Deck 9: Australian Equities Market

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/53

العب

ملء الشاشة (f)

Deck 9: Australian Equities Market

1

Which of the following is not a participant in a share trading transaction?

A)The broker

B)The Australian Securities and Investments Commission

C)The buying and selling parties

D)The ASX

A)The broker

B)The Australian Securities and Investments Commission

C)The buying and selling parties

D)The ASX

The Australian Securities and Investments Commission

2

How are orders placed upon ASX Trade prioritised?

A)By time only

B)By price then time

C)By price only

D)By time then price

A)By time only

B)By price then time

C)By price only

D)By time then price

By price then time

3

Which of the following statements best describes principal trading?

A)A trade which a broker executes at the request of an underwriter

B)A trade which a broker executes on behalf of a client

C)A trade which a broker executes on their own behalf

D)Both B and C

A)A trade which a broker executes at the request of an underwriter

B)A trade which a broker executes on behalf of a client

C)A trade which a broker executes on their own behalf

D)Both B and C

A trade which a broker executes on their own behalf

4

The ASX was one of the first exchanges in the world to .

A)Facilitate trading in derivatives

B)Use an electronic trading system

C)Become a listed public company that trades upon itself

D)All of the above

A)Facilitate trading in derivatives

B)Use an electronic trading system

C)Become a listed public company that trades upon itself

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

5

If an investor wished to purchase shares in a large,ASX- listed mining company,what should the investor do?

A)Place a limit order with the financial controller of the company.

B)Directly access the ITS to submit the order for the shares.

C)Place an order with a broker.

D)None of the above

A)Place a limit order with the financial controller of the company.

B)Directly access the ITS to submit the order for the shares.

C)Place an order with a broker.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

6

What system is used to conduct settlement on the ASX?

A)ASTC- ASX

B)SEATS

C)ITS

D)CHESS

A)ASTC- ASX

B)SEATS

C)ITS

D)CHESS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following constitutes principal trading?

A)A broker placing orders on their house account

B)A broker placing orders on behalf of a client

C)A broker taking the other side of a trade to a client in order to complete a transaction

D)Both A and B

E)Both A and C

A)A broker placing orders on their house account

B)A broker placing orders on behalf of a client

C)A broker taking the other side of a trade to a client in order to complete a transaction

D)Both A and B

E)Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

8

The release of market sensitive information results in an immediate cessation of trading for approximately 10 minutes.What is this is known as?

A)A lunch break

B)A information delay

C)A trading halt

D)An efficiency delay

A)A lunch break

B)A information delay

C)A trading halt

D)An efficiency delay

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

9

A buy order for 2,000 BHP shares at $28.85 will be displayed as on ASX Trade:

A)2T quantity and 2885 in the offer columns

B)2000 quantity and 2885 in the offer columns

C)2000 quantity and 2885 price in the bid columns

D)2T and 2885 price in the bid columns

E)None of the above

A)2T quantity and 2885 in the offer columns

B)2000 quantity and 2885 in the offer columns

C)2000 quantity and 2885 price in the bid columns

D)2T and 2885 price in the bid columns

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is an organisation that pools and invests money on behalf of its clients?

A)A stock exchange

B)An investment advisor

C)An asset consultant

D)A fund manager

E)A stockbroker

A)A stock exchange

B)An investment advisor

C)An asset consultant

D)A fund manager

E)A stockbroker

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following best describes a market order?

A)An order to buy or sell shares off- market

B)An order to buy or sell shares at a specified price

C)An order to buy or sell shares at the prevailing market price

D)An order to buy shares directly from the issuing company

A)An order to buy or sell shares off- market

B)An order to buy or sell shares at a specified price

C)An order to buy or sell shares at the prevailing market price

D)An order to buy shares directly from the issuing company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

12

A single order (that is an order not part of a portfolio)can be placed off market if it is worth more than what amount?

A)$800,000

B)$400,000

C)$600,000

D)$200,000

E)$1,000,000

A)$800,000

B)$400,000

C)$600,000

D)$200,000

E)$1,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

13

The ASX is an example of which type of market?

A)The money market

B)The secondary equity market

C)The derivatives market

D)The primary equity market

A)The money market

B)The secondary equity market

C)The derivatives market

D)The primary equity market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

14

After receiving an order,a broker must execute the trade by finding a:

A)Price taker

B)Settlement officer

C)Market maker

D)Counterparty

A)Price taker

B)Settlement officer

C)Market maker

D)Counterparty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

15

In 2010 approximately what percentage of all Australian adults owned shares in at least one Australian company?

A)55 per cent

B)52 per cent

C)43 per cent

D)58 per cent

E)40 per cent

A)55 per cent

B)52 per cent

C)43 per cent

D)58 per cent

E)40 per cent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is the market in which buyers and sellers can trade their shares?

A)The derivatives market

B)The secondary equity market

C)The money market

D)The primary equity market

A)The derivatives market

B)The secondary equity market

C)The money market

D)The primary equity market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

17

The trading system used by the ASX is known as:

A)NASDAQ

B)FTSE

C)ASX Trade

D)CATS

A)NASDAQ

B)FTSE

C)ASX Trade

D)CATS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is the market in which new shares are issued directly to the public?

A)The stock market

B)The secondary equity market

C)The primary equity market

D)The money market

A)The stock market

B)The secondary equity market

C)The primary equity market

D)The money market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

19

A sell order for 2,000 BHP shares at $28.85 will be displayed as _______ on ASX Trade:

A)2000 quantity and 2885 price in the bid columns

B)2T and 2885 price in the bid columns

C)2T quantity and 2885 in the offer columns

D)2000 quantity and 2885 in the offer columns

E)None of the above

A)2000 quantity and 2885 price in the bid columns

B)2T and 2885 price in the bid columns

C)2T quantity and 2885 in the offer columns

D)2000 quantity and 2885 in the offer columns

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following did not become a member of The Australian Securities Exchange?

A)Stock Exchange of Darwin Ltd

B)Sydney Stock Exchange Ltd

C)Hobart Stock Exchange Ltd

D)Stock Exchange of Perth Ltd

A)Stock Exchange of Darwin Ltd

B)Sydney Stock Exchange Ltd

C)Hobart Stock Exchange Ltd

D)Stock Exchange of Perth Ltd

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following constitutes agency trading?

A)A broker placing orders on their house account

B)A broker placing orders on behalf of a client

C)A broker taking the other side of a trade to a client in order to complete a transaction

D)Both A and B

E)Both B and C

A)A broker placing orders on their house account

B)A broker placing orders on behalf of a client

C)A broker taking the other side of a trade to a client in order to complete a transaction

D)Both A and B

E)Both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

22

How long does settlement take on the ASX?

A)T

B)T+1

C)T+2

D)T+3

A)T

B)T+1

C)T+2

D)T+3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements best describes agency trading?

A)A trade which a broker executes on behalf of a client

B)A trade which a broker executes on their own behalf

C)A trade which a company executes directly in the market

D)A trade which a broking house executes on behalf of itself

A)A trade which a broker executes on behalf of a client

B)A trade which a broker executes on their own behalf

C)A trade which a company executes directly in the market

D)A trade which a broking house executes on behalf of itself

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following securities cannot be traded on the ASX?

A)Fixed income securities such as corporate and government bonds

B)Equity securities such as shares

C)Mutual securities such as Exchange Traded Funds (EFTs)

D)Derivative securities such as warrants and futures

E)All of the above can be traded on the ASX.

A)Fixed income securities such as corporate and government bonds

B)Equity securities such as shares

C)Mutual securities such as Exchange Traded Funds (EFTs)

D)Derivative securities such as warrants and futures

E)All of the above can be traded on the ASX.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

25

The top 10 brokers in 2011 accounted for approximately what share of the total value of trades that year?

A)50 per cent

B)75 per cent

C)65 per cent

D)90 per cent

E)80 per cent

A)50 per cent

B)75 per cent

C)65 per cent

D)90 per cent

E)80 per cent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

26

Buy market order is an order to do which of the following?

A)Buy a parcel of shares at the highest offer price.

B)Buy a parcel of shares at the lowest bid price.

C)Buy a parcel of shares at the lowest offer price.

D)Buy a parcel of shares at the highest bid price.

A)Buy a parcel of shares at the highest offer price.

B)Buy a parcel of shares at the lowest bid price.

C)Buy a parcel of shares at the lowest offer price.

D)Buy a parcel of shares at the highest bid price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

27

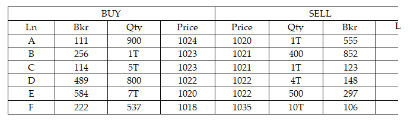

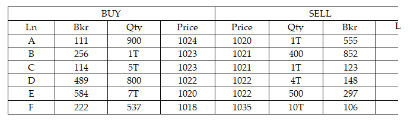

The following is the market for SDF Ltd immediately prior to opening on 3 June 2006:

SDF closed the previous day at $10.20.

Using the ASX opening procedure what will be the opening price for SDF Ltd?

SDF closed the previous day at $10.20.

Using the ASX opening procedure what will be the opening price for SDF Ltd?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

28

ASX Trade is a system which:

A)Uses an open interface to perform Automated Order Processing

B)Allows multi- order transactions

C)Is run by the ASX and is accessible to brokers and trading organisations inside and outside Australia

D)A and B only

E)All of the above

A)Uses an open interface to perform Automated Order Processing

B)Allows multi- order transactions

C)Is run by the ASX and is accessible to brokers and trading organisations inside and outside Australia

D)A and B only

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

29

"Wholesale" fund managers typically:

A)Obtain cash by issuing savings policies to the public

B)Invest superannuation contributions sourced from companies

C)Do not charge investment management fees

D)Obtain cash by selling units directly to the public

A)Obtain cash by issuing savings policies to the public

B)Invest superannuation contributions sourced from companies

C)Do not charge investment management fees

D)Obtain cash by selling units directly to the public

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the objective of a passive fund manager?

A)To earn returns similar to the market index by adopting a 'buy and hold' strategy

B)To earn return similar to the 10- year bond rate by buying and selling treasury notes in an effort to realise capital gains

C)To outperform the index by buying and selling shares in an effort to realise capital gains

D)None of the above

A)To earn returns similar to the market index by adopting a 'buy and hold' strategy

B)To earn return similar to the 10- year bond rate by buying and selling treasury notes in an effort to realise capital gains

C)To outperform the index by buying and selling shares in an effort to realise capital gains

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following best describes a limit order?

A)An order to buy or sell shares at the prevailing market price

B)An order to buy shares directly from the issuing company

C)An order to buy or sell shares at a specified price

D)An order to buy or sell shares off- market

A)An order to buy or sell shares at the prevailing market price

B)An order to buy shares directly from the issuing company

C)An order to buy or sell shares at a specified price

D)An order to buy or sell shares off- market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

32

How may brokers 'execute' orders?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is the objective of an active fund manager?

A)To earn returns similar to the market index by adopting a 'buy and hold' strategy

B)To earn return similar to the 10- year bond rate by buying and selling treasury notes in an effort to realise capital gains

C)To outperform the index by buying and selling shares in an effort to realise capital gains

D)None of the above

A)To earn returns similar to the market index by adopting a 'buy and hold' strategy

B)To earn return similar to the 10- year bond rate by buying and selling treasury notes in an effort to realise capital gains

C)To outperform the index by buying and selling shares in an effort to realise capital gains

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

34

Sell market order is an order to do which of the following?

A)Sell a parcel of shares at the highest bid price.

B)Sell a parcel of shares at the highest offer price.

C)Sell a parcel of shares at the lowest bid price.

D)Sell a parcel of shares at the lowest offer price.

A)Sell a parcel of shares at the highest bid price.

B)Sell a parcel of shares at the highest offer price.

C)Sell a parcel of shares at the lowest bid price.

D)Sell a parcel of shares at the lowest offer price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

35

Research by Aitken and Swan (1993)has shown that the bulk of brokers' business is principal trading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which if the following is not a function of the stock market?

A)Assist the price discovery process.

B)Facilitate liquidation of shareholdings.

C)Support the primary market.

D)Ensure the direct raising of equity capital by companies.

A)Assist the price discovery process.

B)Facilitate liquidation of shareholdings.

C)Support the primary market.

D)Ensure the direct raising of equity capital by companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

37

Both on- market and off- market trades are executed on ASX Trade according to price then time priority.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

38

Normal trading on ASX Trade occurs between .

A)10:10 and 16:00

B)9:09 and 17:00

C)9:09 and 16:00

D)10:10 and 17:00

E)None of the above

A)10:10 and 16:00

B)9:09 and 17:00

C)9:09 and 16:00

D)10:10 and 17:00

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following represents facilitation?

A)A broker placing orders on their house account

B)A broker placing orders on behalf of a client

C)A broker taking the other side of a trade to a client in order to complete a transaction

D)Both A and B

E)Both A and C

A)A broker placing orders on their house account

B)A broker placing orders on behalf of a client

C)A broker taking the other side of a trade to a client in order to complete a transaction

D)Both A and B

E)Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

40

Who are the major participants in the share trading process and what role does each of these play?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

41

A buyer who seeks to have an order to trade shares executed immediately must place a limit order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

42

In addition to equity securities,ASX is also used to trade corporate bonds,hybrid securities,warrants and exchange- traded funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

43

A market order is one that specifies the maximum price at which a client is willing to buy shares,or the minimum price at which the client is willing to sell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

44

A limit order is one that specifies the maximum price at which a client is willing to buy shares,or the minimum price at which the client is willing to sell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

45

New shares are issued and traded in the primary equity market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

46

A fund manager using an active trading strategy typically buys and sells shares hoping to realise capital gains arising from movements in share prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

47

The pre- opening phase is the only time that bids and offers may overlap.At all other times such overlapping orders would be executed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

48

New shares are issued and traded in the secondary equity market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

49

Transactions on the ASX are settled exactly three days after the order has been executed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

50

Orders of total value greater than $1,000,000 may be executed off- market under the ASX trading rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

51

When a company releases material information that may affect its share price,the ASX halts trading for at least 30 minutes so that the market may respond to this news and adjust prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

52

The introduction of CHESS has simplified the transfer of share certificates between the seller and buyer of a company's shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

53

Stocks are opened randomly within +/- 30 seconds of the series of established opening times determined by the ASX and based upon the first letter of the ASX code of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck