Deck 10: The Monetary System

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

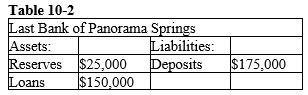

سؤال

سؤال

سؤال

سؤال

سؤال

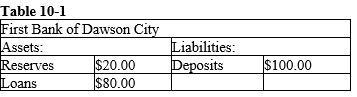

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/204

العب

ملء الشاشة (f)

Deck 10: The Monetary System

1

Which of the following ranks assets from most to least liquid?

A) currency, gold, bonds

B) currency, bonds, gold

C) gold, currency, bonds

D) gold, bonds, currency

A) currency, gold, bonds

B) currency, bonds, gold

C) gold, currency, bonds

D) gold, bonds, currency

currency, bonds, gold

2

Which statement best defines barter?

A) It is an exchange of goods for money.

B) It is an exchange of money for foreign currency.

C) It is a generally accepted legal tender.

D) It is a transaction that requires a double coincidence of wants.

A) It is an exchange of goods for money.

B) It is an exchange of money for foreign currency.

C) It is a generally accepted legal tender.

D) It is a transaction that requires a double coincidence of wants.

It is a transaction that requires a double coincidence of wants.

3

What is a generally accepted medium of exchange?

A) hockey cards

B) treasury bills

C) gold

D) currency

A) hockey cards

B) treasury bills

C) gold

D) currency

currency

4

When Arnold uses dollars to record his income and expenses, how is he using money?

A) as a unit of account

B) as a means of payment

C) as a store of value

D) as a medium of exchange

A) as a unit of account

B) as a means of payment

C) as a store of value

D) as a medium of exchange

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is current Canadian currency?

A) fiat money with intrinsic value

B) fiat money with no intrinsic value

C) commodity money with intrinsic value

D) commodity money with no intrinsic value

A) fiat money with intrinsic value

B) fiat money with no intrinsic value

C) commodity money with intrinsic value

D) commodity money with no intrinsic value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is included in M1+?

A) government bonds

B) demand deposits

C) savings deposits

D) travellers' cheques

A) government bonds

B) demand deposits

C) savings deposits

D) travellers' cheques

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which statement best illustrates the unit of account function of money?

A) You list prices on your new restaurant menu in dollars.

B) You pay for your Toronto FC season tickets with dollars.

C) You keep $1000 in your safe for emergencies.

D) You sell your home for $750 000.

A) You list prices on your new restaurant menu in dollars.

B) You pay for your Toronto FC season tickets with dollars.

C) You keep $1000 in your safe for emergencies.

D) You sell your home for $750 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which statement best illustrates the medium of exchange function of money?

A) You keep some money hidden in your sock drawer.

B) You have your house remortgaged for $500 000.

C) You use cash to buy a new tent for $250.

D) You borrow $500 from your parents for textbooks.

A) You keep some money hidden in your sock drawer.

B) You have your house remortgaged for $500 000.

C) You use cash to buy a new tent for $250.

D) You borrow $500 from your parents for textbooks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following does M1+ include?

A) currency

B) savings deposits

C) travellers' cheques

D) foreign currency accounts

A) currency

B) savings deposits

C) travellers' cheques

D) foreign currency accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following has intrinsic value?

A) a gold coin

B) a one hundred-dollar bill

C) a credit card

D) a personal cheque

A) a gold coin

B) a one hundred-dollar bill

C) a credit card

D) a personal cheque

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

11

What do economists use the word "money" to refer to?

A) income generated by the production of goods and services

B) those assets regularly used to buy goods and services

C) the value of a person's assets

D) the value of stocks and bonds

A) income generated by the production of goods and services

B) those assets regularly used to buy goods and services

C) the value of a person's assets

D) the value of stocks and bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which statement best defines liquidity?

A) It is the ease with which an asset is converted to the medium of exchange.

B) It is a measurement of the intrinsic value of commodity money.

C) It is the ability of an asset to retain purchasing power.

D) It refers to how many times a dollar changes hands in a given year.

A) It is the ease with which an asset is converted to the medium of exchange.

B) It is a measurement of the intrinsic value of commodity money.

C) It is the ability of an asset to retain purchasing power.

D) It refers to how many times a dollar changes hands in a given year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is included in M2 but not in M1+?

A) currency

B) demand deposits

C) savings deposits

D) gold

A) currency

B) demand deposits

C) savings deposits

D) gold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is a characteristic of paper money?

A) It has a high intrinsic value.

B) It hinders efficient allocation of resources.

C) It is valuable because it is generally accepted in trade.

D) It is valuable only because of the legal tender requirement.

A) It has a high intrinsic value.

B) It hinders efficient allocation of resources.

C) It is valuable because it is generally accepted in trade.

D) It is valuable only because of the legal tender requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

15

What does the legal tender requirement imply?

A) People are more likely to accept the dollar as a medium of exchange.

B) The government must hold enough gold to redeem all currency.

C) People may not make trades with anything else.

D) It is illegal to hold foreign currencies.

A) People are more likely to accept the dollar as a medium of exchange.

B) The government must hold enough gold to redeem all currency.

C) People may not make trades with anything else.

D) It is illegal to hold foreign currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

16

What characterizes fiat money?

A) It has no intrinsic value.

B) It is backed by gold.

C) It has intrinsic value equal to its value in exchange.

D) It is an illiquid asset.

A) It has no intrinsic value.

B) It is backed by gold.

C) It has intrinsic value equal to its value in exchange.

D) It is an illiquid asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

17

Madison puts money under her mattress so she can spend it later. Which function of money does this illustrate?

A) store of value

B) medium of exchange

C) unit of account

D) wealth

A) store of value

B) medium of exchange

C) unit of account

D) wealth

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

18

What characterizes commodity money?

A) It is money that is backed by gold.

B) It is the principal type of money in use today.

C) It is money with intrinsic value.

D) It is comprised of receipts created in international trade that are used as a medium of exchange.

A) It is money that is backed by gold.

B) It is the principal type of money in use today.

C) It is money with intrinsic value.

D) It is comprised of receipts created in international trade that are used as a medium of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the role of money in an economy?

A) Money serves as a person's wealth.

B) Money allows people to save

C) Money is an investment asset.

D) Money allows greater specialization.

A) Money serves as a person's wealth.

B) Money allows people to save

C) Money is an investment asset.

D) Money allows greater specialization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

20

What characterizes currency?

A) It has intrinsic value.

B) It has no intrinsic value.

C) It may be used as a medium of exchange but is not legal tender.

D) It performs all the functions of money except providing a unit of account.

A) It has intrinsic value.

B) It has no intrinsic value.

C) It may be used as a medium of exchange but is not legal tender.

D) It performs all the functions of money except providing a unit of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the function of debit cards?

A) They defer payments.

B) They are equivalent to credit cards.

C) They are included in M2.

D) They are used as a method of payment.

A) They defer payments.

B) They are equivalent to credit cards.

C) They are included in M2.

D) They are used as a method of payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the approximate amount of currency in Canada?

A) $84 million

B) $840 million

C) $84 billion

D) $840 billion

A) $84 million

B) $840 million

C) $84 billion

D) $840 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is a credit card?

A) a form of money

B) a form of saving

C) a form of investing

D) a form of payment

A) a form of money

B) a form of saving

C) a form of investing

D) a form of payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which account balance is included in M1+?

A) a chequing account

B) a credit card account

C) a term savings account

D) a stock investment

A) a chequing account

B) a credit card account

C) a term savings account

D) a stock investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is the fundamental function of credit cards?

A) Credit cards are used for deferring payments.

B) Credit cards are used as store of value.

C) Credit cards are used for increasing the money supply.

D) Credit cards are used as investment assets.

A) Credit cards are used for deferring payments.

B) Credit cards are used as store of value.

C) Credit cards are used for increasing the money supply.

D) Credit cards are used as investment assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

26

Who appoints the members of the Board of Directors at the Bank of Canada?

A) the Governor General

B) the Minister of Finance

C) the Director of the IMF

D) the Prime Minister

A) the Governor General

B) the Minister of Finance

C) the Director of the IMF

D) the Prime Minister

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is included in M1+?

A) credit cards

B) savings accounts

C) currency

D) Canada savings bonds

A) credit cards

B) savings accounts

C) currency

D) Canada savings bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

28

For how long is the governor of the Bank of Canada appointed?

A) a two-year term

B) a five-year term

C) a seven-year term

D) a life term

A) a two-year term

B) a five-year term

C) a seven-year term

D) a life term

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

29

If currency is $50 billion, chequable deposits $700 billion, other minor, less liquid categories $300 billion, and credit card debt $500 billion, how much is M1+?

A) $750 billion

B) $1000 billion

C) $1050 billion

D) $1550 billion

A) $750 billion

B) $1000 billion

C) $1050 billion

D) $1550 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is included in M2?

A) gold

B) mortgages

C) currency

D) investment accounts

A) gold

B) mortgages

C) currency

D) investment accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

31

In 2018, what was the average currency holding of Canadian dollars relative to Canadian population?

A) $791

B) $1791

C) $2791

D) $3791

A) $791

B) $1791

C) $2791

D) $3791

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which agency is responsible for regulating the money supply in Canada?

A) Finance Canada

B) the Bank of Canada

C) the Royal Bank of Canada

D) the Canadian Payments Association

A) Finance Canada

B) the Bank of Canada

C) the Royal Bank of Canada

D) the Canadian Payments Association

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

33

On average, Americans have almost twice as much currency as Canadians. What is the most plausible reason for this?

A) Canadians trust their banking system a lot more.

B) Americans are a lot richer than Canadians.

C) The American economy is two times bigger than the Canadian economy.

D) A lot of U.S. currency is held by foreigners.

A) Canadians trust their banking system a lot more.

B) Americans are a lot richer than Canadians.

C) The American economy is two times bigger than the Canadian economy.

D) A lot of U.S. currency is held by foreigners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

34

What does the Bank of Canada NOT do?

A) control the supply of money

B) control the value of money

C) make loans to individuals

D) regulate the banking system

A) control the supply of money

B) control the value of money

C) make loans to individuals

D) regulate the banking system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is included in M2 but not in M1+?

A) demand deposits

B) corporate bonds

C) currency

D) term deposits

A) demand deposits

B) corporate bonds

C) currency

D) term deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is a debit card?

A) a form of postponing debt

B) a means of payment

C) a form of savings

D) a means of borrowing

A) a form of postponing debt

B) a means of payment

C) a form of savings

D) a means of borrowing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is included in the M2 definition of the money supply?

A) credit cards

B) term deposits

C) treasury bills

D) US dollars

A) credit cards

B) term deposits

C) treasury bills

D) US dollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

38

How does M1+ compare with M2?

A) M1+ is smaller and less liquid than M2.

B) M1+ is smaller but more liquid than M2.

C) M1+ is larger than and less liquid than M2.

D) M1+ is larger than but more liquid than M2.

A) M1+ is smaller and less liquid than M2.

B) M1+ is smaller but more liquid than M2.

C) M1+ is larger than and less liquid than M2.

D) M1+ is larger than but more liquid than M2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

39

What does the calculated amount of currency per person in Canada suggest?

A) People tend to hold too much currency.

B) Most payments are made in cash.

C) People do not trust banks.

D) There is a significant illegal activity.

A) People tend to hold too much currency.

B) Most payments are made in cash.

C) People do not trust banks.

D) There is a significant illegal activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which statement best characterizes credit cards?

A) They are a payment form of money.

B) They are part of the M1+ money supply.

C) They are a method of deferring payment.

D) They are a unit of account.

A) They are a payment form of money.

B) They are part of the M1+ money supply.

C) They are a method of deferring payment.

D) They are a unit of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

41

Who owns the Bank of Canada?

A) the Toronto Stock Exchange

B) the US Federal Reserve Bank

C) the chartered banks

D) the federal government of Canada

A) the Toronto Stock Exchange

B) the US Federal Reserve Bank

C) the chartered banks

D) the federal government of Canada

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

42

Suppose a bank has $200,000 in deposits and $150,000 in loans. What is its reserve ratio?

A) 1 percent

B) 5 percent

C) 10 percent

D) 25 percent

A) 1 percent

B) 5 percent

C) 10 percent

D) 25 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

43

When was the Bank of Canada Act first enacted?

A) 1867

B) 1934

C) 1945

D) 1991

A) 1867

B) 1934

C) 1945

D) 1991

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

44

What is a characteristic of the Bank of Montreal?

A) It can issue currency.

B) It is part of the "big 5" commercial banks group.

C) It acts as a central bank for Montreal.

D) It is owned by the Canadian government.

A) It can issue currency.

B) It is part of the "big 5" commercial banks group.

C) It acts as a central bank for Montreal.

D) It is owned by the Canadian government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

45

Fallout from which event led to the creation of the Bank of Canada?

A) World War I

B) the Great Depression

C) the 1970s oil crisis

D) September 11, 2001

A) World War I

B) the Great Depression

C) the 1970s oil crisis

D) September 11, 2001

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

46

How do deposits and reserves appear on a bank's T-account?

A) Both deposits and reserves are assets.

B) Both deposits and reserves are liabilities.

C) Deposits are assets, and reserves are liabilities.

D) Reserves are assets, and deposits are liabilities.

A) Both deposits and reserves are assets.

B) Both deposits and reserves are liabilities.

C) Deposits are assets, and reserves are liabilities.

D) Reserves are assets, and deposits are liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose that the reserve ratio is 7 percent and that a bank has $2000 in deposits. What are its required reserves?

A) $70

B) $140

C) $1400

D) $1860

A) $70

B) $140

C) $1400

D) $1860

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

48

Who chairs the Board of Directors of the Bank of Canada?

A) the governor of the Bank of Canada

B) the Prime Minister

C) the Minister of Finance

D) the Governor General

A) the governor of the Bank of Canada

B) the Prime Minister

C) the Minister of Finance

D) the Governor General

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is one of the functions of the Bank of Canada?

A) to maximize profits on behalf of its shareholders

B) to issue currency

C) to convert currency into gold

D) to bail out the government

A) to maximize profits on behalf of its shareholders

B) to issue currency

C) to convert currency into gold

D) to bail out the government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which organization plays the role of a central bank in Canada?

A) the Royal Canadian Mint

B) the Toronto Stock Exchange

C) the Bank of Canada

D) the Royal Bank of Canada

A) the Royal Canadian Mint

B) the Toronto Stock Exchange

C) the Bank of Canada

D) the Royal Bank of Canada

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

51

Suppose a bank has a 6 percent reserve ratio, $4000 in deposits, and it loans out all it can, given the reserve ratio. Which of the following describes the bank's assets?

A) It has $800 in reserves and $16,000 in loans.

B) It has $240 in reserves and $3760 in loans.

C) It has $240in reserves and $4000 in loans.

D) It has $800 in reserves and $3200 in loans.

A) It has $800 in reserves and $16,000 in loans.

B) It has $240 in reserves and $3760 in loans.

C) It has $240in reserves and $4000 in loans.

D) It has $800 in reserves and $3200 in loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

52

What is the role of the Bank of Canada?

A) to pay off the Canadian debt

B) to make monetary policy

C) to collect taxes

D) to oversee government spending

A) to pay off the Canadian debt

B) to make monetary policy

C) to collect taxes

D) to oversee government spending

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

53

What is the reason behind the seven-year appointment for the governor of Bank of Canada?

A) It makes the system compatible with the ones in other countries.

B) It confers stability to the financial system.

C) It allows the governor time to implement changes and to analyze the results of those changes.

D) It insulates the governor from political pressure.

A) It makes the system compatible with the ones in other countries.

B) It confers stability to the financial system.

C) It allows the governor time to implement changes and to analyze the results of those changes.

D) It insulates the governor from political pressure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

54

Suppose a bank has $10,000 in deposits and $7000 in loans. What is its reserve ratio?

A) 3 percent

B) 7 percent

C) 30 percent

D) 70 percent

A) 3 percent

B) 7 percent

C) 30 percent

D) 70 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

55

When a bank loans out $1000, what happens to the money supply in the long term?

A) It increases by $1000.

B) It decreases by $1000.

C) It increases by more than $1000.

D) It decreases by more than $1000.

A) It increases by $1000.

B) It decreases by $1000.

C) It increases by more than $1000.

D) It decreases by more than $1000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

56

What happens in a 100-percent-reserve banking system?

A) Banks can create money by issuing currency.

B) Banks can create money by lending out reserves.

C) Banks can lend money to their customers.

D) Banks hold as many reserves as they hold deposits.

A) Banks can create money by issuing currency.

B) Banks can create money by lending out reserves.

C) Banks can lend money to their customers.

D) Banks hold as many reserves as they hold deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is most likely to happen under a fractional reserve banking system?

A) Banks hold more reserves than deposits.

B) Banks generally lend out a majority of the funds deposited.

C) Banks cause the money supply to fall by lending out reserves.

D) Banks only accept savings deposits.

A) Banks hold more reserves than deposits.

B) Banks generally lend out a majority of the funds deposited.

C) Banks cause the money supply to fall by lending out reserves.

D) Banks only accept savings deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

58

Suppose that the reserve ratio is 9 percent and that a bank has $3000 in deposits. What are its required reserves?

A) $90

B) $270

C) $333

D) $1730

A) $90

B) $270

C) $333

D) $1730

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

59

If you deposit $100 into a demand deposit at a bank, what does this action do to the money supply?

A) It increases the money supply by more than $100.

B) It increases the money supply by less than $100.

C) It decreases the money supply by more than $100.

D) It decreases the money supply by less than $100.

A) It increases the money supply by more than $100.

B) It increases the money supply by less than $100.

C) It decreases the money supply by more than $100.

D) It decreases the money supply by less than $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

60

Suppose a bank has a 10 percent reserve ratio, $2000 in deposits, and it loans out all it can, given the reserve ratio. Which of the following describes the bank's assets?

A) It has $20 in reserves and $1800 in loans.

B) It has $20 in reserves and $1980 in loans.

C) It has $200 in reserves and $1800 in loans.

D) It has $200 in reserves and $2000 in loans.

A) It has $20 in reserves and $1800 in loans.

B) It has $20 in reserves and $1980 in loans.

C) It has $200 in reserves and $1800 in loans.

D) It has $200 in reserves and $2000 in loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

61

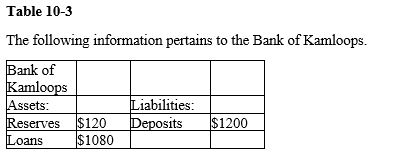

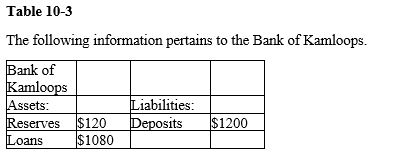

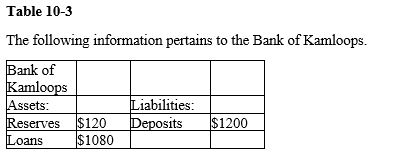

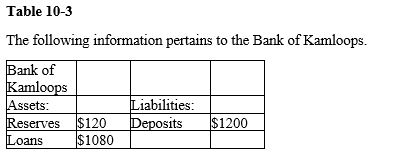

Refer to Table 10-3. If the Bank of Kamloops has loaned out all the money it wants, given its deposits, what is its reserve ratio?

A) 1 percent

B) 5 percent

C) 10 percent

D) 15 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

62

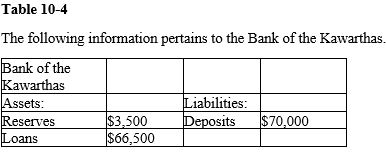

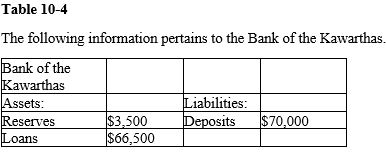

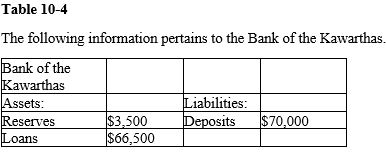

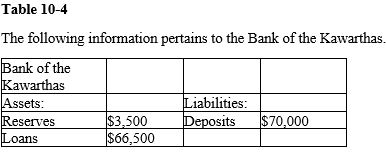

Refer to Table 10-4. Assume that all banks hold the same reserve ratio as the Bank of the Kawarthas. What is the money multiplier?

A) 3.5

B) 17.5

C) 19

D) 20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

63

Refer to Table 10-3. If the Bank of Canada requires banks to hold 5 percent of deposits as reserves, how much in excess reserves does the Bank of Kamloops now hold?

A) $5

B) $25

C) $60

D) $65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

64

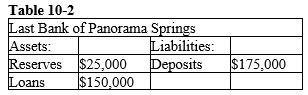

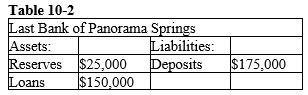

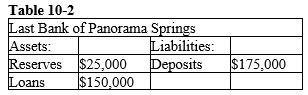

Refer to Table 10-2. If the reserve requirement is 12 percent, what is the state of this bank?

A) It can make a new loan of $17,500.

B) It has less reserves than required.

C) It has excess reserves of less than $5000.

D) It has excess reserves of more than $5000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

65

Refer to Table 10-3. Assume that all other banks hold only the required 5 percent of deposits as reserves and people hold only deposits and no currency. If the Bank of Kamloops decides to hold exactly 5 percent in reserves, by how much would the economy's money supply increase?

A) $500

B) $1200

C) $1500

D) $2000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the reserve ratio is 10 percent and a bank receives a new deposit of $20, what happens to the bank's reserves in the longer term?

A) increase by $2

B) increase by $18

C) increase by $20

D) increase by $200

A) increase by $2

B) increase by $18

C) increase by $20

D) increase by $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

67

Refer to Table 10-4. If the Bank of Canada requires a reserve ratio of 4 percent, how much in excess reserves does the Bank of the Kawarthas now hold?

A) $600

B) $700

C) $1440

D) $1500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

68

Refer to Table 10-4. Assume that all other banks hold only the required 4 percent of deposits as reserves, and that people hold only deposits and no currency. If the Bank of the Kawarthas decides to hold reserves of 4 percent, by how much would the economy's money supply increase?

A) $30,000

B) $35,000

C) $42,000

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

69

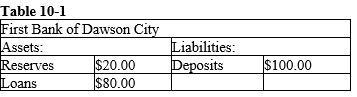

Refer to Table 10-1. If $500 is deposited into the First Bank of Dawson City, what will happen?

A) The bank will be able to make additional loans totalling $500.

B) Excess reserves initially increase by $500.

C) Required reserves initially increase by $10,000.

D) Excess reserves initially increase by $400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

70

If you deposit $5000 into First Hawkeye Bank, what will the bank most likely do?

A) It will eventually increase its required reserves by the reserve ratio times $5000.

B) It will be able to lend out $5000 times the reserve ratio.

C) It will initially see reserves increase by $5000 divided by the reserve ratio.

D) It will be able to lend out $5000.

A) It will eventually increase its required reserves by the reserve ratio times $5000.

B) It will be able to lend out $5000 times the reserve ratio.

C) It will initially see reserves increase by $5000 divided by the reserve ratio.

D) It will be able to lend out $5000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

71

Refer to Table 10-4. If the Bank of the Kawarthas has lent out all the money it can, then what is its reserve ratio?

A) 0 percent

B) 5 percent

C) 20 percent

D) 100 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

72

Refer to Table 10-2. If the reserve requirement is 30 percent, what is this bank's reserve position?

A) It has $29,000 of excess reserves.

B) It needs $10,000 more in reserves to meet its reserve requirement.

C) It needs $27,500 more in reserves to meet its reserve requirement.

D) It just meets its reserve requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

73

Refer to Table 10-2. If the Last Bank of Panorama Springs is holding $4000 in excess reserves, what is the reserve requirement?

A) 8 percent

B) 9 percent

C) 10 percent

D) 12 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

74

A central bank raised the reserve requirement ratio from 5 percent to 8 percent. Other things the same, how does the money multiplier change?

A) It increases by 3.

B) It decreases by 3.

C) It increases by 7.5

D) It decreases by 7.5

A) It increases by 3.

B) It decreases by 3.

C) It increases by 7.5

D) It decreases by 7.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

75

Refer to Table 10-3. Assume that the Bank of Kamloops is holding the required percent of deposits as reserves. Also, assume all other banks hold only the required percent of deposits as reserves, and that people hold only deposits and no currency. What is the money multiplier?

A) 1

B) 5

C) 10

D) 15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

76

If the reserve ratio is 5 percent and a bank receives a new deposit of $1,000, by how much can the bank increase its new loans?

A) by $950

B) by $1,000

C) by $5,000

D) by $20,000

A) by $950

B) by $1,000

C) by $5,000

D) by $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

77

Refer to Table 10-1. What is the reserve ratio?

A) 0 percent

B) 20 percent

C) 80 percent

D) 100 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

78

If the reserve ratio is 10 percent and a bank receives a new deposit of $500, which of the following will this bank most likely do?

A) It will increase its required reserves by $5000.

B) It will make new loans of $5000.

C) It will be able to make new loans of $500.

D) It will initially see its total reserves increase by $500.

A) It will increase its required reserves by $5000.

B) It will make new loans of $5000.

C) It will be able to make new loans of $500.

D) It will initially see its total reserves increase by $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

79

Refer to Table 10-2. If the reserve requirement is 10 percent and then someone deposits $50,000 into the bank, what is the bank's reserve position?

A) It will have $75,000 in excess reserves.

B) It will have $52,500 in excess reserves.

C) It will need to raise reserves by $5000.

D) It will have excess reserves of $2500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

80

Refer to Table 10-1. If $1000 is deposited into the First Bank of Dawson City, what will happen?

A) Reserves will decrease by $800.

B) Liabilities will decrease by $1000.

C) Assets will increase by $1000.

D) Reserves will increase by $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck