Deck 14: Fiscal Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/138

العب

ملء الشاشة (f)

Deck 14: Fiscal Policy

1

President Barack Obama signed into law the American Recovery and Reinvestment Act of 2009, a $789 billion package of tax cuts and spending increases. The spending increases focused mostly on all of the following except

A) assistance to state and local governments.

B) military spending.

C) infrastructure expenditure on highways.

D) rail and healthcare information systems.

E) money to local governments to prevent cuts in education.

A) assistance to state and local governments.

B) military spending.

C) infrastructure expenditure on highways.

D) rail and healthcare information systems.

E) money to local governments to prevent cuts in education.

B

2

In the United States, the fiscal year runs from May to May.

False

3

The major summary document describing U.S. federal fiscal policy is the

A) Economic Report of the President.

B) U.S. Constitution.

C) Congressional Record.

D) federal budget.

E) Federal Reserve Bulletin.

A) Economic Report of the President.

B) U.S. Constitution.

C) Congressional Record.

D) federal budget.

E) Federal Reserve Bulletin.

D

4

A supplemental is

A) another term for transfer payments.

B) changes made to a budget in the current fiscal year.

C) the term used to describe congressional modification of a proposed budget.

D) additions made by the president to the proposed budget.

E) state and local budgets.

A) another term for transfer payments.

B) changes made to a budget in the current fiscal year.

C) the term used to describe congressional modification of a proposed budget.

D) additions made by the president to the proposed budget.

E) state and local budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

5

The U.S. federal budget is a

A) document that analyzes the projected inflation target in the United States and the corresponding federal funds rate and real interest rate.

B) document that reflects the spending plans of each of the 50 states of the United States for a given year.

C) major summary document describing fiscal policy in the United States, including proposals for spending and taxes and the estimate of the corresponding budget deficit or surplus.

D) None of these

A) document that analyzes the projected inflation target in the United States and the corresponding federal funds rate and real interest rate.

B) document that reflects the spending plans of each of the 50 states of the United States for a given year.

C) major summary document describing fiscal policy in the United States, including proposals for spending and taxes and the estimate of the corresponding budget deficit or surplus.

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is true?

A) Though not required by law, the government tends to run a balanced budget year after year.

B) If there is a budget deficit, the government must borrow to pay for the excess spending.

C) If there is a budget deficit, the government must ask the Fed to print money to finance excess spending.

D) By law the federal budget must balance.

E) If there is a budget deficit, the government must raise taxes.

A) Though not required by law, the government tends to run a balanced budget year after year.

B) If there is a budget deficit, the government must borrow to pay for the excess spending.

C) If there is a budget deficit, the government must ask the Fed to print money to finance excess spending.

D) By law the federal budget must balance.

E) If there is a budget deficit, the government must raise taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

7

The whole budget cycle takes

A) the same amount of time the economy takes to achieve long-run equilibrium.

B) one year.

C) more than four years.

D) more than three years.

E) more than two years.

A) the same amount of time the economy takes to achieve long-run equilibrium.

B) one year.

C) more than four years.

D) more than three years.

E) more than two years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

8

All four of the major fiscal interventions implemented in the 2000's decade have been blamed for worsening the long-term budget situation of the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

9

The U.S. federal budget is a major summary document describing fiscal policy in the United States, including proposals for spending and taxes and the estimate of the corresponding budget deficit or surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

10

When tax revenues are equal to spending, there is a

A) budget deficit.

B) government absorption.

C) budget surplus.

D) balanced budget.

E) budget supplement.

A) budget deficit.

B) government absorption.

C) budget surplus.

D) balanced budget.

E) budget supplement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

11

The 2008 and 2009 major fiscal stimulus bills were motivated by the serious economic recession that hit the United States in 2008, and can be classified as "countercyclical."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

12

In 2008, President Bush signed into law the Economic Stimulus Act that mainly included which of the following fiscal measures?

A) Lower marginal income rates and lower estate taxes.

B) Higher marginal income rates and higher government spending.

C) Direct payments to individuals and families in order to raise consumption.

D) Lower government spending and higher interest rates.

E) None of these.

A) Lower marginal income rates and lower estate taxes.

B) Higher marginal income rates and higher government spending.

C) Direct payments to individuals and families in order to raise consumption.

D) Lower government spending and higher interest rates.

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements is true?

A) The budget is not affected by unanticipated economic events such as recessions.

B) The budget is not affected by unanticipated wars and natural disasters.

C) Changes in spending programs can be made throughout the fiscal year.

D) Congress seldom modifies the president's budget proposal.

E) Congress cannot modify the budget once it is enacted.

A) The budget is not affected by unanticipated economic events such as recessions.

B) The budget is not affected by unanticipated wars and natural disasters.

C) Changes in spending programs can be made throughout the fiscal year.

D) Congress seldom modifies the president's budget proposal.

E) Congress cannot modify the budget once it is enacted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

14

Because of the length of the budget cycle, at any given time, the federal government is discussing

A) one budget.

B) two budgets.

C) four budgets.

D) three budgets.

E) five budgets.

A) one budget.

B) two budgets.

C) four budgets.

D) three budgets.

E) five budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is true?

A) The budget approved by Congress cannot be modified throughout the fiscal year.

B) The budget submitted by the president cannot be changed by Congress.

C) In a recession, the actual budget is likely to reflect a larger deficit than the proposed budget.

D) The budget submitted by the president can be changed by Congress and the Federal Reserve.

E) Proposed taxes and spending programs will always be the same as actual taxes and spending programs.

A) The budget approved by Congress cannot be modified throughout the fiscal year.

B) The budget submitted by the president cannot be changed by Congress.

C) In a recession, the actual budget is likely to reflect a larger deficit than the proposed budget.

D) The budget submitted by the president can be changed by Congress and the Federal Reserve.

E) Proposed taxes and spending programs will always be the same as actual taxes and spending programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

16

The president can change only a small part of the budget each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

17

The third substantial piece of fiscal policy legislation passed by the Bush administration, the Economic Stimulus Act of 2008, was the most expensive fiscal policy legislation of the decade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

18

Most of the spending in the enacted budget is determined by

A) the Council of Economic Advisers.

B) current presidential spending programs.

C) the Federal Reserve Board.

D) ongoing programs.

E) spending programs desired by Congress.

A) the Council of Economic Advisers.

B) current presidential spending programs.

C) the Federal Reserve Board.

D) ongoing programs.

E) spending programs desired by Congress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

19

When tax revenues are less than spending, there is a

A) budget surplus.

B) budget deficit.

C) budget supplement.

D) government absorption.

E) balanced budget.

A) budget surplus.

B) budget deficit.

C) budget supplement.

D) government absorption.

E) balanced budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is true about the projected U.S. federal tax revenues and expenditures for 2017?

A) A deficit is projected.

B) Tax revenues are projected to exceed expenditures by $500 billion.

C) The largest expenditure in the budget is defense.

D) All of the above

E) None of the above

A) A deficit is projected.

B) Tax revenues are projected to exceed expenditures by $500 billion.

C) The largest expenditure in the budget is defense.

D) All of the above

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

21

About half of the U.S. budget consists of social security, Medicare, and Medicaid. Which of the following is not true about these important expenditures?

A) These are known as entitlement programs.

B) These programs are expected to remain relatively constant in coming years.

C) Social security and Medicare provide income and health care for the elderly, and Medicaid provides health care for people and families with very low incomes.

D) All of the above represent true facts.

E) None of the above are true facts.

A) These are known as entitlement programs.

B) These programs are expected to remain relatively constant in coming years.

C) Social security and Medicare provide income and health care for the elderly, and Medicaid provides health care for people and families with very low incomes.

D) All of the above represent true facts.

E) None of the above are true facts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

22

Since ____, the U.S. federal government has been running a budget deficit.

A) 1970

B) 1997

C) 2002

D) 2000

E) 1969

A) 1970

B) 1997

C) 2002

D) 2000

E) 1969

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

23

Social security, Medicare, and Medicaid are expected to grow very rapidly in the coming years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

24

Most government expenditures are for purchases of new goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

25

At any one time, there can be discussions in Congress about only one year's budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following types of taxes are not used by the federal government to raise revenue?

A) Payroll taxes

B) Sales taxes

C) Property taxes

D) Income taxes

E) Corporate taxes

A) Payroll taxes

B) Sales taxes

C) Property taxes

D) Income taxes

E) Corporate taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

27

By law, Congress and the president must approve the budget by the beginning of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

28

Early each year, the president of the United States issues an economic report, which contains the economic forecast for the year. This report is prepared by which of the following?

A) By the Fed.

B) By the Department of the Treasury.

C) By the president's Council of Economic Advisers.

D) By the CIA.

E) None of these is correct.

A) By the Fed.

B) By the Department of the Treasury.

C) By the president's Council of Economic Advisers.

D) By the CIA.

E) None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

29

Budget deficits have occurred every year for the past three decades.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following types of taxes have been growing rapidly as a share of federal government revenues?

A) Corporate taxes

B) Sales taxes

C) Payroll taxes

D) Income taxes

E) Property taxes

A) Corporate taxes

B) Sales taxes

C) Payroll taxes

D) Income taxes

E) Property taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

31

There were federal budget surpluses between 1998 and 2001 because income grew very rapidly as the economy expanded during that time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is the largest component of federal government expenditures?

A) Transfer payments

B) Interest payments

C) Capital purchases

D) Defense purchases

E) Payroll for federal government employees

A) Transfer payments

B) Interest payments

C) Capital purchases

D) Defense purchases

E) Payroll for federal government employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following types of taxes provide the least revenue for the federal government?

A) Corporate taxes

B) Income taxes

C) Payroll taxes

D) Sales taxes

E) Property taxes

A) Corporate taxes

B) Income taxes

C) Payroll taxes

D) Sales taxes

E) Property taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

34

For a hypothetical economy in 2010, the deficit was $300 billion, the national debt was $3,800 billion, and the average interest rate on the federal debt was 6.0 percent. The amount of interest payments made that year was

A) $246 billion.

B) $270 billion.

C) $228 billion.

D) $18 billion.

E) $225 billion.

A) $246 billion.

B) $270 billion.

C) $228 billion.

D) $18 billion.

E) $225 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

35

Because the government is the official issuer of money, it does not have to pay interest on its debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

36

The U.S. federal budget for 2017 projects higher expenditures than tax revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

37

The year 2001 was the ____ consecutive year the U.S. federal government had been running a budget ____.

A) fourth; surplus

B) fourth; deficit

C) twenty-eighth; surplus

D) twenty-eighth; deficit

E) secon

A) fourth; surplus

B) fourth; deficit

C) twenty-eighth; surplus

D) twenty-eighth; deficit

E) secon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

38

Social security is the biggest spending item in the U.S. 2017 federal budget, followed by defense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

39

The symbol G used throughout the text stands for

A) federal government expenditures.

B) purchases of goods and services by the federal government.

C) federal plus state and local government purchases of goods and services.

D) federal plus state and local government expenditures.

E) the difference between expenditures and tax revenues for the federal, state, and local governments.

A) federal government expenditures.

B) purchases of goods and services by the federal government.

C) federal plus state and local government purchases of goods and services.

D) federal plus state and local government expenditures.

E) the difference between expenditures and tax revenues for the federal, state, and local governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

40

The president and Congress typically settle on the budget before the beginning of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

41

The debt to GDP ratio grows every time there is a deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

42

In which of the following years was the debt to GDP ratio the lowest?

A) 1992

B) 1973

C) 1985

D) 1960

E) 1950

A) 1992

B) 1973

C) 1985

D) 1960

E) 1950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

43

Interest rate payments are what the federal government pays every year on its debt. Total interest payments equal the interest rate multiplied by the amount of government debt outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

44

The federal deficit is the total amount of outstanding loans that the U.S. federal government owes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

45

The debt to GDP ratio

A) has been falling since 1998.

B) began to increase again in 2002.

C) has remained constant since 1998.

D) began to fall again in 2002.

E) has been increasing since 1998.

A) has been falling since 1998.

B) began to increase again in 2002.

C) has remained constant since 1998.

D) began to fall again in 2002.

E) has been increasing since 1998.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

46

Early each year, the president of the United States issues an economic report, which contains the economic forecast for the year and is prepared by the CIA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose a government has $4,000 billion of debt. This year, real GDP is $8,000 billion, the tax rate is 30 percent, and government spending is $2,000 billion. Which of the following is true?

A) The deficit will decrease by $400 billion.

B) The debt will increase by $400 billion.

C) The deficit will increase by $400 billion.

D) The debt will decrease by $400 billion.

E) Both the deficit and the debt will increase by $400 billion.

A) The deficit will decrease by $400 billion.

B) The debt will increase by $400 billion.

C) The deficit will increase by $400 billion.

D) The debt will decrease by $400 billion.

E) Both the deficit and the debt will increase by $400 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

48

The total amount of outstanding loans owed by the federal government is known as

A) the budget deficit.

B) the federal debt.

C) the current account deficit.

D) the yearly U.S. government deficit.

E) None of these

A) the budget deficit.

B) the federal debt.

C) the current account deficit.

D) the yearly U.S. government deficit.

E) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

49

In which of the following years was the debt to GDP ratio the highest?

A) 1960

B) 1950

C) 1973

D) 1992

E) 1985

A) 1960

B) 1950

C) 1973

D) 1992

E) 1985

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

50

President Bill Clinton's 1994 Economic Report presented the case for "shifting federal spending priorities from consumption to investment," a key fiscal policy principle of his administration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

51

State and local government expenditures are

A) about two-thirds as much as the federal government's expenditures.

B) relatively small when compared to the federal government's expenditures.

C) about the same amount as the federal government's expenditures.

D) usually twice as much as the federal government's expenditures.

E) usually three times as much as the federal government's expenditures.

A) about two-thirds as much as the federal government's expenditures.

B) relatively small when compared to the federal government's expenditures.

C) about the same amount as the federal government's expenditures.

D) usually twice as much as the federal government's expenditures.

E) usually three times as much as the federal government's expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

52

The debt to GDP ratio measures

A) debt as a percentage of per capita GDP.

B) debt as a percentage of nominal GDP.

C) nominal GDP as a percentage of debt.

D) debt as a percentage of real GDP.

E) debt as a percentage of average GDP.

A) debt as a percentage of per capita GDP.

B) debt as a percentage of nominal GDP.

C) nominal GDP as a percentage of debt.

D) debt as a percentage of real GDP.

E) debt as a percentage of average GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

53

U.S. government debt in 2017 was approximately

A) $15,000 billion.

B) $3,000 million.

C) $3,500 million.

D) $4,000 trillion.

E) $5,000 billion.

A) $15,000 billion.

B) $3,000 million.

C) $3,500 million.

D) $4,000 trillion.

E) $5,000 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is true?

A) There is no relationship between the federal deficit and the federal debt.

B) A federal deficit adds to the federal debt.

C) The change in the federal deficit each year equals the federal debt.

D) The federal debt is the same as the federal deficit.

E) The federal debt grew in the period when there was a federal budget surplus.

A) There is no relationship between the federal deficit and the federal debt.

B) A federal deficit adds to the federal debt.

C) The change in the federal deficit each year equals the federal debt.

D) The federal debt is the same as the federal deficit.

E) The federal debt grew in the period when there was a federal budget surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

55

If a federal budget in which expenditures exceed revenue is enacted, the federal government will

A) raise taxes.

B) raise taxes and cut spending.

C) cut spending.

D) sell off assets.

E) borrow money from the private sector.

A) raise taxes.

B) raise taxes and cut spending.

C) cut spending.

D) sell off assets.

E) borrow money from the private sector.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

56

In 1986 the debt to GDP ratio was the highest it had been since the end of World War II.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

57

The largest share of expenditures by state and local governments is for

A) purchases of goods and services.

B) national defense.

C) transfer payments.

D) interest payments.

E) law enforcement.

A) purchases of goods and services.

B) national defense.

C) transfer payments.

D) interest payments.

E) law enforcement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is true about the relationship between the federal budget deficit and the federal debt?

A) Whenever a country has a positive amount of federal debt, it must run a federal budget deficit in that year.

B) As discussed in the textbook, the federal budget deficit represents a real variable, while the federal debt represents a nominal variable.

C) As discussed in the textbook, the federal budget deficit represents a flow variable, while the federal debt represents a stock variable.

D) All of the above are true.

E) None of the above are true.

A) Whenever a country has a positive amount of federal debt, it must run a federal budget deficit in that year.

B) As discussed in the textbook, the federal budget deficit represents a real variable, while the federal debt represents a nominal variable.

C) As discussed in the textbook, the federal budget deficit represents a flow variable, while the federal debt represents a stock variable.

D) All of the above are true.

E) None of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

59

In 2010, the debt to GDP ratio was equal to about 150 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

60

Less than 20 percent of the U.S. budget currently consists of social security, Medicare, and Medicaid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

61

What are the three classes of federal expenditures? Of these, what is the largest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is not an instrument of fiscal policy?

A) Transfer payments

B) Government bonds

C) Income taxes

D) Sales taxes

E) Government purchases

A) Transfer payments

B) Government bonds

C) Income taxes

D) Sales taxes

E) Government purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

63

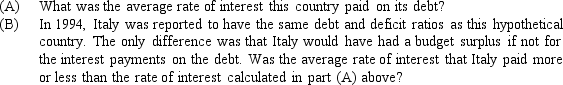

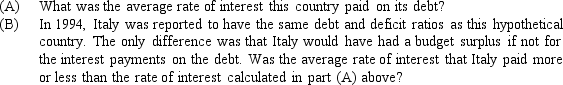

Suppose, for a hypothetical country in 2017, the debt to GDP ratio was 120 percent and the deficit to GDP ratio was 10 percent. If it were not for interest payments on the debt, this country would have a balanced budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

64

Changes in government purchases always lead to fluctuations of real GDP from potential.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

65

A change in taxes can affect potential GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the difference between the deficit and the debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

67

What are the major categories of taxes collected by the federal government? Which of these categories is the largest source of revenue? Which is the smallest source of revenue?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following would cause the AD curve to shift to the left?

A) An increase in tax rates

B) An increase in military purchases

C) An increase in unemployment compensation

D) A decrease in sales taxes

E) A decrease in potential GDP

A) An increase in tax rates

B) An increase in military purchases

C) An increase in unemployment compensation

D) A decrease in sales taxes

E) A decrease in potential GDP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

69

A decrease in tax rates

A) has no effect on the AD curve.

B) causes the AD curve to shift left.

C) causes the AD curve to shift right.

D) has only a short-term effect on real GDP.

E) usually leads to a reduction in potential GDP.

A) has no effect on the AD curve.

B) causes the AD curve to shift left.

C) causes the AD curve to shift right.

D) has only a short-term effect on real GDP.

E) usually leads to a reduction in potential GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

70

An increase in government spending will

A) increase real GDP in the short run and the long run.

B) increase real GDP in the short run.

C) increase the GDP to debt ratio.

D) have no effect on real GDP because taxes will increase.

E) increase real GDP in the short run and potential GDP in the long run.

A) increase real GDP in the short run and the long run.

B) increase real GDP in the short run.

C) increase the GDP to debt ratio.

D) have no effect on real GDP because taxes will increase.

E) increase real GDP in the short run and potential GDP in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

71

To reduce the size of economic fluctuations, the government could

A) make fewer permanent changes in government spending.

B) change government purchases often to encourage a shift of the aggregate demand curve.

C) increase spending during a recession and decrease spending during an expansion.

D) keep government spending fixed to avoid shifting the aggregate demand curve.

E) continually increase government spending to shift the aggregate demand curve to the right.

A) make fewer permanent changes in government spending.

B) change government purchases often to encourage a shift of the aggregate demand curve.

C) increase spending during a recession and decrease spending during an expansion.

D) keep government spending fixed to avoid shifting the aggregate demand curve.

E) continually increase government spending to shift the aggregate demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

72

Suppose a recession occurs unexpectedly in December one year. Explain why the actual budget will differ from the predicted budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following would cause the AD curve to shift to the right?

A) An increase in sales taxes

B) An increase in potential GDP

C) A decrease in unemployment compensation

D) An increase in social security payments

E) A decrease in military purchases

A) An increase in sales taxes

B) An increase in potential GDP

C) A decrease in unemployment compensation

D) An increase in social security payments

E) A decrease in military purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

74

State and local governments do not run deficits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

75

Most state and local government expenditures are for purchases of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

76

Explain the major trends in the debt to GDP ratio since 1950.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

77

Increasing government purchases can contribute to higher inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following statements is true?

A) In the short run, changes in fiscal policy mainly affect potential GDP.

B) Fiscal policy's initial impact on real GDP is permanent.

C) Fiscal policy does not have the potential to reduce the size of economic fluctuations.

D) Erratic changes in fiscal policy can increase economic fluctuations.

E) Fiscal policy cannot cause erratic fluctuations in real GDP.

A) In the short run, changes in fiscal policy mainly affect potential GDP.

B) Fiscal policy's initial impact on real GDP is permanent.

C) Fiscal policy does not have the potential to reduce the size of economic fluctuations.

D) Erratic changes in fiscal policy can increase economic fluctuations.

E) Fiscal policy cannot cause erratic fluctuations in real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

79

Name two reasons why the actual budget may differ from the budget enacted at the start of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

80

A decrease in tax rates

A) has no effect on the AD curve.

B) can lead to an increase in potential GDP.

C) causes the AD curve to shift left.

D) has no long-run effect on potential GDP.

E) has only a short-term effect on real GDP.

A) has no effect on the AD curve.

B) can lead to an increase in potential GDP.

C) causes the AD curve to shift left.

D) has no long-run effect on potential GDP.

E) has only a short-term effect on real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck