Deck 11: Imperfect Competition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/110

العب

ملء الشاشة (f)

Deck 11: Imperfect Competition

1

The theory of oligopoly suggests that

A) entry into the industry is an important force preventing the exploitation of market power by existing firms.

B) game theory is interesting theory but not useful for real corporate managers.

C) the tendency toward joint maximization of profits is greater for a large number of sellers than for a small number of sellers.

D) innovation is weak when there is no price competition.

E) oligopoly may be the best of the feasible alternative market structures when major scale economies exist.

A) entry into the industry is an important force preventing the exploitation of market power by existing firms.

B) game theory is interesting theory but not useful for real corporate managers.

C) the tendency toward joint maximization of profits is greater for a large number of sellers than for a small number of sellers.

D) innovation is weak when there is no price competition.

E) oligopoly may be the best of the feasible alternative market structures when major scale economies exist.

E

2

In imperfectly competitive markets, "administered" prices usually change than prices in perfectly competitive markets, because _ .

A) more often; perfectly competitive firms are price takers

B) less often; changing prices is costless

C) less often; changing prices is costly

D) more often; price becomes a strategic choice

E) more often; they are more flexible

A) more often; perfectly competitive firms are price takers

B) less often; changing prices is costless

C) less often; changing prices is costly

D) more often; price becomes a strategic choice

E) more often; they are more flexible

C

3

The table below shows the market shares for the only firms in a domestic cement market.

-Refer to Table 11- 1. The four- firm concentration ratio in this industry is percent.

A) 67

B) 45

C) 85

D) 92

E) 100

-Refer to Table 11- 1. The four- firm concentration ratio in this industry is percent.

A) 67

B) 45

C) 85

D) 92

E) 100

85

4

An imperfectly competitive industry is often allocatively inefficient when compared to the performance of a competitive industry, because imperfect competitors

A) make profits.

B) operate in the global economy.

C) obtain economies of scale.

D) set price above the marginal cost.

E) maximize profits.

A) make profits.

B) operate in the global economy.

C) obtain economies of scale.

D) set price above the marginal cost.

E) maximize profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

5

By calculating a concentration ratio, economists measure the

A) degree to which firms in the industry use similar technologies.

B) control of a monopolist over its input prices.

C) concentration of firms in one geographic location.

D) fraction of total industry sales accounted for by the largest firms.

E) degree to which a monopolist's output is lower than in perfect competition.

A) degree to which firms in the industry use similar technologies.

B) control of a monopolist over its input prices.

C) concentration of firms in one geographic location.

D) fraction of total industry sales accounted for by the largest firms.

E) degree to which a monopolist's output is lower than in perfect competition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

6

Suppose there are only two firms in an industry. If they each set a high price, they each earn $5000. If they each set a low price, they each earn $2500. If one firm sets a low price while the other sets a high price, the low- price firm earns $7000 while the high- price firm earns $1000. Does a prisoners' dilemma exist?

A) no, the Nash equilibrium does not maximize the individual payoff

B) it cannot be determined from the information provided

C) no, the Nash equilibrium does not maximize the joint payoff

D) yes, the Nash equilibrium does not maximize the joint payoff

E) yes, because there is always a prisoner's dilemma in game theory

A) no, the Nash equilibrium does not maximize the individual payoff

B) it cannot be determined from the information provided

C) no, the Nash equilibrium does not maximize the joint payoff

D) yes, the Nash equilibrium does not maximize the joint payoff

E) yes, because there is always a prisoner's dilemma in game theory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

7

The table below shows the market shares for the only firms in a domestic cement market.

-Refer to Table 11- 1. The eight- firm concentration ratio in this industry is percent.

A) 85

B) 45

C) 100

D) 92

E) 67

-Refer to Table 11- 1. The eight- firm concentration ratio in this industry is percent.

A) 85

B) 45

C) 100

D) 92

E) 67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

8

In which market structure are price fluctuations most common?

A) perfect competition

B) price fluctuations occur with the same frequency in all market structures

C) monopolistic competition

D) monopoly

E) oligopoly

A) perfect competition

B) price fluctuations occur with the same frequency in all market structures

C) monopolistic competition

D) monopoly

E) oligopoly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

9

"Brand proliferation" is an example of

A) an economy of scale.

B) predatory pricing.

C) an absolute cost advantage.

D) a firm- created barrier to entry.

E) collusive behaviour.

A) an economy of scale.

B) predatory pricing.

C) an absolute cost advantage.

D) a firm- created barrier to entry.

E) collusive behaviour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

10

Explicit collusion in an oligopolistic industry

A) occurs when firms achieve the cooperative outcome without an explicit agreement.

B) is a form of predatory pricing.

C) results in competitive behaviour.

D) occurs when firms make an explicit agreement to cooperate.

E) results in a non- cooperative equilibrium.

A) occurs when firms achieve the cooperative outcome without an explicit agreement.

B) is a form of predatory pricing.

C) results in competitive behaviour.

D) occurs when firms make an explicit agreement to cooperate.

E) results in a non- cooperative equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

11

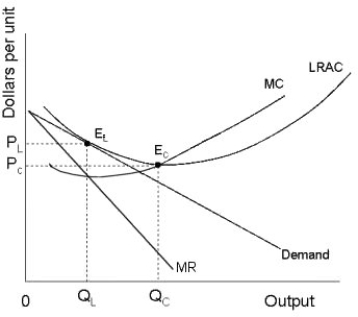

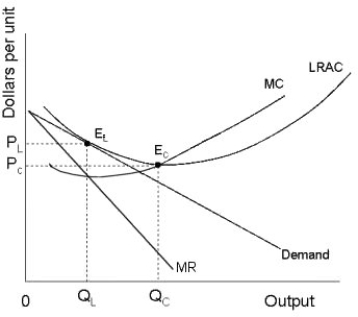

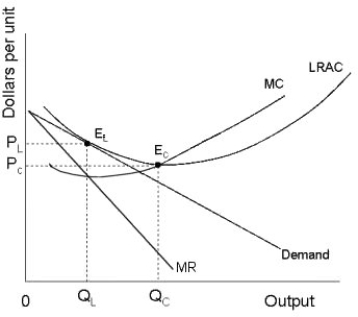

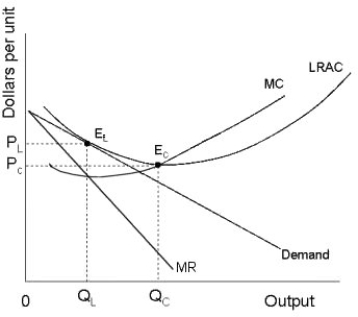

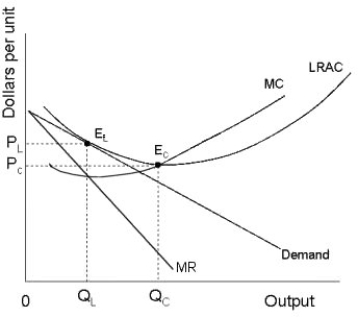

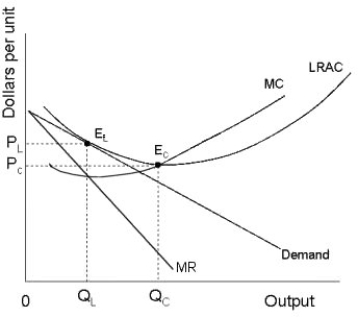

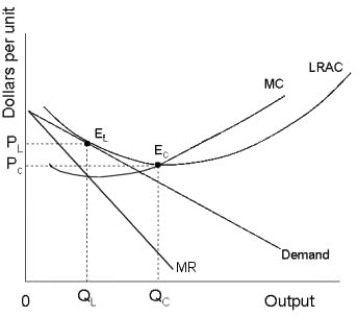

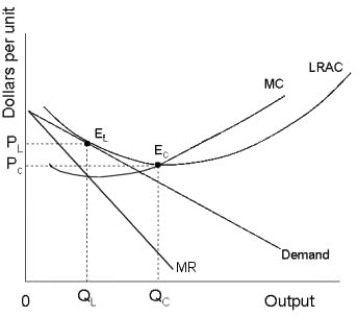

The diagram below shows demand and cost curves for a monopolistically competitive firm.  FIGURE 11- 3

FIGURE 11- 3

Refer to Figure 11- 3. In the long run, a monopolistically competitive firm will

A) produce the output where AC is at its minimum.

B) produce QC at Price PL.

C) produce QL at Price PC.

D) produce QC at Price PC.

E) produce QL at Price PL.

FIGURE 11- 3

FIGURE 11- 3Refer to Figure 11- 3. In the long run, a monopolistically competitive firm will

A) produce the output where AC is at its minimum.

B) produce QC at Price PL.

C) produce QL at Price PC.

D) produce QC at Price PC.

E) produce QL at Price PL.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

12

A good example of a monopolistically competitive firm is

1) The Gap clothing store.

2) Dairy Queen.

3) a Prince Edward Island potato farmer.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2 only

E) 1 and 3 only

1) The Gap clothing store.

2) Dairy Queen.

3) a Prince Edward Island potato farmer.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2 only

E) 1 and 3 only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following products is best considered a differentiated product?

A) topsoil

B) wheat

C) sugar

D) steel

E) shampoo

A) topsoil

B) wheat

C) sugar

D) steel

E) shampoo

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

14

An example of a Canadian industry composed of a few large firms is

A) clothing retailing.

B) restaurants.

C) hair dressers.

D) the accounting profession.

E) gasoline retailing.

A) clothing retailing.

B) restaurants.

C) hair dressers.

D) the accounting profession.

E) gasoline retailing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

15

The diagram below shows demand and cost curves for a monopolistically competitive firm.  FIGURE 11- 3

FIGURE 11- 3

Refer to Figure 11- 3. A monopolistically competitive firm is allocatively inefficient because in the long- run equilibrium

A) price is greater than LRAC at QL.

B) price is greater than MC at QL.

C) MC is greater than price.

D) LRAC is not at its minimum.

E) none of the above -- the long- run equilibrium is allocatively efficient.

FIGURE 11- 3

FIGURE 11- 3Refer to Figure 11- 3. A monopolistically competitive firm is allocatively inefficient because in the long- run equilibrium

A) price is greater than LRAC at QL.

B) price is greater than MC at QL.

C) MC is greater than price.

D) LRAC is not at its minimum.

E) none of the above -- the long- run equilibrium is allocatively efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

16

A Nash equilibrium

A) is an example of a cooperative equilibrium.

B) occurs where all players are maximizing their payoffs given the current behaviour of the other players.

C) occurs where all players are better off than they would be with any other combination of strategies.

D) will in general produce the greatest payoff for the players.

E) is an unstable equilibrium.

A) is an example of a cooperative equilibrium.

B) occurs where all players are maximizing their payoffs given the current behaviour of the other players.

C) occurs where all players are better off than they would be with any other combination of strategies.

D) will in general produce the greatest payoff for the players.

E) is an unstable equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

17

When a monopolistically competitive industry is in long- run equilibrium, the excess capacity in an individual firm is indicated by the difference between

A) price and average cost.

B) zero and the output at which the demand curve is tangent to the ATC curve.

C) the output at which ATC is at a minimum and the output at which price equals marginal cost.

D) the output at which ATC is at a minimum and the output at which marginal revenue is equal to marginal cost.

E) price and marginal cost.

A) price and average cost.

B) zero and the output at which the demand curve is tangent to the ATC curve.

C) the output at which ATC is at a minimum and the output at which price equals marginal cost.

D) the output at which ATC is at a minimum and the output at which marginal revenue is equal to marginal cost.

E) price and marginal cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

18

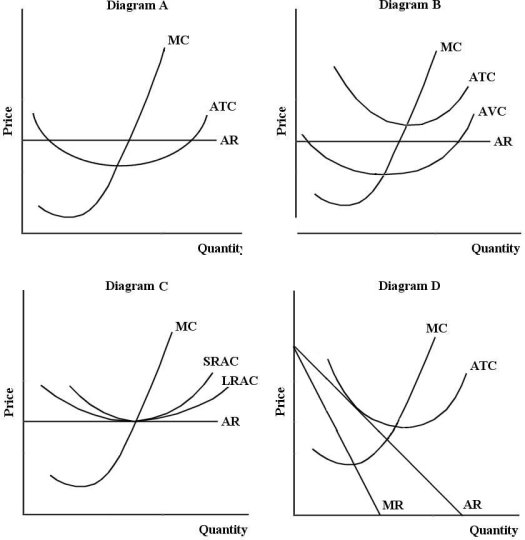

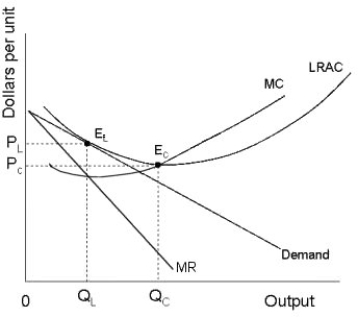

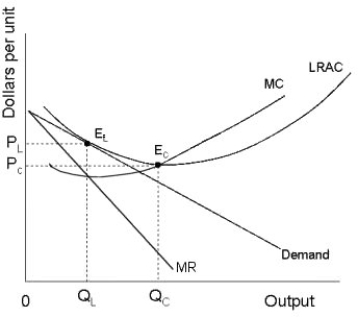

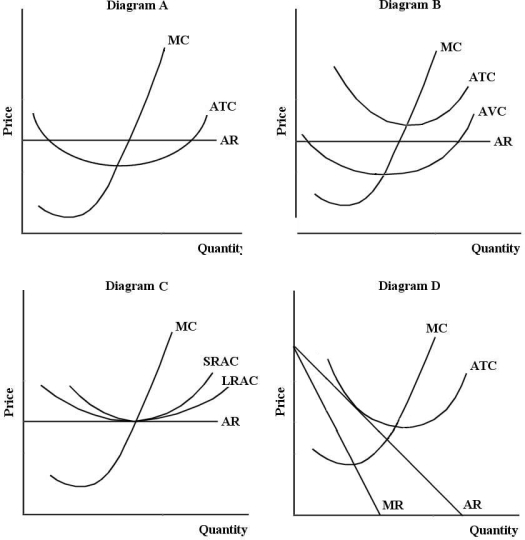

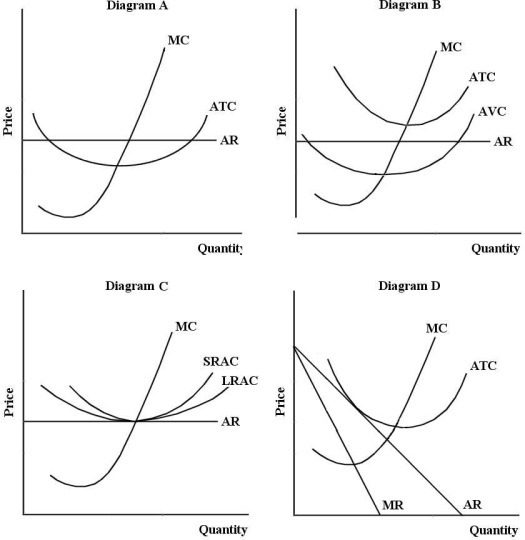

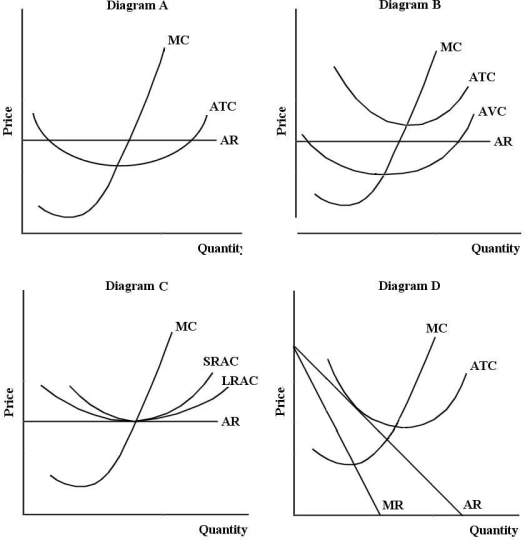

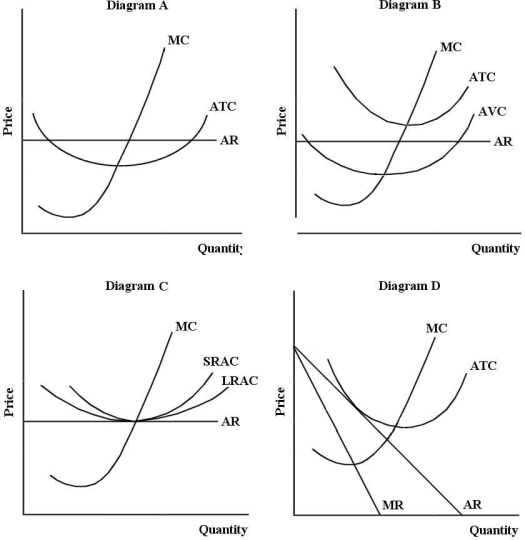

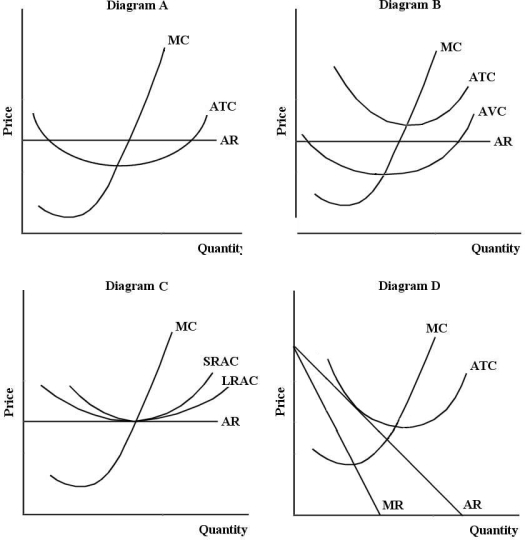

FIGURE 11- 2

FIGURE 11- 2Refer to Figure 11- 2. Diagram C depicts a typical firm in long- run equilibrium in

A) an imperfectly competitive industry

B) monopolistic industry.

C) oligopolistic industry.

D) monopolistically competitive industry.

E) a perfectly competitive industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

19

A monopolistically competitive firm is predicted to earn positive profits

A) only if it maintains excess capacity in the production of it product.

B) only if it advertises its own product.

C) because there are barriers to entry.

D) only in the long run.

E) only in the short run.

A) only if it maintains excess capacity in the production of it product.

B) only if it advertises its own product.

C) because there are barriers to entry.

D) only in the long run.

E) only in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

20

Consider an example of the prisoner's dilemma where 2 firms are making sealed bids on a contract and each firm is allowed to bid either $100 or $180. If both firms bid the same price, the job is shared equally and each firm earns half the value of its bid. Otherwise the lowest bidder wins the contract and receives the full value of its bid (and the other bidder earns zero). The cooperative outcome in this situation is

A) both firms bid $50.

B) both firms bid $180.

C) both firms bid $100.

D) both firms bid $90.

E) one firm bids $100, the other firm bids $180.

A) both firms bid $50.

B) both firms bid $180.

C) both firms bid $100.

D) both firms bid $90.

E) one firm bids $100, the other firm bids $180.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

21

Suppose the market for gasoline retailing (gas stations) in an island economy has 12 firms. The two largest firms each account for 30 percent of sales, the third accounts for 15 percent, the fourth for 7 percent, the fifth for 4 percent and the remaining firms for 2 percent each. Which of the following statements best describes the structure of this local industry?

A) This industry is an oligopoly.

B) This industry is perfectly competitive.

C) This industry is a monopoly.

D) This industry is monopolistically competitive.

E) Either A or D could be correct.

A) This industry is an oligopoly.

B) This industry is perfectly competitive.

C) This industry is a monopoly.

D) This industry is monopolistically competitive.

E) Either A or D could be correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

22

Suppose two firms, Allstom from France, and Bombardier from Canada, are bidding on a contract to replace train cars for the subway system in Mexico City. If they bid the same amount, they share the contract-otherwise, the low bid wins. The figure below shows the payoff matrix for this contest. FIGURE 11- 4

-Refer to Figure 11- 4. What is the Nash equilibrium in this bidding contest between Allstom and Bombardier?

A) The two firms will co- operate and maximize their joint profits at $10 million each.

B) Each firm will bid the high price, expecting a larger total profit.

C) Each firm will bid the low price, and each will earn a profit of $2.5 million.

D) There is no Nash equilibrium in this bidding contest, because each firm can expect to earn at least $5 million.

E) both A and C are Nash equilibrium.

-Refer to Figure 11- 4. What is the Nash equilibrium in this bidding contest between Allstom and Bombardier?

A) The two firms will co- operate and maximize their joint profits at $10 million each.

B) Each firm will bid the high price, expecting a larger total profit.

C) Each firm will bid the low price, and each will earn a profit of $2.5 million.

D) There is no Nash equilibrium in this bidding contest, because each firm can expect to earn at least $5 million.

E) both A and C are Nash equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

23

Consider an example of the prisoner's dilemma where 2 firms are making sealed bids on a highway- construction contract and each firm is allowed to bid either $100 million or $120 million. If both firms bid the same price, the job is shared equally and each firm earns half the value of its bid. Otherwise the lowest bidder wins the contract and receives the full value of its bid (and the other bidder earns zero). The non- cooperative outcome in this situation is

A) both firms bid $100 million.

B) both firms bid $60 million.

C) both firms bid $50 million.

D) both firms bid $120 million.

E) one firm bids $100 million, the other firm bids $120 million.

A) both firms bid $100 million.

B) both firms bid $60 million.

C) both firms bid $50 million.

D) both firms bid $120 million.

E) one firm bids $100 million, the other firm bids $120 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

24

Suppose the 2- firm concentration ratio (measuring output) in a Canadian manufacturing industry is over 90 percent. Why might the market power of these 2 firms be less than the concentration ratio suggests?

A) The product is traded internationally and the two Canadian firms compete with many global rivals.

B) A 2- firm concentration ratio does not provide enough information.

C) A high concentration ratio usually indicates low degrees of market power.

D) The product is purely domestic and there is no international trade.

E) The relevant market is regional and so the concentration ratio is not relevant.

A) The product is traded internationally and the two Canadian firms compete with many global rivals.

B) A 2- firm concentration ratio does not provide enough information.

C) A high concentration ratio usually indicates low degrees of market power.

D) The product is purely domestic and there is no international trade.

E) The relevant market is regional and so the concentration ratio is not relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

25

The main difference between perfect competition and monopolistic competition is

A) monopolistic competition has product differentiation.

B) there are more firms in perfect competition.

C) firms earn profits in the long run in monopolistic competition.

D) perfect competition has freedom of entry and exit.

E) monopolistic competition has lower costs.

A) monopolistic competition has product differentiation.

B) there are more firms in perfect competition.

C) firms earn profits in the long run in monopolistic competition.

D) perfect competition has freedom of entry and exit.

E) monopolistic competition has lower costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

26

One reason an oligopolistic firm may have market power is that

A) it produces a significant fraction of total industry output.

B) it always makes positive profits.

C) the market may be "contestable".

D) there are many similar producers.

E) it has diseconomies of scale.

A) it produces a significant fraction of total industry output.

B) it always makes positive profits.

C) the market may be "contestable".

D) there are many similar producers.

E) it has diseconomies of scale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

27

One prediction about monopolistic competition is that it has higher unit costs than perfect competition. But it is unreasonable to conclude that monopolistic competition is therefore bad for consumers because

A) consumers benefit from products becoming more homogeneous.

B) consumers benefit from lower prices.

C) consumers benefit from an increased variety of products.

D) consumers benefit because of an increase in quantity available.

E) higher production costs means more employment.

A) consumers benefit from products becoming more homogeneous.

B) consumers benefit from lower prices.

C) consumers benefit from an increased variety of products.

D) consumers benefit because of an increase in quantity available.

E) higher production costs means more employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

28

If entry into a monopolistically competitive industry occurs because of positive profits earned by the existing firms, the

A) industry demand curve will shift to the right.

B) demand curve for each existing firm will shift to the left.

C) demand curves for the existing firms will remain unchanged.

D) demand curve for each existing firm will shift to the right.

E) industry demand curve will shift to the left.

A) industry demand curve will shift to the right.

B) demand curve for each existing firm will shift to the left.

C) demand curves for the existing firms will remain unchanged.

D) demand curve for each existing firm will shift to the right.

E) industry demand curve will shift to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

29

Oligopolists make decisions after taking into account the expected reaction of their competitors. In doing this, oligopolists are exhibiting

A) cooperative behaviour.

B) collusive behaviour.

C) non- cooperative behaviour.

D) strategic behaviour.

E) non- strategic behaviour.

A) cooperative behaviour.

B) collusive behaviour.

C) non- cooperative behaviour.

D) strategic behaviour.

E) non- strategic behaviour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

30

A special kind of imperfectly competitive market that has only two firms is called

A) a natural monopoly.

B) an incidental monopoly.

C) a two- tier competitive structure.

D) a dublet.

E) a duopoly.

A) a natural monopoly.

B) an incidental monopoly.

C) a two- tier competitive structure.

D) a dublet.

E) a duopoly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

31

are products that differ from each other enough that they can be sold at different prices, but are similar enough that they can be considered the same product.

A) Necessary products

B) Differentiated products

C) Standardized products

D) Inferior products

E) Complementary products

A) Necessary products

B) Differentiated products

C) Standardized products

D) Inferior products

E) Complementary products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

32

In a monopolistically competitive industry, the freedom of entry and exit leads to

A) zero profits in long- run equilibrium.

B) a negatively sloped demand curve for the industry.

C) deficient capacity in the industry.

D) strategic behaviour with regard to other firms in the industry.

E) brand proliferation.

A) zero profits in long- run equilibrium.

B) a negatively sloped demand curve for the industry.

C) deficient capacity in the industry.

D) strategic behaviour with regard to other firms in the industry.

E) brand proliferation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

33

For firms in an oligopoly, the main advantage of explicit collusion is that it

A) eliminates the gains from cheating.

B) leads to greater product differentiation.

C) reduces the cost per unit of advertising.

D) removes much of the uncertainty about rivals' reactions.

E) makes all firms more productively efficient.

A) eliminates the gains from cheating.

B) leads to greater product differentiation.

C) reduces the cost per unit of advertising.

D) removes much of the uncertainty about rivals' reactions.

E) makes all firms more productively efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

34

In Canada, concentration ratios are the highest in

A) clothing industries.

B) tobacco products.

C) mining.

D) petroleum and coal products.

E) machinery.

A) clothing industries.

B) tobacco products.

C) mining.

D) petroleum and coal products.

E) machinery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

35

The payoff matrix below shows the payoffs for Firm A and Firm B, each of whom can either "cooperate" or "cheat". The numbers in parentheses are (payoff for A, payoff for B).

-Refer to Table 11- 2. If Firm A is indifferent between cheating or cooperating when Firm B chooses to cooperate, x must be equal to

A) 10.

B) 0.

C) 40.

D) 30.

E) 20.

-Refer to Table 11- 2. If Firm A is indifferent between cheating or cooperating when Firm B chooses to cooperate, x must be equal to

A) 10.

B) 0.

C) 40.

D) 30.

E) 20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

36

Consider the following characteristics of a particular industry:

- there is freedom of entry and exit

- in long- run equilibrium, each firm is producing a level of output where there are increasing returns to scale

This industry is likely to be

A) highly concentrated.

B) perfectly competitive.

C) monopolistically competitive.

D) an oligopoly.

E) a cartel.

- there is freedom of entry and exit

- in long- run equilibrium, each firm is producing a level of output where there are increasing returns to scale

This industry is likely to be

A) highly concentrated.

B) perfectly competitive.

C) monopolistically competitive.

D) an oligopoly.

E) a cartel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

37

The payoff matrix below shows the payoffs for Firm A and Firm B, each of whom can either "cooperate" or "cheat". The numbers in parentheses are (payoff for A, payoff for B).

-Refer to Table 11- 2. Of the choices provided below, what is the minimum value for x in order for both firms' cheating to be a Nash equilibrium?

A) 25

B) 80

C) 70

D) 60

E) 40

-Refer to Table 11- 2. Of the choices provided below, what is the minimum value for x in order for both firms' cheating to be a Nash equilibrium?

A) 25

B) 80

C) 70

D) 60

E) 40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

38

When the firms in an oligopoly are in a cooperative equilibrium and are maximizing their joint profits, which of the following statements is true?

A) MR > MC for each individual firm.

B) P > MC for each individual firm.

C) The firms in the industry will jointly be earning monopoly profits.

D) An individual firm could increase profits by cheating.

E) All of the above statements are true.

A) MR > MC for each individual firm.

B) P > MC for each individual firm.

C) The firms in the industry will jointly be earning monopoly profits.

D) An individual firm could increase profits by cheating.

E) All of the above statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

39

With respect to imperfectly competitive markets, an "administered" price is a price determined by

A) a regulatory agency.

B) international competition.

C) solely by market forces.

D) the conscious decision of the firm.

E) the government.

A) a regulatory agency.

B) international competition.

C) solely by market forces.

D) the conscious decision of the firm.

E) the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

40

The presence of significant scale economies in an industry implies that

A) the minimum efficient scale of operation occurs at fairly low output levels.

B) barriers to entry in the industry are non- existent.

C) the firms in the industry will behave as perfect competitors.

D) this industry is more efficient than others.

E) a large share of the market is required by each firm to achieve the lowest possible cost per unit.

A) the minimum efficient scale of operation occurs at fairly low output levels.

B) barriers to entry in the industry are non- existent.

C) the firms in the industry will behave as perfect competitors.

D) this industry is more efficient than others.

E) a large share of the market is required by each firm to achieve the lowest possible cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

41

One difference between a perfectly competitive market and a monopolistically competitive market is that

A) there is no product differentiation in perfect competition.

B) there is strategic interaction among firms in monopolistic competition.

C) there is no product differentiation in monopolistic competition.

D) there are no barriers to entry in monopolistic competition.

E) there are no barriers to exit in monopolistic competition.

A) there is no product differentiation in perfect competition.

B) there is strategic interaction among firms in monopolistic competition.

C) there is no product differentiation in monopolistic competition.

D) there are no barriers to entry in monopolistic competition.

E) there are no barriers to exit in monopolistic competition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

42

29 The payoff matrix below shows the payoffs for Firm A and Firm B, each of whom can either "cooperate" or "cheat". The numbers in parentheses are (payoff for A, payoff for B).

-Refer to Table 11- 2. If x = 40, what is the Nash equilibrium in this game?

A) (Firm A: cheat, Firm B: cheat)

B) (Firm A: cooperate, Firm B: cheat)

C) (Firm A: cheat, Firm B: cooperate)

D) (Firm A: cooperate, Firm B: cooperate)

E) there is no Nash equilibrium for this value of x

-Refer to Table 11- 2. If x = 40, what is the Nash equilibrium in this game?

A) (Firm A: cheat, Firm B: cheat)

B) (Firm A: cooperate, Firm B: cheat)

C) (Firm A: cheat, Firm B: cooperate)

D) (Firm A: cooperate, Firm B: cooperate)

E) there is no Nash equilibrium for this value of x

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

43

Consider an example of the prisoner's dilemma where 2 firms are making sealed bids on a highway- construction contract and each firm is allowed to bid either $100 million or $120 million. If both firms bid the same price, the job is shared equally and each firm earns half the value of its bid. Otherwise the lowest bidder wins the contract and receives the full value of its bid (and the other bidder earns zero). The cooperative outcome in this situation is

A) both firms bid $100 million.

B) both firms bid $120 million.

C) both firms bid $50 million.

D) one firm bids $100 million, the other firm bids $120 million.

E) both firms bid $60 million.

A) both firms bid $100 million.

B) both firms bid $120 million.

C) both firms bid $50 million.

D) one firm bids $100 million, the other firm bids $120 million.

E) both firms bid $60 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

44

An oligopolistic firm can earn positive profits

A) only if it maintains excess capacity in the production of it product.

B) only in the short run.

C) because there are barriers to entry.

D) only in the long run.

E) only if it advertises its own product.

A) only if it maintains excess capacity in the production of it product.

B) only in the short run.

C) because there are barriers to entry.

D) only in the long run.

E) only if it advertises its own product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

45

If firms are able to freely enter and exit a monopolistically competitive industry, then we can predict

A) strategic behaviour with regard to other firms in the industry.

B) zero profits in long- run equilibrium.

C) brand proliferation.

D) that exit will occur until no firm has excess capacity.

E) a negatively sloped demand curve for the industry.

A) strategic behaviour with regard to other firms in the industry.

B) zero profits in long- run equilibrium.

C) brand proliferation.

D) that exit will occur until no firm has excess capacity.

E) a negatively sloped demand curve for the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

46

The diagram below shows demand and cost curves for a monopolistically competitive firm.  FIGURE 11- 3

FIGURE 11- 3

Refer to Figure 11- 3. If an increase in industry demand led to an outward shift in each firm's demand curve, the typical firm would

A) be making losses and some firms would exit the industry in the long run.

B) increase costs in order to break even at PL and QL in the long run.

C) be making profits and new firms would enter the industry in the long run.

D) would expand its output in the long run.

E) decrease costs in order to break even at PL and QL in the long run.

FIGURE 11- 3

FIGURE 11- 3Refer to Figure 11- 3. If an increase in industry demand led to an outward shift in each firm's demand curve, the typical firm would

A) be making losses and some firms would exit the industry in the long run.

B) increase costs in order to break even at PL and QL in the long run.

C) be making profits and new firms would enter the industry in the long run.

D) would expand its output in the long run.

E) decrease costs in order to break even at PL and QL in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

47

A good example of a monopolistically competitive firm is

A) Harvey's.

B) Petro- Canada.

C) Bombardier.

D) a PEI potato farmer.

E) Apple.

A) Harvey's.

B) Petro- Canada.

C) Bombardier.

D) a PEI potato farmer.

E) Apple.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

48

Consider the following characteristics of a particular industry:

- each firm faces a demand curve with a price elasticity greater than 10 000

- each firm produces at a minimum efficient scale in long- run equilibrium This industry is likely to be

A) a cartel.

B) an oligopoly.

C) perfectly competitive.

D) highly concentrated.

E) monopolistically competitive.

- each firm faces a demand curve with a price elasticity greater than 10 000

- each firm produces at a minimum efficient scale in long- run equilibrium This industry is likely to be

A) a cartel.

B) an oligopoly.

C) perfectly competitive.

D) highly concentrated.

E) monopolistically competitive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

49

Consider the following characteristics of a particular industry:

- the four- firm concentration ratio is 78 percent (in the relevant market)

- each firm produces output where P > MC

- firms advertise their product This industry is likely to be

A) monopolistic.

B) a cartel.

C) perfectly competitive.

D) one where each firm has limited market power.

E) an oligopoly.

- the four- firm concentration ratio is 78 percent (in the relevant market)

- each firm produces output where P > MC

- firms advertise their product This industry is likely to be

A) monopolistic.

B) a cartel.

C) perfectly competitive.

D) one where each firm has limited market power.

E) an oligopoly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

50

The diagram below shows demand and cost curves for a monopolistically competitive firm.  FIGURE 11- 3

FIGURE 11- 3

Refer to Figure 11- 3. If a decrease in industry demand led to an inward shift of each firm's demand curve, a typical firm would

A) be making profits and new firms would enter the industry in the long run.

B) decrease costs in order to break even at PL and QL in the long run.

C) exit the industry and the industry would shut down.

D) be making losses and some firms would exit the industry in the long run.

E) increase costs in order to break even at PL and QL in the long run.

FIGURE 11- 3

FIGURE 11- 3Refer to Figure 11- 3. If a decrease in industry demand led to an inward shift of each firm's demand curve, a typical firm would

A) be making profits and new firms would enter the industry in the long run.

B) decrease costs in order to break even at PL and QL in the long run.

C) exit the industry and the industry would shut down.

D) be making losses and some firms would exit the industry in the long run.

E) increase costs in order to break even at PL and QL in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

51

The diagram below shows demand and cost curves for a monopolistically competitive firm.  FIGURE 11- 3

FIGURE 11- 3

Refer to Figure 11- 3. In the long run, a monopolistically competitive firm will

A) make profit by producing at QC and charging price PL.

B) maximize profit by producing output level QC , the minimum point of its LRAC curve

C) lose money by producing at QL and charging price PC.

D) maximize profit but only break even by producing at QL and charging price PL.

E) maximize profit and make positive profit by producing at QL and charging price PL.

FIGURE 11- 3

FIGURE 11- 3Refer to Figure 11- 3. In the long run, a monopolistically competitive firm will

A) make profit by producing at QC and charging price PL.

B) maximize profit by producing output level QC , the minimum point of its LRAC curve

C) lose money by producing at QL and charging price PC.

D) maximize profit but only break even by producing at QL and charging price PL.

E) maximize profit and make positive profit by producing at QL and charging price PL.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

52

FIGURE 11- 2

FIGURE 11- 2Refer to Figure 11- 2. The position of a typical firm when the industry is in long- run equilibrium with free entry and exit and product differentiation is exhibited in diagram

A) A.

B) B.

C) C.

D) D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

53

FIGURE 11- 2

FIGURE 11- 2Refer to Figure 11- 2. In diagram A, the profit- maximizing output for a competitive firm is one where

A) P > MC.

B) P < MC.

C) P = AR = MC.

D) AR = ATC.

E) ATC is at the minimum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

54

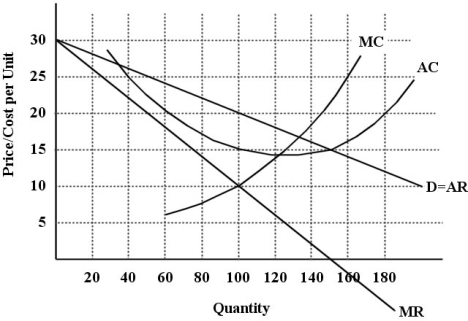

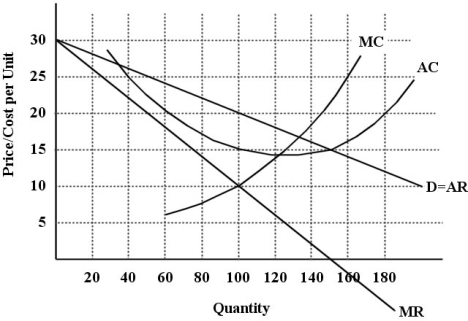

The diagram below shows selected cost and revenue curves for a firm in a monopolistically competitive industry.  FIGURE 11- 1

FIGURE 11- 1

Refer to Figure 11- 1. What price will this profit- maximizing firm set?

A) $20

B) $5

C) $25

D) $10

E) $15

FIGURE 11- 1

FIGURE 11- 1Refer to Figure 11- 1. What price will this profit- maximizing firm set?

A) $20

B) $5

C) $25

D) $10

E) $15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

55

A characteristic of a monopolistically competitive market is that

A) each firm faces a downward- sloping demand curve.

B) the firms in the industry engage in strategic, non- price competition.

C) the firms sell an identical product.

D) entry into the industry is difficult.

E) each firm's marginal revenue curve lies above its demand curve.

A) each firm faces a downward- sloping demand curve.

B) the firms in the industry engage in strategic, non- price competition.

C) the firms sell an identical product.

D) entry into the industry is difficult.

E) each firm's marginal revenue curve lies above its demand curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

56

Both empirical evidence and everyday observation suggest that oligopolies contribute to economic growth in the very- long- run by

A) achieving technological improvements and innovations through research and development.

B) achieving allocative efficiency.

C) decreasing minimum efficient scale.

D) rarely laying off workers.

E) consistently producing at full- capacity output.

A) achieving technological improvements and innovations through research and development.

B) achieving allocative efficiency.

C) decreasing minimum efficient scale.

D) rarely laying off workers.

E) consistently producing at full- capacity output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

57

The demand curve facing a monopolistically competitive firm is quite elastic because

A) there are many close substitutes to the good the firm is producing.

B) the industry is producing a homogeneous product.

C) of the possibility of entry of new firms.

D) goods that are complements to the good the firm is producing also have elastic demand curves.

E) firms are not behaving strategically.

A) there are many close substitutes to the good the firm is producing.

B) the industry is producing a homogeneous product.

C) of the possibility of entry of new firms.

D) goods that are complements to the good the firm is producing also have elastic demand curves.

E) firms are not behaving strategically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

58

A monopolistically competitive firm has some degree of market power because

A) it sells a differentiated product.

B) of natural barriers to entry.

C) it always makes positive profits.

D) of legal barriers to entry.

E) there are few firms in the industry.

A) it sells a differentiated product.

B) of natural barriers to entry.

C) it always makes positive profits.

D) of legal barriers to entry.

E) there are few firms in the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

59

A monopolistically competitive firm maximizes profits in the short run

A) by equating MC with price.

B) by equating MC with MR.

C) by maximizing total revenue.

D) when P = ATC.

E) when P = AVC.

A) by equating MC with price.

B) by equating MC with MR.

C) by maximizing total revenue.

D) when P = ATC.

E) when P = AVC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

60

FIGURE 11- 2

FIGURE 11- 2Refer to Figure 11- 2. In diagram D, the profit- maximizing output for a single- price monopolist occurs where

A) P > MC.

B) P = MC.

C) P < MC.

D) P > AR.

E) P = MR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

61

FIGURE 11- 2

FIGURE 11- 2Refer to Figure 11- 2. A perfectly competitive firm with zero economic profits is depicted in diagram

A) A.

B) B.

C) C.

D) D.

E) B or D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

62

In an oligopolistic industry, which of the following is an example of a firm- created entry barrier?

A) decreasing demand for the product

B) LRAC curve negatively sloped over a large range of output

C) price competition

D) large set- up costs

E) brand proliferation

A) decreasing demand for the product

B) LRAC curve negatively sloped over a large range of output

C) price competition

D) large set- up costs

E) brand proliferation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

63

One characteristic of oligopolistic markets is

A) zero profits in the long run.

B) ease of entry and exit.

C) a horizontal demand curve facing each individual firm.

D) mutual interdependence between firms.

E) a large number of firms in the industry.

A) zero profits in the long run.

B) ease of entry and exit.

C) a horizontal demand curve facing each individual firm.

D) mutual interdependence between firms.

E) a large number of firms in the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

64

Monopolistic competition is similar to perfect competition in that

A) strategic behaviour is common to both market structures.

B) firms in both types of market structure engage in non- price competition.

C) neither has significant barriers to entry.

D) each firm faces a horizontal demand curve.

E) firms in both types of market structures produce a standardized product.

A) strategic behaviour is common to both market structures.

B) firms in both types of market structure engage in non- price competition.

C) neither has significant barriers to entry.

D) each firm faces a horizontal demand curve.

E) firms in both types of market structures produce a standardized product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

65

The process of "creative destruction" in an oligopolistic industry suggests that

A) the prospect of keeping the resulting profits provides an incentive for firms to innovate.

B) there are no costs of exit in oligopoly.

C) profits are driven to zero by the entry of new firms.

D) no firm can survive in the long run.

E) firms can enter and leave without incurring any sunk costs of entry.

A) the prospect of keeping the resulting profits provides an incentive for firms to innovate.

B) there are no costs of exit in oligopoly.

C) profits are driven to zero by the entry of new firms.

D) no firm can survive in the long run.

E) firms can enter and leave without incurring any sunk costs of entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

66

Advertising by existing firms in an oligopolistic industry

A) only exists where natural entry barriers are weak.

B) can be an effective entry barrier to potential entrants to the industry.

C) will increase the expected market share of new entrants to the industry.

D) maximizes joint profits for firms in the industry.

E) allows easy entry to a new entrant with small sales.

A) only exists where natural entry barriers are weak.

B) can be an effective entry barrier to potential entrants to the industry.

C) will increase the expected market share of new entrants to the industry.

D) maximizes joint profits for firms in the industry.

E) allows easy entry to a new entrant with small sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

67

When a monopolistically competitive industry is in long- run equilibrium, each firm will be operating where price is

A) equal to average total cost and to marginal cost.

B) greater than marginal cost but equal to average total cost.

C) greater than average total cost and greater than marginal cost.

D) greater than average total cost but equal to marginal cost.

E) less than marginal cost and equal to average total cost.

A) equal to average total cost and to marginal cost.

B) greater than marginal cost but equal to average total cost.

C) greater than average total cost and greater than marginal cost.

D) greater than average total cost but equal to marginal cost.

E) less than marginal cost and equal to average total cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

68

Consider an industry that is monopolistically competitive. In such a market,

A) firms set prices without any threat of competition.

B) only one firm is present in the industry.

C) firms can charge slightly different prices even though they produce identical goods.

D) firms set prices and are constrained by the existence of close substitutes for their product.

E) firms do not have any price- setting ability because the product is homogeneous.

A) firms set prices without any threat of competition.

B) only one firm is present in the industry.

C) firms can charge slightly different prices even though they produce identical goods.

D) firms set prices and are constrained by the existence of close substitutes for their product.

E) firms do not have any price- setting ability because the product is homogeneous.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

69

If joint profits are to be maximized in an oligopolistic industry with a homogeneous product, the firms

A) have no individual incentive to cheat on the agreement.

B) can produce whatever output they want at the agreed- upon price.

C) must form a cartel in order to be legal.

D) need to determine the share of output each firm will produce.

E) none of the above -- differentiated products are required for joint- profit maximization in oligopoly.

A) have no individual incentive to cheat on the agreement.

B) can produce whatever output they want at the agreed- upon price.

C) must form a cartel in order to be legal.

D) need to determine the share of output each firm will produce.

E) none of the above -- differentiated products are required for joint- profit maximization in oligopoly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

70

Compared with perfect competition, monopolistic competition results in

A) a clearly more efficient social outcome.

B) fewer varieties of the good produced at lower unit costs.

C) a wider variety of the good produced at higher unit cost.

D) fewer varieties of the good produced at higher unit costs.

E) the same degree of variety of the good, but higher unit costs.

A) a clearly more efficient social outcome.

B) fewer varieties of the good produced at lower unit costs.

C) a wider variety of the good produced at higher unit cost.

D) fewer varieties of the good produced at higher unit costs.

E) the same degree of variety of the good, but higher unit costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following is a characteristic of oligopoly?

A) The pricing policies of one firm have no impact on pricing policies of other firms.

B) The industry usually has a low concentration ratio.

C) Firms compete solely on the basis of price.

D) Prices are usually above marginal costs.

E) There are large numbers of significantly sized sellers

A) The pricing policies of one firm have no impact on pricing policies of other firms.

B) The industry usually has a low concentration ratio.

C) Firms compete solely on the basis of price.

D) Prices are usually above marginal costs.

E) There are large numbers of significantly sized sellers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

72

The following statements describe a cooperative equilibrium in an oligopoly where the firms are jointly maximizing profits by restricting output. Which statement is false?

A) P > MC for each individual firm.

B) An individual firm could increase profits by cheating.

C) No individual firm will have an incentive to change output.

D) MR > MC for each individual firm.

E) The firms in the industry will jointly be earning monopoly profits.

A) P > MC for each individual firm.

B) An individual firm could increase profits by cheating.

C) No individual firm will have an incentive to change output.

D) MR > MC for each individual firm.

E) The firms in the industry will jointly be earning monopoly profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

73

Suppose Proctor and Gamble introduces a new brand of laundry detergent. Brand proliferation is an example of

A) explicit collusion.

B) a Nash equilibrium.

C) tacit collusion.

D) a cooperative outcome.

E) a firm- created barrier to entry.

A) explicit collusion.

B) a Nash equilibrium.

C) tacit collusion.

D) a cooperative outcome.

E) a firm- created barrier to entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

74

A monopolistically competitive firm and a monopoly are similar because

A) both firms always operate at their point of minimum average total cost.

B) both firms must behave strategically toward other firms in the industry.

C) each firm can raise its price without losing all of its sales.

D) each firm has a large number of small competitors.

E) both firms will earn zero profits in the long run.

A) both firms always operate at their point of minimum average total cost.

B) both firms must behave strategically toward other firms in the industry.

C) each firm can raise its price without losing all of its sales.

D) each firm has a large number of small competitors.

E) both firms will earn zero profits in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

75

In long- run equilibrium, a monopolistically competitive industry is characterized by

A) zero profits for all firms in the industry.

B) all firms operating at the minimum point of their long- run average cost curves.

C) positive profits for all firms in the industry.

D) positive profits as a result of barriers to entry.

E) a perfectly elastic demand curve facing each firm in the industry.

A) zero profits for all firms in the industry.

B) all firms operating at the minimum point of their long- run average cost curves.

C) positive profits for all firms in the industry.

D) positive profits as a result of barriers to entry.

E) a perfectly elastic demand curve facing each firm in the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

76

In a typical oligopolistic market, there are

A) substantial barriers to entry and firms interact strategically with each other.

B) no barriers to entry and firms sell homogeneous products.

C) substantial entry barriers, and firms are too large to strategically interact with each other.

D) no barriers to entry, but firms sell differentiated products.

E) no barriers to entry and firms interact strategically with each other.

A) substantial barriers to entry and firms interact strategically with each other.

B) no barriers to entry and firms sell homogeneous products.

C) substantial entry barriers, and firms are too large to strategically interact with each other.

D) no barriers to entry, but firms sell differentiated products.

E) no barriers to entry and firms interact strategically with each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

77

Suppose the market for gasoline retailing (gas stations) in an island economy has 12 firms. The two largest firms each account for 30 percent of sales, the third accounts for 15 percent, the fourth for 7 percent, the fifth for 4 percent and the remaining firms for 2 percent each. What is the four- firm concentration ratio?

A) 8 percent

B) 60 percent

C) 100 percent

D) 82 percent

E) 75 percent

A) 8 percent

B) 60 percent

C) 100 percent

D) 82 percent

E) 75 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following industries in Canada can best thought of as oligopolies?

1) breweries

2) women's clothing retailers

3) automobile manufacturers

A) 1 only

B) 2 only

C) 3 only

D) 1 and 3 only

E) 1, 2, and 3

1) breweries

2) women's clothing retailers

3) automobile manufacturers

A) 1 only

B) 2 only

C) 3 only

D) 1 and 3 only

E) 1, 2, and 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

79

The payoff matrix below shows the payoffs to Firms A and B from producing different levels of output. The numbers in parentheses are (payoff to A, payoff to B). TABLE 11- 3

-Refer to Table 11- 3. From the payoff matrix we can infer that

A) there is no Nash equilibrium in the game.

B) it is optimal for Firm A to produce 1000 units of output regardless of what Firm B is doing.

C) it is optimal for Firm B to produce 1000 units of output regardless of what Firm A is doing.

D) both firms are indifferent between an equilibrium (Produce 1000 units, Produce 1000 units) and (Produce 2000 units, Produce 2000 units).

E) it is optimal for Firm A to produce 2000 units of output regardless of what Firm B is doing.

-Refer to Table 11- 3. From the payoff matrix we can infer that

A) there is no Nash equilibrium in the game.

B) it is optimal for Firm A to produce 1000 units of output regardless of what Firm B is doing.

C) it is optimal for Firm B to produce 1000 units of output regardless of what Firm A is doing.

D) both firms are indifferent between an equilibrium (Produce 1000 units, Produce 1000 units) and (Produce 2000 units, Produce 2000 units).

E) it is optimal for Firm A to produce 2000 units of output regardless of what Firm B is doing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

80

FIGURE 11- 2

FIGURE 11- 2Refer to Figure 11- 2. At the short- run profit- maximizing position in diagram B, the firm

A) is making profits.

B) should raise its price.

C) is losing money.

D) should be shut down.

E) should increase output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck