)the commitment date

E)the forward exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements is TRUE about a vehicle currency?

A)It is widely used to denominate contracts made by parties who reside in the country that issues the vehicle currency.

B)The dollar is sometimes called a vehicle currency because of its pivotal role in many foreign exchange deals.

C)There is much skepticism that the euro will ever evolve into a vehicle currency on par with the dollar.

D)The pound sterling,once second only to the dollar as a key international currency,is beginning to rise in importance.

E)Vehicle currencies include nondeliverable currencies like the renminbi.

A)It is widely used to denominate contracts made by parties who reside in the country that issues the vehicle currency.

B)The dollar is sometimes called a vehicle currency because of its pivotal role in many foreign exchange deals.

C)There is much skepticism that the euro will ever evolve into a vehicle currency on par with the dollar.

D)The pound sterling,once second only to the dollar as a key international currency,is beginning to rise in importance.

E)Vehicle currencies include nondeliverable currencies like the renminbi.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

A foreign exchange swap

A)is a spot sale of a currency.

B)is a forward repurchase of the currency.

C)is a spot sale of a currency combined with a forward repurchase of the currency.

D)is a spot sale of a currency combined with a forward sale of the currency.

E)make up a negligible proportion of all foreign exchange trading.

A)is a spot sale of a currency.

B)is a forward repurchase of the currency.

C)is a spot sale of a currency combined with a forward repurchase of the currency.

D)is a spot sale of a currency combined with a forward sale of the currency.

E)make up a negligible proportion of all foreign exchange trading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is NOT an example of a financial derivative?

A)forwards

B)bonds

C)swaps

D)futures

E)options

A)forwards

B)bonds

C)swaps

D)futures

E)options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which one of the following statements is the MOST accurate?

A)Spot exchange rates are always higher than forward exchange rates.

B)Spot exchange rates are always lower than forward exchange rates.

C)Spot exchange rates and forward exchange rates are always equal.

D)Spot exchange rates and forward exchange rates are equal when the value date and the date of the spot transaction are the same.

E)Spot exchange rates and forward exchange rates never move closely together.

A)Spot exchange rates are always higher than forward exchange rates.

B)Spot exchange rates are always lower than forward exchange rates.

C)Spot exchange rates and forward exchange rates are always equal.

D)Spot exchange rates and forward exchange rates are equal when the value date and the date of the spot transaction are the same.

E)Spot exchange rates and forward exchange rates never move closely together.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

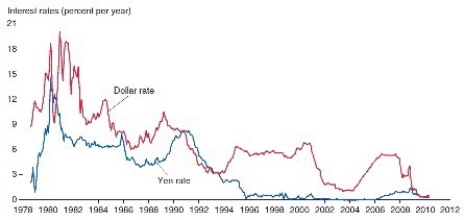

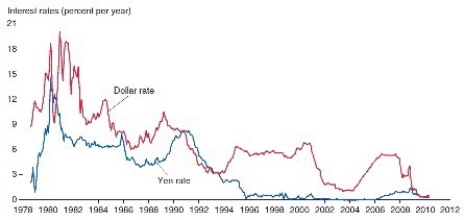

Explain the purpose of the following figure 14-2 from the text in the context of the interest rates on the dollar and the Japanese Yen between 1980 and 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

If the dollar interest rate is 4 percent,the euro interest rate is 6 percent,then

A)an investor should invest only in dollars.

B)an investor should invest only in euros.

C)an investor should be indifferent between dollars and euros.

D)invest only in dollars if the exchange rate is expected to remain constant.

E)invest only in euros if the exchange rate is expected to remain constant.

A)an investor should invest only in dollars.

B)an investor should invest only in euros.

C)an investor should be indifferent between dollars and euros.

D)invest only in dollars if the exchange rate is expected to remain constant.

E)invest only in euros if the exchange rate is expected to remain constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is the expected dollar rate of return on euro deposits if today's exchange rate is $1.10 per euro,next year's expected exchange rate is $1.165 per euro,the dollar interest rate is 10%,and the euro interest rate is 5%?

A)10%

B)11%

C)-1%

D)0%

E)15%

A)10%

B)11%

C)-1%

D)0%

E)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

If the dollar interest rate is 10 percent,the euro interest rate is 12 percent,then

A)an investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

B)an investor should invest only in euros.An investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

C)an investor should be indifferent between dollars and euros.An investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

D)an investor should invest only in dollars.

E)an investor should invest only in euros.

A)an investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

B)an investor should invest only in euros.An investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

C)an investor should be indifferent between dollars and euros.An investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

D)an investor should invest only in dollars.

E)an investor should invest only in euros.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

Explain risk and liquidity of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

The dollar rate of return on euro deposits is

A)approximately the euro interest rate plus the rate of depreciation of the dollar against the euro.

B)approximately the euro interest rate minus the rate of depreciation of the dollar against the euro.

C)the euro interest rate minus the rate of inflation against the euro.

D)the rate of appreciation of the dollar against the euro.

E)the euro interest rate plus the rate of inflation against the euro.

A)approximately the euro interest rate plus the rate of depreciation of the dollar against the euro.

B)approximately the euro interest rate minus the rate of depreciation of the dollar against the euro.

C)the euro interest rate minus the rate of inflation against the euro.

D)the rate of appreciation of the dollar against the euro.

E)the euro interest rate plus the rate of inflation against the euro.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

What are the three factors that affect the demand for foreign currency?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the dollar interest rate is 10 percent and the euro interest rate is 6 percent,then

A)an investor should invest only in dollars if the expected dollar depreciation against the euro is 8 percent.

B)an investor should invest only in euros if the expected dollar depreciation against the euro is 8 percent.

C)an investor should be indifferent between dollars and euros if the expected dollar depreciation against the euro is 8 percent.

D)an investor should invest only in dollars.

E)an investor should invest only in euros.

A)an investor should invest only in dollars if the expected dollar depreciation against the euro is 8 percent.

B)an investor should invest only in euros if the expected dollar depreciation against the euro is 8 percent.

C)an investor should be indifferent between dollars and euros if the expected dollar depreciation against the euro is 8 percent.

D)an investor should invest only in dollars.

E)an investor should invest only in euros.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

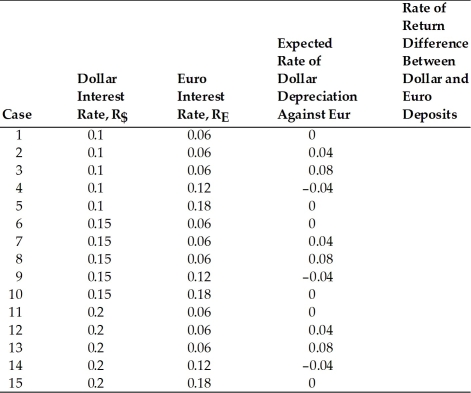

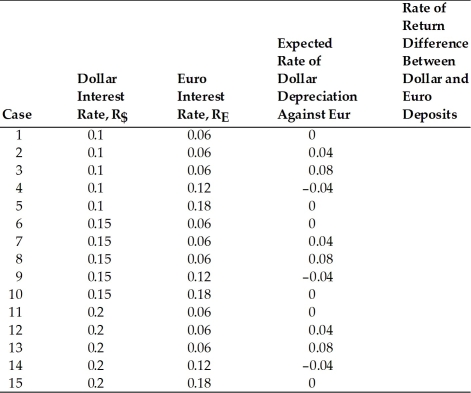

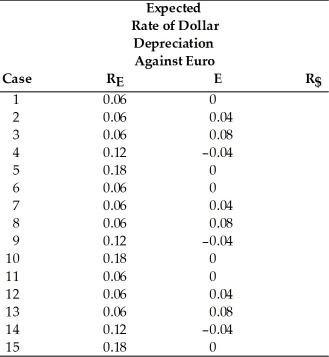

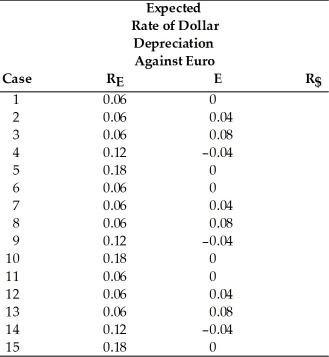

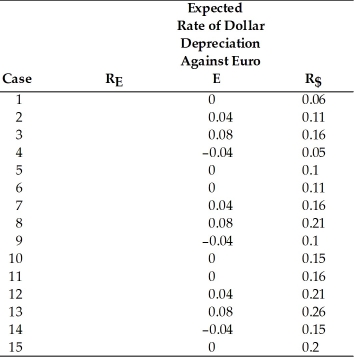

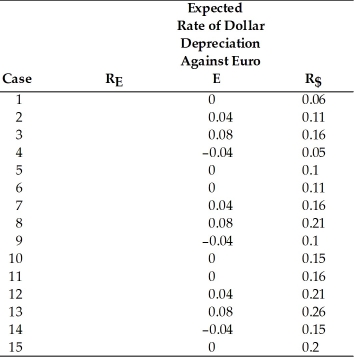

For the following 15 cases,compare the dollar rates of return on dollar and euro deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

Suppose that the one-year forward price of euros in terms of dollars is equal to $1.113 per euro.Further,assume that the spot exchange rate is $1.05 per euro,and the interest rate on dollar deposits is 10 percent and on euro it is 4 percent.Under these assumptions

A)interest parity does not hold.

B)interest parity does hold.

C)it is hard to tell whether interest parity does or does not hold.

D)interest parity fluctuates.

E)Not enough information is given to answer the question.

A)interest parity does not hold.

B)interest parity does hold.

C)it is hard to tell whether interest parity does or does not hold.

D)interest parity fluctuates.

E)Not enough information is given to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

Determine for each,whether the interest parity condition holds or not,if  = 1.10

= 1.10

= 1.10

= 1.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

If the dollar interest rate is 10 percent,the euro interest rate is 6 percent,then

A)an investor should invest only in dollars if the expected dollar depreciation against the euro is 4 percent.

B)an investor should invest only in euros if the expected dollar depreciation against the euro is 4 percent.

C)an investor should be indifferent between dollars and euros if the expected dollar depreciation against the euro is 4 percent.

D)an investor should invest only in dollars.

E)an investor should invest only in euros.

A)an investor should invest only in dollars if the expected dollar depreciation against the euro is 4 percent.

B)an investor should invest only in euros if the expected dollar depreciation against the euro is 4 percent.

C)an investor should be indifferent between dollars and euros if the expected dollar depreciation against the euro is 4 percent.

D)an investor should invest only in dollars.

E)an investor should invest only in euros.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

If the dollar interest rate is 10 percent and the euro interest rate is 6 percent,then an investor should

A)invest only in dollars.

B)invest only in euros.

C)be indifferent between dollars and euros.

D)invest only in dollars if the exchange rate is expected to remain constant.

E)invest only in euros if the exchange rate is expected to remain constant.

A)invest only in dollars.

B)invest only in euros.

C)be indifferent between dollars and euros.

D)invest only in dollars if the exchange rate is expected to remain constant.

E)invest only in euros if the exchange rate is expected to remain constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

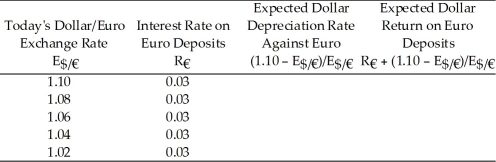

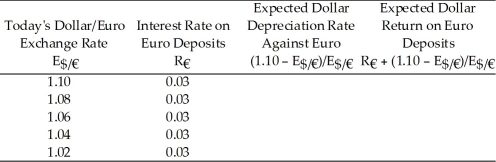

Assume that the euro interest rate is constant at 5 percent,and that the expected exchange rate is 1.05 dollars per one euro.Find the expected dollar return on euro deposits for the following cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

For the table below calculate the EXACT relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is the expected dollar rate of return on euro deposits if today's exchange rate is $1.167 per euro,next year's expected exchange rate is $1.10 per euro,the dollar interest rate is 10%,and the euro interest rate is 5%?

A)10%

B)11%

C)-1%

D)0%

A)10%

B)11%

C)-1%

D)0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is the interest parity condition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which one of the following statements is the MOST accurate?

A)Since dollar and yen interest rates are measured in comparable terms,they can move quite differently over time.

B)Since dollar and yen interest rates are not measured in comparable terms,they can move quite differently over time.

C)Since dollar and yen interest rates are measured in comparable terms,they move quite the same over time.

D)Since dollar and yen interest rates are measured in comparable terms,they still move quite differently over time.

E)Since dollar and yen interest rates are so similar,they move quite the same way over time.

A)Since dollar and yen interest rates are measured in comparable terms,they can move quite differently over time.

B)Since dollar and yen interest rates are not measured in comparable terms,they can move quite differently over time.

C)Since dollar and yen interest rates are measured in comparable terms,they move quite the same over time.

D)Since dollar and yen interest rates are measured in comparable terms,they still move quite differently over time.

E)Since dollar and yen interest rates are so similar,they move quite the same way over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the expected dollar rate of return on dollar deposits if today's exchange rate is $1.10 per euro,next year's expected exchange rate is $1.165 per euro,the dollar interest rate is 10%,and the euro interest rate is 5%?

A)10%

B)11%

C)-1%

D)0%

E)15%

A)10%

B)11%

C)-1%

D)0%

E)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

Using the data in the table above,plot today's dollar/euro exchange rate against the expected dollar return on euro deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

Show graphically a drop in the interest rate paid by euro deposits.What is the effect on the dollar?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assume the U.S.interest rate is 10 percent,and the interest rate on euro deposits is 5 percent.For the following exchange rates,find the forward exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

Calculate the interest rate in the United States,if interest parity condition holds,for the following 15 cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

Explain why (holding interest rates constant),a rise in the expected depreciation in a country's currency leads to depreciation of that currency today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

Calculate the interest rate in the euro zone if interest parity condition holds,for the following 15 cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

The covered interest rate parity condition can be stated as follows: The interest rate on dollar deposits equals the interest rate on euro deposits ________ the forward ________ on euros against dollars.

A)plus;premium

B)minus;premium

C)plus;discount

D)minus;discount

E)times;premium

A)plus;premium

B)minus;premium

C)plus;discount

D)minus;discount

E)times;premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

Discuss the effects of a rise in the interest rate paid by euro deposits on the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which one of the following statements is the MOST accurate?

A)For a fixed interest rate,a rise in the expected future exchange rate causes a rise in the current exchange rate.

B)For a fixed interest rate,a rise in the expected future exchange rate causes a fall in the current exchange rate.

C)For a fixed interest rate,a rise in the expected future exchange rate does not cause a change in the current exchange rate.

D)For a given dollar interest rate and a constant expected exchange rate,a rise in the interest rate of the euro causes the dollar to depreciate.

E)For a fixed interest rate,a fall in the expected future exchange rate causes a rise in the current exchange rate.

A)For a fixed interest rate,a rise in the expected future exchange rate causes a rise in the current exchange rate.

B)For a fixed interest rate,a rise in the expected future exchange rate causes a fall in the current exchange rate.

C)For a fixed interest rate,a rise in the expected future exchange rate does not cause a change in the current exchange rate.

D)For a given dollar interest rate and a constant expected exchange rate,a rise in the interest rate of the euro causes the dollar to depreciate.

E)For a fixed interest rate,a fall in the expected future exchange rate causes a rise in the current exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

The covered interest rate parity condition can be stated as follows: The interest rate on dollar deposits equals the interest rate on euro deposits ________ the forward ________ on dollars against euros.

A)plus;premium

B)plus;discount

C)times;premium

D)minus;premium

E)minus;discount

A)plus;premium

B)plus;discount

C)times;premium

D)minus;premium

E)minus;discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

Show graphically a drop in the interest rate offered by dollar deposits,R$,and the effect on the exchange rate,  .

.

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

71

Explain why the interest parity condition must hold if the foreign exchange market is in equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

Discuss the effects of a rise in the dollar interest rate on the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which one of the following statements is the MOST accurate?

A)A rise in the interest rate offered by dollar deposits causes the dollar to appreciate.

B)A rise in the interest rate offered by dollar deposits causes the dollar to depreciate.

C)A rise in the interest rate offered by dollar deposits does not affect the U.S.dollar.

D)For a given euro interest rate and constant expected exchange rate,a rise in the interest rate offered by dollar deposits causes the dollar to appreciate.

E)A rise in the interest rate offered by the dollar causes the euro to appreciate.

A)A rise in the interest rate offered by dollar deposits causes the dollar to appreciate.

B)A rise in the interest rate offered by dollar deposits causes the dollar to depreciate.

C)A rise in the interest rate offered by dollar deposits does not affect the U.S.dollar.

D)For a given euro interest rate and constant expected exchange rate,a rise in the interest rate offered by dollar deposits causes the dollar to appreciate.

E)A rise in the interest rate offered by the dollar causes the euro to appreciate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

Calculate the Expected Dollar Depreciation Rate against the euro and the expected dollar return on euro deposits if the expected exchange rate is $1.10 per euro.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck