Deck 14: Working Capital New

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 14: Working Capital New

1

Net working capital is an indicator of:

A)The company's ability to repay its immediate debts

B)The company's ability to repay its long- term debt

C)The company is insolvent

D)Shareholders' wealth

A)The company's ability to repay its immediate debts

B)The company's ability to repay its long- term debt

C)The company is insolvent

D)Shareholders' wealth

The company's ability to repay its immediate debts

2

The party that seeks to borrow funds using commercial bills is known as what?

A)The drawer

B)The acceptor

C)The discounter

D)The depositor

A)The drawer

B)The acceptor

C)The discounter

D)The depositor

The drawer

3

The party that is lending funds using commercial bills is known as what?

A)The drawer

B)The acceptor

C)The discounter

D)The depositor

A)The drawer

B)The acceptor

C)The discounter

D)The depositor

The discounter

4

All of the following are assumptions of the Baumol Model except:

A)The firm uses cash at a steady,predictable rate

B)The firm's net cash outflows occur at a steady rate

C)The firm's cash inflows from operations occur at a steady,predictable rate

D)The optimum cash balance the firm should hold

A)The firm uses cash at a steady,predictable rate

B)The firm's net cash outflows occur at a steady rate

C)The firm's cash inflows from operations occur at a steady,predictable rate

D)The optimum cash balance the firm should hold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following regarding the Baumol and Miller- Orr models is correct? They were designed:

A)To expose the trade- off between the opportunity cost of holding cash and the costs associated with holding insufficient cash

B)As definitive solutions to the cash management problems of a company

C)To expose the important considerations involved in determining optimum corporate cash levels

D)A and B

E)A and C

A)To expose the trade- off between the opportunity cost of holding cash and the costs associated with holding insufficient cash

B)As definitive solutions to the cash management problems of a company

C)To expose the important considerations involved in determining optimum corporate cash levels

D)A and B

E)A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following does not apply to promissory notes?

A)They are issued at a discount to face value.

B)They represent a written promise to pay a specified amount of cash to the bearer on an agreed future date.

C)They are secured.

D)They are zero- coupon securities.

A)They are issued at a discount to face value.

B)They represent a written promise to pay a specified amount of cash to the bearer on an agreed future date.

C)They are secured.

D)They are zero- coupon securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

Current liabilities include all but which of the following?

A)Tax payable

B)Bank overdraft

C)Marketable securities

D)Accounts payable

A)Tax payable

B)Bank overdraft

C)Marketable securities

D)Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following can be both a current asset and a current liability?

A)Treasury notes

B)Commercial bills

C)Promissory notes

D)All of the above

E)None of the above

A)Treasury notes

B)Commercial bills

C)Promissory notes

D)All of the above

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following models determine a company's creditworthiness?

A)Altman's Z- score model

B)The Miller- Orr model

C)The Baumol model

D)All of the above

A)Altman's Z- score model

B)The Miller- Orr model

C)The Baumol model

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is not a current liability?

A)Tax liabilities

B)Accounts payable

C)Work in progress

D)Interest payable

A)Tax liabilities

B)Accounts payable

C)Work in progress

D)Interest payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is not a current asset?

A)Accounts receivable

B)Inventories

C)Cash

D)Accounts payable

A)Accounts receivable

B)Inventories

C)Cash

D)Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

Holding cash in a bank cheque account creates:

A)A sunk cost

B)An opportunity cost

C)A future cost

D)None of the above

A)A sunk cost

B)An opportunity cost

C)A future cost

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under the Miller- Orr cash balance model,all of the following are incorrect except:

A)The higher the variance of cash flows is,the greater the upper limit will be

B)The lower the variance of cash flows is,the smaller the upper limit will be

C)The higher the variance of cash flows is,the smaller the upper limit will be

D)The lower the variance of cash flows is,the greater the upper limit will be

A)The higher the variance of cash flows is,the greater the upper limit will be

B)The lower the variance of cash flows is,the smaller the upper limit will be

C)The higher the variance of cash flows is,the smaller the upper limit will be

D)The lower the variance of cash flows is,the greater the upper limit will be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is not a marketable security?

A)Promissory notes

B)Commercial bills

C)Treasury notes

D)Bank deposits

A)Promissory notes

B)Commercial bills

C)Treasury notes

D)Bank deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

The party that acts as an intermediary to facilitate the entire transaction when using commercial bills,is known as what?

A)The drawer

B)The acceptor

C)The discounter

D)The depositor

A)The drawer

B)The acceptor

C)The discounter

D)The depositor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

Inventories include all but which of the following?

A)Accounts receivable

B)Finished goods

C)Work in progress

D)Raw materials

A)Accounts receivable

B)Finished goods

C)Work in progress

D)Raw materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is a characteristic of trade credit?

A)It is a form of permanent (long- term)financing.

B)All of the above

C)It appears on the balance sheet as accounts payable.

D)Credit is arranged by buying goods from the company's suppliers.

A)It is a form of permanent (long- term)financing.

B)All of the above

C)It appears on the balance sheet as accounts payable.

D)Credit is arranged by buying goods from the company's suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

Wombat Company draws a 90- day promissory note for $115,000 with an interest rate of 6% p.a.How much will Wombat receive for this note?

A)$113,323

B)$99,421

C)$50,000

D)$147,650

A)$113,323

B)$99,421

C)$50,000

D)$147,650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

Altman's Z- score is a model that:

A)Predicts a company's probability of insolvency

B)Establishes a company's ability to grant credit

C)Establishes a company's ability to receive credit

D)All of the above

A)Predicts a company's probability of insolvency

B)Establishes a company's ability to grant credit

C)Establishes a company's ability to receive credit

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the Miller- Orr cash balance model,all of the following are incorrect except:

A)The lower cost per trade in fixed income securities,the greater the upper limit will be

B)The lower cost per trade in fixed income securities,the smaller the upper limit will be

C)The higher cost per trade in fixed income securities,the greater the upper limit will be

D)The higher cost per trade in fixed income securities,the smaller the upper limit will be

A)The lower cost per trade in fixed income securities,the greater the upper limit will be

B)The lower cost per trade in fixed income securities,the smaller the upper limit will be

C)The higher cost per trade in fixed income securities,the greater the upper limit will be

D)The higher cost per trade in fixed income securities,the smaller the upper limit will be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Miller- Orr model minimises the opportunity cost of holding cash and the frequency of converting securities into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Baumol model considers a net cash outflow situation only,whereas the Miller- Orr model considers a fluctuating cash- flow stream that can be either inflow or outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following does not apply to a bill of exchange?

A)It is a discount security.

B)It must have an acceptor.

C)It is a commercial bill.

D)It is a promissory note.

A)It is a discount security.

B)It must have an acceptor.

C)It is a commercial bill.

D)It is a promissory note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Baumol model determines the minimum amount of cash that a company should hold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

A company that cannot pay its debts as they fall due is solvent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

The presence of an acceptor makes promissory notes less risky than commercial bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

Credit warning models provide definitive evidence on the financial health of potential customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

A temporary source of finance is:

A)A promissory note

B)Ordinary shares

C)Accounts receivable

D)Interest expense

A)A promissory note

B)Ordinary shares

C)Accounts receivable

D)Interest expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

An Altman Z score of 2.675 is the best discriminator between bankruptcy and non- bankruptcy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

In the event of default by the borrower,the acceptor does not bear the cost of paying the owner of a commercial bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following ratios are included in Altman's Z- score model?

A)Working capital/total assets

B)Earnings after tax/sales

C)Earnings before interest and taxes/total assets

D)A and B

E)A and C

A)Working capital/total assets

B)Earnings after tax/sales

C)Earnings before interest and taxes/total assets

D)A and B

E)A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

Working capital is the total of current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is net working capital?

A)The company's investment in current assets

B)The company's investment in total assets

C)The difference between current assets and current liabilities

D)The difference between a company's total assets and total liabilities

A)The company's investment in current assets

B)The company's investment in total assets

C)The difference between current assets and current liabilities

D)The difference between a company's total assets and total liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

34

Cash equivalents take time to be converted into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

35

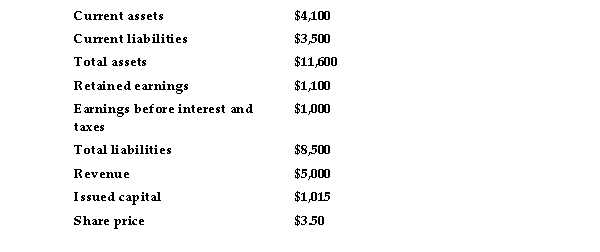

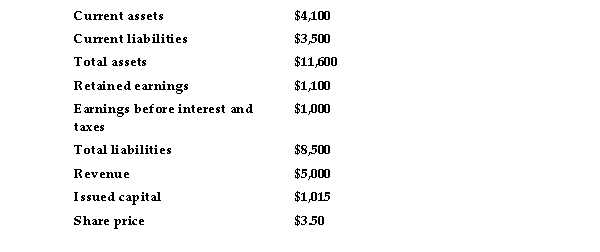

From the following information for Murray River Swamp Boats Ltd,calculate the company's Z score and indicate its likelihood of failure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck