Deck 10: Fiduciary Funds and Permanent Funds

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 10: Fiduciary Funds and Permanent Funds

1

In previous years,Boze City had received a $400,000 gift of cash and investments.The donor had specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested.During the current year,the earnings from this gift were $24,000.The earnings from this gift should generally be considered revenue to which of the following funds?

A)Special revenue fund.

B)Private-purpose trust fund.

C)Agency fund.

D)Permanent fund.

A)Special revenue fund.

B)Private-purpose trust fund.

C)Agency fund.

D)Permanent fund.

D

2

In an agency fund,assets always equal fund balances because there are no liabilities.

False

3

GASB standards require a defined benefit pension plan to report investments at fair market value even if the plan's actuary uses a different value in determining the employer's contribution requirements.

True

4

In accounting for permanent funds only the income can be spent;the principal must be preserved intact.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

The concept of major versus nonmajor funds does not apply to permanent funds,as it does to governmental and proprietary funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

Per GASB Statement No.34,permanent funds are classified as fiduciary funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

The $200,000 gift would be reported in a an):

A)Special revenue fund.

B)Private-purpose trust fund.

C)Agency fund.

D)Permanent fund.

A)Special revenue fund.

B)Private-purpose trust fund.

C)Agency fund.

D)Permanent fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

Colleges that use a fixed rate of return approach to manage the distribution of income from their endowments must apply the same rate to determine how much investment income to report in their financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

During the current year the private-purpose trust fund will recognize,related to earnings:

A)$24,000 revenues.

B)$20,000 revenues.

C)$24,000 addition to net position.

D)$20,000 addition to net position.

A)$24,000 revenues.

B)$20,000 revenues.

C)$24,000 addition to net position.

D)$20,000 addition to net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

Not-for-profits report all investment gains and losses on endowments as additions to temporarily restricted net assets,regardless of donor-imposed restrictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

A government receives a gift of cash and investments with a fair value of $200,000.The donor specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested.The $200,000 gift should be accounted for in which of the following funds?

A)General fund.

B)Private-purpose trust fund.

C)Agency fund.

D)Permanent fund.

A)General fund.

B)Private-purpose trust fund.

C)Agency fund.

D)Permanent fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

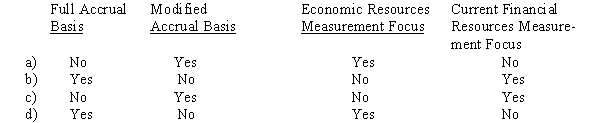

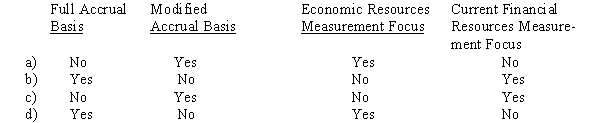

Fiduciary funds focus on current financial resources and use the full accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

Fiduciary funds are excluded from the government-wide financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

Employers that provide postemployment healthcare benefit plans should account for them in private-purpose trust funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

The $20,000 transfer would be reported by the fund that made the transfer as a an)

A)Transfer-out.

B)Expenditure.

C)Deduction from net position-benefits.

D)Expense.

A)Transfer-out.

B)Expenditure.

C)Deduction from net position-benefits.

D)Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

Accounting for the employer's contribution to a defined benefit pension plan is straight forward,because the employer is obligated only to make annual contributions in the amount specified in the plan terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

In contrast to most private-sector pension plans,most government plans are defined contribution plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

Accounting for the employer's contribution to a defined contribution pension plan is straight forward,because the employer is obligated only to make annual contributions in the amount specified in the plan terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

Permanent funds focus on measuring current financial resources and use a modified accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

An employer may have a liability to a defined benefit pension plan other than for its annual required contributions,depending on the future financial health of the plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

Dale City Light & Water a proprietary fund)contributes to a defined benefit pension plan for its employees.During 2014,the city contributed $36 million to the pension plan.The city also made a $4 million contribution related to 2013.The actuarially determined contribution requirement for 2014 was $43 million.The amount of pension expense recognized by Dale City Light & Water for 2014 should be:

A)$ 0

B)$ 36 million

C)$ 40 million

D)$ 43 million

A)$ 0

B)$ 36 million

C)$ 40 million

D)$ 43 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

In which of the following funds would the account "net pension obligation" be most likely to appear?

A)General fund.

B)Enterprise fund.

C)Private-purpose trust fund.

D)Agency fund.

A)General fund.

B)Enterprise fund.

C)Private-purpose trust fund.

D)Agency fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

Several years ago,a donor gave $5 million to Denton City and specified that the principal was to be kept intact but the earnings were to be used to support the operations of city parks.During the current year,the city earned $300,000 on the gift.To what type of fund,should the city transfer the $300,000 earnings?

A)It should not make any transfers.The $300,000 should remain in the city's permanent fund.

B)A special revenue fund.

C)The general fund.

D)An enterprise fund.

A)It should not make any transfers.The $300,000 should remain in the city's permanent fund.

B)A special revenue fund.

C)The general fund.

D)An enterprise fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

Permanent funds are classified as

A)Governmental funds.

B)Proprietary funds.

C)Fiduciary funds.

D)Trust funds.

A)Governmental funds.

B)Proprietary funds.

C)Fiduciary funds.

D)Trust funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is NOT a fiduciary fund?

A)Pension trust fund.

B)Investment trust fund.

C)Permanent fund.

D)Private-purpose trust fund.

A)Pension trust fund.

B)Investment trust fund.

C)Permanent fund.

D)Private-purpose trust fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following activities of a government should be accounted for in a fiduciary fund?

A)Funds received from the federal government to support public transportation activities.

B)Funds received from an individual who specified that the principal must be kept intact but the income can be used to support families of police officers killed in the line of duty.

C)Funds received from the state government that must be used to purchase capital assets.

D)Funds received from a contractor to assist with the development of utility infrastructure.

A)Funds received from the federal government to support public transportation activities.

B)Funds received from an individual who specified that the principal must be kept intact but the income can be used to support families of police officers killed in the line of duty.

C)Funds received from the state government that must be used to purchase capital assets.

D)Funds received from a contractor to assist with the development of utility infrastructure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

What basis of accounting is used to account for the transactions of a government's permanent fund?

A)Full accrual basis of accounting.

B)Modified accrual basis of accounting.

C)Cash basis of accounting.

D)Budgetary basis of accounting.

A)Full accrual basis of accounting.

B)Modified accrual basis of accounting.

C)Cash basis of accounting.

D)Budgetary basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

In which of the following funds would a government report depreciation expense?

A)Private-purpose trust fund.

B)Agency fund.

C)Permanent fund.

D)None of the above

A)Private-purpose trust fund.

B)Agency fund.

C)Permanent fund.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

On its year-end statement of financial position,the charity would report permanently restricted net assets of:

A)$1 million.

B)$1.04 million.

C)$1.03 million.

D)$1.01 million.

A)$1 million.

B)$1.04 million.

C)$1.03 million.

D)$1.01 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

On its year-end statement of activities,the charity would report interest revenues of:

A)$0

B)$30,000

C)$40,000

D)None of the above.

A)$0

B)$30,000

C)$40,000

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

At the beginning of the year,the permanent fund of Rose City had an investment portfolio with a historical cost of $300,000 and a fair value of $330,000.There were no purchases or sales of securities during the year.At the end of the year the portfolio had a fair value of $360,000.At year-end, the city s account for this increase in fair value in which of the following ways?

A)Credit Investment income,$30,000.

B)Credit Investment income,$60,000.

C)Credit Fund balance,$30,000.

D)No entry should be made to recognize an increase in fair value.

A)Credit Investment income,$30,000.

B)Credit Investment income,$60,000.

C)Credit Fund balance,$30,000.

D)No entry should be made to recognize an increase in fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

During the year,a state-owned university received a $5 million gift.The donor specified that the principal of the gift must be held intact for 3 years,but the earnings from the gift can be used to support technology improvements in the college of business.At the end of the 3 years,the donor together with the university president and the college dean will decide how the $5 million gift can be used.The university will report the gift in what type of fund?

A)Permanent fund.

B)Private-purpose trust fund.

C)Plant fund.

C)Special revenue fund

A)Permanent fund.

B)Private-purpose trust fund.

C)Plant fund.

C)Special revenue fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

What basis of accounting is used to account for transactions of a government's private-purpose trust fund?

A)Full accrual basis of accounting.

B)Modified accrual basis of accounting.

C)Cash basis of accounting.

D)Budgetary basis of accounting.

A)Full accrual basis of accounting.

B)Modified accrual basis of accounting.

C)Cash basis of accounting.

D)Budgetary basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would NOT be accounted for in a fiduciary fund of a government?

A)Nonexpendable resources held for the benefit of other governments.

B)Nonexpendable resources held for the benefit of the government holding the resources.

C)Expendable resources held for the benefit of other governments.

D)Funds held as an agent for other entities.

A)Nonexpendable resources held for the benefit of other governments.

B)Nonexpendable resources held for the benefit of the government holding the resources.

C)Expendable resources held for the benefit of other governments.

D)Funds held as an agent for other entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

Maple City has a permanent fund that reported current-year investment earnings realized and unrealized)of $80,000.The endowment principal is $800,000 and the city council has adopted a policy of considering only the inflation-adjusted rate of return to be available for transfer to the recipient fund.During the current year the council declared the inflation-adjusted rate of return to be 8 percent.How much revenue would be recognized in the permanent fund?

A)$ 0.

B)$ 64,000.

C)$ 80,000.

D)Insufficient information to determine.

A)$ 0.

B)$ 64,000.

C)$ 80,000.

D)Insufficient information to determine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

A defined contribution pension plan is one in which the employer agrees to do which of the following?

A)To make payments to a specified pension plan with no guarantee of a specific pension amount to be paid to the employees.

B)To make actuarially determined payments to a pension plan AND to guarantee that the employees will receive a specified pension benefit usually determined by length of service and salary).

C)To make actuarially determined payments to a pension plan that guarantees employees will receive a specified pension usually determined by length of service and salary).

C)To pay specified amounts usually determined by length of service and salary)to the employees upon retirement.

A)To make payments to a specified pension plan with no guarantee of a specific pension amount to be paid to the employees.

B)To make actuarially determined payments to a pension plan AND to guarantee that the employees will receive a specified pension benefit usually determined by length of service and salary).

C)To make actuarially determined payments to a pension plan that guarantees employees will receive a specified pension usually determined by length of service and salary).

C)To pay specified amounts usually determined by length of service and salary)to the employees upon retirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

During the current year the private-purpose trust fund will recognize,related to the cash outflow:

A)$20,000 transfer-out.

B)$20,000 expenses.

C)$24,000 deduction from net position.

D)$20,000 deduction from net position.

A)$20,000 transfer-out.

B)$20,000 expenses.

C)$24,000 deduction from net position.

D)$20,000 deduction from net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

On its year-end statement of financial position,the charity would report temporarily restricted net assets of:

A)$40,000.

B)$ 0.

C)$30,000.

D)$1.04 million.

A)$40,000.

B)$ 0.

C)$30,000.

D)$1.04 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

During the fiscal year ended December 31,2013,Glen City's general fund contributed $60 million to a defined benefit pension plan for city employees.On February 27,2014,the general fund made an additional $3 million contribution related to the 2013 pension contribution requirements.The actuarially determined contribution requirement for 2013 is $65 million.The amount of pension expenditure recognized by the general fund for 2013 should be:

A)$ 0

B)$ 60 million

C)$ 63 million

D)$ 65 million

A)$ 0

B)$ 60 million

C)$ 63 million

D)$ 65 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

A wealthy citizen provided in her will for a gift of cash and other assets to Balsa city.The will specified that the gift was to be kept intact and that the earnings from the gift were to be used to support public parks.At the time of the donation,the gift had a book value in the hands of the donor of $300,000 and a fair value of $500,000.When recording this gift the city would credit

A)Contributions revenues $500,000.

B)Other financing sources-contributions $500,000.

C)Contributions revenues $300,000.

D)Other financing sources-contributions $300,000.

A)Contributions revenues $500,000.

B)Other financing sources-contributions $500,000.

C)Contributions revenues $300,000.

D)Other financing sources-contributions $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

The funded status of a defined benefit pension plan is

A)The result of comparing the actuarial value of plan assets with the plan's actuarial accrued liability for benefits.

B)The amount by which plan assets exceed benefits due to current retirees.

C)Current-year contributions less amounts currently due but not paid to current retirees,

D)The policy as to whether the plan is being financed on a pay-as-you-go cash)basis or through actuarially determined employer contributions.

A)The result of comparing the actuarial value of plan assets with the plan's actuarial accrued liability for benefits.

B)The amount by which plan assets exceed benefits due to current retirees.

C)Current-year contributions less amounts currently due but not paid to current retirees,

D)The policy as to whether the plan is being financed on a pay-as-you-go cash)basis or through actuarially determined employer contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

Assets reported in a government's investment trust fund should include:

A)Only investments owned by external participants in the investment pool.

B)Investments of both the sponsoring government and of external participants in the investment pool.

C)Investments related to the sponsoring government's governmental funds and of external participants in the investment pool.

D)Investments related to the sponsoring government's other fiduciary funds and of external participants in the investment pool.

A)Only investments owned by external participants in the investment pool.

B)Investments of both the sponsoring government and of external participants in the investment pool.

C)Investments related to the sponsoring government's governmental funds and of external participants in the investment pool.

D)Investments related to the sponsoring government's other fiduciary funds and of external participants in the investment pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

Financial assets reported by most investment trust funds of governments should be reported at

A)Cost

B)Amortized historical cost.

C)Fair value on the date of the financial statements.

D)Fair value computed by a weighted-average approach.

A)Cost

B)Amortized historical cost.

C)Fair value on the date of the financial statements.

D)Fair value computed by a weighted-average approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

The fiduciary fund financial statements in a government's annual financial report comprise

A)Consolidated statements only--no separate statements for individual pension plans.

B)A separate column in each statement for each fiduciary fund type.

C)A consolidated assets and benefits statement showing three classes of net assets.

D)Statements reporting information by major fund.

A)Consolidated statements only--no separate statements for individual pension plans.

B)A separate column in each statement for each fiduciary fund type.

C)A consolidated assets and benefits statement showing three classes of net assets.

D)Statements reporting information by major fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

Financial assets reported by qqqqqqqqqqqqq2a7-like investment pools should be reported at

A)Fair value at the date of the financial statements.

B)Amortized historical cost.

C)Fair value computed using a weighted-average approach.

D)Cost.

A)Fair value at the date of the financial statements.

B)Amortized historical cost.

C)Fair value computed using a weighted-average approach.

D)Cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

Citizens within a defined geographic area of Dolan City created a special assessment district to facilitate the construction of sidewalks.The city was responsible for overseeing the entire construction project.The city issued bonds in its own name to pay the contractor for the construction.However,the city was not responsible in any manner for the bonds.The bonds were secured by the special assessments that are levied against properties within the special assessment district.Collections of special assessments would be recorded in which of the following funds of Dolan City?

A)Special assessment fund.

B)Agency fund.

C)Special revenue fund.

D)Debt service fund.

A)Special assessment fund.

B)Agency fund.

C)Special revenue fund.

D)Debt service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

A major difference between defined benefit pension plans and defined contribution pension plans is that

A)In defined benefit plans,the risk of loss is borne primarily by the employer.

B)Accounting for defined benefit plans is much simpler than accounting for defined contribution plans.

C)Employees generally are required to contribute to defined contribution plans but not to defined benefit plans.

D)There is no major difference between the two kinds of pension plans.

A)In defined benefit plans,the risk of loss is borne primarily by the employer.

B)Accounting for defined benefit plans is much simpler than accounting for defined contribution plans.

C)Employees generally are required to contribute to defined contribution plans but not to defined benefit plans.

D)There is no major difference between the two kinds of pension plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

The liabilities related to benefits and refunds of a defined benefit pension plan are reported in a government's fiduciary fund financial statements using the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

GASB standards of accounting for other postemployment benefits OPEB)require that governments

A)Fund their OPEB benefits on an actuarially determined basis.

B)Report actuarially determined required contributions as OPEB expense,regardless of whether the government actually makes the contributions.

C)Report OPEB costs in accordance with the FASB's standards of accounting for OPEB.

D)Only disclose an estimate of their OPEB liabilities.

A)Fund their OPEB benefits on an actuarially determined basis.

B)Report actuarially determined required contributions as OPEB expense,regardless of whether the government actually makes the contributions.

C)Report OPEB costs in accordance with the FASB's standards of accounting for OPEB.

D)Only disclose an estimate of their OPEB liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

Ashby City receives a federal grant to assist in nutrition programs for its senior citizens.Senior citizens whose income is below a specified amount the amount was specified by the Federal government)are eligible to participate in the program.Monthly checks of $100 this amount was specified by the Federal government)will be mailed to eligible senior citizens.The proceeds of this grant should be accounted for in which of the following funds of the city?

A)General fund.

B)Special revenue fund.

C)Agency fund.

D)Private-purpose trust fund.

A)General fund.

B)Special revenue fund.

C)Agency fund.

D)Private-purpose trust fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is NOT a criterion that an employer's annual required contribution must satisfy to be considered acceptable?

A)It must consist of the employer's normal cost plus a provision for amortizing the plan's unfunded actuarially accrued liability.

B)Actual assumptions must be in accordance with standards of the Actuarial Standards Board.

C)Actuarial value of pension plan assets must be based on market values on the financial statement date.

D)Assumptions as to investment earnings should be based on long-term projections.

A)It must consist of the employer's normal cost plus a provision for amortizing the plan's unfunded actuarially accrued liability.

B)Actual assumptions must be in accordance with standards of the Actuarial Standards Board.

C)Actuarial value of pension plan assets must be based on market values on the financial statement date.

D)Assumptions as to investment earnings should be based on long-term projections.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

A plan's unfunded actuarially accrued liability is the excess of the:

A)Actuarially determined plan cost over the actual contribution.

B)Actuarially determined plan cost over the plan assets.

C)Actuarially determined pension liability over the plan assets.

D)Actuarially determined pension liability over the total contributions

A)Actuarially determined plan cost over the actual contribution.

B)Actuarially determined plan cost over the plan assets.

C)Actuarially determined pension liability over the plan assets.

D)Actuarially determined pension liability over the total contributions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

Liabilities reported in pension trust funds consist of

A)Liabilities accrued using the accrual basis of accounting,including the actuarial accrued liability for the plan.

B)Liabilities accrued using the modified accrual basis of accounting,excluding the actuarial accrued liability for the plan.

C)Liabilities accrued using the accrual basis of accounting,excluding the actuarial accrued liability for the plan.

D)Liabilities accrued using the modified accrual basis of accounting,including the plan benefits that will be paid with measurable and available financial resources.

A)Liabilities accrued using the accrual basis of accounting,including the actuarial accrued liability for the plan.

B)Liabilities accrued using the modified accrual basis of accounting,excluding the actuarial accrued liability for the plan.

C)Liabilities accrued using the accrual basis of accounting,excluding the actuarial accrued liability for the plan.

D)Liabilities accrued using the modified accrual basis of accounting,including the plan benefits that will be paid with measurable and available financial resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

Lomond City receives a federal grant to assist in nutrition programs for its senior citizens.The city will select the contractors that will provide meals and approve the participants in the program.The proceeds of this grant should be accounted for in which of the following funds of the city?

A)A governmental fund.

B)An enterprise fund.

C)An agency fund.

D)A private-purpose trust fund.

A)A governmental fund.

B)An enterprise fund.

C)An agency fund.

D)A private-purpose trust fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is NOT true of agency funds?

A)Governments use them to account for resources held as trustee or agent for another government,fund,not-for-profit entity,or individual.

B)They are required to use a modified accrual basis of accounting.

C)They have no operations and therefore are not required to prepare financial statements.

D)Agency fund assets are always offset by liabilities.

A)Governments use them to account for resources held as trustee or agent for another government,fund,not-for-profit entity,or individual.

B)They are required to use a modified accrual basis of accounting.

C)They have no operations and therefore are not required to prepare financial statements.

D)Agency fund assets are always offset by liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

Whether gains on the sale of a government endowment's investments should be considered additions to principal or expendable income for accounting purposes is:

A)An issue that has been resolved by federal law.

B)Debatable,but generally resolved in favor of adding the gains to unrestricted assets expendable),absent donor or legal stipulations.

C)A matter for governments to decide,independent of donor or legal considerations.

D)Debatable,but generally resolved in favor of adding the gains to principal nonexpendable assets),absent donor or legal stipulations.

A)An issue that has been resolved by federal law.

B)Debatable,but generally resolved in favor of adding the gains to unrestricted assets expendable),absent donor or legal stipulations.

C)A matter for governments to decide,independent of donor or legal considerations.

D)Debatable,but generally resolved in favor of adding the gains to principal nonexpendable assets),absent donor or legal stipulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

Governments must present which of the following financial statements for fiduciary funds?

A)Statement of assets and benefits and statement of cash flows.

B)Statement of fiduciary net assets and statement of changes in benefits,

C)Statement of fiduciary net position and statement of changes in fiduciary net position.

D)Statement of net assets and statement of accrued benefit obligations.

A)Statement of assets and benefits and statement of cash flows.

B)Statement of fiduciary net assets and statement of changes in benefits,

C)Statement of fiduciary net position and statement of changes in fiduciary net position.

D)Statement of net assets and statement of accrued benefit obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

Required disclosure by the general fund of a government related to its pension plan does NOT include which of the following?

A)The employer's funding policy.

B)The components of the pension cost.

C)The key assumptions used in determining the pension cost.

D)The present value of the future benefits to be paid.

A)The employer's funding policy.

B)The components of the pension cost.

C)The key assumptions used in determining the pension cost.

D)The present value of the future benefits to be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

The schedule of changes in long-term obligations contains an account "net pension obligation." Which of the following describes the event that gave rise to this account?

A)The actual contribution by a proprietary fund was less than the annual required contribution per the actuary.

B)The actual contribution by a governmental fund was less than the annual required contribution per the actuary.

C)The actuarially computed pension liability exceeded the pension plan assets.

D)The actuarially computed pension liability was less than the pension plan assets.

A)The actual contribution by a proprietary fund was less than the annual required contribution per the actuary.

B)The actual contribution by a governmental fund was less than the annual required contribution per the actuary.

C)The actuarially computed pension liability exceeded the pension plan assets.

D)The actuarially computed pension liability was less than the pension plan assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

The primary financial statements for a government-sponsored pension plan are:

A)Balance sheet and statement of activities.

B)Balance sheet,statement of activities,and cash flows statement.

C)Statement of fiduciary net assets and a statement of changes in fiduciary net assets

D)Balance sheet,statement of activities,cash flows statement,and statement of funding progress.

A)Balance sheet and statement of activities.

B)Balance sheet,statement of activities,and cash flows statement.

C)Statement of fiduciary net assets and a statement of changes in fiduciary net assets

D)Balance sheet,statement of activities,cash flows statement,and statement of funding progress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck