Deck 11: Capital Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 11: Capital Budgeting

1

Which of the following statements is correct about capital assets?

A)For managerial accounting purposes,"capital assets" are defined more narrowly than for financial accounting purposes.

B)Human capital and research and development are both considered capital assets for financial accounting purposes,but not for managerial accounting purposes.

C)Capital assets are only those that can be depreciated,whether using managerial or financial accounting.

D)For managerial accounting purposes,"capital assets" are defined more broadly than for financial accounting purposes.

A)For managerial accounting purposes,"capital assets" are defined more narrowly than for financial accounting purposes.

B)Human capital and research and development are both considered capital assets for financial accounting purposes,but not for managerial accounting purposes.

C)Capital assets are only those that can be depreciated,whether using managerial or financial accounting.

D)For managerial accounting purposes,"capital assets" are defined more broadly than for financial accounting purposes.

D

2

An annuity is a series of consecutive payments that are equal in dollar amount,have interest periods of equal length,and earn an equal interest rate each period.

True

3

The payback period is defined as the average net income divided by the initial investment.

False

4

The profitability index is calculated as the present value of future cash flows divided by the initial investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

Preference decisions compare an investment with some minimum criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

A decision that requires managers to choose from among a set of alternative capital investment opportunities is a(n):

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental decision.

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

When deciding between mutually exclusive investments,a manager should choose the option with the lowest depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

An example of a future value of a single amount problem would be finding how much the right to receive a certain amount in the future would be worth today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

The internal rate of return is the rate of return that yields a zero net present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

The net present value method compares a project's future net income to the initial investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

To find the present value of a single amount,you only need to know the amount to be received in the future,the interest rate,and the number of periods until the amount will be received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

Sensitivity analysis helps determine whether changing the underlying assumptions would affect the decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

When managers must choose among independent projects,they should prioritize projects according to their net present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

The accounting rate of return is the only method that focuses on net income rather than cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

A decision that occurs when managers evaluate a proposed capital investment to determine whether it meets some minimum criteria is a(n):

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental decision.

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

The payback period method ignores the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

Projects that are unrelated to one another,so that investing in one project does not preclude or affect the choice about investing in the other alternatives,are:

A)mutually exclusive projects.

B)screening projects.

C)independent projects.

D)preference projects.

A)mutually exclusive projects.

B)screening projects.

C)independent projects.

D)preference projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

Projects that involve a choice among competing alternatives,where selection of one project implies rejection of all the other alternatives,are:

A)mutually exclusive projects.

B)screening projects.

C)independent projects.

D)preference projects.

A)mutually exclusive projects.

B)screening projects.

C)independent projects.

D)preference projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

Independent projects are unrelated to one another,so that investing in one project does not affect the choice about investing in another project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

The internal rate of return method uses cash flows rather than net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

The accounting rate of return is also called all of the following except:

A)annual rate of return.

B)required rate of return.

C)simple rate of return.

D)unadjusted rate of return.

A)annual rate of return.

B)required rate of return.

C)simple rate of return.

D)unadjusted rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Belmont Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $200,000.The equipment will have an initial cost of $1,000,000 and have an 8-year life.If there is no salvage value of the equipment,what is the accounting rate of return?

A)12.5%

B)20%

C)40%

D)15%

A)12.5%

B)20%

C)40%

D)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

The accounting rate of return is calculated as:

A)initial investment divided by annual net income.

B)initial investment divided by required rate of return.

C)annual net income divided by initial investment.

D)annual net income divided by required rate of return.

A)initial investment divided by annual net income.

B)initial investment divided by required rate of return.

C)annual net income divided by initial investment.

D)annual net income divided by required rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

Nelson Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5-year life.If the salvage value of the equipment is estimated to be $75,000,what is the accounting rate of return? Ignore income taxes.

A)6.25%

B)8.75%

C)25.00%

D)26.67%

A)6.25%

B)8.75%

C)25.00%

D)26.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following would be included in net income but not in annual cash flows?

A)Sales revenue

B)Depreciation

C)Initial investment

D)Direct labor

A)Sales revenue

B)Depreciation

C)Initial investment

D)Direct labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is the formula for accounting rate of return?

A)Initial investment/net income

B)Annual net cash flow/Initial investment

C)Initial investment/Annual net cash flow

D)Annual net income/Initial investment

A)Initial investment/net income

B)Annual net cash flow/Initial investment

C)Initial investment/Annual net cash flow

D)Annual net income/Initial investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following capital budgeting methods focuses on net income rather than cash flows?

A)Payback period

B)Accounting rate of return

C)Net present value

D)Internal rate of return

A)Payback period

B)Accounting rate of return

C)Net present value

D)Internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

Palmer Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 7-year life.If the salvage value of the equipment is estimated to be $75,000,what is the accounting rate of return?

A)14.28%

B)25.00%

C)42.11%

D)147.37%

A)14.28%

B)25.00%

C)42.11%

D)147.37%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Fletcher Corp.is considering the purchase of a new piece of equipment.The equipment will have an initial cost of $400,000,a 5-year life,and a salvage value of $75,000.If the accounting rate of return for the project is 10%,what is the annual increase in net cash flow? Ignore income taxes.

A)$25,000

B)$40,000

C)$65,000

D)$105,000

A)$25,000

B)$40,000

C)$65,000

D)$105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

How does the accounting rate of return differ from the return on investment formula?

A)They are not different;both are calculated by dividing net operating income by initial investment.

B)The numerator in each formula differs;accounting rate of return divides net operating income by initial investment,and return on investment divides gross operating income by initial investment.

C)The numerator in each formula differs;accounting rate of return divides net operating income by average invested assets,while return on investment divides gross operating income by average invested assets.

D)The denominator in each formula differs;accounting rate of return divides net operating income by initial investment,while return on investment divides net operating income by average invested assets.

A)They are not different;both are calculated by dividing net operating income by initial investment.

B)The numerator in each formula differs;accounting rate of return divides net operating income by initial investment,and return on investment divides gross operating income by initial investment.

C)The numerator in each formula differs;accounting rate of return divides net operating income by average invested assets,while return on investment divides gross operating income by average invested assets.

D)The denominator in each formula differs;accounting rate of return divides net operating income by initial investment,while return on investment divides net operating income by average invested assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following methods is calculated as annual net income as a percentage of the original investment in assets?

A)Accounting rate of return

B)Payback period

C)Net present value

D)Internal rate of return

A)Accounting rate of return

B)Payback period

C)Net present value

D)Internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

Addison Corp.is considering the purchase of a new piece of equipment.The equipment will have an initial cost of $900,000,a 6-year life,and no salvage value.If the accounting rate of return for the project is 5%,what is the annual increase in net cash flow? Ignore income taxes.

A)$45,000

B)$105,000

C)$150,000

D)$195,000

A)$45,000

B)$105,000

C)$150,000

D)$195,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a limitation of using the accounting rate of return method for capital budgeting?

A)The accounting rate of return method does not incorporate time value of money.

B)The accounting rate of return method is based on accounting income,rather than cash flow.

C)Net income-on which the accounting rate of return method is based-is more objective than cash flow.

D)The accounting rate of return method is subject to potential manipulation based on accounting choices made by management (e.g. ,the method used to depreciate a capital asset).

A)The accounting rate of return method does not incorporate time value of money.

B)The accounting rate of return method is based on accounting income,rather than cash flow.

C)Net income-on which the accounting rate of return method is based-is more objective than cash flow.

D)The accounting rate of return method is subject to potential manipulation based on accounting choices made by management (e.g. ,the method used to depreciate a capital asset).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

When cash flows are equal each year,the payback period is calculated as:

A)Initial investment × Annual net cash flow.

B)Initial investment/Annual net cash flow.

C)Annual net cash flow/Initial investment.

D)Annual net cash flow − Initial investment/Project life.

A)Initial investment × Annual net cash flow.

B)Initial investment/Annual net cash flow.

C)Annual net cash flow/Initial investment.

D)Annual net cash flow − Initial investment/Project life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

The total time to recover an original investment is the:

A)net present value.

B)internal rate of return.

C)accounting rate of return.

D)payback period.

A)net present value.

B)internal rate of return.

C)accounting rate of return.

D)payback period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

Homer Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 5-year life.If the salvage value of the equipment is estimated to be $75,000,what is the annual net cash flow?

A)$25,000

B)$35,000

C)$165,000

D)$175,000

A)$25,000

B)$35,000

C)$165,000

D)$175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

If cash flows are not equal each year,the payback period:

A)cannot be calculated.

B)is calculated by dividing the initial investment by the average cash flows.

C)is calculated by subtracting each year's cash flows from the initial investment until zero is reached.

D)is calculated by dividing the total years in the project by two.

A)cannot be calculated.

B)is calculated by dividing the initial investment by the average cash flows.

C)is calculated by subtracting each year's cash flows from the initial investment until zero is reached.

D)is calculated by dividing the total years in the project by two.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

Newport Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6-year life.There is no salvage value for the equipment.What is the accounting rate of return? Ignore income taxes.

A)5.56%

B)16.67%

C)22.22%

D)44.44%

A)5.56%

B)16.67%

C)22.22%

D)44.44%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following capital budgeting methods does not use discounted cash flows?

A)Net present value

B)Internal rate of return

C)Payback period

D)Profitability index

A)Net present value

B)Internal rate of return

C)Payback period

D)Profitability index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

Cortland Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net cash flows of $100,000.The equipment will have an initial cost of $400,000 and have a 5-year life.If the salvage value of the equipment is estimated to be $75,000,what is the annual net income? Ignore income taxes.

A)$25,000

B)$35,000

C)$165,000

D)$175,000

A)$25,000

B)$35,000

C)$165,000

D)$175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the hurdle rate is greater than the internal rate of return,the net present value will be:

A)positive.

B)negative.

C)zero.

D)equal to the hurdle rate.

A)positive.

B)negative.

C)zero.

D)equal to the hurdle rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a project has a positive net present value,it means the project is expected to provide returns that are ________ the cost of capital.

A)greater than

B)less than

C)equal to

D)not connected to

A)greater than

B)less than

C)equal to

D)not connected to

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

When making screening decisions using the net present value method,a project is acceptable if:

A)the NPV is greater than the hurdle rate.

B)the NPV is greater than the IRR.

C)the NPV is positive.

D)the NPV is negative.

A)the NPV is greater than the hurdle rate.

B)the NPV is greater than the IRR.

C)the NPV is positive.

D)the NPV is negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

Newport Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6-year life.There is no salvage value for the equipment.If the hurdle rate is 8%,what is the approximate net present value? Ignore income taxes.(Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)$924,580

B)$24,580

C)$900,000

D)$300,000

A)$924,580

B)$24,580

C)$900,000

D)$300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

Belmont Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $200,000.The equipment will have an initial cost of $1,000,000 and have an 8-year life.If there is no salvage value of the equipment,what is the payback period?

A)1.6 years

B)3.08 years

C)5 years

D)8 years

A)1.6 years

B)3.08 years

C)5 years

D)8 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

The method that compares the present value of a project's future cash flows to the initial investment is:

A)accounting rate of return.

B)payback period.

C)net present value.

D)internal rate of return.

A)accounting rate of return.

B)payback period.

C)net present value.

D)internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

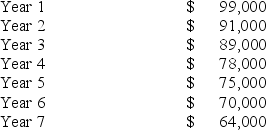

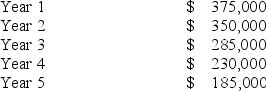

Patterson Corp.is considering the purchase of a new piece of equipment,which would have an initial cost of $500,000,a 7-year life,and $150,000 salvage value.The increase in cash flow each year of the equipment's life would be as follows:  What is the payback period?

What is the payback period?

A)5.51 years

B)5.97 years

C)6.00 years

D)6.18 years

What is the payback period?

What is the payback period?A)5.51 years

B)5.97 years

C)6.00 years

D)6.18 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

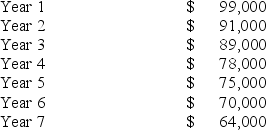

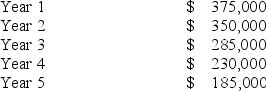

Patterson Corp.is considering the purchase of a new piece of equipment,which would have an initial cost of $500,000,a 7-year life,and $150,000 salvage value.The increase in net income each year of the equipment's life would be as follows:  What is the payback period?

What is the payback period?

A)3.55 years

B)3.82 years

C)5.97 years

D)6.18 years

What is the payback period?

What is the payback period?A)3.55 years

B)3.82 years

C)5.97 years

D)6.18 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statement regarding the payback method is incorrect?

A)The payback period is the amount of time it takes for a capital investment to "pay for itself."

B)In general,projects with longer payback periods are safer investments than those with shorter payback periods.

C)When cash flows are equal each year,the payback period is calculated by dividing the initial investment in the project by its annual cash flow.

D)The payback method is often used as a screening tool for potential investments.

A)The payback period is the amount of time it takes for a capital investment to "pay for itself."

B)In general,projects with longer payback periods are safer investments than those with shorter payback periods.

C)When cash flows are equal each year,the payback period is calculated by dividing the initial investment in the project by its annual cash flow.

D)The payback method is often used as a screening tool for potential investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

Newport Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6-year life.There is no salvage value for the equipment.What is the payback period?

A)1.33 years

B)2.57 years

C)4.50 years

D)6.00 years

A)1.33 years

B)2.57 years

C)4.50 years

D)6.00 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

The minimum required rate of return for a project is the:

A)annual rate of return.

B)accounting rate of return.

C)hurdle rate.

D)internal rate of return.

A)annual rate of return.

B)accounting rate of return.

C)hurdle rate.

D)internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

Byron Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5-year life.The salvage value of the equipment is estimated to be $75,000.If the hurdle rate is 10%,what is the approximate net present value? Ignore income taxes.(Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)$25,648

B)$100,000

C)$175,000

D)($20,291)

A)$25,648

B)$100,000

C)$175,000

D)($20,291)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

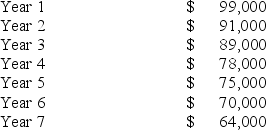

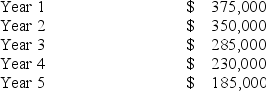

Wright Corp.is considering the purchase of a new piece of equipment,which would have an initial cost of $1,000,000 and a 5-year life.There is no salvage value for the equipment.The increase in net income each year of the equipment's life would be as follows:  What is the payback period?

What is the payback period?

A)1.77 years

B)2.06 years

C)2.96 years

D)3.51 years

What is the payback period?

What is the payback period?A)1.77 years

B)2.06 years

C)2.96 years

D)3.51 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is correct about the net present value method?

A)It is a discounted cash flow method based on net income.

B)It is a non-discounted method based on net income.

C)It is a discounted cash flow method based on cash flow.

D)It is a non-discounted method based on cash flow.

A)It is a discounted cash flow method based on net income.

B)It is a non-discounted method based on net income.

C)It is a discounted cash flow method based on cash flow.

D)It is a non-discounted method based on cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

The payback method:

A)is a complex method of analysis.

B)is infrequently used.

C)incorporates the time value of money.

D)ignores benefits and costs that occur after the project has paid for itself.

A)is a complex method of analysis.

B)is infrequently used.

C)incorporates the time value of money.

D)ignores benefits and costs that occur after the project has paid for itself.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

Nelson Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5-year life.If the salvage value of the equipment is estimated to be $75,000,what is the payback period? Ignore income taxes.

A)3.25 years

B)4.00 years

C)4.75 years

D)7.00 years

A)3.25 years

B)4.00 years

C)4.75 years

D)7.00 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

A positive net present value indicates that a project will:

A)generate a return in excess of the firm's cost of capital.

B)generate more cash than is initially invested.

C)generate more cash than alternative projects.

D)generate a return in excess of alternative projects.

A)generate a return in excess of the firm's cost of capital.

B)generate more cash than is initially invested.

C)generate more cash than alternative projects.

D)generate a return in excess of alternative projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

Newport Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6-year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the approximate net present value? Ignore income taxes.(Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)Negative $28,940

B)Positive $28,940

C)Zero

D)Positive $300,000

A)Negative $28,940

B)Positive $28,940

C)Zero

D)Positive $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

Palmer Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 7-year life.If the salvage value of the equipment is estimated to be $75,000,what is the payback period?

A)2.73 years

B)4.00 years

C)4.75 years

D)7.00 years

A)2.73 years

B)4.00 years

C)4.75 years

D)7.00 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

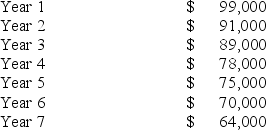

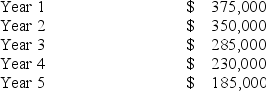

Wright Corp.is considering the purchase of a new piece of equipment,which would have an initial cost of $1,000,000 and a 5-year life.There is no salvage value for the equipment.The increase in cash flow each year of the equipment's life would be as follows:  What is the payback period?

What is the payback period?

A)2.39 years

B)2.96 years

C)3.00 years

D)3.51 years

What is the payback period?

What is the payback period?A)2.39 years

B)2.96 years

C)3.00 years

D)3.51 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

Dallas Corp.is trying to decide whether to lease or purchase a piece of equipment needed for the next five years.The equipment would cost $100,000 to purchase,and maintenance costs would be $10,000 per year.After five years,Dallas estimates it could sell the equipment for $30,000.If Dallas leased the equipment,it would pay a set annual fee that would include all maintenance costs.Dallas has determined after a net present value analysis that at its hurdle rate of 12% it would be better off by $11,000 if it leases the equipment.What would the approximate annual cost be if Dallas were to lease the equipment? (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )

A)$21,800

B)$27,800

C)$30,000

D)$34,700

A)$21,800

B)$27,800

C)$30,000

D)$34,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

The discount rate that would return a net present value equal to zero is the:

A)annual rate of return.

B)accounting rate of return.

C)hurdle rate.

D)internal rate of return.

A)annual rate of return.

B)accounting rate of return.

C)hurdle rate.

D)internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

Randall Corp.is trying to decide whether to lease or purchase a piece of equipment needed for the next five years.The equipment would cost $100,000 to purchase,and maintenance costs would be $10,000 per year.After five years,Randall estimates it could sell the equipment for $30,000.If Randall leases the equipment,it would pay $30,000 each year,which would include all maintenance costs.If the hurdle rate for Randall is 12%,Randall should: (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )

A)lease the equipment,as net present value of cost is about $11,000 less.

B)buy the equipment,as net present value of cost is about $11,000 less.

C)lease the equipment,as net present value of cost is about $30,000 less.

D)buy the equipment,as net present value of cost is about $30,000 less.

A)lease the equipment,as net present value of cost is about $11,000 less.

B)buy the equipment,as net present value of cost is about $11,000 less.

C)lease the equipment,as net present value of cost is about $30,000 less.

D)buy the equipment,as net present value of cost is about $30,000 less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

Olive Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $250,000.The equipment will have an initial cost of $1,300,000 and have an 8-year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the internal rate of return? Ignore income taxes.(Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)Between 6% and 8%

B)Between 8% and 10%

C)Greater than 10%

D)Less than zero

A)Between 6% and 8%

B)Between 8% and 10%

C)Greater than 10%

D)Less than zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

Heidi Inc.is considering whether to lease or purchase a piece of equipment.The total cost to lease the equipment will be $120,000 over its estimated life,while the total cost to buy the equipment will be $75,000 over its estimated life.At Heidi's required rate of return,the net present value of the cost of leasing the equipment is $73,700 and the net present value of the cost of buying the equipment is $68,000.Based on financial factors,Heidi should:

A)lease the equipment,saving $45,000 over buying.

B)buy the equipment,saving $45,000 over leasing.

C)lease the equipment,saving $5,700 over buying.

D)buy the equipment,saving $5,700 over leasing.

A)lease the equipment,saving $45,000 over buying.

B)buy the equipment,saving $45,000 over leasing.

C)lease the equipment,saving $5,700 over buying.

D)buy the equipment,saving $5,700 over leasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

A profitability index greater than ________ means that a project has a positive NPV.

A)negative one

B)zero

C)one

D)the hurdle rate

A)negative one

B)zero

C)one

D)the hurdle rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

Independent projects should be prioritized according to their:

A)profitability index.

B)net present value.

C)payback period.

D)total cash flows.

A)profitability index.

B)net present value.

C)payback period.

D)total cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

The internal rate of return is a measure of:

A)the rate actually earned by the project,considering the time value of money.

B)the rate actually earned by the project,based on accounting income.

C)the rate used to discount the future cash flows to reflect the time value of money.

D)the firm's cost of capital.

A)the rate actually earned by the project,considering the time value of money.

B)the rate actually earned by the project,based on accounting income.

C)the rate used to discount the future cash flows to reflect the time value of money.

D)the firm's cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

When comparing mutually exclusive capital investments,managers should:

A)choose the option with the lowest cost on a net present value basis.

B)choose the option with the lowest undiscounted cost.

C)not use net present value because it cannot be used to compare investments.

D)not use sensitivity analysis.

A)choose the option with the lowest cost on a net present value basis.

B)choose the option with the lowest undiscounted cost.

C)not use net present value because it cannot be used to compare investments.

D)not use sensitivity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

Grace Corp. ,whose required rate of return is 10%,is considering the purchase of a new piece of equipment.The internal rate of return of the project,which has a life of 8 years,is 12%.The project would have:

A)an accounting rate of return greater than 10%.

B)a payback period more than 8 years.

C)a net present value of zero.

D)a net present value greater than zero.

A)an accounting rate of return greater than 10%.

B)a payback period more than 8 years.

C)a net present value of zero.

D)a net present value greater than zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

An analysis that reveals whether changing the underlying assumptions would affect the decision is a:

A)net present value analysis.

B)internal rate of return analysis.

C)payback period analysis.

D)sensitivity analysis.

A)net present value analysis.

B)internal rate of return analysis.

C)payback period analysis.

D)sensitivity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

Lawrence Corp.is considering the purchase of a new piece of equipment.When discounted at a hurdle rate of 8%,the project has a net present value of $24,580.When discounted at a hurdle rate of 10%,the project has a net present value of ($28,940).The internal rate of return of the project is:

A)zero.

B)between zero and 8%.

C)between 8% and 10%.

D)greater than 10%.

A)zero.

B)between zero and 8%.

C)between 8% and 10%.

D)greater than 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

Wilson Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $50,000.The equipment will have an initial cost of $600,000 and have an 8-year life.The salvage value of the equipment is estimated to be $100,000.If the hurdle rate is 10%,what is the approximate net present value? (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)Less than zero

B)$100,000

C)$500,000

D)$46,826

A)Less than zero

B)$100,000

C)$500,000

D)$46,826

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

Foster Inc.is trying to decide whether to lease or purchase a piece of equipment needed for the next ten years.The equipment would cost $45,000 to purchase,and maintenance costs would be $5,000 per year.After ten years,Foster estimates it could sell the equipment for $20,000.If Foster leases the equipment,it would pay $12,000 each year,which would include all maintenance costs.If the hurdle rate for Foster is 10%,Foster should: (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )

A)lease the equipment,as net present value of cost is about $5,700 less.

B)buy the equipment,as net present value of cost is about $5,700 less.

C)lease the equipment,as net present value of cost is about $2,000 less.

D)buy the equipment,as net present value of cost is about $45,000 less.

A)lease the equipment,as net present value of cost is about $5,700 less.

B)buy the equipment,as net present value of cost is about $5,700 less.

C)lease the equipment,as net present value of cost is about $2,000 less.

D)buy the equipment,as net present value of cost is about $45,000 less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

Frank Inc.is trying to decide whether to lease or purchase a piece of equipment needed for the next ten years.The equipment would cost $45,000 to purchase,and maintenance costs would be $5,000 per year.After ten years,Frank estimates it could sell the equipment for $20,000.If Frank leased the equipment,it would pay a set annual fee that would include all maintenance costs.Frank has determined after a net present value analysis that at its hurdle rate of 10%,it would be better off by $5,700 if it buys the equipment.What would the approximate annual cost be if Frank were to lease the equipment? (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )

A)$9,000

B)$7,000

C)$12,000

D)$13,250

A)$9,000

B)$7,000

C)$12,000

D)$13,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

Byron Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5-year life.The salvage value of the equipment is estimated to be $75,000.If the hurdle rate is 10%,what is the internal rate of return? (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)Between 6% and 8%

B)Between 8% and 10%

C)Between 10% and 12%

D)Between 12% and 14%

A)Between 6% and 8%

B)Between 8% and 10%

C)Between 10% and 12%

D)Between 12% and 14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

Devon Corp.is trying to decide whether to lease or purchase a piece of equipment.The total cost lease the equipment will be $150,000 over its estimated life,while the total cost to buy the equipment will be $120,000 over its estimated life.At Devon's required rate of return,the net present value of the cost of leasing the equipment is $108,000 and the net present value of the cost of buying the equipment is $119,000.Based on financial factors,Devon should:

A)lease the equipment,saving $30,000 over buying.

B)buy the equipment,saving $30,000 over leasing.

C)lease the equipment,saving $11,000 over buying.

D)buy the equipment,saving $11,000 over leasing.

A)lease the equipment,saving $30,000 over buying.

B)buy the equipment,saving $30,000 over leasing.

C)lease the equipment,saving $11,000 over buying.

D)buy the equipment,saving $11,000 over leasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

Wilson Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $50,000.The equipment will have an initial cost of $600,000 and have an 8-year life.The salvage value of the equipment is estimated to be $100,000.If the hurdle rate is 10%,what is the internal rate of return? (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)Less than zero

B)Between zero and 10%

C)Between 10% and 15%

D)More than 15%

A)Less than zero

B)Between zero and 10%

C)Between 10% and 15%

D)More than 15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

Byron Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5-year life.The salvage value of the equipment is estimated to be $75,000.If the hurdle rate is 15%,what is the approximate net present value? Ignore income taxes.(Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)Negative $27,490

B)Zero

C)Positive $400,000

D)Positive $75,000

A)Negative $27,490

B)Zero

C)Positive $400,000

D)Positive $75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

Newport Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6-year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the internal rate of return? Ignore income taxes.(Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. )(Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A)Between 6% and 8%

B)Between 8% and 10%

C)Between 10% and 12%

D)Less than zero

A)Between 6% and 8%

B)Between 8% and 10%

C)Between 10% and 12%

D)Less than zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck