Deck 2: Job Order Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/132

العب

ملء الشاشة (f)

Deck 2: Job Order Costing

1

A marketing consulting firm would most likely use process costing.

False

2

To eliminate underapplied overhead at the end of the year,Manufacturing Overhead would be debited and Cost of Goods Sold would be credited.

False

3

Which of the following types of firms would most likely use job order costing?

A)Happy-Oh Cereal Company

B)Huey,Lewey & Dewie,Attorneys

C)SoooSweet Beverage

D)C-5 Cement Company

A)Happy-Oh Cereal Company

B)Huey,Lewey & Dewie,Attorneys

C)SoooSweet Beverage

D)C-5 Cement Company

B

4

Process costing averages the total cost of the process over the number of units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

5

If there is a debit balance in the Manufacturing Overhead account at the end of the period,overhead was underapplied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

6

Indirect materials are recorded directly on the job cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

7

The total manufacturing cost for a job includes the amount of applied overhead using the predetermined overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

8

A predetermined overhead rate is calculated by dividing estimated total manufacturing overhead cost by estimated total cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

9

When manufacturing overhead is applied to a job,a credit is made to the Work in Process account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

10

A job cost sheet will record the direct materials and direct labor used by the job but not the manufacturing overhead applied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is correct?

A)Companies must choose to use either job order costing or process costing;there is no overlap between the two systems.

B)Companies always use job order costing unless it is prohibitively expensive.

C)Companies always use process costing unless it is prohibitively expensive.

D)Companies often provide products and services that have both common and unique characteristics,so they may use a blend of job order and process costing.

A)Companies must choose to use either job order costing or process costing;there is no overlap between the two systems.

B)Companies always use job order costing unless it is prohibitively expensive.

C)Companies always use process costing unless it is prohibitively expensive.

D)Companies often provide products and services that have both common and unique characteristics,so they may use a blend of job order and process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

12

The most common method for disposing of the balance in Manufacturing Overhead is to make a direct adjustment to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

13

When job order costing is used,costs are accumulated on a job cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

14

The cost of materials used on a specific job is first captured on which source document?

A)Cost driver sheet

B)Materials requisition form

C)Labor time ticket

D)Process cost sheet

A)Cost driver sheet

B)Materials requisition form

C)Labor time ticket

D)Process cost sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

15

Source documents are used to assign all manufacturing costs to jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

16

The total amount of cost assigned to jobs that were completed during the year is the cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

17

In a service firm,the cost associated with time that employees spend on training,paperwork,and supervision is considered part of manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is a characteristic of a manufacturing environment that would use job order costing?

A)Standardized production process

B)Continuous manufacturing

C)Homogenous products

D)Differentiated products

A)Standardized production process

B)Continuous manufacturing

C)Homogenous products

D)Differentiated products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following types of firms would most likely use process costing?

A)Superior Auto Body & Repair

B)Crammond Custom Cabinets

C)Sunshine Soft Drinks

D)Jackson & Taylor Tax Service

A)Superior Auto Body & Repair

B)Crammond Custom Cabinets

C)Sunshine Soft Drinks

D)Jackson & Taylor Tax Service

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

20

A materials requisition form is used to authorize the purchase of direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following represents the cost of materials purchased but not yet issued to production?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

22

Manufacturing overhead was estimated to be $500,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $450,000 and actual direct labor hours were 19,000.The predetermined overhead rate per direct labor hour would be:

A)$22.50.

B)$25.00.

C)$23.68.

D)$26.32.

A)$22.50.

B)$25.00.

C)$23.68.

D)$26.32.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

23

The source document that captures how much time a worker has spent on various jobs during the period is a:

A)cost driver sheet.

B)materials requisition form.

C)labor time ticket.

D)job cost sheet.

A)cost driver sheet.

B)materials requisition form.

C)labor time ticket.

D)job cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

24

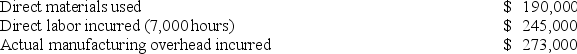

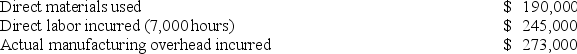

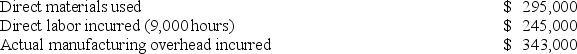

Sawyer Company had the following information for the year:  Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $9,000.How much overhead was applied during the year?

Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $9,000.How much overhead was applied during the year?

A)$245,000

B)$273,000

C)$280,000

D)$320,000

Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $9,000.How much overhead was applied during the year?

Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $9,000.How much overhead was applied during the year?A)$245,000

B)$273,000

C)$280,000

D)$320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

25

When direct materials are used in production,which of the following accounts is debited?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

26

A predetermined overhead rate is calculated by dividing:

A)actual manufacturing overhead cost by estimated total cost driver.

B)estimated total cost driver by estimated manufacturing overhead cost.

C)estimated manufacturing overhead cost by actual total cost driver.

D)estimated manufacturing overhead cost by estimated total cost driver.

A)actual manufacturing overhead cost by estimated total cost driver.

B)estimated total cost driver by estimated manufacturing overhead cost.

C)estimated manufacturing overhead cost by actual total cost driver.

D)estimated manufacturing overhead cost by estimated total cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following represents the cost of the jobs sold during the period?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following represents the cost of jobs completed but not yet sold?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

29

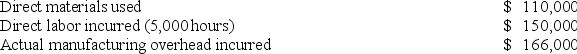

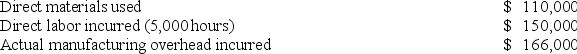

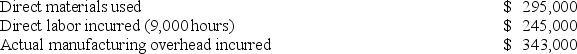

Kilt Company had the following information for the year:  Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours.Assume the only inventory balance is an ending Work in Process balance of $17,000.How much overhead was applied during the year?

Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours.Assume the only inventory balance is an ending Work in Process balance of $17,000.How much overhead was applied during the year?

A)$231,000

B)$150,000

C)$166,000

D)$210,000

Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours.Assume the only inventory balance is an ending Work in Process balance of $17,000.How much overhead was applied during the year?

Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours.Assume the only inventory balance is an ending Work in Process balance of $17,000.How much overhead was applied during the year?A)$231,000

B)$150,000

C)$166,000

D)$210,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

30

Jackson Company had the following information for the year:  Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $19,000.How much overhead was applied during the year?

Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $19,000.How much overhead was applied during the year?

A)$245,000

B)$343,000

C)$360,000

D)$320,000

Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $19,000.How much overhead was applied during the year?

Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $19,000.How much overhead was applied during the year?A)$245,000

B)$343,000

C)$360,000

D)$320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

31

Manufacturing overhead was estimated to be $500,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $450,000 and actual direct labor hours were 19,000.The amount of manufacturing overhead applied to production would be:

A)$500,000.

B)$450,000.

C)$427,500.

D)$475,000.

A)$500,000.

B)$450,000.

C)$427,500.

D)$475,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

32

Manufacturing overhead is applied to each job using which formula?

A)Predetermined overhead rate × actual value of the cost driver for the job

B)Predetermined overhead rate × estimated value of the cost driver for the job

C)Actual overhead rate × estimated value of the cost driver for the job

D)Predetermined overhead rate/actual value of the cost driver for the job

A)Predetermined overhead rate × actual value of the cost driver for the job

B)Predetermined overhead rate × estimated value of the cost driver for the job

C)Actual overhead rate × estimated value of the cost driver for the job

D)Predetermined overhead rate/actual value of the cost driver for the job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

33

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000 and actual labor hours were 21,000.The predetermined overhead rate per direct labor hour would be:

A)$10.00.

B)$1.05.

C)$10.75.

D)$10.24.

A)$10.00.

B)$1.05.

C)$10.75.

D)$10.24.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

34

When manufacturing overhead is applied to production,which of the following accounts is credited?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Manufacturing Overhead

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Manufacturing Overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

35

All the costs assigned to an individual job are summarized on a:

A)cost driver sheet.

B)job cost sheet.

C)materials requisition form.

D)labor time ticket.

A)cost driver sheet.

B)job cost sheet.

C)materials requisition form.

D)labor time ticket.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

36

When materials are purchased,which of the following accounts is debited?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

37

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000 and actual labor hours were 21,000.The amount of manufacturing overhead applied to production would be:

A)$400,000.

B)$415,000.

C)$420,000.

D)$435,750.

A)$400,000.

B)$415,000.

C)$420,000.

D)$435,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

38

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000 and actual labor hours were 21,000.The amount of manufacturing overhead applied to production would be:

A)$200,000.

B)$215,000.

C)$210,000.

D)$225,750.

A)$200,000.

B)$215,000.

C)$210,000.

D)$225,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following represents the accumulated costs of incomplete jobs?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

40

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000 and actual labor hours were 21,000.The predetermined manufacturing overhead rate per direct labor hour would be:

A)$20.00.

B)$0.05.

C)$20.75.

D)$19.05.

A)$20.00.

B)$0.05.

C)$20.75.

D)$19.05.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

41

When units are completed,the cost associated with the job is credited to which account?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following would be used to record the usage of indirect manufacturing resources?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

43

When materials are placed into production:

A)Raw Materials Inventory is debited if the materials are traced directly to the job.

B)Work in Process Inventory is debited if the materials are traced directly to the job.

C)Manufacturing Overhead is debited if the materials are traced directly to the job.

D)Raw Materials Inventory is credited only if the materials are traced directly to the job,otherwise manufacturing overhead is credited.

A)Raw Materials Inventory is debited if the materials are traced directly to the job.

B)Work in Process Inventory is debited if the materials are traced directly to the job.

C)Manufacturing Overhead is debited if the materials are traced directly to the job.

D)Raw Materials Inventory is credited only if the materials are traced directly to the job,otherwise manufacturing overhead is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following would be used to transfer the cost of completed goods during the period to the Finished Goods account?

A)Credit to Raw Materials Inventory.

B)Credit to Work in Process Inventory.

C)Debit to Manufacturing Overhead.

D)Credit to Manufacturing Overhead.

A)Credit to Raw Materials Inventory.

B)Credit to Work in Process Inventory.

C)Debit to Manufacturing Overhead.

D)Credit to Manufacturing Overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following would be used to record the factory supervisor's salary?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following accounts is not affected by applied manufacturing overhead?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following would be used to record the labor cost that is traceable to a specific job?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

48

When units are completed,the cost associated with the job is debited to which account?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

49

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.The amount debited to the Manufacturing Overhead account would be:

A)$400,000.

B)$415,000.

C)$420,000.

D)$435,750.

A)$400,000.

B)$415,000.

C)$420,000.

D)$435,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following would be used to apply manufacturing overhead to production for the period?

A)Credit to Raw Materials Inventory.

B)Credit to Work in Process Inventory.

C)Debit to Manufacturing Overhead.

D)Credit to Manufacturing Overhead.

A)Credit to Raw Materials Inventory.

B)Credit to Work in Process Inventory.

C)Debit to Manufacturing Overhead.

D)Credit to Manufacturing Overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

51

When units are sold,the cost associated with the units is credited to which account?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following would be used to record the property taxes on a factory building?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following would be used to record the labor cost that is not traceable to a specific job?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

54

When direct materials are used in production (as noted by a materials requisition form),which of the following accounts is credited?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following would be used to record the depreciation of manufacturing equipment?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

56

In recording the purchase of materials that are not traced to any specific job,which of the following is correct?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Manufacturing Overhead would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following would be used to apply manufacturing overhead to production for the period?

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Work in Process Inventory would be credited.

A)Raw Materials Inventory would be debited.

B)Work in Process Inventory would be debited.

C)Manufacturing Overhead would be debited.

D)Work in Process Inventory would be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

58

If a company uses a predetermined overhead rate,which of the following statements is correct?

A)Manufacturing Overhead will be debited for estimated overhead.

B)Manufacturing Overhead will be credited for estimated overhead.

C)Manufacturing Overhead will be debited for actual overhead.

D)Manufacturing Overhead will be credited for actual overhead.

A)Manufacturing Overhead will be debited for estimated overhead.

B)Manufacturing Overhead will be credited for estimated overhead.

C)Manufacturing Overhead will be debited for actual overhead.

D)Manufacturing Overhead will be credited for actual overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

59

If materials being placed into production are not traced to a specific job,debit:

A)Raw Materials Inventory.

B)Work in Process Inventory.

C)Manufacturing Overhead.

D)Cost of Goods Sold.

A)Raw Materials Inventory.

B)Work in Process Inventory.

C)Manufacturing Overhead.

D)Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

60

When units are sold,the cost associated with the units is debited to which account?

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

A)Raw Materials Inventory

B)Work in Process Inventory

C)Finished Goods Inventory

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

61

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.The amount credited to the Manufacturing Overhead account would be:

A)$400,000.

B)$415,000.

C)$420,000.

D)$435,750.

A)$400,000.

B)$415,000.

C)$420,000.

D)$435,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

62

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A)Cost of Goods Sold would be credited for $15,000.

B)Cost of Goods Sold would be credited for $5,000.

C)Cost of Goods Sold would be debited for $5,000.

D)Cost of Goods Sold would be debited for $15,000.

A)Cost of Goods Sold would be credited for $15,000.

B)Cost of Goods Sold would be credited for $5,000.

C)Cost of Goods Sold would be debited for $5,000.

D)Cost of Goods Sold would be debited for $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

63

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $225,000,and actual direct labor hours were 19,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A)Manufacturing Overhead would be credited for $12,500.

B)Manufacturing Overhead would be credited for $25,000.

C)Manufacturing Overhead would be debited for $12,500.

D)Manufacturing Overhead would be debited for $25,000.

A)Manufacturing Overhead would be credited for $12,500.

B)Manufacturing Overhead would be credited for $25,000.

C)Manufacturing Overhead would be debited for $12,500.

D)Manufacturing Overhead would be debited for $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

64

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A)Cost of Goods Sold would be credited for $15,000.

B)Cost of Goods Sold would be credited for $5,000.

C)Cost of Goods Sold would be debited for $5,000.

D)Cost of Goods Sold would be debited for $15,000.

A)Cost of Goods Sold would be credited for $15,000.

B)Cost of Goods Sold would be credited for $5,000.

C)Cost of Goods Sold would be debited for $5,000.

D)Cost of Goods Sold would be debited for $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

65

Overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours.Actual overhead was $225,000,and actual direct labor hours were 19,000.The amount debited to the manufacturing overhead account would be:

A)$250,000.

B)$225,000.

C)$213,750.

D)$237,500.

A)$250,000.

B)$225,000.

C)$213,750.

D)$237,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

66

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.The amount credited to the Manufacturing Overhead account would be:

A)$200,000.

B)$215,000.

C)$210,000.

D)$225,750.

A)$200,000.

B)$215,000.

C)$210,000.

D)$225,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

67

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.Which of the following would be correct?

A)Overhead is underapplied by $15,000.

B)Overhead is underapplied by $5,000.

C)Overhead is overapplied by $5,000.

D)Overhead is overapplied by $15,000.

A)Overhead is underapplied by $15,000.

B)Overhead is underapplied by $5,000.

C)Overhead is overapplied by $5,000.

D)Overhead is overapplied by $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

68

The most common method for disposing of over or underapplied overhead is to:

A)recalculate the overhead rate for the period.

B)recalculate the overhead rate for the next period.

C)make a direct adjustment to Work in Process Inventory.

D)make a direct adjustment to Cost of Goods Sold.

A)recalculate the overhead rate for the period.

B)recalculate the overhead rate for the next period.

C)make a direct adjustment to Work in Process Inventory.

D)make a direct adjustment to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

69

Overhead costs are underapplied if the amount applied to Work in Process is:

A)greater than estimated overhead.

B)less than estimated overhead.

C)greater than actual overhead incurred.

D)less than actual overhead incurred.

A)greater than estimated overhead.

B)less than estimated overhead.

C)greater than actual overhead incurred.

D)less than actual overhead incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

70

Underapplied overhead means:

A)too little overhead was applied to raw materials.

B)actual overhead is greater than estimated overhead.

C)finished goods will need to be credited.

D)there is a debit balance remaining in the overhead account.

A)too little overhead was applied to raw materials.

B)actual overhead is greater than estimated overhead.

C)finished goods will need to be credited.

D)there is a debit balance remaining in the overhead account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

71

Overhead costs are overapplied if the amount applied to Work in Process is:

A)greater than estimated overhead.

B)less than estimated overhead.

C)greater than actual overhead incurred.

D)less than actual overhead incurred.

A)greater than estimated overhead.

B)less than estimated overhead.

C)greater than actual overhead incurred.

D)less than actual overhead incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

72

When disposed of,overapplied manufacturing overhead will:

A)increase Cost of Goods Sold.

B)increase Finished Goods.

C)decrease Cost of Goods Sold.

D)decrease Finished Goods.

A)increase Cost of Goods Sold.

B)increase Finished Goods.

C)decrease Cost of Goods Sold.

D)decrease Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

73

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $225,000,and actual direct labor hours were 19,000.The amount credited to the Manufacturing Overhead account would be:

A)$250,000.

B)$225,000.

C)$213,750.

D)$237,500.

A)$250,000.

B)$225,000.

C)$213,750.

D)$237,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

74

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $225,000,and actual direct labor hours were 19,000.Which of the following would be correct?

A)Overhead is underapplied by $25,000.

B)Overhead is underapplied by $12,500.

C)Overhead is overapplied by $12,500.

D)Overhead is overapplied by $25,000.

A)Overhead is underapplied by $25,000.

B)Overhead is underapplied by $12,500.

C)Overhead is overapplied by $12,500.

D)Overhead is overapplied by $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

75

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $225,000,and actual direct labor hours were 19,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A)Cost of Goods Sold would be credited for $25,000.

B)Cost of Goods Sold would be credited for $12,500.

C)Cost of Goods Sold would be debited for $12,500.

D)Cost of Goods Sold would be debited for $25,000.

A)Cost of Goods Sold would be credited for $25,000.

B)Cost of Goods Sold would be credited for $12,500.

C)Cost of Goods Sold would be debited for $12,500.

D)Cost of Goods Sold would be debited for $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

76

When disposed of,underapplied manufacturing overhead will:

A)increase Cost of Goods Sold.

B)increase Finished Goods.

C)decrease Cost of Goods Sold.

D)decrease Finished Goods.

A)increase Cost of Goods Sold.

B)increase Finished Goods.

C)decrease Cost of Goods Sold.

D)decrease Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

77

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A)Manufacturing Overhead would be credited for $5,000.

B)Manufacturing Overhead would be credited for $15,000.

C)Manufacturing Overhead would be debited for $5,000.

D)Manufacturing Overhead would be debited for $15,000.

A)Manufacturing Overhead would be credited for $5,000.

B)Manufacturing Overhead would be credited for $15,000.

C)Manufacturing Overhead would be debited for $5,000.

D)Manufacturing Overhead would be debited for $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

78

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.Which of the following would be correct?

A)Overhead is underapplied by $15,000.

B)Overhead is underapplied by $5,000.

C)Overhead is overapplied by $5,000.

D)Overhead is overapplied by $15,000.

A)Overhead is underapplied by $15,000.

B)Overhead is underapplied by $5,000.

C)Overhead is overapplied by $5,000.

D)Overhead is overapplied by $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

79

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A)Manufacturing Overhead would be credited for $5,000.

B)Manufacturing Overhead would be credited for $20,000.

C)Manufacturing Overhead would be debited for $5,000.

D)Manufacturing Overhead would be debited for $20,000.

A)Manufacturing Overhead would be credited for $5,000.

B)Manufacturing Overhead would be credited for $20,000.

C)Manufacturing Overhead would be debited for $5,000.

D)Manufacturing Overhead would be debited for $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

80

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.The amount debited to the Manufacturing Overhead account would be:

A)$200,000.

B)$215,000.

C)$210,000.

D)$225,750.

A)$200,000.

B)$215,000.

C)$210,000.

D)$225,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck