Deck 11: Fiscal Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

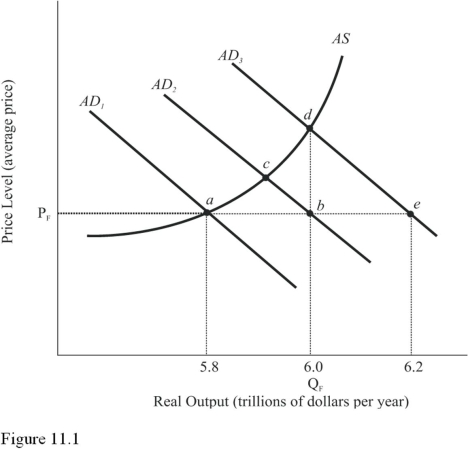

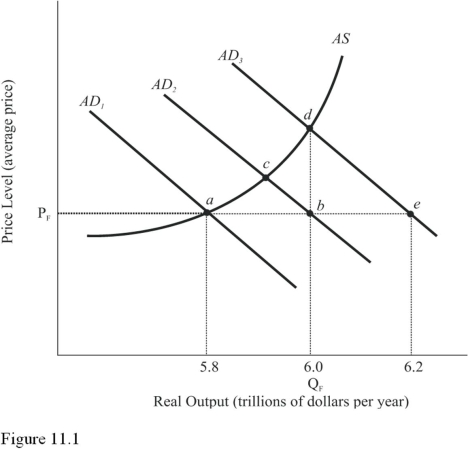

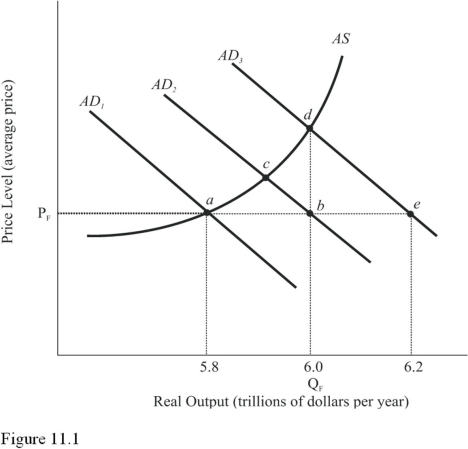

سؤال

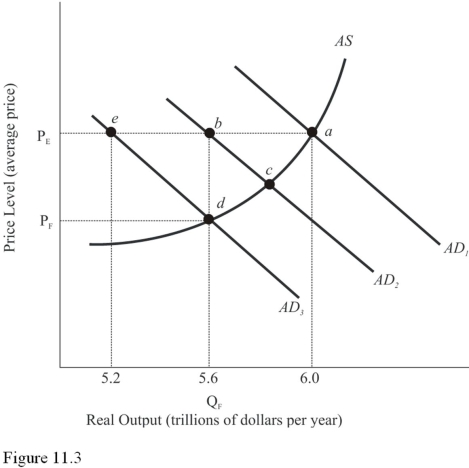

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/133

العب

ملء الشاشة (f)

Deck 11: Fiscal Policy

1

Which of the following is an income transfer?

A)Free medical care made available to the poor by a private physician.

B)Unemployment benefits paid to a factory worker who was laid off.

C)A new highway built by the federal government.

D)A gift of money from a parent to a child.

A)Free medical care made available to the poor by a private physician.

B)Unemployment benefits paid to a factory worker who was laid off.

C)A new highway built by the federal government.

D)A gift of money from a parent to a child.

Unemployment benefits paid to a factory worker who was laid off.

2

The use of government taxes and spending to alter economic outcomes is known as

A)Monetary policy.

B)Fiscal policy.

C)Income policy.

D)Foreign trade policy.

A)Monetary policy.

B)Fiscal policy.

C)Income policy.

D)Foreign trade policy.

Fiscal policy.

3

Payments to individuals for which no current goods or services are exchanged are known as

A)Social Security payroll taxes.

B)Income transfers.

C)AD shortfalls.

D)AD excesses.

A)Social Security payroll taxes.

B)Income transfers.

C)AD shortfalls.

D)AD excesses.

Income transfers.

4

Which of the following would cause both an increase in the price level and an increase in real output?

A)A tax hike.

B)A decrease in production costs.

C)An increase in transfer payments.

D)A decrease in government spending.

A)A tax hike.

B)A decrease in production costs.

C)An increase in transfer payments.

D)A decrease in government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

5

The AD shortfall is the amount of additional aggregate demand needed to achieve full employment after allowing for

A)Multiplier effects.

B)Price level changes.

C)Feedback effects.

D)Fiscal stimulus.

A)Multiplier effects.

B)Price level changes.

C)Feedback effects.

D)Fiscal stimulus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the recessionary GDP gap is $500,then the proper fiscal stimulus when faced with an upward-sloping AS curve is to

A)Shift the AD curve rightward by $500.

B)Shift the AD curve rightward by more than $500.

C)Shift the AD curve leftward by $500.

D)Shift the AS curve rightward by less than $500.

A)Shift the AD curve rightward by $500.

B)Shift the AD curve rightward by more than $500.

C)Shift the AD curve leftward by $500.

D)Shift the AS curve rightward by less than $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

7

The recessionary GDP gap will differ from the AD shortfall when the

A)Multiplier effect raises spending.

B)Budget is balanced.

C)Aggregate supply curve slopes upward.

D)Multiplier effect lowers spending.

A)Multiplier effect raises spending.

B)Budget is balanced.

C)Aggregate supply curve slopes upward.

D)Multiplier effect lowers spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is generally considered a desirable outcome of fiscal policy?

A)More jobs.

B)Higher unemployment rates.

C)A higher price level.

D)Greater deficits.

A)More jobs.

B)Higher unemployment rates.

C)A higher price level.

D)Greater deficits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

9

In a diagram of aggregate demand and supply curves,the GDP gap is measured as the

A)Horizontal distance between the equilibrium output and the full-employment output.

B)Vertical distance between the equilibrium price and the price at which the aggregate demand would intersect aggregate supply at full employment.

C)Horizontal distance between the aggregate demand necessary to achieve full employment and the aggregate demand curve at equilibrium output.

D)Vertical distance between the equilibrium output and the full-employment output.

A)Horizontal distance between the equilibrium output and the full-employment output.

B)Vertical distance between the equilibrium price and the price at which the aggregate demand would intersect aggregate supply at full employment.

C)Horizontal distance between the aggregate demand necessary to achieve full employment and the aggregate demand curve at equilibrium output.

D)Vertical distance between the equilibrium output and the full-employment output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

10

A tax cut intended to increase aggregate demand is an example of

A)Fiscal restraint.

B)Monetary restraint.

C)Fiscal stimulus.

D)Fiscal targeting.

A)Fiscal restraint.

B)Monetary restraint.

C)Fiscal stimulus.

D)Fiscal targeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following will most likely provide fiscal stimulus to the economy?

A)Increasing taxes.

B)Decreasing government spending on goods and services.

C)Increasing transfer payments.

D)Higher interest rates.

A)Increasing taxes.

B)Decreasing government spending on goods and services.

C)Increasing transfer payments.

D)Higher interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

12

Assume the economy is operating below full employment.Which of the following policy actions will allow aggregate spending to increase but will not increase the size of the government in the process?

A)Increase government spending and leave tax rates unchanged.

B)Decrease tax rates and leave government spending unchanged.

C)Increase government spending and taxes by the same amount.

D)Decrease government spending by more than an increase in taxes.

A)Increase government spending and leave tax rates unchanged.

B)Decrease tax rates and leave government spending unchanged.

C)Increase government spending and taxes by the same amount.

D)Decrease government spending by more than an increase in taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to Keynes,the level of economic activity is predominantly determined by the level of

A)Aggregate supply.

B)Aggregate demand.

C)Unemployment.

D)Interest rates.

A)Aggregate supply.

B)Aggregate demand.

C)Unemployment.

D)Interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

14

Keynesians would recommend

A)Higher taxes when there is excess aggregate demand.

B)Lower government expenditures when there is a shortfall in aggregate demand.

C)Reliance on the market rather than the government for adjustment when an undesirable level of aggregate demand occurs.

D)Lower taxes when there is excess aggregate demand.

A)Higher taxes when there is excess aggregate demand.

B)Lower government expenditures when there is a shortfall in aggregate demand.

C)Reliance on the market rather than the government for adjustment when an undesirable level of aggregate demand occurs.

D)Lower taxes when there is excess aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following gave the U.S.federal government the power to tax income?

A)The Sixteenth Amendment to the Constitution.

B)The Full Employment and Balanced Growth Act of 1978.

C)The Social Security Act.

D)The capital gains tax of the Bush administration.

A)The Sixteenth Amendment to the Constitution.

B)The Full Employment and Balanced Growth Act of 1978.

C)The Social Security Act.

D)The capital gains tax of the Bush administration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

16

Prior to 1913,most of the federal government's tax revenues came from

A)Social Security payroll taxes.

B)Customs,whiskey,and tobacco taxes.

C)Individual income taxes.

D)Corporate income taxes.

A)Social Security payroll taxes.

B)Customs,whiskey,and tobacco taxes.

C)Individual income taxes.

D)Corporate income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

17

Fiscal policy works primarily through

A)Shifts of the AS curve.

B)Shifts of the AD curve.

C)The improvement of worker skills through subsidized training programs.

D)Shifts of both AD and AS, as a result of changes in the interest rate.

A)Shifts of the AS curve.

B)Shifts of the AD curve.

C)The improvement of worker skills through subsidized training programs.

D)Shifts of both AD and AS, as a result of changes in the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

18

Nearly half of the federal government's tax revenues come from

A)Social Security payroll taxes.

B)Customs,whiskey,and tobacco taxes.

C)Individual income taxes.

D)Corporate income taxes.

A)Social Security payroll taxes.

B)Customs,whiskey,and tobacco taxes.

C)Individual income taxes.

D)Corporate income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

19

The amount of additional aggregate demand needed to achieve full employment after allowing for price level changes is

A)The AD shortfall.

B)The AD excess.

C)The recessionary GDP gap.

D)The inflationary GDP gap.

A)The AD shortfall.

B)The AD excess.

C)The recessionary GDP gap.

D)The inflationary GDP gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

20

If aggregate demand increases by the amount of the recessionary GDP gap and aggregate supply is upward-sloping,

A)The economy will move to full employment.

B)An AD surplus will occur.

C)A recessionary GDP gap will still exist.

D)An inflationary GDP gap will develop.

A)The economy will move to full employment.

B)An AD surplus will occur.

C)A recessionary GDP gap will still exist.

D)An inflationary GDP gap will develop.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

21

To eliminate an AD shortfall of $100 billion when the economy has an MPC of 0.50,the government should increase spending by

A)$200 billion.

B)$100 billion.

C)$50 billion.

D)$500 billion.

A)$200 billion.

B)$100 billion.

C)$50 billion.

D)$500 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a diagram of aggregate demand and supply curves,the AD shortfall is measured as the

A)Vertical distance between the equilibrium price and the price at which the aggregate demand would intersect aggregate supply at full employment.

B)Horizontal distance between the equilibrium output and the full-employment output.

C)Horizontal distance between the aggregate demand curve necessary for full employment and the aggregate demand curve that intersects AS at the equilibrium price.

D)Vertical distance between the recessionary GDP gap and the inflationary GDP gap.

A)Vertical distance between the equilibrium price and the price at which the aggregate demand would intersect aggregate supply at full employment.

B)Horizontal distance between the equilibrium output and the full-employment output.

C)Horizontal distance between the aggregate demand curve necessary for full employment and the aggregate demand curve that intersects AS at the equilibrium price.

D)Vertical distance between the recessionary GDP gap and the inflationary GDP gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

23

The balanced budget multiplier says that

A)An increase in government spending paid for by a tax cut of equal size has no effect on aggregate demand.

B)An increase in government spending must be paid for by a tax cut of equal size.

C)An increase in government spending paid for by a tax cut of equal size shifts aggregate demand rightward.

D)An increase in government spending paid for by a tax cut of equal size shifts aggregate demand leftward.

A)An increase in government spending paid for by a tax cut of equal size has no effect on aggregate demand.

B)An increase in government spending must be paid for by a tax cut of equal size.

C)An increase in government spending paid for by a tax cut of equal size shifts aggregate demand rightward.

D)An increase in government spending paid for by a tax cut of equal size shifts aggregate demand leftward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is the best choice to eliminate a recessionary gap if the desired fiscal stimulus is $10 billion and the aggregate demand shortfall is $100 billion,while the MPC is 0.90?

A)Tax hike of $11.11 billion.

B)Tax cut of $11.11 billion.

C)Tax hike of $10 billion.

D)Tax cut of $10 billion.

A)Tax hike of $11.11 billion.

B)Tax cut of $11.11 billion.

C)Tax hike of $10 billion.

D)Tax cut of $10 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is true when the government attempts to move the economy to full employment by increasing spending?

A)The desired stimulus should be set by the AD shortfall multiplied by the multiplier.

B)It must initially spend more than the GDP gap if the aggregate supply curve is upward-sloping.

C)The total change in spending includes both the new government spending and the subsequent increases in consumer spending.

D)The desired stimulus should be set by the multiplier divided by the AD shortfall.

A)The desired stimulus should be set by the AD shortfall multiplied by the multiplier.

B)It must initially spend more than the GDP gap if the aggregate supply curve is upward-sloping.

C)The total change in spending includes both the new government spending and the subsequent increases in consumer spending.

D)The desired stimulus should be set by the multiplier divided by the AD shortfall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

26

If the government purchases multiplier is 4 and a change in government spending leads to a $500 million decrease in aggregate demand,we can conclude that

A)Government spending decreased by $125 million.

B)Taxes increased by $500 million.

C)Taxes decreased by $100 million.

D)Government spending decreased by $100 million.

A)Government spending decreased by $125 million.

B)Taxes increased by $500 million.

C)Taxes decreased by $100 million.

D)Government spending decreased by $100 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

27

Assume the MPC is 0.75.To eliminate an AD shortfall of $200 billion,the government should

A)Decrease spending by $50 billion.

B)Increase spending by $50 billion.

C)Increase taxes by $66.7 billion.

D)Increase spending by $800 billion.

A)Decrease spending by $50 billion.

B)Increase spending by $50 billion.

C)Increase taxes by $66.7 billion.

D)Increase spending by $800 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

28

The total change in aggregate spending generated by increased government spending depends on the

A)Marginal propensity to consume.

B)Size of the recessionary GDP gap.

C)AD shortfall.

D)AD excess.

A)Marginal propensity to consume.

B)Size of the recessionary GDP gap.

C)AD shortfall.

D)AD excess.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following formulas is used to find the cumulative increase in AD from a particular fiscal stimulus?

A)Fiscal stimulus ÷ the multiplier.

B)Fiscal stimulus ÷ MPC.

C)The multiplier × fiscal stimulus.

D)MPC × fiscal stimulus.

A)Fiscal stimulus ÷ the multiplier.

B)Fiscal stimulus ÷ MPC.

C)The multiplier × fiscal stimulus.

D)MPC × fiscal stimulus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

30

A tax cut

A)Directly decreases the disposable income of consumers.

B)Contains less fiscal stimulus than an increase in government spending of the same size.

C)Shifts the AD curve to the left.

D)Indirectly increases the disposable income of consumers.

A)Directly decreases the disposable income of consumers.

B)Contains less fiscal stimulus than an increase in government spending of the same size.

C)Shifts the AD curve to the left.

D)Indirectly increases the disposable income of consumers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the MPC equals 0.80,a $200 billion tax decrease will increase consumption in the first round by

A)$40 billion.

B)$160 billion.

C)$200 billion.

D)$100 billion.

A)$40 billion.

B)$160 billion.

C)$200 billion.

D)$100 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

32

The "naïve" Keynesian model is unrealistic because it

A)Does not take into account probable changes in the price level as the economy approaches full employment.

B)Assumes that the price level decreases as AD increases.

C)Assumes that AS is upward sloping when it is more probably horizontal.

D)Does not account for changes in output due to the multiplier.

A)Does not take into account probable changes in the price level as the economy approaches full employment.

B)Assumes that the price level decreases as AD increases.

C)Assumes that AS is upward sloping when it is more probably horizontal.

D)Does not account for changes in output due to the multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

33

A tax cut has a smaller impact on aggregate demand than an increase in government purchases of the same size because

A)A portion of the tax cut is invested.

B)A portion of the tax cut is saved.

C)Tax cuts do not increase disposable income.

D)The tax cut multiplier is equal to 1.

A)A portion of the tax cut is invested.

B)A portion of the tax cut is saved.

C)Tax cuts do not increase disposable income.

D)The tax cut multiplier is equal to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

34

To eliminate an AD shortfall of $100 billion when the economy has an MPC of 0.80,the government should increase transfer payments by

A)$25 billion.

B)$100 billion.

C)$80 billion.

D)$20 billion.

A)$25 billion.

B)$100 billion.

C)$80 billion.

D)$20 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

35

Assume the MPC is 0.80.If the government wants to eliminate an AD shortfall of $300 billion,it should

A)Cut taxes by $75 billion.

B)Cut taxes by $240 billion.

C)Increase taxes by $60 billion.

D)Cut taxes by $60 billion.

A)Cut taxes by $75 billion.

B)Cut taxes by $240 billion.

C)Increase taxes by $60 billion.

D)Cut taxes by $60 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

36

The desired tax cut to close a GDP gap is given by

A)AD shortfall × MPS.

B)Desired fiscal stimulus ÷ MPC.

C)AD shortfall ÷ MPC.

D)Desired fiscal stimulus × MPC.

A)AD shortfall × MPS.

B)Desired fiscal stimulus ÷ MPC.

C)AD shortfall ÷ MPC.

D)Desired fiscal stimulus × MPC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

37

Ceteris paribus,if the AD shortfall equals $600 billion,then the federal government can close it by increasing

A)Government spending by exactly $600 billion.

B)Government spending by less than $600 billion.

C)Taxes by more than $600 billion.

D)Taxes by exactly $600 billion.

A)Government spending by exactly $600 billion.

B)Government spending by less than $600 billion.

C)Taxes by more than $600 billion.

D)Taxes by exactly $600 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

38

The general formula for calculating the desired fiscal stimulus is

A)AD shortfall × the multiplier.

B)1/(AD shortfall × the multiplier).

C)AD shortfall ÷ the multiplier.

D)1/(AD shortfall ÷ the multiplier).

A)AD shortfall × the multiplier.

B)1/(AD shortfall × the multiplier).

C)AD shortfall ÷ the multiplier.

D)1/(AD shortfall ÷ the multiplier).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following explains why the government should not increase spending by the entire amount of the AD shortfall to move the economy to full employment?

A)Price level changes will make up for the difference between the fiscal stimulus and the AD shortfall.

B)The multiplier process will contribute to an additional increase in aggregate demand that will cause an inflationary gap.

C)The government can increase taxes to create an additional increase in aggregate demand.

D)The price level is constant.

A)Price level changes will make up for the difference between the fiscal stimulus and the AD shortfall.

B)The multiplier process will contribute to an additional increase in aggregate demand that will cause an inflationary gap.

C)The government can increase taxes to create an additional increase in aggregate demand.

D)The price level is constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

40

Ceteris paribus,if income was transferred from individuals with a low MPC to those with a high MPC,aggregate demand would

A)Increase.

B)Decrease.

C)Stay the same.

D)Increase or decrease, but not because of the MPC.

A)Increase.

B)Decrease.

C)Stay the same.

D)Increase or decrease, but not because of the MPC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is a policy option to eliminate an AD shortfall?

A)Decrease government purchases.

B)Reduce taxes.

C)Reduce transfer payments.

D)All of the choices are correct.

A)Decrease government purchases.

B)Reduce taxes.

C)Reduce transfer payments.

D)All of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

42

If the MPC equals 0.75,a $100 billion transfer payment decrease will decrease consumption in the first round by

A)$25 billion.

B)$75 billion.

C)$100 billion.

D)$400 billion.

A)$25 billion.

B)$75 billion.

C)$100 billion.

D)$400 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the MPC is 0.80 and the government increases transfer payments by $45 billion,then the initial fiscal stimulus will equal

A)$9 billion.

B)$56.25 billion.

C)$36 billion.

D)$225 billion.

A)$9 billion.

B)$56.25 billion.

C)$36 billion.

D)$225 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

44

When the macro equilibrium is above full employment,fiscal policy should be used to shift aggregate demand by the amount of

A)The difference between saving and investment.

B)The difference between desired saving and desired investment.

C)The AD excess,which also allows for price level changes.

D)None of the choices are correct.

A)The difference between saving and investment.

B)The difference between desired saving and desired investment.

C)The AD excess,which also allows for price level changes.

D)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

45

The fiscal policy target for achieving full employment when an inflationary gap exists is known as the

A)AD shortfall.

B)Fiscal stimulus.

C)AD excess.

D)Fiscal restraint.

A)AD shortfall.

B)Fiscal stimulus.

C)AD excess.

D)Fiscal restraint.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

46

The statement "balancing the budget on the backs of the poor" refers to

A)Transfer payment cuts in order to reduce government expenditures.

B)Tax increases on the poor in order to increase government revenues.

C)Government spending increases in order to increase aggregate expenditures.

D)Government spending cuts on public parks in order to reduce government expenditures.

A)Transfer payment cuts in order to reduce government expenditures.

B)Tax increases on the poor in order to increase government revenues.

C)Government spending increases in order to increase aggregate expenditures.

D)Government spending cuts on public parks in order to reduce government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

47

If the MPC is 0.75,a $200 million transfer payment decrease ultimately

A)Reduces spending by $150 million.

B)Increases spending by $600 million.

C)Reduces spending by $600 million.

D)Increases spending by $150 million.

A)Reduces spending by $150 million.

B)Increases spending by $600 million.

C)Reduces spending by $600 million.

D)Increases spending by $150 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

48

If AD excess equals $40 billion and the MPC equals 0.75,then the desired fiscal restraint equals

A)$10 billion.

B)$53.33 billion.

C)$30 billion.

D)$160 billion.

A)$10 billion.

B)$53.33 billion.

C)$30 billion.

D)$160 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following would not be a policy option to eliminate an AD shortfall?

A)Increase government purchases.

B)Reduce taxes.

C)Reduce transfer payments.

D)Increase transfer payments.

A)Increase government purchases.

B)Reduce taxes.

C)Reduce transfer payments.

D)Increase transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

50

Assume the AS curve is upward-sloping.If the multiplier is 4 and the government increases transfer payments by $10 billion,then real output will increase by

A)Less than $30 billion.

B)Exactly $30 billion.

C)Exactly $40 billion.

D)Exactly $50 billion.

A)Less than $30 billion.

B)Exactly $30 billion.

C)Exactly $40 billion.

D)Exactly $50 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

51

If the desired fiscal restraint is $80 billion and the AD excess is $160 billion,we can conclude that

A)The MPS is 0.50.

B)The multiplier is 0.50.

C)There is a recessionary gap.

D)The MPC is 2.0.

A)The MPS is 0.50.

B)The multiplier is 0.50.

C)There is a recessionary gap.

D)The MPC is 2.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

52

Suppose the government decides to increase taxes by $50 billion and to increase transfer payments by $50 billion.What effect would there be on aggregate demand?

A)No impact.

B)$50 billion increase.

C)More than $50 billion increase after the multiplier effect.

D)$50 billion decrease.

A)No impact.

B)$50 billion increase.

C)More than $50 billion increase after the multiplier effect.

D)$50 billion decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

53

What happens to aggregate demand when government spending and the taxes to pay for it both rise by the same amount?

A)Aggregate demand falls by the amount of the government spending.

B)There is no effect.

C)Aggregate demand rises by the amount of the government spending.

D)Aggregate demand rises by the amount of the government spending times the multiplier.

A)Aggregate demand falls by the amount of the government spending.

B)There is no effect.

C)Aggregate demand rises by the amount of the government spending.

D)Aggregate demand rises by the amount of the government spending times the multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume the MPC is 0.75,taxes increase by $100 billion,and government spending increases by $100 billion.Aggregate demand will

A)Increase by $400 billion.

B)Increase by $100 billion.

C)Decrease by $400 billion.

D)Not change.

A)Increase by $400 billion.

B)Increase by $100 billion.

C)Decrease by $400 billion.

D)Not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the MPC for an economy is 0.90,a $4 billion increase in taxes will ultimately cause consumption to decrease by

A)$40 billion.

B)$36 billion.

C)$4.4 billion.

D)$3.6 billion.

A)$40 billion.

B)$36 billion.

C)$4.4 billion.

D)$3.6 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following would cause the level of income to change by the greatest amount,ceteris paribus?

A)An increase in Social Security payments of $10 billion.

B)A reduction in personal income taxes of $10 billion.

C)An increase in defense spending of $10 billion.

D)All of the other choices have equal impacts on the level of income.

A)An increase in Social Security payments of $10 billion.

B)A reduction in personal income taxes of $10 billion.

C)An increase in defense spending of $10 billion.

D)All of the other choices have equal impacts on the level of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

57

Fiscal restraint is defined as

A)Tax hikes or spending cuts intended to reduce aggregate demand.

B)Tax hikes or spending cuts intended to increase aggregate demand.

C)Tax cuts or spending hikes intended to increase aggregate demand.

D)Tax cuts or spending hikes intended to reduce aggregate demand.

A)Tax hikes or spending cuts intended to reduce aggregate demand.

B)Tax hikes or spending cuts intended to increase aggregate demand.

C)Tax cuts or spending hikes intended to increase aggregate demand.

D)Tax cuts or spending hikes intended to reduce aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

58

The inflationary GDP gap differs from the AD excess when

A)The aggregate supply curve slopes upward.

B)The multiplier effect raises spending.

C)The aggregate supply curve is horizontal.

D)There is a time lag in the implementation of fiscal policy.

A)The aggregate supply curve slopes upward.

B)The multiplier effect raises spending.

C)The aggregate supply curve is horizontal.

D)There is a time lag in the implementation of fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

59

The desired fiscal restraint is equal to

A)Excess AD times the multiplier.

B)Excess AD divided by the multiplier.

C)Desired AD reduction.

D)GDP gap divided by the multiplier.

A)Excess AD times the multiplier.

B)Excess AD divided by the multiplier.

C)Desired AD reduction.

D)GDP gap divided by the multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

60

Assume the economy is at full employment and prices are reasonably stable.If the government wants to increase spending for public schools,which of the following policies will have the least inflationary impact?

A)An increase in taxes by an amount greater than the increase in spending.

B)An increase in taxes by an amount smaller than the increase in spending.

C)An increase in taxes equal to the increase in spending.

D)No change in taxes when expenditures increase.

A)An increase in taxes by an amount greater than the increase in spending.

B)An increase in taxes by an amount smaller than the increase in spending.

C)An increase in taxes equal to the increase in spending.

D)No change in taxes when expenditures increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

61

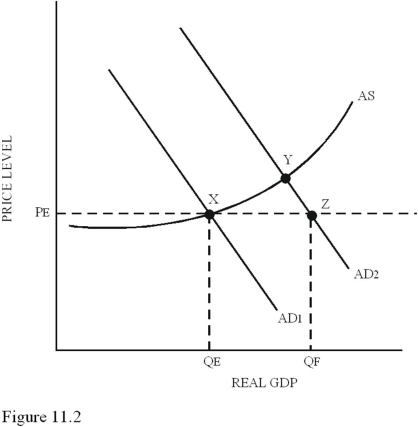

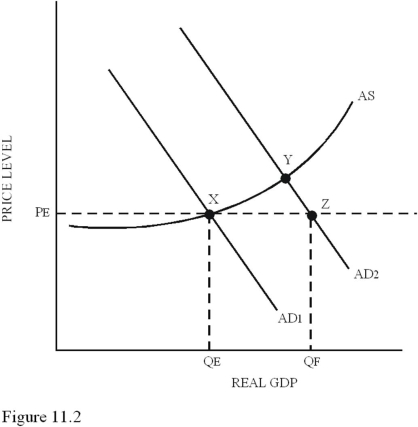

A shift from AD1 to AD2 in Figure 11.2 will

A)Worsen the existing unemployment problem.

B)Reduce,but not close,the GDP gap.

C)Cause significant inflation.

D)Eliminate the GDP gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

62

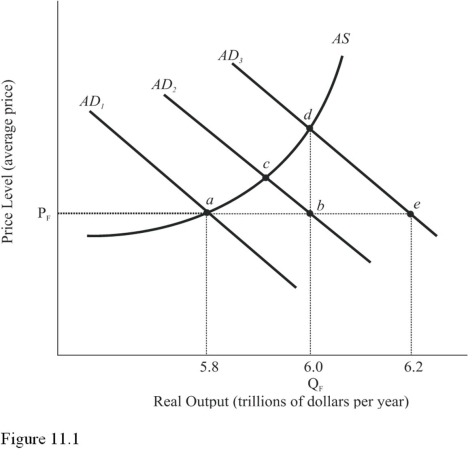

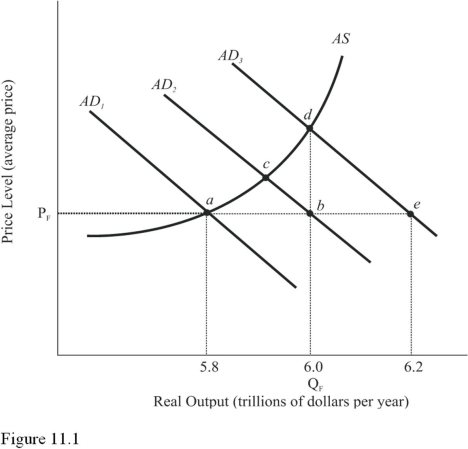

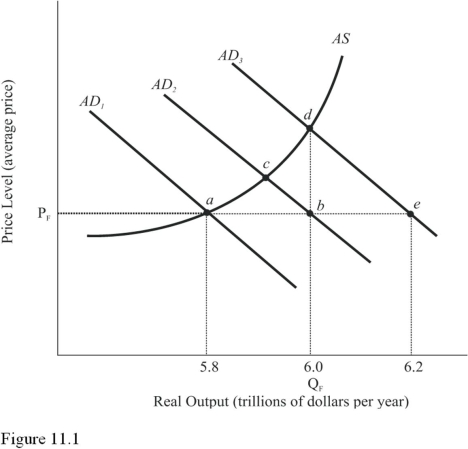

Refer to Figure 11.1.Assume aggregate demand is represented by AD1 and full-employment output is $6.0 trillion.The AD shortfall is equal to

A)$0.2 trillion.

B)$0.4 trillion.

C)$0.6 trillion.

D)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

63

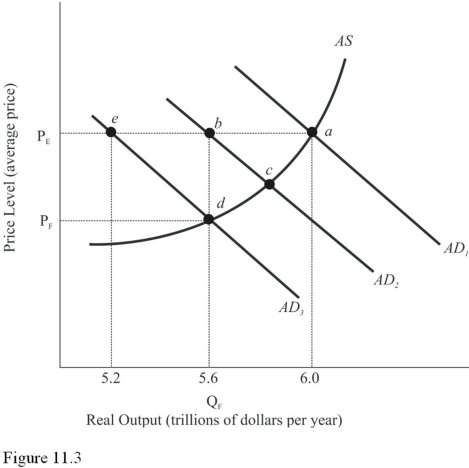

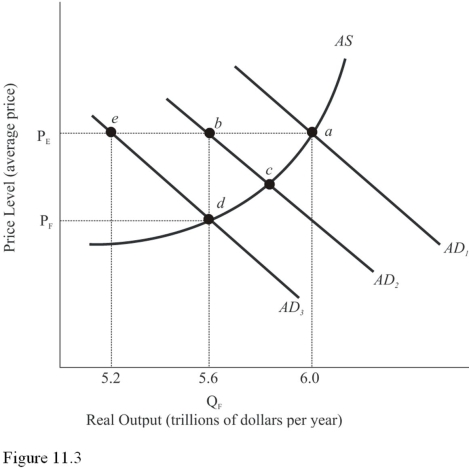

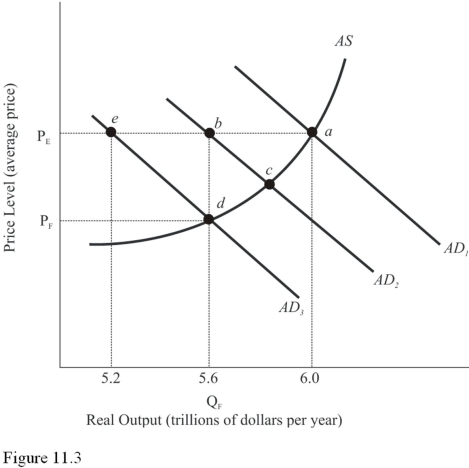

Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.The economy confronts an inflationary GDP gap of

Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.The economy confronts an inflationary GDP gap ofA)$200 billion.

B)$400 billion.

C)$600 billion.

D)$800 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

64

The second crisis of economic theory refers to

A)The typical fiscal policy trade-off between unemployment and inflation.

B)The dominance of Keynesian views in fiscal policy to the exclusion of newer,more enlightened viewpoints.

C)An emphasis on the level of output without concern for the content of output in terms of fiscal policy.

D)Our inability to maintain full employment output over any significant period of time.

A)The typical fiscal policy trade-off between unemployment and inflation.

B)The dominance of Keynesian views in fiscal policy to the exclusion of newer,more enlightened viewpoints.

C)An emphasis on the level of output without concern for the content of output in terms of fiscal policy.

D)Our inability to maintain full employment output over any significant period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

65

Suppose economic conditions call for a tax increase but Congress does not implement this measure because an election is approaching.This is an example of which of the real-world problems associated with fiscal policy?

A)Pork barrel politics.

B)Time lags.

C)Crowding out.

D)Balancing the budget on the backs of the poor.

A)Pork barrel politics.

B)Time lags.

C)Crowding out.

D)Balancing the budget on the backs of the poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

66

Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.If aggregate demand decreases by the amount of the GDP gap,equilibrium will occur at

A)Point a.

B)Point b.

C)Point c.

D)Point d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

67

Ceteris paribus,which of the following is true about the concept of crowding out?

A)It increases the private sector's ability to raise the level of output.

B)It does not affect the private sector's ability to raise the level of output.

C)It reduces the private sector's ability to raise the level of output.

D)It occurs when spending increases are matched with tax increases.

A)It increases the private sector's ability to raise the level of output.

B)It does not affect the private sector's ability to raise the level of output.

C)It reduces the private sector's ability to raise the level of output.

D)It occurs when spending increases are matched with tax increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

68

According to Figure 11.2,a shift from AD1 to AD2 will

A)Move equilibrium to QF.

B)Eliminate the GDP gap because of the increase in output.

C)Move equilibrium to point Y because of an increase in the price level.

D)Move the economy to point Y and then the market mechanism will move the economy to point Z.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

69

Refer to Figure 11.1.Assume aggregate demand is initially represented by AD1 and full-employment output is $6.0 trillion.If aggregate demand increases by the amount of the GDP gap,equilibrium will occur at

A)Point a.

B)Point b.

C)Point c.

D)Point d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

70

Refer to Figure 11.1.Assume aggregate demand is represented by AD1 and full employment output is $6.0 trillion.The equilibrium level of income is

A)$5.0 trillion.

B)$5.8 trillion.

C)$6.0 trillion.

D)$6.2 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

71

Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.The aggregate demand excess is equal to the distance between

A)Point a and point e

B)Point a and point d

C)Point a and point b.

D)Point b and point e

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

72

According to one In the News article,"Economy Is Already Feeling the Impact of Federal Government's Spending Cuts," a decrease in government spending has contributed to the sluggish economy.This would imply that

A)The aggregate demand curve has shifted to the right.

B)The aggregate demand curve has shifted to the left.

C)Injections into the circular flow have increased.

D)The aggregate supply curve has shifted to the right.

A)The aggregate demand curve has shifted to the right.

B)The aggregate demand curve has shifted to the left.

C)Injections into the circular flow have increased.

D)The aggregate supply curve has shifted to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

73

Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.To restore price stability,the AD curve must shift

A)Leftward by $400 billion.

B)Leftward by $800 billion.

C)Rightward by $400 billion.

D)Rightward by $800 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

74

The crowding out effect refers to a decrease in

A)Consumption or investment as a result of an increase in government borrowing.

B)Investment resulting from an increase in consumption and a decrease in savings.

C)Government spending resulting from a decrease in taxes.

D)Consumption resulting from an increase in investment.

A)Consumption or investment as a result of an increase in government borrowing.

B)Investment resulting from an increase in consumption and a decrease in savings.

C)Government spending resulting from a decrease in taxes.

D)Consumption resulting from an increase in investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

75

Using Figure 11.1,which fiscal policy action would increase aggregate demand from AD1 to AD3?

Using Figure 11.1,which fiscal policy action would increase aggregate demand from AD1 to AD3?A)A decrease in transfer payments.

B)A decrease in taxes.

C)A decrease in government spending.

D)A decrease in government spending matched by an equal decrease in taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

76

Refer to Figure 11.1.Assume aggregate demand is represented by AD1 and full-employment output is $6.0 trillion.The economy confronts a real GDP gap of

A)$.2 trillion.

B)$.4 trillion.

C)$.6 trillion.

D)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

77

Joan Robinson,author of The Second Crisis of Economic Theory,is quoted as saying,"Keynes did not want anyone to dig holes and fill them." She is pointing out that

A)The content of fiscal policy is as important as its aggregate impact on the economy.

B)The government should not be interfering in the economy because the jobs created are usually unproductive.

C)As far as stabilization objectives are concerned,the level of spending is the only thing that counts.

D)Keynesian economic policies do not work.

A)The content of fiscal policy is as important as its aggregate impact on the economy.

B)The government should not be interfering in the economy because the jobs created are usually unproductive.

C)As far as stabilization objectives are concerned,the level of spending is the only thing that counts.

D)Keynesian economic policies do not work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

78

Fiscal policy affects

A)The level of output only.

B)The mix of output only.

C)Both the level and the mix of output.

D)Interest rates only, and therefore does not affect the level or mix of output.

A)The level of output only.

B)The mix of output only.

C)Both the level and the mix of output.

D)Interest rates only, and therefore does not affect the level or mix of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the two fiscal stimulus tools will ultimately have the same impact on aggregate spending?

A)$100 billion tax cut and $100 billion increase in government spending.

B)$100 billion increase in government spending and $100 billion increase in transfer payments.

C)$100 billion increase in transfer payments and $100 billion in tax cuts.

D)All of the choices are correct.

A)$100 billion tax cut and $100 billion increase in government spending.

B)$100 billion increase in government spending and $100 billion increase in transfer payments.

C)$100 billion increase in transfer payments and $100 billion in tax cuts.

D)All of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

80

In Figure 11.1,assume that QF is full-employment output and the level of aggregate spending is represented by AD1.If AD1 increases to AD2,which of the following statements is correct?

A)Full employment will be reached.

B)Excess AD and inflation will be the result.

C)Full employment will not be reached because some of the additional spending results in higher prices rather than higher output.

D)A lower price level will result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck