Deck 14: Part A: Money, Banking, and Money Creation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/56

العب

ملء الشاشة (f)

Deck 14: Part A: Money, Banking, and Money Creation

1

What is the problem with printing money to pay down national debt?

As more and more money is added to the system, money loses its value and inflation is the result.

2

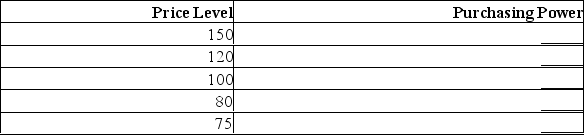

Determine the purchasing power of $1 at each of the price levels indicated in the table and enter in the spaces provided.

3

What is the difference between the M1 and M2 definitions of the money supply?

Both M1 and M2 are definitions of the economy's money supply.M1 is the definition of the money supply with the highest degree of liquidity, the money supply used mainly for transactions purposes.M1 consists of currency (coins and paper money) and demand deposits in chartered banks.M2 consists of everything in M1 plus personal savings deposits and non-personal notice deposits in chartered banks.M2 is a broader, but less liquid, definition of the money supply.

4

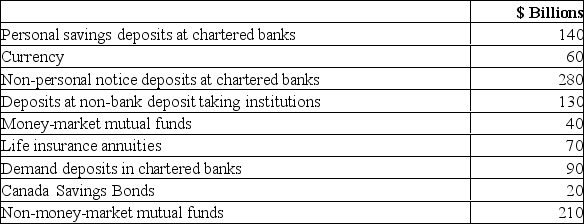

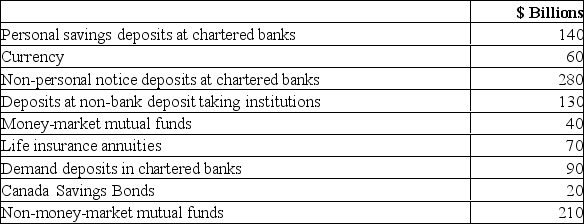

Use the figures in the table below to answer the following questions.  (a) What is the value of M1?

(a) What is the value of M1?

(b) What is the value of M2?

(c) What is the value of M2+?

(d) What is the value of M2++?

(a) What is the value of M1?

(a) What is the value of M1?(b) What is the value of M2?

(c) What is the value of M2+?

(d) What is the value of M2++?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

5

Why is money considered to be debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

6

In Douglas Adams' The Restaurant at the End of the Universe, the Golgafrinchans' management consultant decided to use leaves (from trees) as legal tender (i.e., as money).What is the problem with this plan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

7

Are credit cards money? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

8

What are the three functions that a commodity must fulfill to be useful as money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

9

Why is the intrinsic value of token money less than its face value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose depositors at chartered banks transfer $10 billion from their savings deposits to their deposits in non-bank institutions.What impact does this have on M1, M2, and M2+?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is a chartered bank (in Canada)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

12

Money is what money does.Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

13

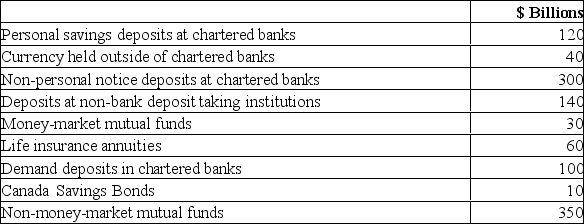

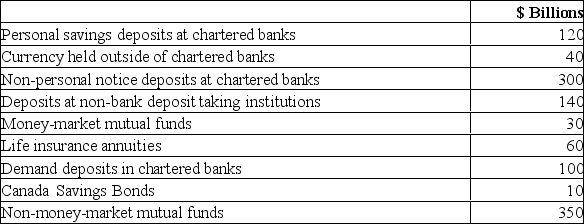

Use the figures in the table below to answer the following questions.  (a) What is the value of M1?

(a) What is the value of M1?

(b) What is the value of M2?

(c) What is the value of M2+?

(d) What is the value of M2++?

(a) What is the value of M1?

(a) What is the value of M1?(b) What is the value of M2?

(c) What is the value of M2+?

(d) What is the value of M2++?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the difference between the M2 and M2+ definitions of the money supply?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

15

What are near monies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is fiat money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

17

Suppose depositors at chartered banks transfer $10 billion from their savings deposits to their demand deposits.What impact does this have on M1, M2, and M2+?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

18

Some government bonds can be redeemed for currency or a cheque at banks.Why, then, isn't it universally agreed that government bonds are part of the money supply?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

19

Provide three key reasons why money has value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

20

When would money that is declared legal tender be worthless?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

21

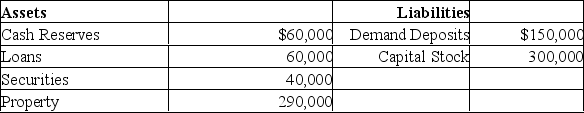

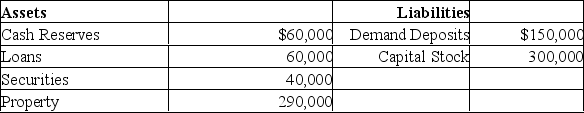

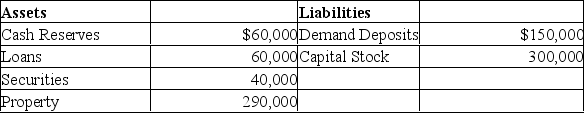

Arrange the following items in the form of a chartered bank's balance sheet, and explain how each might come into being.Capital stock, $300,000; Cash Reserves, $60,000; Property, $290,000; Demand deposits, $150,000; Securities, $40,000; Loans, $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

22

Explain what is meant by fractional reserve banking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

23

Define the desired reserve ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

24

When a cheque is drawn against bank A and deposited in another bank, the first bank loses reserves as the cheque is cleared.Yet the cheque collection involves no loss of reserves by the banking system.Explain what significance this has for the lending ability of the system as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

25

Describe the nature, causes, and effects of the U.S Mortgage Default Crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

26

What happens to the money supply when a bank accepts deposits of currency from the public and places it in demand deposits?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

27

Describe the basic features of a chartered bank's balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

28

Why do financial institutions keep reserves?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

29

What are Mortgage-Backed Securities and how are they created?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the main method banks and other savings institutions use to make profits?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

31

What is the history behind the idea of a fractional reserve banking system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

32

What are the two significant characteristics of the fractional reserve banking system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

33

What are the four main assets of Canada's chartered banks?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

34

How does the problem of Moral Hazard relate to financial investments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

35

Give an equation that shows the relationship between actual, desired, and excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

36

What are the five main liabilities of Canada's chartered banks?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

37

What is the function of the Canadian Payments Association (CPA)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is Securitization and what are its supposed benefits as per government regulators?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

39

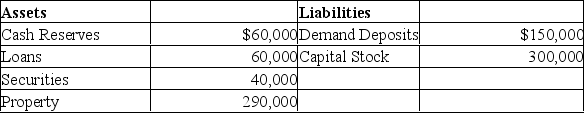

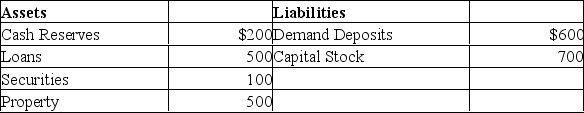

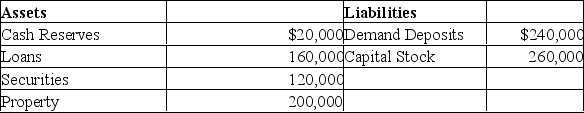

Answer the next questions based on the following balance sheet for a chartered bank.Assume the desired reserve ratio is 33%.  (a) What is the amount of excess reserves?

(a) What is the amount of excess reserves?

(b) By what amount can this bank safely expand its loans?

(c) By expanding its loans by the amount in part (b), what would its demand deposits equal (if all loans were made to customers holding demand deposits)?

(d) If cheques clear against the bank equal to the amount loaned in (b), how much would remain in reserves and in demand deposits?

(a) What is the amount of excess reserves?

(a) What is the amount of excess reserves?(b) By what amount can this bank safely expand its loans?

(c) By expanding its loans by the amount in part (b), what would its demand deposits equal (if all loans were made to customers holding demand deposits)?

(d) If cheques clear against the bank equal to the amount loaned in (b), how much would remain in reserves and in demand deposits?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

40

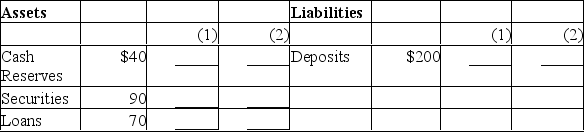

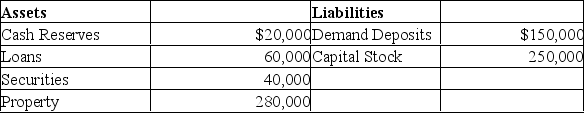

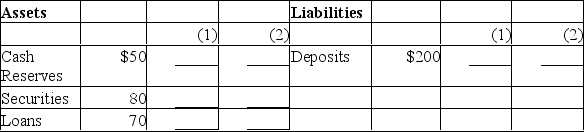

Suppose the First National Bank has the following simplified balance sheet.The reserve ratio is 20% and all dollar figures are in thousands.  Assume that households and businesses deposit $5 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?

Assume that households and businesses deposit $5 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?

(b) In column (2) show what would happen if the bank now loans all of its excess reserves to a depositor.Is there a change in the money supply?

Assume that households and businesses deposit $5 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?

Assume that households and businesses deposit $5 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?(b) In column (2) show what would happen if the bank now loans all of its excess reserves to a depositor.Is there a change in the money supply?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

41

The following is the consolidated balance sheet for the chartered banking system.Assume the desired reserve ratio is 33%.Show the new consolidated balance sheet after maximum loan expansion has occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

42

The following is the consolidated balance sheet for the chartered banking system.Assume the desired reserve ratio is 10%.Show the new consolidated balance sheet after maximum loan expansion has occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

43

What are the two conflicting goals of bankers? How do these conflicting goals get resolved in the overnight loans market?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

44

Define the monetary multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is the effect on the money supply when a chartered bank sells government securities to the public?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

46

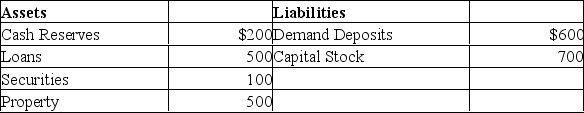

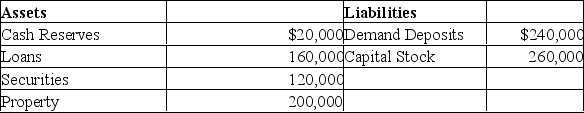

Answer the next question based on the following consolidated balance sheet for the chartered banking system.Assume the desired reserve ratio is 30%.All figures are in millions of dollars.  (a) What is the amount of excess reserves in this chartered banking system?

(a) What is the amount of excess reserves in this chartered banking system?

(b) What is the maximum amount that the money supply can be expanded?

(c) If the reserve ratio fell to 25 percent, what is now the maximum amount that the money supply can be expanded?

(a) What is the amount of excess reserves in this chartered banking system?

(a) What is the amount of excess reserves in this chartered banking system?(b) What is the maximum amount that the money supply can be expanded?

(c) If the reserve ratio fell to 25 percent, what is now the maximum amount that the money supply can be expanded?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

47

Describe and explain what was done during the during the financial crisis of 2007-2008 in the United States (sometimes referred to as Extend and Pretend).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

48

What is the effect on the money supply when a chartered bank buys government securities from the public?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is meant by the overnight lending rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

50

Banks pursue two conflicting goals.Explain what they are and why the conflict.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

51

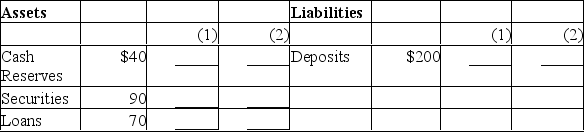

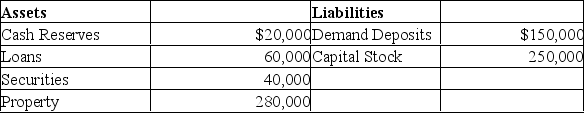

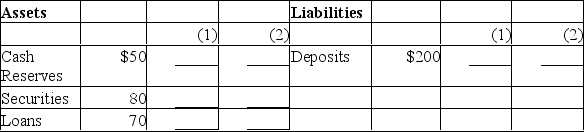

Suppose the Second National Bank has the following simplified balance sheet.The reserve ratio is 25% and all dollar figures are in thousands.  Assume that households and businesses deposit $10 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?

Assume that households and businesses deposit $10 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?

(b) In column (2) show what would happen if the bank now loans all of its excess reserves to a depositor.Is there a change in the money supply?

Assume that households and businesses deposit $10 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?

Assume that households and businesses deposit $10 in this bank and that this currency is added to the bank's reserves.(a) In column (1) show the bank's balance sheet after this occurs.Is there a change in the money supply?(b) In column (2) show what would happen if the bank now loans all of its excess reserves to a depositor.Is there a change in the money supply?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

52

Give an equation that shows the relationship between excess cash reserves, maximum demand-deposit expansion, and the monetary multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

53

How does a decrease in the desired reserve ratio affect multiple-deposit expansion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

54

The following is the consolidated balance sheet for the chartered banking system.Assume the desired reserve ratio is 10%.Show the new consolidated balance sheet after maximum loan contraction has occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

55

How does deterioration in the quality of borrowers affect multiple-deposit expansion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

56

Suppose a fraction of any new loan was kept as cash and not deposited into a bank.How would this currency drain affect multiple-deposit expansion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck