Deck 10: Projected Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 10: Projected Financial Statements

1

The 'typical user' of a projected financial statement would be:

A) members of the local community where the organisation is based.

B) internal manager.

C) potential investor.

D) shareholder.

A) members of the local community where the organisation is based.

B) internal manager.

C) potential investor.

D) shareholder.

B

2

Projected operating profit after tax, plus projected non-cash expenses, adjusted for changes over the period in projected inventory, debtors, creditors, prepayments, accruals and tax due, equals:

A) the projected adjustment in the owners' equity account for the period.

B) projected profit under accrual accounting.

C) projected cash flow from operations.

D) the projected adjustment to the cash at bank account.

A) the projected adjustment in the owners' equity account for the period.

B) projected profit under accrual accounting.

C) projected cash flow from operations.

D) the projected adjustment to the cash at bank account.

C

3

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is: Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Refer to the table above. If a patio set costs $100 to produce, what will be the cost of sales in the budgeted statement of comprehensive income for the period October to December 2015?

A) $2,200,000

B) $1,500,000

C) $1,900,000

D) $1,800,000

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is:

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.Refer to the table above. If a patio set costs $100 to produce, what will be the cost of sales in the budgeted statement of comprehensive income for the period October to December 2015?

A) $2,200,000

B) $1,500,000

C) $1,900,000

D) $1,800,000

A

4

The budgeting process concludes with the preparation of the:

A) projected income statement.

B) sales forecast.

C) projected balance sheet.

D) capital expenditure budget.

A) projected income statement.

B) sales forecast.

C) projected balance sheet.

D) capital expenditure budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the information below to answer the following questions.

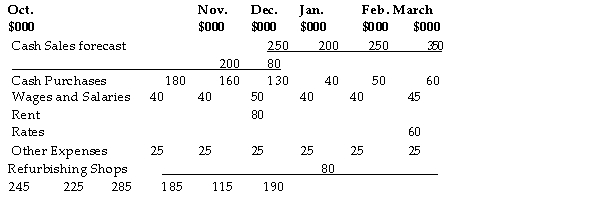

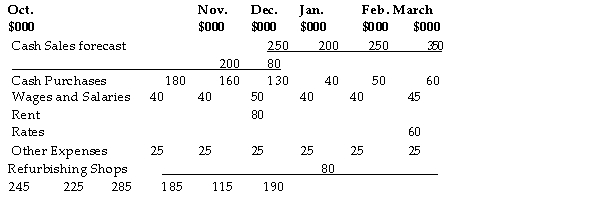

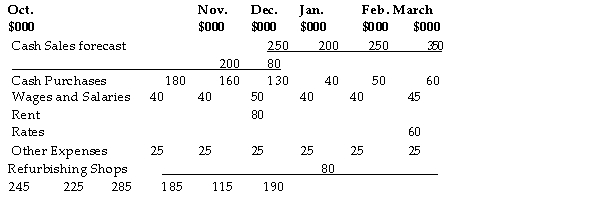

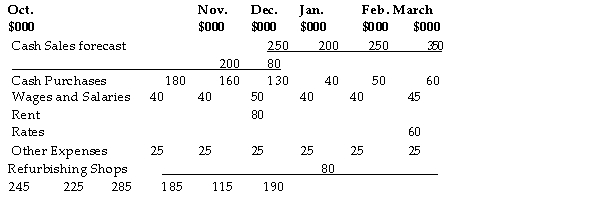

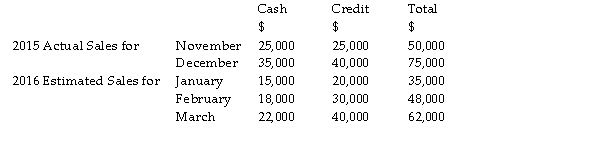

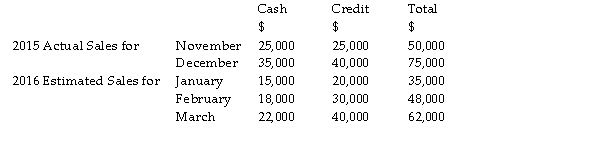

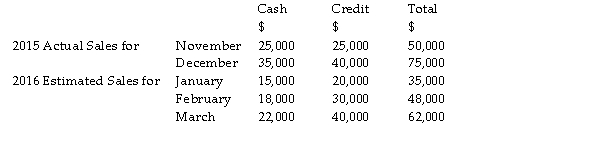

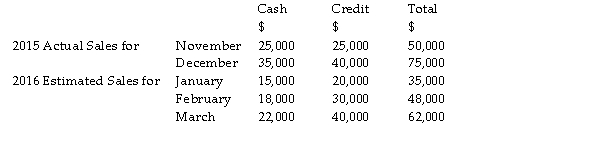

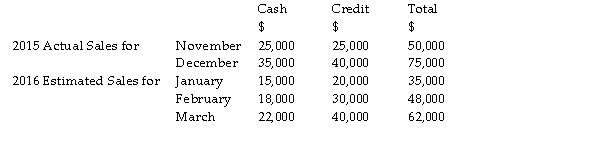

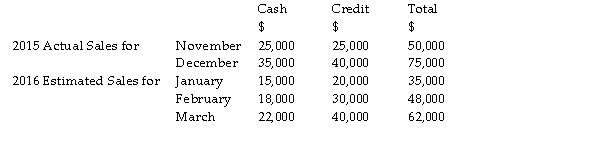

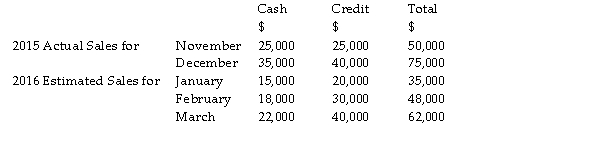

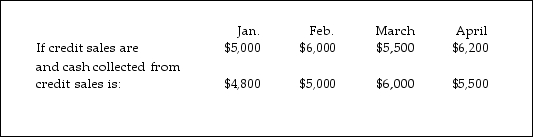

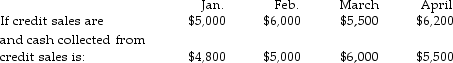

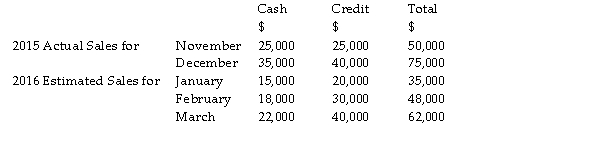

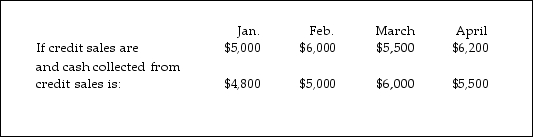

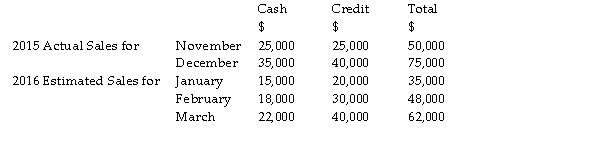

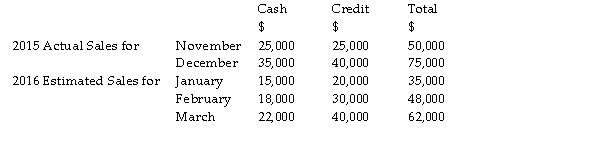

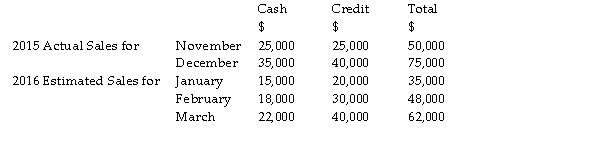

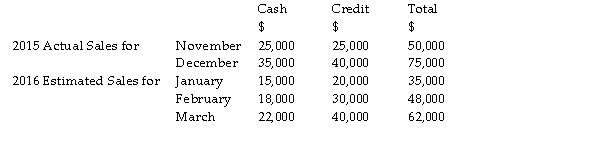

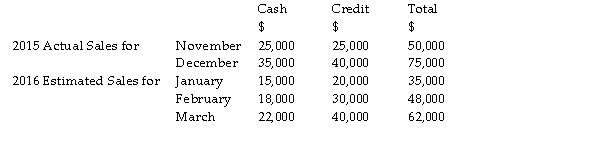

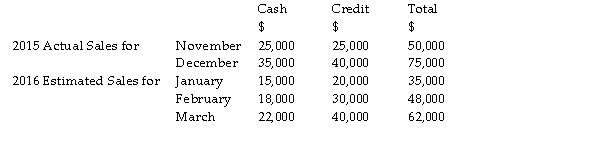

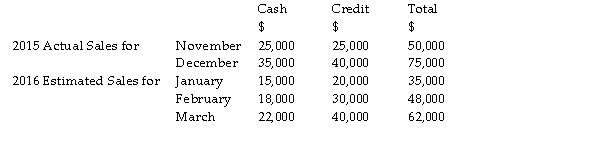

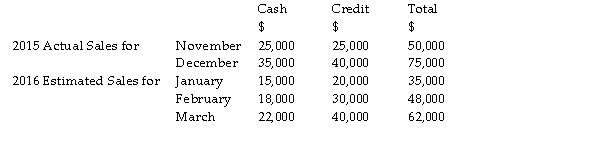

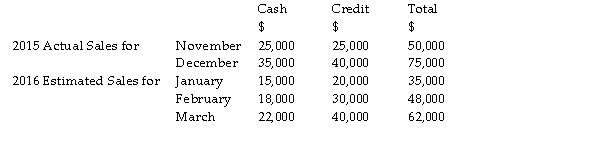

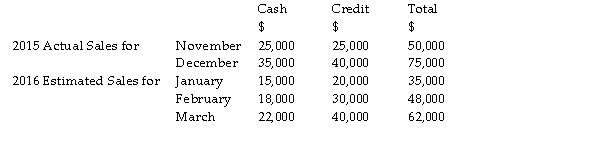

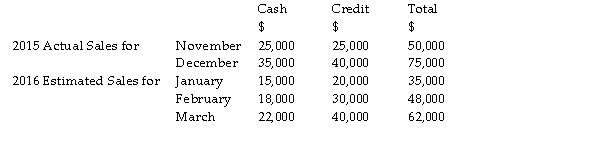

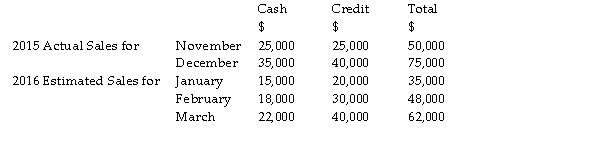

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2015 it had an overdraft of $100,000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

Refer to the table above. The projected cash balance at the end of November is

A) $25,000

B) ($120,000)

C) ($100,000)

D) ($25,000)

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2015 it had an overdraft of $100,000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

Refer to the table above. The projected cash balance at the end of November is

A) $25,000

B) ($120,000)

C) ($100,000)

D) ($25,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of these involves a projection of future cash receipts and cash disbursements?

A) cash budget

B) balance sheet

C) income statement

D) none of the above

A) cash budget

B) balance sheet

C) income statement

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

Sales are $150,000 p.a., cost of sales is $100,000 p.a., fixed expenses are $18,000 p.a. and net profit is $32,000. If there is a 2% increase in the gross profit margin, what will be the new net profit?

A) $34,000

B) $25,000

C) $33,000

D) $32,640

A) $34,000

B) $25,000

C) $33,000

D) $32,640

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

In evaluating projected financial statements, which key question must be asked?

A) Have all relevant outgoings been included?

B) How reliable are the assumptions that have been made?

C) What are the underlying assumptions?

D) All of the above

A) Have all relevant outgoings been included?

B) How reliable are the assumptions that have been made?

C) What are the underlying assumptions?

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Refer to the information above. The cost of sales for February is expected to be:

A) $175,000

B) $197,000

C) $176,000

D) $186,000

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Refer to the information above. The cost of sales for February is expected to be:

A) $175,000

B) $197,000

C) $176,000

D) $186,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

The technique which takes a single variable and examines the effect of changes in that variable on the likely performance and position of the business is known as:

A) sensitivity analysis.

B) historic analysis.

C) performance analysis.

D) management analysis.

A) sensitivity analysis.

B) historic analysis.

C) performance analysis.

D) management analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sales are $150,000 p.a., cost of sales is $100,000 p.a., fixed expenses are $18,000 p.a. and net profit is $32,000. If there is a 10% p.a. increase in sales volume predicted, what will be the new net profit?

A) $37,000

B) $47,000

C) $35,200

D) none of the above

A) $37,000

B) $47,000

C) $35,200

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

To which step in the decision-making process do projected financial statements make the most valuable contribution?

A) identifying objectives

B) gathering data

C) considering options

D) none of the above

A) identifying objectives

B) gathering data

C) considering options

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

The key forecast in projected statements is normally the:

A) forecast of depreciation expense.

B) forecast of sales.

C) estimate of credit collection expenses.

D) estimate of tax disbursements.

A) forecast of depreciation expense.

B) forecast of sales.

C) estimate of credit collection expenses.

D) estimate of tax disbursements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

Use the information below to answer the following questions.

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2015 it had an overdraft of $100,000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

Refer to the table above. The projected cash balance at the end of October is

A) $6,000

B) ($5,000)

C) ($95,000)

D) ($245,000)

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2015 it had an overdraft of $100,000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

Refer to the table above. The projected cash balance at the end of October is

A) $6,000

B) ($5,000)

C) ($95,000)

D) ($245,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

Preparation of projected financial statements:

A) aids investment decisions.

B) aids long-term financial planning.

C) facilitates the planning process.

D) all of the above

A) aids investment decisions.

B) aids long-term financial planning.

C) facilitates the planning process.

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of these will assist managers in developing strategies to deal with projected cash excesses or cash shortages?

A) projected cash flow statement

B) projected balance sheet

C) projected sales revenue

D) projected income statement

A) projected cash flow statement

B) projected balance sheet

C) projected sales revenue

D) projected income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

In Year 1, variable costs per unit of output are $21 and output is 11,000 units. If variable costs are expected to increase by 50c per unit in the following year and output is expected to increase by 10%, the projected figure for total variable costs for Year 2 is:

A) $260,150

B) $6,050

C) $23,650

D) $236,500

A) $260,150

B) $6,050

C) $23,650

D) $236,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

Use the information below to answer the following questions.

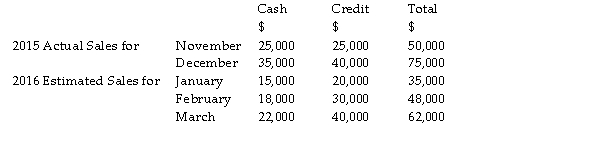

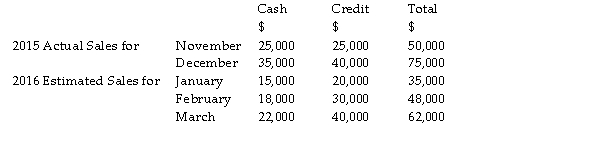

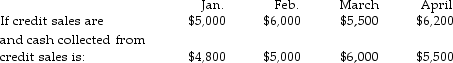

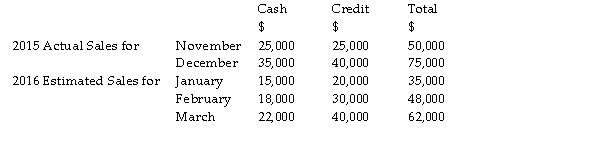

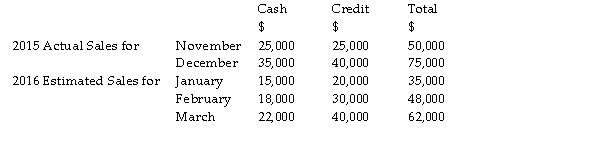

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

Refer to the table above. What is the projected cash inflow from debtors in January?

A) $28,000

B) $15,000

C) $43,000

D) $20,000

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

Refer to the table above. What is the projected cash inflow from debtors in January?

A) $28,000

B) $15,000

C) $43,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

Projected financial statements are less reliable than historic financial statements due to the use of:

A) projected costs.

B) direct costs.

C) actual costs.

D) variable costs.

A) projected costs.

B) direct costs.

C) actual costs.

D) variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

Projected financial statements can assist management with all of the following except:

A) providing a useful insight on the effect of plans on future financial performance.

B) identifying future financing needs.

C) assessing whether the expected outcomes from a particular course of action are acceptable.

D) providing the actual profit figure earned by the business.

A) providing a useful insight on the effect of plans on future financial performance.

B) identifying future financing needs.

C) assessing whether the expected outcomes from a particular course of action are acceptable.

D) providing the actual profit figure earned by the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

A sales forecast for the forthcoming year could be based on:

A) the influence of any events that might significantly affect the past trend.

B) any past trend which is expected to continue.

C) both A and B.

D) neither A nor B.

A) the influence of any events that might significantly affect the past trend.

B) any past trend which is expected to continue.

C) both A and B.

D) neither A nor B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Before using a particular sales forecast, the forecast should be reviewed with respect to:

A) sales projections based on all product lines.

B) sales projections based on economic forecasts.

C) sales forecasts by marketing department.

D) all of the above.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Before using a particular sales forecast, the forecast should be reviewed with respect to:

A) sales projections based on all product lines.

B) sales projections based on economic forecasts.

C) sales forecasts by marketing department.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the information below to answer the following questions.

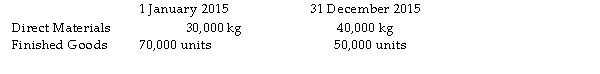

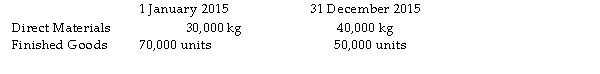

Gillies Company budgets on an annual basis. The following beginning and ending inventory levels are planned for the coming year, 2015. There are two units of material per unit of output.

There are two units of material per unit of output.

Refer to the table above. If 500,000 finished units were to be sold by Gillies Company during the year, what is the amount of direct material that needs to be purchased?

A) 940,000 kgs

B) 970,000 kgs

C) 1,000,000 kgs

D) 1,010,000 kgs

Gillies Company budgets on an annual basis. The following beginning and ending inventory levels are planned for the coming year, 2015.

There are two units of material per unit of output.

There are two units of material per unit of output.Refer to the table above. If 500,000 finished units were to be sold by Gillies Company during the year, what is the amount of direct material that needs to be purchased?

A) 940,000 kgs

B) 970,000 kgs

C) 1,000,000 kgs

D) 1,010,000 kgs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of these is a reason why managers are usually reluctant to make projected financial statements available to groups outside the organisation?

A) Because release could damage their competitive position.

B) Because outsiders may not fully appreciate the assumptions behind the projected statements.

C) Because actual results may vary considerably from projected results.

D) All of the above are reasons.

A) Because release could damage their competitive position.

B) Because outsiders may not fully appreciate the assumptions behind the projected statements.

C) Because actual results may vary considerably from projected results.

D) All of the above are reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

Use the information below to answer the following questions.

The accountant from Trigg Traders examined the following report:

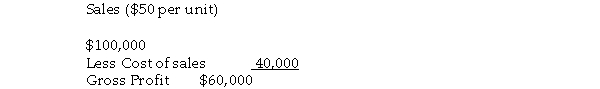

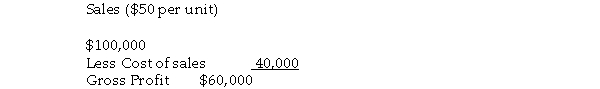

Income statement (extract) for year ended 31 December 2016 The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to

The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to

$25.

Refer to the table above. If the unit cost for 2016 had increased to $30, how many units would have needed to be sold in 2016 to generate a gross profit of $150,000?

A) 7,000 units

B) 7,500 units

C) 8,000 units

D) 6,500 units

The accountant from Trigg Traders examined the following report:

Income statement (extract) for year ended 31 December 2016

The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to

The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to$25.

Refer to the table above. If the unit cost for 2016 had increased to $30, how many units would have needed to be sold in 2016 to generate a gross profit of $150,000?

A) 7,000 units

B) 7,500 units

C) 8,000 units

D) 6,500 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is: Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Refer to the table above. How many sets of patio furniture will be produced in December 2015?

A) 7,200 units

B) 5,200 units

C) 6,400 units

D) 6,200 units

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is:

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.Refer to the table above. How many sets of patio furniture will be produced in December 2015?

A) 7,200 units

B) 5,200 units

C) 6,400 units

D) 6,200 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following in relation to projected financial statements is not correct?

A) Projected financial statements are useful in long-term planning.

B) Projected financial statements look different to historical statements.

C) Projected financial statements are normally prepared for internal purposes only.

D) None of the above, i.e. all are correct statements.

A) Projected financial statements are useful in long-term planning.

B) Projected financial statements look different to historical statements.

C) Projected financial statements are normally prepared for internal purposes only.

D) None of the above, i.e. all are correct statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Projected statements compared with historical statements are:

A) more reliable.

B) more subjective.

C) more objective.

D) less relevant.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Projected statements compared with historical statements are:

A) more reliable.

B) more subjective.

C) more objective.

D) less relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

The report that provides an estimate of the overall financial position of the firm at some future point in time is the:

A) projected balance sheet.

B) projected income statement.

C) cash budget.

D) none of the above

A) projected balance sheet.

B) projected income statement.

C) cash budget.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

On certain occasions, managers may be prepared to release projected information to those outside the business. All the following circumstances could justify the release of information, except

A) when managers feel that the business is under threat of a takeover.

B) when asked by competitors.

C) when making an offer of new shares to the public.

D) when trying to raise finance for the business.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

On certain occasions, managers may be prepared to release projected information to those outside the business. All the following circumstances could justify the release of information, except

A) when managers feel that the business is under threat of a takeover.

B) when asked by competitors.

C) when making an offer of new shares to the public.

D) when trying to raise finance for the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

Spreadsheets are an especially valuable tool in facilitating:

A) sensitivity analysis.

B) cost analysis.

C) performance analysis.

D) revenue analysis.

A) sensitivity analysis.

B) cost analysis.

C) performance analysis.

D) revenue analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Projected financial statements can be prepared on all of the following bases except:

A) a pessimistic view of likely future events.

B) known future events.

C) a 'most likely' view of future events.

D) an optimistic view of likely future events.

A) a pessimistic view of likely future events.

B) known future events.

C) a 'most likely' view of future events.

D) an optimistic view of likely future events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

Refer to the table above. How many units will need to be sold in 2017 to generate a gross profit of $150,000?

A) 4,500 units

B) 5,000 units

C) 6,000 units

D) 5,500 units

A) 4,500 units

B) 5,000 units

C) 6,000 units

D) 5,500 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the information below to answer the following questions.

Gillies Company budgets on an annual basis. The following beginning and ending inventory levels are planned for the coming year, 2015. There are two units of material per unit of output.

There are two units of material per unit of output.

Refer to the table above. If Gillies Company plans to sell 500,000 units during 2015, what is the number of units the firm will need to manufacture during the year?

A) 500,000 units

B) 460,000 units

C) 520,000 units

D) 480,000 units

Gillies Company budgets on an annual basis. The following beginning and ending inventory levels are planned for the coming year, 2015.

There are two units of material per unit of output.

There are two units of material per unit of output.Refer to the table above. If Gillies Company plans to sell 500,000 units during 2015, what is the number of units the firm will need to manufacture during the year?

A) 500,000 units

B) 460,000 units

C) 520,000 units

D) 480,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

If a business wishes to test the effect of a 10% increase in selling price on its budget forecasts, it should use which form of analysis?

A) sensitivity analysis

B) ratio analysis

C) statement analysis

D) vertical analysis

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

If a business wishes to test the effect of a 10% increase in selling price on its budget forecasts, it should use which form of analysis?

A) sensitivity analysis

B) ratio analysis

C) statement analysis

D) vertical analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Refer to the information above. Projected cash payments to trade creditors for the month of February are:

A) $88,000

B) $98,000

C) $186,000

D) $100,000

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Refer to the information above. Projected cash payments to trade creditors for the month of February are:

A) $88,000

B) $98,000

C) $186,000

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Which report provides a projection of income for a period of time into the future?

A) projected balance sheet

B) cash budget

C) projected income statement

D) none of the above

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Which report provides a projection of income for a period of time into the future?

A) projected balance sheet

B) cash budget

C) projected income statement

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

Administrative expenses are expected to be $15,000 for each of the months of January, February and March 2015 and to increase by 10% in each of the next three months of the year. Administrative expenses are paid one month after they are incurred, and include a depreciation charge of $3,000 per month that is not expected to change over the 6 months. The figure for administrative expenses that will appear in the April cash budget is:

A) $15,000

B) $12,000

C) $13,200

D) $16,500

A) $15,000

B) $12,000

C) $13,200

D) $16,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

The most important item in the preparation of projected financial statements is generally projected:

A) employee numbers.

B) expenses.

C) sales.

D) debtors.

A) employee numbers.

B) expenses.

C) sales.

D) debtors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

In preparing a set of budgets using a spreadsheet, all of the following have formulas that are directly linked except:

A) sales and cost of sales.

B) depreciation and accumulated depreciation.

C) debtors and creditors.

D) income tax and profit.

A) sales and cost of sales.

B) depreciation and accumulated depreciation.

C) debtors and creditors.

D) income tax and profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

Which statement in regard to sensitivity analysis is correct?

A) Changing the profit is the best variable to alter when conducting sensitivity analysis.

B) The most information can be gained by changing several variables at the same time.

C) Several variables can be changed, one at a time, to view the effect of each change.

D) All of the above are correct.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

Which statement in regard to sensitivity analysis is correct?

A) Changing the profit is the best variable to alter when conducting sensitivity analysis.

B) The most information can be gained by changing several variables at the same time.

C) Several variables can be changed, one at a time, to view the effect of each change.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

If units sales of the iPad are currently 5,000 units, and those of the Macbook Air are currently double those of the iPad, what will the company's total sales forecast be if sales of the iPad increase by 10 per cent and those of the Macbook Air go up by 2,000 units?

A) 16,000 units

B) 16,500 units

C) 17,500 units

D) 17,000 units

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

If units sales of the iPad are currently 5,000 units, and those of the Macbook Air are currently double those of the iPad, what will the company's total sales forecast be if sales of the iPad increase by 10 per cent and those of the Macbook Air go up by 2,000 units?

A) 16,000 units

B) 16,500 units

C) 17,500 units

D) 17,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

What action might be considered if the cash budget reveals a deficit?

A) purchasing more capital equipment

B) increasing the overdraft limit

C) reducing the period of credit to debtors

D) B and C

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

What action might be considered if the cash budget reveals a deficit?

A) purchasing more capital equipment

B) increasing the overdraft limit

C) reducing the period of credit to debtors

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is: Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

If a firm had credit sales of $1,250,000 for March and collected its sales as 20% in the month of sale and 80% in the month following the sale, how much of March sales would be collected in cash in March?

A) $250,000

B) $1,000,000

C) $312,500

D) $1,250,000

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is:

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.If a firm had credit sales of $1,250,000 for March and collected its sales as 20% in the month of sale and 80% in the month following the sale, how much of March sales would be collected in cash in March?

A) $250,000

B) $1,000,000

C) $312,500

D) $1,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

When do debtors pay their accounts?

When do debtors pay their accounts?

A) in the month of sale

B) two months after the sale

C) one month before the sale

D) one month after the sale

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

When do debtors pay their accounts?

When do debtors pay their accounts?A) in the month of sale

B) two months after the sale

C) one month before the sale

D) one month after the sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

Refer to the table above. What is the total cash expected to be collected from all sales in March?

A) $62,000

B) $50,000

C) $58,000

D) $36,000

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

Refer to the table above. What is the total cash expected to be collected from all sales in March?

A) $62,000

B) $50,000

C) $58,000

D) $36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

Which expense does not appear in a cash budget?

A) rent

B) taxation provided

C) wages

D) supplies

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

Which expense does not appear in a cash budget?

A) rent

B) taxation provided

C) wages

D) supplies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

Refer to the table above. What is the projected cash inflow from debtors in February?

A) $48,000

B) $26,000

C) $18,000

D) $32,000

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

Refer to the table above. What is the projected cash inflow from debtors in February?

A) $48,000

B) $26,000

C) $18,000

D) $32,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

If the opening cash balance at the beginning of the month is $27,500, total cash inflows for the month are $38,000 and total cash outflows are $78,000k the opening cash balance at the beginning of the next month is:

A) $12,500 (deficit)

B) cannot be calculated

C) $67,500 (surplus)

D) $12,500 (surplus)

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

If the opening cash balance at the beginning of the month is $27,500, total cash inflows for the month are $38,000 and total cash outflows are $78,000k the opening cash balance at the beginning of the next month is:

A) $12,500 (deficit)

B) cannot be calculated

C) $67,500 (surplus)

D) $12,500 (surplus)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

Which of the following expenses will stay constant irrespective of the level of sales?

A) local government rates on premises

B) overtime in the production area

C) sales commission

D) cost of sales

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

Which of the following expenses will stay constant irrespective of the level of sales?

A) local government rates on premises

B) overtime in the production area

C) sales commission

D) cost of sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Which of these is a question that could be asked when evaluating the implications of the cash budget?

A) Is the profit level satisfactory?

B) Is the level of gearing satisfactory?

C) Is there any need for additional finance?

D) All are questions that could be asked.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Which of these is a question that could be asked when evaluating the implications of the cash budget?

A) Is the profit level satisfactory?

B) Is the level of gearing satisfactory?

C) Is there any need for additional finance?

D) All are questions that could be asked.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is: Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Refer to the table above. What will be the amount of total production for October 2015?

A) 9,600 units

B) 7,800 units

C) 9,400 units

D) 8,400 units

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is:

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.Refer to the table above. What will be the amount of total production for October 2015?

A) 9,600 units

B) 7,800 units

C) 9,400 units

D) 8,400 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

An expense that is likely to vary directly with the level of production is:

A) depreciation.

B) insurance.

C) raw materials consumed.

D) all of the above.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

An expense that is likely to vary directly with the level of production is:

A) depreciation.

B) insurance.

C) raw materials consumed.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the information below to answer the following questions.

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Refer to the information above. The ending balance in Trade payables for February is expected to be:

A) $197,000

B) $175,000

C) $176,000

D) $186,000

Saddle Company, a leather manufacturer, has a sales budget of $500,000 for February. The cost of sales is estimated to be 35% of sales. All materials purchased by Saddle Company are paid for in the month following the purchase. The beginning inventory for February is $10,000, and an ending inventory of $11,000 is desired. The trade payables balance at the beginning of February is $88,000.

Refer to the information above. The ending balance in Trade payables for February is expected to be:

A) $197,000

B) $175,000

C) $176,000

D) $186,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

In real-world studies on budgeting, it has been found that:

A) inaccurate forecasting has no effect on share price.

B) most companies hit their forecast targets.

C) forecasting is a waste of a company's time.

D) companies with accurate forecasts are rewarded by higher share prices.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

In real-world studies on budgeting, it has been found that:

A) inaccurate forecasting has no effect on share price.

B) most companies hit their forecast targets.

C) forecasting is a waste of a company's time.

D) companies with accurate forecasts are rewarded by higher share prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016. Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

Which question can be answered by using sensitivity analysis?

A) What if sales price is reduced by $10 per unit?

B) What if the credit period taken from suppliers is extended from one month to two months?

C) What if sales volume is 6% higher than expected?

D) All the questions can be answered.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale40 per cent in the month following the sale

Which question can be answered by using sensitivity analysis?

A) What if sales price is reduced by $10 per unit?

B) What if the credit period taken from suppliers is extended from one month to two months?

C) What if sales volume is 6% higher than expected?

D) All the questions can be answered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the information below to answer the following questions.

The accountant from Trigg Traders examined the following report:

Income statement (extract) for year ended 31 December 2016 The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to

The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to

$25.

Refer to the table above. The projected gross profit for 2017 will be:

A) $100,000

B) $10,000

C) $120,000

D) $110,000

The accountant from Trigg Traders examined the following report:

Income statement (extract) for year ended 31 December 2016

The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to

The accountant of Trigg Traders estimated that the quantity of sales would double in 2017 and the unit cost would increase to$25.

Refer to the table above. The projected gross profit for 2017 will be:

A) $100,000

B) $10,000

C) $120,000

D) $110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is: Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Which of the following is a use of cash?

A) taxes paid

B) depreciation

C) net increase in shareholders' equity

D) cash receipts from customers

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold in the last three months of 2015 and the first month of 2016 is:

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.

Finished goods inventory at the end of September is 2,000 units. Finished goods inventory is set at 20 per cent of next month's sales.Which of the following is a use of cash?

A) taxes paid

B) depreciation

C) net increase in shareholders' equity

D) cash receipts from customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck