Deck 13: Fiscal Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/328

العب

ملء الشاشة (f)

Deck 13: Fiscal Policy

1

The purpose of fiscal policy is to

A) maintain price level stability.

B) achieve full employment.

C) promote economic growth.

D) All of the above answers are correct.

A) maintain price level stability.

B) achieve full employment.

C) promote economic growth.

D) All of the above answers are correct.

D

2

Fiscal policy can be defined as

A) government policy with respect to transfer payments such as unemployment compensation and welfare.

B) government spending and tax decisions accomplished using automatic stabilizers.

C) use of the federal budget to reach macroeconomic objectives.

D) government policy to retire the federal government debt.

A) government policy with respect to transfer payments such as unemployment compensation and welfare.

B) government spending and tax decisions accomplished using automatic stabilizers.

C) use of the federal budget to reach macroeconomic objectives.

D) government policy to retire the federal government debt.

C

3

Prior to the Great Depression, the purpose of the federal budget was to _ .

A) finance the activities of the government

B) maintain low interest rates

C) stabilize the economy

D) decrease unemployment

A) finance the activities of the government

B) maintain low interest rates

C) stabilize the economy

D) decrease unemployment

A

4

The use of the U.S. federal budget to help stabilize the economy grew in reaction to the and is known as .

A) stagflation of the 1970s; fiscal policy

B) Great Depression of the 1930s; fiscal policy

C) Great Depression of the 1930s; monetary policy

D) stagflation of the 1970s; government policy

A) stagflation of the 1970s; fiscal policy

B) Great Depression of the 1930s; fiscal policy

C) Great Depression of the 1930s; monetary policy

D) stagflation of the 1970s; government policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fiscal policy includes

A) only decisions related to government expenditure on goods and services and the value of transfer payments.

B) only decisions related to government expenditure on goods and services.

C) only decisions related to the value of transfer payments and tax revenue.

D) decisions related to government expenditure on goods and services, the value of transfer payments, and tax revenue.

A) only decisions related to government expenditure on goods and services and the value of transfer payments.

B) only decisions related to government expenditure on goods and services.

C) only decisions related to the value of transfer payments and tax revenue.

D) decisions related to government expenditure on goods and services, the value of transfer payments, and tax revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which branches of the government play a role in the enacting the federal budget?

I) the President.

II) the House of Representatives.

III) the Senate.

A) I only

B) I and II

C) II and III

D) I, II and III

I) the President.

II) the House of Representatives.

III) the Senate.

A) I only

B) I and II

C) II and III

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

7

Fiscal policy attempts to achieve all of the following objectives EXCEPT .

A) full employment

B) sustained economic growth

C) price level stability

D) a stable money supply

A) full employment

B) sustained economic growth

C) price level stability

D) a stable money supply

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

8

Fiscal policy involves

A) the use of tax and money policies by government to influence the level of interest rates.

B) the use of tax and spending policies by the government.

C) decreasing the role of the Federal Reserve in the everyday life of the economy.

D) the use of interest rates to influence the level of GDP.

A) the use of tax and money policies by government to influence the level of interest rates.

B) the use of tax and spending policies by the government.

C) decreasing the role of the Federal Reserve in the everyday life of the economy.

D) the use of interest rates to influence the level of GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

9

In terms of the budget process, place the following events in order for fiscal year 2009.

I) Congress approves the budget.

II) The president sends a budget to Congress.

III) Supplementary budget laws are passed.

A) II, III, I

B) I, II, III

C) III, II, I

D) II, I, III

I) Congress approves the budget.

II) The president sends a budget to Congress.

III) Supplementary budget laws are passed.

A) II, III, I

B) I, II, III

C) III, II, I

D) II, I, III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

10

The budget process includes the

A) President proposing and Congress passing the budget.

B) Senate proposing and the House of Representatives passing the budget.

C) President passing the budget as proposed by Congress.

D) House of Representatives proposing and the Senate passing the budget.

A) President proposing and Congress passing the budget.

B) Senate proposing and the House of Representatives passing the budget.

C) President passing the budget as proposed by Congress.

D) House of Representatives proposing and the Senate passing the budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fiscal policy

A) is enacted by the Federal Reserve.

B) involves changing interest rates.

C) involves changing the money supply.

D) involves changing taxes and government spending.

A) is enacted by the Federal Reserve.

B) involves changing interest rates.

C) involves changing the money supply.

D) involves changing taxes and government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is included as part of fiscal policy?

A) the level of interest rates

B) money supply

C) the level of government spending

D) monetary policy

A) the level of interest rates

B) money supply

C) the level of government spending

D) monetary policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

13

The largest item of government outlays is .

A) debt reduction

B) transfer payments

C) expenditures on goods and services

D) debt interest

A) debt reduction

B) transfer payments

C) expenditures on goods and services

D) debt interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

14

The purpose of the Employment Act of 1946 was to

A) set targets for the unemployment rate to be achieved by the president.

B) establish an unemployment compensation system.

C) set up the Federal Reserve System.

D) establish goals for the federal government that would promote maximum employment, purchasing power, and production.

A) set targets for the unemployment rate to be achieved by the president.

B) establish an unemployment compensation system.

C) set up the Federal Reserve System.

D) establish goals for the federal government that would promote maximum employment, purchasing power, and production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following government bodies does NOT participate directly in formulating U.S. fiscal policy?

A) the Federal Reserve Board

B) the House of Representatives

C) the Senate

D) the President and his cabinet

A) the Federal Reserve Board

B) the House of Representatives

C) the Senate

D) the President and his cabinet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

16

Tax cuts by the federal government to increase long term growth are known as

A) communism.

B) fiscal policy.

C) socialism.

D) monetary policy.

A) communism.

B) fiscal policy.

C) socialism.

D) monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is considered a purpose of the federal budget?

I) To help the economy achieve full employment.

II) To finance the activities of the federal government.

III) To promote sustained economic growth.

A) I and II

B) I and III

C) I, II and III

D) II and III

I) To help the economy achieve full employment.

II) To finance the activities of the federal government.

III) To promote sustained economic growth.

A) I and II

B) I and III

C) I, II and III

D) II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

18

The Employment Act of 1946 made it the responsibility of the federal government to

A) improve the distribution of income.

B) promote maximum employment.

C) balance its budget because that policy would create the maximum level of employment.

D) provide full employment and a stable balance of payments.

A) improve the distribution of income.

B) promote maximum employment.

C) balance its budget because that policy would create the maximum level of employment.

D) provide full employment and a stable balance of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

19

Changes in which of the following is included as part of fiscal policy?

A) the money supply

B) monetary policy

C) tax rates

D) the level of interest rates

A) the money supply

B) monetary policy

C) tax rates

D) the level of interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

20

All of the following are part of fiscal policy EXCEPT

A) choosing the size of the government deficit.

B) controlling the money supply.

C) setting government spending.

D) setting tax rates.

A) choosing the size of the government deficit.

B) controlling the money supply.

C) setting government spending.

D) setting tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

21

The government receives tax revenues from several sources. Rank the following sources from larges the smallest.

I) corporate income taxes

II) personal income taxes

III) Social Security taxes

A) II, III, I

B) III, II, I

C) I, III, II

D) I, II, III

I) corporate income taxes

II) personal income taxes

III) Social Security taxes

A) II, III, I

B) III, II, I

C) I, III, II

D) I, II, III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

22

The largest part of Federal government outlays is

A) corporate income taxes.

B) debt interest.

C) government expenditure on goods and services.

D) transfer payments.

A) corporate income taxes.

B) debt interest.

C) government expenditure on goods and services.

D) transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is NOT a revenue source for the Federal government?

A) interest on corporate bond holdings

B) social security taxes

C) indirect taxes

D) personal income taxes

A) interest on corporate bond holdings

B) social security taxes

C) indirect taxes

D) personal income taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

24

The categories of federal government outlays, listed from largest to smallest, are

A) debt interest, transfer payments, and expenditure on goods and services.

B) transfer payments, debt interest, and expenditure on goods and services.

C) transfer payments, expenditure on goods and services, and debt interest.

D) expenditure on goods and services, debt interest, and transfer payments.

A) debt interest, transfer payments, and expenditure on goods and services.

B) transfer payments, debt interest, and expenditure on goods and services.

C) transfer payments, expenditure on goods and services, and debt interest.

D) expenditure on goods and services, debt interest, and transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

25

The largest source of government revenues is .

A) corporate income taxes

B) personal income taxes

C) social security taxes

D) indirect taxes

A) corporate income taxes

B) personal income taxes

C) social security taxes

D) indirect taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Council of Economic Advisers

A) proposes the president's budget each year.

B) helps the president make changes in monetary policy.

C) approves fiscal policy changes.

D) helps the president and the public stay informed about the state of the economy.

A) proposes the president's budget each year.

B) helps the president make changes in monetary policy.

C) approves fiscal policy changes.

D) helps the president and the public stay informed about the state of the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the largest source of revenue for the federal government?

A) Social Security taxes

B) sales tax

C) corporate income taxes

D) personal income taxes

A) Social Security taxes

B) sales tax

C) corporate income taxes

D) personal income taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

28

Rank the following federal government outlays from the largest to the smallest.

I) debt interest

II) transfer payments

III) expenditure on goods and services

A) III, II, I

B) III, I, II

C) II, III, I

D) I, II, III

I) debt interest

II) transfer payments

III) expenditure on goods and services

A) III, II, I

B) III, I, II

C) II, III, I

D) I, II, III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Council of Economic Advisors advises the

A) House of Representatives.

B) Senate.

C) Congress.

D) President.

A) House of Representatives.

B) Senate.

C) Congress.

D) President.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Employment Act of 1946 states that it is the responsibility of the federal government to

A) maintain the inflation rate at below 10 percent per year.

B) promote economic equality.

C) promote full employment.

D) All of the above answers are correct.

A) maintain the inflation rate at below 10 percent per year.

B) promote economic equality.

C) promote full employment.

D) All of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

31

All of the following are government outlays EXCEPT

A) transfer payments.

B) expenditure on goods and services.

C) purchases of corporate bonds.

D) interest on the government's debt.

A) transfer payments.

B) expenditure on goods and services.

C) purchases of corporate bonds.

D) interest on the government's debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Council of Economic Advisers have the following roles EXCEPT .

A) proposing the federal government's budget to Congress

B) keeping the President informed about the current state of the economy

C) making forecasts of where the economy is heading

D) monitoring the U.S. economy

A) proposing the federal government's budget to Congress

B) keeping the President informed about the current state of the economy

C) making forecasts of where the economy is heading

D) monitoring the U.S. economy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which component makes up the largest part of government outlays in the federal budget?

A) payment of indirect tax

B) transfer payments

C) debt interest

D) government expenditures on goods and services

A) payment of indirect tax

B) transfer payments

C) debt interest

D) government expenditures on goods and services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

34

In the U.S. federal government budget, the largest government outlay item in recent years has been

A) personal income taxes.

B) interest on the national debt.

C) transfer payments.

D) government expenditures on goods and services.

A) personal income taxes.

B) interest on the national debt.

C) transfer payments.

D) government expenditures on goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is NOT a government outlay?

A) expenditure on goods and services

B) debt interest on the government's debt

C) transfer payments

D) purchases of foreign bonds

A) expenditure on goods and services

B) debt interest on the government's debt

C) transfer payments

D) purchases of foreign bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

36

Federal government expenditures as a percentage of GDP are approximately

A) 66 percent.

B) 20 percent.

C) 50 percent.

D) 10 percent.

A) 66 percent.

B) 20 percent.

C) 50 percent.

D) 10 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

37

Ranked from largest to smallest, the four main sources of federal tax revenue are

A) personal income tax; indirect taxes; Social Security taxes; corporate income tax.

B) personal income tax; Social Security taxes; corporate income tax; indirect taxes.

C) corporate income tax; personal income tax; Social Security taxes; indirect taxes.

D) personal income tax; corporate income tax; indirect taxes, Social Security taxes.

A) personal income tax; indirect taxes; Social Security taxes; corporate income tax.

B) personal income tax; Social Security taxes; corporate income tax; indirect taxes.

C) corporate income tax; personal income tax; Social Security taxes; indirect taxes.

D) personal income tax; corporate income tax; indirect taxes, Social Security taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

38

The Employment Act of 1946 was NOT concerned with

A) farming price supports.

B) economic growth.

C) price stability.

D) full employment.

A) farming price supports.

B) economic growth.

C) price stability.

D) full employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is the largest source of federal government revenue?

A) corporate income taxes

B) personal income taxes

C) Social Security taxes

D) borrowing

A) corporate income taxes

B) personal income taxes

C) Social Security taxes

D) borrowing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

40

All of the following components represent sources of government revenue EXCEPT

A) transfer payments.

B) personal income taxes.

C) corporate income taxes.

D) Social Security taxes.

A) transfer payments.

B) personal income taxes.

C) corporate income taxes.

D) Social Security taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements regarding the U.S government's budget surpluses and deficits is correct?

A) If tax revenues exceed outlays, the government has a budget deficit.

B) During the 1980s large deficits arose from a combination of tax cuts and expenditure increases.

C) Budget deficits tend to shrink during periods of recession.

D) Since 1980, federal tax revenues have generally exceeded outlays.

A) If tax revenues exceed outlays, the government has a budget deficit.

B) During the 1980s large deficits arose from a combination of tax cuts and expenditure increases.

C) Budget deficits tend to shrink during periods of recession.

D) Since 1980, federal tax revenues have generally exceeded outlays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

42

A balanced budget occurs when government

A) outlays exceeds tax revenues.

B) tax revenues equals outlays.

C) tax revenues exceeds outlays.

D) expenditure is zero.

A) outlays exceeds tax revenues.

B) tax revenues equals outlays.

C) tax revenues exceeds outlays.

D) expenditure is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

43

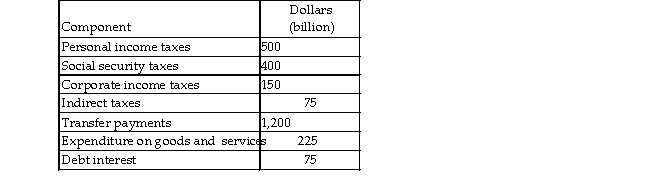

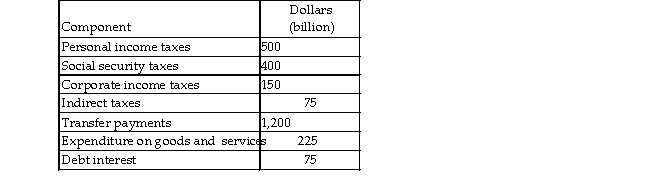

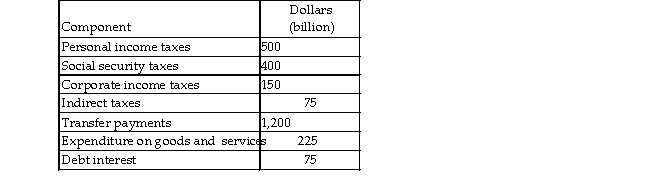

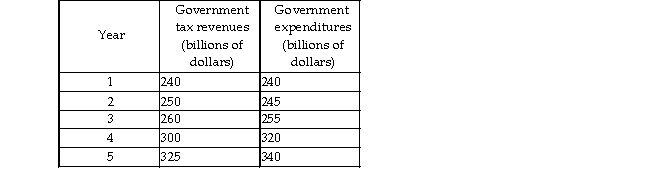

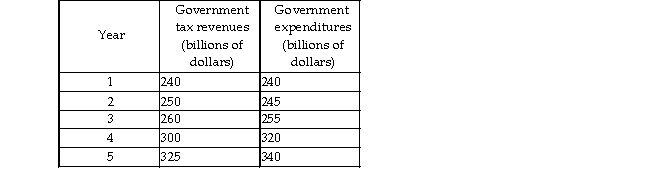

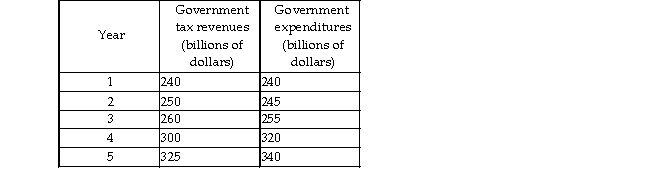

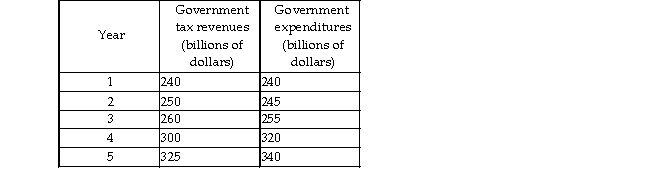

Consider the above table with data for a country's government budget. The country has government revenues of billion.

A) $725

B) $1125

C) $1700

D) $900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

44

A government incurs a budget deficit when

A) exports are less than imports.

B) taxes are greater than government outlays.

C) exports are greater than imports.

D) taxes are less than government outlays.

A) exports are less than imports.

B) taxes are greater than government outlays.

C) exports are greater than imports.

D) taxes are less than government outlays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

45

The government's budget deficit or surplus equals the

A) total tax revenue minus total government outlays.

B) change in outlays divided by change in revenue.

C) average outlay divided by average revenue.

D) change in revenue minus change in outlays.

A) total tax revenue minus total government outlays.

B) change in outlays divided by change in revenue.

C) average outlay divided by average revenue.

D) change in revenue minus change in outlays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider the above table with data for a country's government budget. The data show the government is running a billion.

A) budget surplus of $650

B) budget deficit of $375

C) budget deficit of $550

D) budget surplus of $300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

47

A government surplus is defined as

A) interest payments on the federal government debt.

B) on- budget expenditures.

C) the government printing money to pay its bills.

D) an excess of government tax revenues relative to government outlays.

A) interest payments on the federal government debt.

B) on- budget expenditures.

C) the government printing money to pay its bills.

D) an excess of government tax revenues relative to government outlays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

48

A government budget deficit occurs when

A) government spending is more than what it collects in taxes.

B) U.S. consumers buy more than U.S. producers produce.

C) the value of U.S. imports exceed the value of U.S. exports.

D) foreign holdings of American assets exceed American holdings of foreign assets.

A) government spending is more than what it collects in taxes.

B) U.S. consumers buy more than U.S. producers produce.

C) the value of U.S. imports exceed the value of U.S. exports.

D) foreign holdings of American assets exceed American holdings of foreign assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

49

A budget surplus occurs when government

A) tax revenues equals outlays.

B) tax revenues equal social security expenditures.

C) outlays exceeds tax revenues.

D) tax revenues exceeds outlays.

A) tax revenues equals outlays.

B) tax revenues equal social security expenditures.

C) outlays exceeds tax revenues.

D) tax revenues exceeds outlays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

50

A budget deficit is the difference between

A) foreign holdings of U.S. assets and U.S. holdings of foreign assets.

B) government tax revenues and government outlays.

C) U.S. imports and U.S. exports.

D) what U.S. consumers buy and U.S. producers produce.

A) foreign holdings of U.S. assets and U.S. holdings of foreign assets.

B) government tax revenues and government outlays.

C) U.S. imports and U.S. exports.

D) what U.S. consumers buy and U.S. producers produce.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

51

When tax revenues exceed outlays, the government has a , and when outlays exceed tax revenues, the government has a .

A) budget surplus; budget deficit

B) budget surplus; budget debt

C) budget deficit; budget surplus

D) budget debt; budget surplus

A) budget surplus; budget deficit

B) budget surplus; budget debt

C) budget deficit; budget surplus

D) budget debt; budget surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

52

Consider the above table with data for a country's government budget. Government outlays for the economy equal _ billion.

A) $1200

B) $1500

C) $1425

D) $1275

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

53

The budget deficit

A) decreased during the Bush Administration.

B) reached its peak in the year 2000.

C) is the total outstanding borrowing by the government.

D) is the difference between government outlays and tax revenues.

A) decreased during the Bush Administration.

B) reached its peak in the year 2000.

C) is the total outstanding borrowing by the government.

D) is the difference between government outlays and tax revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the federal government's tax revenues are greater than its outlays, then the federal budget has a

A) balanced budget.

B) transfer payment.

C) deficit.

D) surplus.

A) balanced budget.

B) transfer payment.

C) deficit.

D) surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

55

The U.S. government's budget

A) must be balanced each year.

B) has mostly been in surplus during the past 30 years.

C) has always been in deficit during the past 30 years.

D) has mostly been in deficit during the past 30 years.

A) must be balanced each year.

B) has mostly been in surplus during the past 30 years.

C) has always been in deficit during the past 30 years.

D) has mostly been in deficit during the past 30 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

56

If taxes exactly equaled government outlays in a year the

A) federal government debt would decrease.

B) budget deficit would not change.

C) federal government debt would be zero.

D) budget deficit would be zero.

A) federal government debt would decrease.

B) budget deficit would not change.

C) federal government debt would be zero.

D) budget deficit would be zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

57

Whenever the federal government spends more than it receives in tax revenue, then by definition it

A) increases economic growth.

B) runs a budget surplus.

C) operates a balanced budget.

D) runs a budget deficit.

A) increases economic growth.

B) runs a budget surplus.

C) operates a balanced budget.

D) runs a budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

58

The largest source of revenue for the federal government is and the largest outlay is for

)

A) personal income taxes; interest on national debt

B) personal income taxes; Medicare

C) personal income taxes; transfer payments

D) corporate taxes; Social Security

)

A) personal income taxes; interest on national debt

B) personal income taxes; Medicare

C) personal income taxes; transfer payments

D) corporate taxes; Social Security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

59

Social Security benefits and expenditures on Medicare and Medicaid are classified as

A) production of goods and services.

B) debt interest.

C) transfer payments.

D) purchases of goods and services.

A) production of goods and services.

B) debt interest.

C) transfer payments.

D) purchases of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

60

By definition, a government budget deficit is the situation that occurs when the

A) government outlays exceed what it receives in taxes.

B) economy goes into a recession.

C) government spends money on things which do not produce revenue, such as schools.

D) government miscalculated how much it will receive in taxes.

A) government outlays exceed what it receives in taxes.

B) economy goes into a recession.

C) government spends money on things which do not produce revenue, such as schools.

D) government miscalculated how much it will receive in taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

61

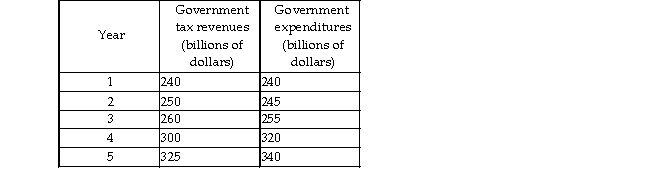

What is the amount of the surplus or deficit incurred in year 4 by the government shown in the above table?

A) $5 billion surplus

B) $320 billion surplus

C) $35 billion surplus

D) $20 billion deficit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

62

An increase in the government _ reduces the government's .

A) debt; budget deficit

B) budget deficit; debt

C) budget surplus; debt

D) None of the above answers is correct.

A) debt; budget deficit

B) budget deficit; debt

C) budget surplus; debt

D) None of the above answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

63

The federal government debt is equal to the

A) annual difference between federal government tax revenues and outlays.

B) obligations of benefits from federal taxes and expenditures.

C) sum of all annual federal government outlays.

D) sum of past budget deficits minus the sum of past budget surpluses.

A) annual difference between federal government tax revenues and outlays.

B) obligations of benefits from federal taxes and expenditures.

C) sum of all annual federal government outlays.

D) sum of past budget deficits minus the sum of past budget surpluses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the government runs a deficit, the total amount of government debt is

A) constant.

B) decreasing.

C) zero.

D) increasing.

A) constant.

B) decreasing.

C) zero.

D) increasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the amount of the surplus or deficit incurred in year 2 by the government shown in the above table?

A) $5 billion deficit

B) $250 billion surplus

C) $0

D) $5 billion surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the government has a balanced budget, the total amount of government debt is

A) increasing.

B) zero.

C) decreasing.

D) constant.

A) increasing.

B) zero.

C) decreasing.

D) constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

67

When the government's outlays exceed its tax revenues, the government

A) incurs a budget deficit.

B) needs to borrow.

C) debt increases.

D) All of the above answers are correct.

A) incurs a budget deficit.

B) needs to borrow.

C) debt increases.

D) All of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

68

The difference between the government debt and the budget deficit is

A) the budget deficit shows the annual discrepancy between government spending and tax revenue and the government debt shows the accumulated balance of past government debts.

B) the government debt shows the annual discrepancy between government spending and tax revenue and the budget deficit shows the accumulated balance of past government debts.

C) not significant because both move in the same direction.

D) none.

A) the budget deficit shows the annual discrepancy between government spending and tax revenue and the government debt shows the accumulated balance of past government debts.

B) the government debt shows the annual discrepancy between government spending and tax revenue and the budget deficit shows the accumulated balance of past government debts.

C) not significant because both move in the same direction.

D) none.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

69

A country has been in existence for only two years. In the first year, tax revenues were $1.0 million and outlays were $1.5 million. In the second year, tax revenues were $1.5 million and outlays were

$2)0 million. At the end of the second year, the government had issued debt worth .

A) $2.5 million

B) $1 million

C) $3.5 million

D) $0.5 million

$2)0 million. At the end of the second year, the government had issued debt worth .

A) $2.5 million

B) $1 million

C) $3.5 million

D) $0.5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

70

If tax revenue equal $1.5 billion and government outlays equal $1.6 billion, then the

A) government debt declines by $0.1 billion.

B) government budget has a surplus of $0.1 billion.

C) government budget has a deficit of $0.1 billion.

D) government debt is equal to $0.1 billion.

A) government debt declines by $0.1 billion.

B) government budget has a surplus of $0.1 billion.

C) government budget has a deficit of $0.1 billion.

D) government debt is equal to $0.1 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is the amount of the surplus or deficit incurred in year 1 by the government shown in the above table?

A) $240 billion surplus

B) $0

C) $25 billion deficit

D) $25 billion surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

72

The sum of past budget deficits in excess of the sum of past budget surpluses refers to

A) the trade deficit.

B) the federal government net worth.

C) the cyclically unbalanced budget.

D) the national debt.

A) the trade deficit.

B) the federal government net worth.

C) the cyclically unbalanced budget.

D) the national debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

73

In 2009, the U.S. government budget registered a deficit. By definition, then,

A) the government debt became negative.

B) tax revenues were less than government outlays.

C) tax revenues were equal to government outlays.

D) tax revenues were greater than government outlays.

A) the government debt became negative.

B) tax revenues were less than government outlays.

C) tax revenues were equal to government outlays.

D) tax revenues were greater than government outlays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

74

If the government runs a surplus, the total amount of government debt is

A) constant.

B) decreasing.

C) zero.

D) increasing.

A) constant.

B) decreasing.

C) zero.

D) increasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

75

In 2009, the federal government of Happy Isle had tax revenues of $1 million, and spent $500,000 on transfer payments, $250,000 on goods and services and $300,000 on debt interest. In 2009, the government of Happy Isle had a .

A) budget deficit of $50,000

B) balanced budget

C) budget deficit of $1,050,000

D) budget surplus of $50,000

A) budget deficit of $50,000

B) balanced budget

C) budget deficit of $1,050,000

D) budget surplus of $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

76

What is the amount of the surplus or deficit incurred in year 5 by the government shown in the above table?

A) $15 billion deficit

B) $5 billion surplus

C) $325 billion surplus

D) $35 billion surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

77

Suppose the only revenue taken in by the government is in the form of income tax, and the tax rate is 10 percent. If aggregate income is $800 billion, and government outlays are $100 billion then the government budget has

A) a deficit of $20 billion.

B) a surplus of $20 billion.

C) a deficit of $80 billion.

D) neither a surplus nor a deficit.

A) a deficit of $20 billion.

B) a surplus of $20 billion.

C) a deficit of $80 billion.

D) neither a surplus nor a deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

78

Suppose a country has been running a persistent government budget deficit. If the deficit is reduced, but remains positive,

A) interest payments on the debt immediately will decrease.

B) government debt will decrease.

C) the country will experience a budget surplus.

D) government debt will increase.

A) interest payments on the debt immediately will decrease.

B) government debt will decrease.

C) the country will experience a budget surplus.

D) government debt will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

79

What is the amount of the surplus or deficit incurred in year 3 by the government shown in the above table?

A) $5 billion deficit

B) $5 billion surplus

C) $0

D) $260 billion surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck

80

A government that currently has a budget deficit can balance its budget by .

A) increasing tax revenues by more than it increases outlays

B) increasing both tax revenues and outlays by the same amount

C) decreasing tax revenues by more than it increases outlays

D) decreasing tax revenues by more than it decreases outlays

A) increasing tax revenues by more than it increases outlays

B) increasing both tax revenues and outlays by the same amount

C) decreasing tax revenues by more than it increases outlays

D) decreasing tax revenues by more than it decreases outlays

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 328 في هذه المجموعة.

فتح الحزمة

k this deck