Deck 15: Part B: Interest Rates and Monetary Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

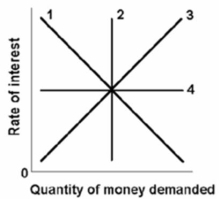

سؤال

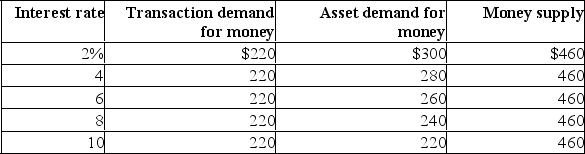

سؤال

سؤال

سؤال

سؤال

سؤال

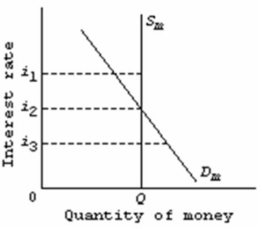

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/239

العب

ملء الشاشة (f)

Deck 15: Part B: Interest Rates and Monetary Policy

1

The price of a bond with no expiration date is $1,000 and the fixed annual interest payment is $100.If the price of the bond falls to $800, the interest rate to a new buyer of the bond is now 8.5 percent.

False

2

There is an asset demand for money because households and business firms use money as a store of value.

True

3

Lower bond prices reduce interest rates.

False

4

An expansionary monetary policy is designed to correct a problem of high unemployment and sluggish economic growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

5

The bank rate is the interest rate at which chartered banks lend to their best corporate customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

6

In the cause-effect chain, a restrictive monetary policy increases the money supply, decreases the interest rate, increases investment spending, and increases aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

7

The asset demand for money varies directly with the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

8

A restrictive monetary policy reduces investment spending and shifts the economy's aggregate demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

9

The largest single liability of the Bank of Canada is its outstanding advances to chartered banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

10

If nominal GDP is $2,000 billion and the amount of money demanded for transactions purposes is $500 billion, then on average each dollar will be spent about four times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

11

A decrease in the nominal GDP, other things remaining the same, will decrease both the total demand for money and the equilibrium rate of interest in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

12

An expansionary monetary policy reduces the supply of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Bank of Canada can use three instruments--Open-market operations, tax collection, and bank rate-to influence the chartered banks' reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

14

Other things equal, an expansionary monetary policy will shift the economy's aggregate demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

15

A restrictive monetary policy may not be effective if the investment-demand curve shifts to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

16

Most economists feel that changes in the interest rate are more likely to affect investment spending than consumer spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

17

When chartered banks borrow from the Bank of Canada, they decrease their excess reserves and their money-creating potential.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

18

Other things being equal, monetary policy will be more effective the flatter the investment-demand curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the monetary authority wished to follow a restrictive monetary policy, it would buy government securities in the open market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

20

Bond prices and interest rates are directly related.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the dollars held for transactions purposes are, on the average, spent four times a year for final goods and services, then the quantity of money people will wish to hold for transactions is equal to:

A)four percent of nominal GDP.

B)25 percent of nominal GDP.

C)nominal GDP multiplied times 4.

D)nominal GDP divided by 25.

A)four percent of nominal GDP.

B)25 percent of nominal GDP.

C)nominal GDP multiplied times 4.

D)nominal GDP divided by 25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

22

Because of the liquidity trap, the Bank of Canada's creation of billions of dollars in excess reserves during the great recession had little or no effect on lending by the chartered banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

23

The reason for the Bank of Canada to have a range for its inflation targeting is that some of the components of the CPI, fluctuate a lot.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

24

The asset demand for money is most closely related to money functioning as a:

A)unit of account.

B)medium of exchange.

C)store of value.

D)measure of value.

A)unit of account.

B)medium of exchange.

C)store of value.

D)measure of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

25

The job of the monetary authorities in limiting the supply of money may be made more complex if chartered banks initially have substantial excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

26

The asset demand for money is downward sloping because:

A)the opportunity cost of holding money increases as the interest rate rises.

B)it is more attractive to hold money at high interest rates than at low interest rates.

C)bond prices rise as interest rates rise.

D)the opportunity cost of holding money declines as the interest rate rises.

A)the opportunity cost of holding money increases as the interest rate rises.

B)it is more attractive to hold money at high interest rates than at low interest rates.

C)bond prices rise as interest rates rise.

D)the opportunity cost of holding money declines as the interest rate rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

27

The transactions demand for money will shift to the:

A)right when the interest rate increases.

B)left when the interest rate decreases.

C)right when aggregate income increases.

D)right when aggregate income decreases.

A)right when the interest rate increases.

B)left when the interest rate decreases.

C)right when aggregate income increases.

D)right when aggregate income decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

28

A restrictive monetary policy invoked to reduce inflation is compatible with the goal of correcting a trade deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

29

An expansionary monetary policy will decrease net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

30

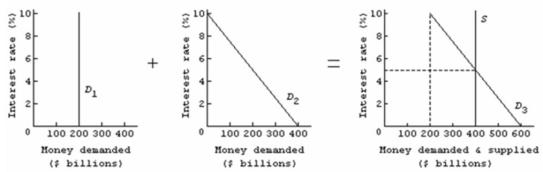

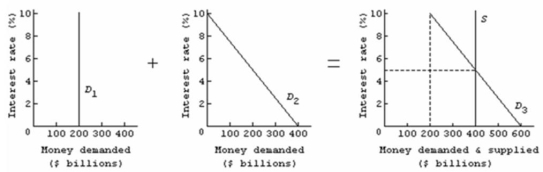

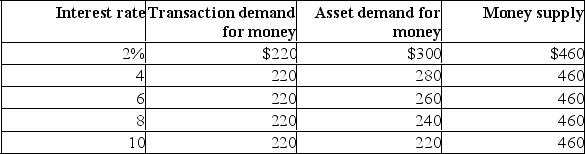

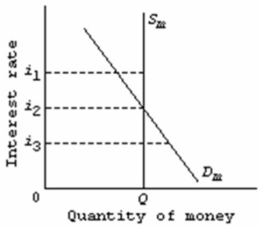

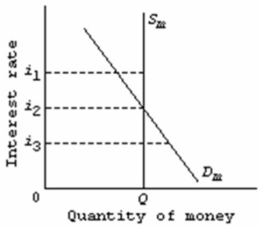

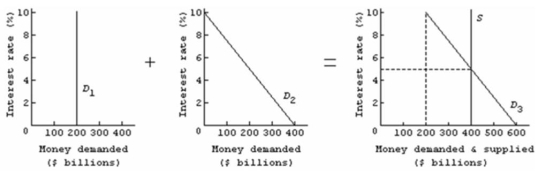

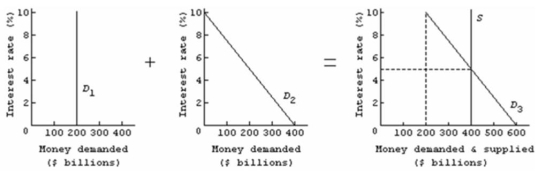

Refer to the market for money diagram above.Curve D1 represents the:

Refer to the market for money diagram above.Curve D1 represents the:A)speculative demand for money.

B)transactions demand for money.

C)asset demand for money.

D)stock of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

31

The opportunity cost of holding money:

A)is zero because money is not an economic resource.

B)varies inversely with the interest rate.

C)varies directly with the interest rate.

D)varies inversely with the level of economic activity.

A)is zero because money is not an economic resource.

B)varies inversely with the interest rate.

C)varies directly with the interest rate.

D)varies inversely with the level of economic activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

32

On a diagram wherein the interest rate and the quantity of money demanded are shown on the vertical and horizontal axes respectively, the transactions demand for money can be represented by:

A)a line parallel to the horizontal axis.

B)a vertical line.

C)a downward sloping line or curve from left to right.

D)an upward sloping line or curve from left to right.

A)a line parallel to the horizontal axis.

B)a vertical line.

C)a downward sloping line or curve from left to right.

D)an upward sloping line or curve from left to right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

33

Quantitative easing refers to the purchasing of private sector assets by a country's central bank in order to provide liquidity to the financial system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

34

An expansionary monetary policy may be more effective than a restrictive monetary policy because chartered banks may decide to hold a large quantity of excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

35

A consumer holds money to meet spending needs.This would be an example of the:

A)use of money as a measure of value.

B)use of money as legal tender.

C)transactions demand for money.

D)asset demand for money.

A)use of money as a measure of value.

B)use of money as legal tender.

C)transactions demand for money.

D)asset demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

36

Monetary policy is subject to less political pressure than fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

37

The transactions demand for money is most closely related to money functioning as a:

A)unit of account.

B)medium of exchange.

C)store of value.

D)both store of value and unit of account.

A)unit of account.

B)medium of exchange.

C)store of value.

D)both store of value and unit of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

38

The major advantages of monetary policy include its flexibility, speed, and political acceptability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

39

To have an independent monetary policy and target inflation, the Bank of Canada must allow the Canadian Dollar to float.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

40

A decrease in the rate of interest would:

A)decrease the opportunity cost of holding money.

B)increase the transactions demand for money.

C)increase the asset demand for money.

D)decrease the price of bonds.

A)decrease the opportunity cost of holding money.

B)increase the transactions demand for money.

C)increase the asset demand for money.

D)decrease the price of bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the money GDP is $600 billion and, on the average, each dollar is spent three times per year, then the amount of money demanded for transactions purposes:

A)will be $1800 billion.

B)will be $600 billion.

C)will be $200 billion.

D)cannot be determined from the information given.

A)will be $1800 billion.

B)will be $600 billion.

C)will be $200 billion.

D)cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

42

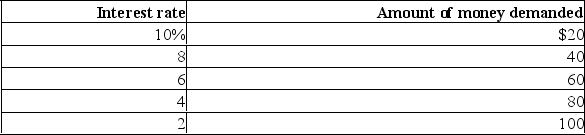

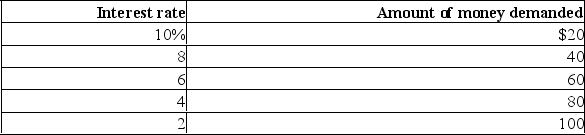

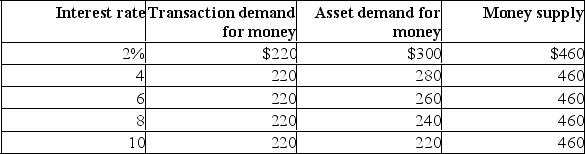

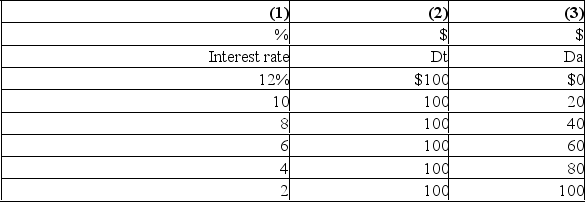

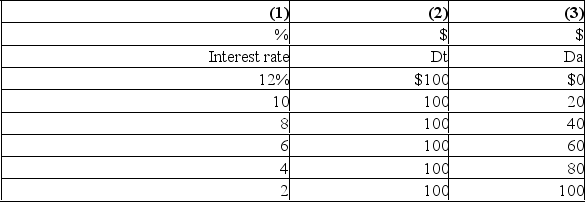

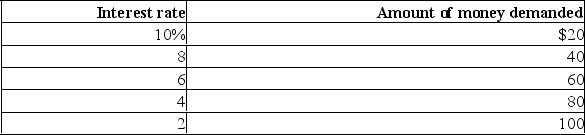

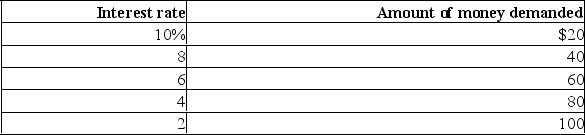

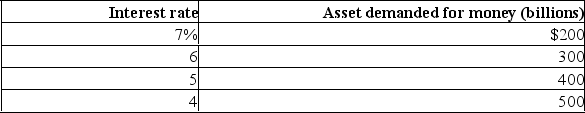

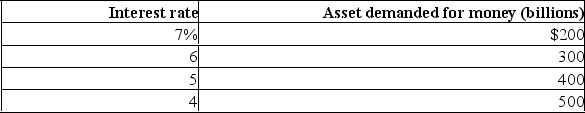

It is assumed that households and businesses want to hold for transactions purposes an amount of money equal to one-half of the GDP.The table shows the amounts of money that households and businesses want to hold as an asset at various interest rates.  Refer to the information above.If the GDP is $200 and the interest rate is 6, what total amount of money will households and businesses want to hold?

Refer to the information above.If the GDP is $200 and the interest rate is 6, what total amount of money will households and businesses want to hold?

A)$120

B)$140

C)$160

D)$180

Refer to the information above.If the GDP is $200 and the interest rate is 6, what total amount of money will households and businesses want to hold?

Refer to the information above.If the GDP is $200 and the interest rate is 6, what total amount of money will households and businesses want to hold?A)$120

B)$140

C)$160

D)$180

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

43

Refer to the above diagram.The asset demand for money is shown by:

Refer to the above diagram.The asset demand for money is shown by:A)D1.

B)D2.

C)D3.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

44

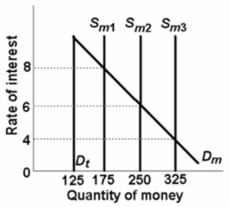

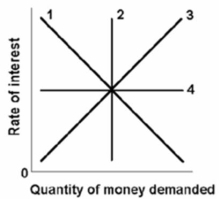

Refer to the graph given below.  In the above graph, Dt represents the transactions demand for money, Dm represents the total demand for money, and Sm represents the supply of money.The transactions demand for money in this market is:

In the above graph, Dt represents the transactions demand for money, Dm represents the total demand for money, and Sm represents the supply of money.The transactions demand for money in this market is:

A)$125.

B)$175.

C)$250.

D)$325.

In the above graph, Dt represents the transactions demand for money, Dm represents the total demand for money, and Sm represents the supply of money.The transactions demand for money in this market is:

In the above graph, Dt represents the transactions demand for money, Dm represents the total demand for money, and Sm represents the supply of money.The transactions demand for money in this market is:A)$125.

B)$175.

C)$250.

D)$325.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

45

On a diagram wherein the interest rate and the quantity of money demanded are shown on the vertical and horizontal axes respectively, the total demand for money can be found by:

A)horizontally adding the transactions and the asset demand for money.

B)vertically subtracting the transactions demand from the asset demand for money.

C)horizontally subtracting the asset demand from the transactions demand for money.

D)vertically adding the transactions and the asset demand for money.

A)horizontally adding the transactions and the asset demand for money.

B)vertically subtracting the transactions demand from the asset demand for money.

C)horizontally subtracting the asset demand from the transactions demand for money.

D)vertically adding the transactions and the asset demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

46

The total demand for money curve will shift to the right as a result of:

A)an increase in nominal GDP.

B)an increase in the interest rate.

C)a decline in the interest rate.

D)a decline in nominal GDP.

A)an increase in nominal GDP.

B)an increase in the interest rate.

C)a decline in the interest rate.

D)a decline in nominal GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following statements is correct? Other things being equal:

A)a decline in real output will shift both the transactions demand curve for money and the total money demand curve to the right.

B)a decline in the interest rate will shift the asset demand curve for money to the right, but leave the total money demand curve unchanged.

C)deflation will shift both the transactions demand curve for money and the total money demand curve to the left.

D)inflation will shift the transactions demand curve for money to the right, but leave the total money demand curve unchanged.

A)a decline in real output will shift both the transactions demand curve for money and the total money demand curve to the right.

B)a decline in the interest rate will shift the asset demand curve for money to the right, but leave the total money demand curve unchanged.

C)deflation will shift both the transactions demand curve for money and the total money demand curve to the left.

D)inflation will shift the transactions demand curve for money to the right, but leave the total money demand curve unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

48

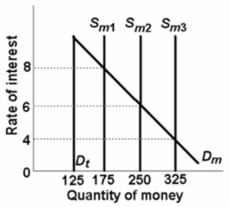

Refer to the graph given below.  In the above graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money.At an interest rate of 4 percent, the asset demand for money would be:

In the above graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money.At an interest rate of 4 percent, the asset demand for money would be:

A)$125.

B)$175.

C)$200.

D)$225.

In the above graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money.At an interest rate of 4 percent, the asset demand for money would be:

In the above graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money.At an interest rate of 4 percent, the asset demand for money would be:A)$125.

B)$175.

C)$200.

D)$225.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

49

Refer to the information below.The transactions demand for money in this market would graph as a:

A)vertical line.

B)horizontal line.

C)line sloping downward and to the right.

D)line sloping upward and to the right.

A)vertical line.

B)horizontal line.

C)line sloping downward and to the right.

D)line sloping upward and to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which line in the above graph would best reflect the slope of the total demand for money curve?

Which line in the above graph would best reflect the slope of the total demand for money curve?A)line 4

B)line 3

C)line 2

D)line 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

51

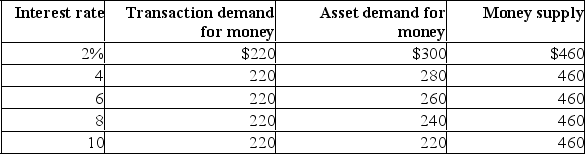

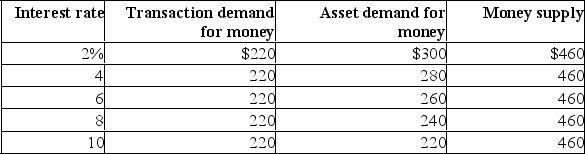

Columns (1) and (2) indicate the transactions demand (Dt) for money and columns (1) and (3) show the asset demand (Da) for money: Refer to the above information.These data suggest that the amount of money that society wishes to hold as an asset:

A)varies directly with the interest rate.

B)varies inversely with the interest rate.

C)varies inversely with the GDP.

D)is independent of the interest rate.

A)varies directly with the interest rate.

B)varies inversely with the interest rate.

C)varies inversely with the GDP.

D)is independent of the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

52

On a diagram wherein the interest rate and the quantity of money demanded are shown on the vertical and horizontal axes respectively, the asset demand for money can be represented by:

A)a line parallel to the horizontal axis.

B)a vertical line.

C)a downward sloping line or curve from left to right.

D)an upward sloping line or curve from left to right.

A)a line parallel to the horizontal axis.

B)a vertical line.

C)a downward sloping line or curve from left to right.

D)an upward sloping line or curve from left to right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

53

The asset demand for money:

A)is unrelated to both the interest rate and the level of GDP.

B)varies inversely with the rate of interest.

C)varies inversely with the level of real GDP.

D)varies directly with the level of nominal GDP.

A)is unrelated to both the interest rate and the level of GDP.

B)varies inversely with the rate of interest.

C)varies inversely with the level of real GDP.

D)varies directly with the level of nominal GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

54

In which case would the quantity of money demanded by the public tend to increase by the greatest amount?

A)The interest rate increases and nominal GDP increases.

B)The interest rate increases and nominal GDP decreases.

C)The interest rate decreases and nominal GDP decreases.

D)The interest rate decreases and nominal GDP increases.

A)The interest rate increases and nominal GDP increases.

B)The interest rate increases and nominal GDP decreases.

C)The interest rate decreases and nominal GDP decreases.

D)The interest rate decreases and nominal GDP increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is correct?

A)The asset demand for money is downward sloping because the opportunity cost of holding money declines as the interest rate rises.

B)The asset demand for money is downward sloping because the opportunity cost of holding money increases as the interest rate rises.

C)The transactions demand for money is downward sloping because the opportunity cost of holding money varies inversely with the interest rate.

D)The asset demand for money is downward sloping because bond prices and the interest rate are directly related.

A)The asset demand for money is downward sloping because the opportunity cost of holding money declines as the interest rate rises.

B)The asset demand for money is downward sloping because the opportunity cost of holding money increases as the interest rate rises.

C)The transactions demand for money is downward sloping because the opportunity cost of holding money varies inversely with the interest rate.

D)The asset demand for money is downward sloping because bond prices and the interest rate are directly related.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

56

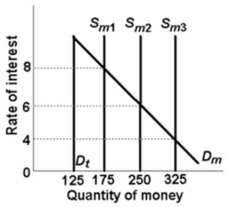

Refer to the market for money diagram below.The downward slope of the money demand curve Dm can best be explained in terms of the:

A)transactions demand for money.

B)direct or positive relationship between bond prices and interest rates.

C)asset demand for money.

D)wealth or real-balances effect.

A)transactions demand for money.

B)direct or positive relationship between bond prices and interest rates.

C)asset demand for money.

D)wealth or real-balances effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which line in the above graph would best reflect the slope of the transactions demand for money curve?

Which line in the above graph would best reflect the slope of the transactions demand for money curve?A)line 1

B)line 2

C)line 3

D)line 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

58

Columns (1) and (2) indicate the transactions demand (Dt) for money and columns (1) and (3) show the asset demand (Da) for money: Refer to the above information.These data suggest that the amount of money demanded for transactions purposes:

A)varies directly with the interest rate.

B)varies inversely with the interest rate.

C)varies inversely with the GDP.

D)is independent of the interest rate.

A)varies directly with the interest rate.

B)varies inversely with the interest rate.

C)varies inversely with the GDP.

D)is independent of the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

59

The total quantity of money demanded is determined by:

A)subtracting the asset demand for money from the transactions demand for money.

B)adding the transactions demand for money to the asset demand for money.

C)subtracting the transactions demand for money from nominal GDP.

D)adding the asset demand for money to nominal GDP.

A)subtracting the asset demand for money from the transactions demand for money.

B)adding the transactions demand for money to the asset demand for money.

C)subtracting the transactions demand for money from nominal GDP.

D)adding the asset demand for money to nominal GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which line in the above graph would best reflect the slope of the asset demand for money curve?

Which line in the above graph would best reflect the slope of the asset demand for money curve?A)line 1

B)line 2

C)line 3

D)line 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

61

Refer to the above information.The total demand for money curve in this market for money would graph as a:

Refer to the above information.The total demand for money curve in this market for money would graph as a:A)vertical line.

B)horizontal line.

C)line sloping upward to the right.

D)line sloping downward to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

62

Refer to the information below.If the money supply is $160, the equilibrium interest rate will be: Columns (1) and (2) indicate the transactions demand (Dt) for money and columns (1) and (3) show the asset demand (Da) for money:

A)10 percent.

B)8 percent.

C)6 percent.

D)4 percent.

A)10 percent.

B)8 percent.

C)6 percent.

D)4 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

63

The interest rate will fall when the:

A)quantity of money demanded exceeds the quantity of money supplied.

B)quantity of money supplied exceeds the quantity of money demanded.

C)demand for money increases.

D)supply of money decreases.

A)quantity of money demanded exceeds the quantity of money supplied.

B)quantity of money supplied exceeds the quantity of money demanded.

C)demand for money increases.

D)supply of money decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

64

Refer to the diagram below for the market for money.Other things equal, the money demand curve in the diagram would shift leftward if:

A)the asset demand for money increased.

B)the transactions demand for money increased.

C)nominal GDP decreased.

D)the overall price level rose.

A)the asset demand for money increased.

B)the transactions demand for money increased.

C)nominal GDP decreased.

D)the overall price level rose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

65

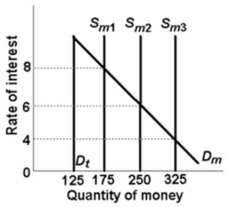

Refer to the above diagram for the market for money.If each dollar held for transactions purposes is spent four times per year on the average, we can infer that the:

Refer to the above diagram for the market for money.If each dollar held for transactions purposes is spent four times per year on the average, we can infer that the:A)real GDP is $800.

B)nominal GDP is $800.

C)money supply must be $800.

D)nominal GDP is $1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

66

Refer to the above diagram for the market for money.The total demand for money is shown by:

Refer to the above diagram for the market for money.The total demand for money is shown by:A)D1.

B)D2.

C)S.

D)D3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

67

In which of the following instances can we be certain that the quantity of money demanded by the public will decrease?

A)nominal GDP decreases and the interest rate decreases

B)nominal GDP increases and the interest rate decreases

C)nominal GDP decreases and the interest rate increases

D)nominal GDP increases and the interest rate increases

A)nominal GDP decreases and the interest rate decreases

B)nominal GDP increases and the interest rate decreases

C)nominal GDP decreases and the interest rate increases

D)nominal GDP increases and the interest rate increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

68

If in the market for money the quantity of money demanded exceeds the money supply, we would expect the interest rate to:

A)fall, causing households and businesses to hold less money.

B)rise, causing households and businesses to hold less money.

C)rise, causing households and businesses to hold more money.

D)fall, causing households and businesses to hold more money.

A)fall, causing households and businesses to hold less money.

B)rise, causing households and businesses to hold less money.

C)rise, causing households and businesses to hold more money.

D)fall, causing households and businesses to hold more money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

69

Assume the equation for the total demand for money is L = .4Y + 80 - 4i, where L is the amount of money demanded, Y is gross domestic product, and i is the interest rate.If gross domestic product is $200 and the interest rate is 10 (percent), what amount of money will society want to hold?

A)$200

B)$120

C)$320

D)$160

A)$200

B)$120

C)$320

D)$160

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

70

The equilibrium rate of interest in the market for money is determined by:

A)the intersection of the supply of money and the asset demand for money.

B)the intersection of the supply of money and the transactions demand for money.

C)the intersection of the supply of money and the total demand for money.

D)none of the above.

A)the intersection of the supply of money and the asset demand for money.

B)the intersection of the supply of money and the transactions demand for money.

C)the intersection of the supply of money and the total demand for money.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

71

It is assumed that households and businesses want to hold for transactions purposes an amount of money equal to one-half of the GDP.The table shows the amounts of money that households and businesses want to hold as an asset at various interest rates.  Refer to the information above.If the GDP is $300 and the supply of money is $230, the equilibrium interest rate will be:

Refer to the information above.If the GDP is $300 and the supply of money is $230, the equilibrium interest rate will be:

A)8 percent.

B)6 percent.

C)2 percent.

D)4 percent.

Refer to the information above.If the GDP is $300 and the supply of money is $230, the equilibrium interest rate will be:

Refer to the information above.If the GDP is $300 and the supply of money is $230, the equilibrium interest rate will be:A)8 percent.

B)6 percent.

C)2 percent.

D)4 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

72

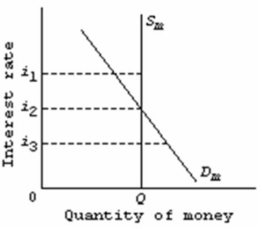

Refer to the above table.Suppose the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table.If the nominal GDP is $2000 billion, the equilibrium interest rate is:

Refer to the above table.Suppose the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table.If the nominal GDP is $2000 billion, the equilibrium interest rate is:A)4 percent.

B)5 percent.

C)6 percent.

D)7 percent. Refer to the above table.Suppose the transa.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

73

Refer to the above information.All else equal, the transaction demand for money in this table would increase if:

Refer to the above information.All else equal, the transaction demand for money in this table would increase if:A)nominal GDP increased.

B)the interest rate fell.

C)the supply of money increased.

D)the supply of money decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

74

The total demand for money will shift to the left as a result of:

A)a decline in nominal GDP.

B)an increase in the price level.

C)a change in the interest rate.

D)an increase in nominal GDP.

A)a decline in nominal GDP.

B)an increase in the price level.

C)a change in the interest rate.

D)an increase in nominal GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

75

Refer to the above table.Suppose the transactions demand for money is $300 billion and the money supply is $700 billion.A decrease in the money supply to $600 billion would cause the interest rate to:

Refer to the above table.Suppose the transactions demand for money is $300 billion and the money supply is $700 billion.A decrease in the money supply to $600 billion would cause the interest rate to:A)rise to 7 percent.

B)rise to 6 percent.

C)fall to 4 percent.

D)fall to 5 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

76

Refer to the above information.At equilibrium in the market for money, the total amount of money demanded is:

Refer to the above information.At equilibrium in the market for money, the total amount of money demanded is:A)$500

B)$480

C)$460

D)$440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

77

When the market for money is in equilibrium:

A)the quantity of money demanded equals the quantity of money supplied.

B)the interest rate is neither increasing nor decreasing.

C)bond prices are stable.

D)all of the above hold true.

A)the quantity of money demanded equals the quantity of money supplied.

B)the interest rate is neither increasing nor decreasing.

C)bond prices are stable.

D)all of the above hold true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

78

An increase in nominal GDP increases the demand for money because:

A)interest rates will rise.

B)more money is needed to finance a larger volume of transactions.

C)bond prices will fall.

D)the opportunity cost of holding money will decline.

A)interest rates will rise.

B)more money is needed to finance a larger volume of transactions.

C)bond prices will fall.

D)the opportunity cost of holding money will decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

79

If the demand for money and the supply of money both decrease, we can conclude that at the equilibrium:

A)interest rate will decline, but we cannot predict the change in the equilibrium quantity of money.

B)quantity of money and the equilibrium interest rate will both increase.

C)quantity of money will increase, but we cannot predict the change in the equilibrium interest rate.

D)quantity of money will decline, but we cannot predict the change in the equilibrium interest rate.

A)interest rate will decline, but we cannot predict the change in the equilibrium quantity of money.

B)quantity of money and the equilibrium interest rate will both increase.

C)quantity of money will increase, but we cannot predict the change in the equilibrium interest rate.

D)quantity of money will decline, but we cannot predict the change in the equilibrium interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck

80

If the quantity of money demanded exceeds the quantity supplied:

A)the supply-of-money curve will shift to the left.

B)the demand-for-money curve will shift to the right.

C)the interest rate will fall.

D)the interest rate will rise.

A)the supply-of-money curve will shift to the left.

B)the demand-for-money curve will shift to the right.

C)the interest rate will fall.

D)the interest rate will rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 239 في هذه المجموعة.

فتح الحزمة

k this deck