Deck 14: Income Taxation of Trusts and Estates

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 14: Income Taxation of Trusts and Estates

1

The term "trust income" when not preceded by an explanatory word relates most closely to

A) gross income.

B) taxable income.

C) distributable net income.

D) net accounting income.

A) gross income.

B) taxable income.

C) distributable net income.

D) net accounting income.

D

2

A tax entity, often called a fiduciary, includes all of the following except

A) estates.

B) complex trusts.

C) testamentary trusts.

D) All of the above are fiduciaries.

A) estates.

B) complex trusts.

C) testamentary trusts.

D) All of the above are fiduciaries.

D

3

An inter vivos trust may be created by all of the following except

A) a grantor.

B) a trustor.

C) an executor.

D) a transferor.

A) a grantor.

B) a trustor.

C) an executor.

D) a transferor.

C

4

The executor or administrator is responsible for all the following estate duties except

A) preserving the estate's existence as a separate taxpayer.

B) collecting the assets.

C) paying the debts and taxes.

D) distributing the property.

A) preserving the estate's existence as a separate taxpayer.

B) collecting the assets.

C) paying the debts and taxes.

D) distributing the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements regarding the taxation of a trust is incorrect?

A) An irrevocable trust's income is taxed to the grantor.

B) Trusts are generally not taxed at favorable rates for income shifting.

C) Trusts are not subject to double taxation.

D) A trust's long-term capital gains are taxed at a top rate of 15%.

A) An irrevocable trust's income is taxed to the grantor.

B) Trusts are generally not taxed at favorable rates for income shifting.

C) Trusts are not subject to double taxation.

D) A trust's long-term capital gains are taxed at a top rate of 15%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

Briefly discuss some of the reasons for using a revocable trust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

For purposes of trust administration, the term "sprinkling" relates to the mandatory distribution of income among various beneficiaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

8

A trust has net accounting income of $15,000. In addition, the trust has a $10,000 capital gain, which is not included in net accounting income. The trust is required to distribute the trust income to the beneficiary. The beneficiary will receive

A) $10,000.

B) $15,000.

C) $24,700.

D) $25,000.

A) $10,000.

B) $15,000.

C) $24,700.

D) $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

Identify which of the following statements is false.

A) For purposes of trust administration, the term "sprinkling" relates to the discretionary authority of the trustee to distribute income among various beneficiaries.

B) The IRS may terminate an estate as a taxpayer after the expiration of a reasonable period of time for performance of the administrative duties.

C) Assets in a revocable trust do not avoid probate.

D) Assets in a revocable trust are included in the gross estate.

A) For purposes of trust administration, the term "sprinkling" relates to the discretionary authority of the trustee to distribute income among various beneficiaries.

B) The IRS may terminate an estate as a taxpayer after the expiration of a reasonable period of time for performance of the administrative duties.

C) Assets in a revocable trust do not avoid probate.

D) Assets in a revocable trust are included in the gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

Beneficiaries of a trust may receive

A) an income interest only.

B) a remainder interest only.

C) both an income and a remainder interest.

D) Any of the above is correct.

A) an income interest only.

B) a remainder interest only.

C) both an income and a remainder interest.

D) Any of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is incorrect?

A) The income tax rules governing estates and trusts are generally identical.

B) Income generated by property owned by an estate or trust is reported on that entity's tax return.

C) Subchapter K contains the special rules applicable to estates and trusts.

D) All of the above are correct.

A) The income tax rules governing estates and trusts are generally identical.

B) Income generated by property owned by an estate or trust is reported on that entity's tax return.

C) Subchapter K contains the special rules applicable to estates and trusts.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

Revocable trusts means

A) the transferor may not demand the assets be returned.

B) income or estate tax savings for the grantor.

C) the trust can be revoked.

D) the grantor is always the beneficiary.

A) the transferor may not demand the assets be returned.

B) income or estate tax savings for the grantor.

C) the trust can be revoked.

D) the grantor is always the beneficiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

The conduit approach for fiduciary income tax means

A) the distributed income has the same character in the hands of the beneficiary as it has to the trust.

B) the distributed income goes to all beneficiaries proportionately.

C) the distributed income is determined by the trustee annually.

D) the distributed income of a remainder interest is determined by the property.

A) the distributed income has the same character in the hands of the beneficiary as it has to the trust.

B) the distributed income goes to all beneficiaries proportionately.

C) the distributed income is determined by the trustee annually.

D) the distributed income of a remainder interest is determined by the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

Identify which of the following statements is false.

A) A conduit approach-that is, the income has the same character in the hands of the beneficiary as it has to the trust-governs for fiduciary income taxation.

B) Essentially, an estate or trust is taxed on any income it earns, whether retained or distributed.

C) Many of the same rules that determine the calculation of taxable income for individuals apply to trusts.

D) Trusts receive a personal exemption.

A) A conduit approach-that is, the income has the same character in the hands of the beneficiary as it has to the trust-governs for fiduciary income taxation.

B) Essentially, an estate or trust is taxed on any income it earns, whether retained or distributed.

C) Many of the same rules that determine the calculation of taxable income for individuals apply to trusts.

D) Trusts receive a personal exemption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a state has adopted the Revised Uniform Principal and Income Act, which of the following statements is correct?

A) The state law definition of trust income will preempt any other definitions.

B) The definition of trust income in the trust document will preempt all other definitions.

C) Under state law, tax-exempt interest will not be allocated to income.

D) The definition of principal in the trust document must classify capital gains as principal.

A) The state law definition of trust income will preempt any other definitions.

B) The definition of trust income in the trust document will preempt all other definitions.

C) Under state law, tax-exempt interest will not be allocated to income.

D) The definition of principal in the trust document must classify capital gains as principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

This year, the Huang Trust received $20,000 of dividends and $30,000 of tax-free interest. It distributes all of its receipts to its beneficiary. How should the beneficiary treat the distribution?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

The governing instrument for the Lopez Trust contains no definitions of income and principal. The Trust is located in a state that has adopted the Uniform Act. In the current year, the trust reports the following receipts and disbursements:

Dividends $10,000

Proceeds from sales of stock, including $10,000 of gain $40,000

Trustee's fee, all charged to income $ 500

CPA's fee for preparation of tax return $ 200

What is the trust's net accounting income?

Dividends $10,000

Proceeds from sales of stock, including $10,000 of gain $40,000

Trustee's fee, all charged to income $ 500

CPA's fee for preparation of tax return $ 200

What is the trust's net accounting income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

Texas Trust receives $10,000 interest on U.S. Treasury bonds and $15,000 interest on State of New York bonds. All $25,000 is distributed to the trust beneficiary, Gary. Which of the following statements is correct?

A) Gary has $25,000 of ordinary gross income.

B) Gary has $10,000 of taxable interest income and $15,000 of tax-free interest income.

C) Gary has no taxable income because the trust must pay the tax.

D) Gary has $10,000 of capital gain and $15,000 of tax-free interest income.

A) Gary has $25,000 of ordinary gross income.

B) Gary has $10,000 of taxable interest income and $15,000 of tax-free interest income.

C) Gary has no taxable income because the trust must pay the tax.

D) Gary has $10,000 of capital gain and $15,000 of tax-free interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

Briefly discuss the reasons for establishing a trust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

Identify which of the following statements is false.

A) State trust law preempts the trust document when defining income.

B) The Uniform Act on principal and income requires depreciation to be charged against income.

C) A statement in the trust instrument concerning the allocation of depreciation to principal or income overrides a provision of state law.

D) The Uniform Act allocates royalties to both principal and income.

A) State trust law preempts the trust document when defining income.

B) The Uniform Act on principal and income requires depreciation to be charged against income.

C) A statement in the trust instrument concerning the allocation of depreciation to principal or income overrides a provision of state law.

D) The Uniform Act allocates royalties to both principal and income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

A trust document does not mention the treatment for depreciation. The state has adopted the Uniform Act. The trust document states that depreciation is a charge against corpus. The trust results are the following:

Business net profits $2,000

Rental income 1,000

Depreciation 100

Rent expense 100

Calculate net accounting income.

Business net profits $2,000

Rental income 1,000

Depreciation 100

Rent expense 100

Calculate net accounting income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

A trust document does not define income or principal. The state in which the trust is operated has adopted the Uniform Act, including allocation of depreciation to income. The trust reports the following:

Net business profits $20,000

Net rental income 5,000

Proceeds from stock sale

(including $10,000 gain) 50,000

Trustee fee (charged to income) 2,000

Depreciation 3,000

What is the amount of the trust's net accounting income?

Net business profits $20,000

Net rental income 5,000

Proceeds from stock sale

(including $10,000 gain) 50,000

Trustee fee (charged to income) 2,000

Depreciation 3,000

What is the amount of the trust's net accounting income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

A trust is required to distribute 10% of its income to Eleanor. In addition, the trustee in his discretion may distribute income to Eleanor and/or Marshall. The trust has net accounting income of $50,000, none of which is tax-exempt. The trust distributes the $5,000 mandatory payment to Eleanor and also distributes discretionary amounts of $5,000 to Eleanor and $5,000 to Marshall. How much must Eleanor include in income?

A) $5,000

B) $10,000

C) $50,000

D) none of the above

A) $5,000

B) $10,000

C) $50,000

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

Outline the classification of principal and income under the Revised Uniform Principal and Income Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

Charitable contributions made by a fiduciary

A) are limited to 50% of fiduciary income.

B) must be authorized in the trust instrument in order to be deductible.

C) flows through to be deducted on the beneficiary's tax return.

D) are subject to the 2% floor.

A) are limited to 50% of fiduciary income.

B) must be authorized in the trust instrument in order to be deductible.

C) flows through to be deducted on the beneficiary's tax return.

D) are subject to the 2% floor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

The personal exemption available to a trust is adjusted annually based on changes in the consumer price index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

Identify which of the following statements is false.

A) A trust receives no standard deduction when computing taxable income.

B) Trust tax preparation fees are miscellaneous itemized deductions and subject to the 2% nondeductible floor.

C) There is no limit on a fiduciary's charitable contribution deduction if such a contribution is authorized in the trust instrument.

D) All of the above are false.

A) A trust receives no standard deduction when computing taxable income.

B) Trust tax preparation fees are miscellaneous itemized deductions and subject to the 2% nondeductible floor.

C) There is no limit on a fiduciary's charitable contribution deduction if such a contribution is authorized in the trust instrument.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

Explain to a client the significance of the income and principal categorization scheme used for fiduciary accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

Estates and trusts

A) are taxed on state and municipal bond interest.

B) are not taxed on capital gains.

C) receive a deduction for administrative expenses not otherwise deducted on the estate tax return (Form 706).

D) receive a $1,000 personal exemption.

A) are taxed on state and municipal bond interest.

B) are not taxed on capital gains.

C) receive a deduction for administrative expenses not otherwise deducted on the estate tax return (Form 706).

D) receive a $1,000 personal exemption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

30

A trust receives no standard deduction when computing taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

A client asks about the relevance of state law in classifying items as principal or income. Explain the relevance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

A trust document does not define income and principal. The state in which the trust is operated has adopted the Uniform Act. The trust reports the following:

Dividends $2,500

Capital gain 1,500

Tax return preparation fee 200

Trustee fees, all charged to income 100

What is the amount of trust's net accounting income?

Dividends $2,500

Capital gain 1,500

Tax return preparation fee 200

Trustee fees, all charged to income 100

What is the amount of trust's net accounting income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

A trust distributes 30% of its income to Mark and 20% to Nancy. The remaining 50% is accumulated. The trust's depreciation is $1,000. The trust instrument is silent regarding the depreciation deduction. State law requires the depreciation be charged to principal. What part of the depreciation deduction will be allocated to Mark?

A) $0

B) $200

C) $300

D) $1,000

A) $0

B) $200

C) $300

D) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

A simple trust

A) may make charitable distributions.

B) may make discretionary distributions of principal.

C) may accumulate income.

D) is required to distribute all of its income currently.

A) may make charitable distributions.

B) may make discretionary distributions of principal.

C) may accumulate income.

D) is required to distribute all of its income currently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

Identify which of the following statements is false.

A) The personal exemption for a trust provides a tax savings when some income is allocated to principal.

B) Distributable net income (DNI) sets the ceiling on the amount of distributions taxed to the beneficiaries.

C) A complex trust must distribute all its income annually.

D) The beneficiaries of a simple trust are taxed on their share of DNI irrespective of the amount they receive.

A) The personal exemption for a trust provides a tax savings when some income is allocated to principal.

B) Distributable net income (DNI) sets the ceiling on the amount of distributions taxed to the beneficiaries.

C) A complex trust must distribute all its income annually.

D) The beneficiaries of a simple trust are taxed on their share of DNI irrespective of the amount they receive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

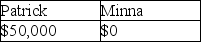

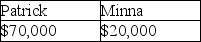

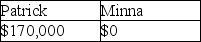

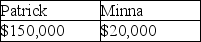

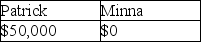

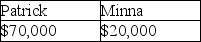

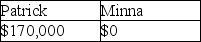

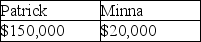

Yellow Trust must distribute 33% of its income annually to Patrick. In addition, the trustee in its discretion may distribute additional income to Minna or Patrick. In the current year, the trust has net accounting income and distributable net income of $150,000, none from tax-exempt sources. The trust makes a $50,000 mandatory distribution to Patrick and a discretionary distribution of $20,000 each to Patrick and Minna. What amounts of income do Patrick and Minna report?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

A complex trust permits accumulation of current income, provides for charitable contributions, or distributes principal during the taxable year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

Little Trust, whose trust instrument is silent with respect to depreciation, collects rental income of $20,000 and pays property taxes of $1,000. Depreciation expense is $5,000.

Little Trust is in a state where all depreciation is charged to principal. What is the trust's net accounting income?

Little Trust is in a state where all depreciation is charged to principal. What is the trust's net accounting income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

List some common examples of principal and income items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

The exemption amount for an estate is

A) $0.

B) $100.

C) $300.

D) $600.

A) $0.

B) $100.

C) $300.

D) $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

A trust must distribute all of its income annually. Capital gains are allocated to principal. The trust has dividend income of $12,000, capital gains of $6,000, and no expenses. Calculate the trust's taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

Panther Trust has net accounting income and distributable net income of $100,000, $75,000 from taxable sources and $25,000 from tax-exempt sources. During the year, the trust makes a mandatory distribution to Julius and Steve of $50,000 each. The distribution deduction is

A) $25,000.

B) $50,000.

C) $75,000.

D) $100,000.

A) $25,000.

B) $50,000.

C) $75,000.

D) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

43

A trust is required to distribute all of its income annually. It distributes all of the income and $2,000 of principal to the beneficiary. Which of the following statements is correct?

A) The trust is a complex trust and is allowed a $300 exemption.

B) The trust is a complex trust and is allowed a $100 exemption.

C) The trust is a simple trust and is allowed a $300 exemption.

D) The trust is a simple trust and is allowed a $100 exemption.

A) The trust is a complex trust and is allowed a $300 exemption.

B) The trust is a complex trust and is allowed a $100 exemption.

C) The trust is a simple trust and is allowed a $300 exemption.

D) The trust is a simple trust and is allowed a $100 exemption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

A trust reports the following results:

Interest from corporate bonds $20,000

Dividends 10,000

Tax-exempt interest 20,000

Trustee fees 6,000

Capital gain 10,000

All of the items are allocated to income except the capital gains. Calculate the maximum amount of trustee fees that are deductible.

Interest from corporate bonds $20,000

Dividends 10,000

Tax-exempt interest 20,000

Trustee fees 6,000

Capital gain 10,000

All of the items are allocated to income except the capital gains. Calculate the maximum amount of trustee fees that are deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

Identify which of the following statements is true.

A) Beneficiaries of simple trusts are taxed currently on their pro rata share of taxable distributable net income (DNI) regardless of the actual amount distributed to them during the period.

B) The income received by the beneficiaries of the trust loses its character once it is distributed.

C) Capital losses remaining in the final year of a trust do not pass through to the beneficiaries succeeding to the trust property.

D) All of the above are false.

A) Beneficiaries of simple trusts are taxed currently on their pro rata share of taxable distributable net income (DNI) regardless of the actual amount distributed to them during the period.

B) The income received by the beneficiaries of the trust loses its character once it is distributed.

C) Capital losses remaining in the final year of a trust do not pass through to the beneficiaries succeeding to the trust property.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

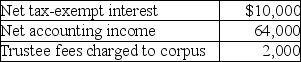

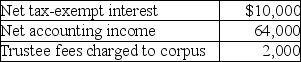

A trust has the following results:  The Uniform Act is followed. The trust document requires one-fifth of the income to be distributed annually to David and the remainder of the income to Patty. What is distributable net income?

The Uniform Act is followed. The trust document requires one-fifth of the income to be distributed annually to David and the remainder of the income to Patty. What is distributable net income?

A) $74,000

B) $72,000

C) $64,000

D) $62,000

The Uniform Act is followed. The trust document requires one-fifth of the income to be distributed annually to David and the remainder of the income to Patty. What is distributable net income?

The Uniform Act is followed. The trust document requires one-fifth of the income to be distributed annually to David and the remainder of the income to Patty. What is distributable net income?A) $74,000

B) $72,000

C) $64,000

D) $62,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

Panther Trust has net accounting income and distributable net income of $100,000, $75,000 from taxable sources and $25,000 from tax-exempt sources. During the year, the trust makes a mandatory distribution to Julius and Steve of $50,000 each. How much of Steve's distribution is taxable?

A) $12,500

B) $25,000

C) $37,500

D) $50,000

A) $12,500

B) $25,000

C) $37,500

D) $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

Ebony Trust was established two years ago with Brent as the beneficiary. The trust instrument instructed the trustee last year to make discretionary distributions of income to Brent. Beginning in two years, the trustee is instructed to pay all of the trust income earned that year to Brent. What was the trust's personal exemption last year? What will the personal exemption be in two years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not an addition to trust taxable income when computing distributable net income (DNI)?

A) distribution deduction

B) capital gains allocated to principal

C) tax-exempt interest

D) personal exemption

A) distribution deduction

B) capital gains allocated to principal

C) tax-exempt interest

D) personal exemption

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

A trust reports the following results:

Dividend income $20,000

Capital gains 10,000

Tax-exempt interest 10,000

Trustee fees 3,000

All of the items above are allocated to income. Calculate the maximum amount of trustee fees that are deductible.

Dividend income $20,000

Capital gains 10,000

Tax-exempt interest 10,000

Trustee fees 3,000

All of the items above are allocated to income. Calculate the maximum amount of trustee fees that are deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

Distributable net income (DNI) does not include capital gains allocated to principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the current year, a trust has distributable net income (DNI) of $30,000. During the year, the trust makes a mandatory distribution to Sarah of $5,000 and a discretionary distribution of $10,000 to Kyle. The trust has no tax-exempt income. The distribution deduction of the trust is

A) $30,000.

B) $15,000.

C) $10,000.

D) $5,000.

A) $30,000.

B) $15,000.

C) $10,000.

D) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

A simple trust has a distributable net income (DNI) of $50,000 and net accounting income of $60,000, all from taxable sources. The trust has a sole beneficiary, Marty. The trust reports on a calendar tax year and distributes the $60,000 of 2018's net accounting income to Marty on January 20, 2019. No other distributions are made in the current year. Marty's taxable income from the trust this year is

A) $0.

B) $49,700.

C) $50,000.

D) $60,000.

A) $0.

B) $49,700.

C) $50,000.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

The $3,000 limitation on deducting net capital losses does not apply to a trust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

Explain the three functions of distributable net income (DNI).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

Melody Trust has $60,000 of DNI for the current year, $20,000 of rental income and $40,000 of corporate bond interest. The trust instrument requires the trustee to distribute 30% of the trust income to Lee and 70% to Sarah, annually. The trust instrument does not require an allocation of the different types of income to the two beneficiaries. What is the amount and composition of the income reported by Lee and Sarah, respectively?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

A trust that is required to distribute all of its income annually receives a exemption for the year of

A) $0, because it retains no income.

B) $100.

C) $300.

D) $600.

A) $0, because it retains no income.

B) $100.

C) $300.

D) $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

A trust reports the following results:

Allocable to

Income Principal

Taxable bond interest $20,000

Rental income 10,000

Gain on sale of investment land 10,000

Property taxes 2,000

Trustee fees 500

The trust must distribute all of its income annually. Calculate taxable income after the distribution deduction.

Allocable to

Income Principal

Taxable bond interest $20,000

Rental income 10,000

Gain on sale of investment land 10,000

Property taxes 2,000

Trustee fees 500

The trust must distribute all of its income annually. Calculate taxable income after the distribution deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

Identify which of the following statements is true.

A) The personal exemption available to a trust is adjusted annually based on changes in the consumer price index.

B) Income received by a trust beneficiary has the same character it had at the trust level.

C) Distributable net income (DNI) excludes tax-exempt income.

D) All of the above are false.

A) The personal exemption available to a trust is adjusted annually based on changes in the consumer price index.

B) Income received by a trust beneficiary has the same character it had at the trust level.

C) Distributable net income (DNI) excludes tax-exempt income.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

A trust is required to distribute all of its income currently. Two years ago, it had a $10,000 capital loss. Last year, it had a $3,000 capital gain. This year, the trust is terminated. Albert has a 40% interest in the trust, and Barbara has a 60% interest. Barbara receives a capital loss pass-through of

A) $0.

B) $2,400.

C) $4,200.

D) $7,000.

A) $0.

B) $2,400.

C) $4,200.

D) $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

A trust has net accounting income and distributable net income (DNI) of $60,000, all from taxable sources. The trustee is required to distribute $40,000 of current income to Harry. In addition, the trustee makes a discretionary distribution to Harry of $10,000 and a discretionary distribution to Susan of $30,000. $20,000 of the $40,000 total discretionary distributions is from corpus. Gross income reportable by Harry is

A) $50,000.

B) $45,000.

C) $37,500.

D) $30,000.

A) $50,000.

B) $45,000.

C) $37,500.

D) $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

Explain how to determine the deductible portion of trustee's fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Williams Trust was established six years ago. The trust document allows the trustee to distribute income in its discretion to beneficiaries Carol and Karen for the next 15 years. The trust will then be terminated and the trust assets will be divided equally between Carol and Karen. Capital gains are part of principal.

The current year income and expenses of the trust are reported below.

Amounts Allocable To

Income Principal

Dividends $15,000

Rental income from land 2,500

Tax-exempt interest 7,500

Rental expenses 500

Trustee's fees $600

Tax return preparation fee 250

Capital gain on stock sale (stock purchased four years ago) 6,000

Distribution of net accounting income to:

Carol 7,000

Karen 3,500

Payment of estimated tax 2,620 1,680

Compute (a) distributable net income (DNI), (b) distribution deduction, (c) trust taxable income, and (d) Carol's and Karen's reportable income and its classification. Charge all of the deductible expenses against the rental income.

The current year income and expenses of the trust are reported below.

Amounts Allocable To

Income Principal

Dividends $15,000

Rental income from land 2,500

Tax-exempt interest 7,500

Rental expenses 500

Trustee's fees $600

Tax return preparation fee 250

Capital gain on stock sale (stock purchased four years ago) 6,000

Distribution of net accounting income to:

Carol 7,000

Karen 3,500

Payment of estimated tax 2,620 1,680

Compute (a) distributable net income (DNI), (b) distribution deduction, (c) trust taxable income, and (d) Carol's and Karen's reportable income and its classification. Charge all of the deductible expenses against the rental income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

Fred, a cash-basis taxpayer, died on January 15, 2018. In 2019, the estate made a $9,000 distribution from estate income to Fred's sole heir. The estate had $20,000 of taxable interest and a $10,000 net long-term capital gain allocable to corpus. The estate incurred $5,000 in expenses attributable to the estate income. What is the estate's distributable net income (DNI)?

A) $15,000

B) $20,000

C) $25,000

D) $30,000

A) $15,000

B) $20,000

C) $25,000

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

Identify which of the following statements is true.

A) Tax-exempt income is allocated among beneficiaries in the proportion that total tax-exempt income bears to total distributable net income (DNI).

B) Both income required to be distributed currently and discretionary income distributions are included in tier-1 distributions.

C) Under the tier system, tier-2 beneficiaries are the first to absorb income.

D) All of the above are false.

A) Tax-exempt income is allocated among beneficiaries in the proportion that total tax-exempt income bears to total distributable net income (DNI).

B) Both income required to be distributed currently and discretionary income distributions are included in tier-1 distributions.

C) Under the tier system, tier-2 beneficiaries are the first to absorb income.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Tucker Trust was established six years ago. The trust is required to distribute all of the trust income at least annually to Betty for life. Capital gains are credited to principal. The current year results of the trust are as follows:

Amounts Allocable To

Income Principal

Dividends $15,000

Rental income from land 2,500

Tax-exempt interest 7,500

Rental expenses 500

Trustee fees $600

Tax return preparation fee 250

Capital gain on stock sale (stock purchased five years ago) 24,250 6,000

Distribution of net accounting income 1,300

Payment of estimated taxes

Compute (a) distributable net income (DNI), (b) the distribution deduction, (c) trust taxable income, and (d) Betty's reportable income and its classification. Charge all of the deductible expenses against rent income.

Amounts Allocable To

Income Principal

Dividends $15,000

Rental income from land 2,500

Tax-exempt interest 7,500

Rental expenses 500

Trustee fees $600

Tax return preparation fee 250

Capital gain on stock sale (stock purchased five years ago) 24,250 6,000

Distribution of net accounting income 1,300

Payment of estimated taxes

Compute (a) distributable net income (DNI), (b) the distribution deduction, (c) trust taxable income, and (d) Betty's reportable income and its classification. Charge all of the deductible expenses against rent income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

The distribution deduction for a complex trust is the lesser of the amount distributed or distributable net income, reduced by net tax-exempt income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

Identify which of the following statements is true.

A) In a complex trust, distributable net income (DNI) does not act as a ceiling on the amount of the distribution deduction.

B) Distributable net income (DNI) is not reduced by the charitable contribution deduction when calculating the deductible discretionary distributions for a complex trust.

C) In a complex trust, distributable net income (DNI) is not reduced by the charitable contribution deduction when comparing DNI with the mandatory distributions in order to determine the amount of the distribution deduction.

D) All of the above are false.

A) In a complex trust, distributable net income (DNI) does not act as a ceiling on the amount of the distribution deduction.

B) Distributable net income (DNI) is not reduced by the charitable contribution deduction when calculating the deductible discretionary distributions for a complex trust.

C) In a complex trust, distributable net income (DNI) is not reduced by the charitable contribution deduction when comparing DNI with the mandatory distributions in order to determine the amount of the distribution deduction.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

A trust has net accounting income of $30,000, but distributable net income (DNI) of only $25,000 because certain expenses are charged to principal. The trust is required to distribute $10,000 to Alice and it makes a discretionary distribution of $20,000 to Ben. The trust has no tax-exempt income. The amount that Ben reports as gross income is

A) $20,000.

B) $16,667.

C) $15,000.

D) none of the above

A) $20,000.

B) $16,667.

C) $15,000.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

A simple trust has the following results:

DNI $60,000

Net tax-exempt interest 8,000

Net accounting income 62,000

Calculate the distribution deduction.

DNI $60,000

Net tax-exempt interest 8,000

Net accounting income 62,000

Calculate the distribution deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

An estate made a distribution to its sole beneficiary of $15,000 for the year. This distribution was not the result of a specific bequest. The estate had $40,000 of taxable interest and $34,000 of expenses attributable to earning that interest. What amount of the distribution is taxable to the beneficiary?

A) $40,000

B) $15,000

C) $6,000

D) $0

A) $40,000

B) $15,000

C) $6,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

Distributable net income (DNI) is not reduced by the charitable contribution deduction when calculating the deductible discretionary distributions for a complex trust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

Describe the tier system for trust beneficiaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

Martha died and by her will, specifically bequeathed, and the executor distributed, $20,000 cash and a $70,000 house to Harold. The distributions were made in a year in which the estate had $65,000 of DNI, all from taxable sources. The maximum Harold will be required to report as gross income as a result of these distributions is

A) $0.

B) $20,000.

C) $65,000.

D) $70,000.

A) $0.

B) $20,000.

C) $65,000.

D) $70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

A trust has distributable net income (DNI) of $50,000, including $30,000 tax-exempt interest income and $20,000 taxable interest income. The trust instrument requires that all income be distributed at least annually, 30% to Jane and 70% to Joe. What is the amount and character of the income that Jane receives?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

In the year of termination, a trust incurs a $20,000 NOL. In addition, it has a $30,000 NOL carryover from the two preceding tax years. The trust distributes 40% of its assets to Sam, 30% of its assets to Alex, and 30% of its assets to Catherine. How much of the NOL can Sam (who has $150,000 of gross income) deduct on his return in the year that the trust terminates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

Apple Trust reports net accounting income of $40,000, all from taxable sources. The trustee is required to distribute $15,000 annually to Megan. The trustee also makes discretionary distributions of $30,000, $7,500 to Megan and $22,500 to Caroline. The trust pays $5,000 of the discretionary distributions from corpus. What is the taxable amount of the Megan's tier-2 distribution?

A) $7,500

B) $6,250

C) $15,000

D) $22,500

A) $7,500

B) $6,250

C) $15,000

D) $22,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

Apple Trust reports net accounting income of $40,000, all from taxable sources. The trustee is required to distribute $15,000 annually to Megan. The trustee also makes discretionary distributions of $30,000, $7,500 to Megan and $22,500 to Caroline. The trust pays $5,000 of the discretionary distributions from corpus. What is the amount of the distribution deduction?

A) $40,000

B) $45,000

C) $15,000

D) $30,000

A) $40,000

B) $45,000

C) $15,000

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

Sukdev Basi funded an irrevocable simple trust in May 2008. The trust benefits Sukdev's son for life and grandson upon the son's death. One of the assets he transferred to the trust was Jetco stock, which had an FMV on the transfer date of $40,000. Sukdev's basis in the stock was $44,000, and he paid no gift tax on the transfer. The stock's value has dropped to $33,000, and the trustee thinks that now, October 2011, might be the time to sell the stock and take the loss deduction. For 2011, the trust will have $20,000 of income exclusive of any gain or loss. Sukdev's taxable income is approximately $15,000. What tax and nontax issues should the trustee consider concerning the possible sale of the stock?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

Identify which of the following statements is true.

A) An individual cannot be both a tier-1 and tier-2 beneficiary in the same year.

B) Tier-2 beneficiaries potentially can receive more favorable tax treatment than tier-1 beneficiaries.

C) Bequests of specific sums of money when distributed out of an estate result in the recognition of gross income by the beneficiary receiving the bequest.

D) All of the above are false.

A) An individual cannot be both a tier-1 and tier-2 beneficiary in the same year.

B) Tier-2 beneficiaries potentially can receive more favorable tax treatment than tier-1 beneficiaries.

C) Bequests of specific sums of money when distributed out of an estate result in the recognition of gross income by the beneficiary receiving the bequest.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck