Deck 5: Corporate Reporting: Income, earnings Per Share, and Retained Earnings

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

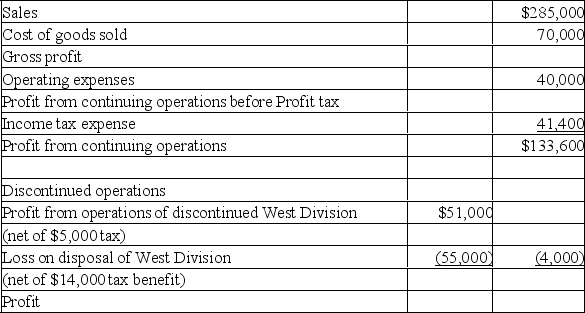

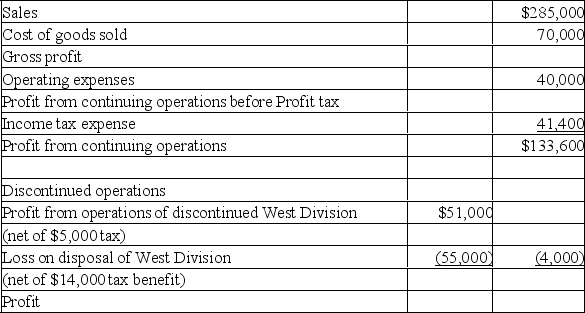

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

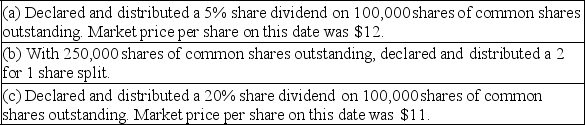

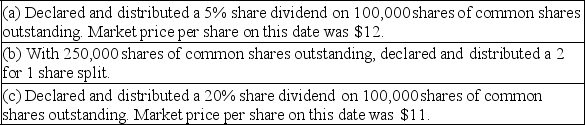

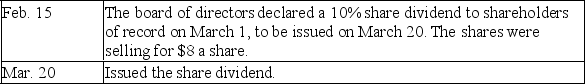

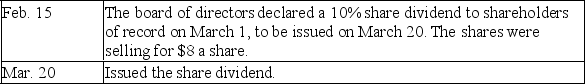

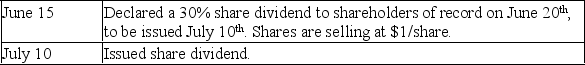

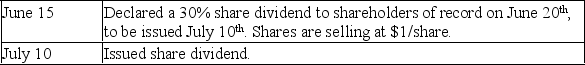

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 5: Corporate Reporting: Income, earnings Per Share, and Retained Earnings

1

If a company's activities include operations that are being discontinued,the income or loss effects of the discontinued operations are included on the income statement in income from continuing operations.

False

2

Share dividends are recorded at market value.

True

3

A share split decreases the market price of the company shares.

True

4

The statement of comprehensive income is a detailed statement of net income plus or minus any other comprehensive income items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

A share split is the distribution of additional shares to shareholders according to their percent of ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

Earnings per share is the amount of income earned by each share of a company's outstanding common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

A share dividend reduces a corporation's assets and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

A share dividend capitalizes retained earnings because it decreases a company's contributed capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

A share dividend reduces the number of previously outstanding shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

A share dividend increases the number of previously outstanding shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

A share dividend is a distribution of corporate assets as a dividend that returns part of the original investment to shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

A 10% share dividend increases the number of outstanding shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

A reverse share split reduces the market value of shares and the par value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

The journal entry to record $25,000 market value in share dividends on the date of declaration can be a debit to share dividends and a credit to common share dividends distributable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

A share dividend is a corporation's distribution of its own shares to its shareholders without receiving any payment in return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

A share dividend is not a liability on the balance sheet because it does not require a distribution of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

Earnings per share is calculated by dividing the number of common shares outstanding by net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

A cash dividend does not reduce a corporation's assets or equity,while a share dividend reduces both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

A share split affects total equity as reported on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

The journal entry to record $10,000 in a share dividend on the declaration date can include a debit to cash dividends declared and a credit to dividends payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a corporation calls in its outstanding shares and issues more than one new share in exchange for each old share,this is a:

A)Share split.

B)Share dividend.

C)Cash dividend.

D)Reverse share split.

E)Liquidating dividend

A)Share split.

B)Share dividend.

C)Cash dividend.

D)Reverse share split.

E)Liquidating dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

Failure to record the declaration and distribution of a share dividend would

A)Have no effect on total equity

B)Cause the outstanding shares to exceed the equity

C)Cause an understatement of equity

D)Cause an overstatement of equity

E)Cause the balance sheet to be out of balance

A)Have no effect on total equity

B)Cause the outstanding shares to exceed the equity

C)Cause an understatement of equity

D)Cause an overstatement of equity

E)Cause the balance sheet to be out of balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

Changes in accounting estimates are

A)Considered to be accounting errors

B)Reported by retrospective restatement of financial statements

C)Accounted for with a cumulative "catch-up" adjustment

D)Considered to be a change in accounting policy

E)Accounted for in the period of the change and future periods

A)Considered to be accounting errors

B)Reported by retrospective restatement of financial statements

C)Accounted for with a cumulative "catch-up" adjustment

D)Considered to be a change in accounting policy

E)Accounted for in the period of the change and future periods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

A company can change from one acceptable accounting principle to another as long as the change improves the usefulness of information in its financial statements or it is required by IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

Just before Arugone Funeral Homes Inc.issued a 10% share dividend on December 1,the following data were collected: The amount that total equity will increase (decrease)as a result of recording the share dividend is

A)$7,500

B)$(9,000)

C)$22,500

D)$(27,000)

E)$-0-

A)$7,500

B)$(9,000)

C)$22,500

D)$(27,000)

E)$-0-

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

A change in accounting policy will be presented on the:

A)Income Statement.

B)Balance Sheet.

C)Cash Flow Statement.

D)Statement of Changes in Equity

E)All of these

A)Income Statement.

B)Balance Sheet.

C)Cash Flow Statement.

D)Statement of Changes in Equity

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

Hunter Ltd.declares a 10% share dividend on December 31,2020.Currently Hunter has 10,000 shares outstanding.The market value of the shares on the date of declaration is $1 per share.The value to be assigned to this share dividend is

A)$1,000

B)$4,000

C)$6,000

D)$8,000

E)$9,000

A)$1,000

B)$4,000

C)$6,000

D)$8,000

E)$9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

A correction of errors in prior year financial statements require an adjustment to opening retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Retained earnings are part of the shareholders' claim on the company's net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

The cumulative effect of changing accounting principles is only reported for the year of the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Changes in accounting estimates are treated as accounting errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

An expanded income statement for a corporation with discontinued operations includes information on

A)Continuing operations

B)Discontinued operations

C)Earnings per share

D)Net income

E)All of these

A)Continuing operations

B)Discontinued operations

C)Earnings per share

D)Net income

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Reporting for discontinued operations includes:

A)Income or loss from operating the discontinued segment (net of tax

B)Gain or loss from disposal of the segment's net assets (net of tax)

C)Income or loss from operating the discontinued operations (net of tax)and gain or loss from disposal of the operation's net assets (net of tax)

D)Tax benefits of the discontinued segment

E)All of these

A)Income or loss from operating the discontinued segment (net of tax

B)Gain or loss from disposal of the segment's net assets (net of tax)

C)Income or loss from operating the discontinued operations (net of tax)and gain or loss from disposal of the operation's net assets (net of tax)

D)Tax benefits of the discontinued segment

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

Retirement of shares

A)Reduces the number of issued shares

B)Is not permissible under law if the interest of the shareholders is not jeopardized

C)Is accounted for like SPLIT shares

D)Reduces the number of issued shares and is permissible under law if the interest of the shareholders is not jeopardized

E)All of these

A)Reduces the number of issued shares

B)Is not permissible under law if the interest of the shareholders is not jeopardized

C)Is accounted for like SPLIT shares

D)Reduces the number of issued shares and is permissible under law if the interest of the shareholders is not jeopardized

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

The amount of income earned by each outstanding common share of a corporation is known as

A)Restricted retained earnings

B)Income from continuing operations

C)Earnings per share

D)Dividends payable

E)A share dividend

A)Restricted retained earnings

B)Income from continuing operations

C)Earnings per share

D)Dividends payable

E)A share dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Changes in accounting estimates are applied in determining expenses for the current and future periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

After using an expected useful life of seven years and no residual value to depreciate its machine over the preceding two years,a company decided early this year that the machine would last only three more years.The change in accounting estimate results in an adjustment to ending retained earnings for the prior period with no impact on any future periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

Restrictions on retained earnings can be

A)Limits that identify how much of the retained earnings balance is not available for dividends or the repurchase of shares

B)Statutory limits set by government

C)Due to loan agreements

D)Set by a corporation's directors in order to limit dividends and maintain cash

E)All of these answers

A)Limits that identify how much of the retained earnings balance is not available for dividends or the repurchase of shares

B)Statutory limits set by government

C)Due to loan agreements

D)Set by a corporation's directors in order to limit dividends and maintain cash

E)All of these answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

Restricted retained earnings must be disclosed on the balance sheet or the statement of changes in equity,or in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

Retrospective restatement of financial statements can result from

A)Changes in estimates

B)Changes in accounting policies

C)Errors in the current income statements

D)Changes in tax law

E)Contributed capital

A)Changes in estimates

B)Changes in accounting policies

C)Errors in the current income statements

D)Changes in tax law

E)Contributed capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

The act of a corporation to call in its shares and issue one new share in the place of more than one share previously outstanding is a

A)Share dividend

B)Reverse share split

C)Liquidating dividend

D)Share split

E)Cash dividend

A)Share dividend

B)Reverse share split

C)Liquidating dividend

D)Share split

E)Cash dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

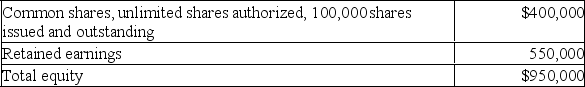

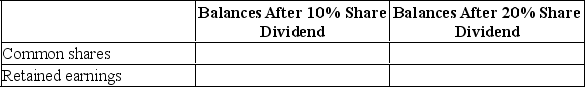

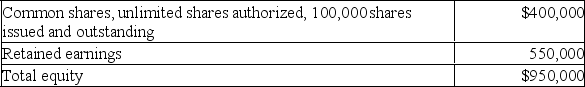

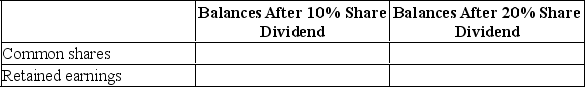

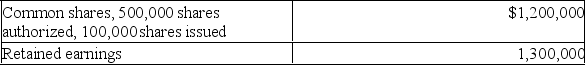

On July 31,Sweep Airline Ltd.'s equity was:

Also note that on July 31 the market value of Sweep Airline's shares was $12 per share.The directors considered declaring a 10% or 20% share dividend and wanted to know what effect each share dividend would have on total equity.Calculate the balances that should be in the following accounts after a share dividend distribution.

Also note that on July 31 the market value of Sweep Airline's shares was $12 per share.The directors considered declaring a 10% or 20% share dividend and wanted to know what effect each share dividend would have on total equity.Calculate the balances that should be in the following accounts after a share dividend distribution.

Also note that on July 31 the market value of Sweep Airline's shares was $12 per share.The directors considered declaring a 10% or 20% share dividend and wanted to know what effect each share dividend would have on total equity.Calculate the balances that should be in the following accounts after a share dividend distribution.

Also note that on July 31 the market value of Sweep Airline's shares was $12 per share.The directors considered declaring a 10% or 20% share dividend and wanted to know what effect each share dividend would have on total equity.Calculate the balances that should be in the following accounts after a share dividend distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

Explain how to calculate earnings per share and how it is used for analysis of a company's financial status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

Given the following information about Fox Creek Travel Corporation's current-year activities,answer the questions listed below: What amounts should be reported on the income statement for the items missing:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

North American Construction Corp.has three lines of business including surveying,excavating and planning.These product lines are considered to be

A)Other comprehensive income

B)Discontinued operations

C)Operating segments

D)Contributed capital

E)All of these

A)Other comprehensive income

B)Discontinued operations

C)Operating segments

D)Contributed capital

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

Companies use share dividends

A)To keep the market price of the shares affordable

B)To increase the market value of shares

C)To increase contributed capital

D)To raise capital for the company for future expansion

E)All of these

A)To keep the market price of the shares affordable

B)To increase the market value of shares

C)To increase contributed capital

D)To raise capital for the company for future expansion

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

Shares that are reacquired and are not cancelled by the issuing corporation are called

A)Capital shares

B)Treasury shares

C)Redeemed shares

D)Preferred shares

E)Callable shares

A)Capital shares

B)Treasury shares

C)Redeemed shares

D)Preferred shares

E)Callable shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

Item(s)that would be included in other comprehensive income include

A)Unrealized gains (losses)on held for trading investments

B)Unrealized gains (losses)on available-for-sale investments

C)Unrealized gains (losses)on held to maturity investments

D)Unrealized gains (losses)on discontinued operation

E)Net income

A)Unrealized gains (losses)on held for trading investments

B)Unrealized gains (losses)on available-for-sale investments

C)Unrealized gains (losses)on held to maturity investments

D)Unrealized gains (losses)on discontinued operation

E)Net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

Describe share dividends and share splits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

For each of the following independent situations,present the necessary journal entry:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

A change from moving weighted average to FIFO reporting is

A)A change that results in a discontinued operation

B)A change in accounting principle and is allowed if it improves the usefulness of information in the financial statements

C)Not allowed once an inventory costing method has been chosen

D)Allowed if it improves the usefulness of information in the financial statements

E)A change in accounting principle and is not allowed even if it improves the usefulness of information in the financial statements

A)A change that results in a discontinued operation

B)A change in accounting principle and is allowed if it improves the usefulness of information in the financial statements

C)Not allowed once an inventory costing method has been chosen

D)Allowed if it improves the usefulness of information in the financial statements

E)A change in accounting principle and is not allowed even if it improves the usefulness of information in the financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

A share dividend transfers

A)Contributed capital to retained earnings

B)Contributed capital to assets

C)Retained earnings to assets

D)Retained earnings to contributed capital

E)Assets to contributed capital

A)Contributed capital to retained earnings

B)Contributed capital to assets

C)Retained earnings to assets

D)Retained earnings to contributed capital

E)Assets to contributed capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Explain where each of the following items should appear in the financial statements of Reid and Right Corp,a publishing company: (1)After the retirement of the company's CEO,the company has decided to downsize its operations.This will include the elimination of the children's book segment of operations.(2)The company holds 500 shares in Dakota Corp.that originally cost $2,000; the shares now have a market value of $4,000.They are being accounted for as an available-for-sale investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

A corporation's distribution of its own shares to its shareholders without receiving any payment in return is a

A)Premium on shares

B)Share subscription

C)Share dividend

D)Discount on shares

E)Preferred share

A)Premium on shares

B)Share subscription

C)Share dividend

D)Discount on shares

E)Preferred share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

The financial statement impact for a company that desires to make a change in accounting policy include(s)

A)Retrospective restatement of prior period financial statements

B)Financial impact charged or credited (net of tax)to the opening balance of retained earnings

C)The nature and justification for the change

D)The effect of the change on current year net income

E)All of these

A)Retrospective restatement of prior period financial statements

B)Financial impact charged or credited (net of tax)to the opening balance of retained earnings

C)The nature and justification for the change

D)The effect of the change on current year net income

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

A share dividend

A)Is a distribution of additional shares to its shareholders without receiving any payment

B)Transfers a portion of equity from retained earnings to contributed capital

C)Is often referred to as a stock dividend

D)Does not reduce a corporation's assets and equity

E)All of these

A)Is a distribution of additional shares to its shareholders without receiving any payment

B)Transfers a portion of equity from retained earnings to contributed capital

C)Is often referred to as a stock dividend

D)Does not reduce a corporation's assets and equity

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Sweet Sleep Corp.equity on January 1 was as follows: common shares,unlimited shares authorized,150,000 shares issued and outstanding; retained earnings,$600,000.Prepare journal entries to record the following transactions:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Retained earnings

A)Are the cumulative net profits or losses minus dividends paid since the date of incorporation

B)Are part of the income statement

C)Represent an amount of cash available to pay shareholders

D)Are the cumulative net profits or losses minus dividends paid since the date of incorporation and are part of shareholders' equity

E)All of these

A)Are the cumulative net profits or losses minus dividends paid since the date of incorporation

B)Are part of the income statement

C)Represent an amount of cash available to pay shareholders

D)Are the cumulative net profits or losses minus dividends paid since the date of incorporation and are part of shareholders' equity

E)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

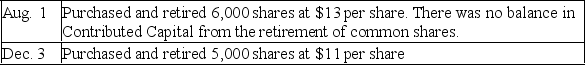

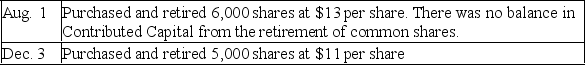

Coquitlam Crunch Corporation has 60,000 common shares outstanding.The following transactions related to the company's shares took place during the year:

Prepare the journal entries to record the transactions.

Prepare the journal entries to record the transactions.

Prepare the journal entries to record the transactions.

Prepare the journal entries to record the transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

Explain the form and content of an expanded income statement for a corporation with discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

Quantum Corporation had net income of $35,000 and paid preferred dividends of $6,000.Quantum had 4,000 common shares outstanding.Calculate the earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Habitat Corporation issued common shares for $35 each.Two years later,on June 10,200 shares were repurchased and retired at a cost of $60 each.The company has $8,000 in contributed capital from the previous retirement of common shares.Present the general journal entry to record the June 10 transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

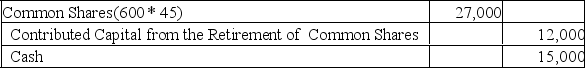

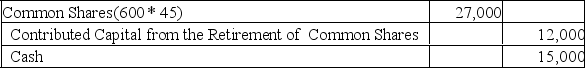

Quadrant Corporation originally issued its common shares at $45 per share.

(1)Prepare a journal entry to record the retirement of 600 shares if Quadrant Corporation paid $25 per share.

(2)Prepare a journal entry to record the retirement of 600 shares if Quadrant Corporation paid $75 per share.Quadrant has $12,000 in contributed capital from the previous retirement of common shares.

(1)Prepare a journal entry to record the retirement of 600 shares if Quadrant Corporation paid $25 per share.

(2)Prepare a journal entry to record the retirement of 600 shares if Quadrant Corporation paid $75 per share.Quadrant has $12,000 in contributed capital from the previous retirement of common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

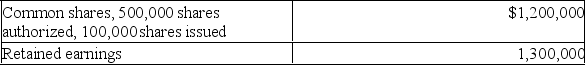

Brook Link Inc.had the following equity as of December 31,Year 1:

The following transactions related to the company's shares took place during Year 2:

The following transactions related to the company's shares took place during Year 2:

Prepare the journal entries to record the Year 2 transactions.

Prepare the journal entries to record the Year 2 transactions.

The following transactions related to the company's shares took place during Year 2:

The following transactions related to the company's shares took place during Year 2: Prepare the journal entries to record the Year 2 transactions.

Prepare the journal entries to record the Year 2 transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

Kriton Corporation had net income of $375,000 and paid preferred dividends of $80,000.Kriton had 50,000 common shares outstanding.Calculate the earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

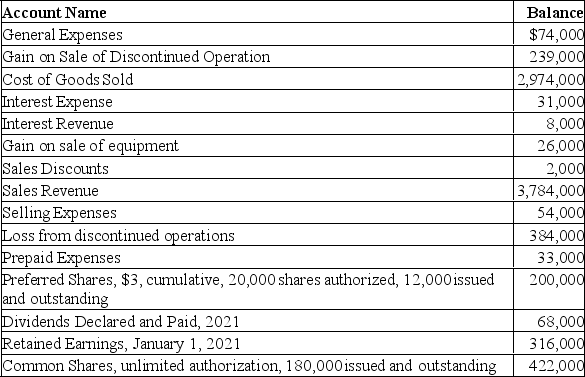

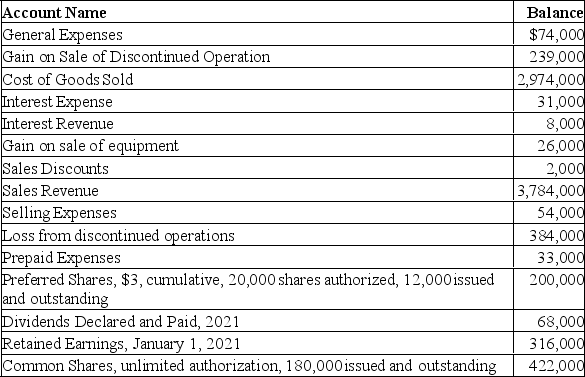

The following information was taken from the ledger and other records of Lillie Inc.at December 31,2021.All amounts are pre-tax.

Additional Information: There was no change in number of preferred shares during the year.Preferred share cash dividends were in arrears for 2020.There were 140,000 common shares outstanding on January 1,2021.24,000 shares were issued on April 1,2021 and another 16,000 shares were issued on Oct.1,2021.Required: Prepare an Income Statement in good form for Lillie Inc.for the fiscal year ended December 31,2021.Use an income tax rate of 40%.Include full earnings per share disclosure and show all calculations.

Additional Information: There was no change in number of preferred shares during the year.Preferred share cash dividends were in arrears for 2020.There were 140,000 common shares outstanding on January 1,2021.24,000 shares were issued on April 1,2021 and another 16,000 shares were issued on Oct.1,2021.Required: Prepare an Income Statement in good form for Lillie Inc.for the fiscal year ended December 31,2021.Use an income tax rate of 40%.Include full earnings per share disclosure and show all calculations.

Additional Information: There was no change in number of preferred shares during the year.Preferred share cash dividends were in arrears for 2020.There were 140,000 common shares outstanding on January 1,2021.24,000 shares were issued on April 1,2021 and another 16,000 shares were issued on Oct.1,2021.Required: Prepare an Income Statement in good form for Lillie Inc.for the fiscal year ended December 31,2021.Use an income tax rate of 40%.Include full earnings per share disclosure and show all calculations.

Additional Information: There was no change in number of preferred shares during the year.Preferred share cash dividends were in arrears for 2020.There were 140,000 common shares outstanding on January 1,2021.24,000 shares were issued on April 1,2021 and another 16,000 shares were issued on Oct.1,2021.Required: Prepare an Income Statement in good form for Lillie Inc.for the fiscal year ended December 31,2021.Use an income tax rate of 40%.Include full earnings per share disclosure and show all calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck