Deck 13: Risk Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 13: Risk Management

1

Suppose that willed Oil has agreed to sell 1 million barrels of light sweet crude oil to a company in Japan for 6456.19 Japanese Yen per barrel and the current exchange rate is 130.56 Japanese Yen to one Australian dollar.If the exchange rates move to 120.45 Japanese Yen to one Australian dollar,what will be the impact upon Willex's cash flows?

A)Increased by $4.15 million Australian dollars

B)Decreased by $4.15 million Australian dollars

C)Increased by 4.15 million Japanese yen

D)Decreased by 4.15 million Japanese yen

A)Increased by $4.15 million Australian dollars

B)Decreased by $4.15 million Australian dollars

C)Increased by 4.15 million Japanese yen

D)Decreased by 4.15 million Japanese yen

Increased by $4.15 million Australian dollars

2

Those firms that deal frequently in large volume of banking/money market transactions are going to be most concerned with what type of risk?

A)Default risk

B)Foreign exchange risk

C)Country risk

D)Interest rate risk

A)Default risk

B)Foreign exchange risk

C)Country risk

D)Interest rate risk

Interest rate risk

3

A trader sells a gold futures contract at A$450.00/oz and then closes it out at A$480.00/oz.Each contract is for 10,000 ounces of gold.What has been the change in the trader's position in the futures contract?

A)Gain of $300,000.00

B)Loss of $300,000.00

C)Gain of $30.00

D)Loss of $30.00

A)Gain of $300,000.00

B)Loss of $300,000.00

C)Gain of $30.00

D)Loss of $30.00

Loss of $300,000.00

4

A trader purchases 10 BHP call options,each contract being for 1,000 BHP Billiton shares,at a strike price of $32.20.The trader then closes out the position when the market price for BHP Billiton shares is $32.50.What has been the change in the trader's wealth position?

A)The trader made a loss of $300 ignoring transaction costs.

B)The trader made a profit of $300 ignoring transaction costs.

C)The trader made a loss of $3,000 ignoring transaction costs.

D)The trader made a profit of $3,000 ignoring transaction costs.

A)The trader made a loss of $300 ignoring transaction costs.

B)The trader made a profit of $300 ignoring transaction costs.

C)The trader made a loss of $3,000 ignoring transaction costs.

D)The trader made a profit of $3,000 ignoring transaction costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

Ideally,in undertaking risk management,a financial manager would construct a _______ of the company and the markets in which it operates.

A)Financial profile

B)Risk analysis

C)Risk model

D)Financial model

A)Financial profile

B)Risk analysis

C)Risk model

D)Financial model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

Forward contracts are similar to normal transactions between buyers and sellers with one exception.Which of the following statements best describes it?

A)The timing of payment is different.

B)The timing of ownership transfer is different.

C)The timing of price derivation is different.

D)Both A and B

A)The timing of payment is different.

B)The timing of ownership transfer is different.

C)The timing of price derivation is different.

D)Both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is not a derivative contract?

A)A gold futures contract

B)A stock option

C)A forward agreement

D)Shares in Western Mining Ltd

A)A gold futures contract

B)A stock option

C)A forward agreement

D)Shares in Western Mining Ltd

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

The holder of a put option will ________ if the terminal asset price is below the exercise price

A)Make a loss

B)Eliminate the risk

C)Make a gain

D)Make neither a gain nor a loss

A)Make a loss

B)Eliminate the risk

C)Make a gain

D)Make neither a gain nor a loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

A bank- accepted bill contract has been quoted as being priced at 95.60 by a futures trader.What does this mean?

A)The bill's yield is 95.60 per cent.

B)The bill's yield is 4.40 per cent.

C)The price of the bill is $95.60.

D)The settlement price for the futures contract is $95.60.

A)The bill's yield is 95.60 per cent.

B)The bill's yield is 4.40 per cent.

C)The price of the bill is $95.60.

D)The settlement price for the futures contract is $95.60.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

Techniques that involve hedging,purchasing insurance,or changing gearing ratios or both in order to manage risk exposure are known as techniques.

A)Selective

B)Real

C)Nominal

D)Financial

A)Selective

B)Real

C)Nominal

D)Financial

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

A contract in which the buyer and seller agree to transfer ownership of an asset and cash at some time in the future,but with the price fixed at the time the contract is written is known as what?

A)A swap agreement

B)A forward contract

C)An options contract

D)A bank- accepted bill

A)A swap agreement

B)A forward contract

C)An options contract

D)A bank- accepted bill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

A writer of a call option on BHP shares has _.

A)The right to buy BHP shares at a specified price

B)The obligation to sell BHP shares at a specified price if the contract is exercised

C)The right to sell BHP shares at a specified price

D)The obligation to buy BHP shares at a specified price if the contract is exercised

A)The right to buy BHP shares at a specified price

B)The obligation to sell BHP shares at a specified price if the contract is exercised

C)The right to sell BHP shares at a specified price

D)The obligation to buy BHP shares at a specified price if the contract is exercised

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

What does the term 'sensitivity analysis' refer to?

A)The process of analysing the effects of a range of possible future outcomes

B)The process of analysing the effects of the most likely future outcomes

C)The process of modelling the effects of the most likely future outcomes

D)The process of modelling the effects of a range of possible future outcomes

A)The process of analysing the effects of a range of possible future outcomes

B)The process of analysing the effects of the most likely future outcomes

C)The process of modelling the effects of the most likely future outcomes

D)The process of modelling the effects of a range of possible future outcomes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

Options that can be exercised at any time up to expiration date are known as:

A)Singapore options

B)American options

C)European options

D)Swiss options

A)Singapore options

B)American options

C)European options

D)Swiss options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following best describes a situation in which a firm holds both an asset and a liability of the same size that are exposed to the same price fluctuations?

A)Natural hedge

B)Physical hedge

C)Portfolio hedge

D)Divergent hedge

A)Natural hedge

B)Physical hedge

C)Portfolio hedge

D)Divergent hedge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is the risk that is a function of a company's degree of leverage?

A)Capital risk

B)Financial risk

C)Business risk

D)Credit risk

A)Capital risk

B)Financial risk

C)Business risk

D)Credit risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

JBL wishes to cap its variable borrowing rate at 10.5%.To facilitate this,JBL's bank requires a premium of 0.3%.If the market reset interest rate is currently 9.6%,what is the rate of interest that JBL is paying to the bank?

A)9.9%

B)9.6%

C)10.5%

D)10.8%

A)9.9%

B)9.6%

C)10.5%

D)10.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements,referring to the degree of price fluctuation that might ultimately result in corporate failure,is not true?

A)It is known as the critical level.

B)It is the same for all companies.

C)It is the point beyond which the ongoing viability of the company would be seriously diminished.

D)All of these statements are true.

A)It is known as the critical level.

B)It is the same for all companies.

C)It is the point beyond which the ongoing viability of the company would be seriously diminished.

D)All of these statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is the main source of financial risk?

A)Foreign operations and exchange rate volatility

B)Corporate debt and interest rate volatility

C)Volatility in world oil prices

D)Fluctuating share prices

A)Foreign operations and exchange rate volatility

B)Corporate debt and interest rate volatility

C)Volatility in world oil prices

D)Fluctuating share prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

A diagram that illustrates the potential gains and losses from a variation in the price of an underlying asset is known as what?

A)A break- even diagram

B)A hedge diagram

C)A divergence diagram

D)A payoff diagram

A)A break- even diagram

B)A hedge diagram

C)A divergence diagram

D)A payoff diagram

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

Suppose Superior Textiles Ltd has negotiated a call option contract on 50,000 kg of wool at an exercise price of $12.00/kg.The seller of this call option charges a premium of $1.20/kg,so the total premium is $60,000.Under the terms of the agreement,Superior Textiles is only able to buy the wool from the option writer on the expiry date,which is in three months time.Would the option be exercised in three months time if the price of wool is $14.00/kg? What would be the gain/loss arising from using the call option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

A bank- accepted bill contract is yielding 3.8%.What is the price being quoted by a futures trader?

A)$96.20

B)$100.00

C)$103.80

D)Cannot determine the price

A)$96.20

B)$100.00

C)$103.80

D)Cannot determine the price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

The strike price is:

A)The current price of the underlying security

B)The stated price at which the holder of the option can buy or sell the underlying security

C)The premium paid for an option

D)The price of the option

A)The current price of the underlying security

B)The stated price at which the holder of the option can buy or sell the underlying security

C)The premium paid for an option

D)The price of the option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

On 9 June 2008 XHZ Fashions Ltd decides that it needs to 'lock in' the cost of borrowing

$10 million,which will be required for the 90- day Christmas/New Year trading period from 18 December 2008 until 18 March 2009.Ms Christina Lightfoot,the CFO,of XHZ Fashions Ltd has been looking at using BAB futures contracts as a means to hedge this exposure.She has identified the following contracts trading of the SFE:

• June 2006 BAB futures that expire on 18 June 2008 and are currently priced at 93.70

• December 2008 BAB futures that expire on 18 December and are currently priced at 94.20

• March 2009 BAB futures that expire on 18 March and are currently priced at 94.80

Using this information answer the following questions:

a)Which contracts should Ms Lightfoot use to hedge this position? Why?

b)How many contracts will be required? What type of position will XHZ Fashions have to take in these contracts?

c)What interest rate will XHZ Fashions Ltd be paying on its borrowing if uses BAB futures for the hedge?

d)Demonstrate how the future contracts will have benefited the company if interest rates turned out to be 6.3% on 18 December 2008.

$10 million,which will be required for the 90- day Christmas/New Year trading period from 18 December 2008 until 18 March 2009.Ms Christina Lightfoot,the CFO,of XHZ Fashions Ltd has been looking at using BAB futures contracts as a means to hedge this exposure.She has identified the following contracts trading of the SFE:

• June 2006 BAB futures that expire on 18 June 2008 and are currently priced at 93.70

• December 2008 BAB futures that expire on 18 December and are currently priced at 94.20

• March 2009 BAB futures that expire on 18 March and are currently priced at 94.80

Using this information answer the following questions:

a)Which contracts should Ms Lightfoot use to hedge this position? Why?

b)How many contracts will be required? What type of position will XHZ Fashions have to take in these contracts?

c)What interest rate will XHZ Fashions Ltd be paying on its borrowing if uses BAB futures for the hedge?

d)Demonstrate how the future contracts will have benefited the company if interest rates turned out to be 6.3% on 18 December 2008.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

Options differ from futures contracts in that an option is an obligation on both parties whilst a futures contract is only an obligation on the writer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

The setting up forward transactions to protect against adverse price fluctuations also eliminates the chance of gaining the advantage of any favourable price fluctuations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

An importer who is expecting to pay for a purchase in three months' time buys a foreign- currency call option today.Which of the following is correct?

A)Benefit from exercising the option if the foreign currency falls below the option exchange rate.

B)Benefit from exercising the option if the foreign currency rises above the option exchange rate.

C)Be protected from adverse exchange rate risk but be able to benefit financially from favourable exchange rate movements.

D)Both A and C

E)Both B and C

A)Benefit from exercising the option if the foreign currency falls below the option exchange rate.

B)Benefit from exercising the option if the foreign currency rises above the option exchange rate.

C)Be protected from adverse exchange rate risk but be able to benefit financially from favourable exchange rate movements.

D)Both A and C

E)Both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

An agreement where two firms exchange their interest payment obligations for a period of time (i.e.fixed for floating)is known as what?

A)An interest rate swap

B)A forward rate agreement

C)An interest rate put option

D)A financial futures contract

A)An interest rate swap

B)A forward rate agreement

C)An interest rate put option

D)A financial futures contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is a derivative security?

A)Convertible debt

B)A forward exchange contract

C)A hire purchase contract

D)None of the above

A)Convertible debt

B)A forward exchange contract

C)A hire purchase contract

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

Risk management is concerned primarily with controlling what?

A)Potential losses

B)Potential gains

C)Both of the above

D)None of the above

A)Potential losses

B)Potential gains

C)Both of the above

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

DVD Entertainment Group Ltd has net borrowings of $186 million,which are subject to a variable interest rate.If interest rates rise by 0.5% what will be the impact on DVD's cash flows?

A)Rise by $93 million

B)Fall by $0.93 million

C)Fall by $93 million

D)Rise by $0.93 million

A)Rise by $93 million

B)Fall by $0.93 million

C)Fall by $93 million

D)Rise by $0.93 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

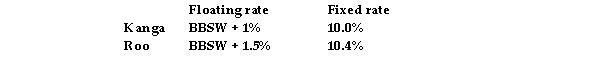

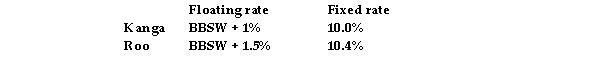

Assume the following borrowing rates ,respectively,for Kanga Bicycles and Roo Bikes :  Suppose Kanga issues floating- rate debt and Roo issues fixed- rate debt,after which they engage in the following swap:

Suppose Kanga issues floating- rate debt and Roo issues fixed- rate debt,after which they engage in the following swap:

Kanga will make a fixed 8.95% payment to Roo,and Roo will make a floating- rate payment equal to BBSW to A.What are the resulting net payments of Kanga and Roo?

Suppose Kanga issues floating- rate debt and Roo issues fixed- rate debt,after which they engage in the following swap:

Suppose Kanga issues floating- rate debt and Roo issues fixed- rate debt,after which they engage in the following swap:Kanga will make a fixed 8.95% payment to Roo,and Roo will make a floating- rate payment equal to BBSW to A.What are the resulting net payments of Kanga and Roo?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following would create business risk within an oil company?

A)The impact of new environmental laws encouraging the uses of alternative energy sources

B)Uncertainty over potential new oil reserves

C)The entrance of new oil producers into the industry

D)Fluctuations in the price of oil on the market

E)All of the above

A)The impact of new environmental laws encouraging the uses of alternative energy sources

B)Uncertainty over potential new oil reserves

C)The entrance of new oil producers into the industry

D)Fluctuations in the price of oil on the market

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

Derivatives are contracts whose value is based on the price of an underlying asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not an example of a real risk management technique?

A)Hedging transactions

B)Abandoning high- risk projects

C)Retrenching employees

D)Choosing less- risky production processes

A)Hedging transactions

B)Abandoning high- risk projects

C)Retrenching employees

D)Choosing less- risky production processes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

A firm that processes frequent,large- volume importations of goods is likely to be most concerned with what type of risk?

A)Default risk

B)Foreign exchange risk

C)Country risk

D)Interest rate risk

A)Default risk

B)Foreign exchange risk

C)Country risk

D)Interest rate risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

The value of a derivative contract is based on what?

A)The price of an underlying commodity

B)The price of an underlying market index

C)The price of an underlying stock

D)All of the above

A)The price of an underlying commodity

B)The price of an underlying market index

C)The price of an underlying stock

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

An option contract gives the holder the ,but not the ,to buy (or sell)an asset at a specified price.

A)Obligation,requirement

B)Right,invitation

C)Right,obligation

D)Obligation,right

A)Obligation,requirement

B)Right,invitation

C)Right,obligation

D)Obligation,right

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is the risk that is inherent in a company's operations?

A)Business risk

B)Credit risk

C)Capital risk

D)Interest rate risk

E)Financial risk

A)Business risk

B)Credit risk

C)Capital risk

D)Interest rate risk

E)Financial risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is not a feature of a futures contract?

A)Ability to be traded on an organised exchange

B)Standardised specifications

C)The requirement to pay deposits and margins

D)Price determined at the time the contract is written

E)They are all features of a futures contract.

A)Ability to be traded on an organised exchange

B)Standardised specifications

C)The requirement to pay deposits and margins

D)Price determined at the time the contract is written

E)They are all features of a futures contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

Forward contracts are the same as futures contracts only they cannot be traded and are not necessarily standardised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

Derivative securities have the characteristics of both debt and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

It is not possible to eliminate all interest rate risk with an interest rate swap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

A swap is essentially a strip of forward contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

'Risk' refers only to potential losses.Potential gains are not considered to be 'risk'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

A forward contract increases risk because it is not completed until some date in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

Corporate risk management reduces total risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

In a forward contract the buyer and seller agree to transfer ownership of the item now and pay for it at some future date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

When determining a company's exposure to risk,financial managers believe that all hedges add value,no matter how costly they are.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

Futures contracts are superior to forward contracts because they ensure that a firm can perfectly hedge its exposures to volatility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

In practice,futures hedging transactions will usually carry some small residual risk of losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

An American option can be exercised any time up to,and including,the maturity date whilst European options can only be exercised on the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck