Deck 5: Responsibility Accounting and Transfer Pricing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/13

العب

ملء الشاشة (f)

Deck 5: Responsibility Accounting and Transfer Pricing

1

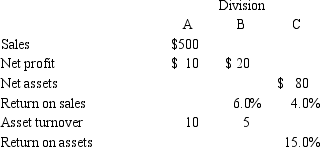

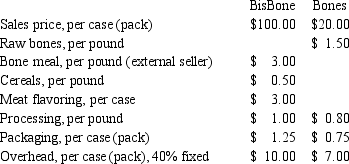

Given the following division performance indicators,which is true?

A)A's return on assets is double that of B

B)C is the best division at managing its assets

C)A's sales are 66.7% bigger than C's

D)B would benefit least from a 10% increase in sales

E)All of the choices are correct

A)A's return on assets is double that of B

B)C is the best division at managing its assets

C)A's sales are 66.7% bigger than C's

D)B would benefit least from a 10% increase in sales

E)All of the choices are correct

C

2

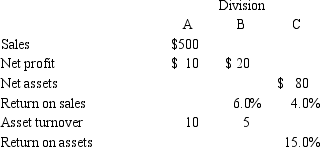

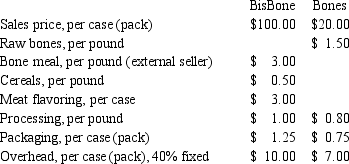

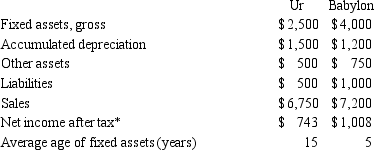

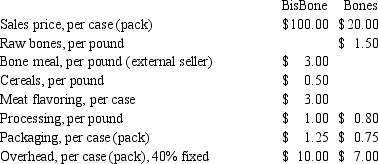

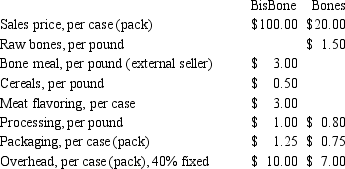

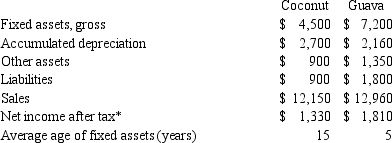

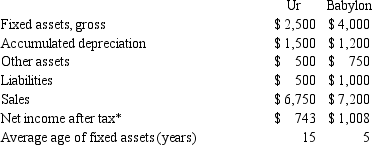

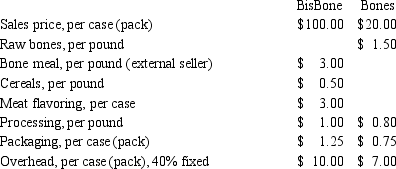

12. Grammy Girl Products (GGP)has two divisions,Bones and Biscuits,both of which usually have independence in sourcing and pricing decisions.There is an unlimited supply of raw bones.Biscuits manufactures,amongst other items,a specialty product called BisBone.The BisBone formula requires 70% bone meal and 30% cereal per pound,plus a dollop of meat flavoring.BisBone is usually sold in 20-pound cases and processed bones in 5-pound packs.Cost and sales pricing data appears below.  In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

Should GGP encourage an internal transaction for this order if Bones has outside customers for the bone meal,and,if so,at what price?

A)No,because it will undermine the benefits of decentralization

B)Yes,at $2.70 per pound

C)No,because GGP will be worse off

D)Yes,at the external market price of $3 per pound

E)Yes,but at some other price

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.Should GGP encourage an internal transaction for this order if Bones has outside customers for the bone meal,and,if so,at what price?

A)No,because it will undermine the benefits of decentralization

B)Yes,at $2.70 per pound

C)No,because GGP will be worse off

D)Yes,at the external market price of $3 per pound

E)Yes,but at some other price

C

3

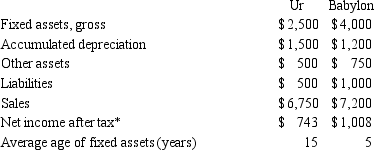

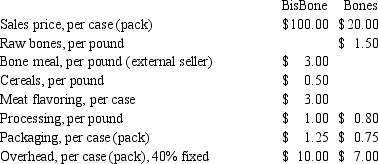

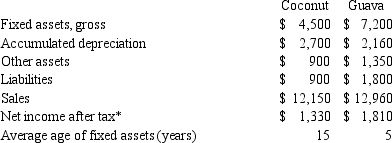

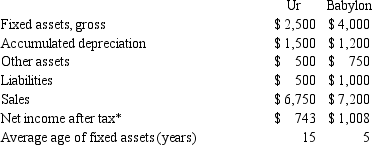

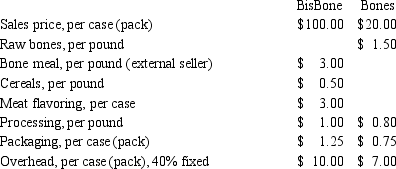

Mesopotamian Materials Inc.(MMI)has two decentralized divisions (Ur and Babylon)that have decision making responsibility over the amount of resources invested in their divisions.Recent financial extracts for both divisions are presented below:  *Net income is after tax but before interest

*Net income is after tax but before interest

MMI's weighted average cost of capital (WACC)is 11.5%.The MMI measures division performance based on the book value of net assets.The producer price index 15 years ago was 100,116 five years ago,and currently is 125.

Using historical costs,which is true?

A)Ur's return on sales (net income percentage)is 14%

B)Ur's return on net assets (RONA)is 74%

C)Babylon's net asset turnover is 6.75

D)Babylon's return on assets (ROA)is 40%

E)None of the choices are correct

*Net income is after tax but before interest

*Net income is after tax but before interestMMI's weighted average cost of capital (WACC)is 11.5%.The MMI measures division performance based on the book value of net assets.The producer price index 15 years ago was 100,116 five years ago,and currently is 125.

Using historical costs,which is true?

A)Ur's return on sales (net income percentage)is 14%

B)Ur's return on net assets (RONA)is 74%

C)Babylon's net asset turnover is 6.75

D)Babylon's return on assets (ROA)is 40%

E)None of the choices are correct

B

4

Mesopotamian Materials Inc.(MMI)has two decentralized divisions (Ur and Babylon)that have decision making responsibility over the amount of resources invested in their divisions.Recent financial extracts for both divisions are presented below:  *Net income is after tax but before interest

*Net income is after tax but before interest

MMI's weighted average cost of capital (WACC)is 11.5%.The MMI measures division performance based on the book value of net assets.The producer price index 15 years ago was 100,116 five years ago,and currently is 125.

Ur can increase its ROI by:

A)increasing product contribution margin

B)increasing sales volume

C)reducing discretionary expenses

D)taking on debt

E)all of the choices are correct

*Net income is after tax but before interest

*Net income is after tax but before interestMMI's weighted average cost of capital (WACC)is 11.5%.The MMI measures division performance based on the book value of net assets.The producer price index 15 years ago was 100,116 five years ago,and currently is 125.

Ur can increase its ROI by:

A)increasing product contribution margin

B)increasing sales volume

C)reducing discretionary expenses

D)taking on debt

E)all of the choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

5

Bobo,Inc.manufactures small motors used in refrigerators,washing machines,and other household appliances in JuJu division.JuJu division is located in a country with a 30% income tax rate.JuJu transfers the motors to LaSalle division which is located in a country with a 40% income tax rate.The variable cost per motor is $560 and LaSalle sells each motor for $960.Bobo,Inc.'s full cost per motor is $800.Should the transfer be priced at variable cost or full cost,and why?

A)Variable cost because total firm net income is $400

B)Variable cost because total firm taxes will be minimized

C)Full cost because it leads to accurate measures of local performance by JuJu

D)Full cost because total firm net income is higher by $24 per motor

E)Either price will result in the same total net income for Bobo,Inc.

A)Variable cost because total firm net income is $400

B)Variable cost because total firm taxes will be minimized

C)Full cost because it leads to accurate measures of local performance by JuJu

D)Full cost because total firm net income is higher by $24 per motor

E)Either price will result in the same total net income for Bobo,Inc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

6

Grammy Girl Products (GGP)has two divisions,Bones and Biscuits,both of which usually have independence in sourcing and pricing decisions.There is an unlimited supply of raw bones.Biscuits manufactures,amongst other items,a specialty product called BisBone.The BisBone formula requires 70% bone meal and 30% cereal per pound,plus a dollop of meat flavoring.BisBone is usually sold in 20-pound cases and processed bones in 5-pound packs.Cost and sales pricing data appears below.  In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

If Bones is operating below capacity,what is the minimum price that it should quote Biscuits per sack of bone meal to maximize GGP's profits?

A)$240

B)$239

C)$251.20

D)$296

E)None of the choices are correct

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.If Bones is operating below capacity,what is the minimum price that it should quote Biscuits per sack of bone meal to maximize GGP's profits?

A)$240

B)$239

C)$251.20

D)$296

E)None of the choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

7

10. Grammy Girl Products (GGP)has two divisions,Bones and Biscuits,both of which usually have independence in sourcing and pricing decisions.There is an unlimited supply of raw bones.Biscuits manufactures,amongst other items,a specialty product called BisBone.The BisBone formula requires 70% bone meal and 30% cereal per pound,plus a dollop of meat flavoring.BisBone is usually sold in 20-pound cases and processed bones in 5-pound packs.Cost and sales pricing data appears below.  In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

If Bones is at capacity and has sufficient outside customers for the containers,what is the minimum price that it should quote Biscuits per sack of bone meal to maximize GGP's profits?

A)$245

B)$360

C)$297.50

D)$355

E)None of the choices are correct

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.If Bones is at capacity and has sufficient outside customers for the containers,what is the minimum price that it should quote Biscuits per sack of bone meal to maximize GGP's profits?

A)$245

B)$360

C)$297.50

D)$355

E)None of the choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

8

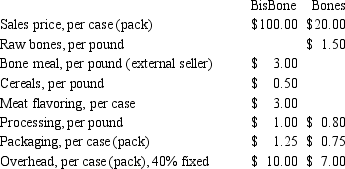

5. Honolulu Enterprises has two decentralized divisions (Coconut and Guava)that have decision making responsibility over the amount of resources invested in their divisions.Recent financial extracts for both divisions are presented below:

*Net income is after tax but before interest

*Net income is after tax but before interest

Honolulu's weighted average cost of capital (WACC)is 15% and the company uses residual income as a method to evaluate performance.Which of the following statements is correct?

A)Coconut's ROI will be raised by divesting of a project with a 20% ROI but its RI will be lower.

B)Coconut's RI will decrease by taking on a project with a $12 cost and net income before interest of $3.

C)Guava's RI will increase by taking on a project with an $8 cost and net income before interest of $1.1.

D)Coconut's RI is less than Guava's RI.

E)None of the choices are correct

*Net income is after tax but before interest

*Net income is after tax but before interestHonolulu's weighted average cost of capital (WACC)is 15% and the company uses residual income as a method to evaluate performance.Which of the following statements is correct?

A)Coconut's ROI will be raised by divesting of a project with a 20% ROI but its RI will be lower.

B)Coconut's RI will decrease by taking on a project with a $12 cost and net income before interest of $3.

C)Guava's RI will increase by taking on a project with an $8 cost and net income before interest of $1.1.

D)Coconut's RI is less than Guava's RI.

E)None of the choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

9

Mesopotamian Materials Inc.(MMI)has two decentralized divisions (Ur and Babylon)that have decision making responsibility over the amount of resources invested in their divisions.Recent financial extracts for both divisions are presented below:  *Net income is after tax but before interest

*Net income is after tax but before interest

MMI's weighted average cost of capital (WACC)is 11.5%.The MMI measures division performance based on the book value of net assets.The producer price index 15 years ago was 100,116 five years ago,and currently is 125.

Using historical costs,which is true?

A)Babylon is a profit center

B)At a WACC of 5%,Ur's residual income is lower than Babylon's by $123

C)At the planned WACC (11.5%),Ur's residual income is higher than Babylon's by $87

D)At a WACC of 25%,Ur's residual income is higher than Babylon's by $123

E)None of the choices are correct

*Net income is after tax but before interest

*Net income is after tax but before interestMMI's weighted average cost of capital (WACC)is 11.5%.The MMI measures division performance based on the book value of net assets.The producer price index 15 years ago was 100,116 five years ago,and currently is 125.

Using historical costs,which is true?

A)Babylon is a profit center

B)At a WACC of 5%,Ur's residual income is lower than Babylon's by $123

C)At the planned WACC (11.5%),Ur's residual income is higher than Babylon's by $87

D)At a WACC of 25%,Ur's residual income is higher than Babylon's by $123

E)None of the choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

10

Economic value added (EVA):

A)uses the same basic formula as return on investment (ROI)

B)ignores R&D spending

C)decreases a manager's incentive to maximize firm value

D)is easy to administer

E)measures the total return after deducting the cost of all capital employed by the firm

A)uses the same basic formula as return on investment (ROI)

B)ignores R&D spending

C)decreases a manager's incentive to maximize firm value

D)is easy to administer

E)measures the total return after deducting the cost of all capital employed by the firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which is true of a firm's transfer pricing policy?

A)Produces optimal results when set at the head office

B)Always promotes goal congruence

C)Leads to accurate measures of local performance

D)Is often designed to minimize tax expense

E)All of the choices are correct

A)Produces optimal results when set at the head office

B)Always promotes goal congruence

C)Leads to accurate measures of local performance

D)Is often designed to minimize tax expense

E)All of the choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

12

Grammy Girl Products (GGP)has two divisions,Bones and Biscuits,both of which usually have independence in sourcing and pricing decisions.There is an unlimited supply of raw bones.Biscuits manufactures,amongst other items,a specialty product called BisBone.The BisBone formula requires 70% bone meal and 30% cereal per pound,plus a dollop of meat flavoring.BisBone is usually sold in 20-pound cases and processed bones in 5-pound packs.Cost and sales pricing data appears below.  In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

Should Biscuits buy bone meal from Bones at the price of $3.55 per pound?

A)Yes,because it is $0.55 per pound cheaper than its external supplier's

B)No,because it is $0.55 per pound more costly than its external supplier's

C)Yes,because it is $0.025 per pound cheaper than its external supplier's

D)No,because it is $0.60 per pound more costly than its external supplier's

E)None of the choices are correct

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.

In lieu of its normal processing,Bones sometimes grinds raw bones into bone meal (grinding costs $0.05 per pound)When bone meal is sold to Biscuits,bulk packaging is used which costs $1 per 100 pound sack;when sold to other firms,it is packed in 50-pound containers,costing $3 each.Bones prices the container product at $180.Biscuits just received an order for 800 cases of one of its specialty products,BisBone,and is contemplating purchasing bone meal from its sister division.Should Biscuits buy bone meal from Bones at the price of $3.55 per pound?

A)Yes,because it is $0.55 per pound cheaper than its external supplier's

B)No,because it is $0.55 per pound more costly than its external supplier's

C)Yes,because it is $0.025 per pound cheaper than its external supplier's

D)No,because it is $0.60 per pound more costly than its external supplier's

E)None of the choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck

13

Each of the following responsibility centers and decision rights are correctly matched,except:

A)Cost center-input mix

B)Investment center-capital invested

C)Profit center-capital invested

D)Investment center-product mix

E)Profit center-input mix

A)Cost center-input mix

B)Investment center-capital invested

C)Profit center-capital invested

D)Investment center-product mix

E)Profit center-input mix

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 13 في هذه المجموعة.

فتح الحزمة

k this deck